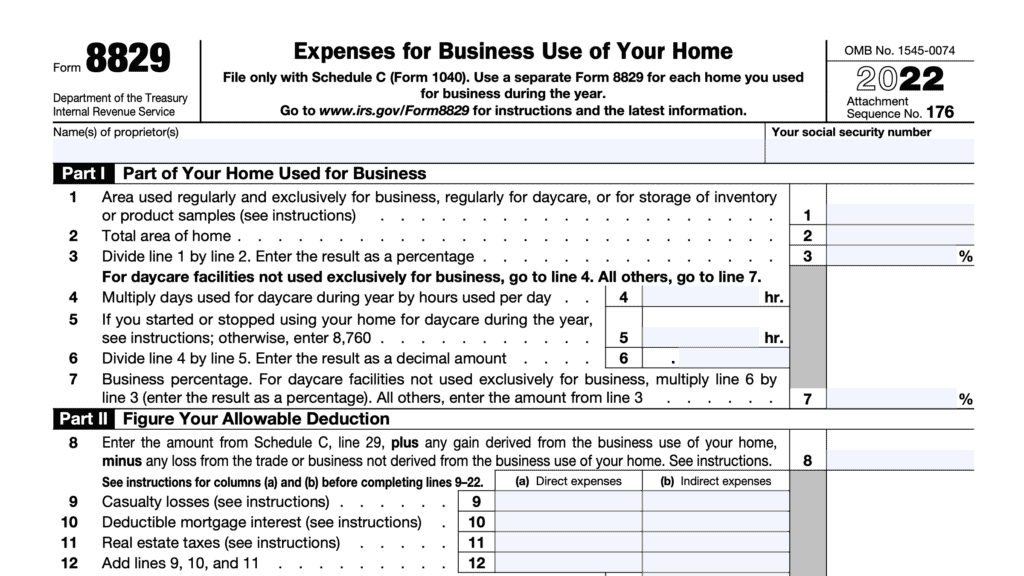

IRS Form 8829 Instructions

If you have a home-based business, you might be wondering how you can deduct business expenses against your taxable income. The federal government allows certain taxpayers, such as small business owners, to deduct business-related expenses from their taxable income by filing IRS Form 8829 with their federal income tax return.

Table of contents

In this article, we’ll walk through the basics of this tax form and the home business deduction, to include:

- Background information on Form 8829

- Recognized business deductions and how you can calculate them

- How to complete and file Form 8829

Let’s begin by walking through the tax form itself.

How do I complete IRS Form 8829?

There are four parts to this tax form:

- Part I: Part of Your Home Used for Business

- Part II: Figure Your Allowable Deduction

- Part III: Depreciation of Your Home

- Part IV: Carryover of Unallowed Expenses

Let’s go through each part, step by step.

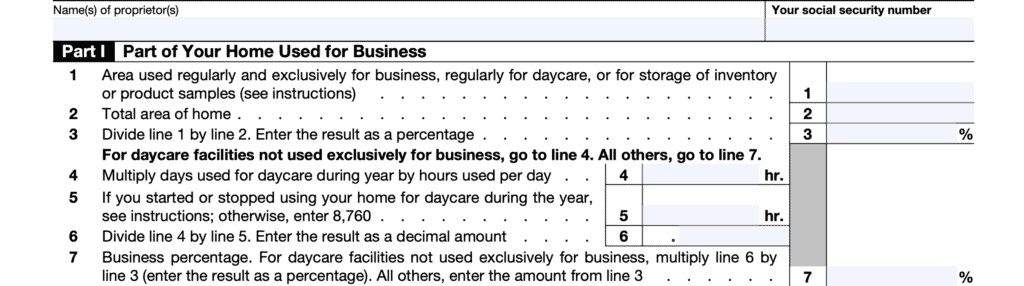

Part I: Part of Your Home Used for Business

In Part I, we’ll determine the amount of your home used for business purposes. This will help calculate the percentage of indirect expenses that you can deduct from gross income.

Line 1: Area used regularly and exclusively for business

Enter the area, in square feet, dedicated to exclusive and regular business use. If you have inventory or product samples or you operate a daycare facility, please see additional details in the form instructions.

Line 2: Total area of home

Enter the total area, in square feet, of your home.

Line 3: Percentage of home used for business

Divide Line 1 by Line 2. This represents the percentage of your house dedicated for business use. If you operate a daycare facility that is not exclusively used for business, go to Line 4. Otherwise, proceed to Line 7.

Line 4

Multiply the number of days used for daycare during the tax year by the number of hours used each day. This total should represent the number of hours used in a year as a daycare facility.

