IRS Form 3922 Instructions

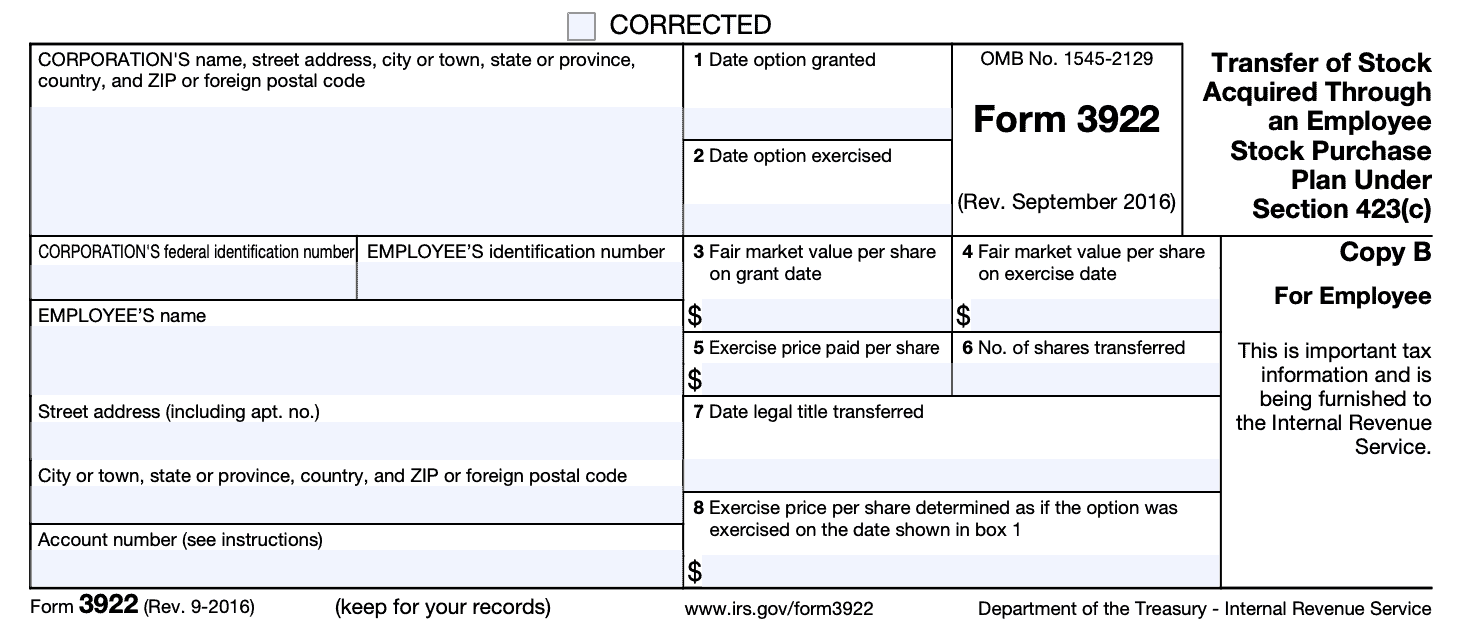

If you participate in an employee stock purchase plan, you probably will receive IRS Form 3922 from your employer at the end of the tax year.

This article will walk you through IRS Form 3922 so you can better understand the tax impact to your situation. Let’s start with step by step guidance on what you’ll find on Form 3922.

Table of contents

What information does IRS Form 3922 give me?

Let’s walk through this informational form step by step, so you can understand what to expect.

Top

At the top of the form, there is a box marked, “Corrected (if checked).” If your employer must refile a revised version of the form, this should be checked.

Left side

The left side of the form contains the company’s contact information, such as:

- Name

- Address

- City & State

- Zip code

It also contains the company’s taxpayer identification number, as well as the employee’s. Pursuant to Treasury Regulations section 301.6109-4, all filers of this form may truncate a recipient’s identification number, including:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN), or

- Employer identification number (EIN) on payee statement

Truncation is not allowed on any documents the filer files with the IRS.

Unlike IRS Form 3921, there are no additional information fields for a transfer agent. You’ll want to review this form to make sure everything is correct.

You may also see the account number filled in. The IRS requires employers to complete this field if there are multiple accounts for the same employee. Otherwise, the IRS suggests that employers complete the field as a best practice.

Box 1: Date option granted

In this field, you’ll find the date of grant. This isn’t the date that you exercised the option to purchase stock. This is the date that the company granted the option to you for you to purchase stock at a discounted price.

Box 2: Date option exercised

This date marks the exercise of the option itself. In other words, this represents the purchase date of the company stock you bought during the year.

Box 3: Fair market value per share on grant date

This is the fair market value of a share of stock on the date you were first able to participate in the program.

Box 4: Fair market value per share on exercise date

This box contains the fair market value of the stock on the date of exercise, reported as price per share.

Box 5: Exercise price paid per share

Shows the purchase price paid per share on the date you purchased the stock.

The difference between the fair market value of the shares and the exercise price is known as the spread.

Example: The stock’s fair market value on the date of exercise was $70 per share. However, you’re eligible to purchase shares of company stock at a 10% discount under the employee purchase plan, or $63 per share. The spread is $7 per share ($70 – $63).

