IRS Form 4952 Instructions

In light of the Tax Cuts and Jobs Act, more and more people are taking the standard deduction on their federal returns than before. If you itemize your deductions on Schedule A of your IRS Form 1040, the investment interest expense deduction might be an overlooked opportunity for tax savings.

This article will walk you through IRS Form 4952 so you can better understand:

- How you can identify investment interest expense as one of your tax deductions

- What deductions you can take (and which you cannot take) on Form 4952

- How to complete IRS Form 4952 on your tax return

Let’s start with discussing what investment interest expense is.

Table of contents

How do I complete Form 4952?

IRS Form 4952 contains 3 parts:

- Part I: Total Investment Interest Expense

- Part II: Net Investment Income

- Part III: Investment Interest Expense Deduction

We’ll walk through each part, one step at a time.

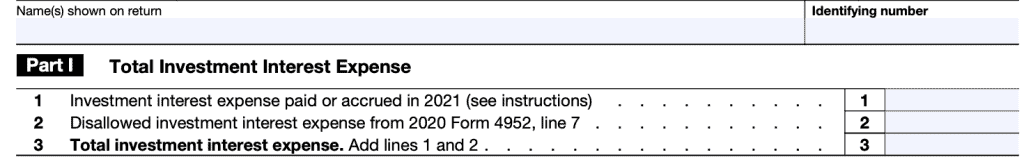

Part I: Total Investment Interest Expense

In Part I, you’ll note the total amount of investment interest expense, either paid in the current year, or carried forward from a previous tax year.

Top: Taxpayer name and ID number

Enter your name and ID number. Most tax preparation software will auto-populate this part of the tax form for you.

Line 1: Investment interest expense paid or accrued in current year

Enter the actual investment interest expense paid or accrued, regardless of when you assumed the debt. This includes:

- Investment interest expense reported on Schedule K-1 from a partnership or S-corporation

- Amortization of bond premium on taxable bonds purchased after October 22, 1986, but before January 1, 1988. Unless you decided to offset amortizable bond premium against the interest payments on the bond

Investment interest expense does not include the items mentioned above:

- Personal interest

- Passive income activities

- Capitalized interest expense

- Interest expense related to tax-free interest income

- Interest paid on indebtedness regarding life insurance, endowment, or annuity contracts issued after June 8, 1997

Line 2: Disallowed investment interest expense from prior year

If you have any disallowed investment interest from the prior tax year, enter it here. You’ll find that on Line 7 of the previous year’s Form 4952.

Line 3: Total

Add lines 1 and 2.

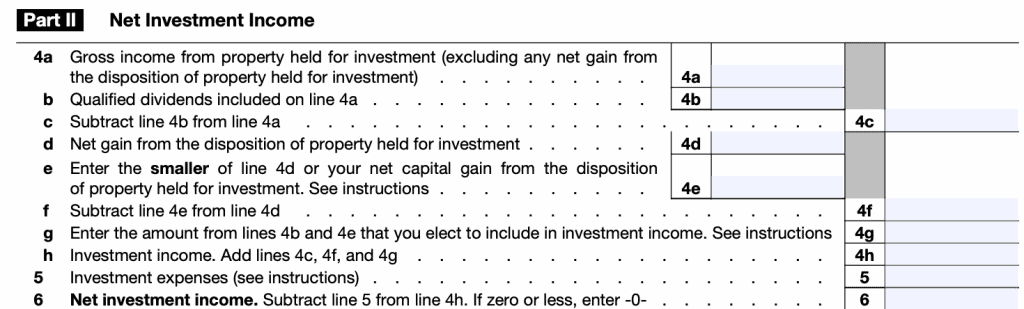

Part II: Net Investment Income

In Part II, you’ll calculate the total amount of investment income eligible to be offset against your interest expense.

Line 4a: Gross income from property held for investment

In Line 4a, you’ll include gross income from property held for investment. This includes:

- Interest income

- Ordinary dividends (except Alaska Permanent Fund dividends)

- Annuity income

- Royalties

- Investment income reported on Schedule K-1 from a partnership or S-corporation

- Net investment income from an estate or trust

- Net passive income from a passive activity of a publicly traded partnership

- Child’s income (if filing Form 8814-Parents’ Election to Report Child’s Interest and Dividends)

Parents’ Election To Report

Child’s Interest and Dividends

Do not include any amount of net gain from the disposition of investment property. You will report this on Line 4d.

Line 4b: Qualified dividends included on Line 4a

You’ll see this information on IRS Form 1099, Line 1b. If you choose to include qualified dividends in net investment income to qualify for the expense deduction, you can add them back in Line 4g.

