What is Non Ad Valorem Tax?

If you’re a new homeowner in the state of Florida, you might be surprised when you receive your first property tax bill. Depending on which state you previously lived in, you might understand how your real estate taxes were assessed prior to your move. But as a new home owner in Florida, there is one question you should understand the answer to: “What is non ad valorem tax?”

In this article, we’ll explore this unique topic and answer some common questions about non ad valorem tax, including:

- What is the difference between ad valorem and non-ad valorem taxes?

- How are non ad valorem taxes calculated?

- Who can impose a non ad valorem tax?

Let’s start with answering the up front question: “What is non ad valorem tax?”

Contents

What is non ad valorem tax?

Non ad valorem assessments are special assessments that a local government may impose on property owners for a specified purpose. Although non ad valorem assessments are not a property tax or a real estate tax, they are enforceable under Florida law.

Property owners may be held responsible for nonpayment of such assessment.

What is the difference between ad valorem tax and non ad valorem tax?

There are several key differences between ad valorem tax and non ad valorem tax. Before we dig into those differences, let’s take a moment to pause and discuss what an ad valorem tax is.

What is an ad valorem tax?

An ad valorem tax is a tax based upon the assessed value of a property. This could be real property, such as a house, or personal property, like a car or boat. In Latin, ad valorem literally means, “according to value.”

When assessing an ad valorem tax, the property appraiser’s office usually does two things:

- Determines the assessed property value for each property

- Assigns millage rates for specified services, such as schools and roads

In an ad valorem tax system, the more valuable your property, the higher your property tax bill probably will be. This is true regardless of how much, or how little, of the service you may use.

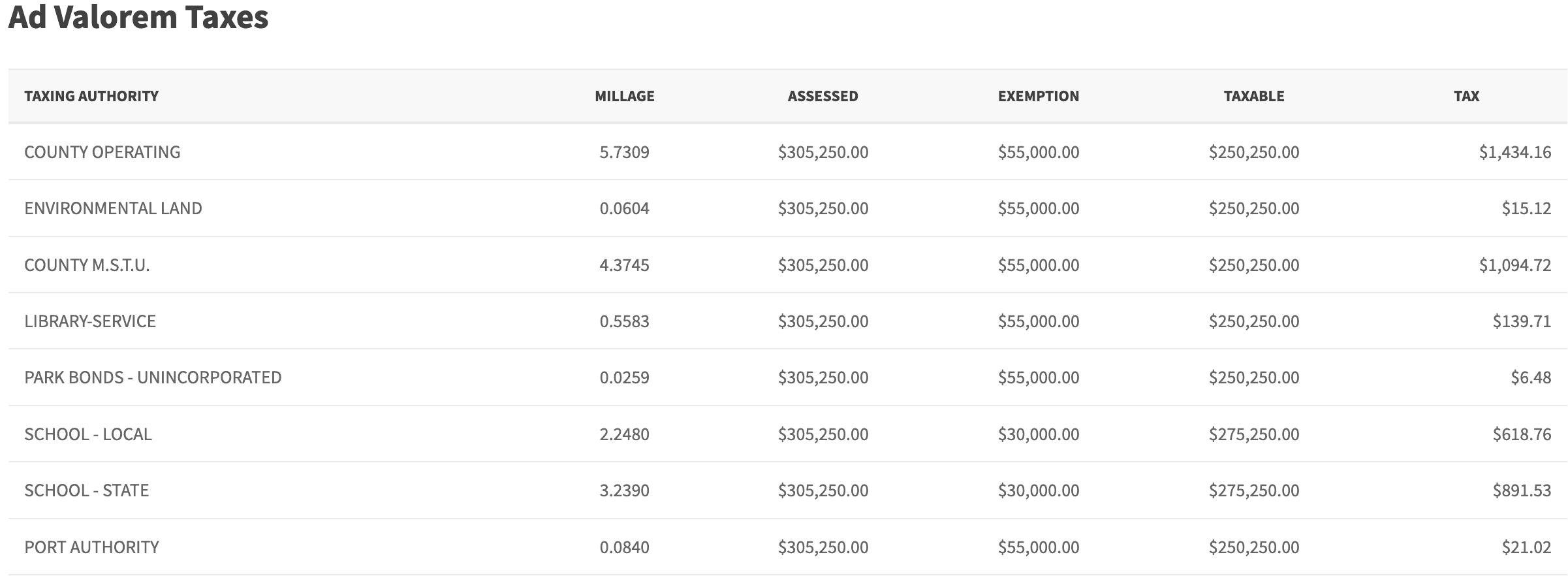

Below is an example of ad valorem property taxes, from my own property tax bill.

