IRS Form 4506 Instructions

Taxpayers who need tax information from a previously filed return may request information through the IRS website. However, if a taxpayer needs the entire tax return, then he or she may need to file IRS Form 4506, Request for Copy of Tax Return.

In this article, we’ll walk through this tax form, including:

- How to complete & file IRS Form 4506

- Alternatives to filing IRS Form 4506

- Frequently asked questions

Let’s start with a tutorial on completing this tax form.

Table of contents

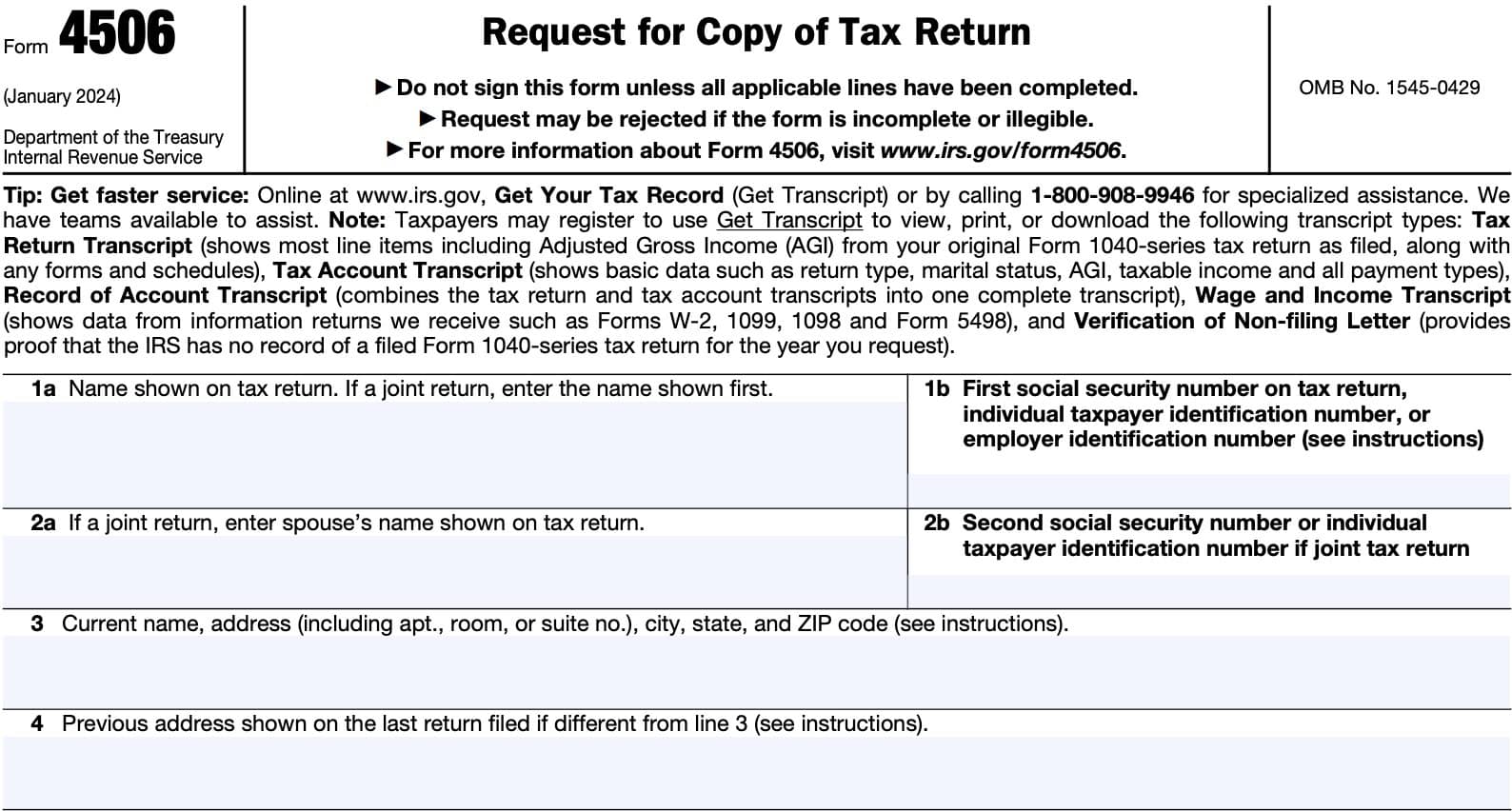

How do I complete IRS Form 4506?

