What Happens to Your Tax Liability With Proper Financial Planning?

What happens to your tax liability with proper financial planning? Proper financial planning can help people lower taxable income and save money on their tax bill. By reducing their tax burden, people can increase how much money they save in the current year and in future years.

Contents

Introduction

Every year, most people file their tax return without thinking about tax planning. At best, they might ask their accountant how much money they can expect back when they file their tax return.

During tax time, an accountant doesn’t have time to help with proper income tax planning. Most tax preparers, like the ones at H&R Block, aren’t qualified to serve as a tax advisor.

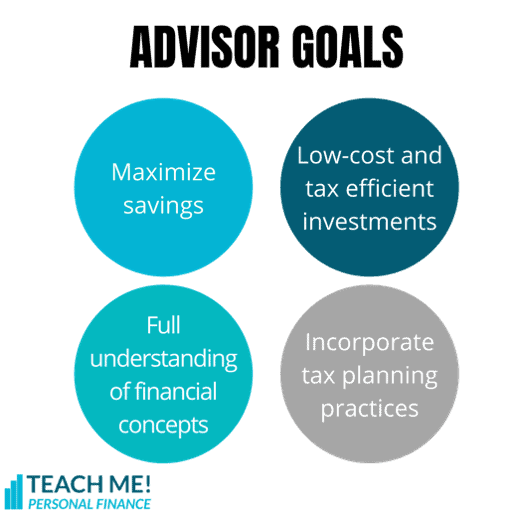

But a qualified financial advisor, such as a Certified Financial Planner™, can help with tax planning. By incorporating taxes into their financial planning process, advisors help clients:

- Maximize savings into their retirement plans & individual retirement accounts (IRAs)

- Find low-cost and tax-efficient investments to reach their financial goals

- Understand concepts like marginal tax rates, tax brackets, and adjusted gross income

- Incorporate tax planning practices such as tax-loss harvesting and Roth conversions.

How do taxes impact your financial planning?

Taxes have a direct impact on financial planning because the amount of taxes you have to pay directly impacts your financial situation. The best possible way to do financial planning is when you incorporate tax efficient ways to meet your financial goals.

According to the CFP board:

The less money you pay in taxes, the more you have to devote toward your financial goals. A big part of financial planning is tax planning, which can help you make the most of tax-advantaged savings opportunities and tax breaks, as well as help you manage your income and withdrawals to minimize the tax consequences.

Certified Financial Planner Board of Standards

In other words, effective tax planning equals tax savings. And tax savings is synonymous with better financial planning.

Many astute people like to do their own tax planning. Other people, especially business owners, might do tax planning with their accountants. This might be a good idea for people who have huge businesses, or who can take the time to stay current on tax laws.

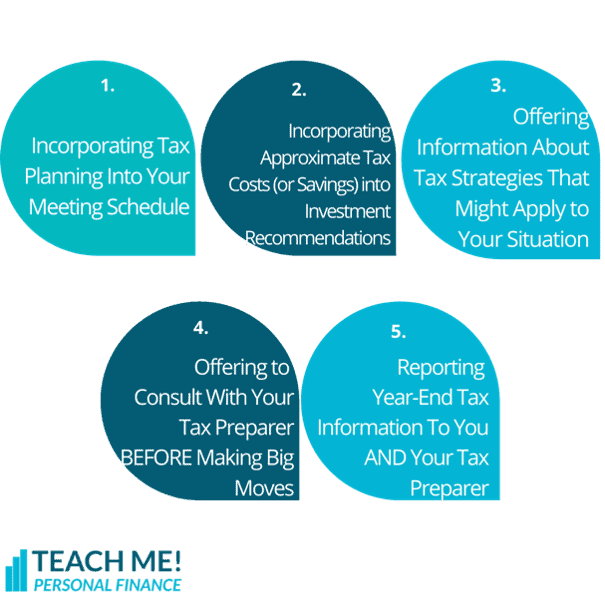

5 tax-related things your financial advisor should be doing every year

For everyone who wants someone else to help them, a good starting point might be to see how your financial advisor will help with your tax situation. Here are some things you should expect from your financial advisor.

