IRS Form 5695 Instructions

In late 2022, the Inflation Reduction Act created many significant changes intended to help businesses and individuals invest more money in clean, energy-efficient improvements. This includes extending the federal tax credit for a variety of qualified residential energy improvements that taxpayers can claim using IRS Form 5695.

In this article, we’ll walk through everything you need to know about this tax form, to include:

- The impact of the Inflation Reduction Act on energy-related tax credits

- Which energy-saving improvements qualify for a tax credit

- Limitations to the tax credits you can take for energy efficiency projects

- How to complete Form 5695 to properly calculate the maximum tax credit

Let’s start by walking through this tax form, step by step.

Table of contents

- How do I complete IRS Form 5695?

- Impact of the inflation Reduction Act on Renewable Energy Tax Credits

- What tax credits can I claim with IRS form 5695?

- Tax credit limitations

- Which Residential improvements are eligible for tax credits in 2023?

- Video walkthrough

- Frequently asked questions

- Where can I find a copy of IRS Form 5695?

- Related tax forms

- What do you think?

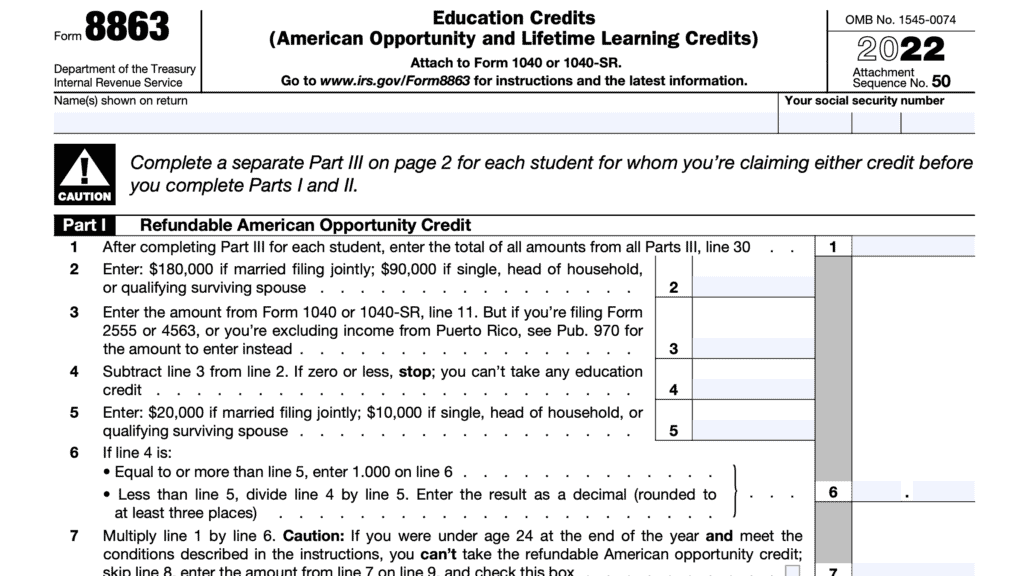

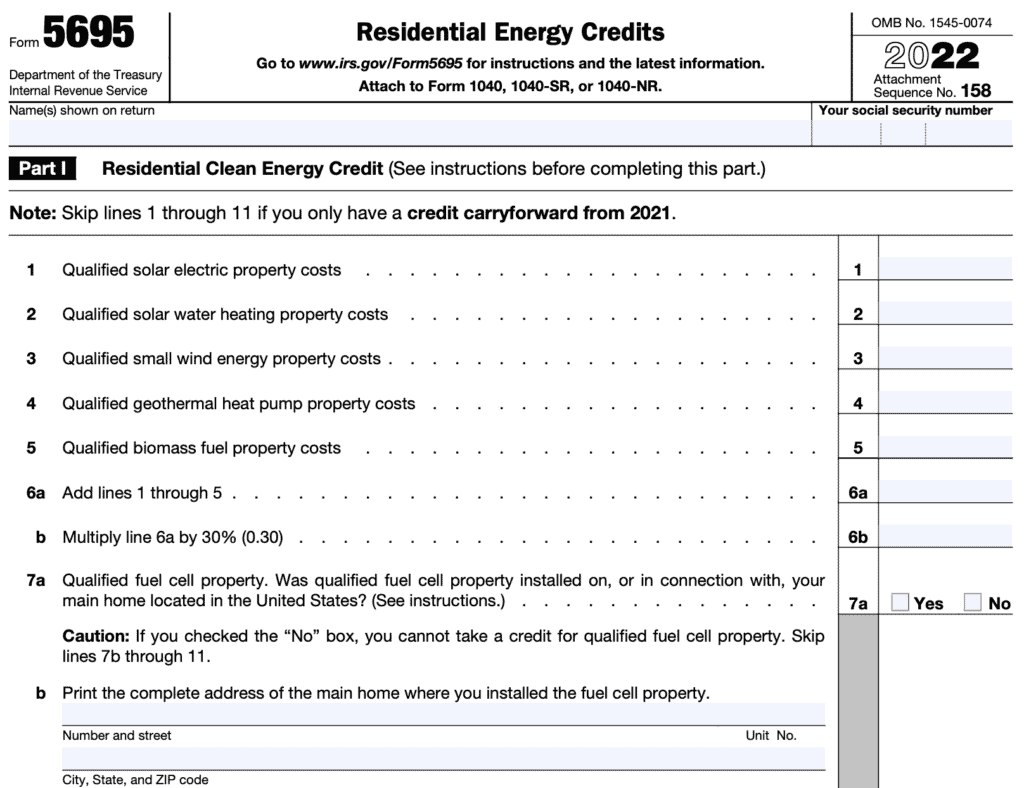

How do I complete IRS Form 5695?

There are two parts to Form 5695:

- Part I: Residential Clean Energy Credit

- Part II: Energy Efficient Home Improvement Credit

