VTI vs VTSAX: Which is the Better Total Stock Market Fund?

VTI (Vanguard Total Stock Market ETF) is one of the world’s most popular exchange-traded funds. VTSAX, Vanguard Total Stock Market Index Fund Admiral Shares, is one of the world’s most popular mutual funds. Each of these low-cost index funds:

- Is owned and managed by Vanguard

- Is extremely tax-efficient

- Has an extremely low expense ratio, compared to their peers

- Is a relatively better investment than active funds with similar investment objectives

As a result, both of these funds are great options for long-term investors. They especially are appealing to investors who focus on holding long term investments with extremely low costs.

This article will explore both funds in depth. Specifically, we will discuss both fund’s:

- Investment focus

- Investment holdings & size

- Performance

- Turnover & tax impact in an investment portfolio

We’ll also give you pointers on where an average investor can purchase these funds, and what to watch out for when you set up your investment accounts.

Before we go forward, it’s important to note that both VTI and VTSAX track the exact same index, the CRSP US Total Market Index. The CRSP US Total Market Index follows the entire US stock market. With that said, there are nuanced differences between these total stock market funds.

Those slight differences primarily stem from the fact that VTI is an index fund, and VTSAX is a mutual fund. This distinction is also reflected in their respective fees. Before we discuss VTI vs VTSAX, let’s take a closer look at the difference between an ETF and mutual fund.

Contents

Differences between an ETF and mutual fund

Both ETFs and mutual funds are investment vehicles that pool a variety of different investments for individual investors.

These investments might be stocks, fixed income instruments, commodities, or other assets that an individual investor might not have access to on their own. In the case of VTI and VTSAX, those pooled investments consist solely of individual stocks.

Since the investments in each fund are virtually identical, let’s look at some of the key differences between an ETF and mutual fund.

Liquidity

Liquidity is arguably the biggest difference between mutual fund and ETFs.

Mutual funds are managed by a mutual fund manager. The mutual fund company sells shares of a mutual fund to investors.

The value of these shares is known as the net asset value (NAV). The mutual fund’s NAV is based upon the combined value of the underlying stocks. This value is calculated after the stock market has closed for the day.

When an investor sells, or redeems, a mutual fund, it is the mutual fund manager buying back shares of the mutual fund. But the transaction does not close until after the exchanges have closed for the day. After market hours, the NAV is recalculated, and the mutual fund shares are redeemed at the new NAV value.

ETFs are traded on a stock exchange, just like individual stocks are. Since ETFs are traded on an exchange, they can be sold throughout the day. And since another investor (not the mutual fund company) is the other party, the trade is executed immediately.

This might not be a big deal during normal times. However, it matters a LOT during market turmoil. Especially when severe stock market changes cause the markets to close.

For example, during the first weeks of the COVID-19 pandemic, the entire stock market closed several times in the middle of the trading day. ETF holders who wanted to sell shares often did better than the mutual fund holders who had to wait until the end of the trading day for their trades to be executed.

Tax efficiency

Index funds, whether they’re ETFs or mutual funds, can be tax-efficient. But ETFs have a slight edge over their mutual fund counterparts.

When shareholders redeem mutual funds, the mutual fund manager has to have sufficient cash to redeem shares. When there’s a run on the stock market (like during the COVID early days), that fund manager might need to sell additional stocks to generate that cash. And those sales can generate additional capital gains, which are passed onto the remaining shareholders.

Conversely, when ETF investors sell their shares, it’s another ETF investor buying those shares. That means there isn’t a fund manager selling assets in order to buy those ETF shares.

Differences in trade execution

There are several differences in how ETF trades work, versus mutual fund trades. With VTI vs. VTSAX, this difference might make an investor decide on one fund versus the other. Here are three ways that ETFs trade differently from mutual funds.

ETFs have different purchase minimums.

The purchase minimum for an ETF is 1 share. Since they trade like a stock, most ETFs can be traded with any financial institution with minimal or zero transaction fees. So an investor can buy 1 share, or 5000 shares of the same ETF at the same cost per share.

Mutual funds usually have a minimum initial investment, in terms of dollars. For example, when purchasing VTSAX at Vanguard, the minimum investment for new investors is $3,000. You can buy shares of VTSAX at Schwab for less than $3,000, but you’d also pay a transaction fee each time. This makes that option cost-prohibitive.

