IRS Form 14157 Instructions

If you have a complaint about your tax preparer, or if you suspect that your tax professional is has engaged in fraudulent activity, you don’t have to remain silent. This in-depth article will show you how to use IRS Form 14157 to file a complaint against your tax return preparer.

Specifically, we will discuss:

- Exactly what IRS Form 14157 is

- What types of complaints you can file with this IRS form

- How to complete Form 14157

- How to file the completed form

Let’s start with step by step instructions on how to complete Form 14157.

Table of contents

How do I complete IRS Form 14157?

This form is relatively straightforward, and has 4 sections. We’ll go through each section with step-by-step instructions.

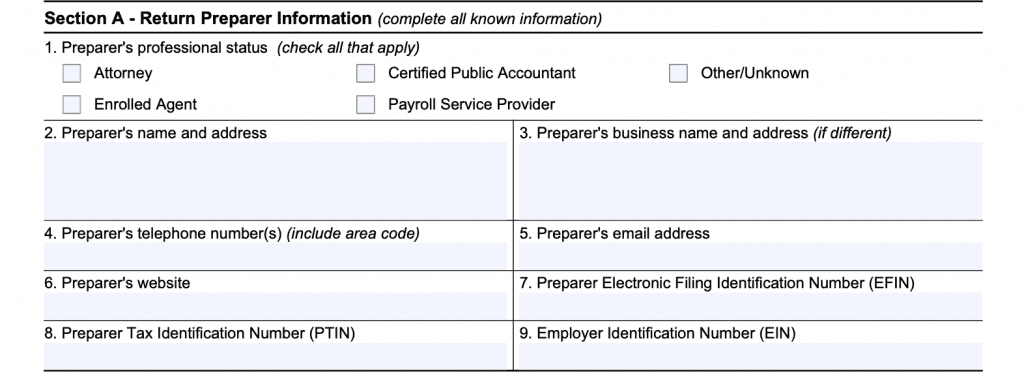

Section A – Return Preparer Information

The first section contains 9 lines, all about the paid preparer.

Line 1: Preparer’s professional status

Do you know whether your tax preparer is a tax professional, such as an attorney, enrolled agent, or certified public accountant? Tax professionals who hold these select qualifications are responsible to the IRS for professional conduct. They can face disciplinary actions from the federal government.

Moreover, certified public accountants (CPAs) must report to their respective state board of accountancy. Likewise, state bar associations hold attorneys to a higher standard. Enrolled agents report to the IRS Office of Enrollment.

These professional credentials have multiple organizations ensuring proper conduct.

Line 2: Preparer’s name and address

List the preparer’s mailing address, including city, state, and zip code.

Line 3: Preparer’s business name and address

If different, list the tax preparer’s business address information.

Line 4: Tax preparer’s phone number

List your tax preparer’s phone number, including area code.

Line 5: Preparer’s email address

Your preparer’s email address goes here.

Line 6: Preparer’s website

If your tax preparer has a website, put the URL here.

Line 7: Preparer’s electronic filing identification number (EFIN)

The IRS requires paid tax return preparers to register with the IRS e-file system in order to file electronic tax returns. The IRS assigns each tax return preparer an EFIN. This number goes into Line 7.

If you don’t know the preparer’s EFIN, it may be on IRS Form 8879 of your tax return

Line 8: Preparer’s PTIN

The IRS also requires tax return preparers to obtain a preparer tax identification number (PTIN). Although reputable preparers will have a PTIN, this is probably a little more difficult to look up. And in the case of non-credentialed preparers or unscrupulous preparers, you probably won’t be able to find this information at all.

However, you may be able to ascertain whether your tax return preparer has a PTIN in the first place. The IRS maintains a listing of preparers, known as the IRS Directory of Federal Tax Return Preparers. If your preparer has a PTIN, he or she will be listed here.

Line 9: Preparer’s employer identification number (EIN)

If known, insert the EIN here.

