IRS Form 4506-B Instructions

The Internal Revenue Code allows certain organizations to maintain a tax-exempt status as long as they comply with certain requirements, such as keeping certain documents available for inspection. You can also request copies of these documents from the Internal Revenue Service. For example, you can file IRS Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter to request applications or determination letters located in the IRS files.

In this article, we’ll walk through everything you need to know about IRS Form 4506-B, including:

- How to complete and file IRS Form 4506-B

- Costs and other considerations associated with filing this form

- Alternate means to request certain information about a tax-exempt organization

Let’s start with an overview of this tax form and how it works.

Table of contents

How do I complete IRS Form 4506-B?

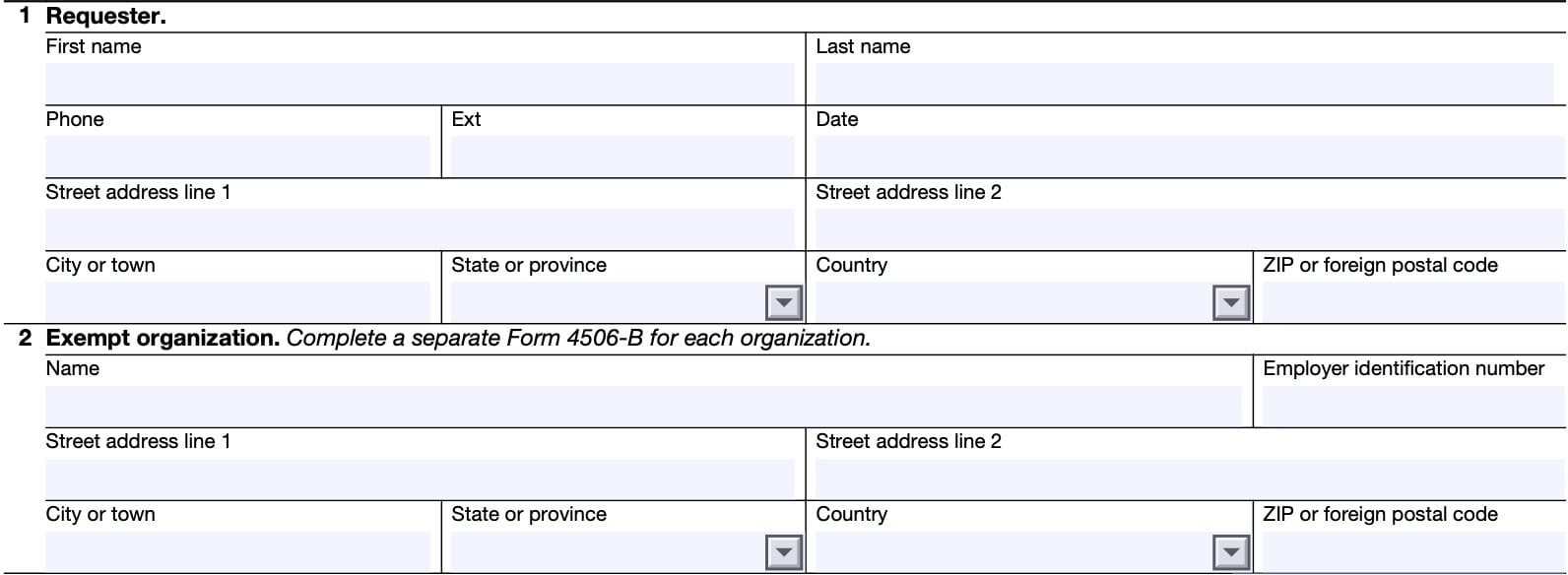

IRS Form 4506-B is a one-page form that you submit online through the IRS website. Let’s go over each part, step by step.

Part 1: Requester information

You’ll need to enter the following information on your own behalf:

- Complete name

- Telephone number

- Street address, including city, state, and zip code

- Date

Part 2: Exempt organization information

Enter the following information for the tax-exempt organization you are requesting information for:

- Name of tax exempt organization

- Employer identification number

- Street address, including city, state, country, and ZIP code

If you are completing Form 4506-B for multiple tax-exempt organizations, you will need to complete a Form 4506-B request for each organization.

