IRS Form 8814 Instructions

If you have a child with unearned income, such as dividend income or interest, your child’s unearned income may be subject to kiddie tax rules. However, if your child’s income solely comes from dividends and interest, then it might be easier for you to report your child’s investment income on your personal tax return, instead of your child’s return. This article will walk you through IRS Form 8814 so you can learn about:

- What is IRS Form 8814

- How kiddie tax rules may impact your income tax return

- Whether or not you can use IRS Form 8814 to report your child’s total investment income

- When does it make sense to file Form 8814 instead of the child’s own return

- How to complete Form 8814

Let’s start with some background information on IRS Form 8814.

Table of contents

How do I fill out Form 8814?

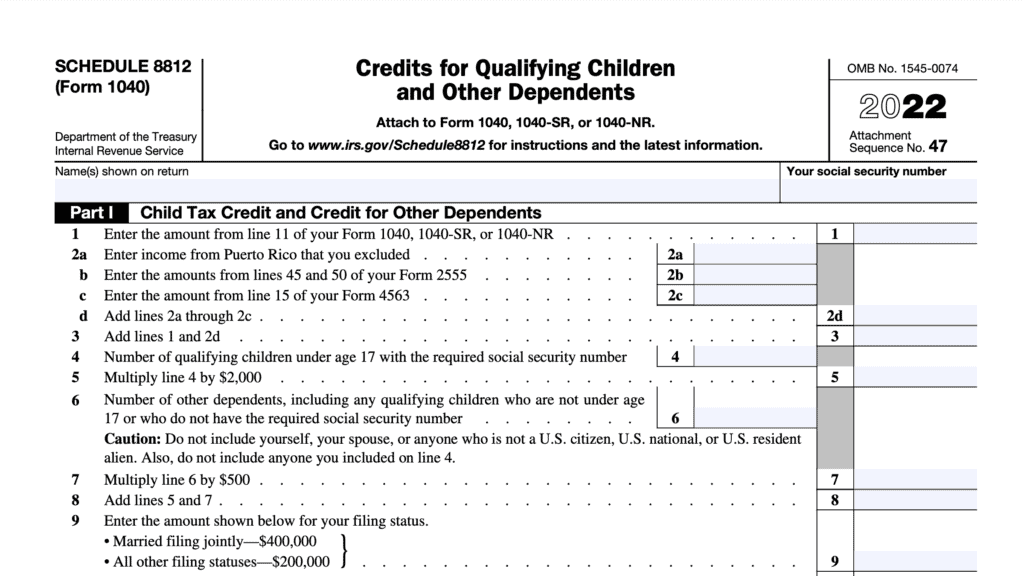

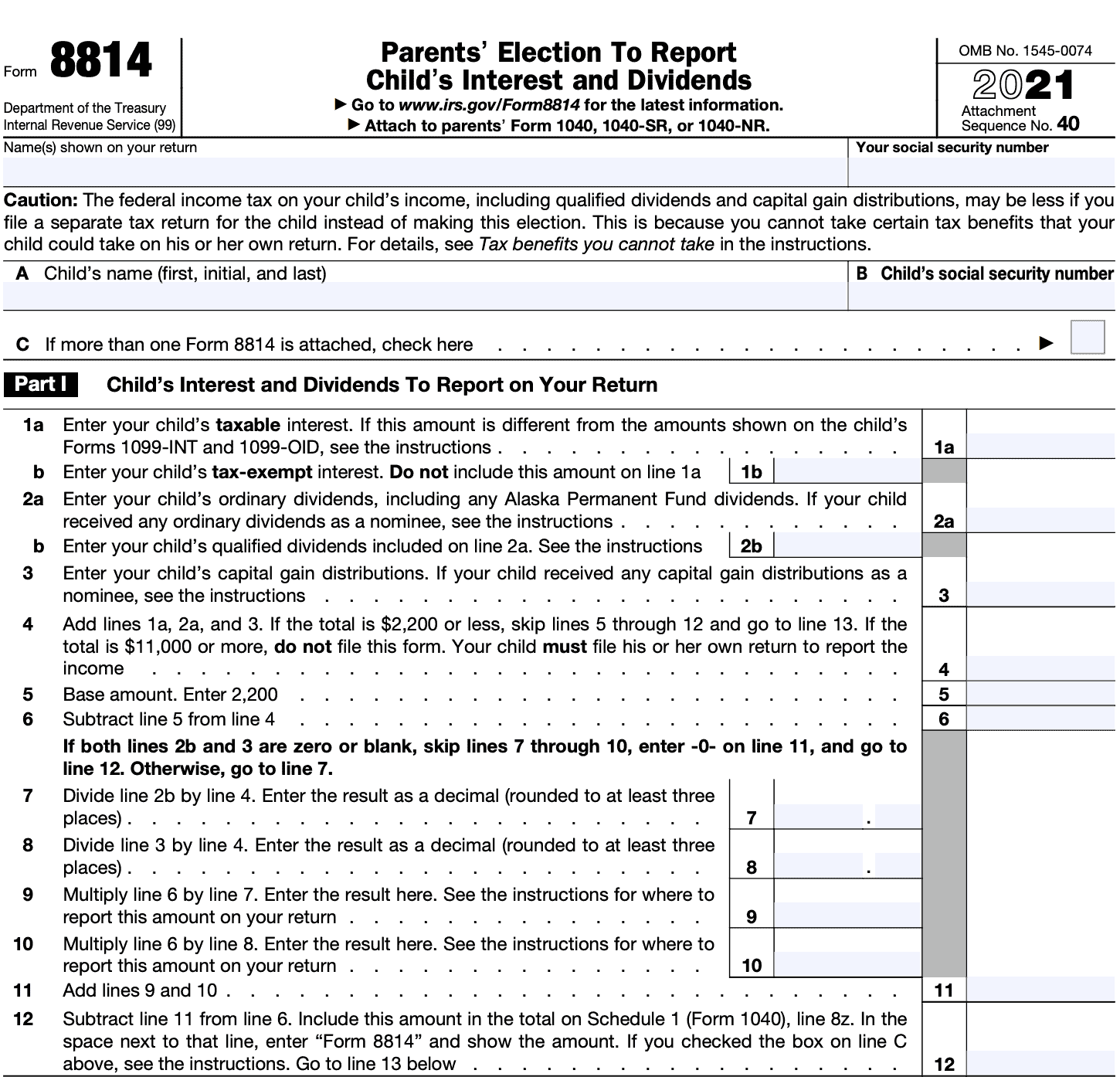

Fortunately, this one-page federal form is fairly straightforward, with 2 parts:

- Part I: Child’s Interest and Dividends to Report on Your Return

- Part II: Tax on the first $2,200 of Child’s Interest and Dividends

We’ll walk through each part, step by step.

Part I: Child’s Interest and Dividends to Report on Your Return

Top

At the top, you’ll enter:

- Parents’ name, as shown on tax return

- Parent’s Social Security number

- Child’s name

- Child’s Social Security number

- Whether or not more than one Form 8814 is attached

The top of this form also reiterates that the federal income tax liability may be lower if your child files a separate tax return.

Line 1: Child’s interest income

On Line 1a, include taxable interest, as reported on IRS Form 1099-INT or Form 1099-OID. On Line 1b, include tax-exempt interest.

