IRS Form 945 Instructions

If you’re reading this article, odds are that you’re trying to report federal tax withheld for non payroll payments. In that case, this article will walk you through IRS Form 945, step by step, so you understand everything you need to know.

We’ll walk through:

- The purpose of IRS Form 945

- Who should file?

- How to complete the form

- Best practices-things to do and to avoid

Let’s start with a step by step walkthrough of this tax form.

Contents

Table of contents

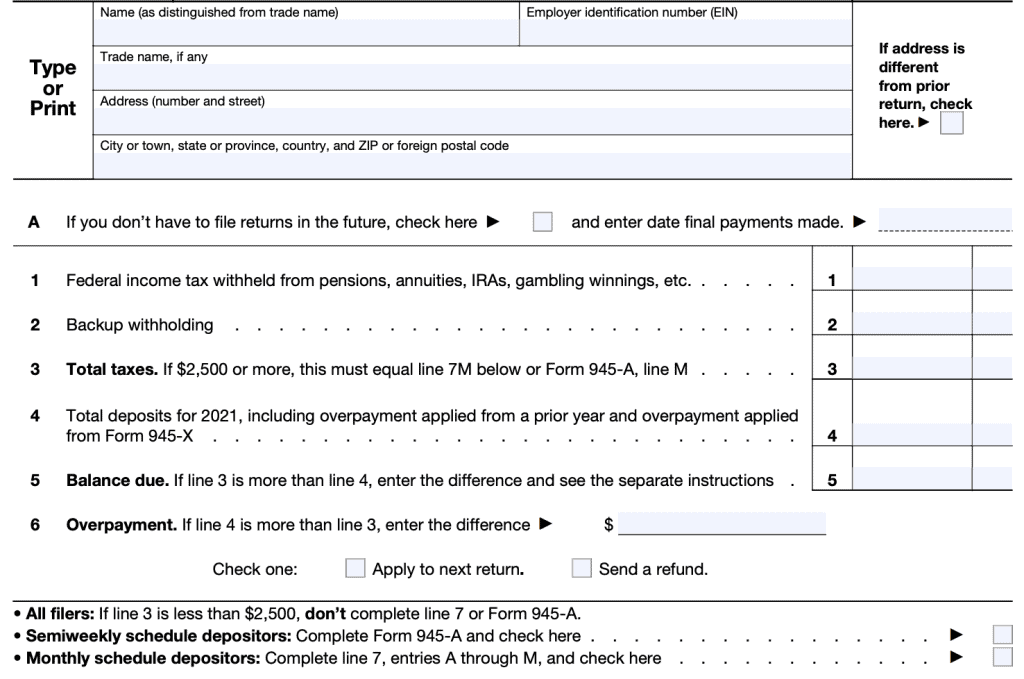

How do I complete IRS Form 945?

Fortunately, Form 945 only contains one page, making it fairly straightforward. For simplicity’s sake, we’ve broken down our step-by-step instructions into two parts: top and bottom.

Top of the form

At the very top of the form, you’ll include the following information:

- Business name

- Employer identification number (EIN)

- Trade name, if applicable

- Address

- City, state, and zip code

If your address has changed since you previously filed Form 945, please check the applicable box to the right.

Line A

Check this box if you are filing your final return and are going out of business or closing down operations. Enter the date of the final nonpayroll federal withholding.

If you are selling your business, you’ll check Line A, report the final payment date, and the total taxes that you withheld. The new owner will file a new Form 945 to report nonpayroll withholdings under their ownership.

Line 1: Federal income tax withheld

On Line 1, enter the amount you withheld (or were required to withhold) from the following:

- Pensions (including distributions from tax-favored retirement plans)

- Annuities

- IRA distributions

- Military retirement

- Indian gaming profits

- Gambling winnings (regular withholding only)

- Voluntary amount withheld on certain government payments

- Dividends or other distributions by an ANC

Line 2: Backup withholding

Enter backup withholdings, to include backup withholding on gambling winnings.

Additionally, regulated investment companies (RICs) and real estate investment trusts (REITs) must report any backup withholding on Form 945 in the year that the dividends are actually paid. For example, a REIT would report January payments of dividends declared in October of the prior year in the year that they actually paid the dividends.

Line 3: Total taxes

Add lines 1 and 2.

If total taxes are $2,500 or more, the amount reported on line 3 must equal the total liability for the year reported on line 7M (see Monthly Summary of Federal Tax Liability, below), or line M of Form 945-A.

Line 4: Total deposits for the calendar year

Enter total Form 945 deposits for the year. This also includes

- Overpayments applied from filing an amended form, known as Form 945-X

- Overpayments applied from the previous year’s tax return

Line 5: Balance due

Subtract Line 4 from Line 3. If Line 3 is greater than Line 4, enter the difference in Line 5.