Each of these tax credits is calculated separately, then incorporated into Schedule 3 of the taxpayer’s federal income tax return. Below are the steps to complete the form for tax year 2022.

Part I: Residential Clean Energy Credit

If you only have a credit carryforward from tax year 2021, you can skip lines 1 through 11. Otherwise, let’s start at the top.

Line 1: Qualified solar electric property costs

Enter the total costs for any qualifying solar electric property.

Line 2: Qualified solar water heating property costs

Enter the total costs for any qualifying solar water-heating property.

Line 3: Qualified Small Wind Energy property costs

Enter the total costs for any qualifying small wind energy property.

Line 4: Qualified Geothermal Heat Pump property costs

Enter the total costs for any qualifying geothermal heat pump property.

Line 5: Qualified Biomass Fuel property costs

Enter the total costs for any qualifying biomass fuel property.

Line 6

In Line 6a, add the totals of Lines 1 through 5.

For Line 6b, multiply the total in Line 6a by 30% (0.30).

Line 7: Qualified fuel cell property

In Line 7a, indicate whether or not the qualified fuel cell property was installed in your primary residence within the United States.

If you answer ‘Yes,’ proceed to Line 7b. If not, proceed to Line 12. You cannot take a tax credit for the fuel cell property.

In Line 7b, enter the complete address for the primary residence where you installed the fuel cell property.

