How does compound interest work?

In this post, we’ll be covering one of the key pieces of building wealth known as the power of compound interest. Needless to say, compound interest is a wonderful thing. But how does compound interest work?

We’ll go into depth about the benefits of compound interest, particularly as it leads to financial success for patient investors.

But first, let’s start by recognizing some of the famous people who understood how powerful compound growth actually is.

Contents

Famous quotes about the power of compounding

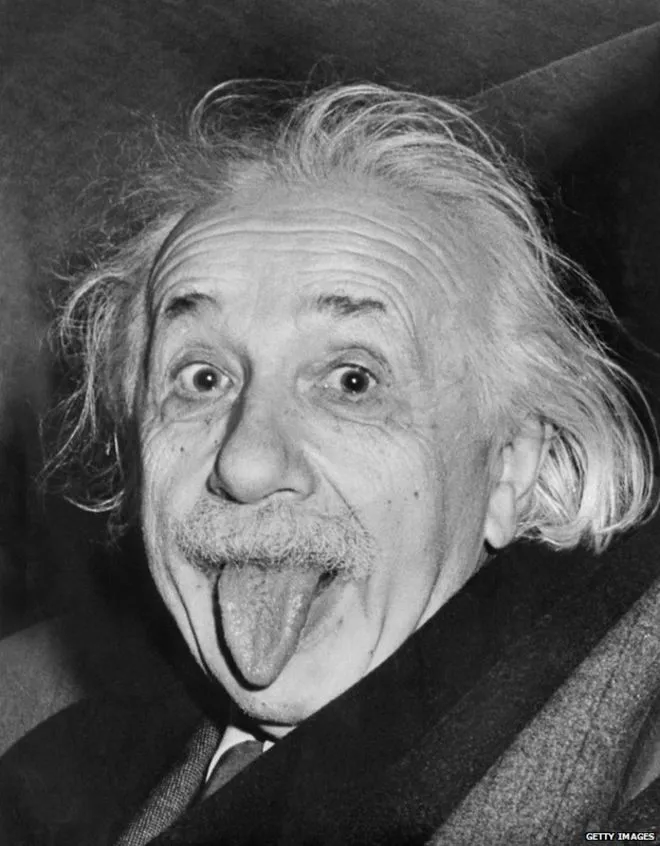

Let’s start with one of the more famous quotes out there on the internet. This quote about the power of compound growth is usually attributed to Albert Einstein.

“Compound interest is the 8th wonder of the world. He who understands it earns it. He who doesn’t pays it.”

Albert Einstein …maybe

Of course, Einstein’s quote isn’t the only one out there. Here are a couple more quotes from notable geniuses.

Money makes money. And the money that money makes, makes money.

Benjamin Franklin

While Benjamin Franklin didn’t expressly state the words ‘compound interest,’ it’s clear that his citation was describing the compounding of interest over time.

Finally, we would be remiss if we didn’t have a quote from the most famous investor of our time, Warren Buffett.

“Start early. I started building this little snowball at the top of a very long hill. The trick to have a very long hill is either starting very young or living to be very old.”

Warren Buffett, 1999 Berkshire Hathaway shareholders’ meeting

Here’s another quote from Warren Buffett:

My wealth has come from a combination of living in America, some lucky genes, and compound interest

Warren Buffett

And there probably isn’t better proof of the advantage of compound interest than Warren Buffett. According to a recent article by Barron’s, Buffett amassed over 90% of his wealth after turning age 65.

Needless to say, compound interest is a powerful force. And the earlier you start to harness its power by putting your money to work for you, the better off you’ll be.

How do you define compound interest?

When it comes to calculating investment return, there are two types of interest. There is simple interest, and there is compound interest. Before we understand compound interest, we should define and understand simple interest.

What is simple interest?

Simple interest is the interest calculated on an investment at a fixed rate. Let’s imagine that you have a $1,000 savings bond paying 6% per year.

That’s $60 per year. Each year. For as long as you have the bond. Here’s what that payout looks like.

| Year | Interest payment | Total interest paid | Total interest & princippal |

| 1 | $60 | $60 | $1,060 |

| 2 | $60 | $120 | $1,120 |

| 3 | $60 | $180 | $1,180 |

| 4 | $60 | $240 | $1,240 |

| 5 | $60 | $300 | $1,300 |

What is compound interest?

In contrast, compound interest builds on top of the previous interest. Over time, this becomes a cumulative effect.