As a general rule, if your total federal income taxes are greater than $2,500, AND you deposited all taxes by their respective due date, your balance due should be zero.

You should only have a balance due if your taxes were less than $2,500, and you were not required to make federal deposits.

Paying balance due

If you were required to make federal tax deposits, pay the amount shown on line 5 by electronic funds transfer (EFT), via the electronic federal tax payment system (EFTPS).

If you weren’t required to make federal tax deposits or if you’re a monthly schedule depositor making a payment under the accuracy of deposits rule (see section 11 of Pub. 15), you may pay the amount shown on line 5 by one of the following forms of payment:

- EFT

- Credit card

- Debit card

- Check

- Money order

- Electronic funds withdrawal (EFW)

See the IRS Payments page for more details about making payments.

Line 6: Overpayment

If Line 4 is greater than Line 3, enter the difference in Line 6. You should never enter a value in both Line 5 and Line 6.

You have two choices regarding the overpayment:

- Apply the overpayment from the current year tax return to next year’s return, OR

- Request the IRS to send a refund

If there is a past due tax account that is associated with your employer ID number, the IRS may select to divert your refund to pay that tax balance.

Bottom of the form

The second half of the form contains the monthly summary of when federal payments were made, and the filer’s signature.

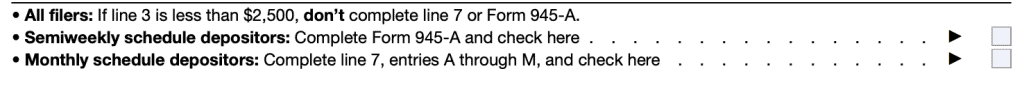

Before we proceed to Line 7, it’s important to note several boxes between Lines 6 and 7. Let’s go through each one.

All filers: If Line 3 is less than $2,500, do not complete Line 7. Instead, proceed to the signature blocks below.

Semiweekly schedule depositors: If you are semiweekly schedule depositor, you’ll check the appropriate box and complete Form 945-A, Annual Record of Federal Tax Liability.

Form 945-A is similar to Form 945. However, it provides the taxpayer a way to document specific dates payments were sent to the IRS.

Monthly schedule depositors: If you are a monthly depositor, complete Line 7 and check the appropriate box.

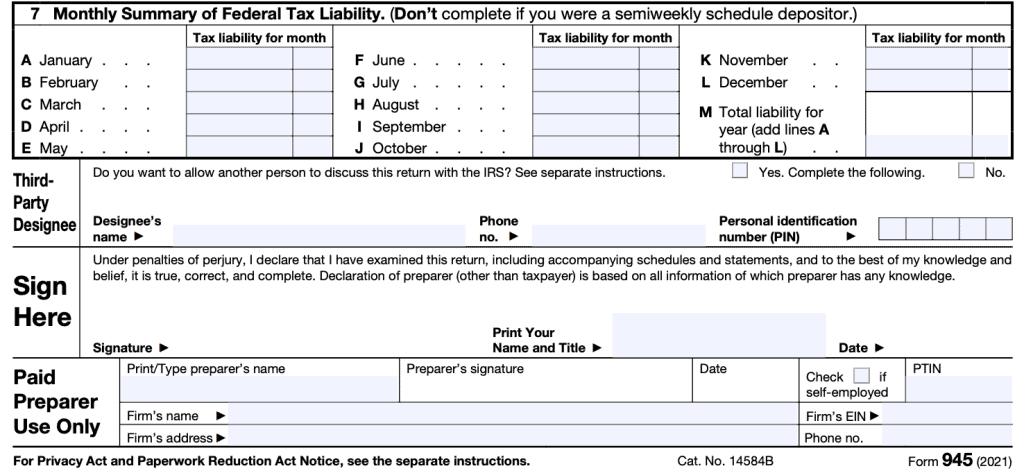

Line 7: Monthly summary of federal tax liability

You will only complete Line 7 if:

- Line 3 was greater than $2,500, AND

- You are a monthly schedule depositor

If that’s the case, then simply enter the tax liability for each month in Boxes A-L. Add them up to arrive at the total liability for the year. Enter that number into Box M.

Third Party Designee

If you authorize a third party to discuss your tax return with the IRS, complete this box. If not, select No and move to the signature field.

The IRS will require the designee’s name, phone number, and a personal identification number (PIN). The designee can select his or her own PIN. This field authorizes the third-party designee to:

- Give the IRS any information that is missing from your return.

- Call the IRS for information about the processing of your return.

