IRS Form 2555: A Foreign Earned Income Guide

If you are a U.S. citizen or resident alien living overseas, you may be able to exclude certain foreign earned income from your U.S. tax return. While you still have to declare all worldwide income to the Internal Revenue Service on your federal income tax return, filing IRS Form 2555 may help you exclude some of your foreign income for from U.S. taxation.

In this article, we’ll walk through the foreign earned income exclusion, specifically:

- Who may claim the foreign earned income exclusion

- How you can calculate your income exclusion

- How a US expat can file IRS Form 2555 to claim the foreign income exclusion

Let’s start with a little background information on the foreign earned income exclusion itself.

Contents

What is the foreign earned income exclusion?

Technically, there are three different types of exclusions or deductions associated with foreign earned income:

- Foreign earned income exclusion

- Foreign housing exclusion

- Foreign housing deduction

While each of these is slightly different, all three have the same prerequisites.

Who qualifies for the foreign earned income exclusion?

To claim a tax break associated with foreign income, a taxpayer must:

- Have foreign earned income

- Have a tax home in a foreign country

- Meet the requirements for either the bona fide residence test or the physical presence test.

What is the bona-fide residence test?

US taxpayers may pass the bona fide residence test in one of two ways:

- Be a U.S. citizen who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year.

- Be a U.S. resident alien who is a citizen or national of a country with which:

- The United States has an income tax treaty in effect and

- Who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year

What is the physical presence test?

To satisfy the physical presence test criteria, a US expat can be either a U.S. citizen or U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of at least 12 consecutive months.

The IRS website contains additional information on:

- How to count the number of days during travel events

- How to determine the 12 month period

- How to determine a full day in a foreign country

The most important aspect is that any foreign earned income exclusion or deduction cannot be greater than the amount of foreign earned income that a taxpayer declares in the first place.

What is considered to be foreign earned income?

In general, the IRS considers the following types of income to be earned income:

- Salaries and wages

- Commissions

- Bonuses

- Professional fees

- Tips

For purposes of determining the foreign earned income exclusion, the IRS also considers the following to be earned income:

- Certain noncash income and allowances or reimbursements, such as:

- Cost of living allowances

- Overseas differential

- Family allowances

- Education

- Home leave

- Quarters

- Moving expenses, unless excluded from taxable income

- The fair market value of property or facilities provided to you by your employer in the form of any of the following:

- Lodging

- Meals

- Use of a car or transportation

Not considered earned income

The following are not considered to be earned income for purposes of determining a foreign income exclusion:

- Dividend and interest

- Capital gains

- Gambling winnings

- Alimony

- Social security benefits

- Pensions

- Annuities

Additionally, the IRS specifically excludes the following:

- Reimbursements for expenses incurred on behalf of your employer under an accountable plan

- The value of meals and lodging furnished for the convenience of your employer that was not included in your income

- Pay received as an employee of the U.S. government

- Amounts included in your income because of your employer’s contributions to either of the following:

- Nonexempt employee trust or

- Nonqualified annuity contract

- Payments received after the end of the tax year following the tax year in which you performed the services that earned the income

Might be considered earned income

Finally, the IRS may consider any of the following sources of income to be either earned income or unearned income. This largely depends on taxpayer circumstances:

- Business profits

- Royalties

- Rents

- Scholarships and fellowships

Let’s focus our attention on the IRS tax form itself and how we can use it to claim a foreign tax exclusion.

What is IRS Form 2555?

IRS Form 2555, Foreign Earned Income, is the tax form that a U.S. person, citizen or resident, may use to:

- Declare the amount of income earned while living outside the United States

- Calculate the income exclusion or tax deduction amount from those earnings

Eligible taxpayers will file this tax form with their income tax return. Tax season for most taxpayers ends on (or around) April 15 of the following tax year. However, certain taxpayers may qualify for a two-month automatic extension if they meet both of the following requirements:

- Taxpayer lives outside the United States (including Puerto Rico) on the tax return’s due date

- The taxpayer’s tax home is outside the United States throughout the entire testing period for either the bona-fide residence test or the physical presence test

Let’s proceed to completing the tax form itself.

How do I complete IRS Form 2555?

This three-page tax form contains 9 parts. However, most taxpayers will not need to complete all parts. Let’s start with the first part.

