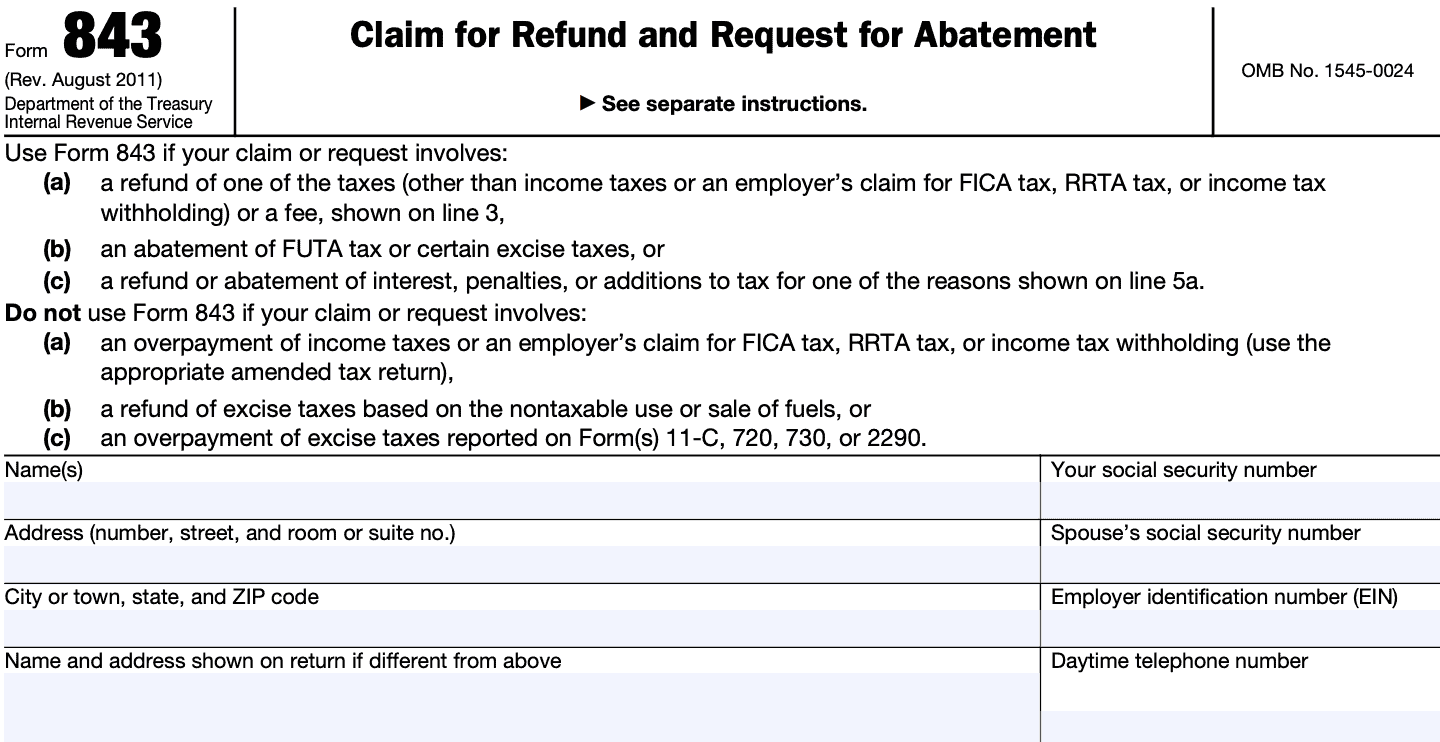

IRS Form 843 Instructions

In some situations, the federal government may collect more revenue than it’s otherwise entitled to. Other times, taxpayers may have made a mistake or have paid penalties, interest, or additional taxes that they shouldn’t have paid. In certain tax situations, the Internal Revenue Service may consider administrative relief for taxpayers who file IRS Form 843.

