IRS Form 8606 Instructions

If you have a nondeductible IRA or if you want to make backdoor Roth conversions, you may need to file IRS Form 8606, Nondeductible IRAs. If you don’t know about this important tax form, you may be paying taxes that you shouldn’t be paying!

This article will walk through:

- How to complete IRS Form 8606

- Why IRS Form 8606 is crucial to a backdoor Roth conversion strategy

- Frequently asked questions

Let’s begin with a step by step review of this tax form.

Table of contents

How To Complete IRS Form 8606

This section will give you a layman’s guide to filling out Form 8606. As a reminder, this is not tax advice. These are not official instructions from the Internal Revenue Service, and this does not cover every tax situation.

If you’re using tax software like TurboTax, you probably will answer some questions and the software will autopopulate the form for you. But be careful in answering these questions, because mistakes in calculating basis will carry forward each year.

There are three parts to this tax form:

- Part I: Nondeductible contributions to traditional IRAs and distributions to traditional, SIMPLE, and SEP IRAs

- Part II: Roth conversions

- Part III: Distributions From Roth, Roth SEP, or Roth SIMPLE IRAs

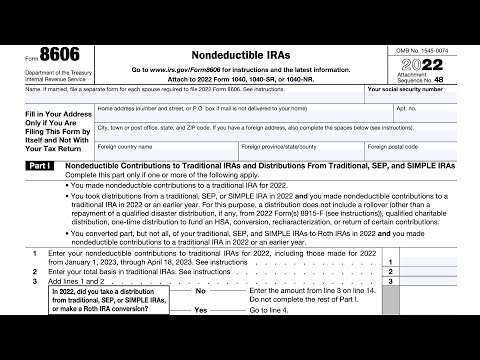

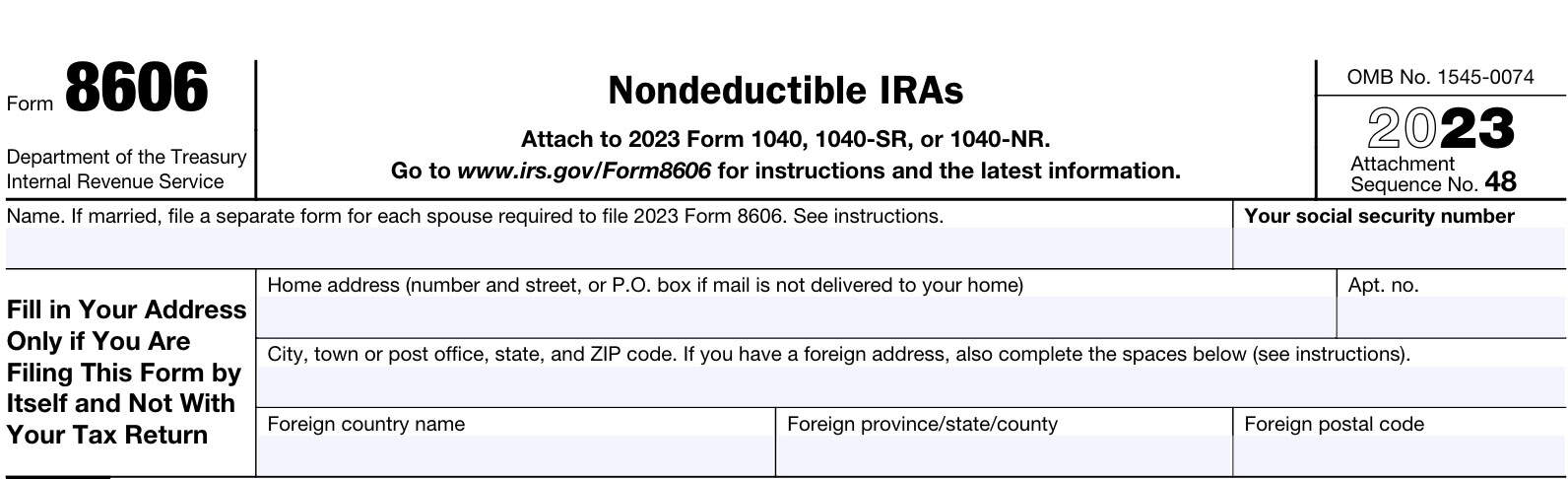

Before we start with Part I, let’s take a look at the taxpayer information fields at the top of the form.