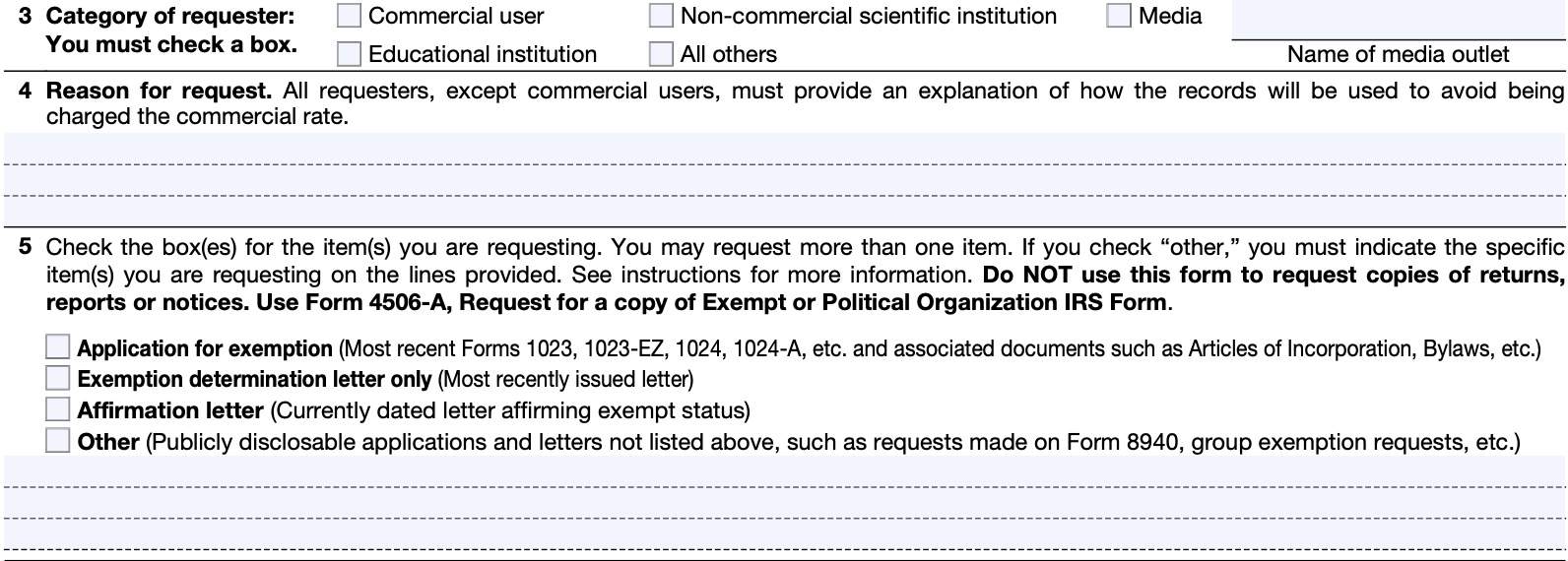

Part 3: Category of requester

Check one of the following boxes:

- Commercial user

- Non-commercial scientific institution

- Media

- If selected, enter the name of the media outlet in the space provided

- Educational institution

- All others

The IRS instructions do not give much guidance, so you’ll have to use your judgment in deciding which box to select.

Part 4: Reason for request

Unless you are a commercial user, all other applicants must enter a reason for requesting these records as well as a written explanation of how they will be used. Otherwise, the Internal Revenue Service may charge you the commercial rate, instead of the non-commercial rate.

How much will this request cost?

Depending on your status, the IRS reserves the right to charge an adequate fee for the cost of reproducing an existing public document.

For commercial users, the rate to photocopy filed documents is 20 cents per page. For all other requesters, the cost is:

- First 100 pages: No cost

- Subsequent pages: 20 cents per page

The IRS will send you a bill for the reproduction cost of requested documents. If your application will cost $250 or more to process, then the IRS will bill you in advance.

