5 Crucial Tax Tips For Horse Owners

As a horse owner, it’s highly unlikely that tax breaks had anything to do with your love of horses. Nor are taxes a reason for business owners to get into the horse industry.

With that said, proper tax planning can take some of the bite out of those hefty business expenses, especially for equine business owners. However, the Internal Revenue Service pays close attention to horse businesses to ensure they follow very specific rules when trying to deduct horse-related expenses.

Table of contents

Here are 5 important tax tips for horse owners that everyone should know.

Tax Tip #1: Know the difference between a horse business and a horse hobby

The dreaded hobby rules are probably the biggest obstacle for new horse owners, especially if they’re intent on running a horse operation.

What is a business and what is a hobby?

According to the IRS, a hobby is an activity that someone pursues because they enjoy it and do not intend to make a profit. Conversely, people operate a business with the intention of making a profit.

Tax difference between a business and a hobby

For tax purposes, a legitimate business is eligible for preferential tax treatment. Some of these tax breaks include:

- Being able to take depreciation deductions on equipment and other investments

- Taking deductions on necessary expenses incurred while operating a business

- Deducting operating losses in a given year when the business isn’t profitable

Conversely, hobby loss rules basically mean that if, in the eyes of the IRS, you’re engaging in an activity as a hobby, and not for valid business purposes, then you do not get any of the tax benefits of a business.

Can I still deduct hobby expenses on Schedule A of my tax return?

As of right now, no. The Tax Cuts and Jobs Act (TCJA) completely eliminated itemized deductions for hobby related expenses. This restriction is set to expire in 2025 unless it is renewed.

How can you tell the difference between a business and a hobby for tax purposes?

There are two primary ways to tell the difference. One is objective, and the other is subjective.

Safe harbor rule

The safe harbor rule, if met, provides the taxpayer with the benefit of the doubt that their horse activity is a legitimate business.

Normally, the safe harbor rule provides that general presumption of profit intent exists for a business that shows a profit in 3 of the previous 5 tax years (ending with the tax year in question). While the IRS can still challenge this, the burden of proof is on the IRS to show that this profitable venture is not a business. Since a business has a profit motive by definition, the IRS usually will respect the safe harbor rule.

For horse-related activities, the requirement is to demonstrate a profit in 2 of the previous 7 years. The IRS considers the following to be horse-related activities for safe harbor purposes:

- Operating a horse breeding business

- Horse racing

- Participating in horse shows

- Training horses

The IRS recognizes that not all intentional business ventures are profitable, especially for new industry participants. That’s why the IRS has published consideration factors to help taxpayers determine whether their venture is a business activity or hobby.

Consideration factors

These consideration factors are what an IRS representative would consider if you were subjected to an IRS audit.

- The taxpayer carries out activity in a businesslike manner and maintains complete and accurate books and accurate records.

- The taxpayer puts time and effort into the activity to show they intend to make it a profitable business activity.

- The taxpayer depends on income from the activity for their livelihood.

- The taxpayer has personal motives for carrying out the activity such as general enjoyment or relaxation.

- The taxpayer has enough income from other sources to fund the activity

- Losses are due to circumstances beyond the taxpayer’s control or are normal for the startup phase of their type of business.

- There is a change to methods of operation to improve profitability.

- Taxpayer and their advisor have the knowledge needed to carry out the activity as a successful business.

- The taxpayer was successful in making a profit in similar activities in the past.

- Activity makes a profit in some years and how much profit it makes during those profit years.

- The taxpayer can expect to make a future profit from the appreciation of the assets used in the activity.

There is the caveat that no single factor is more important than the other, and that all factors must be considered when determining whether your activity is a business activity.

The bottom line is that you can’t expect to take a leisurely approach to your horse farm, then turn around and expect the same tax treatment as horse-related businesses who take their business plan seriously.

Tax Tip #2: Treat your business like a business

The first IRS consideration factor literally instructs the taxpayer to treat their business activity like a business. The most difficult part is not making key business decisions, but all the minutia that goes into running a business.

Here are some of the most important things you should consider about good business practices.

Keep good records

The best way to show that your activity is a business is to ensure that you have good records. Having intact records allows you to demonstrate a sense of professionalism.