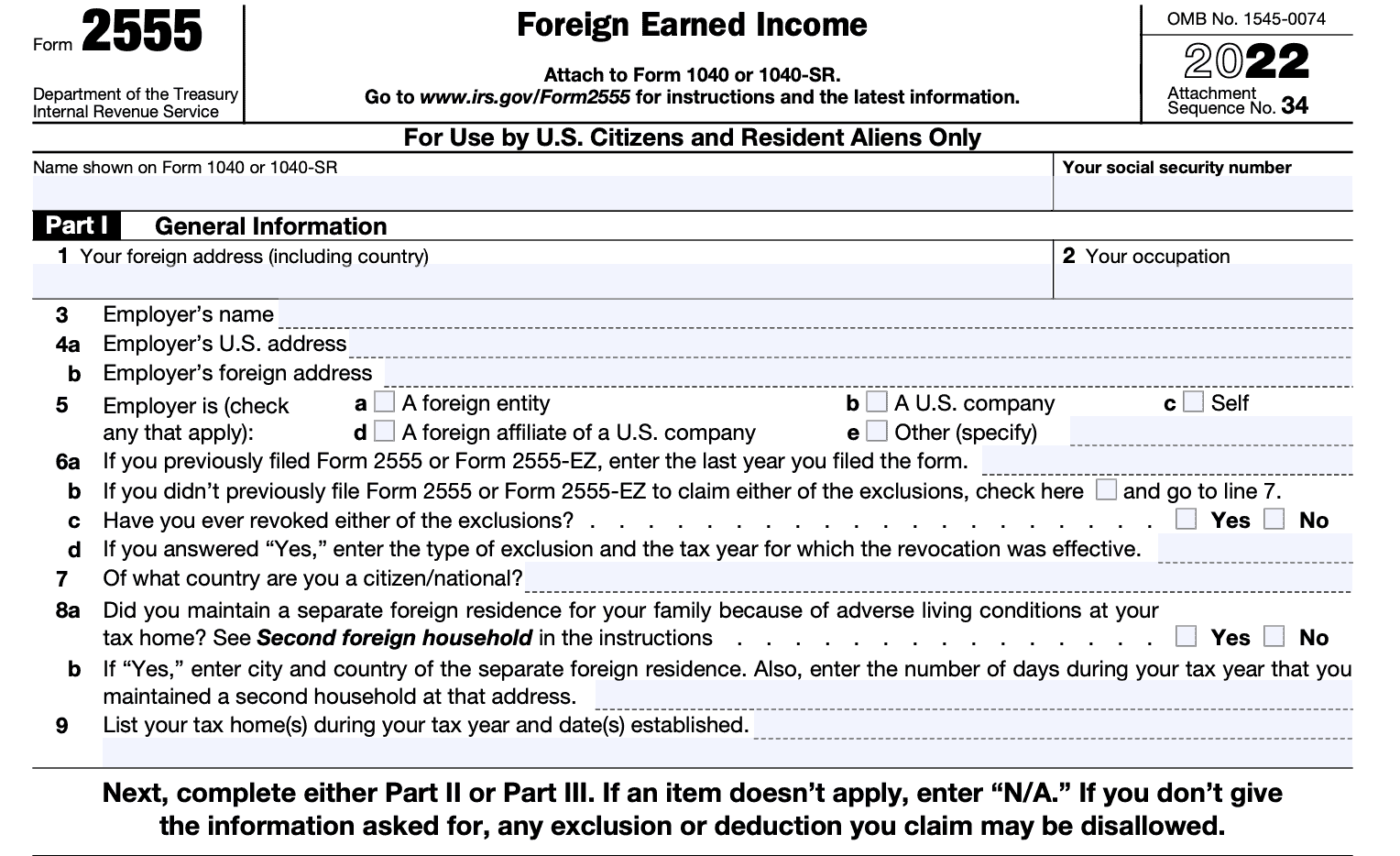

Part I: General Information

All taxpayers must complete this section. Before entering information in Part I, enter your full name and Social Security number, as indicated on your U.S. income tax return. Normally, your tax preparation software should autofill these fields.

Line 1: Foreign address

List your entire foreign address. This includes the following:

- Street address

- City or town

- Province or state

- Country

- Zip code or postal code

Line 2: Taxpayer occupation

Enter your occupation in Line 2.

Line 3: Employer’s name

Enter the name of your employer.

Line 4: Employer’s address

In Line 4a, enter your employer’s U.S. address. For Line 4b, enter your employer’s foreign address.

Line 5: Employer status

Check any of the following statuses that apply to your employer:

- Foreign entity

- Foreign affiliate of a U.S. company

- U.S. company

- Self-employed

- Other (explain)

Line 6

In Line 6a, list the most recent year that you filed either Form 25555 or Form 2555-EZ. If you’ve never filed either form with your annual tax return, check the box in Line 6b and proceed directly to Line 7.

In the case that you’ve ever revoked either of the tax exclusions, check “Yes,” then enter the type of exclusion and the applicable tax year. If you have not, check “No,” and proceed to Line 7.

Line 7

List the country of which you are a citizen or national.

Line 8

Did you maintain a separate foreign residence for your family because of adverse living conditions at your tax home? If so, you may be able to also exclude reasonable living expenses for the second home that you maintained for your family.

Enter the city and country, if applicable. Also enter the number of full days during the tax year that you maintained a second household at that address.

Line 9: Tax home(s) during tax year

List your tax home(s) and the date(s) that you established the tax home(s).