Taxpayer Information

At the top of the form, enter your name and Social Security number. If you are married, you’ll need to complete a separate Form 8606 for each spouse separately.

Complete the address field only if you are filing Form 8606 by itself and not with your federal income tax return.

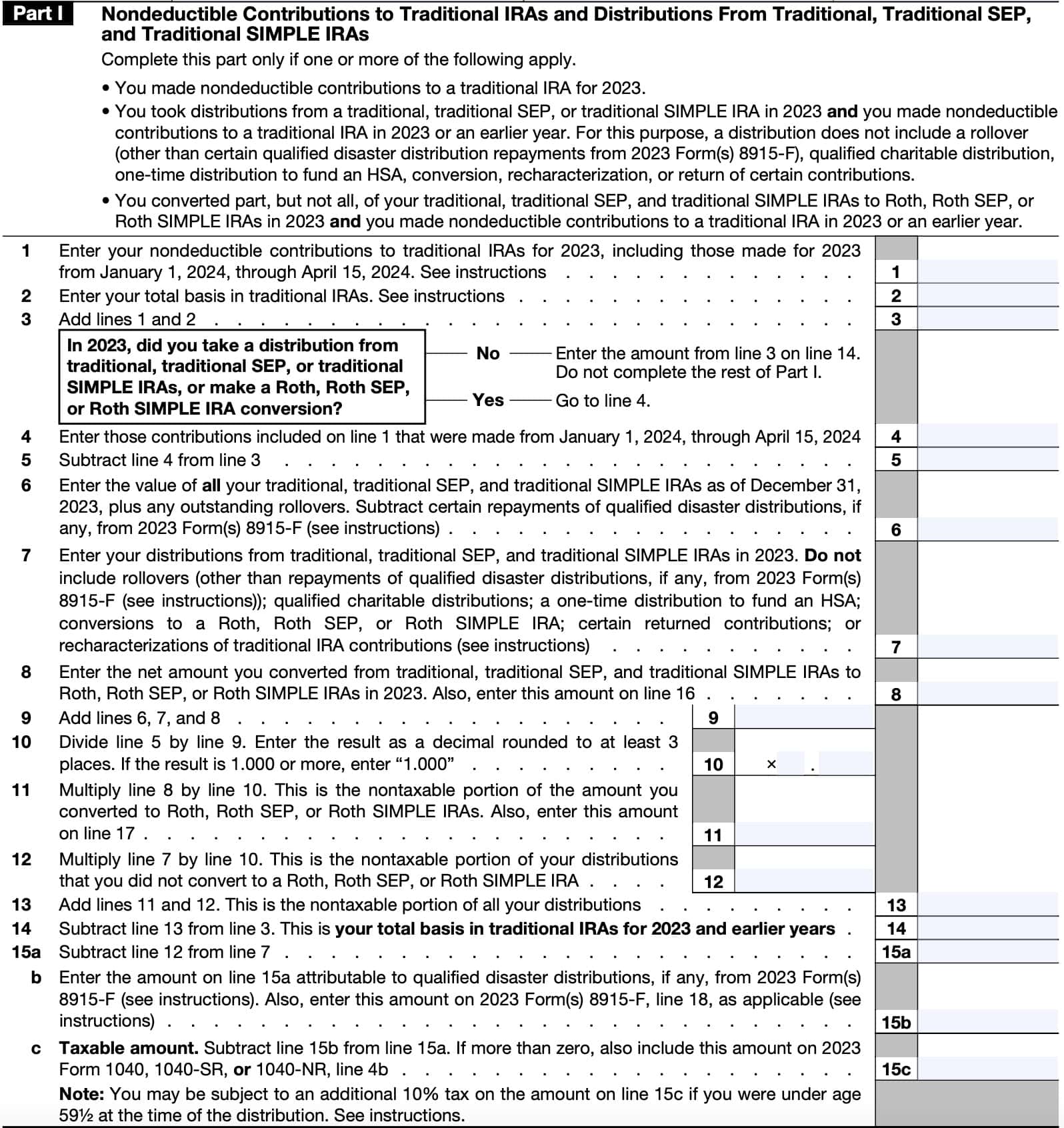

Part I: Nondeductible Contributions To Traditional IRAs And Distributions To Traditional, SIMPLE, And SEP IRAs

