IRS Form 4137 Instructions

The federal government requires all taxpayers to declare income from all sources. Tip workers face the additional step of declaring their income to their employer, then paying taxes on that declared income. This guide to IRS Form 4137 will help you understand:

- When you must file this tax form

- Penalties for not reporting tip income on Form 4137

- How to calculate your Social Security and Medicare taxes for unreported tips that you did not declare to your employer

Let’s start with a walkthrough on how to complete this tax form.

Table of contents

How do I complete IRS Form 4137?

This one-page form is fairly straightforward. Nevertheless, we’ll walk through it, step by step. Once complete, include this form with your federal income tax return (IRS Form 1040, IRS Form 1040-SR, or IRS Form 1040-NR).

Let’s start at the top, with Line 1.

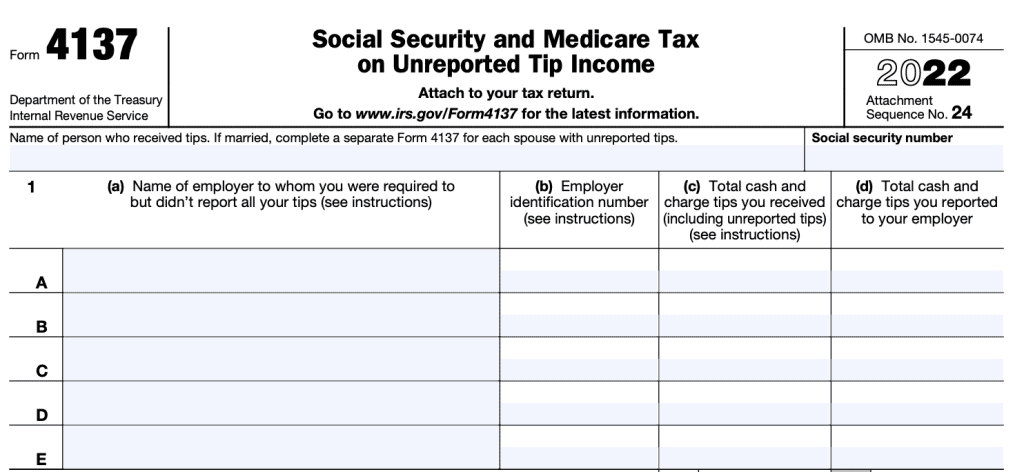

Line 1

You must complete one row for each employer that you worked for in the tax year. If you worked for more than 5 employers, you may attach an additional statement that provides the requested Line 1 information in a similar format.

For each employer, you should provide the following information:

Column (a): Name of employer

This should reflect your employer’s name as seen on your Form W-2.

Column (b): Employer identification number (EIN)

Either report your employer’s EIN as stated on Form W-2, or write “applied for,” if there is no EIN.

Column (c): Total cash and charge tips you received, and Column (d) Total cash and charge tips you reported

For Column (c) and Column (d), you should report the following:

- Total tips you reported to your employer on time. This includes tips you reported, by the 10th day of the month following the month you received them.

- For example, tips you received in December 2021 that you reported to your employer after December 31, 2021, but by January 10, 2022, are considered income in 2022 and should be included on your 2022 Form W-2 and reported on Form 4137, Line 1. Report these tips in column (d).

- Tips that you received in December 2022, but reported by January 10, 2023, should be included on 2023’s Form W-2 and reported on Form 4137 in 2023.

- Tips you didn’t report to your employer on time. Report these tips in column (d).

- For example, tips you received in December 2022 that you reported to your employer after January 10, 2023, are considered income in 2022 because you didn’t report them to your employer on time.

- Tips you didn’t report at all

- This includes allocated tips shown in Box 8 on your Form(s) W-2, unless you can prove that your unreported tips are less than the amount in Box 8.

- Report these tips in column (c).

- Tips that you were not required to report to your employer

- Because they totaled less than $20 during the calendar month.

- Report these in column (c)

