Form SSA-44 Instructions

Did you receive an IRMAA determination letter? If you have recently experienced a life-changing event, you may be able to use Form SSA-44, also known as Medicare Income-Related Monthly Adjustment Amount – Life Changing Event.

The SSA-44 allows the Social Security Administration (SSA) to make the necessary corrections to lower or eliminate your IRMAA.

In this article, we’ll walk you step by step through:

- How the SSA-44 works

- When you might consider using the SSA-44

- Key information you can find on the SSA-44

- How to fill out the SSA-44

- What documentation you may need to send with your filled out SSA-44

- How to submit the SSA-44 for consideration

- Resources that may help you walk through the SSA-44 form

We’ll start by walking through how to complete the form, step by step. But before we do, I’ve created a low-cost, convenient course that goes through everything you’re about to read below.

If you don’t want to read all of this information, please visit my IRMAA course page to decide if it’s right for you. If not, please feel free to read this article and watch the YouTube tutorial, free of charge!

Table of contents

How to fill out the SSA-44

There are five steps to filling out the SSA-44. We will break down each step of the SSA-44 so you can clearly understand what is required.

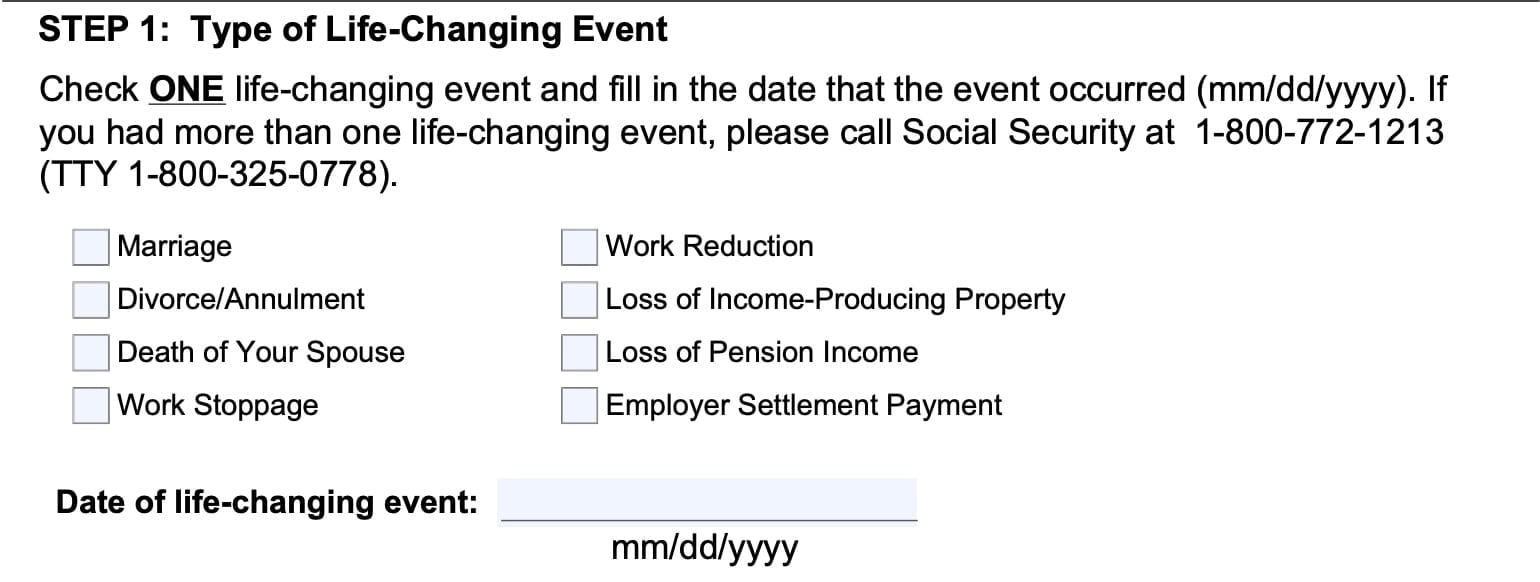

Step One: Type of Life-Changing Event

This is the type of life-changing event that happened in your life, and when it occurred. The eight types of life-changing events that SSA will consider in their IRMAA determination are:

- Marriage: You entered into a legal marriage

- Divorce/Annulment: Your legal marriage ended, and you will not file a joint return for the year.

- Death of your spouse: Your spouse died.

- Work Stoppage: You or your spouse stopped working.

- Work Reduction: You or your spouse reduced your work hours

- Loss of Income-Producing Property: You or your spouse experienced a loss of income-producing property not under your control.

- Examples include disaster, losing property due to arson, fraud or theft

- Loss of Pension Income: You or your spouse experienced some sort of disruption (cessation, termination, or reorganization) of an employer’s pension plan.

- Employer Settlement Payment: You or your spouse receive a settlement from your employer/former employer because of bankruptcy.

SSA 44 Step One asks what type of life-changing event occurred and when it happened. This step also asks for the date that the event took place, because it must be in the same tax year or an earlier tax year than the one you ask SSA to consider.