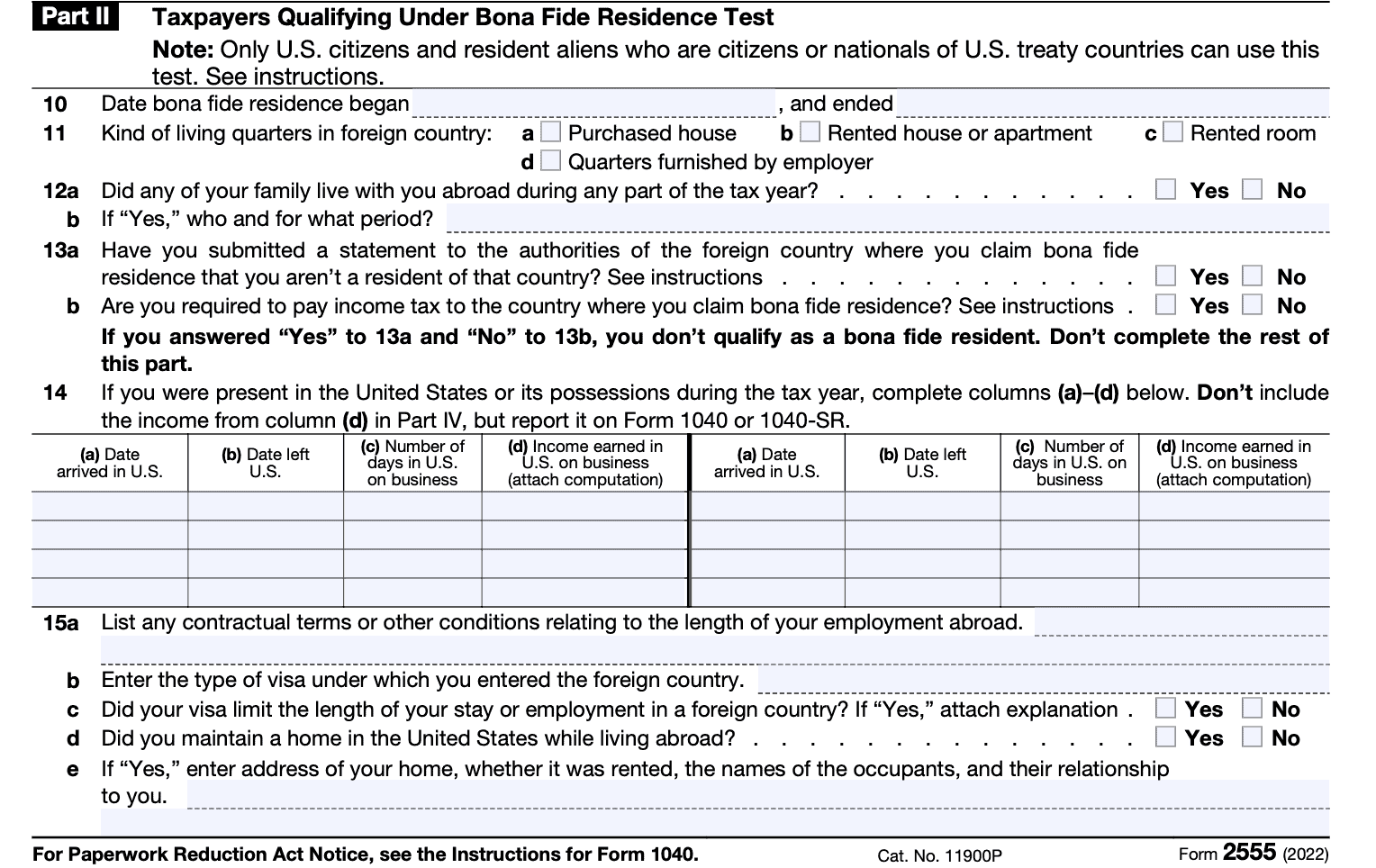

Part II: Taxpayers Qualifying Under Bona Fide Residence Test

Taxpayers may either complete Part II or Part III. However, they are not required to complete both parts. If you qualify under the physical presence test, skip to Part III.

To complete Part II, ensure that you meet the test requirements for the bona fide residence test.

Line 10: Date of bona fide residence

Enter the date(s) your residence began and ended. If you are still maintaining your bona fide residence, enter “Continues” instead of an end date.

Line 11: Type of living quarters

Check the type of quarters that make up your bona fide residence:

- Purchased house

- Rented house or apartment

- Rented room

- Quarters furnished by employer

Line 12

Did your family with you during any part of the tax year? If so, check “Yes” and enter:

- Which family members lived with you

- The dates that your family members lived with you.

Line 13

In Line 13a, check Yes or No.

If you’ve submitted a statement to authorities within the foreign country that you are not a resident of that country, then you are not considered a bona fide resident if authorities:

- Respond with a determination that you are not subject to their income tax laws due to nonresidency, or

- Have not responded with an adverse determination about your residency status

For Line 13b, if you are required to pay income taxes to the foreign country where you reside, then enter “Yes.” Otherwise, check “No.

If you answered Yes to 13a, but No to 13b, then you should skip the rest of Part II. You do not qualify as a bona fide resident. However, you may proceed to Part III to determine whether you qualify under the physical presence test.

Line 14: Dates in U.S.

If you were in the United States or its possessions at all during the tax year, complete columns (a) through (d) for each visit. Do not include any income in Part IV, but report the income on your income tax return.

Line 15

Answer each question as appropriate. If there are any contractual terms or conditions regarding your employment overseas, enter them in Line 15a.

For Line 15b, enter the type of visa under which you entered the foreign country. If the visa limits the length of your stay in that country, enter “Yes” for Line 15c then attach a written explanation to the Form 25555.

If you maintained a home in the United States, enter “Yes” in Line 15d and the following information in Line 15e:

- Home address

- Whether it was rented to other occupants

- Tenants or occupants

- Relationship to you

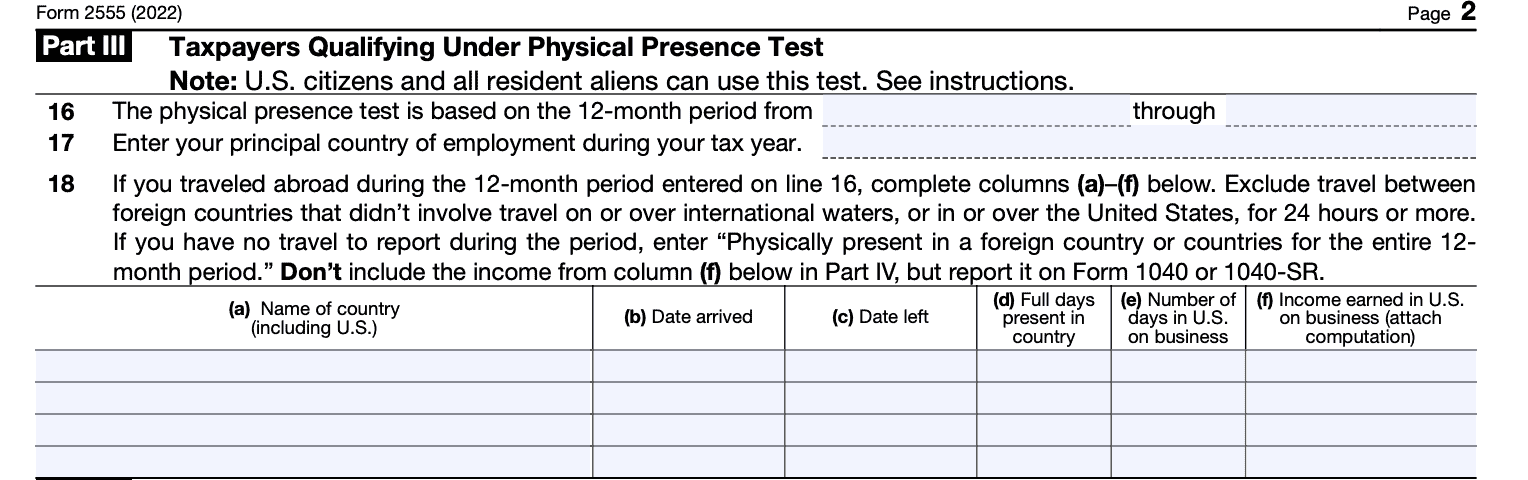

Part III: Taxpayers Qualifying Under Physical Presence Test

Before completing Part III, you may consider reviewing the physical presence test requirements.