You only fill out Part I of Form 8606 if one of the following apply:

- You made nondeductible IRA contributions in the current tax year

- You took distributions from a traditional, SIMPLE, or SEP IRA in the current tax year AND you made nondeductible IRA contributions in the current year or an earlier year

- You converted part (but not all) of your traditional, SEP, or SIMPLE IRA assets in the current tax year AND you made nondeductible IRA contributions in the current tax year or an earlier year

If this applies to you, then here’s what you should include for each line.

Line 1: Nondeductible Traditional IRA Contributions.

You’ll include all nondeductible traditional IRA contributions for the tax year here. The tax year includes up to the filing deadline.

So for the 2023 tax year, you could include any nondeductible IRA contribution made from January 1, 2024 through the 2023 tax filing deadline, which is April 18, 2024.

But if you made a contribution in January through April of 2024 for tax year 2024, do not include that number here. You’ll save it for the tax filing season in 2025.

If you used the IRA deduction worksheet located in the Schedule 1 instructions, or from IRS Publication 590-A, you should refer to the instructions for additional guidance.

Line 2: Basis In Traditional IRAs

This is basis that will transfer from previous tax years. If this is your first year filing Form 8606, then this number will probably be zero.

However, even if this is your first filing year, you may still have basis if:

- You had a return of excess traditional IRA contributions

- You had a transfer of part or all of a traditional, SIMPLE, or SEP IRA incident to divorce or separation

- You had a rollover of a nontaxable amount from a qualified retirement plan to your traditional, SIMPLE, or SEP IRA that you did not previously report.

If you’re carrying forward basis from a previous tax year, you’ll use the carryforward number from that year’s tax return.

Use the chart below to determine which line to carry forward from your prior year form:

| If your most recent Form 8606 was… | Then use this line from your Form 8606 |

| After 2000 | Line 14 |

| After 1992, but before 2001 | Line 12 |

| After 1988, but before 1993 | Line 14 |

| 1988 | The total of the amounts on Lines 7 and 16 of that Form 8606. |

| 1987 | The total of the amounts on Lines 4 and 113 of that Form 8606. |

For example, if your most recent Form 8606 was in 2020, then you would carry forward the number located in Line 14 of that year’s Form 8606. This is the case for all tax returns on or after tax year 2001.

Line 3

Add Lines 1 and 2.

If you did not take a distribution from a traditional, SIMPLE, or SEP IRA, or do a Roth conversion, then the instructions tell you to skip down to Line 14.

Line 4: Contributions Made In The Current Calendar Year

Line 4 has you back out the contributions for the current year. For example, a 2023 tax return would back out contributions made from January 1 to April 18, 2024.

If you made deductible AND nondeductible IRA contributions in both years, you can decide which contributions were deductible, and which were nondeductible, regardless of tax year.

But for purposes of figuring the nondeductible distributions, contributions made in the later year do not count.

Line 5

Subtract Line 4 from Line 3, then enter the total here.

Line 6: Total Value Of ALL Traditional, SIMPLE, And SEP IRAs Plus Outstanding Rollovers

This is the total of your IRAs at calendar year-end. You’ll usually get a year-end statement account from your financial institution around the end of January.

Outstanding Rollovers

Usually, outstanding rollovers are subject to a 60-day rollover rule. For purposes of reporting on Form 8606, an outstanding rollover is a rollover made after November 1 of the given tax year, but within the 60-day rollover rule.

If a rollover falls outside the 60-day rule, the taxpayer can certify (in writing) why they missed the deadline to the IRA custodian or financial institution. This will allow the institution to properly report the transaction to the Internal Revenue Service. IRS Revenue Procedure 2020-46 gives more guidance on written certifications.

Neither of the following are subject to the 60-day rollover rule:

- Direct rollovers: Rollovers between accounts within one financial institution

- Trustee-to-trustee rollovers: Rollovers between accounts at separate financial institutions

Line 7: Distributions From Traditional, SIMPLE, And SEP IRAs

This includes distributions in the given tax year only. For tax year 2023, this would include only distributions made in 2023.