Let’s imagine that the SSA calculated the 2024 IRMAA with 2022 tax information. However, you got married in 2023. In that case, you could use the 2023 information instead.

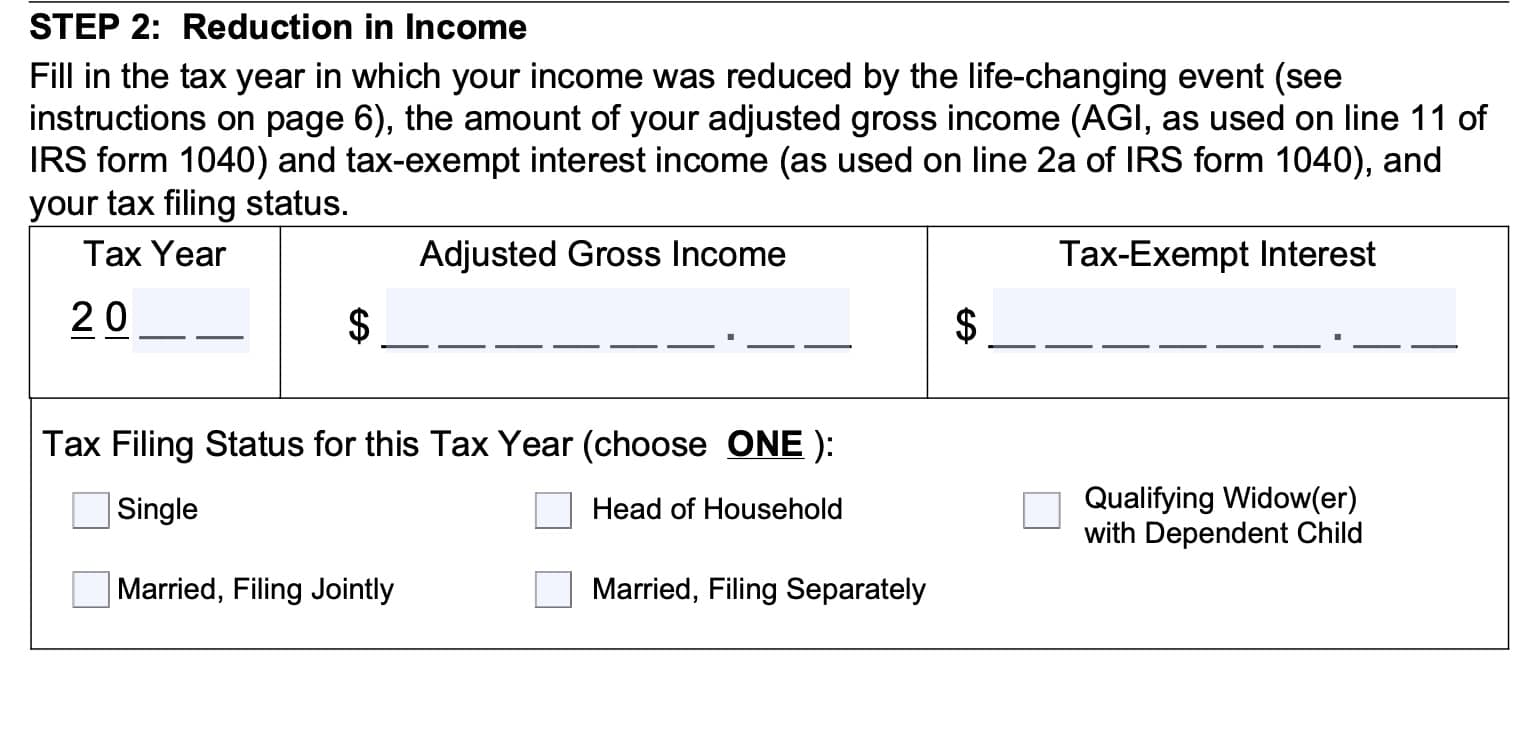

Step Two: Reduction in Income

This is where you fill in the modified adjusted gross income (MAGI) for the given tax year. For most people, the 2022 tax data would have gone into the 2024 IRMAA calculation.

The SSA calculates your MAGI using two lines on your tax return:

- Adjusted Gross Income: Line 7 of Form 1040 or Form 1040-SR of your tax return

- Tax-Exempt Interest: Line 2A of Form 1040 from your tax return

- An example of tax-exempt interest would be municipal bond interest.

SSA 44 Step Two asks for your tax information and filing status for the tax year in question.

You’ll simply fill in this information, as well as the tax filing status for that year.

Be sure that you only report what was already reported on your tax return. Don’t change anything here. That will be in Step 3.