Line 16: 12 month period

Enter the dates that you wish to include for purposes of the physical presence test. This qualifying period must be for 12 consecutive months, part of which must be for the prior year that your tax return is based upon.

Do not enter “Continues” for the end date. Simply include either the last day of the 12-month period or of the tax year.

Line 17: Country of employment

Enter the principal country of your employment during the tax year.

Line 18

If you traveled abroad during the period that you entered on Line 16, complete columns (a) through (f), including:

- Name of the country

- Date of arrival

- Date of departure

- Number of full days present in the country

- Number of days in the U.S. for business

- Income earned in U.S. on business

Exclude any travel between foreign countries that did not involve:

- Travel on or over international waters

- Travel in or over the United States for 24 hours or more

If there is no such travel, enter “Physically present in a foreign country/countries for the entire 12-month period.” Do not include any income in column (f) in Part IV, but report it on Form 1040 or Form 1040-SR.

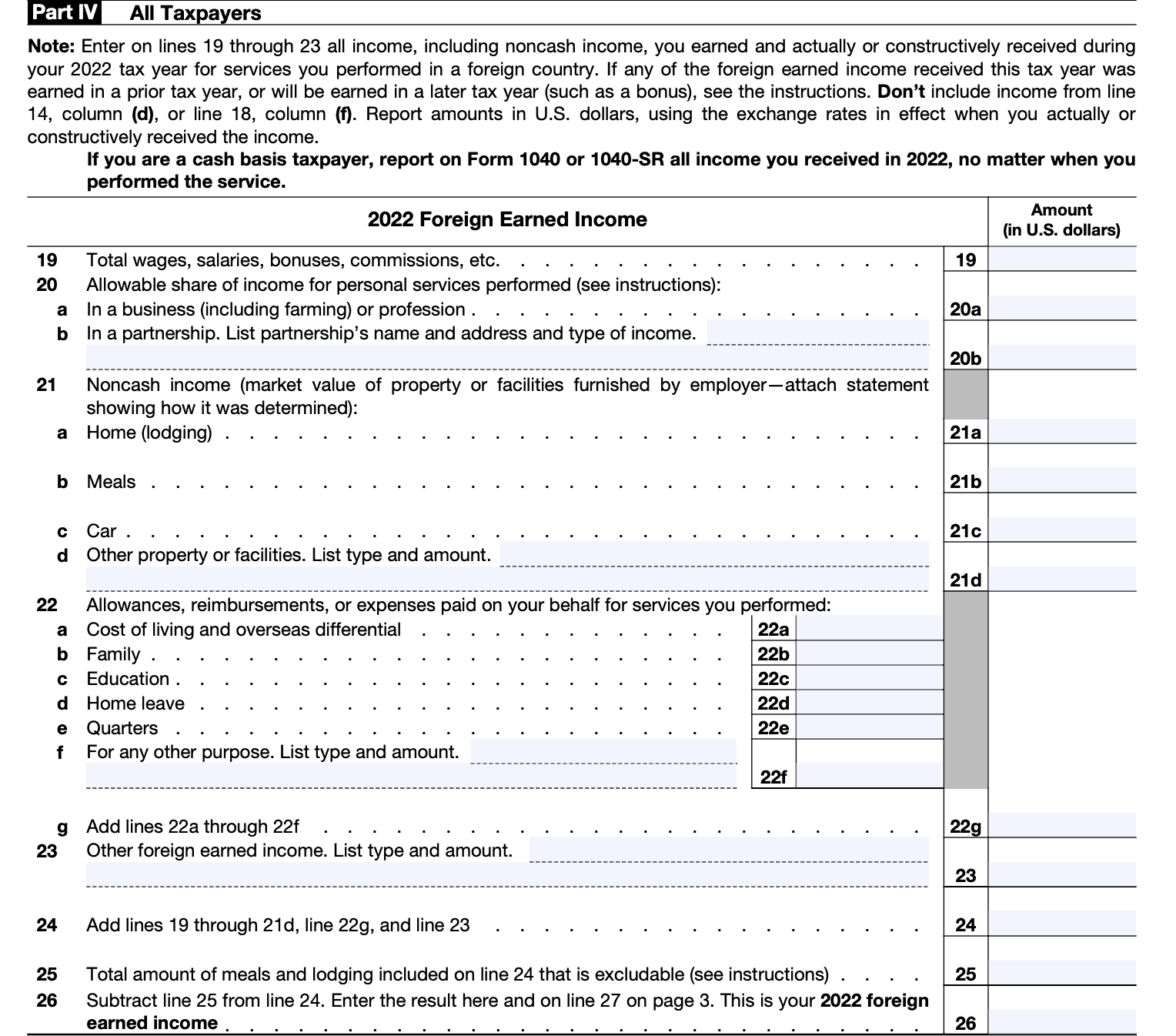

Part IV: All Taxpayers

All taxpayers must report all foreign earned income you earned and actually (or constructively) received during the tax year for services performed in a foreign country.

Constructive receipt: This means that you could have received the money, but chose not to. A common example would be a paper check that you received on December 28, 2022 but chose not to deposit until January 2, 2023. You would have constructively received the check in the 2022 tax year.

Cash basis taxpayers should report all income received in the tax year, regardless of when you earned the income.

Line 19: Toal wages, salaries, bonuses, commissions

Enter all cash compensation from your employer that was considered earned income.

Line 20: Allowable share of income for personal services

If you engaged in an unincorporated trade or business in which both personal services and capital were material income-producing factors, you may consider a reasonable amount of compensation for your personal services to be earned income. This amount may not exceed 30% of your share of the profits after subtracting the self-employment income tax deduction.

