IRS Form 8948 Instructions

The Internal Revenue Service requires most paid tax return preparers to file their clients’ federal income tax returns electronically. When the tax preparer cannot do this, they must file IRS Form 8948 and explain why. Additionally, the tax preparer must:

- Furnish a copy of this tax form to each client

- Have the client sign Form 8948 to acknowledge the manual filing

- Include the form with the client’s tax return

This article will walk you, the taxpayer, through what to expect if you see this form. Let’s start with step by step guidance on how your tax preparer would complete this form.

Table of contents

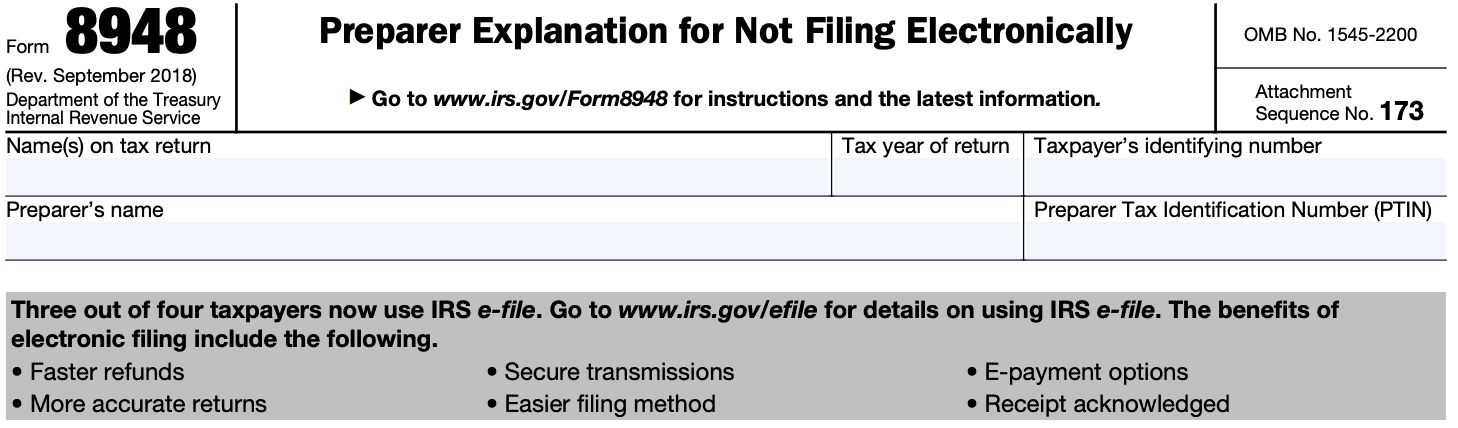

How do I complete IRS Form 8948?

This one-page tax form is fairly straightforward. Fortunately, you would not have to complete this form, because your tax preparer should do this.

We’ll go through it in two parts for complete understanding.

Taxpayer information

At the top of the form you’ll see:

- Taxpayer’s name

- Tax year of the particular return

- Taxpayer’s identifying number

- Can be their Social Security number (SSN) or Taxpayer Identification Number (TIN)

- Preparer’s name

- Preparer tax identification number (PTIN)

Each paid tax preparer has a PTIN that allows the IRS to know who filed a specific tax return. It also allows taxpayers to look up publicly available information about their tax return preparer. You can find more information about your tax return preparer in the Treasury Department’s Directory of Federal Tax Return Preparers with Credentials and Select Qualifications.

In this section, you’ll also find additional information on why the federal government relies on electronic filing for tax returns. Over the past 10+ years since the e-file mandate, there have been significant benefits, including:

- Taxpayers receiving faster refunds

- Tax returns are more accurate than with paper filing

- Electronic return transmissions are more secure

- Taxpayers find it easier to file

- There are options to pay electronically

- Taxpayers are notified when the IRS has received their tax return

The rest of the tax form contains reasons the paid preparer did not file electronically.