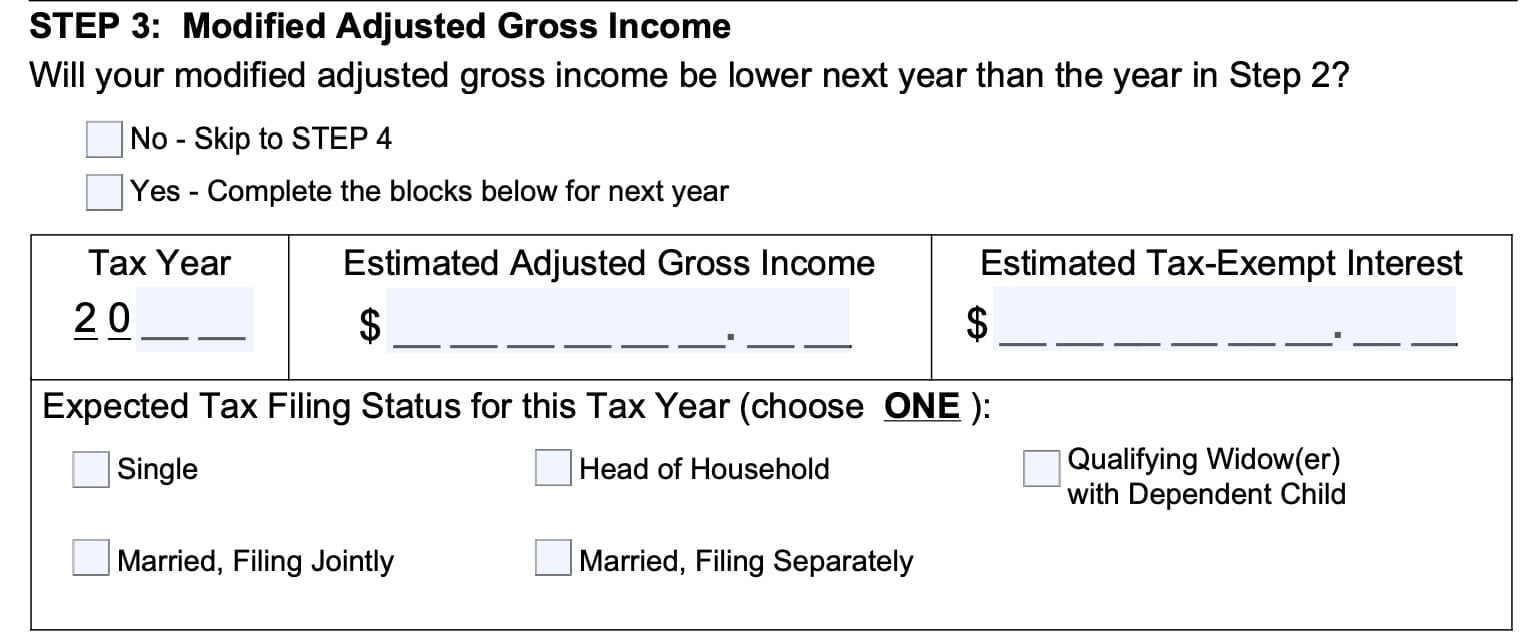

Step Three: Modified Adjusted Gross Income

This is where you estimate your income to be based upon your life-changing event. This step has three parts:

- Will your MAGI be lower next year than the year in Step 2?

- If the answer is ‘Yes,’ then you’ll complete the rest of Step 3.

- If the answer is ‘No,’ then you’ll skip to Step 4.

- Note: It doesn’t always have to go down. For example, if you got married, but your income didn’t change, then you would answer ‘No’ and move to Step 4.

- Fill in the tax year, estimated AGI, and estimated tax-exempt interest. If you work with a financial advisor or a tax professional, then they can run a tax projection for you based upon your life-changing event. If not, then you might have to do this yourself.

- Expected tax filing status. If your tax filing status hasn’t changed, then this should be straightforward. However, if you got married or divorced, or became a widow(er), then this might be a little difficult. Below is a little background.

Marriage/Divorce

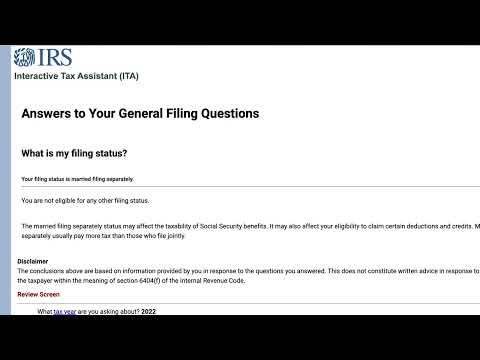

According to the IRS, your filing status is based upon your marital status as of December 31 of the year on your tax return.

Marriage: If you got married before December 31, then you can file as married (either jointly or separately). If you get married on January 1 of the next year, then you would file as single (unless you are filing jointly with a deceased spouse for the year in question).

Divorce: If your divorce decree is finalized before the end of the year, then you would file as Single. If your divorce becomes effective on January 1 or later, then you would file as married (either separately or jointly).

Deceased Spouse: If your spouse died, then you can file a joint tax return for the year in which they died. After that, you’ll either file as single (if you didn’t remarry), married (if you did remarry), or qualifying widow(er) (if you have a dependent child). If you are able to file as a qualifying widow(er), that privilege exists for the two tax years after your spouse’s death.