If your child received interest as a nominee, that means he or she received interest income belonging to someone else. Report this amount with the letters, “ND” on the dotted line next to Line 1a. Do not include this in the total for Line 1a.

Line 2: Child’s dividend income

On Line 2a, include ordinary dividends, including any Alaska Permanent Fund dividends. You will find this on IRS Form 1040-DIV, Box 1a.

If your child received ordinary dividends as a nominee, that means he or she received ordinary dividend income belonging to someone else. Report this amount with the letters, “ND” on the dotted line next to Line 2a. Do not include this in the total for Line 2a.

On Line 2b, include qualified dividends. Qualified dividends are dividends subject to preferential tax rates, similar to capital gains. You will find this on IRS Form 1040-DIV, Box 1b.

Line 3: Child’s capital gain distributions

Enter the capital gain distributions your child received in the tax year. You will find these on Form 1099-DIV, Box 2a.

If your child received capital gains distributions as a nominee, that means he or she received capital gains distributions that belonged to someone else. Report this amount with the letters, “ND” on the dotted line next to Line 3. Do not include this in the total for Line 3.

Line 4

Total Lines 1a, 2a, and 3.

If the total is $2,200 or less, go directly to Line 13. You do not need to complete Lines 5 through 12.

If the amount is greater than $2,200 but less than $11,000, then you may use this form. However, you must complete Lines 5 through 12.

If the amount is $11,000 or greater, stop. You cannot file this form, and your child must file a separate tax return.

Line 5: Base amount

Enter $2,200 in Line 5.