Let’s walk through this one-page tax form, step by step.

Line 1: Taxpayer information

In Line 1a, enter the taxpayer’s name. If your individual tax return request is for a joint tax return, enter the primary taxpayer, or name shown first on your joint return.

In Line 1b, enter the first taxpayer’s tax identification number. This can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Employer identification number (EIN)

- If the taxpayer is an employer

If you are requesting a Form 1040 with Schedule C, you should still enter your SSN, even if you have an employer identification number.

Line 2: Spouse information

If you’re requesting a joint return, then enter the spouse’s information in Line 2 in the same manner as the first taxpayer’s information in Line 1.

Line 3: Current name & address

Enter the current mailing address. This should include:

- Taxpayer name

- Street number and address

- City

- State

- Zip code

If your mailing address is a post office box, then enter your P.O. Box information.

Line 4: Previous address shown on last return filed

If the address listed on your past tax return is different from your current address, then enter your old address in Line 4.

When there are different addresses on Lines 3 and 4 and you have not updated your address with the IRS, then you will need to file one of the following with your tax return request:

- Individual taxpayers: IRS Form 8822, Change of Address

- Business owners: IRS Form 8822-B, Change of Address or Responsible Party — Business

Line 5: Third party address

If you are requesting that your tax return be sent to a third party, enter the third party information here. This should include the following information:

- Third party’s name

- Address

- Telephone number

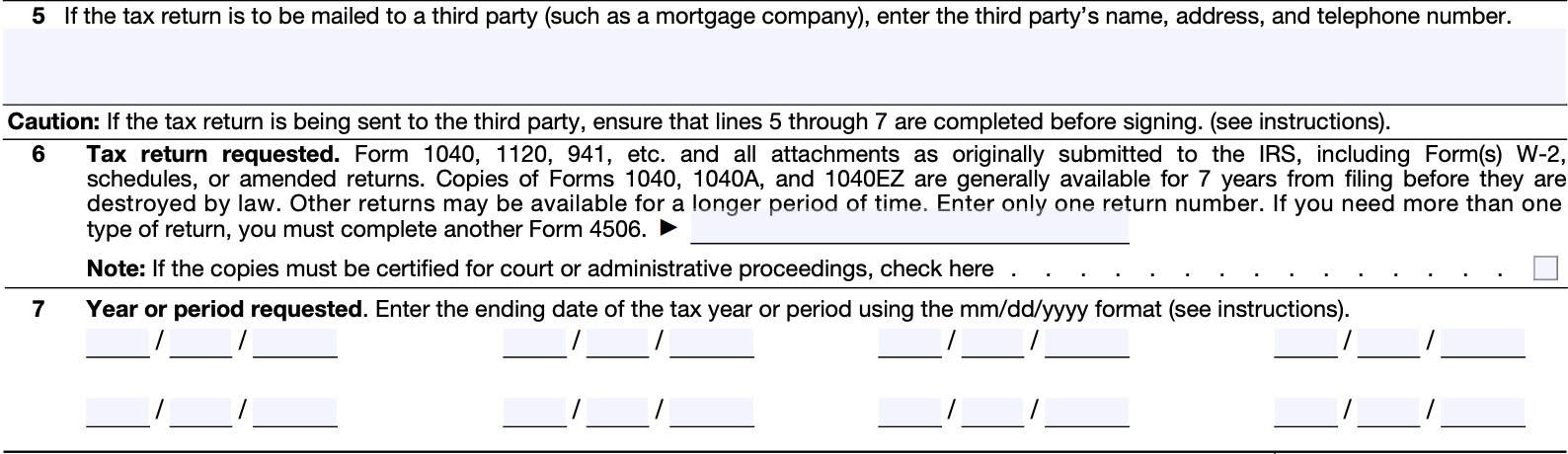

Line 6: Tax return requested

Enter the tax form number applicable to your tax return. In general, your tax return will include accompanying information, such as schedules, Form W-2, or other attachments.