This article will walk you through the basics of this tax form, including:

- When you should file Form 843

- When you should NOT file Form 843

- How to complete and file Form 843 with the Internal Revenue Service

Let’s start with some step by step instructions on IRS Form 843.

Contents

Table of contents

How do I complete IRS Form 843?

This one-page tax form is relatively straightforward, and should be simple for most taxpayers to fill out. Let’s start with the taxpayer information at the top of the form.

Taxpayer information

In the taxpayer information fields, you’ll need to provide the following, as shown on the applicable tax return:

- Taxpayer name

- Taxpayer Social Security number (SSN)

- Address, including city, state and zip code

- Employer identification number (EIN)

- Daytime telephone number

If you are a married couple filing a joint return, you will need to provide SSNs for both spouses. If you have an individual taxpayer identification number (ITIN) instead of an SSN, you may use that instead.

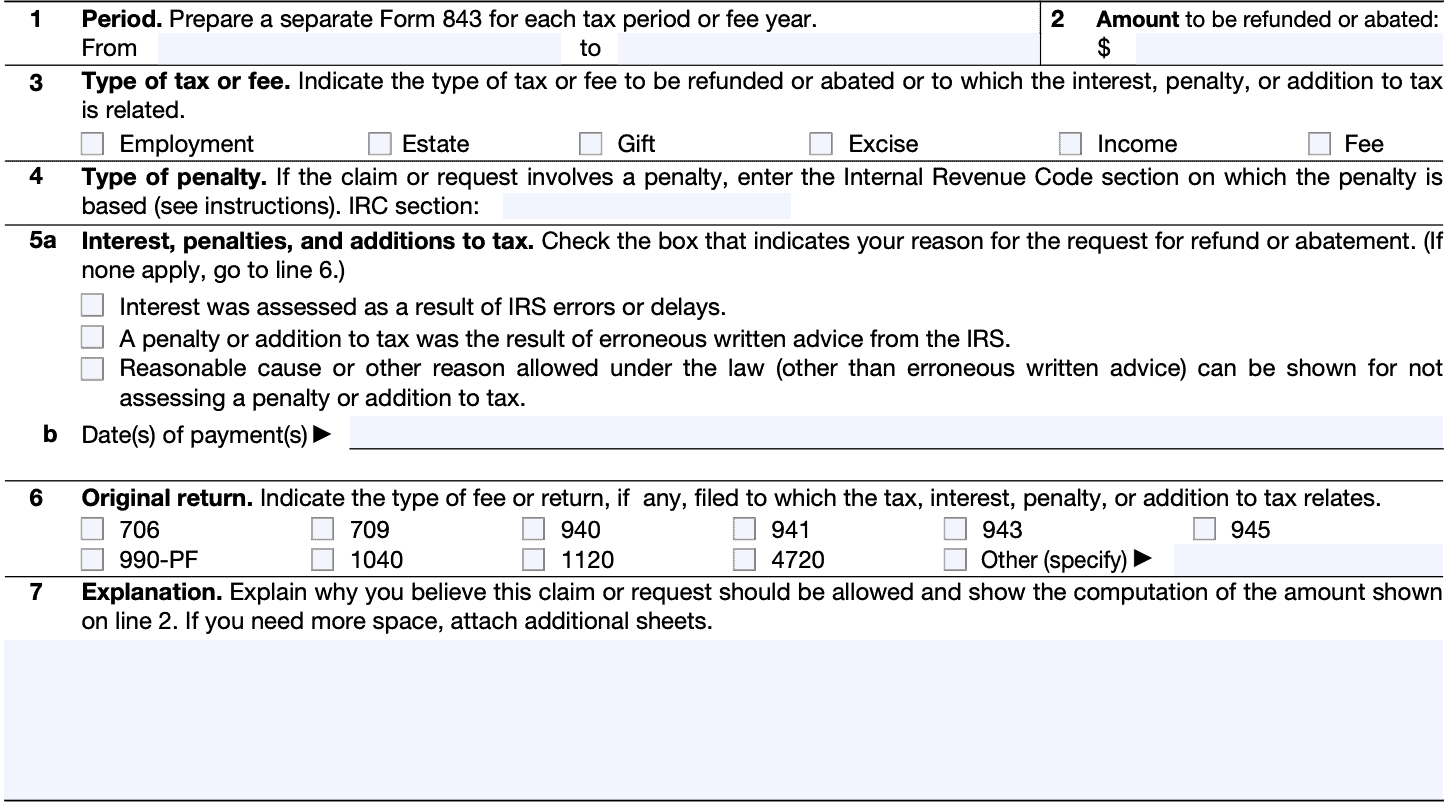

Refund or abatement request

The request itself has 7 lines. Since there are specific instructions, we’ll go through each line, one at a time.

Line 1: Tax period

Enter the tax period or tax year for which you are applying. If you are applying for a prescription brand refund, write the fee year in the ‘From’ line.

If you have multiple tax periods or more than one tax period, you must submit a separate Form 843 for each one.

Line 2: Amount to be refunded or abated

Enter the amount that you expect the IRS to refund or abate.

Line 3: Type of tax or fee

In Line 3, enter the tax type or the type of fee to be refunded/abated, or to which the interest, penalty, or additional tax is related. The IRS allows you to choose from the following:

- Employment tax

- Estate tax

- Gift tax

- Excise tax

- Income tax

- Fee

There are additional instructions for certain situations.

Excess tier 2 RRTA

For excess tier 2 RRTA tax abatement, do the following:

- Complete Lines 1 and 2

- Check the box for ‘Employment’ in Line 3

- Skip Lines 4, 5, and 6

- Enter “Excess Tier 2 RRTA” on Line 7 and show your calculation

Branded prescription drug fees

To request abatement of a branded prescription drug fee:

- Write “Branded Prescription Drug Fee” across the top of the form

- On Line 1, enter the fee year on the “From” line