However, you should not include the following items in the Line 7 amount:

- Roth conversions

- Recharacterizations of traditional contributions to Roth contributions

- Rollovers into a qualified plan

- A one-time distribution to fund an HSA

- Distributions that are treated as a return of contribution

- Qualified charitable distributions

- Certain qualified disaster distributions

- Distributions incident to divorce

Line 8: Net Roth Conversions

If you did Roth conversions from a traditional, SIMPLE, or SEP IRA, you’ll enter the net Roth conversion amount here.

This will be the same number you enter on Line 16.

Line 9

Add the following items, then enter the total in Line 9:

- Line 6: Year-end account balances

- Line 7: Total distributions

- Line 8: Total Roth conversions

Line 10

Divide Line 5 by Line 9. Input the answer as a decimal using 3 decimal places. This represents the ratio of basis to total IRA assets.

For example, if Line 5 was $5,000 and Line 9 was $10,000, then Line 10 would be .500.

This ratio will help you calculate the nontaxable portion of any distributions or Roth conversions on Line 11.

Line 11

Multiply Line 8 by Line 10, then enter the answer here.

For example, if Line 10 was .500 and Line 8 was $2,000, then Line 11 would be $1,000.

This represents the nontaxable portion of your Roth IRA conversions. This number will also go into Line 17.

Line 12

This is the nontaxable portion of your total IRA distributions (not including Roth conversions).

Line 13

Add Lines 11 & 12.

This represents the combined nontaxable distributions from your IRAs, both distributions and Roth conversions.

Line 14

Subtract Line 13 from Line 3.

This represents your total basis in traditional IRAs for the reported tax year and earlier tax years.

Line 15

This consists of 3 sections: Line 15a, Line 15b, and Line 15c.

Line 15a

Subtract Line 12, the nontaxable of total IRA distributions but not Roth conversions, from Line 7, total IRA distributions, not including Roth conversions.

Line 15b

The amount from Line 12 attributable to qualified disasters.

Note: If you do not have IRS Form 8915-D or IRS Form 8915-F, you probably will leave this blank.

Line 15c

Subtract Line 15b from Line 15a. This is the taxable part of your IRA distribution.

You will use the number on Line 15c (if it is not zero), on Line 4b of your Form 1040 (taxable IRA distributions).

Early Withdrawal Penalties

If you are under the age of 59½ at the time of distribution, you may be subject to a 10% early withdrawal penalty. Also, if you withdrew from a SIMPLE IRA within the first 2 years of having the account, you may be subject to a 25% early withdrawal penalty.

To calculate early withdrawal penalties, you may need to file IRS Form 5329, Additional Taxes. From there, you would report any additional taxes on Schedule 2 of your Form 1040 when filing your tax return.