Below are some examples of the most common tax forms:

- IRS Form 1040: U.S. Individual Income Tax Return

- IRS Form 1041: U.S. Income Tax Return for Estates & Trusts

- IRS Form 1120: U.S. Corporation Income Tax Return

In most situations, the IRS retains past tax returns for up to 7 years. The IRS may retain some tax returns or other taxpayer data for longer periods.

You can only enter one type of tax return in Line 6. If you need tax information for multiple types of tax returns, then you will to submit more than one IRS Form 4506.

If the requested forms are for court or administrative proceedings and must be certified, check the appropriate box.

Line 7: Year or period requested

Enter the ending date of the tax year or tax period using the mm/dd/yyyy format. For multiple tax years, there is sufficient room to request up to 8 years of tax returns.

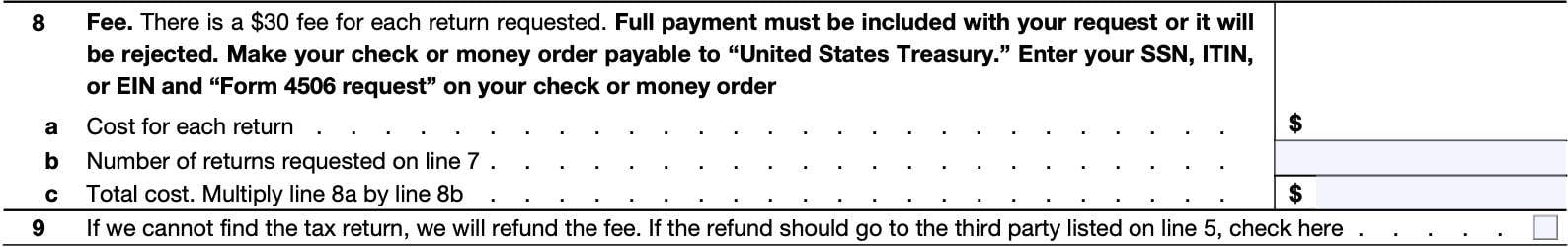

Line 8: Fee

The IRS charges $30 for each requested tax return. If your completed Form 4506 does not have an accompanying check, the IRS will reject your request.

In Line 8a, enter $30 as the cost for each tax return. In Line 8b, enter the number of returns requested on Line 7, above.

Finally, multiply Lines 8a and 8b. Enter the result in Line 8c.

Writing your check

A couple of pointers for taxpayers:

- Make the check or money order payable to ‘United States Treasury’

- The IRS requests taxpayers to include your taxpayer ID number (SSN, ITIN, or EIN) on check or money order, as well as “Form 4506 request”

Line 9

In the case that the IRS cannot find the exact copy of your tax return, you will receive a refund of your application fee.

Check the box in Line 9 if you believe that the refunded fee should go to the third party listed on Line 5.

