IRS Form 4563 Instructions

In the United States, the federal tax system primarily applies to the 50 states and the District of Columbia. When it comes to territories of the United States, like Puerto Rico, the U.S. Virgin Islands, Guam, and American Samoa, different tax rules may apply. In American Samoa, bona fide residents can exclude certain income by filing IRS Form 4563 with their income tax return.

This article will walk you through how those tax rules impact residents of American Samoa. Specifically, we’ll discuss:

- Tax benefits available to bona fide residents of American Samoa

- How residents can use IRS Form 4563 to exclude certain income on their federal income tax return

- Common situations that arise, and how they are treated for tax purposes

Let’s start by going through IRS Form 4563 in more depth.

Contents

Table of contents

How do I complete IRS Form 4563?

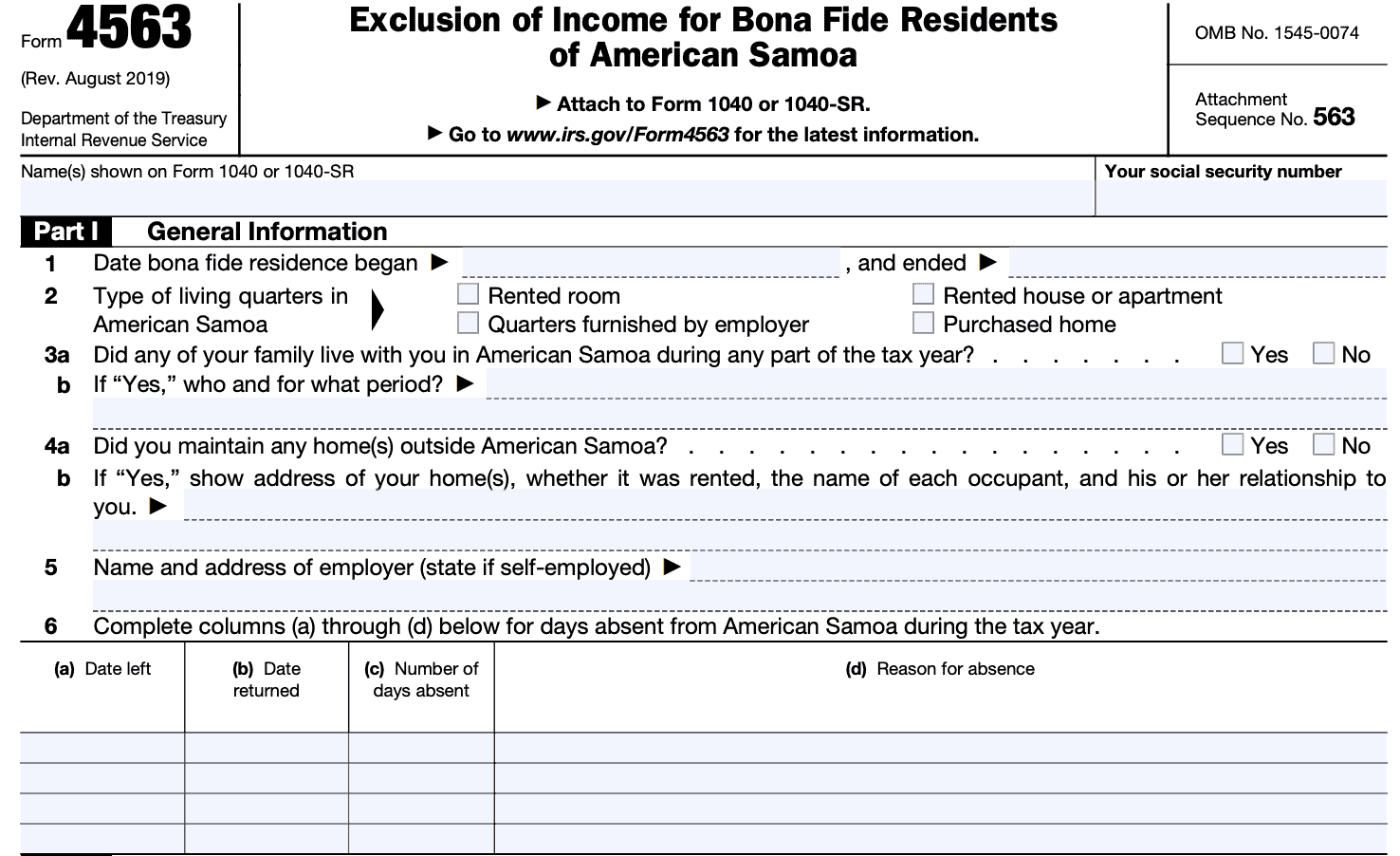

This one-page form is relatively straightforward and simple to complete. We’ll walk through how to complete Form 4563, step by step.

