IRS Form 4972 Instructions

Normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. For qualified plans of participants born before January 2, 1936, there exists an opportunity to take a qualified lump-sum distribution, which can result in a lower tax bill. This article will walk you through how to use IRS Form 4972 to:

- Understand whether you are eligible for qualified lump-sum distributions

- How to calculate the tax liability for a qualified lump-sum distribution

Let’s start by getting a better understanding of what a qualified lump-sum distribution actually is.

Table of contents

How do I complete Form 4972?

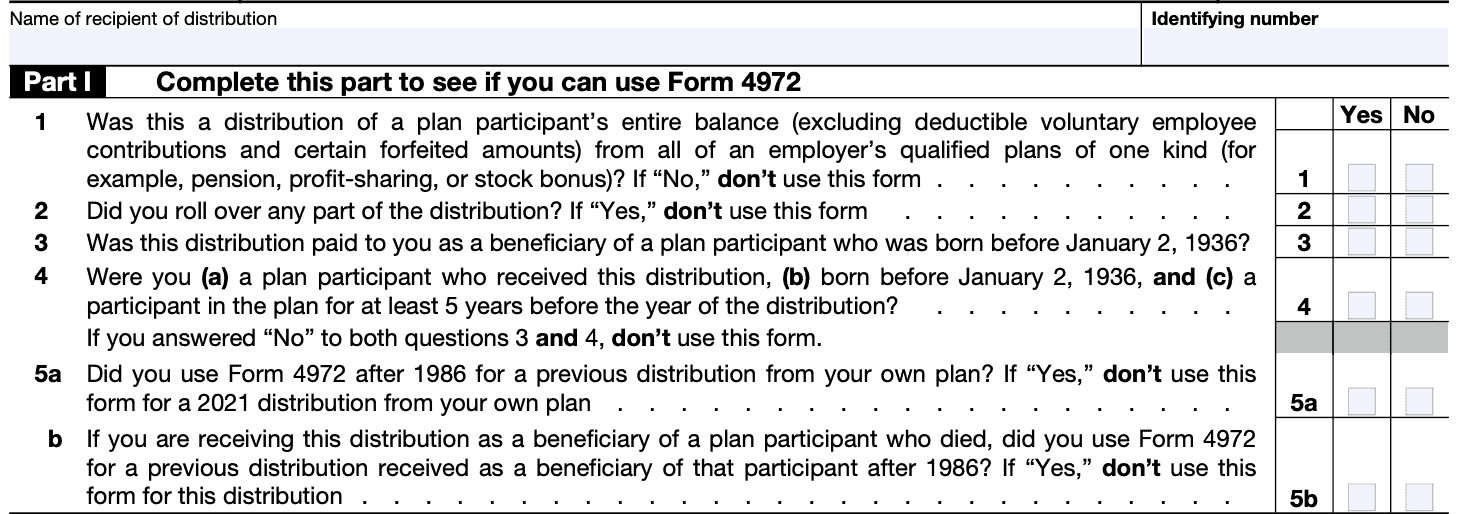

There are three parts to this one-page tax form:

- Part I: Complete this part to see if you can use Form 4972

- Part II: Complete this part to choose the 20% capital gain elections

- Part III: Complete this part to choose the 10-year tax options

Part I: Complete this part to see if you can use Form 4972

Part I contains several screening questions. Each screening question

Just above part 1, enter the:

- Name of the recipient

- Identifying number of the recipient

Line 1: Was this a complete distribution of a plan participant’s entire balance?

This excludes deductible voluntary employee contributions and certain forfeited amounts. If the answer is “No,” you cannot use this form.

Line 2: Did you roll over any part of the distribution?

If “Yes,” you cannot use this form.

Line 3: Was this distribution paid to you as a beneficiary of a plan participant born before January 2, 1936?

If you answer ‘No’ to Line 3, then you must answer ‘Yes’ to Line 4 in order to use this form.

Line 4: Were you a plan participant?

To answer ‘Yes’ to Line 4, you must have been a plan participant who:

- Received the distribution

- Was born before January 2, 1936, AND

- Participated in the plan for at least 5 years before the year of distribution

If you answered ‘No’ to both Lines 3 and 4, then you cannot use this form.