The IRS has a page where you can determine your filing status, which takes about 5-10 minutes to walk through. Check it out in this Youtube video.

SSA 44 Step Three asks for your expected MAGI for the year following the year of your life-changing event.

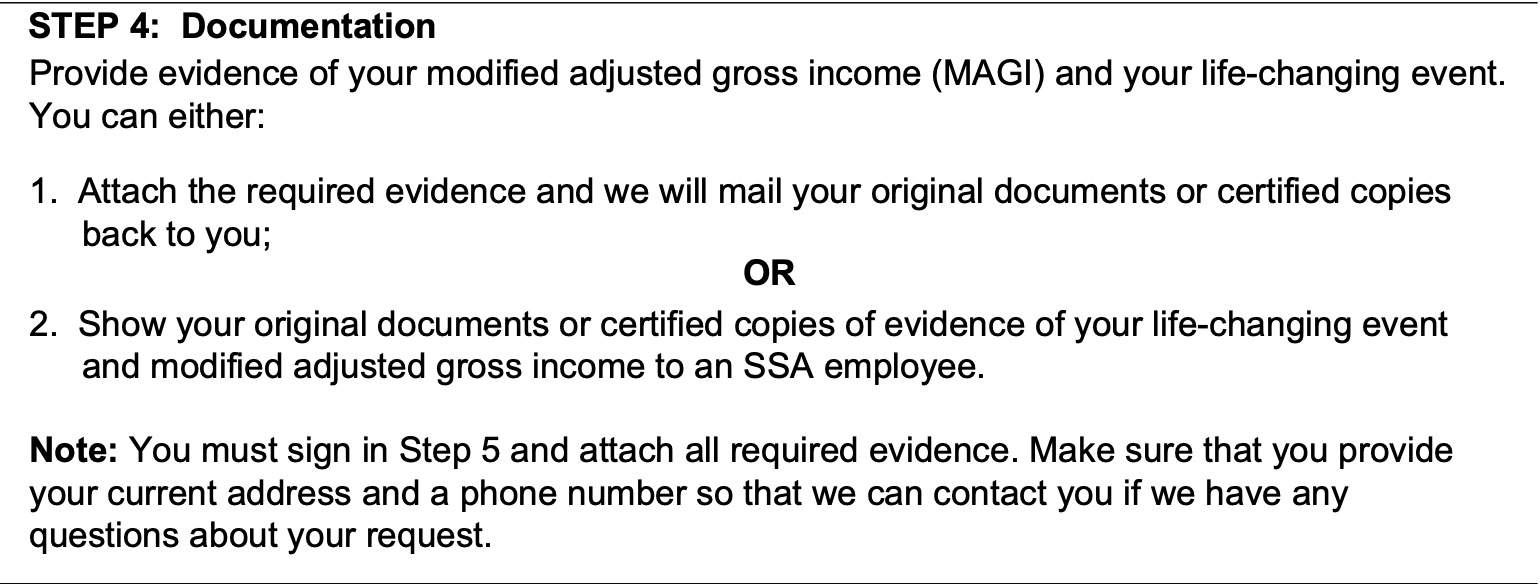

Step Four: Documentation

In this step, you’ll collect the required documents (or certified copies of those documents), depending on your life-changing event. You can find this list on page 8 of the SSA-44.

Hint: If you only have one copy of the document, you may want to get a copy so you can keep the original.

In the case of a work stoppage or reduction, you simply need to sign a statement (under penalty of perjury) that you’ve partially or completely stopped working, or that you took a job with less compensation.

While the SSA returns all submitted documents, you should keep a copy for your own records.

SSA 44 Step Four asks for supporting documentation.