Line 5

If you started or stopped using your home for daycare during the year, you must prorate the amount of time the home was in use as a daycare facility. To do this, you should multiply the number of days available by 24 hours.

If your home was used as a daycare facility the entire year, enter 8,760.

Line 6

Divide Line 4 by Line 5. Enter the result as a decimal.

Line 7: Business percentage

If your daycare facility was not used exclusively for business, multiply Line 6 by Line 3, and enter the result as a percentage. Otherwise, carry down the amount from Line 3.

Part II: Figure Your Allowable Deduction

In Part II, we’ll calculate the direct and indirect expenses that you may use for your overall tax deduction.

Line 8

In Line 8, enter the amount from Schedule C, Line 29, plus the following:

- Add any gains derived from the business use of your home

- Subtract any loss from the trade or business not derived from the business use of your home

If applicable, these gains and losses might appear on either:

- IRS Form 8949, Sales and Other Dispositions of Capital Assets

- IRS Form 4797, Sales of Business Property

If either of these apply, please refer to the form instructions for more specific guidance.

For Lines 9 through 23, you’ll notice two columns:

- Column (a): Direct expenses

- Column (b): Indirect expenses

When entering expenses, you should enter 100% of your incurred expense, either direct, or indirect, into the appropriate column.

The exception is if the business percentage of a specific indirect expense is different from the percentage given in Line 7. In that case, enter the business portion of the expense in column (a), and leave column (b) blank.

For Lines 9, 10, and 11, these amounts should reflect the amount you could have chosen to itemize on Schedule A of your annual tax return, had it not been a deductible business expense.

Line 9: Casualty losses

If you have casualty losses, you’ll need to complete IRS Form 4684, Casualties and Thefts, to calculate the amount to put into Line 9. See the form instructions for more detail.

Line 10: Deductible mortgage interest

If you claim the standard deduction, do not include any mortgage interest in Line 10. Instead, enter the entire business use on Line 16.

If you itemize deductions, follow these steps:

- Treat all mortgage interest as a personal expense, then figure the amount that would be deductible as an itemized deduction on Schedule A.

- In column (b), include the amount of deductible mortgage interest attributable to the home where you conducted the business.

Do not include any numbers in column (a), even if you use a separate structure in your home in connection with your business. Any amounts that you do not claim on Schedule A, or in Line 10, can be entered on Line 16 as excess mortgage interest.

Refer to the form instructions for more detail

Line 11: Real Estate taxes

If you claim the standard deduction, do not include any real estate taxes in Line 11. Instead, enter the entire amount attributable to business use on Line 16.

If you itemize deductions, follow these steps:

- Determine whether the total amount of your state and local taxes attributable to the home exceeds $10,000 ($5,000 for a married couple filing separately). If less, enter the amount attributable to business use in Line 11b

- If greater, see the Line 11 worksheet in the form instructions.

- Enter the resulting amount in column (a).

Line 12

Add Lines 9, 10, and 11. You should have a total in column (a) and column (b).

Line 13

Multiply the result from Line 12, column (b) by the business percentage in Line 7. This represents the amount of indirect expenses attributable to business use.

Line 14

Add Line 12, column (a) and Line 13.

In other words, you are adding all direct expenses from column (a), and the business use-related indirect expenses from column (b).

Line 15

Line 16: Excess mortgage interest

If claiming the standard deduction: Enter all home mortgage interest in column (b).

If itemizing deductions: Enter the difference between:

- Total amount of mortgage interest paid

- Total amount of mortgage interest claimed on Line 10

Line 17

If claiming the standard deduction: Enter all state and local taxes attributable to the home in column (b).

If you used the Line 11 worksheet: Include the amount from Line 10 of the Line 11 worksheet in column (a). Otherwise, enter nothing.

Line 18: Insurance

Enter the amount of insurance premiums paid in column (b).

Line 19: Rent

If you rent your home, include the rent that you paid in column (b). If you own your own home, or if your home is provided at no cost, you cannot deduct the rental value of the home in Line 19.

Line 20: Repairs and Maintenance

Enter the amount of repairs or maintenance costs in column (b).

Line 21: Utilities

Enter the total cost of utilities in column (b).

Line 22: Other expenses

Include any operating expenses not previously provided.

Line 23

Add Lines 16 through 22.