Line 4c: Subtract Line 4b from Line 4a

Self-explanatory.

Line 4d: Net gain from the disposition of investment property

For Line 4d, net gain is the excess (if any) of your total gains over total losses from the disposition of investment property. To figure this amount, you must include:

- Capital gain distributions from mutual funds

- Capital loss carryovers

Net gain from the disposition of property held for investment is the

excess, if any, of your total gains over your total losses from the

disposition of property held for investment. When figuring this amount,

include capital gain distributions from mutual funds and capital loss

carryovers.

Line 4e: Enter the smaller of Line 4d or net capital gain

Net capital gain is the excess (if any) of any long-term capital gain over your net short-term capital loss from the sale or disposition of investment property.

You’ll either carry forward Line 4d, or input the net capital gain, whichever is smaller.

Line 4f: Subtract Line 4e from Line 4d

Self-explanatory.

Line 4g: Enter the amount from Lines 4b and 4e that you want to include in investment income.

As previously mentioned, qualified dividends and net capital gain from disposition of investment property are generally excluded from investment income.

In Line 4g, you can choose how much, if any, you would like to include in investment income. This amount cannot exceed the sum of Lines 4b and 4e. You’ll need to enter this amount on one of the following (whichever applies):

- Schedule D Tax Worksheet, Line 3

- Schedule D (Form 1041), Line 25

- Qualified Dividends Tax Worksheet, Line 3, in the instructions for Form 1041

Taxpayers must make this election on a timely filed return, including extensions. However, if you timely filed your return without the election, you can make the election on an amended tax return filed within 6 months of the due date. Simply write “Filed pursuant to Section 301.9100-2” on the amended tax return and filed it at the same location as the original return.

Line 4h: Investment income

Add Lines 4c, 4f, and 4g. This represents your total investment income.

Line 5: Investment expenses

These are allowed deductions, besides interest expense, that are directly connected with investment income. The IRS includes depreciation or depletion allowed on assets that produce investment income as two such examples.

Include investment expenses that are:

- Incurred directly by you

- Reported to you on Schedule K-1 from a partnership or S-corporation, only if you are allowed a deduction for the expense on your return

Do not include miscellaneous itemized deductions. These deductions are not allowed in tax years that begin after 2017 or before 2026.

Line 6: Net investment income

Subtract Line 5 from Line 4h. If this number is negative, enter zero.

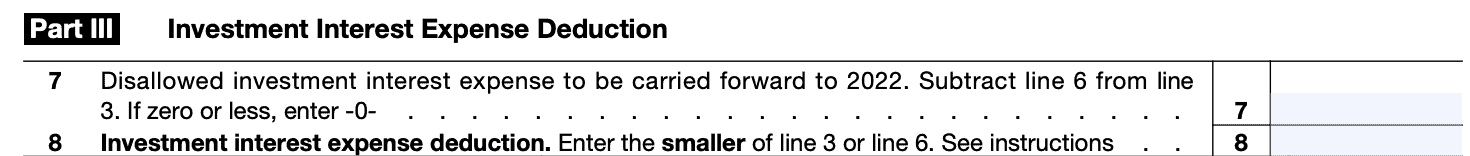

Part III: Investment Interest Expense Deduction

In Part III, we’ll see how much of your investment expense deduction can be taken.

Line 7: Disallowed investment interest expense to be carried forward

Subtract Line 6 from Line 3. If zero or less, enter zero.

Line 8: Investment interest expense deduction

Enter the smaller of Line 3 or Line 6. Generally, you’ll include this amount on Schedule A, Line 9, unless:

- Part of the expense is attributable to royalties (Schedule E)

- You’re filing a return on behalf of an estate or trust. Estates and trusts report on Form 1041, Line 10

- Any of your deductible investment interest expense is attributable to an activity for which you are not at risk. You’ll need to use Form 6198 to calculate your deductible investment interest expense

- You might be subject to alternative minimum tax (AMT). This may be an adjustment. See Form 6251 for details.

years.

What investment interest expenses qualify for a tax deduction?

It might be easier to list the types of interest expenses that do not qualify for a tax deduction, under the tax code. This would include:

- Personal interest, including qualified residence interest (like your home mortgage)

- Interest expense attributable to a passive activity. This would include:

- Any trade in which you do not materially participate

- Rental activity (although interest expenses on rental property may be deductible on Schedule C or Schedule E, depending on your tax situation

- Capitalized interest expense, such as construction interest under Section 263A

- Interest expense related to tax-exempt interest income.