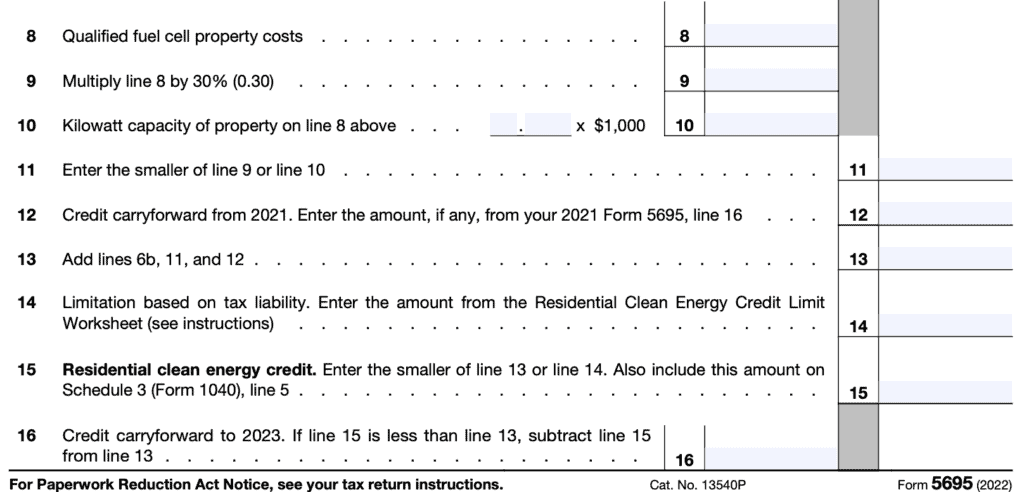

Line 8: Qualified Fuel Cell Property Costs

Enter the costs for your qualified fuel cell property.

Line 9

Multiply Line 8 by 30% (0.30).

Line 10: Kilowatt capacity

Determine the kilowatt capacity of the fuel cell property. Multiply this number by $1,000 and enter the total into Line 10.

Line 11

Take the smaller of Line 9 or Line 10.

Line 12: Credit carryforward from previous tax year

Enter any tax credit carryforward from the previous tax year. You should find this number on your previous year’s Form 5695, Line 16.

Line 13

Add the totals of:

- Line 6b

- Line 11

- Line 12

Line 14: Limit based upon Federal tax liability

The IRS website contains instructions on how to calculate this number. Here is the step-by-step process to calculate this, directly from the Residential Clean Energy Worksheet:

- Step 1: Enter the number from Line 18 of the current year’s Form 1040, 1040-NR, or 1040-SR

- Step 2: Enter the total of the following tax credits from your current year income tax return:

- Negative IRS Form 8978 Adjustment, Schedule 3 (Form 1040), Line 6l

- Foreign Tax Credit, Schedule 3 (Form 1040), Line 1

- Credit for Child and Dependent Care Expenses, Schedule 3 (Form 1040), Line 2

- Credit for the Elderly or the Disabled, Schedule R (Form 1040), Line 22

- Nonrefundable Education Credits, Schedule 3 (Form 1040), Line 3

- Retirement Savings Contributions Credit, Schedule 3 (Form 1040), Line 4

- Energy Efficient Home Improvement Credit, Form 5695, Line 30

- Alternative Motor Vehicle Credit, Personal use part, Form 8910, Line 15

- Qualified Plug-in Electric Drive Motor Vehicle Credit, Personal use part, Form 8936, Line 23

- Child Tax Credit and Credit for Other Dependents, Form 1040, 1040-SR, or 1040-NR, Line 19

- Mortgage Interest Credit, Form 8396, Line 9

- Adoption Credit, IRS Form 8839, Line 16

- Carryforward of the District of Columbia First-Time Homebuyer Credit, Form 8859, Line 3

- Step 3: Subtract the total tax credits calculated in Step 2 from the number you entered in Step 1.

- Enter this total on Line 14. If the result is zero or less, enter ‘0.’

Line 15: Residential Clean Energy Credit

Enter the smaller of:

- Line 13

- Line 14

Enter this number on Schedule 3, Line 5.

Line 16: Credit carryforward

If Line 15 is less than Line 13, subtract Line 15 from Line 13 and enter the difference here. This is your tax credit carryforward to next year.

Part II: Energy Efficient Home Improvement Credit

Follow the steps in Part II to calculate and claim the energy efficient home improvement credit. Let’s start with Line 17.

Line 17

In Line 17a, determine whether the qualified energy efficiency improvements or residential energy property costs were for your primary residence located in the United States. If no, stop here. You cannot claim the energy efficient home improvement credit, and you should not complete Part II.