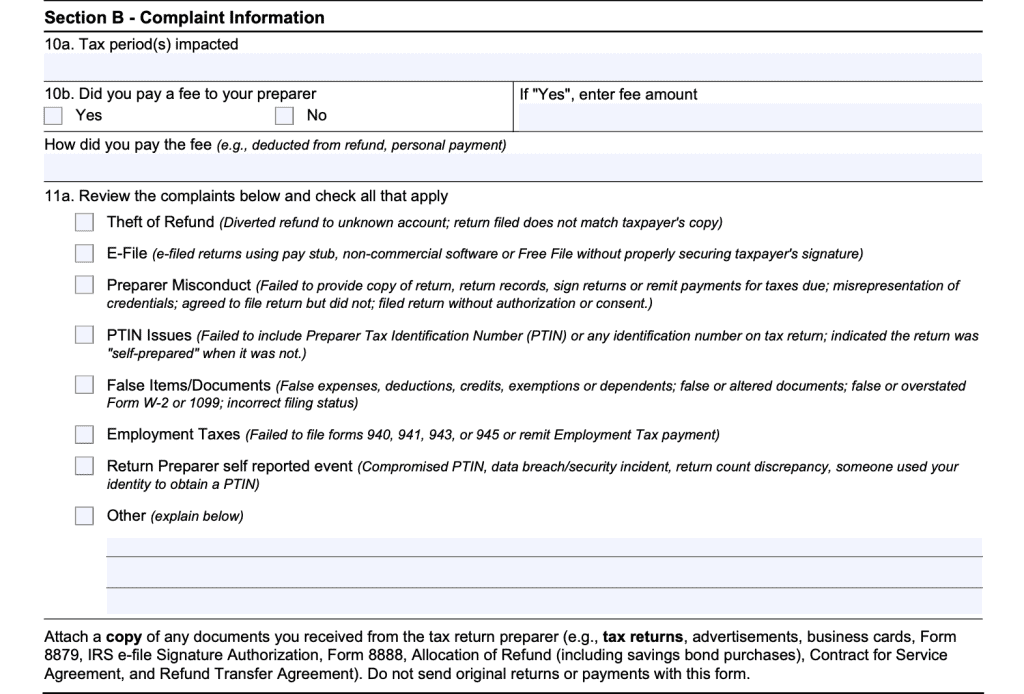

Section B – Complaint Information

In Section B, you’ll give the IRS more information about the incident or complaint itself.

Line 10a: Tax period(s) impacted

State the tax period you were impacted. Was it just one tax season, or multiple?

Line 10b: Did you pay a fee?

Did you pay a fee, and if so, how much?

You might wonder why this question exists. The IRS holds independent tax preparers who operate for money to a different standard than someone who might be helping their relative with their income tax return.

Line 11a: Type of complaints

We’ve briefly discussed the types of activities warrant a complaint. You’ll want to make sure you attach a copy of any documents you’ve received from the return preparer as supporting documentation.

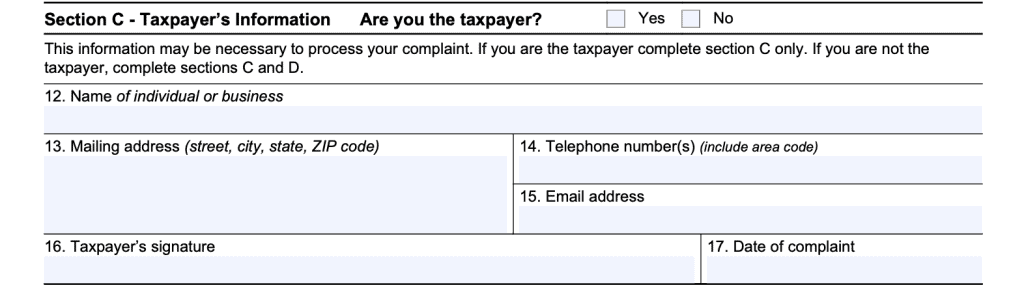

Section C – Taxpayer’s Information

Taxpayer’s information goes into Section C. Everything is fairly straightforward.

If you are the taxpayer and complainant, then you’ll only need to complete Section C. You’ll leave Section D unfilled.

If you are filing the complaint on behalf of a taxpayer, you’ll put the taxpayer information in Section C and move on to Section D.

Line 12: Taxpayer’s name

Taxpayer’s name goes here.

Line 13: Mailing address

Insert taxpayer’s address.

Line 14: Telephone number

Taxpayer’s phone number.

Line 15: Email address

Insert taxpayer’s email address here.

Line 16: Taxpayer signature

Taxpayer signs here.

Line 17: Date of complaint

Taxpayer will date the complaint in Line 17.