- Complete Line 2.

- On Line 3, check the box for “Fee.”

- Skip Lines 4 and 5.

- On Line 6, check the “Other” box and enter “BPD Fee” in the space provided

- For Line 7, identify the claim as “branded prescription drug fee”

- Provide a written explanation for why you are claiming a refund.

- Attach a copy of IRS Form 8947 to the Form 843, which demonstrates the basis for the fee calculation

Line 4: Type of penalty

For abatement of penalties, enter the Internal Revenue Code section number of the penalty involved. Here are some of the most common code sections for IRS penalty abatement requests:

- IRC Section 6651(a)(1): Failure to file individual income tax return

- IRC Section 6698(a)(1): Failure to file partnership tax return

- IRC Section 6651(a)(2): Failure to pay income tax due on the due date

- IRC Section 6656: Failure to deposit penalties

Line 5: Interest, penalties, and additions to tax

Check any box that applies. If none apply, skip Line 5 and proceed directly to Line 6.

If interest was assessed because of IRS errors or delays

The IRS can abate interest on assessed tax as a result of IRS error, but only if:

- There was an unreasonable delay or error that occurred during the processing of your case

- You did not have anything to do with the delay or error

Additionally, the interest can only be abated in tax cases where a notice of deficiency is required. This includes:

- Income tax

- Generation-skipping transfer tax (GSTT)

- Estate and gift taxes

- Certain excise taxes

To request an abatement of interest on a tax,

- Write “Request for Abatement of Interest Under Section 6404(e)” at the top of Form 843

- Complete Lines 1 through 3

- Check the first box on Line 5a, then show dates of any interest payment or tax payment on Line 5b

- On Line 7, state the following:

- The type of tax involved

- When you first received a written IRS notice about the tax deficiency

- The specific period for which you are requesting abatement of interest,

- The circumstances surrounding your tax case, and

- Why you believe that failure to abate the interest would result in grossly unfair treatment

Requesting abatement or refund of a tax as a result of erroneous written advice

If you received erroneous advice from an IRS official that increased your tax liability, the IRS may abate or refund any part of tax penalties or addition to tax that occurred.

