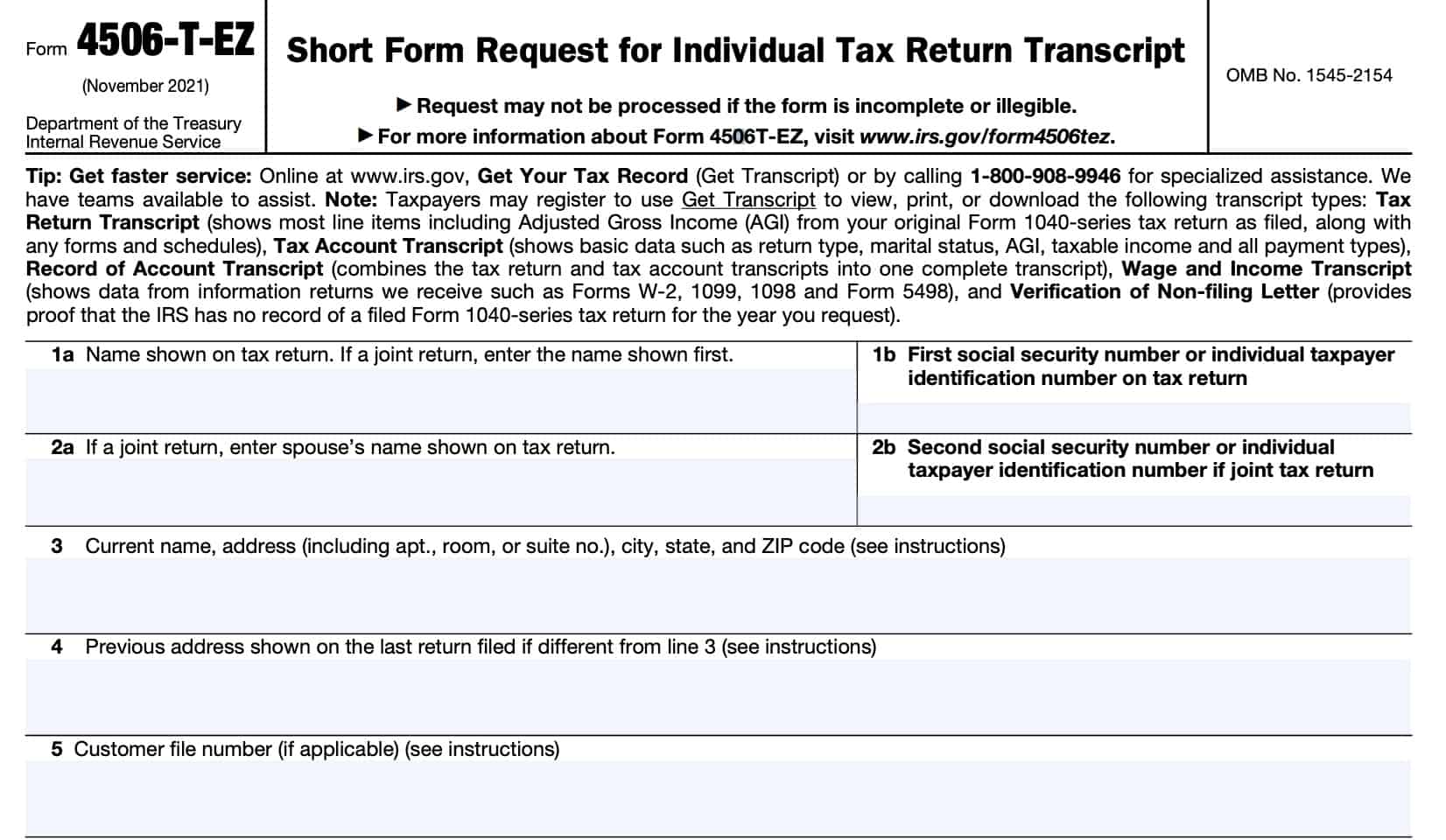

IRS Form 4506-T-EZ Instructions

If you’ve lost your prior year tax returns, or ned to send tax transcripts to a third party, there are many ways to request tax information from the Internal Revenue Service. One of those ways is to file IRS Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript.