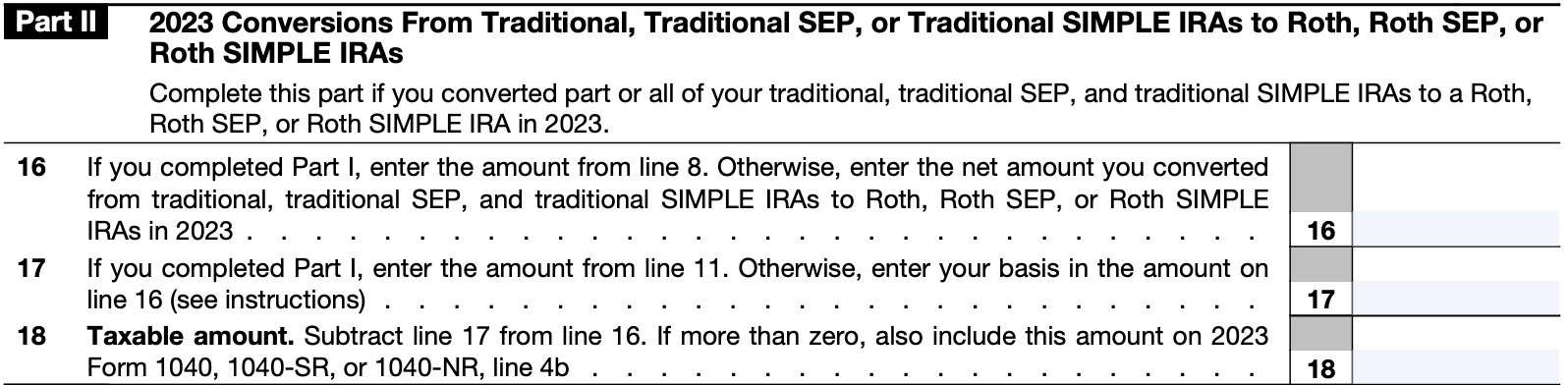

Part II: Roth Conversions

You’ll only fill out Part II if you did Roth conversions during the tax year. If you did not do Roth conversions, then skip to Part III.

Line 16

Carry over the Roth conversion amount from Line 8.

Line 17

Carry over the nontaxable Roth conversion amount from Line 11.

If you did not complete Line 11, then enter the total basis amount from Line 2, plus the contributions you made for the tax year that were made before the conversion.

Line 18: Taxable Amount

Subtract Line 17 from Line 16.

If this number is zero or less, do not include on Form 1040, Line 4b (taxable IRA distributions). You will include this number on Form 1040, Line 4a (IRA distributions).