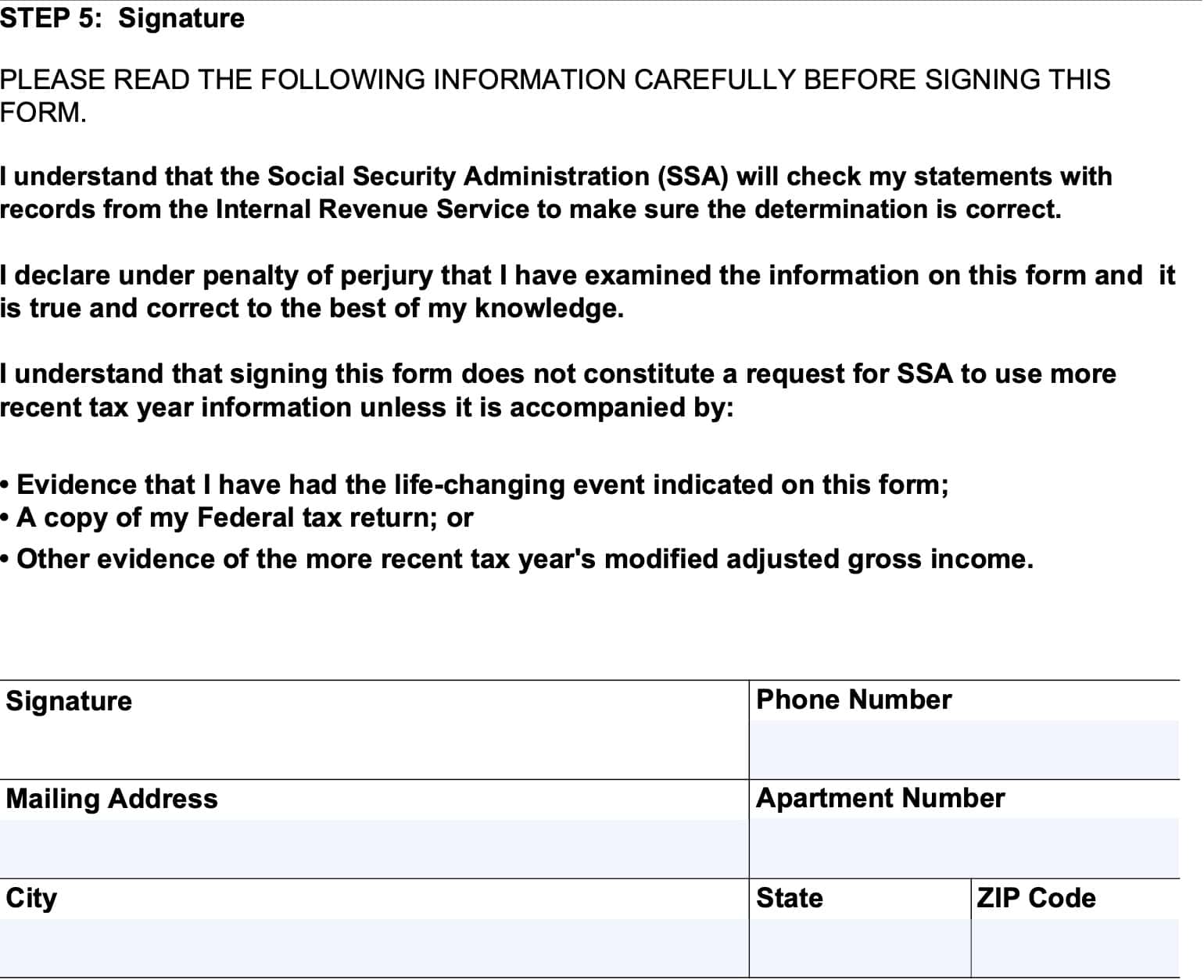

Step Five: Signature

You’ll sign the document under penalty of perjury. In other words, if you attempt to defraud the government, you can face penalties. So this form should only be completed if you’re sincere.

You’ll also want to provide a copy of your tax return, which will help speed up the determination process.

SSA 44 Step Five asks for your signature (sworn under oath).

Please note: If there are two spouses on Medicare, you’ll probably each receive an IRMAA determination letter. If that’s the case, then you’ll need to do this for each spouse.

How Form SSA-44 works

IRMAA (also known as Income-Related Monthly Adjustment Amount) is an increase in Medicare premiums based on income. In other words, the United States government uses your tax returns to determine whether you should pay more for Medicare than the standard premium. If IRMAA applies, you pay an additional surcharge for both Medicare Part B and Part D.

If your income tax returns reflect a higher modified adjusted gross income (MAGI), you’ll receive a letter known as an “Initial Determination Notice.” The Social Security Administration usually sends these notices in advance of the following year.

For example, 2024’s IRMAA letters were sent towards the end of 2023. However, those determinations were mostly based upon 2022 tax returns.

The reason for this is simply because 2023 hadn’t even finished. Because of this process, IRMAA determinations are (at best) based upon tax information that is two years old.

And a lot could have changed in your life between 2022 and 2024 that might have lowered your income. For example, many people retire and their income naturally goes down in retirement.

In recognition of this, the SSA defines specific events that may have impacted your income as ‘life-changing events.’

Key information you can find on SSA-44

Virtually everything you need to successfully complete the SSA-44 is found on the SSA-44 itself. However, it’s worth pointing out some of the useful things you can find on the form:

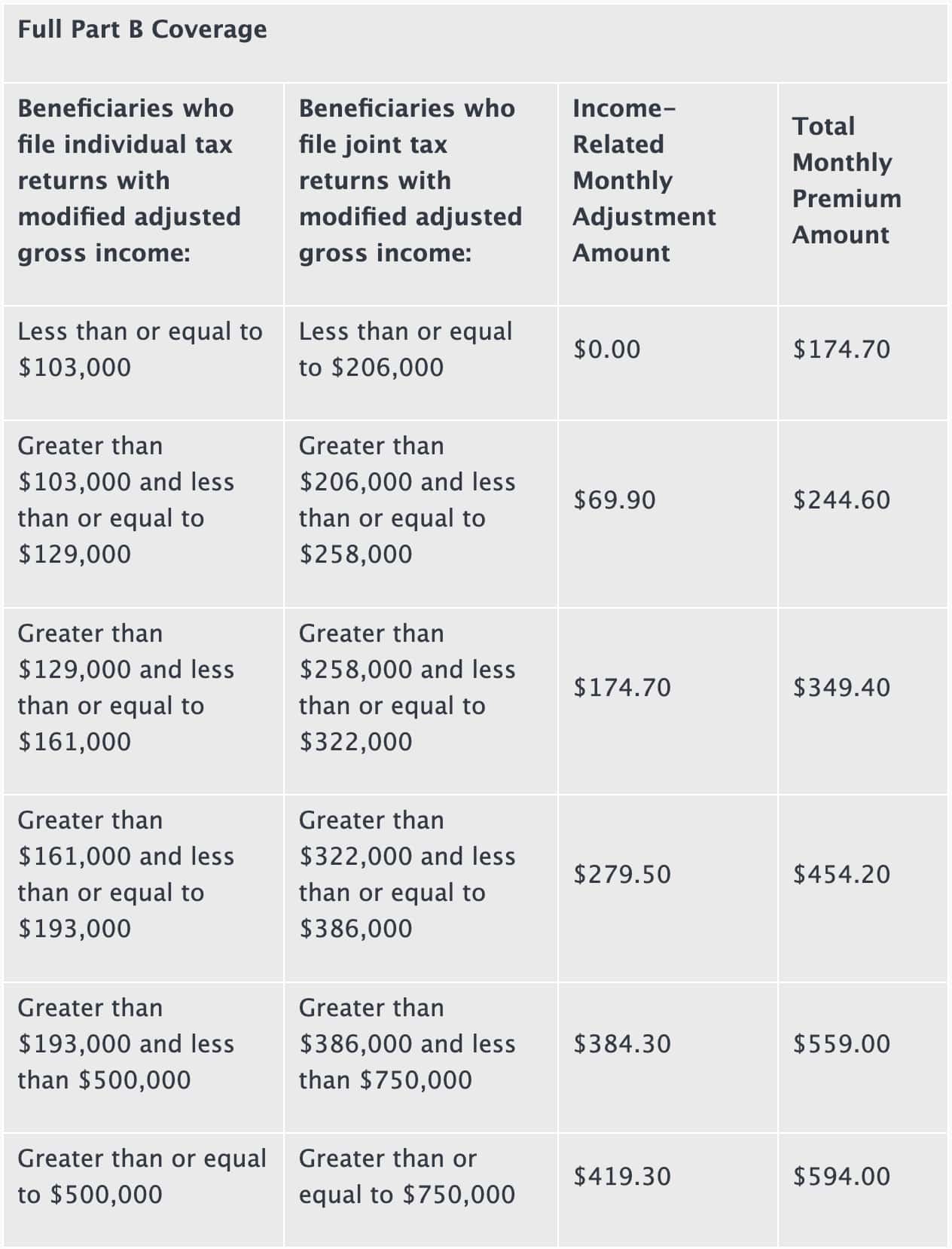

Part B premium tables

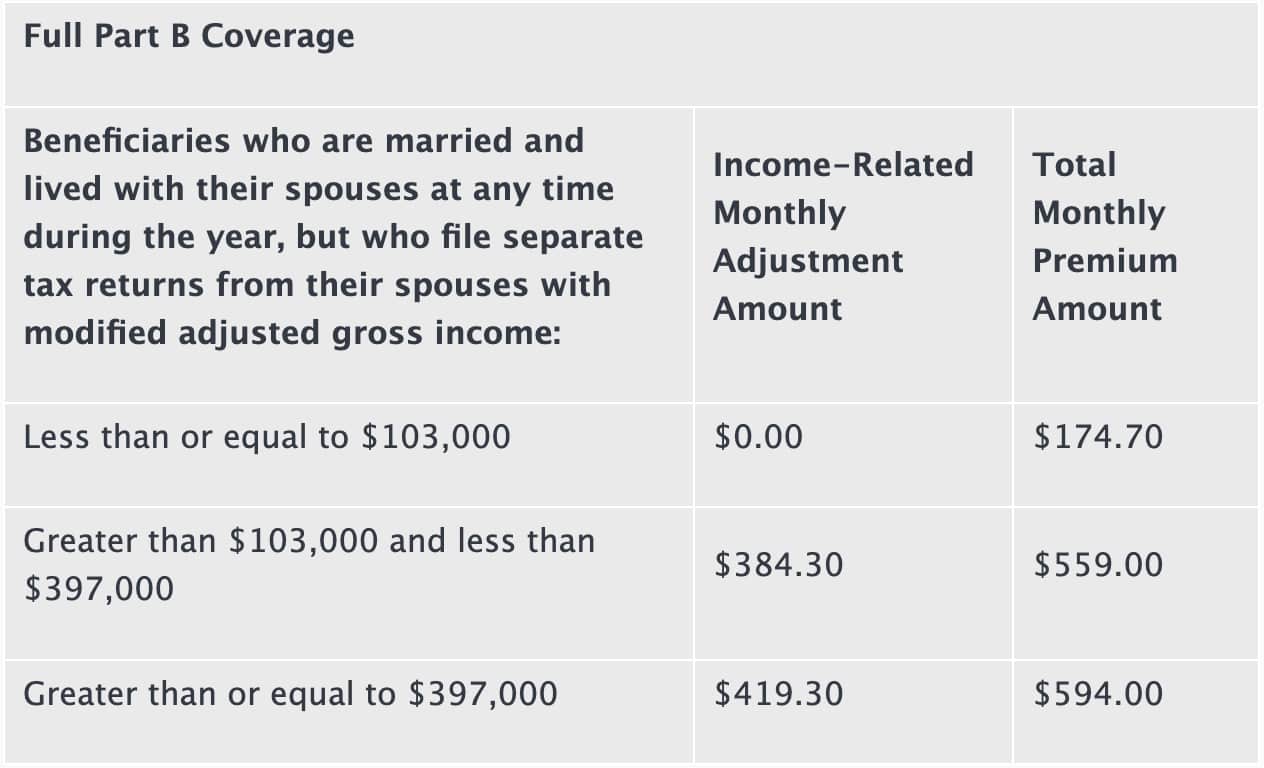

Here are the tables for Part B premiums:

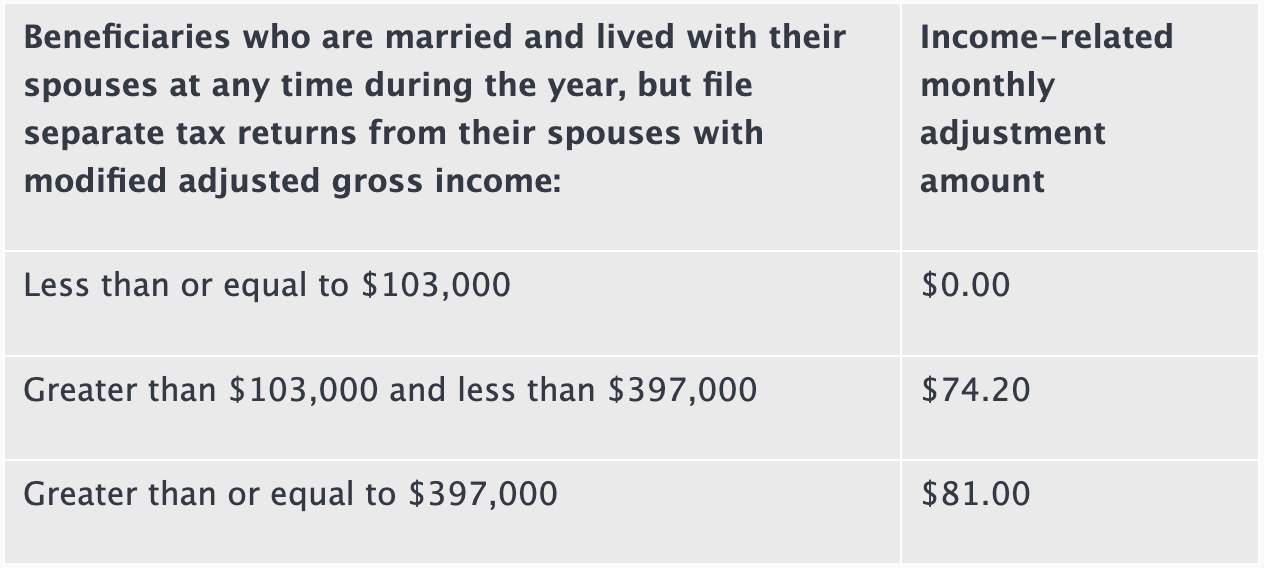

Below is a separate table for married taxpayers filing separate returns.