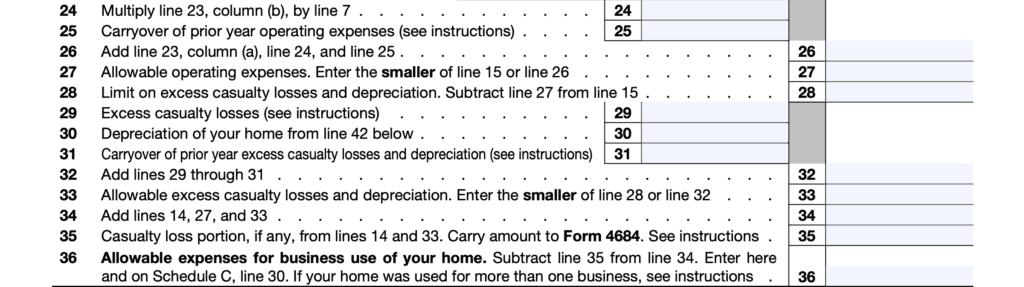

Line 24

Multiply Line 23, column (b), by Line 7.

Line 25: Carryover of prior year operating expenses

Enter any amount from Line 43 of your prior year Form 8829.

If you did not file a Form 8829, then your carryover of prior year operating expenses is the amount of operating expenses shown in Part IV of the last Form 8829, if any, that you previously filed to claim a deduction for business use of the home.

For example, if you filed a 2020 Form 8829 and you used the simplified method for 2021 but are not using it for 2022, enter the amount from line 6a of your 2021 Simplified Method Worksheet (or line 43 of your 2020 Form 8829).

Line 26

Add the following:

Line 27: Allowable operating expenses

Enter the smaller of:

This represents the allowable operating expenses that you can deduct.

Line 28: Limit on excess casualty losses and depreciation

Subtract Line 27 from Line 15.

Line 29: Excess casualty losses

Determine the casualty losses attributable to the home in which you conducted business that are in excess of the amount reported on Line 9, if any.

Multiply this number by the business percentage of those losses and enter the result.

Line 30: Depreciation allowable

Enter the number from Line 42, below.

Line 31: Carryover of prior year excess casualty losses and depreciation

Enter any amount from last year’s Form 8829, Line 44.

If you did not file a Form 8829 last year, then your carryover of prior year excess casualty losses and depreciation is the amount of excess casualty losses and depreciation shown in Part IV of

the last Form 8829, if any, that you filed to claim a deduction for business use of the home.

For example, if you filed a 2020 Form 8829 and you used the simplified method for 2021 but are not using it for 2022, enter the amount from line 6b of your 2021 Simplified Method Worksheet (or line 44 of your 2020 Form 8829).

Line 32

Add Lines 29 through 31.

Line 33: Allowable excess casualty losses and depreciation

Enter the smaller of:

- Line 28

- Line 32

Line 34

Add the following:

Line 35: Casualty Loss portion

If applicable, enter this amount on Form 4684, line 27, and enter “See Form

8829″ above line 27.

Line 36

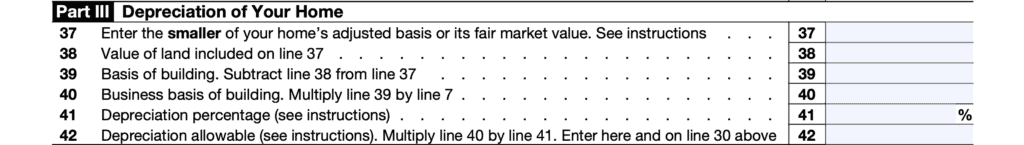

Part III: Depreciation of Your Home

In Part III, we’ll calculate the allowable home depreciation associated with your business.

Line 37

Enter the smaller of the following:

- Your home’s fair market value on the date you placed into service for business use, or

- The cost of your home (including land), without any previous adjustments to basis

Line 38: Value of land

Enter the cost value, or market value, of the land on which your home sits, as of the date you placed into service.

Line 39: Basis of building

Subtract Line 38 from Line 37. This gives you the cost basis of the building itself, from which you can calculate depreciation.

Line 40: Business Basis of building

Multiply Line 39 by Line 7.

Line 41: Depreciation percentage

Depending on the date your building was placed into service, enter the appropriate percentage as outlined in the form instructions.

Line 42: Depreciation allowable

Multiply Line 40 by Line 41. Enter this amount here and on Line 30:.

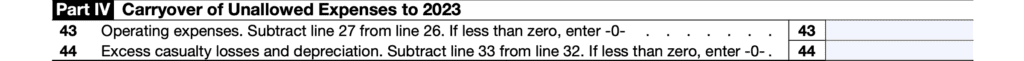

Part IV: Carryover of Unallowed Expenses

In Part IV, we’ll calculate the amount of excess expenses that must be carried forward to the following tax year.