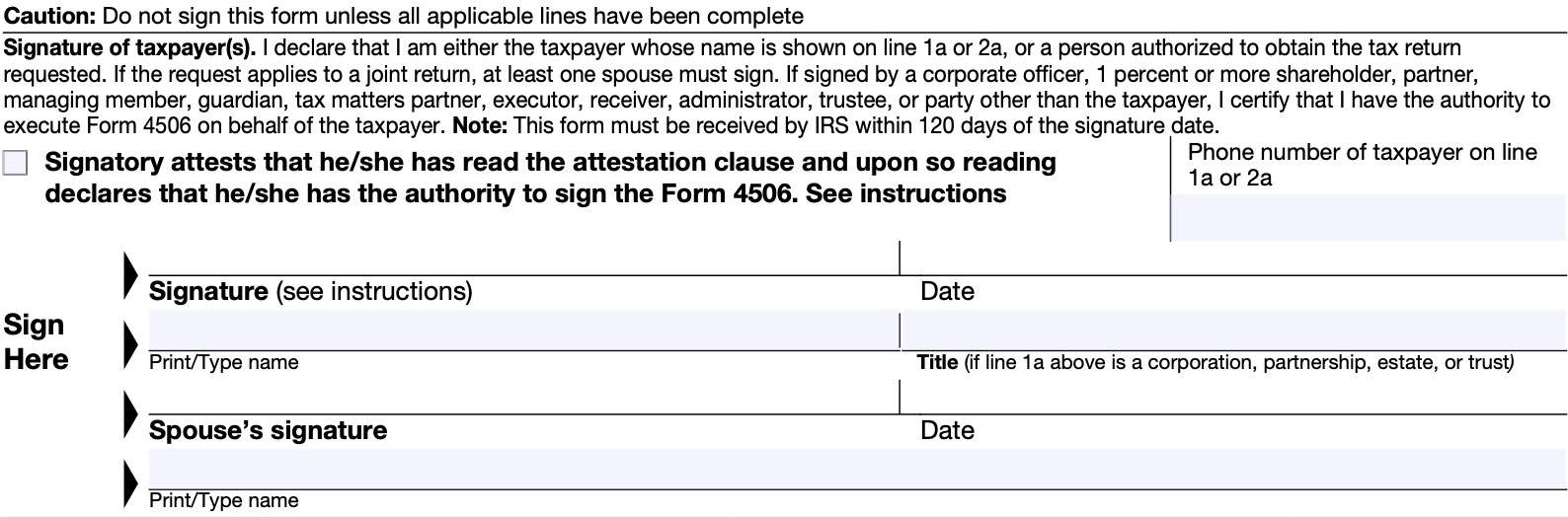

Signature

In the signature field, there are several items worth noting.

Attestation clause

Check the box indicating that you’ve read the attestation clause, and that you have the authority to sign IRS Form 4506.

Telephone number

Just above the signature field, enter the telephone number of either taxpayer named in Line 1 or Line 2.

Signature

For individuals, only one spouse needs to sign this form. For corporations, any of the following may sign Form 4506:

- An officer having legal authority to bind the corporation

- Any person designated by the board of directors or other governing body

- Any officer or employee on written request by any principal officer and attested to by the secretary or other officer

Shareholder of record: A bona fide shareholder of record owning at least 1% of the corporation’s outstanding stock may submit a Form 4506. However, the requester must also provide documentation to support the requester’s right to receive the tax information.

Appointed representative: An appointed representative may request a copy of this form on the taxpayer’s behalf. However, this authority must be specified in writing on IRS Form 2848, Line 5a.

Finally, the IRS must receive this request within 120 calendar days of the date of signature. Otherwise, the IRS will reject your request.

Video walkthrough

Watch this instructional video to learn more about requesting a copy of your tax return with IRS Form 4506.

Do I have to file IRS Form 4506 to receive my tax information?

Not necessarily. If you do not need an exact copy of your tax return, there may be other ways to obtain your own tax information without paying the user fee.

IRS website

If you simply want to access your tax record, you may set up an online account. From your online account, you can simply select ‘Get Transcript.’

In this menu, the page will ask you why you’re requesting this information. Some of the most common reasons include:

- Income verification

- Mortgage related

- Small business loan

- Health care

- Tax purposes

Additionally, you’ll be prompted for a customer file number. Generally speaking, your mortgage lender or federal student aid processor might assign a file number that you can use. Otherwise, you can leave this field blank.

Once you select the reason, you’ll come to a dashboard containing several options:

- Return transcript

- Record of account transcript

- Account transcript

- Wage & income transcript

Let’s take a closer look at each type of tax transcript.

Return transcript

Return transcripts show most line items from your Form 1040-series tax return. These line items appear as your original tax return was filed, including any accompanying forms and schedules.

In many cases, a tax return transcript will meet the requirements of lending institutions offering mortgages.

Record of account transcript

Record of account transcripts combine the information from return and account transcripts. In other words, a record of account transcript contains information from your original filed return, as well as any changes that occurred after the original return was filed.

Account transcript

Account transcripts show changes you or the IRS made after you filed your original return. These changes could include transactions like making estimated tax payments or filing an amended return.

Wage & income transcript

Wage and income transcripts show data from information returns. This will include information reported to the IRS on the following:

- W-2 Form

- Form 1098

- Form 1099

Looking for a different version of Form 4506?

If you stumbled upon this page by accident, don’t feel bad. There are many versions of Form 4506, each with different purposes.