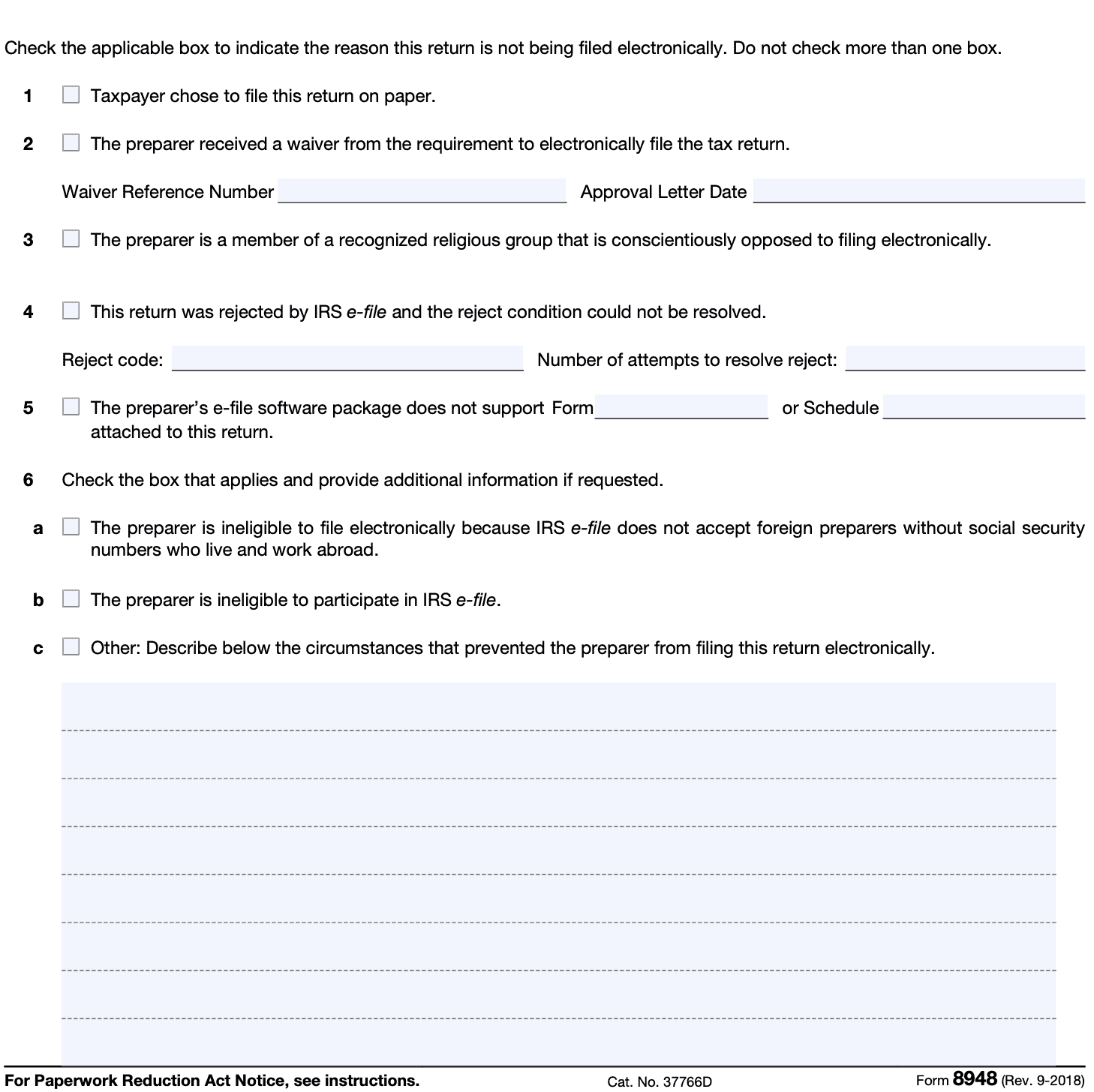

Reason the tax return is not filed as an electronic document

There are several possible scenarios to explain why the tax return preparer might file the tax return in paper format. Let’s look at each of them a little more closely.

The taxpayer chose to file a paper return.

If you have a tax preparer prepare your tax return, but elect to file a paper return on your own, then you will see a check in this box. However, the form instructions specifically state that Form 8948 does not meet the criteria of a taxpayer choice statement, based on IRS Revenue Procedure 2011-25.