Part D premium tables

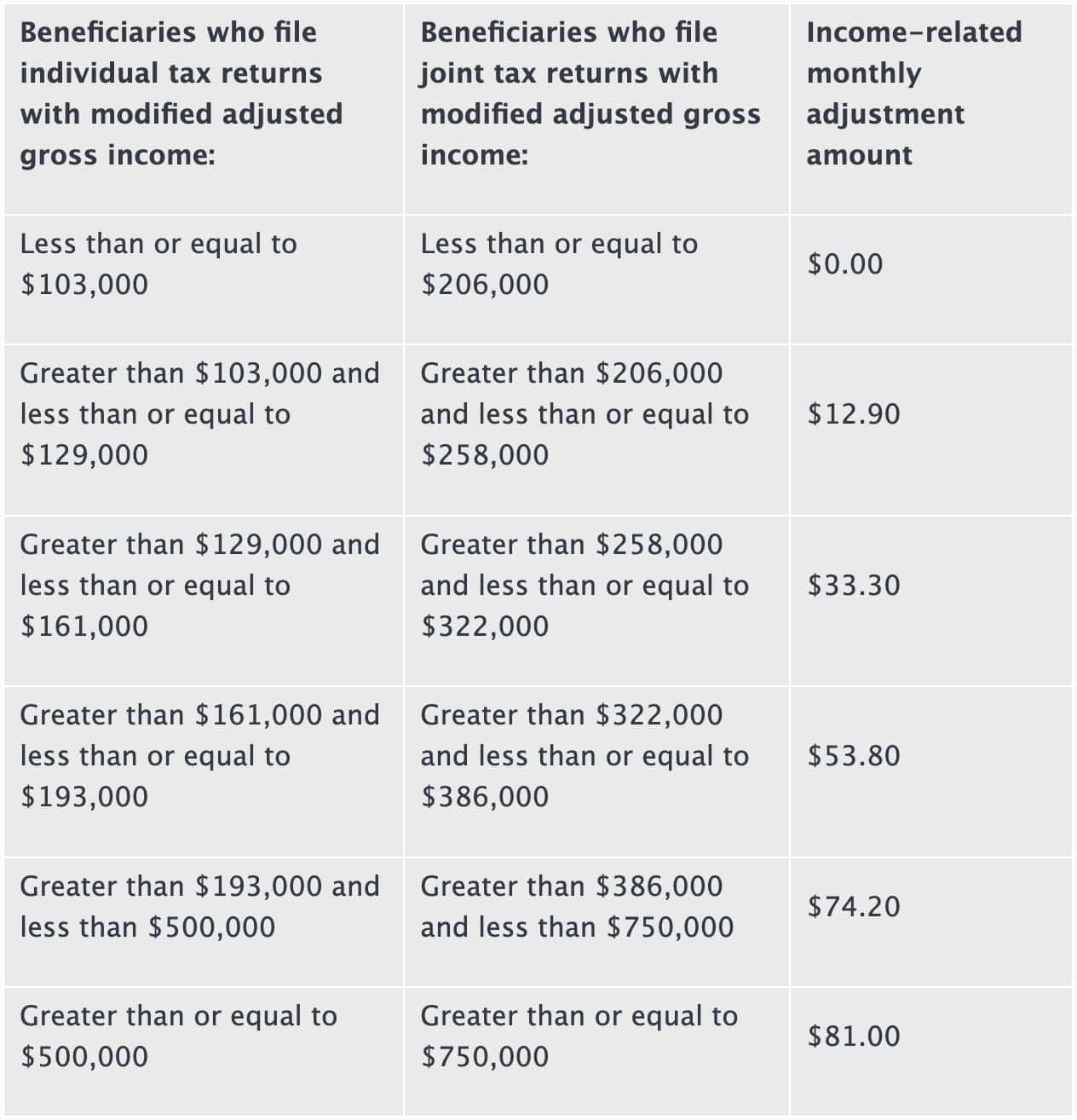

And here are the surcharges for Medicare Part D:

From here, you can figure out not only what SSA is billing you, but what you should be paying based upon your life-changing event.

For example, if your 2022 MAGI was $120,000 and you filed a tax return as a single taxpayer, then you would fall under the first IRMAA tier.

This means that you would be expected to pay an additional $69.90 in Part B premiums per month. Your Part D premiums would go up by $12.90 per month.

Let’s say you got married in 2023, but your income wasn’t expected to increase. This is a change in your tax filing status. That means you could be reconsidered as if you were married, filing jointly (which you probably would end up doing when you file your 2023 tax return).

In that case, your $120,000 MAGI would be under the IRMAA threshold and you wouldn’t pay any additional premiums.

In other words, you can use this table to have a pretty good estimate of where you’ll end up before you start filling out the paperwork.

Video walkthrough

When you might consider using SSA-44

If a life-changing event has impacted your income, then you would use the SSA-44 to request a reconsideration of the new facts for a new IRMAA determination.

Submitting an SSA-44 is not an appeal—it’s actually much simpler than the appeals process. An SSA-44 asks the SSA to consider new income-related facts as if they were part of the initial determination.

Frequently asked questions about SSA-44

Unfortunately, the Social Security Administration cannot accept electronic versions of this form. You must bring your completed SSA-44 to your local Social Security office for consideration.

Yes. If the Social Security Administration processes your request for consideration, then your new Part B and Part D premiums will be retroactively applied to the beginning of the year.

No. You can complete this form your self, or with the assistance of an SSA representative. There is no reason you should feel compelled to pay someone to complete this form for you.

You can call your local Social Security office for instructions on how to submit the SSA-44 and supporting documentation. To find the closest Social Security office to you, go to the Social Security Office Locator and type in your zip code.

Do you need assistance completing Form SSA 44?

After helping numerous clients and readers to complete this form, I decided to create a course for people who need a little bit of extra help understanding their form.

This low-cost course was designed to be a user-friendly and affordable option for people who want to make sure they complete the form correctly, but are frustrated by long waits and customer service at the Social Security Administration.

For more information, please check out my IRMAA course page.

Where can I find a copy of SSA-44?

You can go to the SSA website to save a copy of this form for your records or to complete. You may also obtain a copy from your local SSA office.

For your convenience, we’ve attached the latest version of this form to the bottom of this article.