Part I: General Information

In Part I, we’ll simply go through the information fields that the U.S. Internal Revenue Service (IRS) requires to document your residency status.

Line 1: Date bona fide residence began and ended

If you meet the bona fide residence criteria, noted above, list the dates that your bona fide residence began, and ended (if applicable). If the end date is not applicable, you may enter, “Not ended,” in the second field.

Line 2: Type of living quarters in American Samoa

Check the appropriate box:

- Rented room

- Rented house or apartment

- Quarters furnished by employer

- Purchased home

Line 3: Did any of your family live with you in American Samoa during any part of the tax year?

If so, check ‘Yes’ on Line 3a. On Line 3b, list which family member, and the period of time they lived with you.

If not, check ‘No’ on Line 3a and leave Line 3b blank.

Line 4: Did you maintain any home(s) outside American Samoa?

If so, check ‘Yes’ on Line 4a. On Line 4b, list the following:

- Address

- Whether the home was rented

- Name of each occupant, and any relationship, if applicable

If not, check ‘No’ on Line 4a and leave Line 4b blank.

Line 5: Name and address of employer

Self-explanatory. If you are self-employed, state so.

Line 6: Days of absence

For each period of absence, complete columns (a) through (d) and list the following:

- Date you left

- Date you returned

- Number of days absent

- See IRS Publication 570 if you are not sure how to consider a day as present or absent

- Reason for absence

If, in a single day, you are physically present in the United States and American Samoa, the IRS considers you to be present in American Samoa on that day.

If, you are in American Samoa and another U.S. territory in a single day, and American Samoa is your tax home, then the IRS considers you to be present in American Samoa on that day.

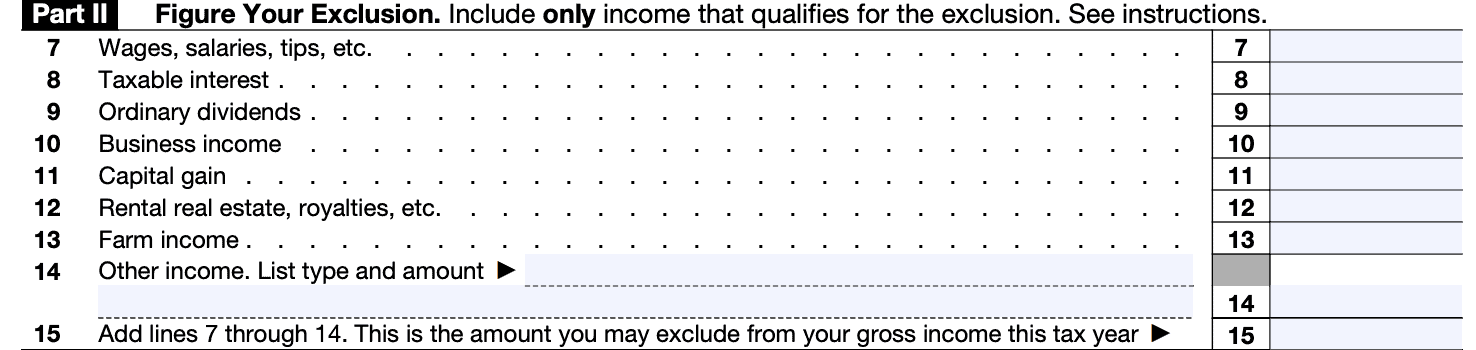

Part II: Figure Your Exclusion

In Part II, we’ll calculate how much you can exclude from your taxable income. In each line, include only the amount of income that was:

- Earned from sources in American Samoa, or

- Effectively connected with the conduct of a trade or business in American Samoa