Line 6

Subtract Line 5 from Line 4.

If both Lines 2b and 3 are zero or they are blank, skip Lines 7 through 10. Enter ‘0’ on Line 11, and go directly to Line 12.

Otherwise, proceed to Line 7.

Line 7

Divide Line 2b by Line 4. Enter the result as a decimal rounded to at least three places.

Line 8

Divide Line 3 by Line 4. Enter the result as a decimal rounded to at least three places.

Line 9

Multiply Line 6 by Line 7. Enter the result here.

According to the form instructions, you should also include this amount on Form 1040, 1040-SR, or 1040-NR, under Lines 3a and 3b. These are the lines for qualified dividends and ordinary dividends, respectively. Enter ‘Form 8814’ and this amount on the dotted line unless you file Schedule B, Interest and Ordinary Dividends.

If you file Schedule B, include this amount on Line 5. Identify this amount as coming from ‘Form 8814,’ then complete the rest of Schedule B as instructed. Also include this amount on Form 1040, 1040-SR, or 1040-NR, Line 3a.

You must file Schedule B if this amount, plus the parents’ dividends total more than $1,500.

Line 10

Multiply Line 6 by Line 8. Enter the result here.

According to the form instructions, you should also include this amount on Schedule D, Line 13, as well as Line 7 of of Form 1040, 1040-SR, or 1040-NR. Enter ‘Form 8814’ on the dotted line next to Line 13 on Schedule D, or in the blank space next to Line 7 on the 1040.

See Publication 929 for details if any of the child’s capital gain distributions were reported on Form 1099-DIV as one of the following:

- Unrecaptured Section 1250 gain

- Section 1202 gain, or

- Collectibles (28%) gain

Line 11

Add Lines 9 and 10.

Line 12

Subtract Line 11 from Line 6. Include this amount in the total on Schedule 1 (Form 1040), Line 8z. In the space next to that line, enter “Form 8814” and show the amount.

According to the form instructions, if you checked the box on Line C, indicating that you have more than one Form 8814, you’ll do the following:

- Add the amounts from Line 12 on all of your Forms 8814

- Include the result on Schedule 1, Line 8z

- Enter ‘Form 8814’ and the total of the Line 12 amounts in the space on that line.

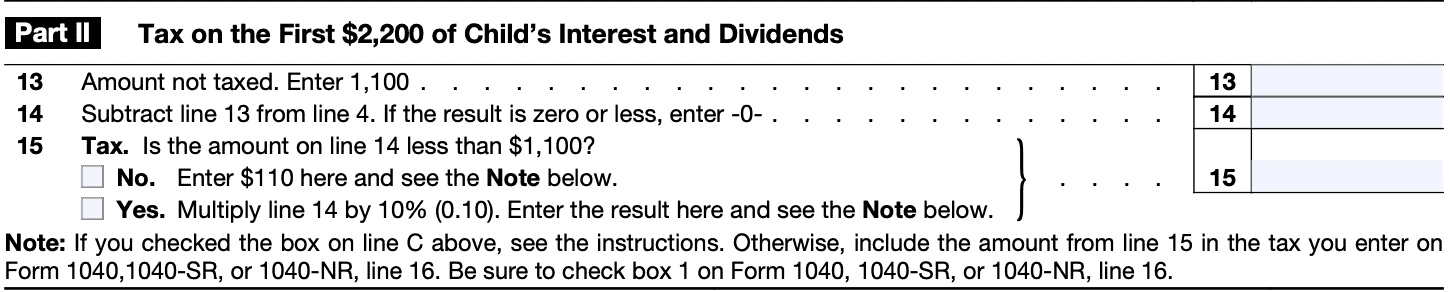

Part II: Tax on the First $2,200 of Child’s Interest and Dividends

Line 13

Enter $1,100. This represents the amount of your child’s unearned income that is not taxed.

Line 14

Subtract Line 113 from Line 4. If the result is zero or less, enter ‘0.’

Line 15: Is the amount on Line 14 less than $1,100?

If no, enter $110 on Line 15. Also, include the amount from Line 15 in the tax that you enter on Line 16 of Form 1040, 1040-SR, or 1040-NR. Ensure you check Box one on Line 16.

If yes, multiply Line 14 by 10%. Enter the result here and on Line 16 of Form 1040, 1040-SR, or 1040-NR.

If you checked the box on Line C above, be sure to add the Line 15 amounts from all Forms 8814 to Line 16 on the Form 1040.