In this article, we’ll give you step by step instructions on completing this request as well as some commonly asked questions about your tax return transcript. Let’s start by going through this form, step by step.

Table of contents

How do I complete IRS Form 4506-T-EZ?

According to the IRS, this short form request should take about 20 minutes to complete. However, tax filers may find that it takes much less time. Let’s go through this, step by step.

Line 1: Name as shown on tax return

In Line 1a, enter your complete name as shown on the income tax return. For Line 1b, enter either your Social Security number or individual taxpayer identification number (ITIN), as shown on the tax return.

If your request pertains to a business return, you may enter an employer identification number (EIN), instead of your ITIN or SSN.

If you are requesting a transcript for a joint tax return, put the name of the primary taxpayer. This is the name listed first on the tax return.

Line 2: Spouse’s name as shown on tax return

If applicable, enter your spouse’s name, as shown on the requested tax return, in Line 2a. For Line 2b, enter your spouse’s taxpayer ID number.

Line 3: Current address

In Line 3, enter your current address information, to include:

- Street address

- City

- State

- Zip code

If you use a post office box for mail, then you may enter your P.O. Box in lieu of your street address.

Where will the IRS mail my tax return transcript?

Keep in mind: As of July 2019, to protect taxpayer data, the Internal Revenue Service will only mail your tax transcript to your address of record, regardless of what you enter into Line 3 or Line 4.

Line 4: Previous address

If you used a different address on your latest tax return from the address that you entered into Line 3, then enter that address in Line 4.

Line 5: Customer file number

You do not need to complete Line 5. However, if you wish to have a unique file number for your tax record, then you may enter up to 10 digits in Line 5. This file number will be shown on the tax account transcript that the IRS sends you.

