IRS Form 8879-EG instructions

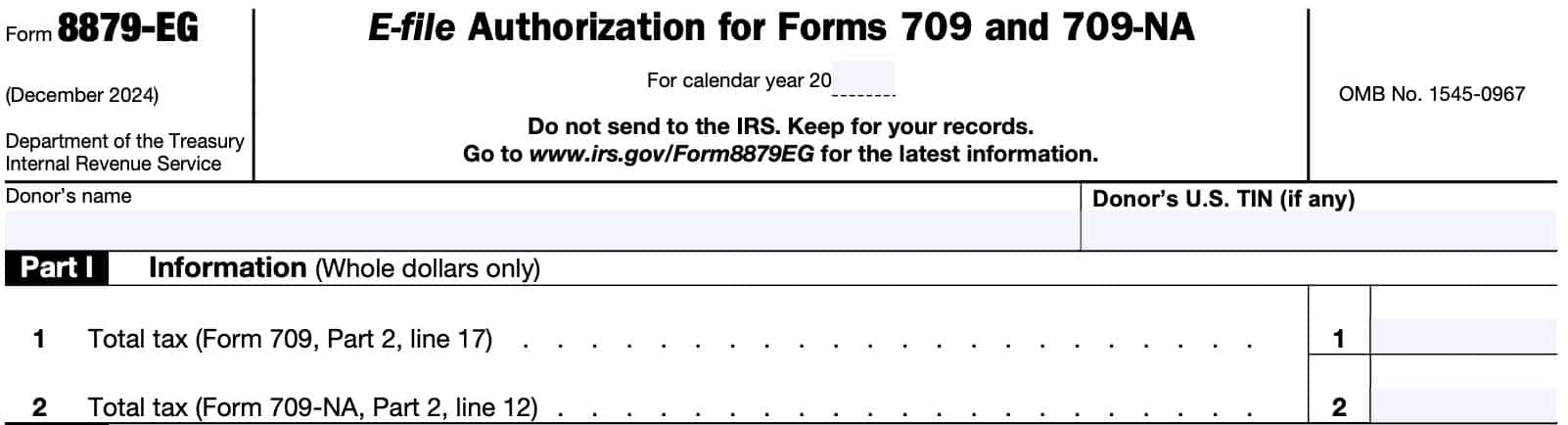

When filing a gift tax return, the donor may choose to allow their tax professional to electronically sign the federal tax returns on his or her behalf. The donor can do this by using IRS Form 8879-EG, E-file Authorization for Forms 709 and 709-NA.

In this article, we’ll go over what you need to know about IRS Form 8879-EG, including:

- How to complete IRS Form 8879-EG

- Donor responsibilities

- Frequently asked questions

Let’s start with an overview of how to complete this tax form.

Table of contents

How do I complete IRS Form 8879-EG?

There are three parts to IRS Form 8879-EG:

- Part I: Information

- Part II: Donor Declaration and Signature Authorization

- Part III: Certification and Authentication

Before we begin with Part I, let’s take a look at the information fields at the very top of IRS Form 8879-EG.

Top of IRS Form 8879-EG

At the very top of IRS Form 8879-EG, there are a few information fields to complete.

Calendar year

Enter the year of your gift tax return. If using tax preparation software, your software should automatically complete this field.

Donor’s name

Enter the taxpayer’s name in this field.

Donor’s U.S. TIN

If you are filing IRS Form 709, enter your Social Security number (SSN) or individual taxpayer identification number (ITIN), as applicable.

Part I: Information

In Part I, we’ll enter certain tax return information from the gift tax return. When completing Part I, keep in mind that you should enter a value in either Line 1 or Line 2, but not both.

Line 1: Total Tax

If you are filing IRS Form 709, enter the amount from Part 2, Line 17.

Line 2: Total tax

If you are filing IRS Form 709-NA, then enter the amount from Part 2, Line 12.