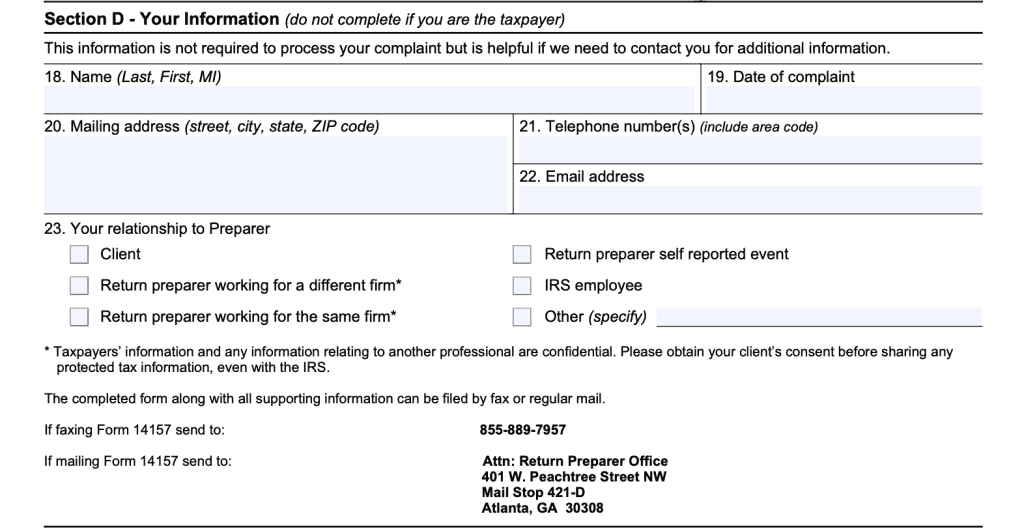

Section D – Your Information

If you are the taxpayer, do not complete Section D. If you are not the taxpayer, the IRS will want your contact information in case they need you to answer additional questions.

Line 18: Name

Your name goes here.

Line 19: Date of complaint

Date of complaint

Line 20: Mailing address

Insert your mailing address.

Line 21: Telephone number

Insert your phone number, including area code.

Line 22: Email address

Your email address goes here.

Line 23: Relationship to preparer

How are you familiar with the tax preparer? Are you a client, fellow return preparer, or IRS employee? Or is there another relationship?

How do I file Form 14157?

You can fax the completed form to the IRS at: (855) 889-7957. If you’re mailing the form, you’ll want to mail it to:

ATTN: Return Preparer Office

401 W. Peachtree Street NW

Mail Stop 421-D

Atlanta, GA 30308

Video walkthrough

Watch this informative video to learn more about filing a complaint against your tax return preparer.

Frequently asked questions

IRS Form 14157-Return Preparer Complaint, is the form a taxpayer may use when reporting a professional tax preparer to the Internal Revenue Service. The IRS requires each paid tax return preparer to register and to have a preparer tax identification number (PTIN). As a result, the IRS can use a filed Form 14157 to start an investigation and hold unethical tax return preparers accountable for unprofessional activity.

Taxpayers may use this form to file a wide variety of complaints, including:

-Theft of refund

-Improper use of the e-File system or disobeying the IRS e-file rules

-Preparer misconduct

-PTIN issues

-Using false items or documents when filing income tax returns

–Employment tax issues

Additionally, a registered tax return preparer who believes their PTIN or other credentials are compromised can use Form 14157 to report this to the IRS.