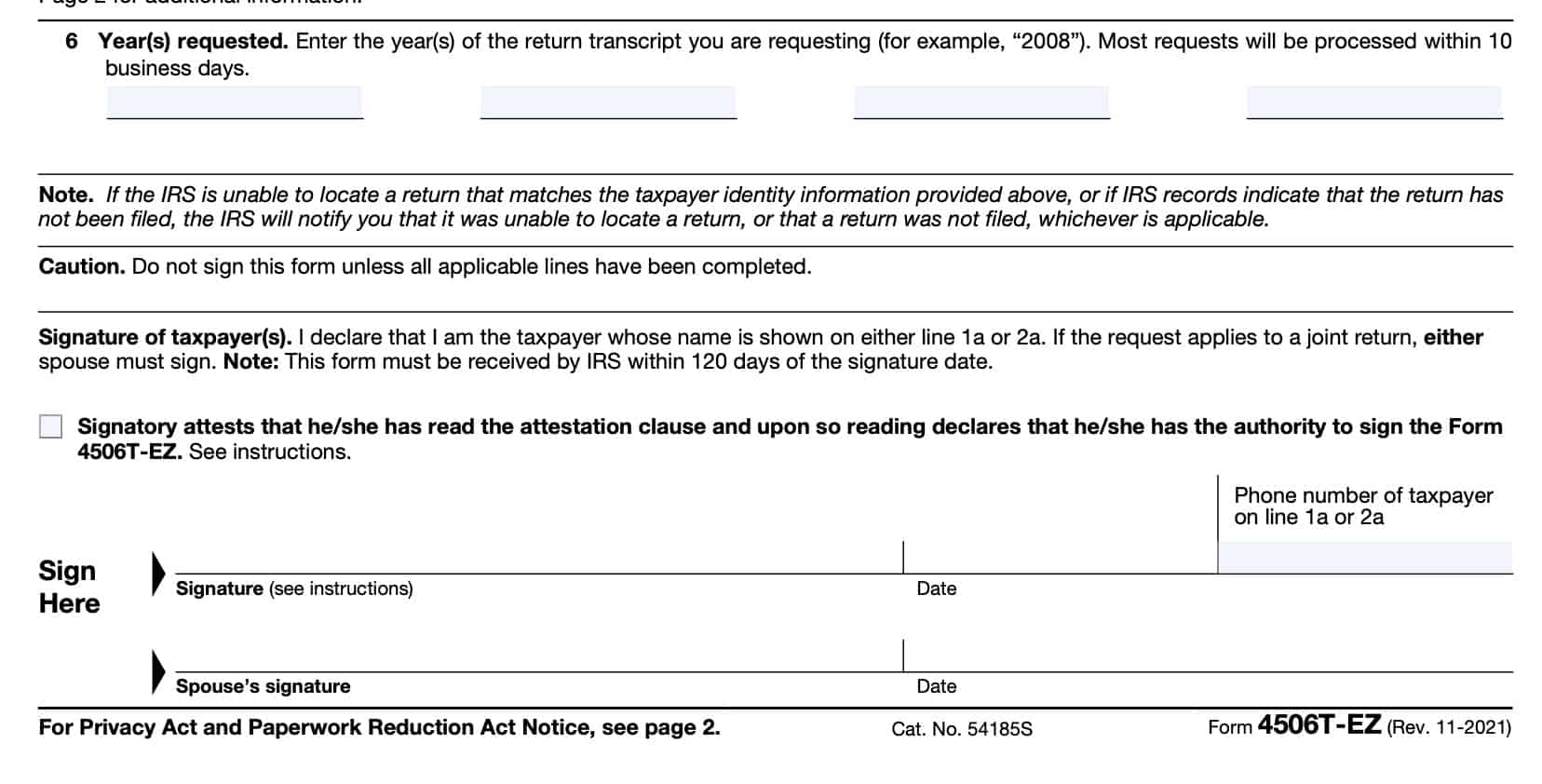

Line 6: Year(s) Requested

Enter the year or years for the individual tax return transcript that you are requesting. You are allowed to use this form to request a transcript for the current year as well as three prior years.

If you need tax account information for a tax period outside of these, you may need to use Form 4506-T, Transcript of Tax Return, instead of Form 4506-T-EZ.

Signature field

In the signature field, you must check the box that attests your authority to sign as either the primary taxpayer or spouse as listed in Line 1 or Line 2.

From there, sign and date the form, and provide a telephone number where you can be reached in case the IRS has questions. You may use a mobile phone number if you do not have an office number or landline in your house.

The IRS must receive your completed IRS form within 120 days of the date of signature.

Looking For A Different Version Of Form 4506?

If you stumbled upon this page by accident, don’t feel bad. There are many versions of Form 4506, each with different purposes.

We’ve written articles on literally all of the 4506 tax forms. Instead of hitting the ‘Back’ button, take a quick second to peruse the list below to find the version that you want.

- IRS Form 4506, Request for Copy of Tax Return

- IRS Form 4506-A, Request for a Copy of Exempt or Political Organization

- IRS Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter

- IRS Form 4506-C, IVES Request for Transcript of Tax Return

- IRS Form 4506-F, Identity Theft Victims Request for Copy of Fraudulent Tax Return

- IRS Form 4506-T, Request for Transcript of Tax Return

Video walkthrough

Watch this instructional video to learn more about how to file IRS Form 4506-T-EZ for your short form request.

Frequently asked questions

You may get tax return transcript information by phone or through your online IRS account.

You may use Form 4506-T-EZ to get transcripts of a Form 1040 filed in the current year or three prior years. You may need to complete the 4506-T Form if requesting other information, such as a W-2 Form, requesting prior year return information beyond three years, or if your fiscal tax year is not the same as a calendar year.

Not always. As of July 2019, the IRS will only mail your paper IRS tax return transcript to the address on record. You may change your address in writing, by phone, by filing an income tax return with your new address, or by filing IRS Form 8822, Change of Address, or IRS Form 8822-B, Change of Address For Business.

When you get transcript information for your tax return, you can expect to see most line items, including Adjusted Gross Income (AGI), from your original Form 1040-series tax return as filed. You will also see line item information for any forms and schedules filed with your original return. You will not see payments, penalty assessments, or adjustments made to the originally filed return.

According to the form instructions, the IRS normally takes about 10 business days to process Form 4506 T-EZ requests. If you need tax account information more quickly, you may get your transcript online by logging into your online IRS account.

Send your completed request form to the IRS office address that corresponds to where your most recent tax return was filed. You can find the IRS mailing addresses and fax numbers on the back of your Form 4506-T-EZ.

Where can I find IRS Form 4506-T-EZ?

You may find this transcript request on the IRS website. For your convenience, we’ve enclosed a copy in this article.