Incorporating Tax Planning Into Your Meeting Schedule

You don’t need to be a CPA or enrolled agent to do tax planning. And when you look at the CFP® accreditation, tax planning is a part of the curriculum. If your financial advisor is a CFP®, they already have a working understanding of how taxes work.

What are tax planning meetings? Mid-year, many advisors will sit down with their clients to discuss last year’s tax return. and compare it to what’s going on in the current year (plus any possible upcoming events).

By reviewing last year’s tax return, the advisor provides a second set of eyes. If there is an error in the tax return, you can file an amended return. And with a tax projection, your advisor can help clients:

- Understand what their tax liabilities could look like next spring

- Ensure they are withholding the right amount of money in federal income taxes

- Consider tax planning options in the coming year, like timing of income at year-end

Many tax planning advisors discuss taxes in at least one meeting per year with each client. This usually occurs in the June-October timeframe.

Doing tax planning in the summer/fall time enables taxpayers to make adjustments. It also allows clients to put tax strategies in place. Finally, it allows the client to answer questions like:

- Do I contribute to a traditional IRA or a Roth IRA?

- Do I take the standard deduction or do I itemize my tax deductions on Schedule A??

- What can I do to lower my federal income tax?

Proper planning helps you avoid big surprises in the spring, when you file.

Incorporating Approximate Tax Costs (or Savings) into Investment Recommendations

Many advisors don’t tell their clients the tax impact of selling their stocks or mutual funds. They don’t bother explaining the difference between short-term and long-term capital gains. And most of these advisors don’t even hint at what the client might pay in capital gains taxes.

This seems to be unconscionable. Calculating taxes might not be easy. But any investment software can estimate capital gains incurred when making a trade. Using technology can help mitigate the tax burden caused by capital gains.

Yet, this seems to happen more than you would think.

This isn’t an annual task, so much as a task that’s done with every investment recommendation. The annual task is helping you compile the year-end information for your tax preparer (see #5 below).

Offering Information About Tax Strategies That Might Apply to Your Situation

When you change jobs, who are you more likely to call, your CPA or your financial advisor? Perhaps you would call your accountant. More likely, you’ll call your advisor. A good advisor will help you understand:

- Your new pay structure

- Bonuses and other compensation, and

- Employee benefits

How about getting a divorce? You might talk to your CPA about how to file that year’s tax return. But you’re more likely to talk with your advisor about what your finances will look like after the divorce. Having children? Same.

You get the picture. Your accountant might know more tax strategies, but your advisor is going to know more about you. And your tax planning will be a little more insightful with a good financial advisor. You don’t need to wait until you see your CPA to talk about possibilities. And your advisor can always say, “Check with your accountant, but….”

Offering to Consult With Your Tax Preparer BEFORE Making Big Moves

Do you know what works better than having your advisor say, “Check with your accountant?”

Having your advisor say, “I believe we should do (proposed tax strategy). Let’s set up a time to call your accountant talk it over.”

After all, accountants can’t fix many things after the fact. The phrase, “An ounce of prevention is better than a pound of cure,” has never been more appropriate.

So the accountant wants to know BEFORE things occur, so they can help guide you. And having the advisor offer to do that means that’s one less thing that you have to manage.

Of course, offering this service is something that your advisor would only do if they:

- Took the time to learn about taxes

- Took the time to learn more about you, then applied their tax knowledge to your situation

- Valued your accountant’s expertise

- Had confidence that an accountant would agree with their suggestion

When a financial advisor reaches out to the accountant, the accountant feels like someone values their expertise.

More valuable: If your financial advisor says, “I checked with your accountant, and we’re going to do this. I’ll send an email to both of you to discuss the details.” This assumes that your financial advisor and accountant trust each other.