In Line 20a, enter the amounts of allocable income for a business or profession. For Line 20b, enter the amounts allocable to partnership shares, then list the partnership’s name, address, and type of income.

Line 21: Noncash income

On the appropriate line, enter any noncash income for the following provided by your employer:

- Home or lodging

- Meals

- Car

- Other property or facilities

Line 22: Allowances, reimbursements, or paid expenses

Enter any allowances, reimburses, or expenses paid on your behalf regarding:

- Cost of living allowances (includes overseas differential)

- Family

- Education

- Home leave

- Quarters

- Allowances for other purposes: list the type and amount paid

Total these amounts under Line 22g.

Line 23: Other foreign earned income

List any other foreign earned income not already indicated. If you have multiple sources of foreign earned income, you may enter “Various” for the type of income.

Line 24: Total foreign earned income

Add the following lines:

- Line 19

- Line 20

- Line 21a through 21d

- Line 22g (total of all sums in Line 22)

- Line 23

Line 25: Excludable meals and lodging

To be considered excludable, meals and lodging must be:

- Provided on your employer’s premises

- Provided for the convenience of your employer

- Required as a condition of your employment

IRS Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, contains additional information.

Line 26: Foreign earned income

Subtract Line 25 from Line 24. This represents your foreign earned income for the tax year. Also enter this amount on Line 27, below.

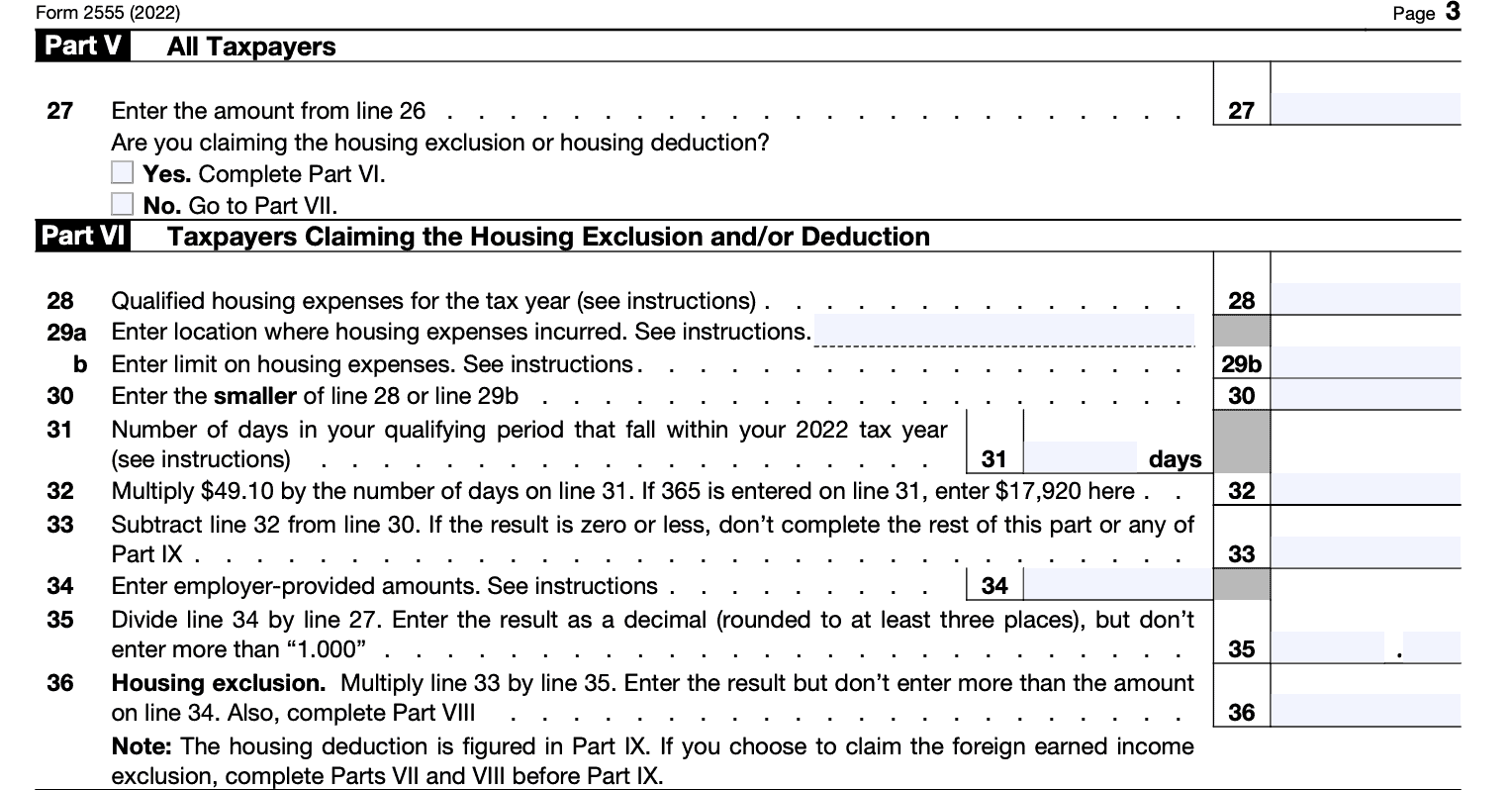

Part V: All Taxpayers

Line 27

Carry over the amount from Line 26, above. If you are claiming either the housing exclusion or housing deduction, proceed to Part VI, below. If not, skip Part VI, and go directly to Part VII.

Part VI: Taxpayers claiming the housing exclusion and/or deduction

Taxpayers who seek to claim either the housing exclusion or deduction should complete Part VI.

Line 28: Qualified housing expenses

Qualified housing expenses include:

- Rent

- Utilities

- Not including telephone expenses

- Property insurance

- Includes real and personal property

- Nonrefundable fees paid to obtain a lease, such as an application fee

- Furniture rental

- Parking

- Household repairs

Do not include:

- Deductible interest and taxes

- Amounts deductible by a tenant-stockholder in connection with cooperative housing

- The costs incurred in buying or improving a home

- Principal payments on a mortgage

- Depreciation

- Domestic labor

- Television

- Furniture or accessories that you purchase instead of rent

If you are married filing a joint return, you and your spouse must calculate hour foreign housing amount jointly. If filing a separate return, only one spouse may claim the exclusion.