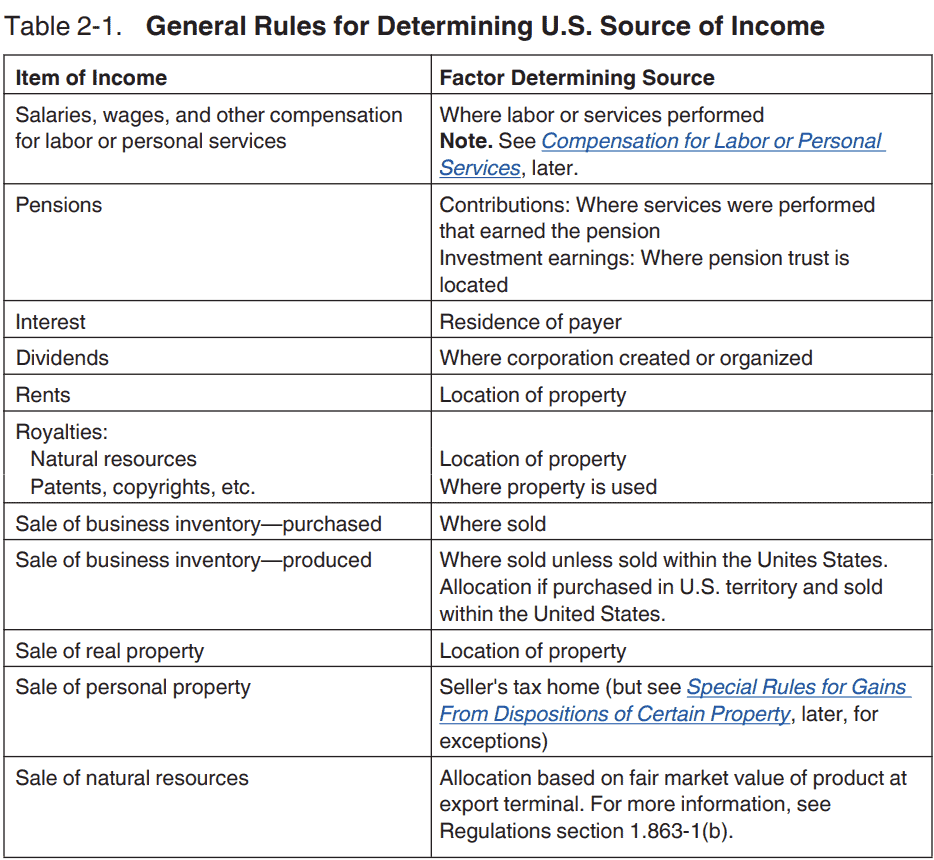

Table 2-1 from IRS Publication 570 gives general rules on how to determine the source of certain types of income.

Line 7: Wages, salaries, tips, etc.

If you worked both in and outside American Samoa, include only wages, salaries, or tips earned while you were in American Samoa.

There is a de minimis exception to this rule. Generally speaking, income from American Samoa does not include compensation for services performed in American Samoa if you:

- Were a U.S. citizen or U.S. resident

- Were not a bona fide resident of American Samoa,

- Were not employed by, or under contract with, an individual, partnership, or corporation engaged in trade or business in American Samoa,

- Temporarily performed services in American Samoa for 90 days or less, and earned less than $3,000 from such services

Line 8: Taxable interest

For this line, the IRS considers the source of interest income to be where the source is located. For example, American Samoan source income includes interest from a certificate of deposit issued by a bank or branch of a U.S. bank in American Samoa.

If you also own more than 10% of the corporation paying interest, there may be additional requirements. Treasury Regulations Section 1.937-2(i) contains more details.

Do not include tax-free interest income, such as that from municipal bonds.

Line 9: Ordinary dividends

The IRS considers the source of dividends to be where the company is located.

Treasury Regulations Section 1.937-2(g) contains additional information for shareholders who own more than 10% of the corporation issuing dividends.

