IRS Form 3921 Instructions

If you’re exercising incentive stock options for the first time, you might receive IRS Form 3921 from your employer. This article will walk you through IRS Form 3921 so you can better understand the tax impact of your ISOs.

Table of contents

IRS Form 3921 Instructions

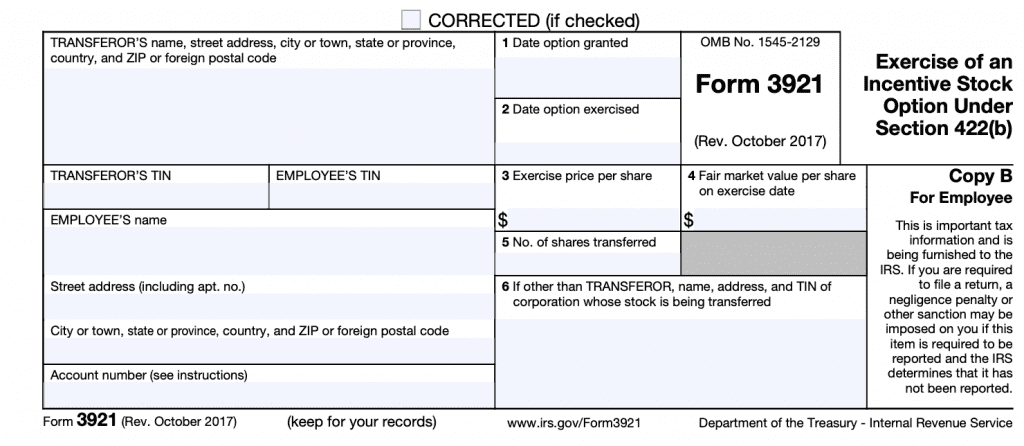

In most of our articles, we walk you through how to complete the tax form. However, since IRS Form 3921 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 3921 from, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 4 copies of Forms 3921. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy C: For the corporation

- Copy D: For the transferor

Let’s walk through this informational form step by step, so you can understand what to expect.

Top

At the top of the form, there is a box marked, “Corrected (if checked).” If your employer must refile a revised version of the form, this should be checked.

Left side

The left side of the form contains the transferor’s contact information, such as:

- Name

- Address

- City & State

- Zip code

It also contains the transferor’s taxpayer identification number, as well as the employee’s. If your company uses a transfer agent, this will be different from the company’s information. You’ll want to review this form to make sure everything is correct.

You may also see the account number filled in. The IRS requires employers to complete this field if there are multiple accounts for the same employee. Otherwise, the IRS suggests that employers complete the field as a best practice.

Line 1: Date option granted

In this field, you’ll find the date of grant. This isn’t the date that you exercised the option. This is the date that the company granted the option to you.

In some cases, employees might receive ISOs that vest over time. Line 1 contains the date that this specific set of ISOs vested, becoming eligible for the exercise of option.

For exercising employees who exercise more than one grant: You can expect to receive multiple copies of this form, each with their own grant date.

Line 2: Date option exercised

This date marks the exercise of the option itself.

Line 3: Exercise price per share

For the exercise of an ISO, this is the predetermined price at which the employee can purchase the underlying stock. This purchase price of the stock is also known as the exercise price or the strike price.

Line 4: Fair market value per share on exercise date

This line contains the stock’s fair market value on the date of exercise, reported as price per share.

The difference between the fair market value of the shares and the exercise price is known as the spread.

Example: You exercised ISOs at a cost of $50 per share. The stock’s fair market value on the date of exercise was $70 per share. The spread is $20 per share ($70 – $50).

Line 5: Number of shares transferred

Under line 5, you’ll find the number of shares transferred to you after the exercise of your ISO shares.

Example: Using the previous example, let’s imagine your exercise of incentive stock options was for 200 shares. The total spread is $4,000 ($20 per share times 200 shares)

Line 6: Corporation whose stock is being transferred

If the TRANSFEROR field contains information that does not belong to the company who transferred their stock, then the company’s information will go into Line 6.

Who files IRS Form 3921?

According to the Internal Revenue Service, all employers must file IRS Form 3921 for each calendar year that the company transfers any shares of stock pursuant to an employee’s ISO exercises during the year.

There are 4 copies of Form 3921, which the employer must file. Each copy goes to a different recipient:

- Copy A: Internal Revenue Service Center where the company files its tax return. On the IRS website, the form instructions specifically state that the company must use a scannable version of the form.

- Copy B: Employee

- Copy C: Company retains for corporate records

- Copy D: Transferor, if the transferor is a different entity from the employer.

