IRS Form 8379 Instructions

Perhaps you were expecting a big tax refund when you received a notice of offset indicating that the Department of Treasury is using your federal tax refund to pay your spouse’s debt. While you won’t be able to get your entire refund back, you can use IRS Form 8379 to ask the IRS for injured spouse relief. This tax form might help you get your share of the refund that you were otherwise entitled to.

This article will help you to understand:

- What an injured spouse is

- How to use IRS Form 8379 to get your share of a joint refund back

- What other types of relief might be available if you’re not an injured spouse

Let’s start with discussing going through this tax form, step by step.

Table of contents

What is IRS Form 8379?

If you are an injured spouse, you can request your share of a joint tax refund by filing IRS Form 8379-Injured Spouse Allocation. This form helps the IRS understand how much of your joint tax liability should be used to pay your spouse’s past-due debt, and how much belongs to you.

The amount that belongs to you is known as the injured spouse allocation.

How do I complete IRS Form 8379?

If you’re working with a tax professional, such as a certified public accountant or enrolled agent, you’ll probably want them to file Form 8379 on your behalf. However, we’ll walk you through this step by step if you’re doing this yourself.

For more specific guidance, please refer to the IRS instructions.

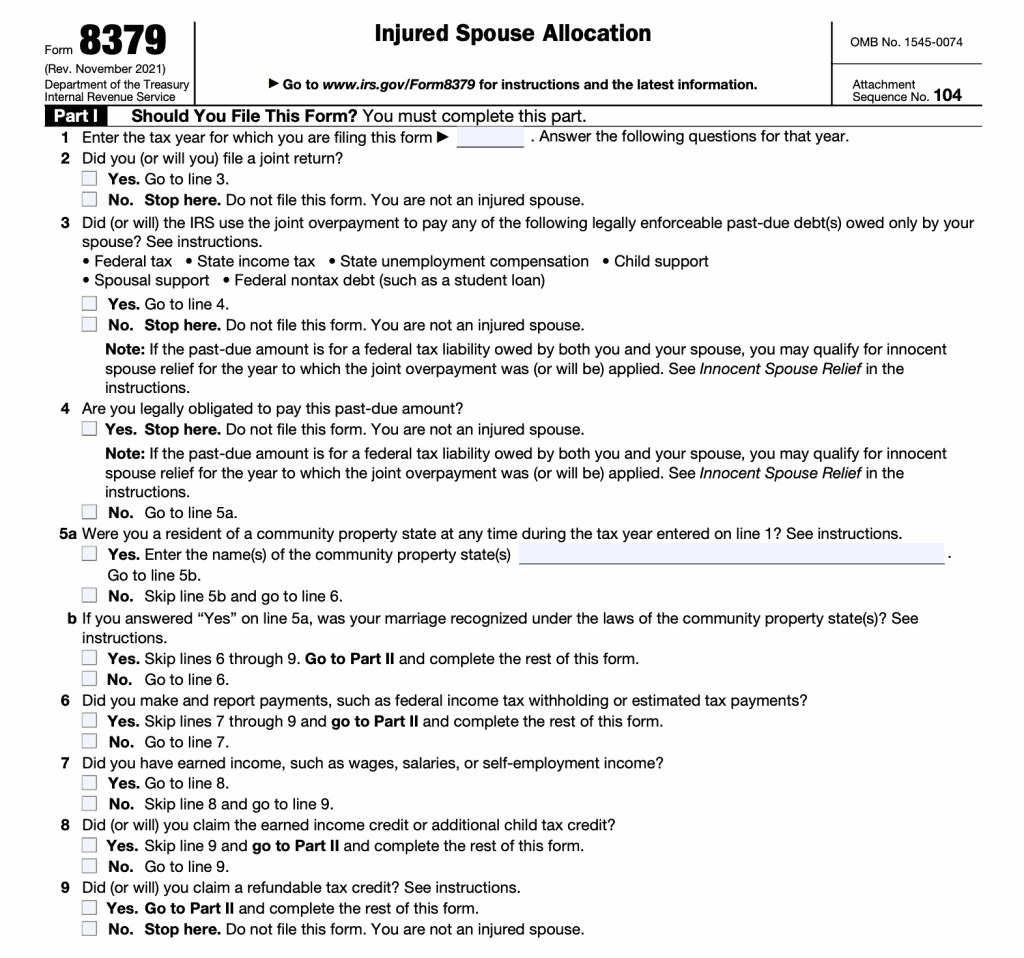

Part I-Should You File This Form?