Line 10: Business income

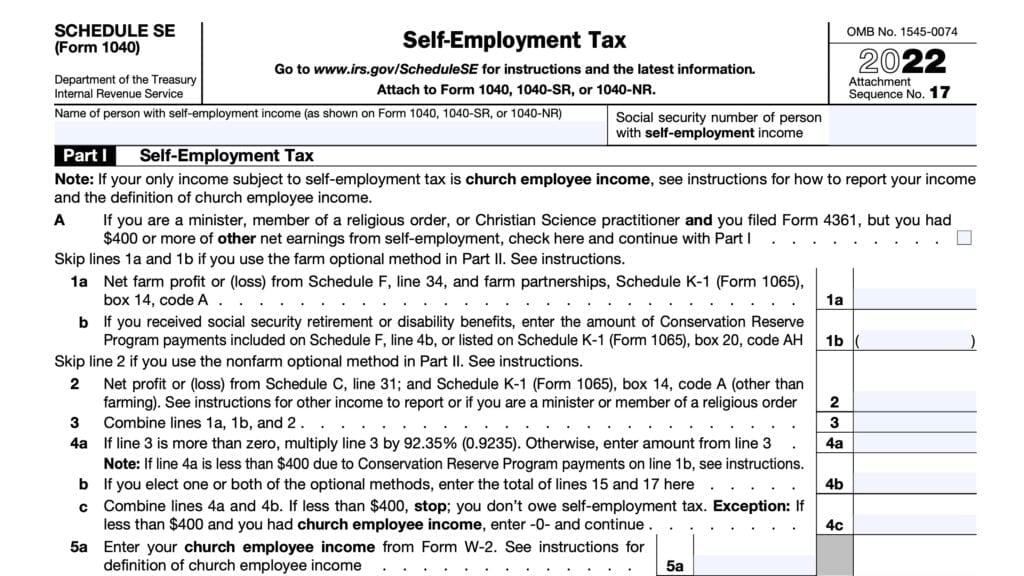

List any income produced by your business that qualifies for exclusion. If you are self-employed and your earnings were $400 or more, you may need to pay self-employment taxes even though you may exclude your net earnings from taxable income.

If you must file a U.S. tax return, you can report your self-employment earnings on Schedule SE of your income tax return.

Line 11: Capital gain

Enter the amount of capital gains connected to the sale of property associated with American Samoa here. Do not include capital gains from the sale of investments or property not associated with the territory.

Line 12: Rental real estate, royalties, etc.

Only include income from rental real estate located in American Samoa.

Line 13: Farm income

Only include income from farms located in American Samoa.

Line 14: Other income

Include income from all sources, so long as they qualify for the exclusion.

Line 15: Total income

Add Lines 7 through 14. Do not include this total, or any of the income numbers leading to this total, to your IRS Form 1040. Instead, attach IRS Form 4563 to your income tax return.

Video walkthrough

Watch this informative video to learn more about claiming your income exclusion on IRS Form 4563.

Requirements as a bona fide resident of American Samoa

We’ll break down the exact requirements that taxpayers must meet to be considered bona fide residents of American Samoa. Let’s start by discussing exactly what that means.

What is a bona fide resident of American Samoa?

Generally speaking, to qualify as a bona fide resident of American Samoa, you must meet 3 criteria:

- Presence test

- You do not have a tax home outside American Samoa, and

- You do not have a closer connection to the United States or to a foreign country than to the relevant territory

What is the presence test?

If you are a U.S. citizen or resident alien, you can satisfy the presence test by meeting one of the 5 qualifying criteria:

- You were present in American Samoa for at least 183 days of the previous tax year

- You were present in American Samoa for at least 549 days during the 3-year period that includes the current tax year and the 2 immediately preceding tax years

- During each year of the 3-year period, you must be present in American Samoa for at least 60 days

- You were present in the United States for no more than 90 days during the tax year.

- You had earned income in the United States of no more than a total of $3,000 and were present for more days in American Samoa than in the United States during the tax year.

- The IRS considers earned income to be compensation for personal services performed, such as wages, salaries, or professional fees

- You had no significant connection to the United States during the tax year

Different rules, such as the substantial presence test, apply to non-resident aliens. IRS Publication 519, U.S. Tax Guide for Aliens, contains more information.

How do I count days of presence for the presence test?

You do not have to be physically present in a territory, such as American Samoa, to meet the IRS criteria for the presence test. IRS Publication 570 allows for the following exceptions:

- Days that you are outside the territory to receive medical care for yourself or one of the following family members:

- Parent

- Spouse

- Child: includes stepchildren, foster children, or adopted children

- Days you are unable to return due to a FEMA-declared disaster or because mandatory evacuation orders are in effect

- Any day (up to 30 days total) in which you are outside American Samoa and the United States

- Only applies if you are present in American Samoa more than you are present in the U.S.

- Does not count for the 60-day minimum presence to meet the 549-day presence test, above

Frequently asked questions

IRS Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, is the tax form used to exclude earnings from gross income when filing their federal tax return. A bona fide resident of American Samoa is generally exempt from U.S. tax on their American Samoa source income.

If you are an active duty of the U.S. Armed Forces, you can only exclude income if you are a bona fide resident of American Samoa. If you maintain residency in another state, you cannot exclude income earned while stationed in American Samoa.

As a military servicemember, if you maintain your status as a resident of American Samoa, your military income is considered sourced in American Samoa under the Servicemembers Civil Relief Act (SCRA).

If you are a bona fide resident of American Samoa, you must file a U.S. tax return if your gross income subject to U.S. income tax equals or exceeds the filing requirement.

Where can I find IRS Form 4563?

You may find this tax form on the IRS website or by downloading the file below.