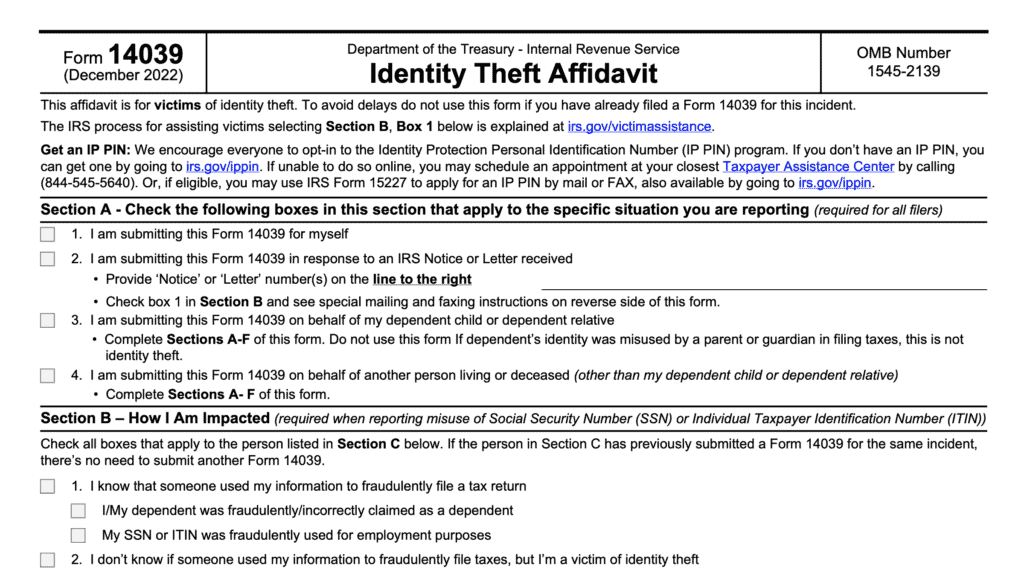

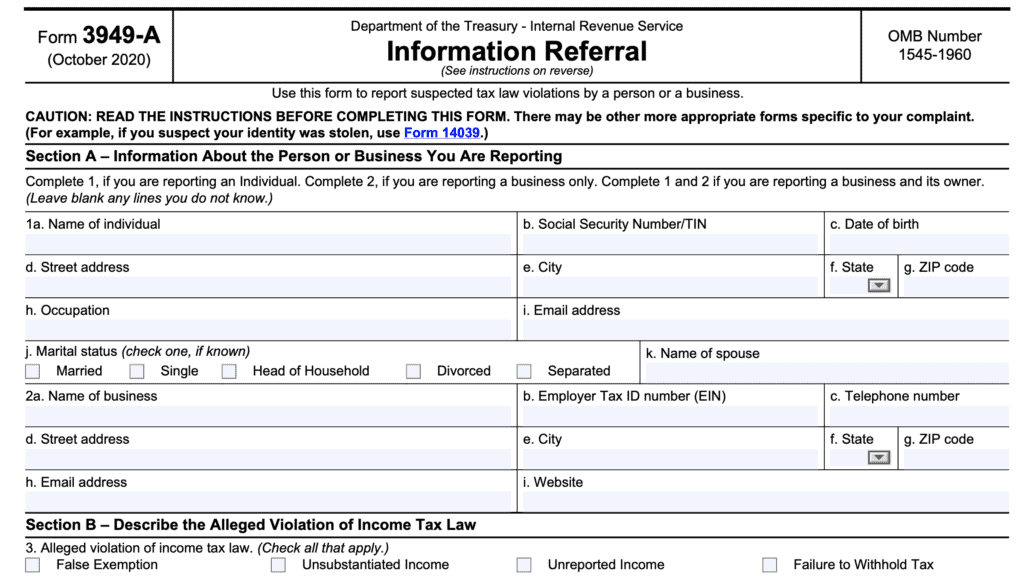

If you believe you’ve been a victim of identity theft, you should report it on IRS Form 14039-Identity Theft Affidavit. If you believe that someone has committed tax fraud, report them on IRS Form 3949-A, Information Referral.

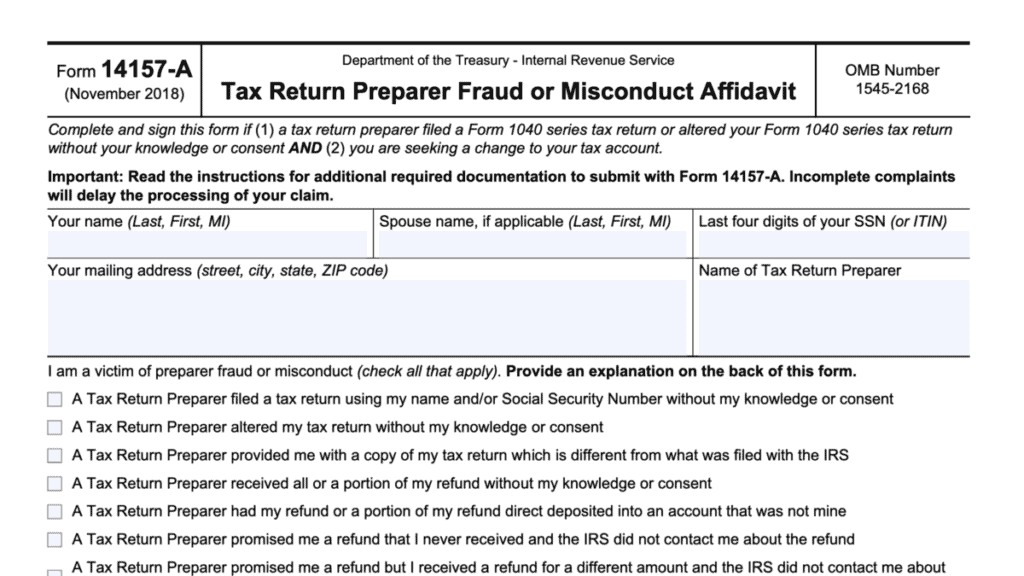

If you must file Form 14157-A, it must always be accompanied by Form 14157. Here are instances where you might file both:

-A dishonest tax preparer who files an income tax return without the taxpayer’s permission

-Altering your tax return documents.

-Using an incorrect filing status or altering federal tax returns to generate a larger refund.

-Creating false expenses, deductions or credits to generate bigger refunds.

-Misdirecting your refund into the tax preparer’s bank account.

Where do I get a copy of IRS Form 14157?

You may obtain a copy of the tax form from the IRS website or download it here.