And that’s important, especially when your business gets to that level when you can’t do everything yourself.

Hire professional help

Most small business owners keep their own books at first. After all, until your business makes money, you probably have to do most things yourself.

However, most smart business owners recognize when administrative tasks, like keeping the company’s books, is starting to intrude on the best use of their time–business activities that produce income. And there are a lot of bookkeeping options out there.

But when it comes to preparing your financial statements or filing your business tax returns, hire a Certified Public Accountant (CPA) or enrolled agent. Not only can you rest assured that you’ll be tax-compliant, but you’ll have a tax advisor to give you tax advice when you’re making business decisions.

Be on time

Business owners sometimes have a reputation for being eccentric, aloof, or on their own schedule. When it comes to taxes, that can be a bad thing. Instead, you should:

- File your tax returns on time, or file a timely extension, should you need one during tax season

- If audited or asked to participate in a conference, show up on time

- Treat your professional help with the same courtesy you expect from them

Be interested in learning about your business

The CEO of any business generally doesn’t know the tiniest details at the worker level. And perhaps, you won’t be able to, either. But it’s hard to imagine a CEO who isn’t genuinely interested in learning more about their business than they already do know.

And that’s the approach you should take. Especially when you’re looking at deductible expenses.

Tax Tip #3: Know your expenses

There are generally 5 categories of deductible expenses you should be aware of in your horse business. The first four categories are similar to what you would see in a regular business, while the last category consists of expenses unique to the equine industry.

We’ll walk through each of these in a little more detail. This list is not all-inclusive, but you can reference IRS Publication 535-Business Expenses for more clarity. Or ask your accountant.

Administrative expenses

These are the required expenses to keep any business running, regardless of industry. This might include things like:

- Accounting and bookkeeping fees

- Advertising and promotion

- Bank service charges

- Business licenses and dues

- Computers and software

- Legal fees

- Liability and other business insurance

- Postage and delivery fees

- Printing and copying

- Property and excise taxes

- Telephone and utilities

In other words, what it would take just to keep the lights on and the operation running.

Business travel

This may or may not apply to you. If you compete in horse shows or invest in race horses, you may travel frequently. If you simply own a farm and train horses, it might not. But here are some legitimate business travel expenses you may be able to deduct from your business:

- Airfare

- Automobile expenses-This can be either calculated using a standard mileage rate or actual expenses

- Hotels

- Meals (up to 50% of the cost is deductible as a business expense)

- Transportation

- Tolls

Labor costs

One of the biggest expenses in any business is labor. And it’s not just wages, but all the additional employee-related costs. Here’s a partial list of what you might be able to deduct.

- Contract labor fees and expenses

- Employee pensions and benefits

- Employee wages

- Payroll taxes (employer portion)

- Workers compensation insurance

Miscellaneous expenses

These are all miscellaneous expenses that can provide legitimate tax deductions, which in turn lowers your taxable income.

- Books, magazines, and videos required for your business

- Business gifts (up to $25 per person, per year, is deductible)

