IRS Form 8822 Instructions

When moving from one place to another, people often notify the post office of their change in address. But to avoid tax issues, it’s also prudent to inform the Internal Revenue Service. You can do this by filing IRS Form 8822, Change of Address.

In this article, we’ll walk through the IRS change of address form, step by step, including:

- How to complete IRS Form 8822

- Other ways to update your address with the IRS

- Filing considerations

Let’s start with a walk through of how to complete this form.

Table of contents

How do I complete IRS Form 8822?

This one-page form is pretty straightforward, with two parts:

- Part I: Complete This Part To Change Your Home Mailing Address

- Part II: Signature

Let’s begin at the top of Part I.

Part I: Complete This Part To Change Your Home Mailing Address

Part I contains most of the information fields for changing your address.

Line 1: Individual income tax returns

For Line 1, simply check the respective box for individual income tax returns. You should check this box unless you’re not required to file an income tax return.

Check the additional box if your last tax return was a jointly filed return and you’re now moving to a new residence. This could be because of divorce or separation.

Line 2: Gift, estate, or generation-skipping transfer tax returns

Most people are not required to file gift tax returns (IRS Form 709) or estate and generation-skipping transfer tax returns (IRS Form 706). But if you are doing so, check the applicable box.

If you’re filing Form 706 or 706-NA, enter the name of the decedent and the decedent’s Social Security number.

Line 3a: Taxpayer name

In Line 3a, enter your name.

Line 3b: Taxpayer Social Security number

Enter your full Social Security number in Line 3b.

Line 4a: Spouse’s name

In Line 4a, enter your spouse’s first name and last name, if applicable.

Line 4b: Spouse’s Social Security number

In Line 4b, enter your spouse’s full Social Security number.

Line 5a: Prior Name(s)

Complete this field if your name changed, even if the cause was due to divorce or marriage.

If you haven’t already, you may also want to file an application for a new Social Security card by filing Form SS-5 with the Social Security Administration.

Line 5b: Spouse’s prior name(s)

Any prior names that your spouse may have used should go into Line 5b, as applicable.

Line 6a: Old address

Enter your complete old mailing address, including street name, city, state, and zip code.

P.O Box

If you have a PO Box, enter your box number instead of the street number only if the post office does not deliver mail to your street address.

Foreign address

Follow the country’s practice for entering your address. Do not abbreviate the name of the country.

“In Care of” Address

If you receive your mail in care of a third party, such as your accountant or attorney, enter “C/O” followed by the third party’s name.

Line 6b: Spouse’s old address

In a similar manner, enter your spouse’s prior address, if it is different from the address you entered in Line 6a.

Line 7: New address

In Line 7, follow the same instructions as Line 6 as they pertain to your current address.

Part II: Signature

In Part II, you’ll enter your signature. First, you may enter a daytime telephone number where you can be reached, if the IRS has any questions.

Taxpayer signature

If you are the taxpayer, you must sign the bottom of this form, unless you have an authorized representative signing for you (see below).

Spouse signature

If you are married, your spouse must sign as well, unless you checked the additional box in Line 1 indicating that you are establishing a separate residence after having previously filed a joint return.

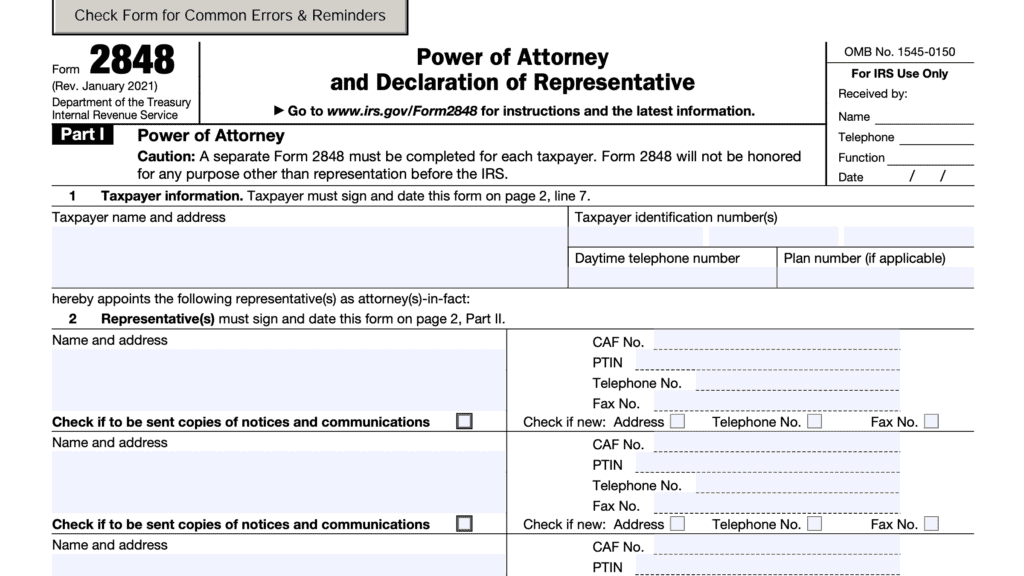

Signature of representative

If a representative, such as an accountant, is signing on the taxpayer’s behalf, that person must attach a copy of your power of attorney or a completed IRS Form 2848, Power of Attorney and Declaration of Representative, to the completed Form 8822.