The IRS will abate the penalty or addition to tax only if:

- You reasonably relied on the written advice

- The written advice was in response to a specific written request for advice made by you (or your representative who is allowed to practice before the IRS), and

- The penalty or addition to tax did not result from your failure to provide the IRS with adequate or accurate information.

Treasury Regulations 301.6404-3 contains more detail.

To request an abatement or refund of a penalty or addition to tax because of erroneous written advice, do the following:

- Write “Request for Abatement of Penalty or Addition to Tax Under Section 6404(f)” at the top of Form 843

- Complete Lines 1 through 4

- Check the second box on Line 5a. On Line 5b, enter the date of any tax payment you may have made

- Attach the following to your Form 843:

- Your written request for advice

- The erroneous written advice that the IRS provided you

- Any report of tax adjustments that identify the tax penalty or addition to tax related to the erroneous advice

Line 6: Original return

Check the appropriate tax return type for which the tax, interest, penalty, or addition to tax applies.

Line 7: Explanation

Provide a written explanation of the tax issues and state why you believe that the IRS should approve this claim or request. If you have additional information that you cannot include on the form itself, or you need to attach additional pages, be sure to include the following information on each page:

- Taxpayer name

- Taxpayer ID number: SSN, ITIN, or EIN

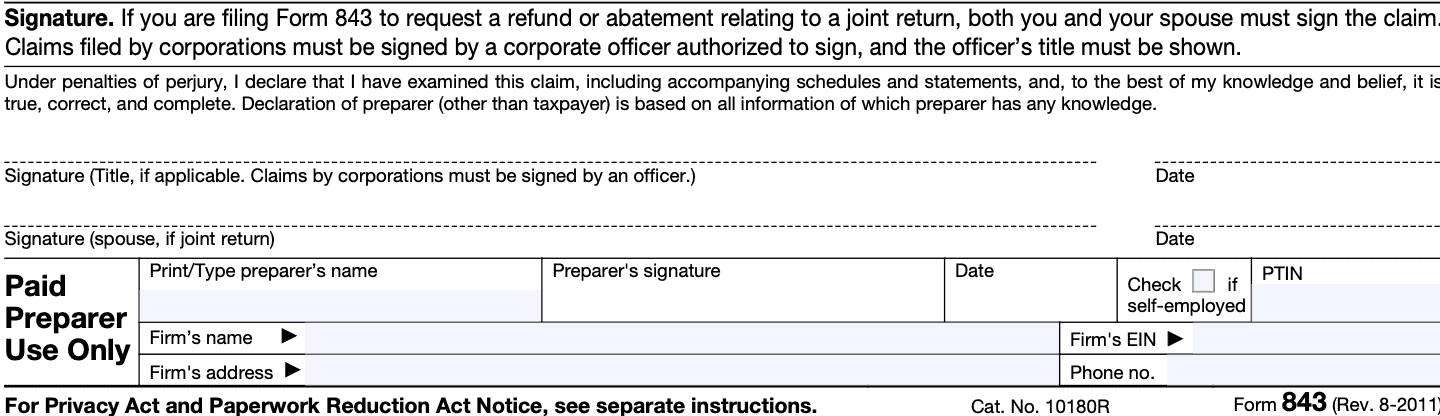

Signature fields

If you are filing for a jointly filed return, you and your spouse must sign the claim. For corporate requests, you must be a corporate officer authorized to sign on the company’s behalf, and your title must be clearly indicated.

If you are working with a tax professional, your tax preparer will complete the following fields:

- Preparer’s name

- Firm’s name and address

- Firm’s EIN

- Preparer Tax Identification Number (PTIN)

- Phone number

Both you and your tax professional are signing this form under penalties of perjury.