How are non ad valorem taxes different from ad valorem taxes?

There are several key differences between ad valorem and non ad valorem taxes.

1. Non ad valorem assessments are based upon costs incurred and benefits provided.

In other words, a taxing authority may impose non ad valorem assessments to select property owners within its district. However, that taxing authority must determine:

- Who benefits from the specific service or program being provided

- An equitable manner to calculate the assessment responsibility of each taxpayer

2. Non ad valorem assessments may be calculated using factors that do not include property value or millage rates.

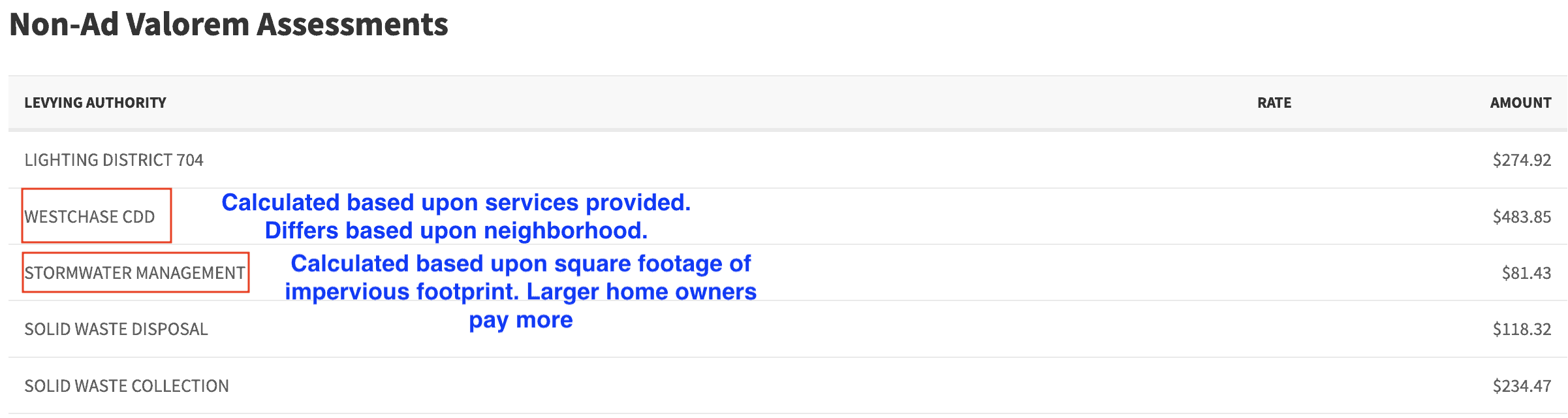

For example, on my property tax bill, there is a non ad valorem assessment for our county’s storm water management program. In Florida, each county is responsible for managing stormwater runoff to offset pollution in our state’s waterways.

Our tax collector’s office has determined that the cost of managing storm water runoff is directly related to each property’s impermeable footprint.

To this extent, our county has calculated a base rate for each property owner, based upon the building’s square footage. And since every property owner receives a community benefit from the stormwater runoff program, everyone pays this particular assessment.

Conversely, I am a resident of a community development district (CDD) within our county. Our CDD provides unique services to our residents, depending on the neighborhood each resident lives in.

Only residents of our CDD pay our CDD assessment. Even then, not everyone pays the same assessment, because different services are provided to different residents.

A perfect example of this is the assessment that our CDD imposes for homeowners who live in gated neighborhoods. They pay an additional assessment to offset the costs of building, owning, and maintaining a gate. Some of these gated communities also have guards.