It’s easier to buy fractional shares of a mutual fund

Most trading platforms allow you to buy fractional shares of a mutual fund. Most investors do this when they decide to invest a specific dollar amount on a regular basis over time. This is called dollar-cost averaging.

Generally speaking, those same trading platforms require you to buy whole shares of an ETF. The primary exception appears to be M1 Finance, which allows investors to invest in fractional shares. Generally speaking, though, you can’t do this with ETFs on most trading platforms.

That said, mutual funds are also available in more places than ETFs.

ETFs usually don’t appear in your workplace retirement plan

Because they require whole shares to be traded, you’ll likely not see ETFs in a 401k or 403b plan.

But you’ll see mutual funds. Often, you’ll see different versions of the exact same mutual fund. And that’s because they often exist in different share classes.

Mutual funds have share classes

Because they don’t have a minimum, ETFs don’t have a share class. One share costs the same price per share as 50,000.

Conversely, a larger investment in a mutual fund means less risk for that fund manager. So mutual funds often offer a price break (in terms of lower expense ratios) for larger investments.

For example, Vanguard’s California Long-Term Tax-Exempt Fund exists in two share classes: Investor and Admiral. You can get Investor shares at a $3,000 minimum investment, but the expense ratio is 0.17%. Admiral shares have a lower expense ratio at 0.09%, but you have to start with a $50,000 minimum investment.

VTSAX starts at a $3,000 minimum investment, even though they are available as Admiral shares.

Aside from share class differences, you might see some fees in mutual fund that you won’t usually see in ETFs.

Mutual funds might have transaction fees

ETFs generally don’t have transaction fees, since they’re traded like stocks.

This depends on who is issuing the mutual fund, and how you are buying the fund. For example, if you are a Vanguard account owner, buying a Vanguard mutual fund, there are zero transaction costs. But if you’re buying that same Vanguard fund in your Schwab trading account, you’ll likely incur transaction fees.

And that’s for no-load funds. No load-funds, like Vanguard, are mutual funds that do not have a commission attached to them. But many funds charge loads, or commissions, when you:

- Buy shares of the fund

- Sell shares of the fund

- Or both

But if you’re into dollar cost averaging, then mutual funds have an advantage over ETFs.

Let’s take a look at the investment focus of these funds.

Investment Focus

Both VTI and VTSAX have an investment objective to follow (not outperform) the CRSP, which tracks the entire U.S. stock market. Because they are both index funds, they purchase identically equal amounts of every publicly traded stock in the United States, while avoiding international stocks completely.

What is the CRSP U.S. Total Market Index?

The CRSP US Total Market Index is an index created by the Center for Research in Security Prices. The Center is a recognized global leader in research-quality historical market data and returns.

The US Total Market Index is the CRSP’s representation of the entire US stock market, across mega-cap and large-cap stocks, as well as mid-cap and small-cap companies.

As of the quarter ending 3/31/2022, the CRSP US Total Market Index contained 4,092 companies. This represented approximately $45.3 trillion in market capitalization.

As of 3/31/2022, both VTSAX and VTI held individual stocks in approximately 4,124 publicly traded U.S. companies.