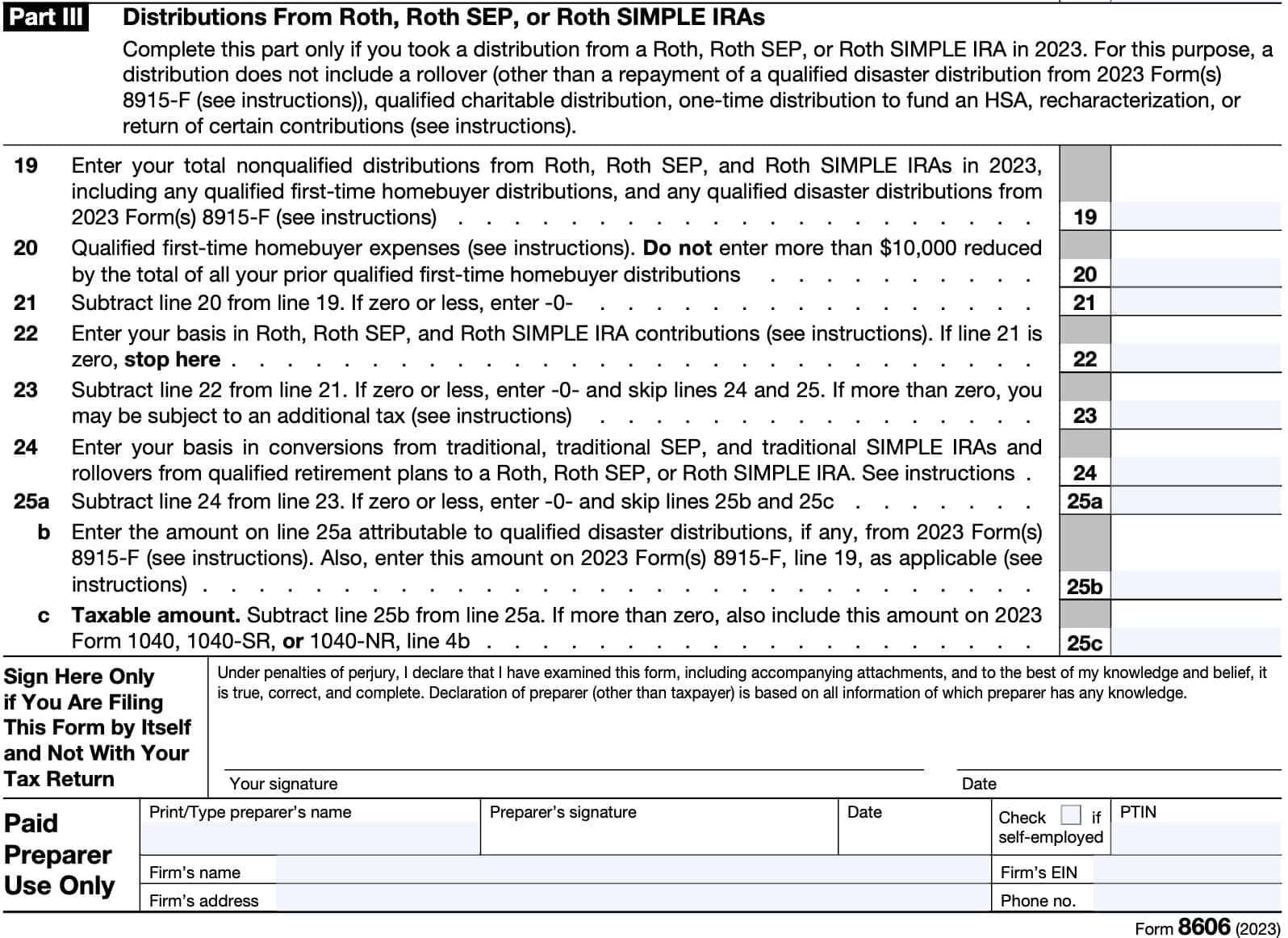

Part III: Roth IRA Distributions

Line 19: Nonqualified Roth IRA Distributions

Include all nonqualified Roth IRA distributions, including qualified first-time homebuyer distributions and qualified natural disaster distributions.

But do not include any of the following:

- Outstanding rollovers

- Recharacterizations

- Distributions that are a return of contributions

- Distributions made on or after age 59½, as long as you made a contribution in any year at least 5 years prior.

- For tax year 2023, this includes contributions for any tax year from 1998 to 2018.

- One-time distribution to fund an HSA

- Qualified charitable distributions (QCDs)

- Distributions made upon death or due to disability for any Roth IRA where a contribution was made at least 5 years prior.

- Qualified distributions from Form 8915-F that were repaid in 2023, on or before the repayment deadline

- Distributions incident to divorce

If you meet the criteria, those qualified distributions will not appear on your Form 8606. So, for most retirees worrying about reporting their Roth IRA withdrawals, don’t.

Line 20: Qualified First-Time Homebuyer Expenses

Since the lifetime limit is $10,000, this separate block forces the calculation. Any withdrawals for expenses exceeding this amount may be subject to penalty.

Line 21

Subtract Line 20 from Line 19. If this number is zero or less, you’ll enter 0.

Line 22: Roth IRA Basis

If you’ve never taken a Roth distribution, you’ll simply enter all contributions through the tax year in question. This also includes adjustments for transfers incident to divorce. Finally, for military death gratuity or SGLI recipients, the proceeds that were rolled into a Roth account are calculated as part of the basis in your Roth account.

If you did take a distribution, you’ll need to calculate the basis using the Basis in Regular Roth IRA Contributions Worksheet for Line 22, in the form instructions.

Line 23

Subtract Line 22 from Line 21.

If the basis (Line 22) is more than the distribution (Line 21), this number will be zero, and you can skip to the signature block.

If the basis is less than the distribution, then at least some of your distribution might be taxable.

Line 24

Enter basis from Roth conversions from traditional, SEP, and SIMPLE IRAs, as well as rollovers from qualified retirement plans to a Roth IRA.

If You’ve Never Done A Roth Conversion

This number will be zero.

If You Took A Roth Distribution Before The Tax Year

If you previously took a Roth distribution in excess of your basis in regular Roth IRA contributions in 2011 or later, then your basis is the excess of that year’s Line 24 amount over that year’s Line 23 amount.

For example, if you took a Roth distribution in 2022, then your basis would be the excess of Line 24 from your 2022 Form 8606 over the Line 23 amount from that form.

If your most recent distribution was from a tax year prior to 2011, then you should refer to the form instructions for additional guidance.

If You Did Roth Conversions, But Never Took A Roth Distribution

You’ll include the total of your Roth conversions here. The IRS instructions contain year-by-year instructions on which lines to import conversion amounts from.

This number will be adjusted by any adjustment in basis for conversions or rollovers incident to a divorce.

Line 25

This consists of 3 sections: Line 25a, Line 25b, and Line 25c.

Line 25a

Subtract Line 24 (basis from Roth conversions) from Line 23 (total distributions minus basis from Roth contributions).

Line 25b

Enter the amount from Line 25a attributable to qualified disasters.

Note: If you do not have Form 8915-D or Form 8915-F, you probably will leave this blank.