There are 9 questions in the first part of the form. Each question will help determine whether you are an injured spouse, and walk you through relief options for your specific situation.

Line 1: Tax year for the tax return

Enter the tax year for the income tax return for which you are claiming injured spouse status.

Line 2: Is this a joint return?

If this is not a joint tax return, then the IRS does not consider you to be an injured spouse.

Line 3: Did the IRS use the joint overpayment to pay certain debts?

There are certain types of debt that are eligible for the Treasury Offset Program, administered by the U.S. Treasury Department’s Bureau of the Fiscal Service. These debts include:

- Past-due federal tax

- State taxes, such as state income tax

- State unemployment compensation debts

- Child support payments

- Spousal support to a former spouse

- Federal non-tax debt, such as student loans

If your share of the joint refund was garnished to pay these types of debt, then you can move forward with your injured spouse claim.

Line 4: Are you legally obligated to pay this debt?

If you answered ‘Yes,’ then you technically are not an injured spouse. An injured spouse is not legally obligated to pay their spouse’s past due debt.

However, if you are a negatively impacted spouse and unaware of your spouse’s actions, you may qualify for innocent spouse relief.

Innocent spouse relief falls under different rules, covered in a separate section of the Internal Revenue Code.

Line 5a: Were you a resident of a community property state during the tax year?

Community property states may have different rules that apply to the calculation of injured spouse relief.

While IRS Publication 555 contains more information about the tax impacts of community property states, the IRS has created a revenue ruling for each state community property law.

| If you live in… | Then use the following IRS Revenue Ruling |

| Arizona or Wisconsin | Rev. Rul. 2004-71, available at: IRS.gov/IRB/2004-30_IRB#RR-2004-71 |

| California, Idaho, or Louisiana | Rev. Rul. 2004-72, available at: IRS.gov/IRB/2004-30_IRB#RR-2004-72 |

| Nevada, New Mexico, or Washington | Rev. Rul. 2004-73, available at: IRS.gov/IRB/2004-30_IRB#RR-2004-73 |

| Texas | Rev. Rul. 2004-74, available at: IRS.gov/IRB/2004-30_IRB#RR-2004-74 |

Enter the state name in 5a.

Line 5b: If you resided in a community property state, was your marriage recognized under state law?

Even though the Supreme Court ruled that same-sex marriages are constitutional, you may still answer “No” if all of the following apply:

- You have a same-sex spouse whom you legally married in a jurisdiction that recognizes same-sex marriages.

- You resided during the tax year in a community property state that did not recognize same-sex marriages during the tax year.

- The state’s community property laws did not apply to you during the tax year.

If you answered “No,” go to Line 6. If you answered “Yes,” skip Lines 6-9 and go to Part II.

Line 6: Did you make or report federal income tax payments, including estimated tax payments?

If yes, skip questions 7-9 and proceed to Part II.

Line 7: Did you have earned income, such as wages, salaries, or self-employment income?

If you answered, “No,” skip Line 8 and go to Question 9.

Line 8: Did you claim the earned income credit or additional child tax credit?

If yes, skip Question 9 and go to Part II.

Line 9: Will you claim a refundable tax credit this year?

Refundable tax credits include:

- American opportunity credit (2009 and later years).

- Credit for federal tax paid on fuels.

- Refundable prior year minimum tax.

- Health coverage tax credit.

- Premium tax credit (2014 and later years).

- Recovery rebate credit (2020 and 2021).

- Refundable child tax credit (2021).

- Refundable child and dependent care tax credit (2021).

- Qualified sick and family leave credits for certain self-employed individuals.

If you answer “No,” then you are not considered an injured spouse.

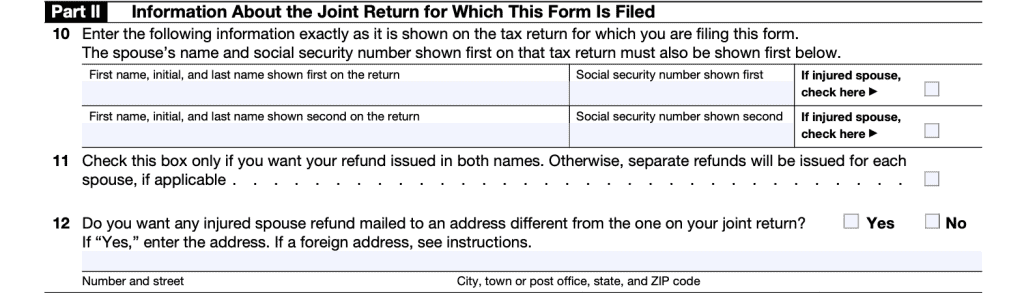

Part II-Information about the Joint Return

Part II requests information about the joint return in question.