Line 5a: Did you use Form 4972 after 1986 for a previous distribution from your own plan?

If you took a distribution in a prior year and answer ‘Yes,’ you cannot use this form.

Line 5b: If you received this distribution as a beneficiary of a plan participant who died, did you use Form 4972 after 1986 for a previous distribution?

If ‘Yes,’ you cannot use this form.

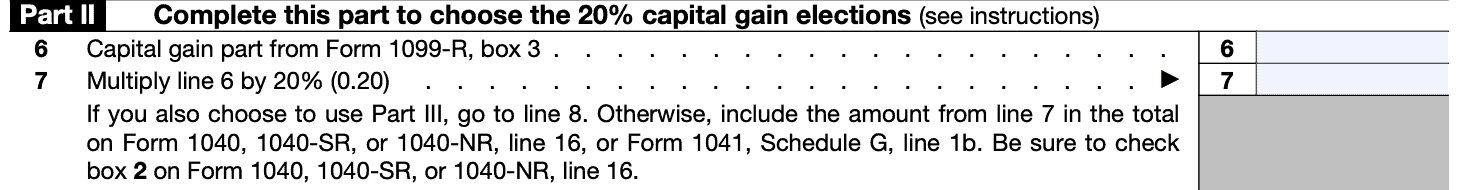

Part II: Complete this part to choose the 20% capital gain elections

In Part II, you will calculate the amount of your distribution that qualifies for capital gain treatment. For that, you will need your 1099-R tax form available.

If you are not making the 20% capital gain election, or if your distribution does not contain any capital gains, then you do not need to complete Part II. Simply leave this line blank and move ahead to Line 8.

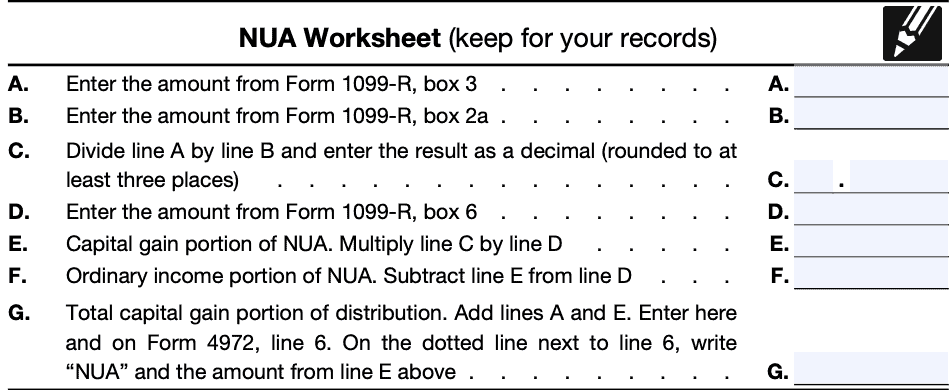

Net unrealized appreciation

The Internal Revenue Service gives specific guidance about net unrealized appreciation (NUA). If you include NUA in your taxable income, you’ll complete an NUA worksheet to calculate the number that you should enter in Line 6.

The IRS instructions contain a copy of this worksheet, outlined below. When filing Form 4972, you do not need to include the NUA worksheet. This is strictly for your records.