If Yes, enter the address in Line 17b. Include the street address, city, state, and zip code.

In Line 17c, answer whether the improvements were related to the new construction of your main home. You can only take a tax credit for improvements not related to home construction.

Line 18: Lifetime Limitation

In tax year 2022, the lifetime limitation for this tax credit is $500. In Line 18, add the total of all previously taken tax credits. This includes the Form 5695 totals as follows:

- Tax year 2006, Line 12

- Tax year 2007, Line 15

- Tax year 2009, Line 11

- Tax year 2010, Line 11

- Tax year 2011, Line 14

- Tax year 2012, Line 32

- Tax year 2013, Line 30

- Tax year 2014, Line 30

- Tax year 2015, Line 30

- Tax year 2016, Line 30

- Tax year 2017, Line 30

- Tax year 2018, Line 30

- Tax year 2019, Line 30

- Tax year 2020, Line 30

- Tax year 2021, Line 30

If these previous tax credits exceed $500, stop. You cannot take the tax credit in 2022.

Line 19: Qualified energy efficiency improvements

In Line 19, you can only include costs of original use material that is reasonably expected to last. for at least 5 years. This cannot include installation costs.

Line 19a: Insulation material

Enter the qualified costs of insulation material used to reduce heat loss or gain in your residence.

Line 19b: Exterior doors

Enter the qualified costs of exterior doors that meet or exceed ENERGY STAR program requirements.

Line 19c: Metal or asphalt roof meeting ENERGY STAR program requirements

Enter qualifying costs of any metal or asphalt roof that meets or exceeds the Energy Star program requirements.

Please note: There appears to be conflicting guidance. The 2022 IRS Form 5695 still refers to qualifying metal or asphalt roofs. It appears that the Inflation Reduction Act extended this tax credit under the Residential Clean Energy Credit or the Energy Efficient Home Improvement Credit for tax year 2022 only.

However, there is an IRS FAQ page that explicitly states most non-solar roofing expenditures are not eligible for the Energy Efficient Home Improvement Credit, which provides a credit for solar tile installation.

The ENERGY STAR governmental website states that the ENERGY STAR program withdrew certification on roof products effective 6/1/22.

As a result, you should consult with your tax professional before attempting to claim this tax credit for a roof that you installed in 2022.

Line 19d: Exterior windows and skylights

Enter the qualified costs of windows and skylights that meet or exceed ENERGY STAR program requirements.

Line 19e: Maximum costs

This number, $2,000, is automatically entered for you. Your maximum credits cannot exceed $2,000 in 2022.

Line 19f: Window expense worksheet totals

Enter the total of previously claimed credits for window expenses. If you’ve previously claimed a credit for windows, you may use the window expense worksheet in the IRS form instructions to calculate this number.

Otherwise, enter ‘0.’

Line 19g

Subtract Line 19f from Line 19e. If Line 19f equals zero, enter $2,000, which is the number from Line 19e.

Line 19h

Enter the smaller of Line 19d or Line 19g. This number should not exceed $2,000.