Residents of our community who do not live in a gated neighborhood may pay our CDD fee, but that CDD fee does not include the costs for managing the gated neighborhood.

3. Ad valorem taxes are assessed over a calendar year, generally January 1 through December 31.

Like ad valorem taxes, non ad valorem taxes are calculated on an annual basis. The taxing authority may calculate these assessments over a calendar year.

But they may also be assessed over a fiscal year. A fiscal year runs from October 1st to September 30th of the next year.

4. Non ad valorem assessments may be collected in advance; ad valorem taxes are generally assessed in arrears.

Since non ad valorem assessments are levied for specific purposes, the taxing authority may collect them in advance. Collected funds are generally used to pay the costs over the next year.

The taxing authority evaluates the assessments annually, and adjusts them as necessary.

Who can impose a non ad valorem tax?

Florida statutes and the Florida state constitution allow for the creation of special districts, charged with specified purposes.

For example, my community development district is a special district that was created to help facilitate the development of necessary infrastructure to support a residential community. Prior to the establishment of our CDD, there was no municipal government infrastructure in place for water, recreational parks, lighting, or sewage disposal.

So the developer created our CDD to issue bonds to create this infrastructure from the ground up. Since then, the CDD’s bonds have been paid off, but the CDD still exists to maintain the infrastructure that was built 30+ years ago.

Looking at the rest of my non-ad valorem assessment, you can see:

- Lighting district assessment: Our CDD created a special district to support the street lighting within our community.

- Solid waste disposal: Non ad valorem assessment imposed by our county for solid waste management, not a special district. Calculated based upon family dwelling type (senior citizens get a discount)

- Solid waste collection: Our county imposes a flat rate to each resident for solid waste collection as part of the solid waste assessment

Who collects the non ad valorem tax?

Even though non ad valorem tax can be imposed by a variety of taxing authorities, you’ll generally find non ad valorem tax on your county’s annual tax bills. Generally, the county tax collector is charged with the collection of taxes or special assessments on behalf of the levying authorities.

Frequently asked questions

Below are some of the most frequently asked questions about non ad valorem taxes.

What is a non-ad valorem assessment roll?

According to the Florida statutes, the non-ad valorem assessment rolls are the tax rolls prepared by a local government and certified to the tax collector for collection. Florida law has specific time frames for the preparation of assessment rolls to ensure that property owners are duly notified each year.

When do I find out about our non-ad valorem assessments?

Usually, your local governing board will send written correspondence to explain how they calculated the assessments, before tax notices are sent.

If you do not see this correspondence, you’ll see the assessments on your tax notice. Also, you can usually check out the public records on your county’s tax collector’s website and examine your property tax bill online.

What happens if I do not pay non-ad valorem assessments?

Just like regular property taxes, there is a process for the enforcement of non-ad valorem assessments. The county can enforce collection process for nonpayment of special assessments in the same manner as nonpayment of a property tax.

This can include the imposition of a tax lien for delinquent taxes, which may be enforceable in court. If left unpaid, this property may be lawfully seized from the property owner in accordance with the state’s collections process.

Can I deduct non-ad valorem assessments from my income tax return?

This is not tax advice, but generally no. The IRS has previously issued guidance on which state and local taxes may be deductible on a federal income tax return.

This guidance generally states that taxes imposed in a manner similar to non ad valorem taxes are not tax deductible for federal tax purposes. For example, the IRS website specifically states that neither taxes for local benefits, nor itemized taxes for services such as garbage collection are not deductible.

Do I get a discount for paying in advance?

Florida law does provide a discount for early payment of annual tax bills and special assessments. Assuming that the due date is on April 1st of the tax year, this early payment discount would be:

- 4% of the overall tax liability if paid in November of the year preceding the tax year, or within 30 days of the first time the property owner receives a copy of the notice

- 3% of the tax liability if paid in December

- 2% of the tax liability if paid in January

- 1% of the tax liability if paid in February

- 0% discount if paid in March, or before the taxes become delinquent