Part 5: Item(s) requested

In this part, you’ll check the box (or boxes) for the items that you would like the IRS to provide you. If you check ‘Other,’ then you must specify the item or items that you’re requesting in the provided spaces.

Below, we’ll describe what the IRS will send you for each box that you select.

Application for exemption

If you select this, then the IRS will send you a copy of the most recently approved application for exemption submitted by the tax-exempt organization, as well as all supporting documentation and the IRS determination letter. This may include any of the following forms, as well as supporting statements:

- IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

- IRS Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

- IRS Form 1024, Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code

- IRS Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code

You will only receive the most recent application by checking this box if the organization did either of the following:

- Previously filed a tax exemption application under a different Internal Revenue Code section or subsection, or

- Was previously granted a recognition of exemption, which was revoked, then reinstated after re-filing

To receive these previous applications, you must check the Other box and indicate this in the provided space.

Exemption determination letter only

Requesters who select this box will only receive the determination letter that the IRS issued in response to the most recently approved exemption application.

Tax exempt organization search

For determination letters issued in 2014 or later, you may find these online through the IRS Tax Exempt Organization Search (TEOS) page.

Once you’re on the IRS TEOS page, you’ll find a lot of resources about public charities and tax-exempt organizations. Here is a partial list of some of the things you can do on the TEOS page:

- Conduct a tax-exempt organization search

- Obtain a copy of a determination letter

- Research an organization’s tax-exempt status

- Access bulk data downloads

- Obtain an online copy of an exempt organization’s prior year returns, such as:

- IRS Form 990, Return of Organization Exempt from Income Tax

- IRS Form 990-EZ, Short Form Return of Organization Exempt from Income Tax

- IRS Form 990-PF, Return of Private Foundation

Most of these resources are available without having to pay a user fee.

Affirmation letter

If you select this box, the IRS will send you a letter with the current date affirming the current exempt status of the organization.

Other

You will need to use this box to specifically request any other items that are available for public inspection. Examples may include, but are not limited to:

- Group exemption requests

- Some requests previously made on IRS Form 8940

- Prior exemption applications

However, the form states that you should not use Form 4506-B to request copies of tax returns, reports, or notices. Instead, you should use IRS Form 4506-A, Request for a copy of Exempt or Political Organization IRS Form.

The IRS states that these requests may take longer to process, and could result in significant delays.

Filing IRS Form 4506-B

According to the form instructions, you can only submit this document online from the IRS website. You must have Adobe Acrobat installed on your computer to submit your request.

Looking for a different version of Form 4506?

If you stumbled upon this page by accident, don’t feel bad. There are many versions of IRS Form 4506, with different purposes.

We’ve written articles on virtually all of the 4506 tax forms. Instead of hitting the ‘Back’ button, take a quick second to peruse the list below to find the version that you want.

- IRS Form 4506, Request for Copy of Tax Return

- IRS Form 4506-A, Request for Public Inspection or Copy of Exempt or Political Organization IRS Form

- IRS Form 4506-C, IVES Request for Transcript of Tax Return

- IRS Form 4506-F, Identity Theft Victims Request for Copy of Fraudulent Tax Return

- IRS Form 4506-T, Request for Transcript of Tax Return

- IRS Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript

Video walkthrough

Watch this instructional video to learn about IRS Form 4506-B.

Frequently asked questions

You may use IRS Form 4506-B to request a copy of an exempt organization’s exemption application or IRS determination letter. Under Internal Revenue Code Section 6104, each exempt organization must keep these documents available for public inspection.

Yes. In fact, the Internal Revenue Service will only allow you to submit Form 4506-B via email through the IRS website. This occurs when you hit the Submit Form button at the bottom of the page.

Where can I find IRS Form 4506-B?

You can find the latest versions of IRS forms on the IRS website. For your convenience, we’ve enclosed the latest version of this form right here, in this article.

Although you must file from the website, it’s a good idea to save a copy of your completed Form 4506-B before you file.