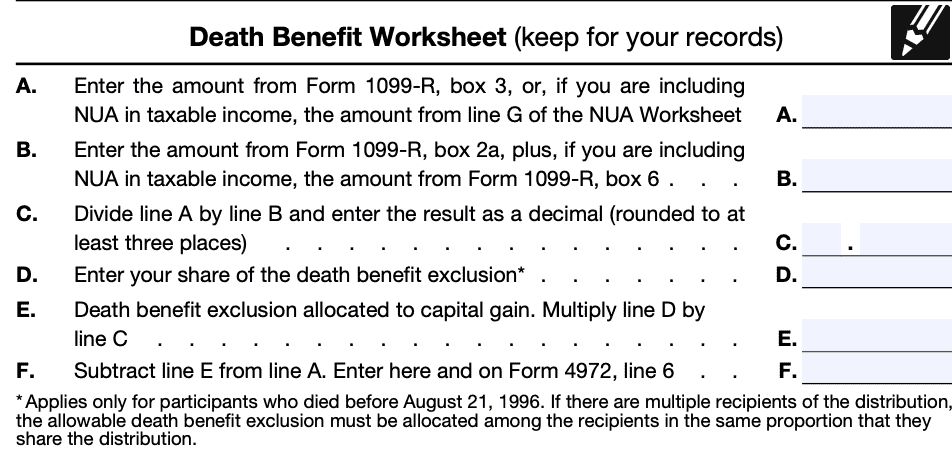

Death benefit amount

If any estate tax was paid on the lump-sum distribution, the capital gain amount must be reduced accordingly. Even if you do not take the death benefit exclusion, you must complete this worksheet, through at least Line C. There is a death benefit worksheet to help calculate the adjustment.

As with the NUA worksheet, you do not need to file the death benefit worksheet with the tax return.

Line 6: Capital gain part from Form 1099-R

This may require adjustments as calculated in the NUA worksheet or death benefit worksheet, mentioned above.

If not, you’ll find this amount in Box 3. This is the capital gain amount.

Line 7: Multiply Line 6 by 20%

This calculation will give you the amount of capital gains tax on your distribution. Should you choose to complete Part III, below, then continue to Line 8.

If you do not complete Part III, then enter this number into one of the following:

- Line 7 on Form 1040

- Line 7 on Form 1040-SR

- Line 16 on Form 1040-NR

- Schedule G, Line 1b, on Form 1041

When filing a Form 1040, be sure to check Box 2.