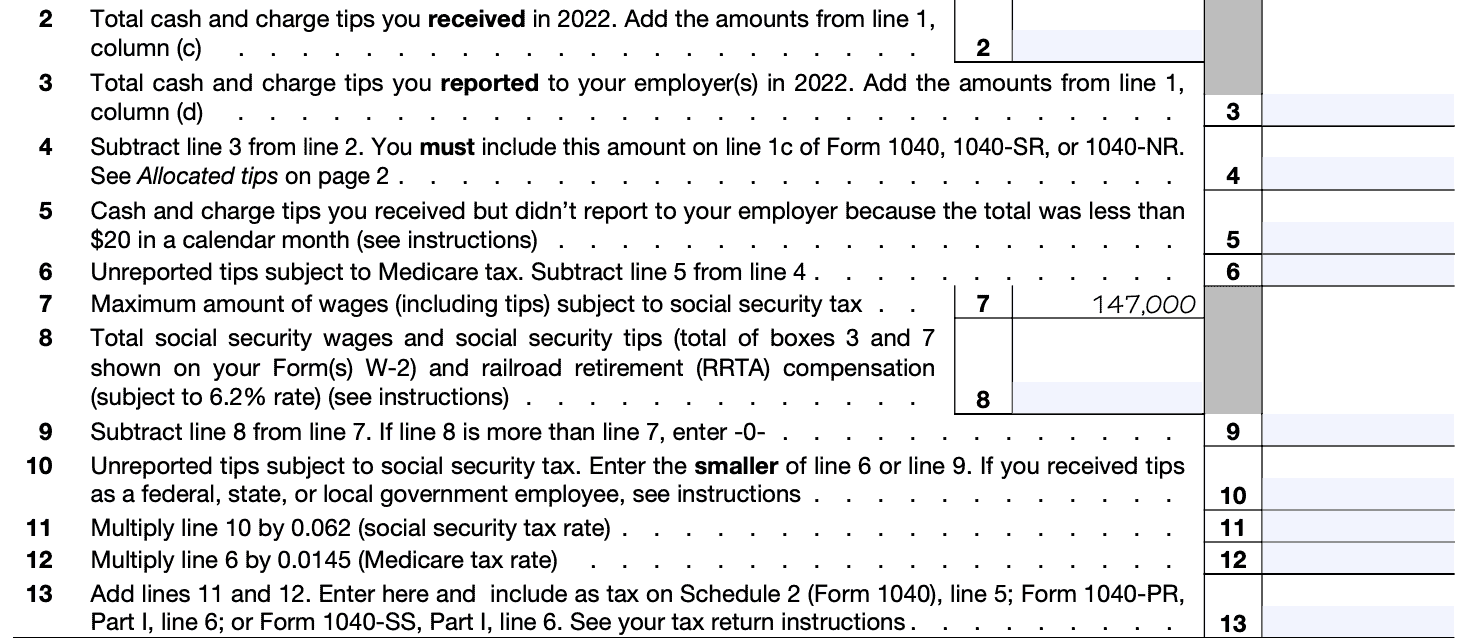

Line 2: Total cash and charge tips received

If you have more than 5 employers, you may have provided additional information on a separate page. However, use only 1 Form 4137 to complete Lines 2-13. When carrying amounts from Line 1, be sure to include similar information from additional sheets as required.

Total the amounts from Line 1, Column (c), and similar information from other pages as applicable.

Line 3: Total cash and charge tips reported

Total the amounts from Line 1, Column (d) and similar information from other pages as applicable.

Line 4

Subtract Line 3 from Line 2. Include this amount on Line 1c of Form 1040, 1040-SR, or 1040-NR, as applicable. This includes allocated tips reported in Box 8 of your Forms W-2.

Line 5: Cash and charge tips less than $20

Enter only the cash or charge tips that you were not required to report because the total was less than $20 in a month. You do not need to pay FICA taxes on these tips.

Line 6: Unreported tips subject to Medicare tax

Subtract Line 5 from Line 4. This calculates the amount of unreported tips that you must still pay Medicare taxes on.

If you must file IRS Form 8959 to calculate the additional Medicare tax, include this number on Line 2.

Line 7: Maximum wages subject to Social Security tax

For 2022, this number is $147,000. For 2023, this number is $160,200.

Line 8: Total Social Security wages and Social Security tips

This should be the total of Boxes 3 and 7 on your Form(s) W-2 and RRTA compensation, subject to Social Security taxes. For RRTA compensation, do not include a number higher than the amount in Line 7.

Line 9

Subtract Line 8 from Line 7. If this results in a negative number, enter ‘0.’

Line 10: Unreported tips subject to Social Security tax

Enter the smaller of:

- Line 6

- Line 9

If Line 6 includes tips you received for work you did as a federal, state, or local government employee, and your pay was subject only to the 1.45% Medicare tax, subtract the amount of those tips from the Line 6 amount only for the purpose of comparing lines 6 and 9. Don’t reduce the actual entry on Line 6.

Instead, enter “1.45% tips” and the amount you subtracted on the dotted line next to Line 10.

Line 11: Social Security taxes

Multiply Line 10 by the Social Security tax rate of 6.2%.

Line 12: Medicare taxes

Multiply Line 6 by the Medicare tax rate of 1.45%. Do not include any amounts that you might have calculated for the additional Medicare tax.