Line 29

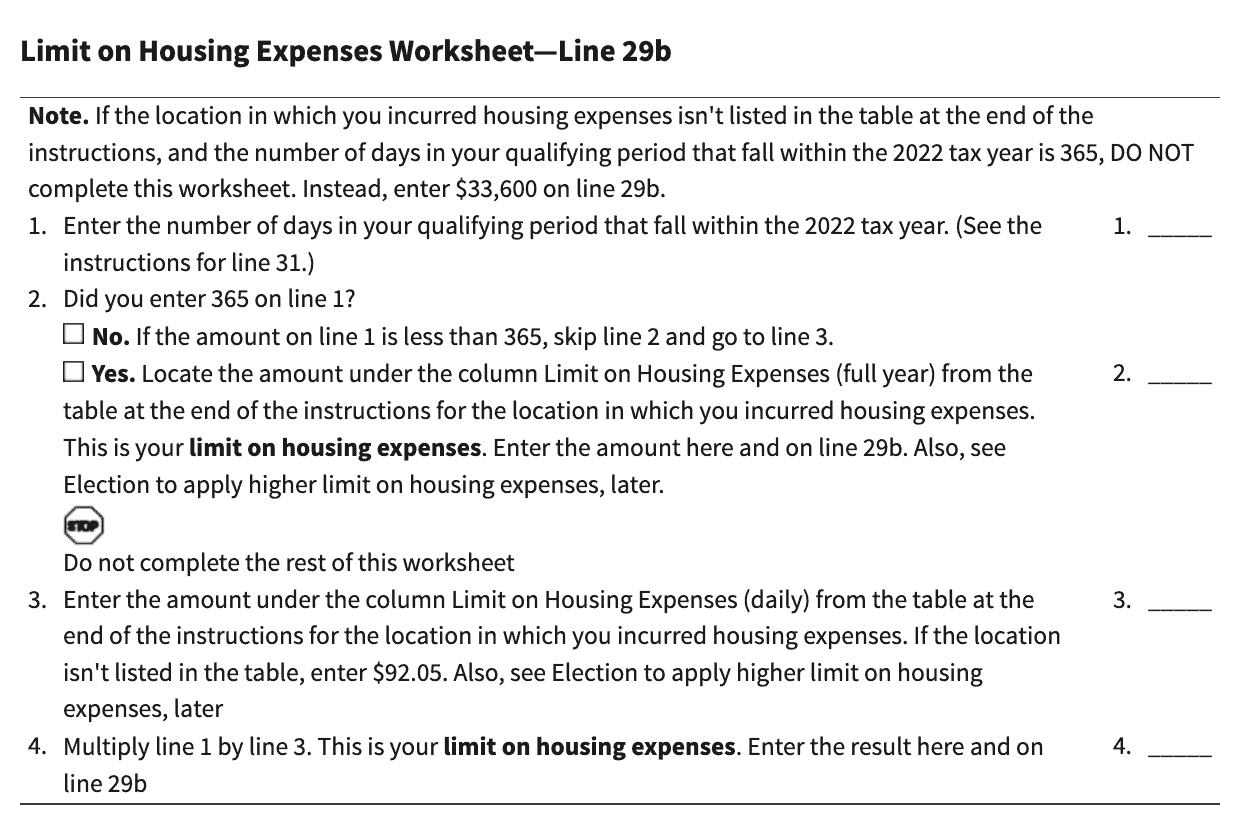

In Line 29a, enter the city and country where your primary residence was during the tax year. For Line 29b, enter the limit on housing expenses for your location.

If your location is listed in the IRS form instructions, then you’ll need to calculate Line 29b using the housing expenses calculation worksheet below. If your location is not listed in the table, and the number of days in your qualifying period equals 365, you can simply include the federal government’s limit.

For tax year 2022, the federal limit on housing expenses is $33,600.

Line 30

Enter the smaller of:

- Line 28

- Line 29b

Line 31

Enter the number of days within your qualifying period. Your qualifying period is the period of time that you pass either the bona-fide residency test or the physical presence test.

Line 32

Multiply $49.10 by the number of days in Line 31. If the number in Line 31 equals 365, enter $17,920 in Line 32.

Line 33

Subtract Line 32 from Line 30. If the result is zero or less, do not complete this part or Part IX, below.

Line 34: Employer-provided amounts

Enter all employer-provided amounts that are considered to be foreign earned income includable in your gross income for the year. Examples of employer-provided amounts include the following:

- Wages and salaries received from your employer.

- The fair market value of compensation provided in kind, such as the fair rental value of lodging provided by your employer that is not already included on Line 25

- Rent paid by your employer directly to your landlord

- Amounts paid by your employer to reimburse you for expenses, such as:

- Housing expenses

- Educational expenses of your dependents

- Part of a tax equalization plan

Line 35

Divide Line 34 by Line 27. Enter the amount as a three-decimal number, but not one greater than 1.000.

Line 36: Housing exclusion

Multiply Line 33 by Line 35. However, this amount cannot be greater than the employer-provided amounts in Line 34.

If claiming the foreign earned income exclusion, proceed to Part VII, below. If not, go to Part VIII.