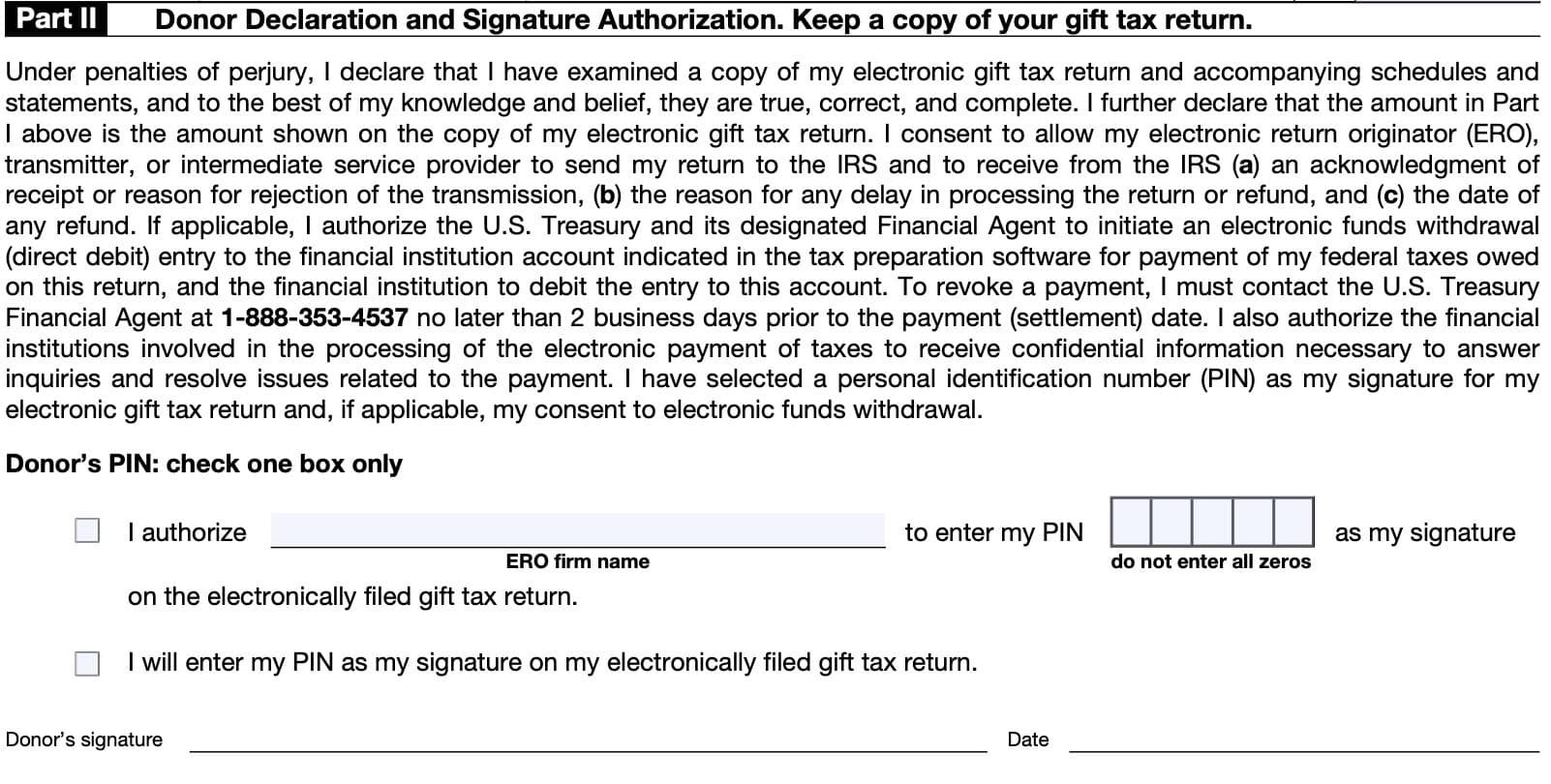

Part II: Donor Declaration and Signature Authorization

In Part II, we’ll go over the declaration and signature authorization of the donor. Before we get into the instructions, we should take a moment to go over some of the IRS requirements outlined in the finer print.

What does the declaration say?

There are a few main points you should know here.

You may be subject to legal penalties

In the first line, you are declaring, under penalties of perjury, that:

- You have personally reviewed the tax return, and

- The tax return is true, correct, and complete, to the best of your knowledge

You’re giving certain permissions to your tax professional

In the declaration, you are giving your electronic return originator (ERO), transmitter, or intermediate service provider permission to send and receive certain information to the IRS.