Line 25c: Taxable Amount

Subtract Line 25b from Line 25a. This is the taxable part of your Roth IRA distribution.

Essentially, Line 25c should be zero, even if you are younger than 59½ if you are withdrawing less than the amount of your total contributions (counted towards basis), and conversions (also counted towards basis). Any additional amounts are considered earnings, and may be taxable if not part of a qualified withdrawal.

Let’s take a closer look at some filing considerations for Form 8606.

Filing Considerations

Many taxpayers erroneously believe that since Roth IRA contributions grow tax-deferred, and qualified distributions are tax-free, they’ll never need to report anything. But IRS Form 8606 covers so much more than that.

Below are some filing considerations about IRS Form 8606, starting with what this form actually does.

What Is IRS Form 8606?

IRS Form 8606 is a tax form that helps an IRA owner keep track of and report tax basis in IRA accounts to the Internal Revenue Service.

Despite its limiting title, IRS Form 8606 actually serves multiple purposes:

- Reporting nondeductible IRA contributions

- Reporting distributions from traditional IRAs, SEP IRAs, or SIMPLE IRAs if there is basis in these accounts

- Reporting Roth conversions

Let’s take a look at each one, a little more closely.

Reporting Nondeductible IRA Contributions

Of course, if you’re making nondeductible contributions to a traditional IRA (individual retirement account), you’ll report them here. Reporting nondeductible contributions allows you to report (and keep) track of the basis inside your traditional IRAs.

Keeping track of basis of traditional IRAs isn’t that important while you’re still accumulating retirement savings. However, if you have after-tax dollars and pre-tax dollars in your IRAs, then qualified withdrawals are subject to the Roth conversion pro rata rule.

And in your retirement years, knowing the basis of your IRA accounts will allow you to better determine the tax treatment of your withdrawals. This way, you know exactly how much tax-free money you have access to.

And if you’re doing executing a backdoor Roth strategy every year, you’ll be reporting your nondeductible contributions as part of your backdoor Roth conversion strategy.

Facilitating Backdoor Roth IRA Conversions

If you’re not familiar with the concept of a backdoor Roth IRA conversion, the premise is simple.

When most people start their careers, their gross income is low enough so they can contribute directly to their Roth IRAs. As their careers progress, their income gradually (or suddenly) increases.

At some point, the taxpayer may exceed the income limits for being able to make a direct Roth IRA contribution. Hence, the backdoor Roth conversion.

Instead of contributing directly to a Roth IRA, many taxpayers will make a nondeductible IRA contribution. From there, they’ll make a Roth conversion from their traditional IRA account. Since they’ve already paid tax on the contribution, the Roth conversion is a tax-free transaction.

Nondeductible IRA contributions are reported on Part 1 on IRS Form 8606.

Reporting Distributions From Traditional IRAs, SEP IRAs, Or SIMPLE IRAs If There Is Basis In These Accounts.

Normally, distributions from an IRA in any given tax year are reported on IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. And if the distribution is reported only on the 1099-R, and is not a designated Roth distribution, then the assumption is that 100% of the distribution came from the pretax amounts.

But if you made a non-deductible IRA contribution into a traditional account, then you’ve established tax basis in that account, simply known as basis. Generally speaking, basis is the cost of an investment.

For example, let’s imagine you have an IRA with $5,000 in pre-tax money. You make a $5,000 nondeductible traditional IRA contribution. You now have an IRA account worth $10,000, $5,000 of which is your IRA basis.

When reported properly, qualified withdrawals from the portion of the distribution that’s allocated to basis will be excluded from taxable income.

Form 8606 will help ensure that you don’t get taxed twice on the same IRA contribution by helping you keep track of the taxable part of the distribution. Distributions from accounts with after-tax amounts are reported on Part 1 of Form 8606.

Reporting Roth Conversions

If you’re implementing your Roth conversion strategy, then you’ll be reporting Roth conversions on Form 8606 as well. Form 8606 helps track the cost basis of all IRA balances, including non-deductible contributions.

Again, the intention is to avoid paying income taxes twice on the same investment in your own IRA. Roth conversions from a traditional, SIMPLE, or SEP IRA are reported on Part 2 of Form 8606.

Nonqualified Roth IRA distributions are reported in Part 3 of Form 8606. This includes a one-time distribution for a first-time homebuyer.