VTI vs VTSAX: Fund holdings

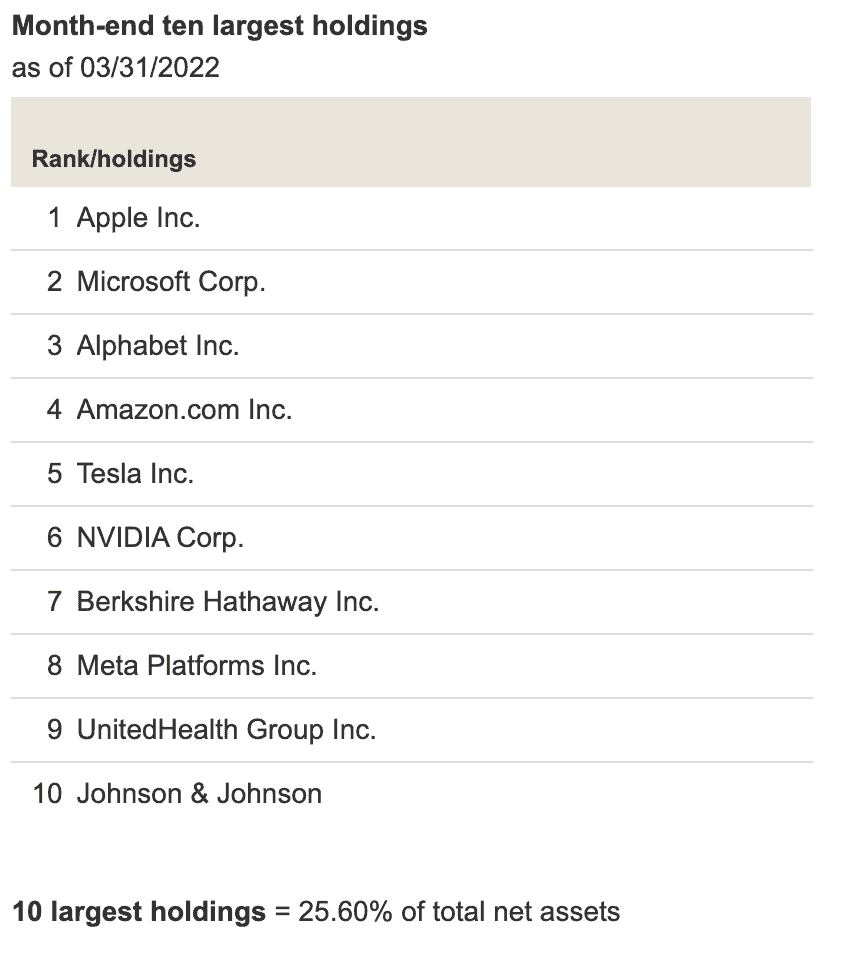

The fund holdings are virtually the same for VTI and VTSAX. Let’s take a closer look at what the top ten holdings look like:

Top Ten Holdings

The top ten holdings represent almost 25% of the entire portfolio for both Vanguard funds. As outlined in the picture below, the top holdings are mostly from the technology sector.

However, Warren Buffett’s Berkshire Hathaway is in the top ten, as well as two health sector companies, United Health Group and Johnson & Johnson.

Since the top ten for both Vanguard funds comprise approximately 25% of their total holdings, the remaining 75% is allocated to approximately 4,100 other companies.

Let’s take a look at the overall holdings of both funds, by sector. The holdings are represented by a pie chart to make it easier to visualize.

Overall Holdings

As you can see, technology companies represent a little over a quarter of the entire CRSP, followed by consumer discretionary items (15.27%), health care (12.86%), and industrials (12.65%).

Since both VTSAX and VTI largely track the CRSP, their holdings look very similar.

Growth vs. value stocks

Both of these funds are passive index funds which follow the entire US stock market. As a result, neither fund tries to achieve a slant towards growth or value.

But because the CRSP Total US Stock Market is a market cap index, you might find that these funds tilt slightly more towards large-cap growth rather than value stocks.

Let’s look at the total assets under management (AUM).

Assets under management

Vanguard’s index funds are some of the most popular index funds in the world. Whether you’re discussing mutual funds or ETFs, their low fees make them highly desired by new investors.

Because they track one of the most popular stock indices, VTI and VTSAX are two of the largest funds offered by Vanguard. The combined value of both VTSAX and VTI weighs in at about $1.3 trillion in AUM.

According to ETF Database, which maintains a list of the top 100 ETFs by assets managed, VTI manages about $287.3 billion. This makes VTI the world’s 3rd largest ETF, just behind SPY and IVV.

It follows that VTSAX makes up the remaining $1 trillion in total net assets, which makes it the world’s largest mutual fund.

Let’s take a look at performance, both relative to the CRSP benchmark as well as absolute performance.

VTI vs. VTSAX: Investment performance

Before we dive in, both VTI and VTSAX are total market funds. But the major difference in these returns is based on two factors: management fees & taxes.

Expense ratios

Also known as management fees, expense ratios are taken from the investment (in both cases, Vanguard) to cover the costs of operating the fund. Usually, expense ratios are reflected by an adjustment to the end of day share price.

An advantage of an index fund over similar funds is that you do not have to pay active fund managers, investment analysts, or other staff to manage the investments. So low fees make index funds a good choice for many investors.