Filing considerations

There are some filing considerations we should understand when it comes to notifying the Internal Revenue Service of a change in address.

Where do I file IRS Form 8822?

You cannot file this form electronically. You must file Form 8822 by mail.

The IRS mailing address depends on two factors:

- Whether or not you’re filing gift, estate, or GSTT tax returns on Forms 706 or 709

- Where your old home address used to be

Filing gift tax, estate tax, or GSTT tax returns

If you checked the box in Line 2 indicating that you’re involved in filing one of these tax returns, then send your completed form to:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999-0023

Filing by location of old address

There are three U.S. based IRS locations for taxpayers to file their completed Form 8822:

IRS Service Center, Kansas City

Taxpayers located in the following states should mail their completed change of address form to the Kansas City office.

- Alabama

- Georgia

- Iowa

- Massachusetts

- New Hampshire

- North Carolina

- Tennessee

- Wisconsin

- Arkansas

- Illinois

- Kentucky

- Minnesota

- New Jersey

- Oklahoma

- Vermont

- Delaware

- Indiana

- Maine

- Missouri

- New York

- South Carolina

- Virginia

Send your completed Form 8822 to the following location:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999-0023

IRS Service Center, Ogden

Taxpayers located in the following states should mail their completed change of address form to the Ogden location.

- Alaska

- Colorado

- Hawaii

- Maryland

- Nebraska

- North Dakota

- Pennsylvania

- Utah

- Wyoming

- Arizona

- Connecticut

- Idaho

- Michigan

- Nevada

- Ohio

- Rhode Island

- Washington

- California

- District of Columbia

- Kansas

- Montana

- New Mexico

- Oregon

- South Dakota

- West Virginia

As applicable, send your change of address form to the following address:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0023

IRS Service Center, Austin

Taxpayers located in the following states should mail their completed change of address form to:

- Florida

- Louisiana

- Mississippi

- Texas

Send your completed form to:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0023

Additionally, send your completed form to the Austin address if one of the following applies to your situation:

- You’re moving from a foreign country

- You’re moving from American Samoa or Puerto Rico

- You’re excluding income under IRC Section 933 as a resident of Puerto Rico

- You’re moving from an APO or FPO address

- You file one of the following tax forms:

- IRS Form 2555 or 2555-EZ

- You are a dual status alien or non bona fide resident of Guam or the U.S. Virgin Islands.

If you are a bona fide resident of the U.S. Virgin Islands or Guam or the Virgin Islands, see below.

Guam

Bona fide residents of Guam should send their completed Form 8822 to:

Department of Revenue and Taxation

Government of Guam

P.O. Box 23607

GMF, GU 96921

U.S. Virgin Islands

Bona fide residents of the U.S. Virgin Islands should send their completed Form 8822 to:

V.I. Bureau of Internal Revenue

6115 Estate Smith Bay

Suite 225

St. Thomas, VI 00802

If you’re changing the mailing address for your children

To update the address on file for one or more children who file their own tax return, you’ll have to file a separate Form 8822 for each child.

If you’re also changing your business address

Taxpayers who plan to update their home and business address should plan to update their business location separately. File IRS Form 8822-B, Change of Address or Responsible Party – Business, to update your business mailing address with the IRS.

Other ways to update your address

You do not have to file Form 8822 to update your address with the IRS. You may also update your address by:

- Filing your income tax return

- Sending the IRS a signed, written statement with the following information:

- Your full name

- Your old and new addresses

- Your identifying number:

- Social Security number,

- Individual taxpayer identification number (ITIN), or

- Employer identification number (EIN)

- Calling the IRS to update your address

Video walkthrough

Watch this Youtube video for step by step Form 8822 instructions.

Frequently asked questions

Normally, when taxpayers file income tax returns with a new home mailing address, the IRS will update its taxpayer records accordingly. If you’re in the middle of resolving outstanding tax matters while you move, then you might be better off informing the IRS of an address change by filing this tax form. If you’re changing both your home and business addresses, you should use Form 8822-B to update your new business location.

You cannot file this form electronically. You must file Form 8822 by mail to the appropriate IRS Service Center. The IRS mailing address depends on whether you’re filing Forms 706 or 709, and where your old home address used to be.

According to the form instructions, you should give the Internal Revenue Service about 4 to 6 weeks to allow for processing of this IRS change of address form.

Where can I find IRS Form 8822?

As with most other tax forms, you can find IRS Form 8822 on the IRS website. For your convenience, we’ve attached a copy of the latest version to the bottom of this article.