Part 3 is used to determine whether a tax penalty might apply to a non-qualified Roth IRA distribution. If so, Part 3 will indicate this.

Who Must File Form 8606?

According to the IRS, a taxpayer must file Form 8606 if they:

- Made any nondeductible IRA contribution.

- This includes repayment of a qualified natural disaster or reservist distribution.

- Received distributions from a traditional, SIMPLE, or SEP IRA, and the basis is greater than zero.

- This doesn’t include rollovers, qualified charitable distributions (QCDs), a one-time distribution to fund a health savings account (HSA), conversion, recharacterization, or the return of certain contributions.

- There was a transfer of part or all of an IRA as part of the divorce agreement, and that transfer changed the basis in the account.

- There was a distribution from a Roth IRA.

- There was a distribution from an inherited IRA that had basis, or there was a distribution from an inherited Roth IRA that wasn’t a qualified distribution.

If you’ve filed Form 8606 on your federal income tax return in prior years, you’re probably going to be filing Form 8606 going forward.

Video Walkthrough

In this video, we go over how to complete Form 8606, step by step.

Frequently Asked Questions

Form 8606 is filed annually by a taxpayer as part of their federal income tax return for the prior year. If you’re filing Form 8606, you’ll want to include it when you file your Form 1040.

If you’re not required to file a Form 1040, you might still be required to file Form 8606. For example, you might be taking qualified IRA distributions, and using Form 8606 to report nontaxable amounts. If you’re required to file without filing an individual income tax return, it’s a good idea to include your address on Page 1 of the form, as well as your signature & date on Page 2.

You may report incorrect information on your tax return and eventually pay more in federal income tax than you otherwise would have to. Additionally, taxpayers who do not file Form 8606 may face a $50 fine unless they can demonstrate reasonable cause.

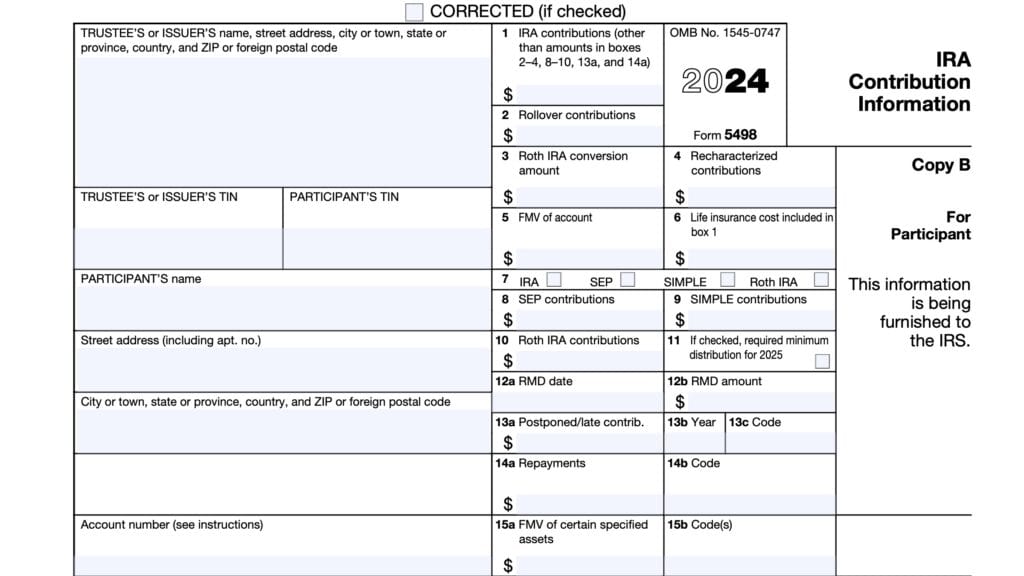

For Roth conversions, you can expect to receive a Form 1099-R from the financial institution reporting on the account where your conversion came from. Normally, the Roth conversion is coded with distribution code 2 on the 1099-R, in Block 7. The IRS will expect you to file Form 8606 with your tax return for accurate reporting of your transaction.

Where can I find a copy of IRS Form 8606?

You can find a copy of this tax form on the IRS website. For your convenience, we’ve enclosed the latest version of Form 8606 below.