IRS Form 8944 Instructions

Most taxpayers will never file IRS Form 8944 with the Internal Revenue Service, even when they have a financial or economic hardship preventing them from paying their taxes on time. However, tax return preparers do file this form when they experience financial hardship.

This article will help you better understand:

- What IRS Form 8944 is used for

- What to expect if you hire a tax return preparer who files this form with the IRS

- What a taxpayer should do instead of Form 8944 for hardship waiver requests

Let’s start with going through this tax form, step by step, for a clearer picture.

Table of contents

How do I complete Form 8944?

Most taxpayers would not complete Form 8944, as this form is filed by tax preparers. However, we’ll include snapshots and step by step instructions of this one-page form for educational purposes.

Let’s start with the top portion of the form.

Top section

There are no official sections of this form. But to make things easier to read, the top portion contains the first six lines.

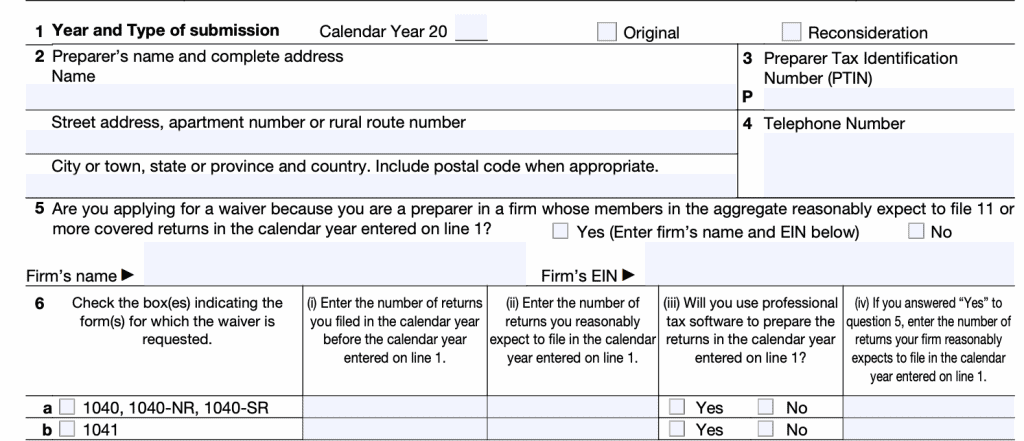

Line 1: Year and type of submission

In this line, the tax preparer will enter the calendar year of the request. Additionally, the preparer will check whether this is an original submission or a reconsideration of a previous submission.

An original submission is the preparer’s first request for a hardship waiver for the calendar year entered in this line.

A reconsideration includes additional information that the tax preparer believes will help the IRS representative overturn the denial of a previous request.

Line 2: Preparer’s name and complete address

Self-explanatory. The tax preparer will include their full name and complete mailing address.

Line 3: Preparer Tax Identification Number

Every tax preparer has a preparer tax ID number, known as a PTIN. The PTIN goes into Line 3.

Line 4: Telephone number

Self-explanatory. Provide your complete phone number, including area code.

Line 5: Reason for waiver

This line asks whether the tax preparer expects to file 11 or more covered returns in the coming tax year as a member of a tax preparation firm. Tax preparers who are not members of a firm should answer ‘No’ to this form and move onto Line 6.

Remember, the specified tax return preparer definition is based upon the number of returns (more than 10). This question asks the preparer to declare whether they believe themselves to be a specified tax return preparer as defined by the Internal Revenue Code.

If so, then enter the firm’s name and employer identification number (EIN) under Line 5.

Please note if you are a member of a tax preparation firm: If you personally expect to file 10 or fewer tax returns, but the firm expects to file 11 or more in the given year, you may still be required to e-file the tax returns you’ve prepared.

According to the form instructions, “All tax return preparers in a firm must e-file the covered returns they prepare and file if the firm’s preparers, in the aggregate, reasonably expect to file 11 or more covered returns in a calendar year.”

Line 6: Number of returns

Check the appropriate boxes next to the types of form(s) for which you are requesting the hardship waiver. This section attempts to separate individual income tax returns (Forms 1040) from estate and tax returns (Form 1041). For each type of form, you’ll enter:

Section (i)

The number of returns filed in the past year.

Section (ii)

The number of tax returns you reasonably expect to file in the coming calendar year.

When determining this estimate, do not count returns that you reasonably expect your clients will choose to have completed in a paper format and will file with the IRS themselves.

Also, do not count returns that you do not expect to e-file for various reasons. For example, do not

count forms that cannot currently be filed electronically (such as Form 1041-QFT). For more information, see Notice 2011-26 as modified by Notice 2020-70.

Section (iii)

Whether you plan to use professional tax preparation software to prepare the tax returns.

Section (iv)

The number of returns your tax preparation firm expects to file in the upcoming year. If you answered ‘No’ to Line 5, you should not answer this question.

When determining this estimate, do not count any return that would be excluded for the reasons provided earlier in the instructions for line 6(ii).