So you may need to complete a separate statement for the preparer’s records.

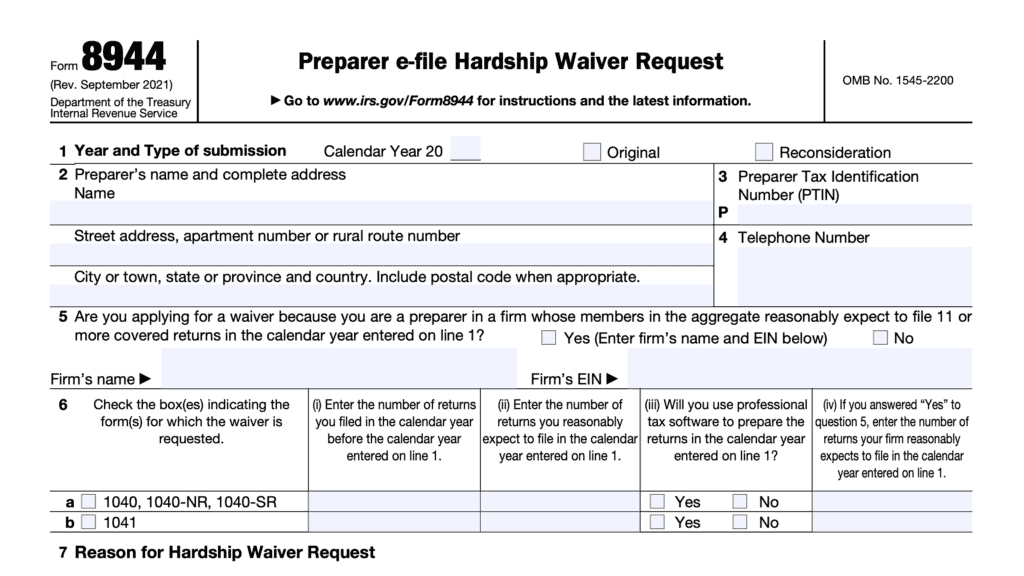

The tax return preparer submitted a waiver request that the IRS approved.

Your preparer will check this box if he or she received an approved undue hardship waiver for the current year. You should notice the waiver reference number and approval letter date as well.

The preparer’s religion prevents electronic filing.

Your tax return preparer will check this box if he or she is a member of a recognized religious group that is conscientiously opposed to its members using electronic technology, including the electronic filing of personal income tax returns. This religious group must have existed continuously since December 31, 1950.

The tax return was previously rejected and the preparer could not resolve the issue.

If there is a check in this box, it means that your preparer previously tried to submit this tax return electronically, but the IRS did not accept it for some reason. You should see a rejection code and the number of attempts your preparer made to resolve the issue.

The tax preparation software does not support a specific form or schedule attached to the return.

Your preparer will check this box if their tax preparation software does not support one or more required forms or schedules as part of the tax return. You should see the form, schedule, or a list of forms and schedules that the tax software does not support.

The preparer is ineligible to file for another reason.

There are several reasons why your tax return preparer might be ineligible to file electronically.

Foreign preparers without SSNs who live and work abroad cannot file electronically

You’ll see this box checked if the preparer is:

- A foreign person without a valid SSN who cannot enroll in IRS e-file and

- Is not a member of a firm that is eligible to e-file.

To qualify to check this box, the preparer must have applied for a PTIN and submitted Form 8946, PTIN Supplemental Application For Foreign Persons Without a Social Security Number.

The tax preparer is ineligible to participate in IRS e-file.

The preparer must have received a letter from the IRS enforcing the sanction and the sanction must be in effect for some or all of the calendar year in which the return is being filed.

The preparer may check this box until such time as the sanction period ends or the IRS accepts the preparer into the IRS e-file program, whichever occurs first.

If the preparer has filed a pending application for the IRS e-file program at the same time the sanction period ends, the preparer may continue to check this box until the IRS makes a decision about the preparer’s application.

Other

You’ll see a check in this box if there is another verifiable and documented explanation for not using e-file.

Who must file IRS Form 8948?