Line 43: Operating expenses

Subtract Line 27 from Line 26. If less than zero, enter ‘0.’

Line 44: Excess casualty losses and depreciation

Subtract Line 33 from Line 32. If less than zero, enter ‘0.’

What is IRS Form 8829?

IRS Form 8829, Expenses for Business Use of Your Home, is the tax form that the Internal Revenue Service created for taxpayers to calculate the following:

- Allowable expenses for business use of your home that may be deducted from taxable income

- Nondeductible expenses in the current tax year that must be carried over to the following year

However, not every taxpayer can or should use Form 8829. Let’s take a closer look at who should and who should not use Form 8829 to calculate their home business deductions.

Who should complete Form 8829?

Generally, taxpayers can deduct business expenses that apply to a part of their home only if that part is exclusively used on a regular basis:

- As the principal place of business for trades or businesses

- As a place of business used by patients, clients, or customers in the normal course of trade or business; or

- In connection with a trade or business if it is a separate structure that is not attached to the home.

There are a few key concepts to discuss for a complete understanding.

What is a principal place of business?

According to the IRS, to determine whether your home office qualifies as your principal place of business, you should consider the following two factors:

- The relative importance of the activities performed at each place where you conduct business.

- The amount of time spent at each place where you conduct business.

What is exclusive use?

The other important word here is exclusively. Taxpayers usually cannot use the same part of their home for business and personal use. Exceptions exist for certain residences that may be used for:

- Storing inventory or product samples

- Operating certain daycare facilities

But not all taxpayers are allowed to use this tax form for a home office deduction.

Who is not allowed to use IRS Form 8829?

According to the form instructions, the taxpayers in the following situations cannot use Form 8829:

- You are claiming expenses for business use of your home as a partner or you are claiming these expenses on Schedule F (Form 1040).

- Instead, complete the Worksheet To Figure the Deduction for Business Use of Your Home in Pub. 587.

- All of the expenses for business use of your home are properly allocable to inventory costs.

- Instead, figure these expenses in Schedule C, Part III.

- You have elected to use the simplified method for this home for 2022.

- If you had more than one home during the year that you used for business, you can use the simplified method for only one home.

- Use Form 8829 to claim expenses for business use of the other home.

- Employees cannot claim any expenses for the business use of their home

What are deductible expenses for the business use of my home?

According to the IRS, you may be able to claim the following tax write-offs to the extent that they otherwise qualify for the home office tax deduction:

- Real estate taxes

- Home mortgage interest

- Casualty losses not reimbursed by your homeowner’s insurance policy

- Depreciation

- Homeowner’s insurance

- Rent paid for the use of property you do not own but use in your trade or business

- Repairs and maintenance

- Home security system

- Utilities and services

- For telephone usage, the first landline is considered a personal use, nondeductible expense. However, a second landline for business purposes, as well as all business-related long-distance calls, are considered business expenses

Where can I find IRS Form 8829?

Like other tax forms, you may find the latest version of this tax form on the IRS website. For your convenience, we’ve attached a copy of the bottom of this article.

Video walkthrough

Watch this instructional video for more details on how to complete IRS Form 8829.

Frequently asked questions

You can use either the simplified method or actual expenses method to calculate home-related business expenses.

In the simplified option, the IRS allows taxpayers to multiply the total square footage of your home that is used exclusively for your home business by $5.

For example, let’s imagine that you use a home office that measures 15 feet by 20 feet, or a total of 300 square feet. Using the simplified method, you could multiply 300 square feet by $5, resulting in a $1,500 tax deduction on Schedule C. The maximum square footage of your home office deduction using the simplified method is 300 square feet, or a total deduction of $1,500.

In the actual expenses method, you can deduct either direct expenses or indirect expenses related to the part of the home dedicated to business use.

No. If you use the simplified method, you cannot use any actual expenses related to the business use of your home. Finally, you cannot use any carried over actual home office expenses from prior year tax returns.

No. You cannot deduct any depreciation related to the portion of your home used in your business.

Direct expenses are expenses incurred only for the business use of your home. Examples might include painting your home office or making repairs to a light fixture inside your home office.

Indirect expenses are expenses incurred for the maintenance or upkeep for your entire home. Examples might include a homeowner’s insurance policy, utilities, or painting your entire home.

Your home office will qualify as your principal place of business if you meet the following requirements:

-You use it exclusively and regularly for administrative or management activities of your trade or business.

-You have no other fixed location where you conduct substantial administrative or management activities of your trade or business.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!