Line 10: Taxpayer information

Line 10 should contain the complete name and Social Security number for both spouses, according to the jointly filed tax return. The injured spouse will check the appropriate box next to their name.

Line 11: Refund box

Check this box only if you want the refund issued in both spouse’s names. Otherwise, leave it blank.

Line 12: Different address

If you want your refund mailed to the address on your tax return, check “No.” If you want a different address, check “Yes” and fill in the new address.

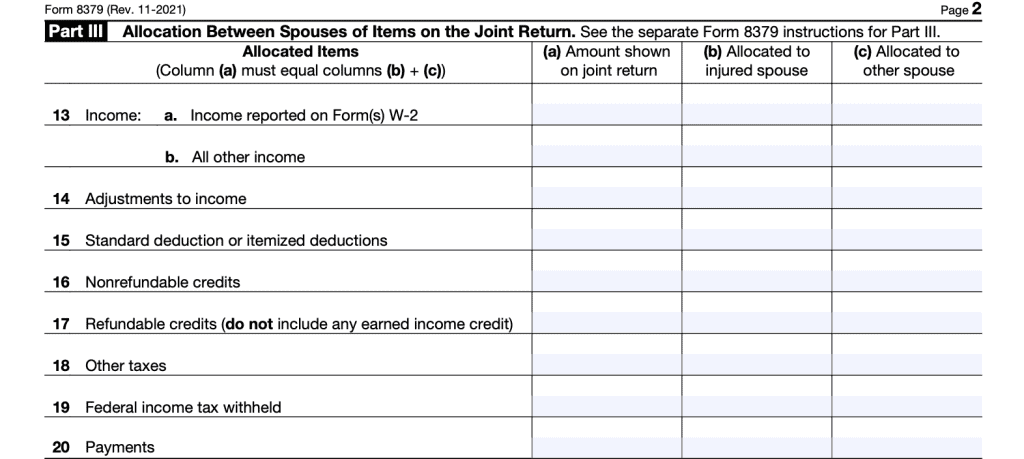

Part III-Allocation between spouses

If you’re working with a tax professional, you may want that person to complete Part III on your behalf. If you are completing this by yourself, you’ll need to separate each of these line items for each spouse.

In essence, you’re treating this as if you and your spouse are filing separate income tax returns. From there, the IRS will determine your injured spouse allocation.

In column (a) for each line, you’ll need to report the number as it appears on your tax return. In column (b), you’ll report your share (injured spouse’s share), and in column (c), you’ll report the other spouse’s share. As indicated on the form, both columns (b) and (c) must add up to column (a).

Line 13: Income

On Line 13a, include any wage income that you included on your tax return. You should find these on Line 1 of IRS Form 1040.

- Total

- Injured spouse

- Non-injured spouse

For Line 13b, include all other income reported on your tax return. You’ll find these on Lines 1 through 9 of your Form 1040.

Line 14: Adjustments to income

Include the adjustments to income from your tax return. You should find these on Line 10 of Form 1040.

Line 15: Deductions

Enter the total deduction amount in column (a). You’ll find this in Line 12(c) of your 1040.

If you took the standard deduction: In columns (b) and (c), you’ll enter 1/2 of the total deduction in each column.

If you itemized deductions: You’ll need to allocate each deduction (such as medical expenses) to the spouse entitled to that deduction.

Additionally, if you are eligible for additional deductions due to age or blindness, you’ll need to compute your additional deduction using the IRS Form 8379 instructions.

Line 16: Nonrefundable credits

You’ll find these on Line 19 of your tax return and in Part I of Schedule 3. For columns (b) and (c) you’ll allocate any credits attributable to a dependent to the spouse who would have claimed that credit in a separate return.

Do not include earned income credit here, as the IRS will determine each spouse’s allocation.