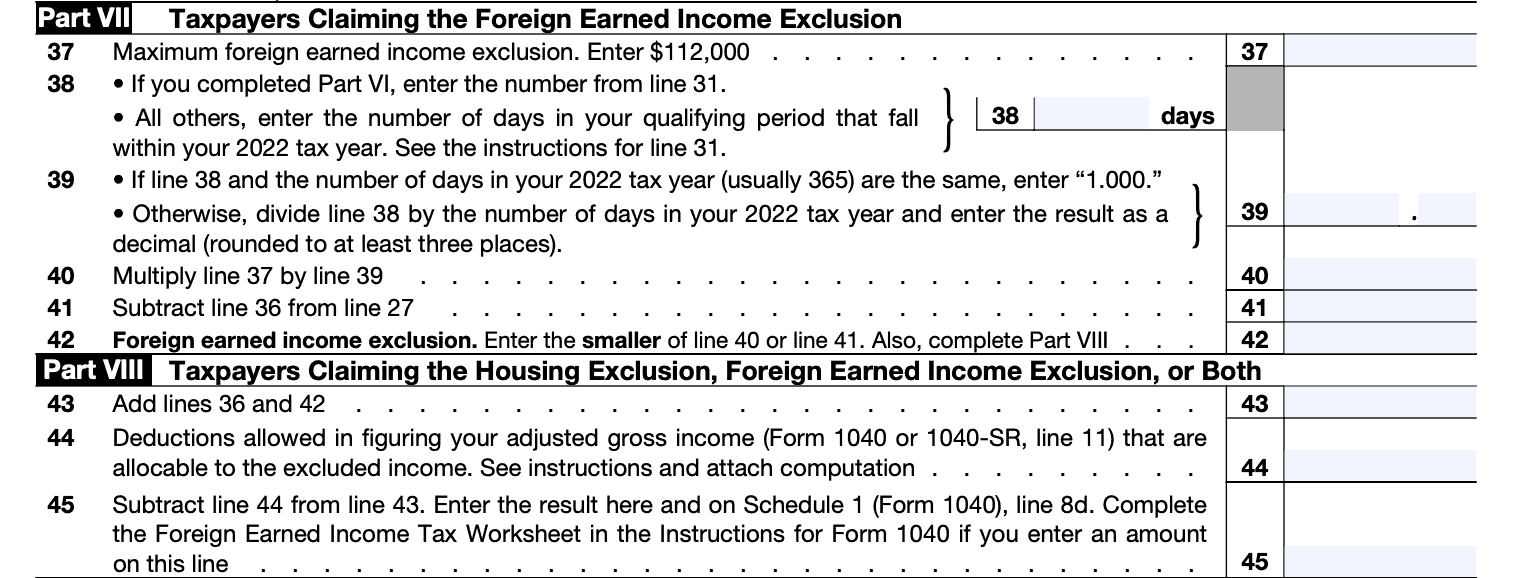

Part VII: Taxpayers claiming the foreign earned income exclusion

If you are married, and you and your spouse each qualify for, and choose to claim, the foreign earned income exclusion, you must each:

- Figure the amount of the exclusion separately

- Complete Part VII of your separate Forms 2555

Line 37: Maximum foreign earned income exclusion

Enter $112,000.

Line 38

If you completed Part VI, enter the number from Line 31. If not, enter the number of days in your qualifying period that fall within your given tax year, using instructions for Line 31 as necessary.

Line 39

If Line 38 and the number of days in the tax year are the same, enter 1.000. Otherwise, divide Line 38 by the number of days and enter the result as a decimal rounded to three places. This number should be no larger than 1.000.

Line 40

Multiply Line 37 by Line 39 and enter the result here.

Line 41

Subtract Line 36 from Line 27.

Line 42: Foreign earned income exclusion

Enter the smaller of:

- Line 40

- Line 41

Proceed to Part VIII, below.

Part VIII: Taxpayers claiming the housing exclusion, foreign earned income exclusion, or both

Line 43

Line 44: Deductions allowed in determining adjusted gross income, allocable to excluded income

On Schedule 1 and related forms and schedules, each taxpayer should report all allowable deductions in determining adjusted gross income (AGI).

On Line 44, include the total amount of those deductions that were not allowed because they were allocated to excluded income. This might include:

- Deductible part of self-employment tax

- Expenses claimed on Schedule C

Line 45

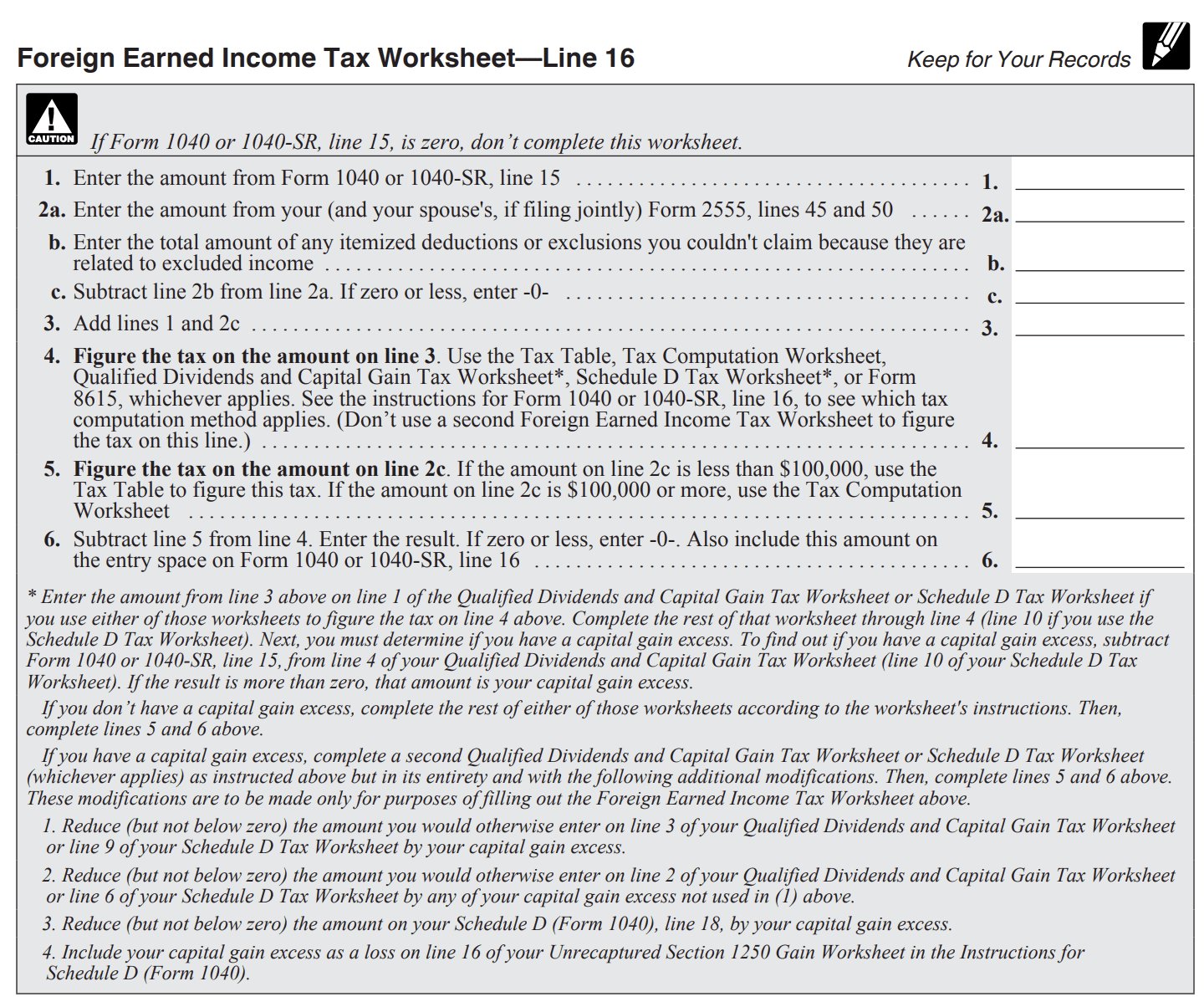

Subtract Line 44 from Line 43. Enter the result on Schedule 1, Line 8d. If you enter any amount on Line 45, you must complete the foreign earned income tax worksheet located on Page 35 of the Form 1040 instructions.

A copy is below for your convenience. If you’d prefer, go on to Part IX.

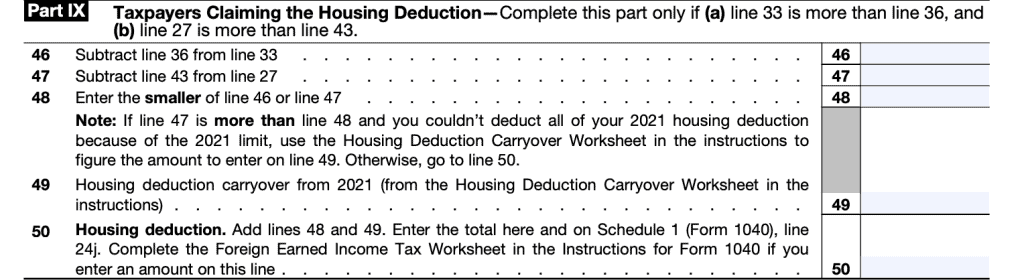

Part IX: Taxpayers claiming the housing deduction

Taxpayers claiming the housing deduction only need to complete Part IX if:

Line 46

Subtract Line 36 from Line 33.

Line 47

Subtract Line 43 from Line 27.

Line 48

Enter the smaller of:

- Line 46

- Line 47

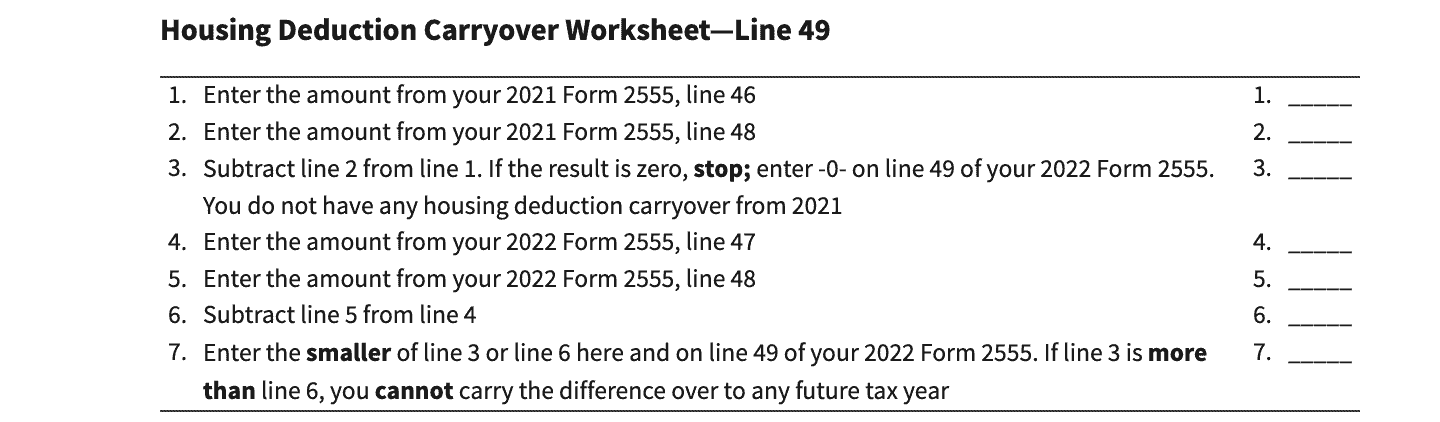

Line 49: Housing deduction carryover from prior year return

If applicable, use the housing deduction carryover worksheet (see below) to determine what to enter in Line 49.

Line 50: Housing deduction

Add Lines 48 and 49. Enter the total here and on Schedule 1, Line 24j. Complete the Foreign Earned Income Tax Worksheet if you enter an amount on this line.

How do I file IRS Form 2555?

You should file Form 2555 with the same office that you would normally file your income tax return with. For your convenience, the IRS maintains a list of mailing addresses for overseas taxpayers.

Where can I find IRS Form 2555?

Like other tax forms, you may find IRS Form 2555 on the IRS website. The most recent version is located below for your convenience.

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!