Box 6: Number of shares transferred

Under Box 6, you’ll find the number of shares transferred to you after you purchased the company’s stock.

Example: Using the previous example, let’s imagine your purchase of ESPP shares was for 200 shares. The total spread is $1,400 ($7 per share times 200 company shares).

Box 7: Date legal title transferred

Shows the date legal title of the shares was first transferred by you. In other words, the first date in which you received shares of the company stock.

Box 8: Exercise price per share determined as if the option was exercised on the date shown in Box 1

If the exercise price per share was not fixed or determinable on the date entered in Box 1, Box 8 shows the exercise price per share determined as if the option was exercised on the date in Box 1.

If the exercise price per share was fixed or determinable on the date shown in Box 1, then this box will be blank.

Who files IRS Form 3922?

According to the Internal Revenue Service, all employers must file IRS Form 3922 for each calendar year that the company transfers any shares of stock pursuant to an employee’s ESPP purchases during the year.

There are 3 copies of Form 3922, which the employer must file. Each copy goes to a different recipient:

- Copy A: Internal Revenue Service Center where the company files its tax return.

- Copy B: Employee

- Copy C: Company retains for corporate records

Exception: The IRS does not require the company to issue IRS Form 3922 to an employee under the following circumstances:

- The employee is a nonresident alien

- The company was not required to provide Form W-2 to the employee from the time between the first day of the calendar year of the grant date and the last day of the calendar year in which the employee transferred legal title to shares of stock under the program.

Filing IRS Form 3922

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Frequently asked questions

Below are some frequently asked questions about employee stock purchase plans and Form 3922.

IRS Form 3922, Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c), reports specific details about the transfer of stock due to participation in an employee stock purchase plan, or ESPP.

The due date for all employers to issue IRS Form 3922 to their employees is January 31 of the calendar year following the first transfers of stock under the stock purchase program.

No. This form is provided to employees for informational purposes. As with most information returns, it is a good idea to retain your Form 3922 in your tax records. However, the IRS does not require you to file this form with your tax return.

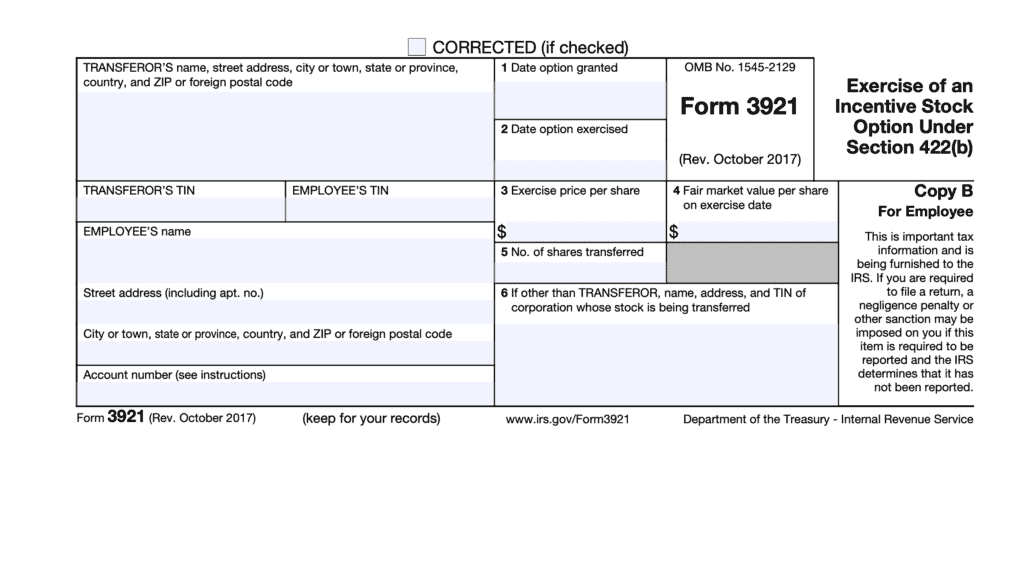

No. Incentive stock options (ISOs) happen under a different program, governed under IRC Section 422(b). Your employer should report the exercise of ISOs on IRS Form 3921.

Section 423(c) is the part of the Internal Revenue Code that governs taxation of ESPP stock transfers at a discounted price to the fair market value of the company stock.

Each employer’s ESPP plan has its own rules. However, the tax code does mandate certain requirements.

There are three requirements according to the tax code:

-The ESPP must be available to all employees, with certain exceptions

-All employees must have the same rights under the ESPP

-The ESPP’s stock discount cannot exceed 15%.

Generally, A qualifying ESPP plan must be available to all employees, except for:

-Employees who have been with the company for less than 2 years

-Part-time employees who work less than 20 hours per week, or 5 months in any calendar year

-Highly compensated employees, as defined in IRC Section 414(g)

No employee may purchase more than $25,000 in company stock under a qualifying ESPP within a calendar year.

Generally, the limit is 5 years from the date the option was first granted.

Under Section 423(c), under no circumstances may a company’s ESPP allow an employee to purchase company stock at a discount greater than 15% of the fair market value of such share at the time such option was granted.

Any further discount is considered taxable compensation to the employee, and may be subject to income tax.

Where can I find a copy of IRS Form 3922?

As with most official forms, you can find a copy of Form 3922 on the IRS website. For informational purposes, a copy of the form is also available below in PDF format.