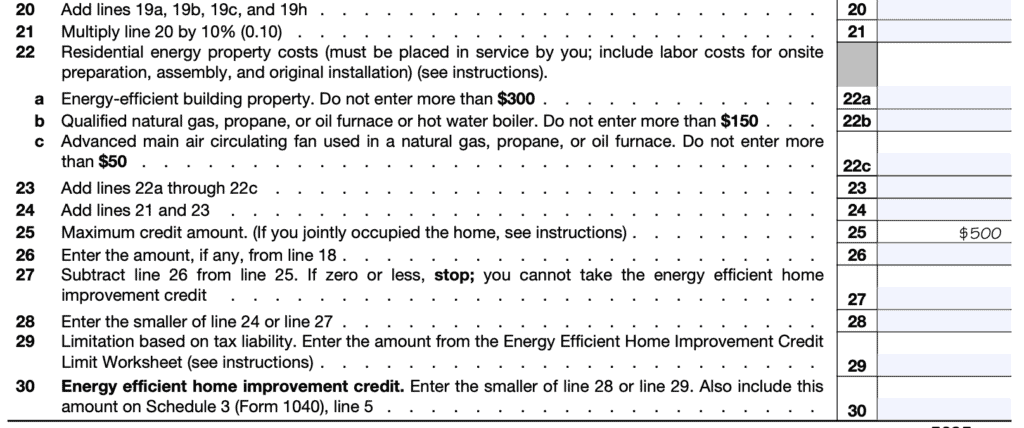

Line 20

Enter the total of the following lines:

- Line 19a

- Line 19b

- Line 19c

- Line 19h

Line 21

Multiply Line 20 by 10% (0.10).

Line 22: Residential energy property costs

These costs can include labor costs for onsite preparation, assembly, and original installation. However, this must have been placed in service by the taxpayer in the current tax year.

Line 22a: Energy-efficient building property

Enter the amounts you paid for any of the following energy-efficient building properties:

- An electric heat pump water heater that yields a Uniform Energy Factor of at least 2.2 in the standard Department of Energy test procedure.

- An electric heat pump that achieves the highest efficiency tier established by the Consortium for Energy Efficiency (CEE) as in effect on January 1, 2009.

- A central air conditioner that achieves the highest efficiency tier that has been established by the CEE as in effect on January 1, 2009.

- A natural gas, propane, or oil water heater that has a Uniform Energy Factor of at least 0.82 or a thermal efficiency of at least 90%.

Do not enter more than $300.

Line 22b: Qualified water boiler

Enter the amounts you paid for a natural gas, propane, or oil furnace or hot water boiler. This boiler must achieve an annual fuel utilization rate of at least 95 to qualify.

Do not enter more than $150.

Line 22c: Advanced main air circulating fan

Enter the amounts you paid for an advanced main air circulating fan used in a natural gas, propane, or oil furnace. To qualify, this fan must use no more than 2% of the total annual energy use of the furnace, as determined in the standard Department of Energy test procedures.

Do not enter more than $50.

Line 23

Add Lines 22a through 22c.

Line 24

Add Lines 21 and 23.

Line 25: Maximum credit amount

This number, $500, has already been entered for you. This is the maximum Energy Efficient Home Improvement Credit you can take in tax year 2022.

Line 26: Lifetime Limitation

Enter the amount, if any, from Line 18.

Line 27: Current Year Limit

Subtract Line 26 from Line 25. If this number is zero or less, stop. You cannot take this credit. If the result is a positive number, proceed to Line 28.

Line 28

Enter the smaller of:

- Line 24

- Line 27

Line 29: Limitation based upon tax liability

This represents the limit based upon other tax credits you may have taken for the 2022 tax year, including:

- Negative Form 8978 Adjustment, Schedule 3 (Form 1040), Line 6l

- Foreign Tax Credit, Schedule 3 (Form 1040), Line 1

- Credit for Child and Dependent Care Expenses, Schedule 3 (Form 1040), Line 2

- Credit for the Elderly or the Disabled, Schedule R (Form 1040), Line 22

- Nonrefundable Education Credits, Schedule 3 (Form 1040), Line 3

- Retirement Savings Contributions Credit, Schedule 3 (Form 1040), Line 4

If applicable, you can refer to the calculation worksheet in the IRS Form instructions.

Line 30: Energy Efficient Home Improvement Credit

Enter the smaller of:

- Line 28

- Line 29

This represents the energy efficient home improvement credit that you can take in 2022.

Impact of the inflation Reduction Act on Renewable Energy Tax Credits

In late 2022, the federal government passed the Inflation Reduction Act, which provides tax credits for individuals and businesses who invest in a variety of energy efficiency improvements.