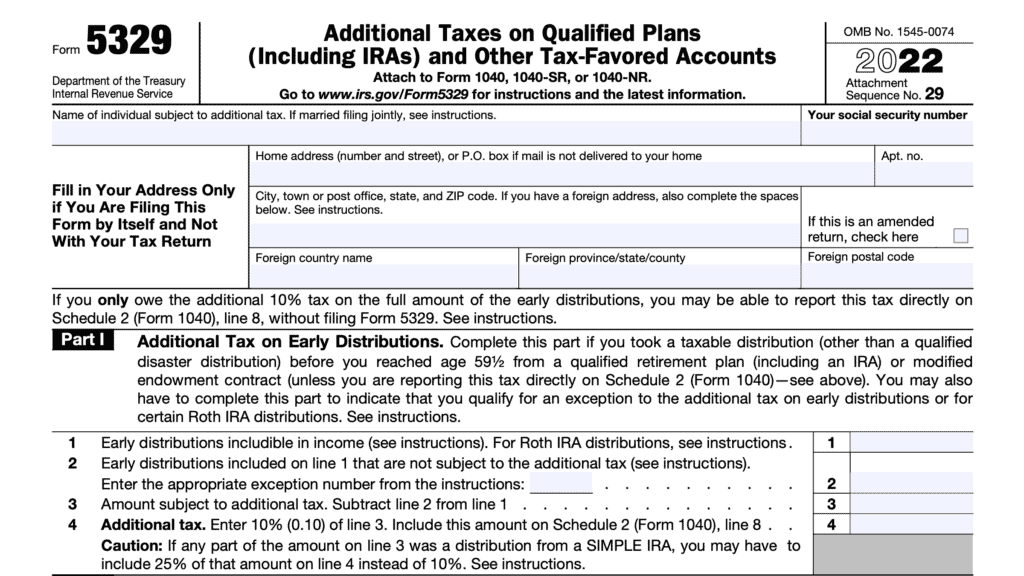

Exception: The IRS does not require the company to issue IRS Form 3921 to an employee under the following circumstances:

- The employee is a nonresident alien

- The company was not required to provide Form W-2 to the employee from the time between the first day of the calendar year of the grant and the last day of the calendar year in which the employee exercised the option.

Filing IRS Form 3921

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

What’s the difference between an ISO and NSO?

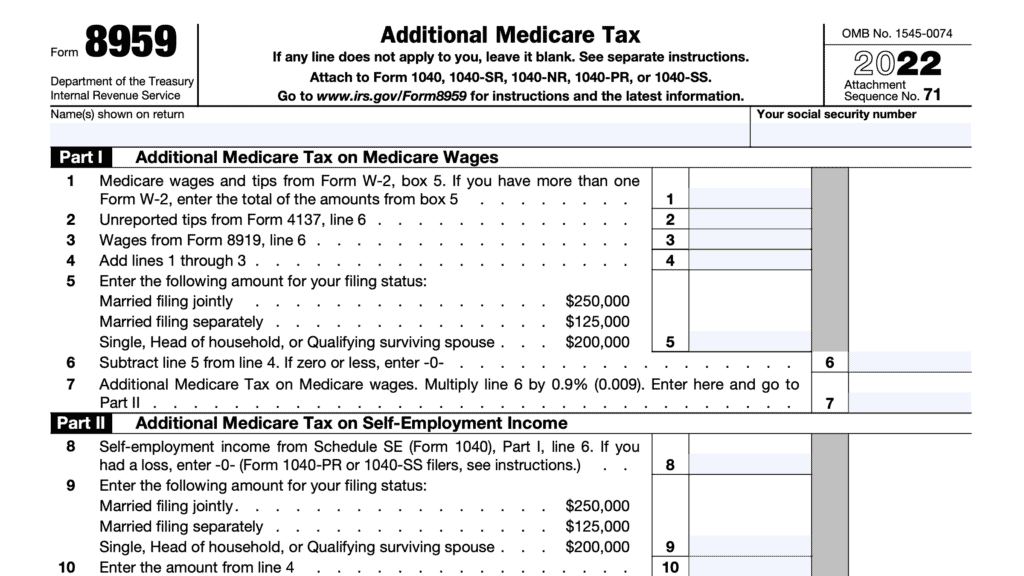

For tax purposes, an ISO is subject to the following:

- Long-term capital gains tax on the difference between exercise price and sales price (capital gain)

- AMT income tax on the spread between exercise price and fair market value of the stock on the day of exercise (if applicable)

An NSO is subject to the following:

- Capital gains tax on the capital gain. This can be either long-term or short-term capital gains, depending on the holding period

- Ordinary income tax on the spread (not subject to payroll tax)

If the employee is subject to AMT, it might be preferable to immediately sell the stock after exercising the option. This helps avoid any capital gains associated with the sale, but has no impact on AMT.