Line 17: Refundable credits (not including earned income credit)

You’ll find these on Line 28-30 of your tax return and in Part II of Schedule 3. For columns (b) and (c) you’ll allocate any credits attributable to a dependent to the spouse who would have claimed that credit in a separate return.

Do not include earned income credit here, as the IRS will determine each spouse’s allocation.

Line 18: Other taxes

You can find these in Schedule 2 of your original tax return.

Line 19: Federal income tax withheld

This will be found on Line 25d of your original tax return.

Line 20: Payments

You’ll find additional payments on Line 26 of your tax return.

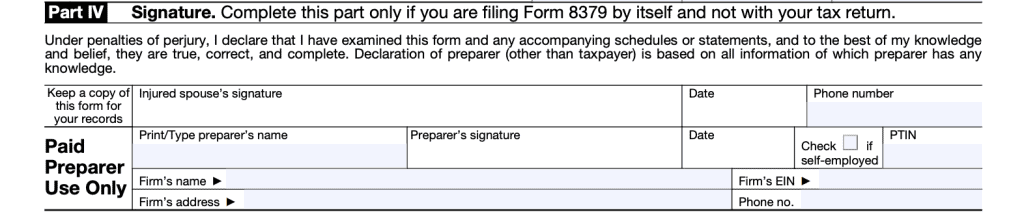

Part IV-Signature

Part IV is simply the signature section. Only the injured spouse needs to sign this form. If you’re working with a paid tax preparer, that tax professional will input their information as well.

Video walkthrough

Watch this instructional video to learn more about Form 8379 and injured spouse allocation.

Frequently asked questions

If you filed a joint income tax return, and you are not responsible for your spouse’s debt, then the IRS considers you to be an injured spouse. As an injured spouse, you can request your portion of the refund back from the IRS, by using IRS Form 8379.

You may file IRS Form 8379 either with your original tax return or separately. Where you turn in this form depends on how you filed your original return. If filing after you’ve submitted your tax return, you may submit the completed form to the IRS service center where you turned in your tax return. If filing with an amended return or after electronically submitting your tax return, you may submit the form to the IRS center where you live.

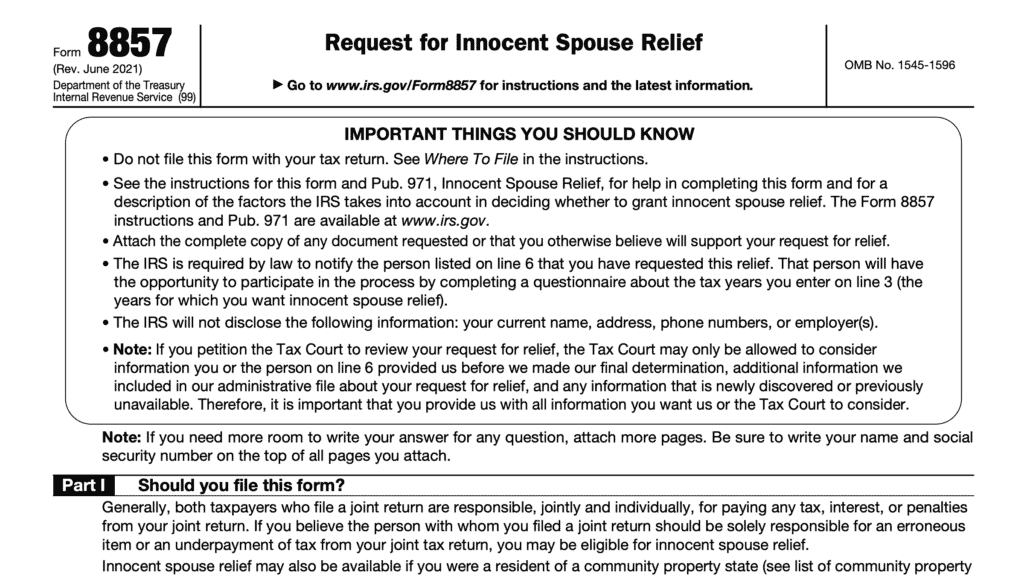

No. You must use IRS Form 8857 to request innocent spouse relief.

The IRS grants innocent spouse relief to one spouse to prevent that spouse from having to pay additional income tax due to tax return errors caused by the other spouse. Injured spouse allocation allows a spouse to claim money taken from his or her tax refund to pay the other spouse’s debt.

Where can I get a copy of IRS Form 8379?

You can obtain a free download from the IRS website or by clicking the file below.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!