We’ve written articles on literally all of the 4506 tax forms. Instead of hitting the ‘Back’ button, take a quick second to peruse the list below to find the version that you want.

- IRS Form 4506-A, Request for a Copy of Exempt or Political Organization IRS Form

- IRS Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter

- IRS Form 4506-C, IVES Request for Transcript of Tax Return

- IRS Form 4506-F, Identity Theft Victims Request for Copy of Fraudulent Tax Return

- IRS Form 4506-T, Request for Transcript of Tax Return

- IRS Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript

How do I file IRS Form 4506?

You cannot file this tax form online. The IRS will only accept mailed versions of Form 4506, accompanied by full payment in the form of check or money order.

You must mail your completed IRS Form 4506 to the correct IRS office, based upon your state of filing & taxpayer status.

Individual returns

Requests for individual tax returns (includes taxpayers whose filing status is married filing jointly) will go to one of three places, depending on which state you lived in, or your business was in, when you filed the tax return.

Austin, TX

Internal Revenue Service

RAIVS Team

Stop 6716 AUSC

Austin, TX 73301

If you lived in any of the following states or locations, send your completed request to the Austin IRS address listed above.

- Florida

- Louisiana

- Mississippi

- Texas

- Any mailing address outside the United States (foreign country, APO/FPO address, territory or possession)

Kansas City, MO

Internal Revenue Service

RAIVS Team

Stop 6705 S-2

Kansas City, MO 64999

If you lived in any of the following states or locations, send your completed request to the above Kansas City IRS location.

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Indiana

- Iowa

- Kentucky

- Maine

- Massachusetts

- Minnesota

- Missouri

- New Hampshire

- New Jersey

- New York

- North Carolina

- Oklahoma

- South Carolina

- Tennessee

- Vermont

- Virginia

- Wisconsin

Ogden, UT

Internal Revenue Service

RAIVS Team

P.O. Box 9941

Mail Stop 6734

Ogden, UT 84409

If you lived in any of the following states or locations, send your completed request to the Ogden IRS location listed above.

- Alaska

- Arizona

- California

- Colorado

- Connecticut

- District of Columbia

- Hawaii

- Idaho

- Kansas

- Maryland

- Michigan

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Ohio

- Oregon

- Pennsylvania

- Rhode Island

- South Dakota

- Utah

- Washington

- West Virginia

- Wyoming

All other returns

For tax returns not in the 1040 series, you will send your request to either Kansas City or Ogden, depending on location when the tax return was filed.

Kansas City, MO

If your location was in any of the following states or locations, send your completed request to the Kansas City IRS location below.

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Illinois

- Indiana

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Vermont

- Virginia

- West Virginia

- Wisconsin

Internal Revenue Service

RAIVS Team

Stop 6705 S-2

Kansas City, MO 64999

Ogden, UT

If you lived in any of the following states or locations, send your completed request to the Ogden IRS address below.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Hawaii

- Idaho

- Iowa

- Kansas

- Louisiana

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oklahoma

- Oregon

- South Dakota

- Texas

- Utah

- Washington

- Wyoming

- Any mailing address outside the United States (FPO/APO, foreign country, territory or possession)

Internal Revenue Service

RAIVS Team

P.O. Box 9941

Mail Stop 6734

Ogden, UT 84409

How do I find IRS Form 4506?

You can get a copy of the form from the IRS website. For your convenience, we’ve attached the latest version to this article, just below.

Frequently asked questions

According to the Internal Revenue Service, you should expect to receive a copy of your return within 75 calendar days of filing IRS Form 4506.

Not everyone does. Some lenders may be registered with the IRS’ Income Verification Express Service (IVES). IVES participants may request tax return information using IRS Form 4506-C, which requires less taxpayer information than Form 4506.

IRS Form 4506, Request for Copy of Tax Return, is the IRS form that taxpayers may use to request a copy of their tax return from the Internal Revenue Service. There is a $30 user fee for each tax return requested.

Taxpayers use IRS Form 4506 to obtain copies of tax returns while they may use IRS Form 4506-T to request tax return transcripts. Taxpayers may also use IRS Form 4506-T to request information not included on a tax return, such as changes to their tax record or tax account.