- Furniture and equipment purchases and rentals

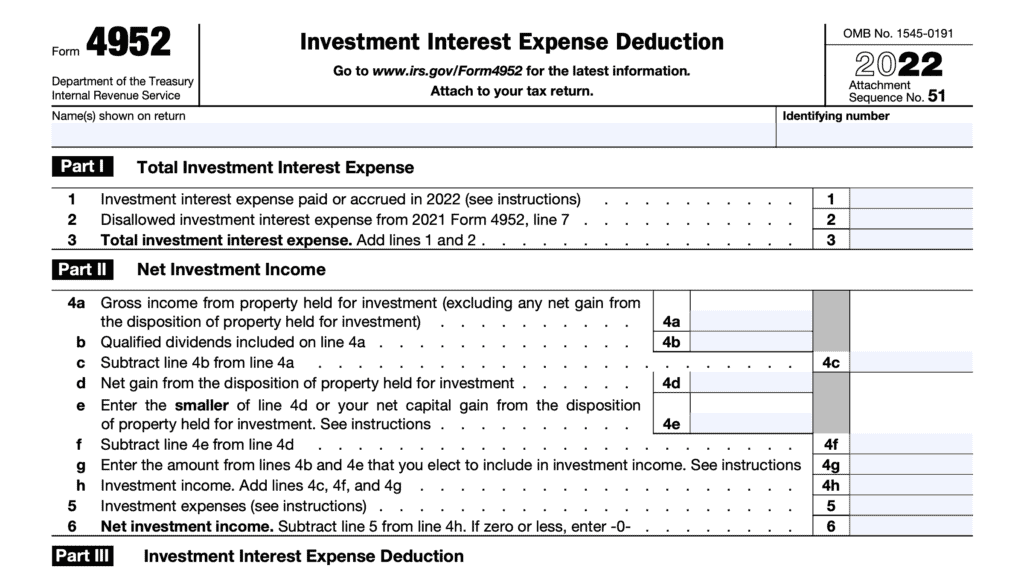

- Interest on equipment loans

- Interest on farm loans

- Mortgage interest

- Office supplies

- Repair and maintenance costs

Horse-related business expenses

Finally, here are some of the equine expenses you may be able to take.

- Barn and stable supplies

- Breeding fees

- Broodmare leases

- Equine therapy

- Farrier fees

- Horse feed and shavings

- Trade organization member fees

- Trailering horses

- Training horses for shows or for sale

- Veterinary fees

- Work clothing such as riding breeches, boots and helmets (includes fitting and laundering)

When in doubt, ask your accountant!

Your accountant can give you the best advice if you have a question whether to take an expense deduction. And remember, if you’re buying business assets (horses are considered a business asset), you may need to take depreciation into account instead.

Tax Tip #4: Depreciate, depreciate, depreciate!

According to the IRS, if you purchase a business asset that is expected to last more than a year, then under normal circumstances, you cannot take a full expense deduction for that year. Instead, you must depreciate the asset over its expected life.

Depreciation is such a vast tax topic, the IRS has a publication for it: IRS Publication 946-How to Depreciate Property. Publication 946 goes into detail about:

- Different categories of assets, and their depreciation schedules

- How to accelerate depreciation in certain cases (take more deductions in earlier years)

- Tax treatment of assets upon sale

You don’t need to know the details about depreciation, just that you can depreciate certain property used for business purposes. You also need a good accountant to help you understand what you can depreciate, and the rules that go into depreciation.

How does depreciation of horses work?

The IRS considers horses used for a proper business purpose to be depreciable property. Depending on the horse’s age and purpose, the horse’s value can be depreciated over several years for tax purposes. This means that you can claim a tax deduction simply for owning the horse and putting it to work!

For example, race horses are considered tangible personal property for deprecation purposes. Which means you can depreciate the cost of the horse over the course of several years. This can range from 3 years (meaning that you can write off certain costs related to buying and owning that horse over 3 tax years), to 12 years.

Race horses that are older than 2 years and other horses older than 12 years old can be depreciated over a 3-year period from the time they’re placed into service. Placed in service means that the property is ready and available for its intended use.

Before going too far, be sure to check with your accountant!

Don’t forget about Section 179!

Normally, personal property is depreciated over its intended schedule (3 years, 5 years, etc). However, Section 179 is a special provision that allows business owners to take an immediate deduction for certain assets instead of over its lifetime.

Tangible personal property, such as livestock, may be eligible for Section 179 treatment, subject to certain dollar thresholds and business income limitations. See your accountant for more details.

Tax Tip #5: Pay attention to capital gains

Many people are familiar with the difference between long term and short term capital gains. Generally speaking, gains on the sale of a business asset held for more than one year (defined as one year PLUS one day or longer), qualifies as a long term capital gain, subject to preferential tax treatment. Anything held for a shorter period of time is considered short term capital gains, and is taxed as ordinary income.

The exception is for horses and cattle. The required holding period for long term capital gains tax treatment when selling horses is 24 months, not one year.

Video walkthrough

For your convenience, we’ve summarized this article in this fresh video, which you can check out right here.

Related articles

What do you think?

If you have thoughts or stories you’d like to share about your horse business, we’d like to hear them! Please post your thoughts in the comments section below!