Line 13: Total FICA taxes

Add Line 11 and Line 12. Enter this number on one of the following, as applicable:

- Filing IRS Form 1040: Schedule 2, Line 5

- Filing IRS Form 1040-SR: Part I, Line 6

- Filing IRS Form 1040-NR: Part I, Line 6

What is IRS Form 4137?

IRS Form 4137, Social Security and Medicare Tax on Unreported Tip Income, helps tip workers calculate Social Security tax and Medicare tax on cash tips that were not reported to their employer. These taxes are also known as FICA taxes (Federal Insurance Contributions Act).

This includes allocated tips that were shown on the employee’s Form W-2, that must be reported as tip income.

What are allocated tips?

Allocated tips are additional tips that your employer has assigned to you, on top of the tips you received during the tax year. This is in addition to the tip income that you’ve already reported. Allocated tips are reported in Box 8 of your Form W-2.

Your employer must allocate tips if:

- You worked in a large food or beverage establishment

- Examples include restaurants, cocktail lounges, or similar establishments

- You received any tips directly from customers, and

- The amount of tips you reported to your employer was less than your share of 8% of food and drink sales.

- Your employer may request a lower rate, subject to IRS approval

Although allocated tips are shown on your Form W-2, they are not included in Box 1, so no FICA taxes are withheld from these tips.

What are FICA taxes?

FICA tax is a U.S. payroll tax that represents the combined Social Security and Medicare taxes. The FICA tax rate is broken into two equal parts: employer responsibility and employee responsibility.

For every dollar that an employee earns, the employee and employer must contribute the same amount, based upon the prevailing tax rates for both Social Security and Medicare.

What is the Social Security tax rate?

The Social Security tax rate is currently 6.2% of the employee’s wages for both the employer and employee, for a combined tax rate of 12.4%.

There is a maximum amount of wages that Social Security taxes apply to, known as the maximum earnings limit or maximum table earnings. This amount, which the SSA adjusts each year for inflation:

- Was $147,000 in 2022

- Is $160,200 for 2023

For each year that an employer reports Social Security earnings, those earnings are posted to that employee’s Social Security record. When that employee becomes eligible for Social Security, their Social Security earnings are calculated based upon their earnings record.

What is the Medicare tax rate?

The Medicare tax rate is currently 1.45% of the employee’s wages for both the employer and employee, for a combined tax rate of 2.9%. Unlike Social Security, there is no ceiling for Medicare tax.

On top of the traditional Medicare tax, there is an additional Medicare tax. This additional tax applies to high earnings with income over a certain threshold:

- $250,000 for married couples filing a joint tax return

- $125,000 for married filing separately

- $200,000 for all other taxpayers

- Single, qualifying surviving spouse, head of household

The additional Medicare tax rate is 0.9% of Medicare wages above the earnings threshold, which is not adjusted for inflation. Your employer does not pay the additional Medicare tax.

Who must file IRS Form 4137?

You must file Form 4137 if:

- You received cash and charge tips of $20 or more in a calendar month and didn’t report all of those tips to your employer.

- Your Form(s) W-2, Box 8, shows allocated tips that you must report as income

Tips that you must report to your employer

You are supposed to report all cash tips over $20 in a calendar month to your employer in a written report, no later than 10 days after the end of the month. This report should include:

- Tips your employer paid to you for charge customers

- Tips you received directly from customers,

- Tips you received from other employees under any tip-sharing arrangement

Railroad Retirement Tax Act (RRTA) employees

RRTA employees should not use Form 4137 to report work that is covered by the RRTA. For railroad retirement compensation purposes, employees should report their tips to their employer.

Penalty for not reporting tips

The IRS may impose a penalty equal to 50% of all payroll taxes due for the unreported tips. This includes:

- Social Security taxes

- Medicare taxes, including the additional Medicare tax

Let’s proceed to the form walkthrough.

Video walkthrough

Watch this informative video to learn more about how to file IRS Form 4137 to report previously unreported tip income for Social Security and Medicare tax purposes.

Frequently asked questions

Allocated tips are additional tips that your employer has assigned to you, on top of the tips you received during the tax year. This is in addition to the tip income that you’ve already reported. Allocated tips are reported in Box 8 of your Form W-2.

The Internal Revenue Service receives information from third parties, such as employers and financial institutions. Using an automated system, the Automated Underreporter (AUR) function compares the information reported by third parties to the information reported on your tax return to identify potential discrepancies.

You must file IRS Form 4137 if you had $20 or more in tip income in any given month that you did not report to your employer, or your Form W-2, Box 8, shows allocated tip income that you must report.

Where can I find IRS Form 4137?

You may find IRS Form 4137 on the IRS website. For your convenience, we’ve enclosed the most current version at the bottom of this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!