Let’s look at what that bond would pay out over 5 years, if the interest were compounded annually.

| Year | Interest payment | Total interest paid | Total interest & principal |

| 1 | $60 | $60 | $1,060 |

| 2 | $63.60 | $123.60 | $1,123.60 |

| 3 | $67.42 | $191.02 | $1,191.02 |

| 4 | $71.46 | $262.48 | $1,262.48 |

| 5 | $75.75 | $338.23 | $1,338.23 |

At the end of the first year, both bonds would have paid the same amount. But at the end of the second year, you’ll notice a slight difference between the two. In the third year, that difference has grown.

That difference is the magic of compound interest. And it gets better each year.

At the end of 5 years, the difference between the first bond and the second bond is only $38.23. But the magic of compound interest is the exponential growth that accompanies it. This growth manifests itself in the later years of an investment return.

So fast forward 30 years. Bond 1 is still paying $60 per year, and has paid out $1,800 on the original $1,000 investment. Okay.

Bond 2 would have paid out $4,743.49 in year 30 alone. And it would have paid out over $53,800 in interest over the course of 30 years.

Why does compound interest work this way?

Simply put, the compound interest formula is interest on an investment or liability that is calculated against the principal AND all previously accrued interest. In comparison, simple interest is interest that is only applied against the original principal.

This is different from a simple interest in which the interest rate is applied against the principal only. When calculating investment return over a long period of time, this can add up to a huge sum of money.

How does compound interest work in a 401k?

Let’s look at another example, this time with stock returns in your retirement accounts.

For the sake of easy math, assume you have $1,000 to invest in your 401k with a fund that has averaged a 10% annual return over the past 30 years. It’ll be a few years until you’ll need it, so you might as well let it grow.

Example #1: The Effect Of Compounding Interest On $1,000

| YEAR | PRINCIPAL INVESTMENT | ENDING BALANCE |

|---|---|---|

| One | $1,000 | $1,100 |

| Two | $0 | $1,210 |

| Three | $0 | $1,331 |

| Four | $0 | $1,464.10 |

| Five | $0 | $1,610.51 |

| Six | $0 | $1,771.56 |

| Seven | $0 | $1,948.72 |

| Ten | $0 | $2,593.74 |

| Twenty | $0 | $6,727.50 |

| Thirty | $0 | $17,449.40 |

You’ll see the effects of compounding interest over time, beginning as early as year 2–and the magic really kicks after 10, 20, and 30 years.

If you left that $1,000 in this investment for 30 years, over time as a result, with compound interest you would have $17,449!

And keep in mind, you didn’t contribute anything beyond the initial investment.

Let’s see what would happen if you added just $1,000 per year over a 30 year period.

Example #2: The Effect Of Compounding Interest On $1,000 Invested Annually

| YEAR | PRINCIPAL INVESTMENT | ENDING BALANCE |

|---|---|---|

| One | $1,000 | $1,100 |

| Two | $1,000 | $2,310 |

| Three | $1,000 | $3,641 |

| Four | $1,000 | $5,105.10 |

| Five | $1,000 | $6,715.61 |

| Six | $1,000 | $8,487.17 |

| Seven | $1,000 | $10,435.89 |

| Ten | $1,000 | $17,531.17 |

| Twenty | $1,000 | $63,002.50 |

| Thirty | $1,000 | $180,943.42 $1,000 invested annually at 10% compounding interest would leave you with over $180K after 30 years! With compound interest, in 30 years, your investment would have grown to nearly $181,000 with just $30,000 invested. But the amazing part is that two-thirds of the total growth happened in the last ten years. Want to hear the coolest part of all? You have this power at your fingertips RIGHT NOW! Seriously. You can set up an investment account and start saving today, invest a few dollars in a Vanguard S&P 500 index fund, and leave it alone. Compounding interest will take care of the rest. Now admittedly, this illustration, done for educational purposes only, oversimplifies the “how, when, and where” of investing in the stock market. And past performance is no indication of future results. But it definitely covers the “why.” How to maximize compound interestFirst, you need free cash flow that you can invest, and the confidence that you can leave it invested. For that, you need a budget that works. After all, if you’re always in a financial crisis, you won’t be able to leave your money invested for any length of time. Therefore, the sooner you pay off debt and take control of your financial destiny, the sooner you can start investing. The more time you have on your side, the more you’ll benefit from the wonders of compound interest. And staying invested for the long run is one of the hallmarks of a great investor. To help get rolling, I’d recommend starting with this guide for the basics of personal finance, which covers the following:

Now that you know the answer to how does compound interest works, are you ready to start investing? The sooner you start investing, the longer you have to benefit from its power to create the financial future you want. If you are already utilizing compound interest to your benefit, please share your motivating successes in the comments below! Any tools, tips for others ready to start investing? |