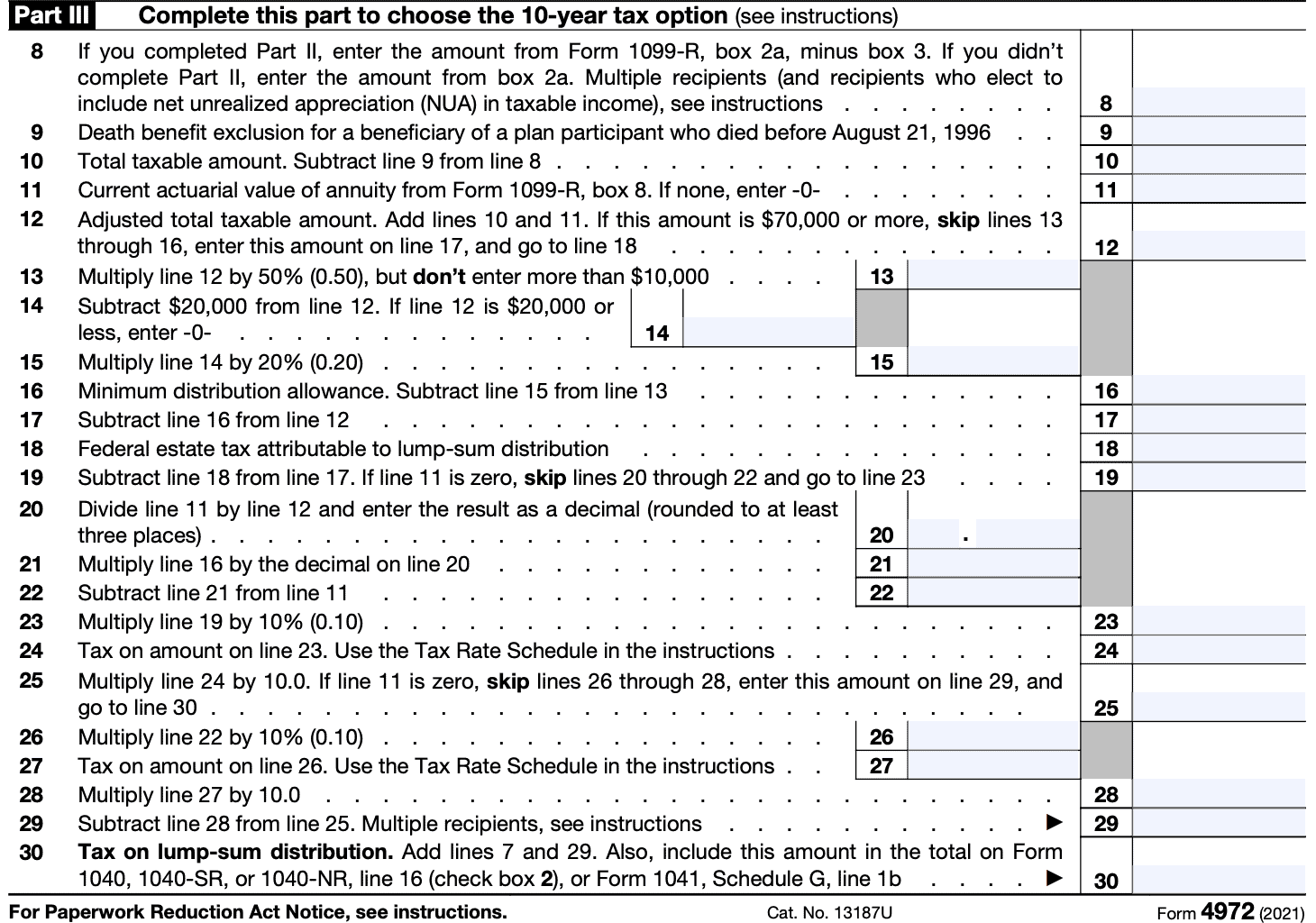

Part III: Complete this part to choose the 10-year tax option

Line 8

If you complete Part II, enter the amount from Form 1099-R, Box 2a, minus Box 3. If you did not complete Part II, simply enter the amount from Box 2a.

The IRS website contains detailed instructions for multiple recipients or recipients who include NUA in taxable income.

Line 9: Death benefit exclusion

If you received the distribution because of the participant’s death and the participant died before August 21, 1996, you may be eligible to exclude up to $5,000 of the lump sum from your gross income.

This exclusion applies to beneficiaries and estates of:

- Common-law employees

- Self-employed individuals

- Shareholder-employees who owned more than 2% of the stock of an S-corporation

If you made a 20% capital gain election, enter the amount from Line D of the death benefit worksheet minus Line E from that worksheet.

Line 10: Total taxable amount

Subtract Line 9 from Line 8.

Line 11: Actuarial value of annuity from Form 1099-R

Enter the value in Box 8. If blank, enter ‘0’ then go to Line 12.

Line 12: Adjusted total taxable amount

Add Lines 10 and 11.

If this number is $70,000 or more, skip Lines 13-16, enter this number on Line 17, and go to Line 18.

If this number is less than $70,000, go to Line 13.

Line 13: Multiply Line 12 by 50%

Do not enter more than $10,000.

Line 14: Subtract $20,000 from Line 12

If Line 12 is $20,000 or less, enter ‘0.’

Line 15: Multiply Line 14 by 20%

Self-explanatory

Line 16: Minimum distribution allowance

Subtract Line 15 from Line 13.

Line 17: Subtract Line 16 from Line 12.

Self-explanatory

Line 18: Federal estate tax attributable to lump-sum distribution

You should get this amount from the deceased’s estate administrator. If there is no estate tax, or if you are the plan participant, this line should be blank.

Line 19: Subtract Line 18 from Line 17

If Line 11 is zero, skip Lines 20-22 and go to Line 23. Otherwise, go to Line 20.

Line 20: Divide Line 11 by Line 12

Enter the result as a decimal, rounded to at least 3 places.

Line 21: Multiply Line 16 by the decimal in Line 20.