This new legislation was passed to address energy improvement projects across many areas, including:

- Businesses which invest in energy efficiency or clean energy projects

- Taxpayers who invest in energy efficient vehicles

- Residential energy efficiency projects

At the time of this writing, the Internal Revenue Service was still working to implement many of these new tax credits. As a result, please note that this article was written for educational purposes. Do not interpret this article as tax advice. For specific tax advice for your situation, please contact a tax professional.

For residential projects, this represents an extension of existing tax credits that were due to expire at the end of the year, an increase in many other tax credits, and new tax credits that might not have been previously available. Now, many of these tax credits are available for up to 10 years, expiring with the 2032 tax year.

Before we discuss specific qualifying improvements, let’s dig a little further to learn about the changes to the tax credits themselves.

What tax credits can I claim with IRS form 5695?

There are two categories of tax credits that a homeowner may claim using this tax form:

- Residential clean energy credit, and

- Energy efficient home improvement credit

These credits are not new, but they are new names for previously existing tax credits. The residential clean energy credit used to be the residential energy efficient property credit.

Likewise, the nonbusiness energy property credit became the energy efficient home improvement credit.

For each credit, there are certain limitations to be aware of. Also, there are differences between the limits that apply for the 2022 tax year, and the applicable limits for future tax years.

Tax credit limitations

For each residential improvement, there is a general limitation, by percentage and dollar amount. However, the total tax credit available is limited as well. Let’s look at the limitation for each available tax credit.

Residential clean energy credit limits

The residential clean energy credit is 30% of the total expenditure costs for a qualified project. The Inflation Reduction Act extended this credit to be effective for tax year 2022 through 2035, as outlined below.

There are no lifetime or annual limitations. However, there is a phase-out period after 2032:

- Tax year 2033: 26% of costs

- Tax year 2034: 22% of costs

- Tax year 2035 and beyond: 0%

There is a limitation based upon your current year’s federal income tax liability.

Energy efficient home improvement Credit limits (2022)

For tax years leading up to, and including 2022, the energy efficient home improvement credit was 10% of qualified expenditures, with a lifetime dollar limit of $500. Additionally, there were line-item limitations on certain expenditures, which included:

This includes the following annual limits for 2022 only:

- Air source heat pumps: $300

- Central A/C units: $300

- Furnaces or hot water boilers: $150

- Furnaces or hot water boilers: $150

- Advanced main air circulating fan (for furnace systems): $50

- Insulation: $500

- Roofs: $500

- Exterior doors: $500

- Windows: $200

If you are looking to claim a tax credit for the 2022 tax year, the ENERGY STAR website contains important information regarding qualifying requirements for each of these improvements.

Energy efficient home improvement Credit limits (2023)

For tax years 2023 through 2032, this credit has increased from 10% of expenditures to 30% of expenditures (not including installation costs). The lifetime limit has changed to an annual dollar limit of $1,200. This change allows homeowners to invest in more projects over a longer period of time while still qualifying for the credit.

This includes the following annual limits:

- Home energy audits: $150

- Exterior doors: $250 per door, or $500 per year

- Exterior windows and skylights: $600

- Central A/C units: $600

- Electric panels and related equipment: $600

- Natural gas, propane and oil water heaters: $600

- Furnaces or hot water boilers: $600

Additionally, an annual $2,000 credit exists for:

- Electric or natural gas heat pump water heaters

- Electric or natural gas heat pumps, and

- Biomass stoves and biomass boilers

This extra credit limitation is in addition to the $1,200 aggregate limit on other qualifying investments. This represents a total annual limit of $3,200 for energy efficient home improvement credits.

Which Residential improvements are eligible for tax credits in 2023?

According to the government’s EnergyStar website, residential improvements in the following categories are eligible for tax credits starting in 2023:

- Heating and Cooling Tax Credits

- Water Heating Tax Credits

- Building Products Tax Credits

- Residential Clean Energy Tax Credits

- Electric Panel Upgrade Tax Credits

- Home Audit Incentive Tax Credits

Before we explore each of these in depth, it’s important to recognize that there are certain annual and lifetime aggregation limits that may apply.