Any specified preparer who files more than 10 covered returns in any calendar year must file IRS Form 8948 for each income tax return not filed electronically. The tax preparer must include a copy of the Form 8948 with their client’s return so the taxpayer can review it before filing.

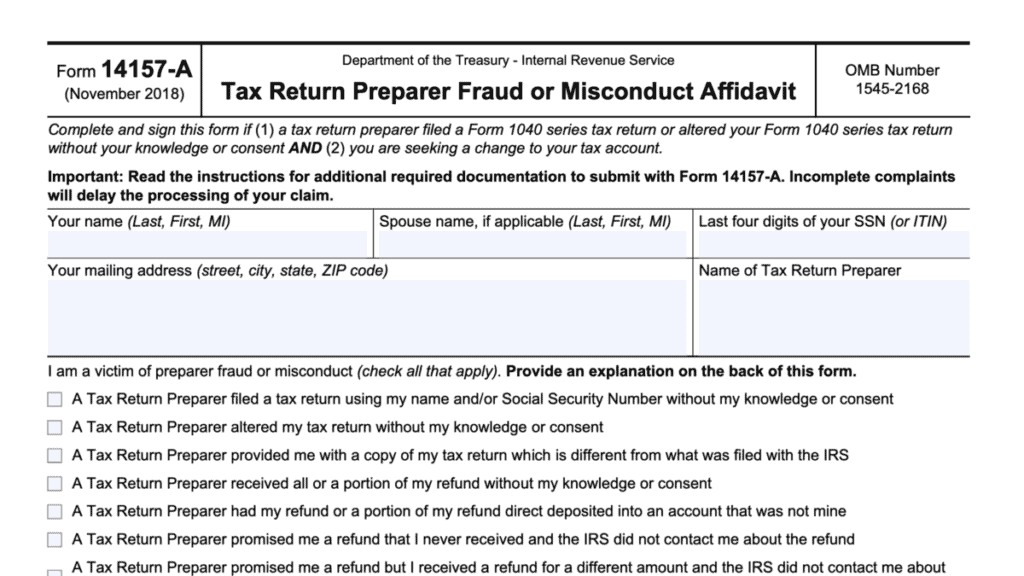

Approved preparer E-File hardship waiver request

Any specified tax return preparer who previously submitted IRS Form 8944, Preparer e-file Hardship Waiver Request, and received a letter of approval should still file a completed Form 8948 with the tax return sent to the IRS.

Taxpayer choice statement

However, the taxpayer choice statement, as described in 26 CFR § 301.6011-7(a)(4)(ii) is a separate document indicating that:

- The taxpayer chooses to file the tax return in paper format, and

- The taxpayer, not the tax preparer, will submit their federal return to the IRS

In this scenario, the tax preparer should keep a copy of the hand-signed taxpayer choice statement with their records. The tax preparer will not attach the statement to the income tax return or send it to the IRS.

Video walkthrough

Watch this instructional video to learn more about IRS Form 8948.

Frequently asked questions

IRS Form 8948, Preparer Explanation for Not Filing Electronically, is the tax form that specified tax preparers use to explain why a particular federal income tax return is being submitted on paper, despite the IRS e-file requirement.

Since 2011, Section 6011(e)(3) of the Internal Revenue Code has required specified tax return preparers to use electronically file individual income tax returns. This is known as an e-file mandate. The IRS e-file system helps taxpayers protect important personal information, make payments and receive tax refunds more quickly, and minimize common mistakes that occur with a paper tax return.

Section 6011(e)(3)(B) defines a specified tax return preparer as a tax return preparer that reasonably expects to file 11 or more individual income tax returns during a calendar year. Form 8948 is used by specified tax return preparers to identify returns that meet allowable exceptions to the IRS e-file requirement.

According to the IRS, a covered tax return is any income tax return filed on behalf of an individual, estate, or trust. Some covered tax returns cannot be filed electronically, either because the IRS has given specific guidance, or because they contain forms, schedules, or documentation that cannot be submitted electronically or with IRS Form 8453, Transmittal Document.

Where can I find a copy of IRS Form 8948?

You can download this federal form from the IRS website or by selecting the file below.