Self-explanatory

Line 22: Subtract Line 21 from Line 11

Self-explanatory

Line 23: Multiply Line 19 by 10%

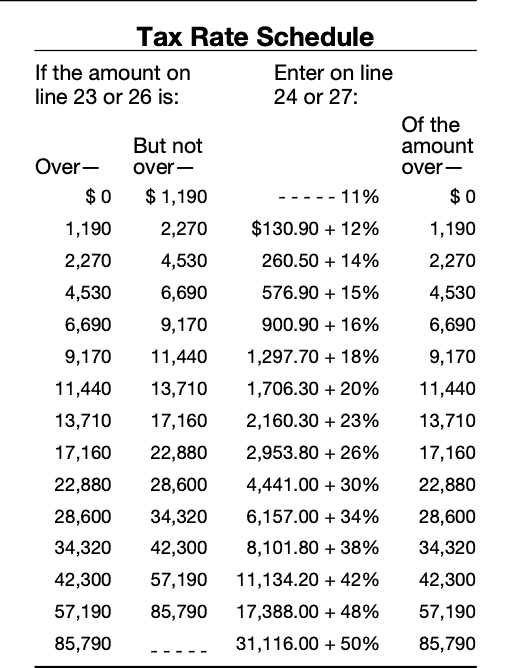

Line 24: Total tax on the amount in Line 23

The Form 4972 instructions contain a special tax rate schedule for this calculation.

Line 25: Multiply Line 24 by 10

If Line 11 equals zero, skip Lines 26-28, enter this number on Line 29, and go to Line 30.

Line 26: Multiply Line 22 by 10%

Self-explanatory

Line 27: Tax on amount on Line 26

Use the same tax rate schedule that you used for Line 23.

Line 28: Multiply Line 27 by 10.0

Self-explanatory.

Line 29: Subtract Line 28 from Line 25.

There are special instructions for multiple recipients.

Line 30: Tax on lump-sum distribution

Add Lines 7 and 29. Include this amount in the total on:

- Line 16 on Form 1040

- Line 16 on Form 1040-SR

- Line 16 on Form 1040-NR

- Schedule G, Line 1b, on Form 1041

Be sure to check Box 2.

What is a qualified lump-sum distribution?

A qualified lump-sum distribution is a distribution from a qualified plan that meets certain criteria. The distribution must be:

- A complete and total distribution from the plan

- The only lump sum distribution from the plan (certain exceptions exist for elections made before 1986)

- Made from a plan where the participant was born before January 2, 1936. This can be a distribution to an alternate payee or beneficiary of a plan participant.

Qualified lump-sum distributions may qualify for either:

- 20% capital gain election treatment

- 10-year tax option

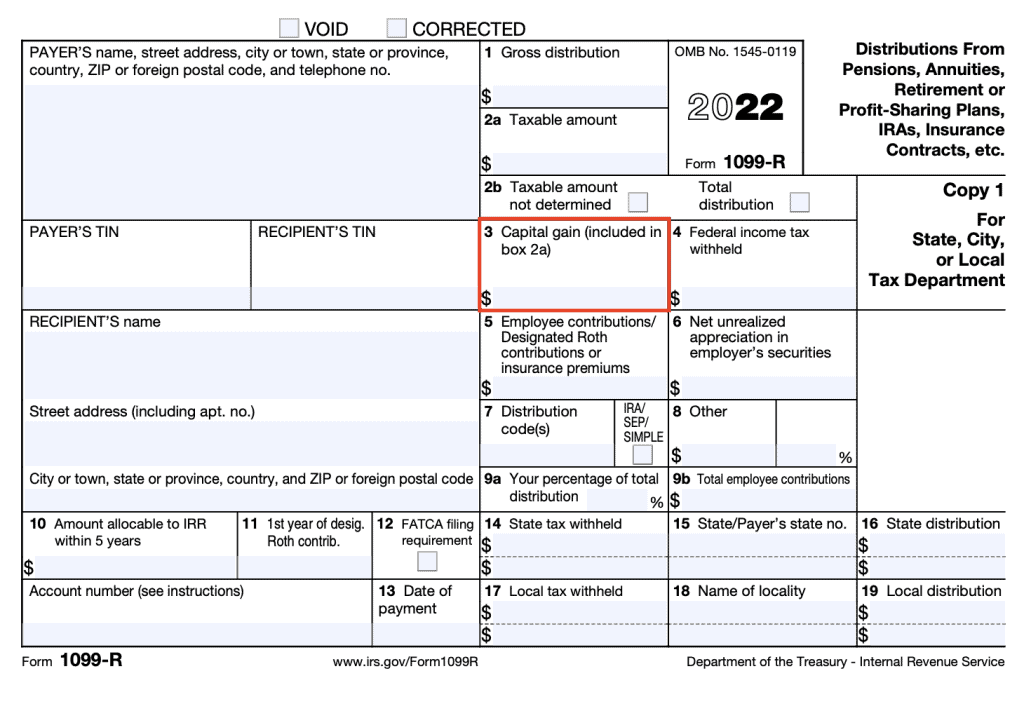

The form walks through the tax calculations, based upon the recipient’s IRS Form 1099-R. Before completing this form, you should verify the accuracy of the information reported in your Form 1099-R.

The primary requirement for qualified lump-sum distributions is that the plan participant must have been born before January 2, 1936. However, there are other requirements that may preclude a plan participant from taking a qualified distribution.

What is not considered a qualified lump-sum distribution?

Below is a list of distributions that are not considered to be qualified lump-sum distributions:

- The part of a distribution not rolled over if the distribution is partially rolled over to another qualified plan or an IRA.

- Any distribution if an earlier election to use either the 5- or 10-year tax option had been made after 1986 for the same plan participant.

- U.S. Retirement Plan Bonds distributed with the lump sum.

- A distribution made during the first 5 tax years that the participant was in the plan, unless it was made because the participant died.

- The current actuarial value of any annuity contract included in the lump sum (Form 1099-R, box 8, should show this amount, which you use only to figure tax on the ordinary income part of the distribution).

- A distribution to a 5% owner that is subject to penalties under section 72(m)(5)(A).

- A distribution from an IRA.

- A distribution from a tax-sheltered annuity (section 403(b) plan).

- A distribution of the redemption proceeds of bonds rolled over tax free to a qualified pension plan, etc., from a qualified bond purchase plan.

- A distribution from a qualified plan if the participant or his or her surviving spouse previously received an eligible rollover distribution from the same plan (or another plan of the employer that must be combined with that plan for the lump-sum distribution rules) and the previous distribution was rolled over tax free to another qualified plan or an IRA.

- A distribution from a qualified plan that received a rollover after 2001 from an IRA (other than a conduit IRA), a governmental section 457(b) plan, or a section 403(b) tax sheltered annuity on behalf of the plan participant.

- A distribution from a qualified plan that received a rollover after 2001 from another qualified plan on behalf of that plan participant’s surviving spouse.

- A corrective distribution of excess deferrals, excess contributions, excess aggregate

- contributions, or excess annual additions.

- A lump-sum credit or payment under the alternative annuity option from the Federal Civil Service Retirement System (or the Federal Employees’ Retirement System).

Who can file IRS Form 4972?

Virtually any taxpayer can file this federal form. Part I, described below, contains screening criteria to identify whether a taxpayer is eligible for preferential tax treatment for their lump-sum payment.

Based on the questions in Part I, you will be largely ineligible to file Form 4972 if you:

- Did not completely distribute the entire balance of the qualified plan

- Rolled over any part of the distribution

- Were not a plan participant born before January 2, 1936 or one of the following:

- A beneficiary of a plan participant born before January 2, 1936 or

- An alternate payee of a plan participant born before January 2, 1936 (e.g. recipient under a qualified domestic relations order, or QDRO)

- Were not a participant for at least 5 years prior to receiving this distribution (unless the participant is deceased)

- Used Form 4972 in a previous filing after 1986

Video walkthrough

Watch this instructional video to learn how to calculate the tax on your lump sum distributions using IRS Form 4972.

Frequently asked questions

Generally speaking, a lump sum distribution is the complete distribution or payment of a plan participant’s entire balance from all qualified plans under a single employer, within the same tax year.

Taxpayers may use IRS Form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains election, 10-year tax election, or both. This option is only available for qualified plans where the participant was born before January 2, 1936.

Taxpayers may avoid taxation on a lump sum distribution by transferring the proceeds to another tax-preferred account, such as an IRA or another qualified retirement plan. However, this option might not be available in all situations.

How do I find a copy of Form 4972?

You can download a copy of this form on the IRS website, or download the version below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!