Bottom section

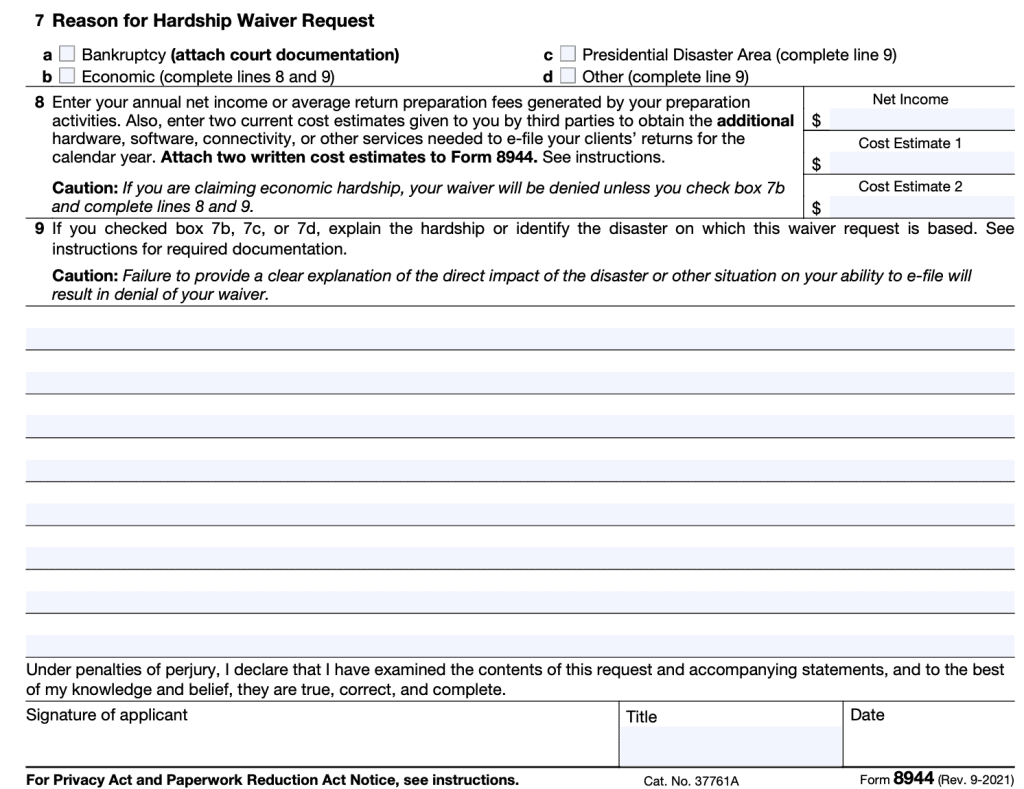

The bottom section identifies the reason for the hardship waiver request, as well as the economic impact of obtaining the required resources to meet IRS e-file requirements.

Line 7: Reason for Hardship Waiver Request

Check the appropriate box. However, check only one box, even if multiple reasons apply.

If you checked bankruptcy, and you have bankruptcy documentation, you must attach copies of these documents to your Form 8944.

For waiver requests citing economic reasons, you must complete Lines 8 and 9, below.

If you checked either Presidential Disaster Area (Box c) or Other (Box d), then you need to identify the disaster or conditions in Line 9 below.

Line 8

For tax preparers citing economic reasons for their hardship waiver request, Line 8 is mandatory.

Under net income, enter the annual income or average tax return preparation fees that your tax prep generates.

You’ll also need to enter two current, third-party cost estimates to obtain the additional resources you require to e-file client returns. According to the instructions, these cost estimates must reflect the total amount that each third party vendor will charge for:

- Purchasing a computer, if you do not have one

- Installing software and software upgrades

- Programming current system

- Costs to produce your electronic files

The IRS will not accept cost estimates written in any year except for the calendar year in which the request is filed.

Line 9

If you selected box 7b, 7c, or 7d, you must explain the hardship or identify the disaster behind the waiver request.

For economic waivers, you must explain why the additional expenses would cause an undue hardship.

Waivers for Presidential disaster declaration must include documentation on how the disaster directly impacted your ability to electronically file returns as an IRS e-file provider.

Waivers filed for other hardships must provide complete documentation detailing:

- The hardship described on Line 9, and

- The hardship’s impact on your ability to electronically file tax returns.

If you attach additional sheet(s), include on each sheet the name entered on Line 2 and the PTIN entered on Line 3.

The IRS specifically states that the federal government will not consider a hardship waiver request based on the lack of an Electronic Filing Identification Number (EFIN). It is the tax preparer’s responsibility to take all required steps to comply with the IRS e-filing requirement.

Signature block

In the signature field, the tax preparer will certify, under penalties of perjury, that the presented facts and accompanying statements are true and accurate.

Video walkthrough

Watch this video for step-by-step guidance on applying for a preparer’s e-file hardship waiver with Form 8944.

Frequently asked questions

A specified tax return preparer experiencing undue hardship due to their financial situation will file Form 8944 with the IRS to request relief from certain electronic filing requirements.

No. A taxpayer requesting relief from collection activity due to an IRS tax bill, penalties or interest may look for IRS assistance through penalty abatement, an offer in compromise, or installment agreement.

IRS Form 8944, Preparer e-File Hardship Waiver Request, is the tax form that a specified tax return preparer files with the IRS to request an undue hardship waiver from electronic tax return filing requirements in a given year.

The IRS requires any licensed tax preparer experiencing economic problems to submit their request before tax season starts in earnest. Generally, the tax preparer must submit their Form 8944 request between October 1 of the tax year in question and February 15 of the following year. If the due date happens to fall on a weekend or federal holiday, then that year’s deadline is the following business day.

Where can I get a copy of IRS Form 8944?

You may obtain a copy of this form from the IRS website or by selecting the file below.