Video walkthrough

Watch this instructional video to learn more about using IRS Form 8814 to report your child’s interest and dividend income on your income tax return.

Frequently asked questions

IRS Form 8814, Parents’ Election to Report Child’s Interest and Dividends, is the tax form parents may use to report unearned income on behalf of certain children who meet certain criteria. There are benefits and drawbacks to this election.

The primary benefit for using IRS Form 8814 is the ability to simplify tax reporting. This may help taxpayers with a minor child, child with special needs, or a full-time student who may not know how to file their own tax return. Additionally, tax preparation costs may be lower because there are fewer tax returns to file.

The primary drawback is the possible loss or limitation of certain tax benefits. This may include making your child’s tax rate higher than it should be, loss of certain deductions, and higher adjusted gross income (AGI), which may limit or preclude other tax benefits you may otherwise be entitled to.

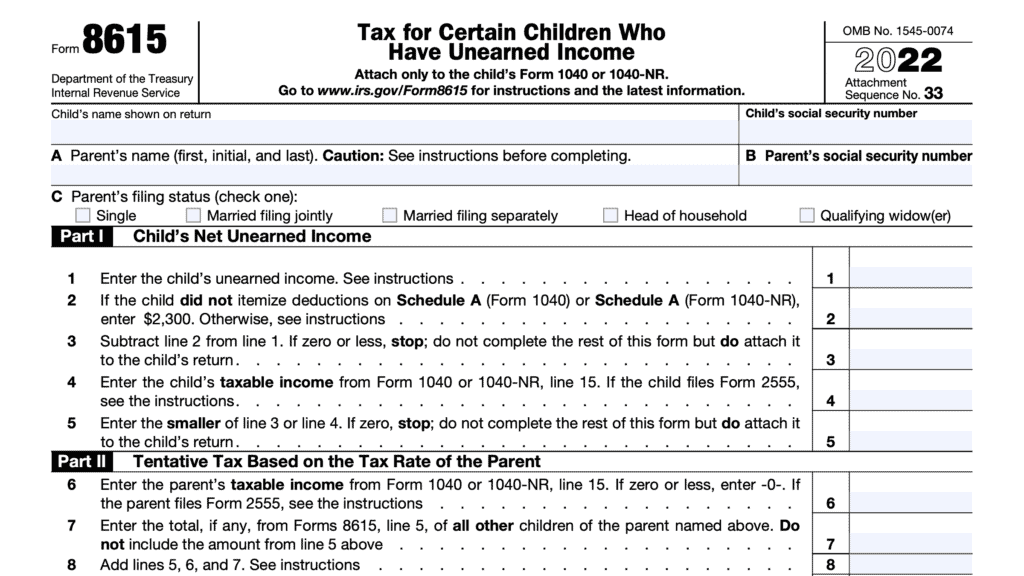

What are kiddie tax rules?

Under the tax code, children generally enjoy preferential tax rates to their parents. This is primarily because most children have lower income than their parents.

As a result, some parents may find it advantageous to title income producing investments in their child’s name for federal income tax purposes. In 1986, Congress instituted a set of rules, known as kiddie tax rules, designed to close this loophole.

What do kiddie tax rates look like?

For 2022, the tax treatment of a child’s unearned income is as follows:

- The first $1,150 qualifies for the child’s standard deduction. This means no tax applies to the first $1,150 of unearned income.

- The second $1,150 is taxed at the child’s tax rate, usually 10%.

- The rest of the child’s unearned income is taxed at their parent’s tax rate.

Who is subject to kiddie tax rules?

According to the Internal Revenue Service, the kiddie tax rules may apply in the following situations:

- If your child’s interest, dividends, and other unearned income total more than $2,200, it may be subject to a specific tax on the unearned income of certain children. See the Instructions for Form 8615, Tax for Certain Children Who Have Unearned Income for more information.

- If your child’s only income is interest and dividend income (including capital gain distributions) and totals less than $11,000, you may be able to elect to include that income on your return rather than file a return for your child. See Form 8814, Parents’ Election To Report Child’s Interest and Dividends.

We’re going to focus on the second of these rules.