Let’s take a closer look at each one in more detail.

Heating and Cooling Tax Credits

A homeowner can claim a tax credit for any of the following heating and cooling investments:

- Air source heat pumps

- Central air conditioning

- Boilers

- Biomass fuel stoves

- Furnaces

Let’s look at each of these to see the maximum available tax credit and eligibility requirements, as determined by the federal government, through its ENERGY STAR program.

Air source heat pumps

Maximum tax credit: 30% of the project cost, up to a maximum of $2,000.

Qualifying requirements: For heat pumps, the maximum ENERGY STAR offers a general certification and a cold climate certification.

For general certification, all ducted heat pumps that have earned the ENERGY STAR label are eligible. Additionally, certified non-ducted (mini-split) systems with the following energy ratings:

- SEER2 > 16

- EER2 > 12

- HSPF2 > 9

For the ENERGY STAR Cold Climate designation, eligible systems are:

- ducted with EER2 > 10

- mini-splits with

- SEER2 > 16

- EER2 > 9

- HSPF2 > 9.5

Central air conditioning

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: For split systems, ENERGY STAR certified equipment with SEER2 ≧ 16 is eligible. All ENERGY STAR certified packaged systems are also eligible for the tax credit.

Boilers

Maximum tax credit: 30% of the total cost, up to a maximum of $600.

Qualifying requirements: For gas boilers, ENERGY STAR certified gas boilers with AFUE ≧ 95% are eligible for the credit. For oil boilers, the equipment must be rated by the manufacturer for use with fuel blends containing at least 20% biodiesel, renewable diesel, or second-generation biofuel, by volume.

Biomass fuel stoves

Maximum tax credit: 30% of the project cost, up to a maximum of $2,000.

Qualifying requirements: Biomass stoves burn biomass fuel to heat a home or water. Biomass fuel includes:

- Agricultural crops and trees

- Wood, wood waste, and residues (including wood pellets)

- Plants, grasses, residues, and fibers

Biomass stoves must have a thermal efficiency rating of at least 75% to qualify for any credits.

Furnaces

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: For gas furnaces, ENERGY STAR certified gas furnaces with AFUE ≧ 97% are eligible. For oil furnaces, the equipment must be rated by the manufacturer for use with fuel blends containing at least 20% biodiesel, renewable diesel, or second-generation biofuel.

Water Heating Tax Credits

A homeowner may claim a tax credit for either heat pump water heaters or water heaters operated by natural gas, oil, or propane.

Heat Pump Water Heaters

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: All ENERGY STAR rated heat pump water heaters are eligible for the tax credit.

Water Heaters using natural gas, oil, or propane

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: ENERGY STAR certified models are eligible, based on the following:

- Tanks less than 55 gallons: At least 0.81 UEF

- Tanks greater than or equal to 55 gallons: At least 0.86 UEF

Building Products Tax Credits

Homeowners may be able to claim tax credits for insulation, windows or skylights, and exterior doors.

Insulation

Maximum tax credit: 30% of the project cost, up to a maximum of $1,200.

Qualifying requirements: Typical bulk insulation, such as batts, rolls, blow-in fibers, rigid boards, expanding spray, and pour-in-place products qualify for the tax credit. Other products that reduce air leaks can qualify, as long as they come with a manufacturer’s certification. These products can include:

- Weather stripping

- Spray foam in a can, designed to air seal

- Caulking products

- House wrap

Windows & Skylights

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: To qualify for the tax credit, exterior windows or skylights must meet the ENERGY STAR most efficient criteria.

Exterior Doors

Maximum tax credit: 30% of the project cost, up to a maximum of $500.

Qualifying requirements: Exterior doors must be ENERGY STAR certified to qualify for a tax credit.