Let’s move on to when you should file Form 843.

When should I file IRS Form 843?

The IRS recommends using the abatement form to request any of the following:

- Tax refunds

- Except in cases where another tax form is more appropriate

- An abatement of tax

- Does not include income, estate, or gift tax

- Employers cannot use Form 843 to request an abatement of the following taxes:

- FICA

- RRTA

- Income tax withholding

- A refund to an employee of excess Social Security, Medicare, or RRTA taxes withheld by any one employer

- Only if your employer will not adjust the overcollection

- A refund of Social Security or Medicare taxes that were withheld in error,

- Only if your employer will not adjust the overcollection

- Nonresident aliens should consult IRS Publication 519, U.S. Tax Guide for Aliens, for specific instructions

- A refund of excess tier 2 RRTA tax when:

- You had more than one railroad employer for the year and

- Your total tier 2 RRTA tax withheld or paid for the year was more than the tier 2 limit.

- A refund or abatement of interest, penalties, or additions to tax, caused by:

- Certain IRS errors or delays, or

- Certain erroneous written advice from the IRS

- Refunds or tax abatements of a penalty or addition to tax due to reasonable cause or another reason allowed under the law

- This includes a request for an abatement or refund of the Section 6676 penalty for an erroneous claim for refund, where the claim was due to a reasonable cause. The assessed penalty is 20% of the amount determined to be excessive.

- A refund of the penalty imposed under Section 6715 of the Internal Revenue Code for misuse of dyed fuel

- A refund or abatement of tier 1 RRTA tax for an employee representative

- A refund of a branded prescription drug fee

- If requesting a branded prescription drug fee refund, the IRS recommends writing “Branded Prescription Drug Fee” across the top of the tax form.

When can I NOT file IRS Form 843?

Conversely, the IRS instructions state that you should not file this form in tax situations where other tax forms are more appropriate.

Common examples include:

- IRS Form 1040-X, Amended U.S. Individual Income Tax Return: Use this amended form in any of the following situations:

- To change any amounts previously reported on Form 1040 or similar forms

- To change amounts previously adjusted by the IRS, or

- To make certain elections after the prescribed deadline

- File with IRS Form 8959 to correct stated tax liability for additional Medicare tax

- IRS Form 8379, Injured Spouse Allocation: Use this form to claim your portion of a joint refund that the federal government used to offset your spouse’s past due obligations

- IRS Form 1045, Application for Tentative Refund, to apply for a “quick refund” resulting from any overpayment of tax due to:

- The claim of right adjustment or

- The carryback of the loss or unused credit

- IRS Form 4136, Credit for Federal Tax Paid on Fuels, to claim a credit for:

- Certain nontaxable uses (or sales) of fuel during the income tax year, or

- If you are a producer claiming a credit for alcohol fuel mixtures or biodiesel mixtures

The form instructions contain a complete list of situations in which a different tax form is more appropriate than Form 843.

Video walkthrough

Watch this instructional video to learn more about using Form 843 to request a refund or abatement.

Frequently asked questions

Unlike most tax forms, you cannot file Form 843 electronically. Depending on your tax situation, you must forward this form to the IRS Service Center best suited to address your request, as outlined in the form instructions. If filing in response to an IRS letter, follow the directions as stated in the letter.