Specifically, you are granting permission to receive:

- Acknowledgment of receipt or reason for rejection of the transmission (tax return)

- Reasons for delays in processing the tax return or tax refund

- Date of any refund that may be owed to the estate or trust

You’re giving the federal government permission to conduct electronic funds withdrawal from a bank account

If you owe gift tax to the United States government, your electronic signature authorizes the U.S. Treasury, through its designated financial agent, take electronic payment of the gift tax bill.

The federal government will do this by direct debit from your financial institution account.

If you wish to revoke a payment, you must contact the financial agent no later than 2 business days prior to the payment or settlement date.

Donor’s PIN

Once you’ve read the declaration, you may choose one of the available personal identification number (PIN) methods:

- ERO enters your PIN for you

- Enter your own PIN

Select the first box if you authorize your tax preparer to enter your PIN. You’ll enter the five-digit PIN on the electronic Form 8879-EG, which your tax preparer will use to provide your IRS electronic signature.

Otherwise, you will enter your own PIN in the tax preparation software prior to electronic filing of the tax return.

Below the PIN, sign and date the form as the donor.

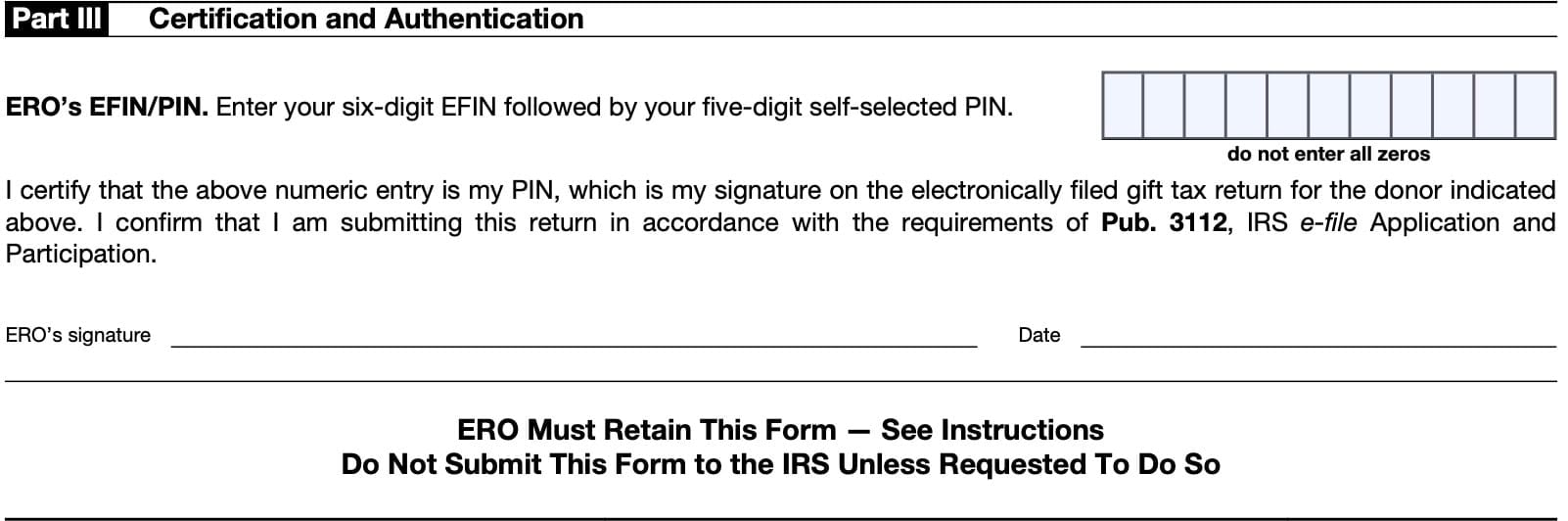

Part III: Certification and Authentication

In Part III, your tax return preparer will enter his or PIN, which consists of:

- The ERO’s six-digit electronic filing identification number (EFIN), followed by

- A five-digit PIN

Below this field, the ERO will sign and date the Form 8879-EG.

Filing IRS Form 8879-EG

As the taxpayer, there are a couple of things you may want to know about IRS Form 8879-EG.

Your tax return preparer won’t send this form to the IRS

In fact, the form itself says in bold print, “Don’t send to the IRS. Keep for your records.” Your tax return preparer is required to keep this form for at least 3 years after the tax return is filed, or after the IRS has received the tax return, whichever is later.