- For example, margin interest paid on your stocks and mutual funds may be deductible, but interest paid on tax-exempt income from municipal bonds is not.

- Interest expense on indebtedness regarding life insurance, endowment, or annuity contracts issued after June 8, 1997. This applies even if the proceeds were used to buy investment property.

Even if your expenses do qualify for a tax deduction, there are other rules that apply. Specifically, there is a limit to the amount you can deduct in the current year.

Limitation on deducting investment interest expense

The amount of investment interest expense that you can deduct in the current year is limited to the amount of your investment income.

Let’s imagine your entire investment interest expense for the current year is $5,000. However, this was the year that you decided to do some tax loss harvesting to qualify for a lower tax rate and lower your tax bill. Because of this, your investing activity resulted in net losses for the year.

This means that your investment interest expense is disallowed for the current tax year. However, you may carry forward your interest expense to a future tax year.

In addition to this limitation, there is another distinction that taxpayers should understand.

Treatment of qualified dividends and capital gains

Generally speaking, qualified dividends, capital gains distributions, and the net gain from disposition of property held for investment is not included as investment income. However, a taxpayer may choose to include qualified dividends and net capital gain on IRS Form 4952 for the purpose of deducting interest expense. With stipulations.

Including qualified dividends as investment income

For purposes of IRS Form 4952, qualified dividend income is not considered investment income. A taxpayer may elect to include any amount of qualified dividends as investment income. However, that taxpayer must lower the amount of qualified dividends eligible for lower capital gains tax rates.

Note: This has no impact on ordinary dividends, which are taxed as ordinary income.

Including net capital gain as investment income

As with qualified dividends, net capital gain from the disposition of income-producing property is not normally considered investment income. A taxpayer may choose to include any amount of net capital gain for the purpose of deducting investment income interest expense. However, that taxpayer must reduce their net gain eligible for long-term capital gains tax treatment by the same amount.

Note: This has no impact on short-term capital gains, which are taxed at the taxpayer’s ordinary tax rate.

How can I deduct investment interest expense?

Qualifying investment interest expenses may be calculated on IRS Form 4952-Investment Interest Expense Deduction. Generally speaking, taxpayers must itemize any deductible investment expenses on Schedule A of their individual income tax return. However, certain exceptions exist:

- Schedule E: Taxpayers with interest expense attributable to royalties will report that expense on Schedule E

- Estates and trusts: Estates and trusts will report their interest expense on Line 10, Form 1041

- At-risk limitations: If any amount of your deductible investment interest expense is attributable to an activity for which you are not at risk, you must use IRS Form 6198, At-Risk Limitations, to figure deductible investment interest expense.

- AMT: Deductible investment interest expense may be an adjustment for calculating alternative minimum tax. See IRS Form 6251, Alternative Minimum Tax-Individuals, for more details.

Video walkthrough

Watch this instructional video to learn more about deducting investment interest expenses on Form 4952.

Frequently asked questions

Taxpayers who wish to claim investment interest expenses as a tax deduction generally must file Form 4952 with their income tax return. There are exceptions. Individuals do not need to file Form 4952 if they meet all of the following tests:

-Investment income from interest and ordinary dividends minus qualified dividends is more than the investment interest expense.

-No other deductible investment expenses

-No carryover of disallowed investment interest expense from the prior year

In other words, if it appears that you probably wouldn’t receive a deduction for investment interest expenses, you don’t need to file this form.

Generally speaking, investment interest is interest that a taxpayer pays to acquire investment property or assets for the production of investment income. The Internal Revenue Service does place certain restrictions on what interest expenses qualify for a deduction, and what you cannot deduct.

For tax purposes, investment property includes property that produces the following types of income not derived in the ordinary course of a trade or business:

-Interest income

-Dividend income

-Annuity income

-Royalties

Investment property also includes property that produces a gain or loss from the sale or trade. This property can be income-producing or held for investment, as long as it is not an interest in a passive activity.

Investment property also includes an interest in a trade or business activity in which the taxpayer did not materially participate (other than a passive activity).

Vacant land that a taxpayer purchased for investment purchases qualifies as investment property. Interest payments on the acquisition of this property could be eligible for investment interest deduction, as long as the other rules are met.

In contrast, your primary residence is not considered investment property. Your home mortgage is an allowable deduction on Schedule A. However, it would not be considered as an investment interest expense.

Stocks and mutual funds bought through your brokerage firm in a margin account are another example of investment property that might qualify for investment interest expense deduction.

Where can I get a copy of IRS Form 4952?

You can download a copy of the form from the IRS website or by selecting the form below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!