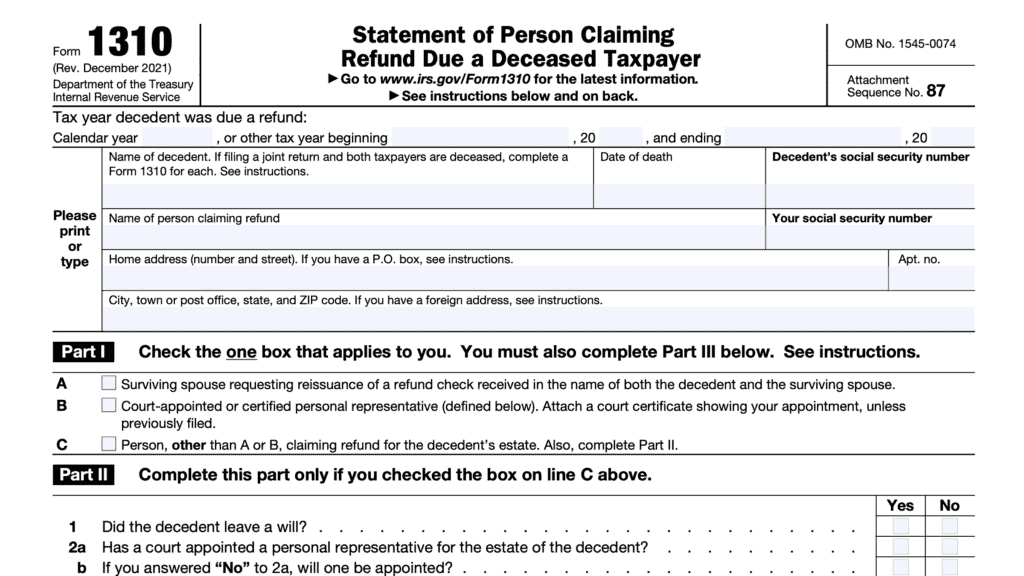

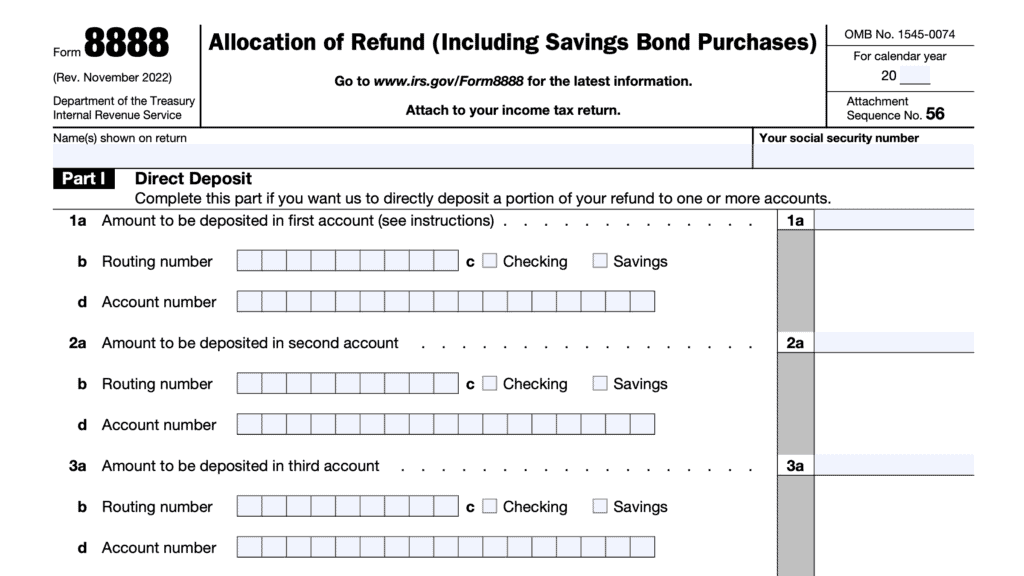

According to the Internal Revenue Service, you should not use Form 843 in situations where another tax form is more appropriate. Examples may include: filing an amended tax return (Form 1040-X), injured spouse allocation (Form 8379), or requesting a tentative refund (Form 1045).

IRS Form 843, Claim for Refund and Request for Abatement, is the multipurpose tax document that people may use to claim a tax refund or request an abatement of tax, penalties, or interest in certain situations.

Where can I find IRS Form 843?

You may download this tax form from the IRS website. However, the most recent version is located at the bottom of this article for your convenience.