VTI’s expense ratio is 0.03%, while VTSAX’s expense ratio comes in at 0.04%. That means for every $10,000 invested, Vanguard takes $3 per year for VTI or $4 for VTSAX.

In comparison, most financial advisors consider a fund to be relatively inexpensive if the fund’s expense ratio is less than 1% per year.

Vanguard can afford to keep these costs down because of the low turnover rate inside the funds. But there is some turnover, which creates tax impacts.

Tax drag

Mutual funds and ETFs do participate in taxable events. These taxable events include harvesting capital gains or receiving dividends from the underlying companies.

It’s hard to view the impact of taxes on annual returns because Vanguard does not pay taxes on these events. The investor does.

Dividends

In most investment accounts, it’s hard to notice dividends. But quarterly, you’ll probably see dividend transactions for each of the mutual funds or ETFs in your investment portfolio.

If your fund has a low amount of dividend-paying stocks, you’ll likely see a relatively low payout. But in a taxable account, you will pay taxes on dividends. This could be qualified dividends (subject to capital gains tax), ordinary dividends (subject to income tax at ordinary income tax rates), or a combination of both.

Capital gains distributions

And at the end of the year, near the end of December, you’ll see capital gains distributions in each of your funds. The amount of distributions depends on the amount of activity in your fund.

If your fund has high turnover, you’ll likely be subject to a lot of capital gains distributions. High turnover means an active fund manager is consistently buying and selling underlying securities within the fund. Those capital gains are required to be passed on to the fundholder (that is you).

Fortunately, index funds are subject to relatively minimal turnover. Each of these indices is reset annually. And the rebalancing in the funds is done quarterly. So there isn’t a lot of buying and selling. So less impact on your performance.

But as previously mentioned, VTSAX may participate in more buying and selling than VTI. This simply is a result of having to keep an appropriate amount of cash available for redemptions, not because of active fund management.

Let’s take a look at the relative performance of VTI and VTSAX vs. the CRSP Index.

VTI vs. VTSAX vs. CRSP Index

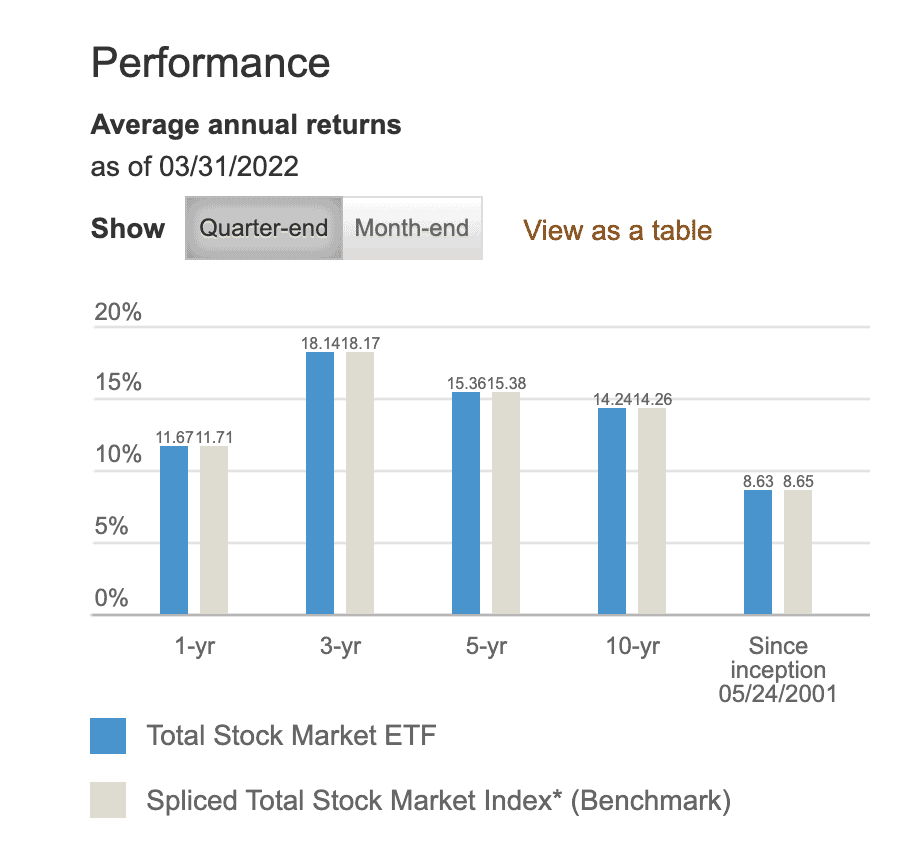

Here is the breakdown of VTI’s annual investment performance over the past year, 3 years, 5 years, past decade, and over its history:

- 1-year: 11.67%

- 3-year: 18.14%

- 5-year: 15.36%

- 10-year: 14.24%

- Since inception: 8.63%

As you can see, VTI’s performance trails slightly behind its target index, based on its expense ratio drag.

Since its inception in 2001, VTI’s average annual investment performance is 8.63%. You’ll notice ‘spliced total stock market index.’ This simply reflects the fact that VTI tracked three different stock market indices since inception:

- Dow Jones U.S. Total Stock Market Index (formerly known as the Wilshire 5000) until 2005

- MSCI US Broad Market Index (from 2005 until 2013)

- CRSP US Total Market Index (since 2013)

All three indices reflect the overall U.S. total stock market.

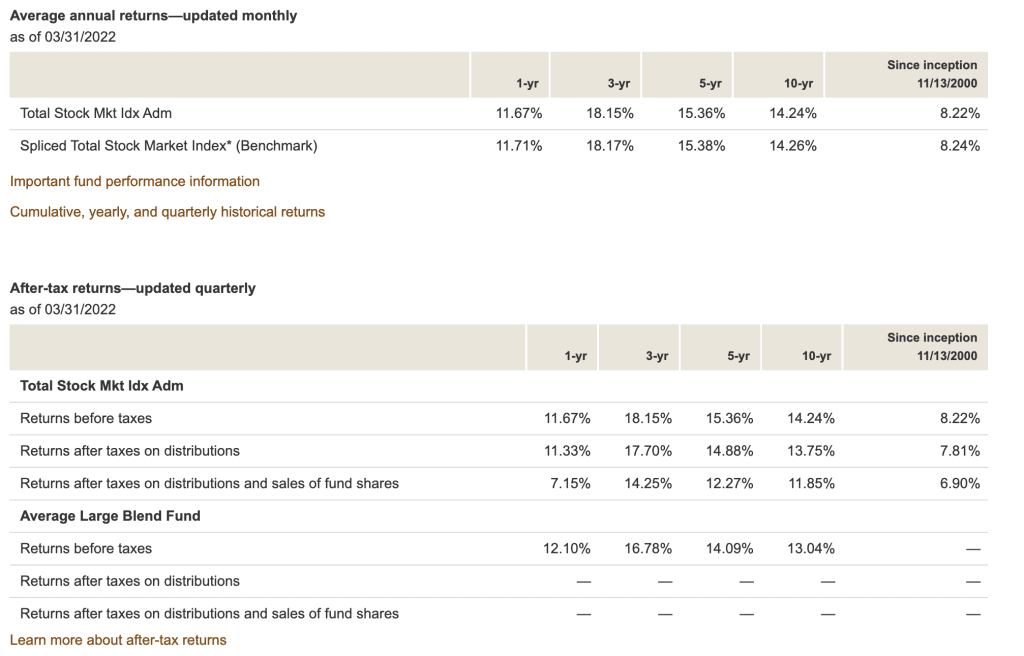

Although they have similar returns, VTSAX slightly trails both the CRSP and VTI. This is primarily because of the expense ratio difference. However, you can see that there is a difference in the after-tax investment performance, as well.

The other main difference in their past performance is the ‘since inception’ investment statistic. This is due to the fact that John Bogle (former chairman and founder of Vanguard) launched VTSAX in 2000, while VTI launched in 2001.

Conclusion

At the end of the day, both VTI and VTSAX offer low-cost ways to invest in the entire market. And this is a great way to invest for long-term performance and achieve financial independence. Other than your preference for a mutual fund or ETF, there is no huge difference between the two.

You can purchase VTI and VTSAX through almost any online brokerage firm or through your financial advisor. However, they are completely transaction cost free at Vanguard (subject to account minimums).