Residential Clean Energy Tax Credits

Homeowners might be eligible for a residential clean energy credit for the following energy-efficient home improvements:

- Geothermal heat pumps

- Small wind turbines

- Solar energy systems

- Fuel cells

- Battery storage technology

In this category, the maximum available tax credit is as follows:

- For property placed into service after December 31, 2021 and before January 1, 2033: 30% of the project cost.

- For property placed into service after December 31, 2032 and before January 1, 2034: 26% of the project cost.

- For property placed into service after December 31, 2033 and before January 1, 2035: 22% of the project cost.

Geothermal heat pumps

Qualifying requirements: Qualified geothermal heat pump property must be ENERGY STAR certified and use the ground or ground water as a thermal energy source (for heating purposes), or as a thermal energy sink (for cooling purposes).

Small wind turbines

Qualifying requirements: A qualified small wind energy property must use a wind turbine to generate electricity for use in connection with a home:

- Located in the United States

- Used as a residence by the taxpayer

Tax credits include installation costs.

Solar energy systems

Qualifying requirements:

For solar water heaters, at least 50% of the energy created must come from the sun. The solar panel system must be certified by the Solar Rating and Certification Corporation (SRCC) or a similar entity endorsed by the state government where the property is located.

For solar panels, (also known as a photovoltaic system or a solar electric system), the system must provide electricity for the residence, and must meet applicable fire and electrical code safety requirements.

The qualifying property does not have to be the taxpayer’s principal residence.

Fuel cells

Maximum tax credit: In addition to the previously stated guidelines, the maximum credit is $500 per half kilowatt (kW) of electric capacity.

Qualifying requirements:

- The fuel cell must have a nameplate capacity of at least 0.5 kW of electricity using an electrochemical process and an electricity-only generation efficiency greater than 30%.

- The home served by the system MUST be the taxpayer’s principal residence.

- In case of joint occupancy, the maximum qualifying costs that can be taken into account by all occupants for figuring the credit is $1,667 per 0.5 kW.

- This does not apply to married individuals filing a joint return.

- The credit that may be claimed by each individual is proportional to the costs he or she paid.

Battery storage technology

Qualifying requirements: Qualified battery storage technology must have a capacity of at least 3 kilowatt hours.

Electric Panel Upgrade Tax Credits

This tax credit is available to homeowners who invest in an upgrade to their existing electrical panel.

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: To qualify, an electrical panel must meet the following criteria:

- Must be installed in a manner consistent with the National Electric Code,

- Must have a load capacity of at least 200 amps,

- Must be installed in conjunction with, and enable the installation and use of:

- any qualified energy efficiency improvements, or

- any qualified energy property (heat pump water heater, heat pump, central air conditioner, water heater, furnace or hot water boiler, biomass stove or boiler)

Home Audit Incentive Tax Credits

A home energy audit allows a homeowner to identify the most significant and cost-effective energy improvements for their primary residence.

Maximum tax credit: 30% of the project cost, up to a maximum of $150.

Qualifying requirements: To qualify, a home energy audit must:

- Identify the most significant and cost-effective energy efficiency improvements with respect to the residence

- Must include an estimate of the energy and cost savings for each improvement

- Be conducted and prepared by a certified home energy auditor

Let’s move on to the tax form itself.

Video walkthrough

Watch this instructional video to get step by step guidance on filing IRS Form 5695 to claim residential energy tax credits.

Frequently asked questions

The energy efficient home improvement credit has been extended to 2032. The residential clean energy credit (30% of qualified costs) has been extended in full to 2032. This phases down to 26% in 2033, 22% in 2034, and 0% after 2034.

Through tax year 2022, the maximum lifetime credit taxpayers could take was $500. For tax years 2023 through 2032, there is a maximum of $1,200 per year, or $12,000 total during the life of the tax credit.

In 2022, Congress changed the nonbusiness energy property credit to the energy efficient home improvement tax credit.

Where can I find a copy of IRS Form 5695?

You may obtain a copy of this federal tax form from the IRS website. For your convenience, we’ve included the most current version at the end of this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!