You don’t have to complete IRS Form 8879-EG

A donor and an ERO use Form 8879-EG when the donor wants to use a personal identification number (PIN) to:

- Electronically sign an estate’s or trust’s electronic income tax return and,

- Consent to electronic funds withdrawal (direct debit), if applicable

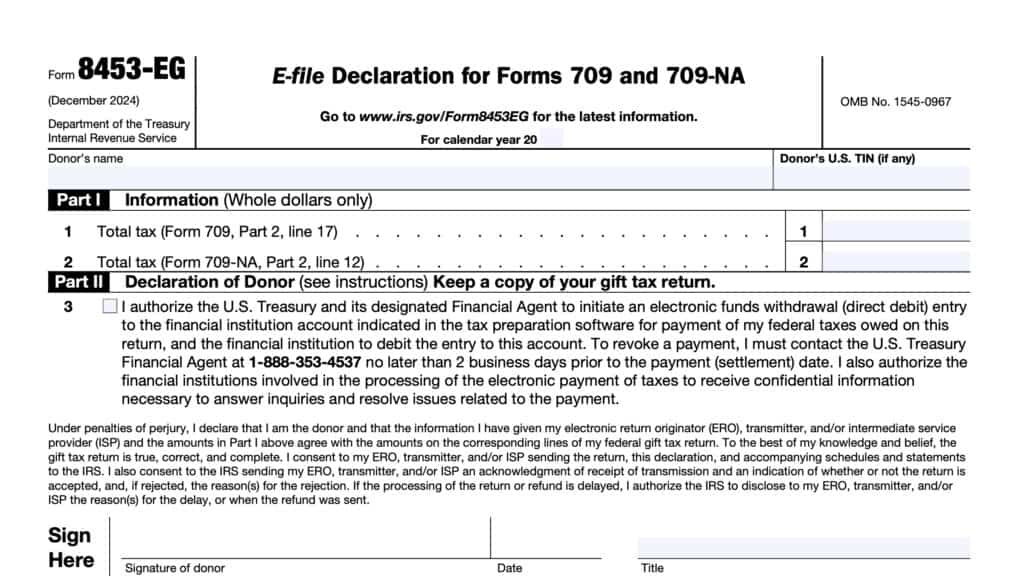

A donor who doesn’t want to use Form 8879-EG must use IRS Form 8453-EG, E-file Declaration for Forms 709 and 709-NA.

Your tax preparer has certain responsibilities

According to the IRS instructions, your tax return preparer (or ERO) must do the following:

- Enter the name and EIN of the estate or trust at the top of the form;

- Complete Part I using the amounts from the estate’s or trust’s income tax return;

- Zero may be entered when appropriate

- Enter on the authorization line in Part II the ERO firm name if the ERO is authorized to enter the donor’s PIN;

- Not the name of the individual preparing the return

- Give the donor a copy of Form 8879-EG for completion and review, and

- Acceptable delivery methods include hand delivery, U.S. mail, private delivery service, email, Internet website, and fax

- Complete Part III, including a signature and date

You have responsibilities as well

As the donor, you must do the following:

- Verify the accuracy of the estate’s or trust’s prepared income tax return;

- Check the appropriate box in Part II to either:

- Authorize the ERO to enter the donor’s PIN or

- Choose to enter it in person;

- Indicate or verify your PIN when authorizing the ERO to enter it

- The PIN must be five numbers other than all zeros

- Sign and date Part II; and

- Return the completed Form 8879-EG to the ERO

The acceptable delivery methods include:

- Hand delivery

- U.S. mail

- Private delivery service

- Internet website, and

- Fax

Your tax return preparer will not submit the tax return until after he or she receives your signed form.

Video walkthrough

Frequently asked questions

IRS Form 8879-EG, E-file Authorization for Forms 709 and 709-NA, provides the IRS e-file signature authorization that allows a tax return preparer to file a gift tax return on behalf of the donor.

According to the IRS instructions, a donor does not have to complete IRS Form 8879-EG. However, a donor who does not use Form 8879-EG must use Form 8453-EG, E-file Declaration for Forms 709 and 709-NA, for an IRS e-file return.

Where can I find IRS Form 8879-EG?

You can find tax forms such as IRS Form 8879-EG on the Internal Revenue Service website. For your convenience, we’ve enclosed the latest version of IRS Form 8879-EG in this article, as a PDF form.