Reporting Year-End Tax Information To You AND Your Tax Preparer

Financial institutions must send each client tax forms by January 31 each year. This includes:

- 1099-R (retirement income)

- 1099-B (brokerage accounts)

- 1099-DIV (dividends)

- 1099-INT (interest)

- 1099-MISC (income from other sources).

Sometimes, the institution sends a 1099-Composite. The 1099-Composite combines many of the above forms.

Yet, these institutions usually ask the Internal Revenue Service for extensions. This means that clients might receive forms later than January 31. Or not at all. Wouldn’t it be nice if your financial advisor helped in this regard?

Many advisors send their clients a year-end summary that outlines:

- Major taxable events (like capital gains or IRA distributions)

- Required minimum distribution (RMD) calculations, and the actual amount distributed.

- Tax withholdings from your investment accounts

- What forms you should expect to receive (and which ones you should not expect to receive)

Each year, in January, proactive financial advisors forward this information to each client. That way, the CPA will know when to start preparing the tax return. Given permission, many advisors will forward information to the CPA directly.

Why don’t more financial advisors do tax planning?

Several reasons come to mind:

Many financial advisors don’t want to do the work.

Tax projections involve:

- Getting your tax return

- Learning more about your life, then

- Being proactive about things that might impact your tax bill.

This takes work. And it’s not the fun kind of work, like closing a new client. Ironically, this is also where tax planning opportunities lie. Many advisors never get around to them, because they don’t want to take the time.

The advisor doesn’t want to get in the way of your CPA.

Accounting is one of the most trusted professions in America. Financial services….one of the least trusted.

While this is a valid concern, accountants do make mistakes. And accountants don’t always see everything the advisor sees. But many people never receive tax planning guidance from their CPA (or never ask for it). If a financial planner’s tax projection differs from the CPAs, that presents an opportunity for deeper discussion.

The advisor says they don’t want to be accountable for giving unlicensed tax advice. Yet, the same advisor might recommend selling investments that cost thousands of dollars in capital gains. Then, they put your money into another investment without another thought.

Every time your advisor recommends that you sell something, they’re already giving you advice that has tax implications. They should at least educate themselves on the things you can look up on your own. And they can always CYA by prefacing their discussions with, “Check with your accountant, but I believe….”

They don’t believe in ‘tax evasion.’

Neither do tax planners. Tax evasion is illegal, and should be avoided. Tax avoidance, on the other hand, simply is making sure you don’t pay more in taxes than you’re supposed to. Not only is tax avoidance legal, but it’s smart financial planning.

What if my financial advisor doesn’t do tax planning?

There’s a simple answer to this: find one who does. There are plenty of place to find a fiduciary advisor who does financial planning. Here are three places to find an advisor who is willing to work with new clients:

1. Alliance of Comprehensive Planners (ACP): ACP was founded in 1995 by a tax attorney. ACP’s guiding principle has been to incorporate tax planning into the financial planning process. Today, ACP has over 150 members throughout the United States. ACP members are Certified Financial Planners, and many of them are tax professionals. You can learn more on the ACP website.

2. National Association of Financial Planning Advisors (NAPFA): NAPFA is the pre-eminent trade organization for fee-only financial planners. However, not all NAPFA members practice tax planning, so you will have to do some due diligence.

3. Personal Capital: As one of the largest fee-only investment advisors, Personal Capital has a wealth of financial planning expertise. Additionally, its size enables access to technology many advisors can’t provide. As result, Personal Capital has tools that will help you track your net worth, manage investments, and keep track of your expenses. Even if you’re not ready to start working with a Personal Capital advisor, you can open a free Personal Capital account here.

Conclusion

With proper financial planning, you can minimize your taxes, plan the proper payment of taxes throughout the year, and make ensure there aren’t any surprises when you file your tax return. Moreover, lowering your tax bill is a sound way to increase your long-term net worth. In fact, financial planning just isn’t the same without sound tax planning.