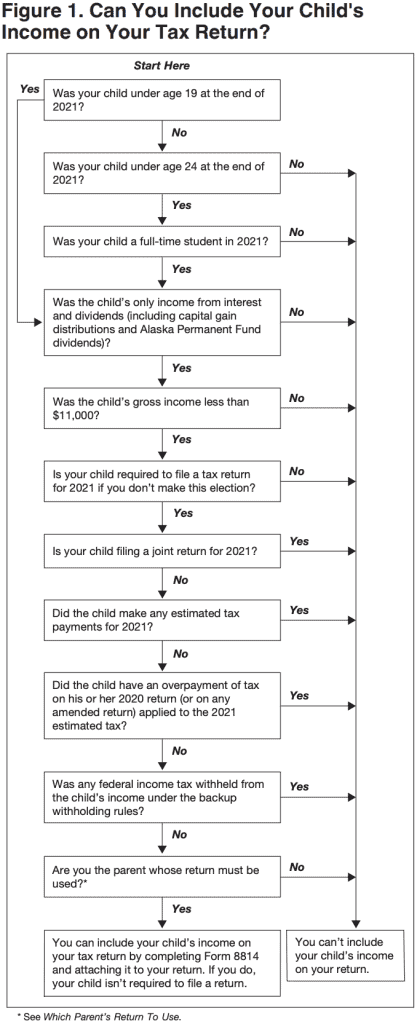

Who can use IRS Form 8814?

According to the form instructions, only certain taxpayers may elect to report their child’s interest and dividend income on the parent’s return.

Parents may make the election only if all of the following conditions apply:

- Your child was under age 19 at the end of the year unless he or she is a full-time student at a qualified educational institution.

- If your child is a full-time student, then he or she must be under age 24 at the end of the year.

- Your child’s income solely came from interest and dividends.

- This includes capital gain distributions and Alaska Permanent Fund dividends

- This includes qualified dividends and ordinary dividend income

- Your child’s gross income was less than $11,000

- Your child would otherwise have to file a tax return unless you make this election

- Your child does not file a joint return for the tax year

- No estimated tax payment was made for the year

- No overpayment was applied from a previous year tax return or amended return

- No federal income tax was withheld

- You are the parent whose return must be used when applying special tax rules for children.

Below is a flowchart from the IRS website to help navigate this decision.

Parents’ tax returns

The parents’ tax situation may impact who can use this tax form. Here are some example scenarios from IRS Publication 929:

If both parents are married, filing jointly

You can use the joint tax return to make the election.

If both parents are married, but filing separate returns

Use the tax return of the parent with the greater taxable income.

If the parents are married, but not living each other, and the custodial parent is considered unmarried for federal income tax purposes, use the custodial parent’s return.

When the custodial parent is not considered unmarried, then you must use the tax return of the parent with the greater taxable income.

If both parents never married

Use the tax return of the parent with the higher taxable income.

If parents are divorced

When the parents are divorced or legally separated, and the custodial parent is considered unmarried, use the custodial parent’s tax return.

If custodial parent remarried

If the custodial parent is remarried, then the IRS will treat the stepparent as the child’s other parent for tax purposes. In a joint return, use the joint return.

If filing separate returns, use the tax return for the person with the higher taxable income.

When does it make sense to use IRS Form 8814?

Generally, filing Form 8814 makes sense in situations where:

- Tax return preparation costs outweigh the potential tax benefits of reporting your child’s income on a separate return

- The tax impact on the parent’s return is nominal

According to IRS Publication 929, here are some situations worth considering:

Qualified dividends or capital gain distributions

If your child received qualified dividends or capital gain distributions, you may pay up to $110 more tax if you make this election instead of filing a separate tax return for the child.

Impact to child’s deductions

By making the Form 8814 election, you can’t take any of the following deductions that the child would be entitled to on his or her return.

- The additional standard deduction if the child is blind.

- The deduction for a penalty on an early withdrawal of your child’s savings.

- Itemized deductions (such as your child’s investment interest expenses or charitable contributions).

Deductible investment interest

If you take the investment interest deduction, your child’s unearned income is now considered your unearned income. You must take this into consideration when calculating your investment interest deduction.

Alternative minimum tax (AMT)

If your child received tax-exempt interest (or exempt-interest dividends paid by a regulated investment

company) from certain private activity bonds, you must determine if that interest is a tax preference item for AMT purposes.

If that is the case, then you may need to determine what, if any, impact this will have on your own AMT situation.

Net investment income tax

Any number that you report on Line 12 of IRS Form 8814 will directly impact your net investment income reported on IRS Form 8960. See the Form 8960 instructions for more information.

Where can I find a copy of IRS Form 8814?

You may download a copy of this federal form from the IRS website or by selecting the file below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!