- Respond to certain IRS notices that you have shared with your designee about math errors and return preparation. The IRS won’t send notices to your designee.

This designation does not authorize your designee to:

- Bind you, the taxpayer, to anything, including additional tax liabilities

- Represent you before the IRS

Signature

As the taxpayer, you’ll sign and date in this field, and print your name and title. It’s important to note that this signature declares, under penalties of perjury, that the tax return is accurate to the best of your knowledge.

Paid Preparer Use Only

If you have a paid tax preparer, such as an accountant or enrolled agent, that person will enter their information here. This includes:

- Preparer’s printed name

- Preparer’s signature

- Date

- Preparer Tax ID Number (PTIN)

- Business name

- Business address

- EIN

- Phone number

Video walkthrough

Watch this instructional video to learn more about filing your nonpayroll tax withholdings with IRS Form 945.

What is IRS Form 945?

IRS Form 945-Annual Return of Withheld Federal Income Tax, is the tax form used to report non-payroll tax withholdings made on behalf of individual taxpayers. These nonpayroll payments may include:

- Pensions, including distributions from tax-favored retirement plans

- Section 401(k)

- Section 403(b)

- Governmental section 457(b) plans

- Annuities

- IRA distributions

- Military retirement

- Gambling winnings

- Indian gaming profits

- Certain government payments on which the recipient elected voluntary income tax withholding

- Dividends and other distributions by an Alaska Native Corporation (ANC) on which the recipient elected voluntary income tax withholding and

- Payments subject to backup withholding

Who must file Form 945?

According to the IRS website, anybody who withholds, or is required to withhold, federal income tax from nonpayroll payments must file Form 945. Specifically, this includes anyone who reports federal tax withholdings on the following:

- IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- IRS Form 1099-MISC, Miscellaneous Information

- IRS Form 1099-NEC, Nonemployee Compensation

- IRS Form W-2G, Certain Gambling Winnings

In other words, if you’ve withheld income tax from individuals and reported it on one of the above forms, then the Internal Revenue Service also expects you to file Form 945. For many employers, the most common reason to file Form 945 is to report tax withholdings from payments made to independent contractors on Form 1099-MISC.

However, there is some information that may be reported elsewhere, that does not belong on Form 945.

What information is not included on IRS Form 945?

You should not report the following information on IRS Form 945:

- Payroll withholdings: Instead, report these on one of the following, as applicable:

- IRS Form 941, Employer’s Quarterly Federal Tax Return

- IRS Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees

- IRS Form 944, Employer’s Annual Federal Tax Return

- Schedule H (Form 1040), Household Employment Taxes

- Form CT-1, Employer’s Annual Railroad Retirement Tax Return

- Distributions from nonqualified plans or deferred compensation arrangements: Instead, report distributions and federal income tax withholding from such plans on IRS Form 941 or Form 944, as appropriate.

- Payments to agricultural workers on an H-2A visa, reported on Form W-2: If such an employee is being paid as a 1099 worker, they may be subject to backup withholding. You should report any 1099 backup withholding on Form 945, but not taxes reported on Form W-2.

Where do I file IRS Form 945?

The IRS encourages taxpayers to file this form electronically, when possible. However, if this is not possible, you can send a paper form to the appropriate IRS center, as listed in the chart below.

| If you’re in… | Without a payment | With a payment |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0042 | Internal Revenue Service P.O. Box 806534 Cincinnati, OH 45280-6534 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0042 | Internal Revenue Service P.O. Box 932300 Louisville, KY 40293-2300 |

| No legal residence or principal place of business in any state | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932300 Louisville, KY 40293-2300 |

| Special filing address for exempt organizations; federal, state, and local governmental entities; and Indian tribal governmental entities, regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0042 | Internal Revenue Service P.O. Box 932300 Louisville, KY 40293-2300 |

Frequently asked questions

IRS Form 945, Annual Return of Withheld Federal Tax, is used to report withheld federal income tax from nonpayroll payments such as pensions, military retirement, gambling winnings, Indian gaming profits and withholding from certain payments.

Backup withholding occurs when IRS rules mandate that a payer withhold a certain percentage of tax from payments, usually on Form 1099. The IRS might mandate backup withholding in cases where the payee does not provide a taxpayer identification number or does not report certain earnings.

Generally, taxpayers must file IRS Form 945 by January 31st of the year following the tax year filed. If the taxpayer has already made all payments in a timely matter, the IRS generally allows an additional 10 calendar days, to February 10th. If a deadline falls on a weekend or holiday, the due date is usually the next business day.

Where can I Find IRS Form 945?

You may download a free copy of the form from the IRS website or by clicking the file below.