Video walkthrough

Watch this informative video to learn more about how your employer will report ISOs on Form 3921.

Frequently asked questions

Below are some frequently asked questions about ISOs and Form 3921.

IRS Form 3921-Exercise of an Incentive Stock Option Under Section 422(b), reports specific details about the transfer of stock due to an exercise of incentive stock options (ISOs) under a company’s ISO plan or program.

An incentive stock option, known as an ISO, is a common type of equity compensation that employers grant to important employees. Because of their preferential treatment under the Internal Revenue Code, this may be a popular form of compensation. This is especially true for cash-strapped employers who expect their stock price to increase significantly in the future.

While there is preferential treatment for regular income tax purposes, the exercise of ISOs is subject to alternative minimum tax (AMT).

There are several components to ISO taxation, based upon the ISO grant, exercise, and sale of underlying stock. ISO grants are not a taxable event. The ISO exercise is not subject to regular income tax, but may be subject to AMT. The sale of underlying stock is a taxable event.

The sale of company stock after exercise is a taxable event. The timing of the stock sale also determines whether an ISO remains qualified for preferential treatment. This can be either a qualifying disposition or a disqualifying disposition.

A stock option meets the requirements for qualifying disposition if the employee sells the stock more than 2 years after the grant and more than 1 year after the exercise of the ISO.

All sales that do not meet the criteria of a qualifying disposition are disqualifying dispositions. Disqualifying dispositions of an ISO cause the ISO to become a non-qualified stock option (NSO).

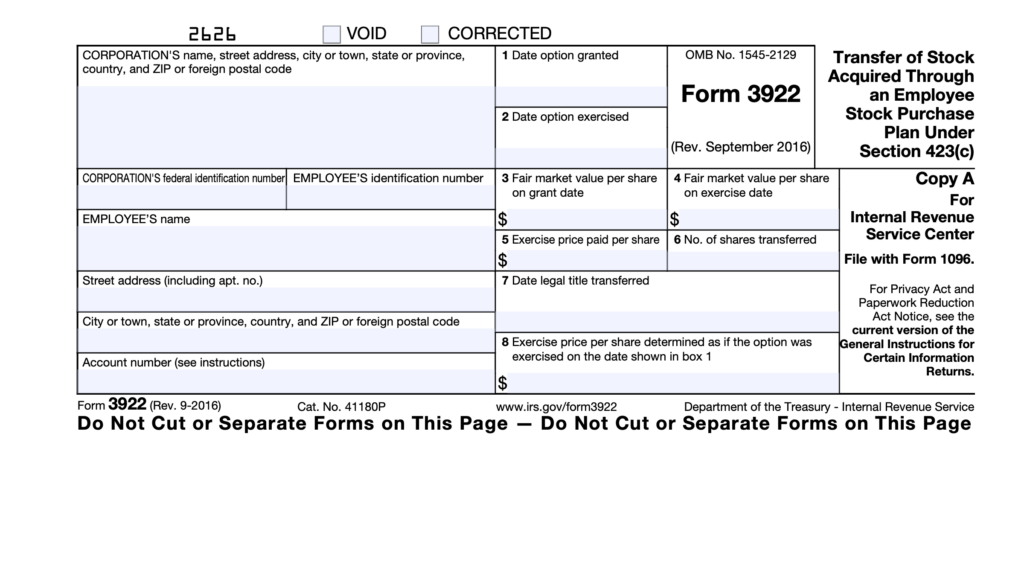

No. Employee stock purchases happen under a different program, known as an employee stock purchase plan (ESPP). ESPP stock transfers are recorded on IRS Form 3922.

The due date for all employers to issue IRS Form 3921 to their employees is January 31 of the calendar year following the exercise of ISOs. This includes any former employee who exercised their stock options after leaving the employer.

No. As with most information returns, it is a good idea to retain your Form 3921 in your tax records. However, the IRS does not require you to file this form with your tax return.

If the sale of company stock meets the criteria for qualifying disposition, and the taxpayer is not subject to AMT, then the employee will pay taxes only on the capital gain. The capital gain is the difference between the strike price and the sales price.

Because a qualifying disposition requires the employee to hold the stock for more than 1 year, the employee will pay tax on the capital gain at preferential long-term capital gains rates.

Where can I find a copy of IRS Form 3921?

As with most official forms, you can find a copy of Form 3921 on the IRS website. For informational purposes, a copy of the form is also available below.