IRS Form 1098-Q Instructions

If you have invested part of your qualified retirement plan or IRA into a qualified longevity annuity contract, or QLAC, you may receive IRS Form 1098-Q at the end of the tax year. IRS Form 1098-Q, Qualifying Longevity Annuity Contract Information, is not required for taxpayers to file their federal income tax return, but does contain important information.

In this article, we’ll help break down IRS Form 1098-Q so you can better understand this informational form.

Table of contents

IRS Form 1098-Q Instructions

In most of our articles, we walk you through how to complete the tax form.

However, since Form-1098 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1098-Q form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 versions of 1098-Q forms.

Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For participant’s tax records

- Copy C: For issuer’s tax records

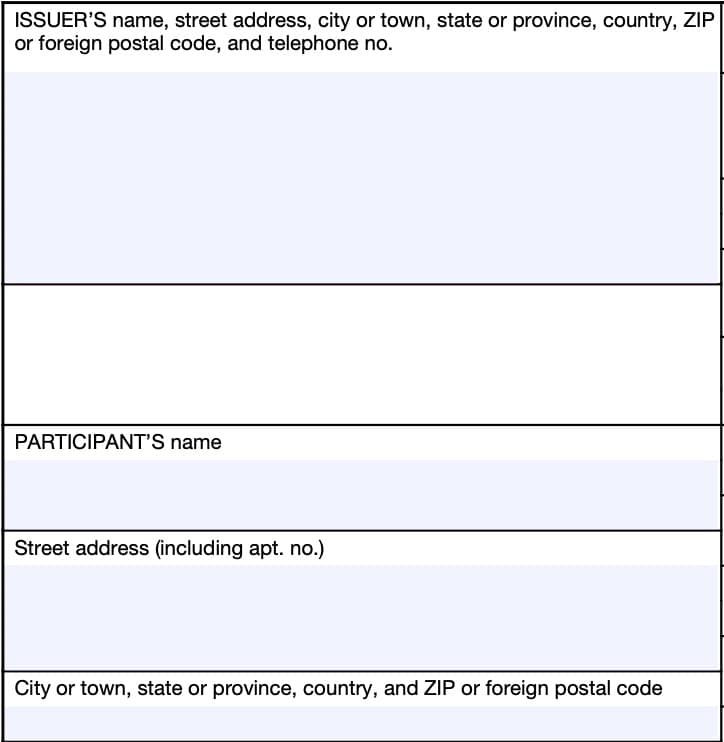

Taxpayer Information

On the upper left side, you’ll see the information for both the issuer and the participant. You’ll want to review these for accuracy.

Issuer’s Name, Address, And Telephone Number

You should see the issuer’s complete name, address, and phone numbers in this field.

Recipient’s Name And Address

You should see your name, street address, and zip code reflected in these fields. If your address is incorrect, you should notify the insurance company and the Internal Revenue Service.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

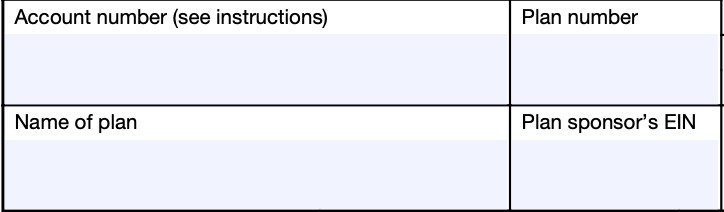

Account information

The account information field contains specific annuity contract information about the insurance contracts covered by this tax form.

Account number

This field may show an account or other unique number that the issuer assigned to distinguish your account.

Plan number

If you purchased the annuity contract under a retirement plan, this field will contain the plan number associated with the contract.

Name of plan

If applicable, this field will contain the name of the plan under which you purchaed this annuity contract.

Plan sponsor’s EIN

As applicable, this field will contain the plan sponsor’s EIN. This should be different from the annuity company’s TIN, located in a separate TIN field.

Taxpayer identification numbers

At the top of the form, in the middle, you’ll see the taxpayer identification number (TIN) for both the filer and the recipient.

Issuer’s TIN

This is the insurance company’s taxpayer identification number (TIN). This should be an employer identification number, or EIN.

The issuer’s TIN should never be truncated.

Recipient’s TIN

As the recipient, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Valid Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct.

However, you may only see part of your taxpayer identification number (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which issuers send directly to the Internal Revenue Service, is never truncated.

Next, let’s look at the numbered boxes on the right-hand side of the form.

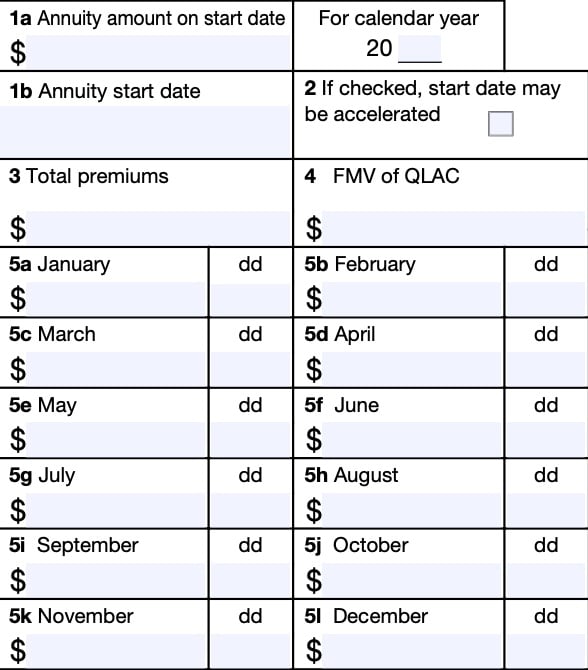

Boxes 1 through 5

On the right side of Form 1098-Q, you’ll see information about the annuity itself. Let’s start with Line 1a.

Box 1a: Annuity amount on start date

If the annuity payments have not started, shows the annuity amount payable on start date.

Box 1b: Annuity start date

If the payments have not started, Box 1b shows the date on which the annuity is scheduled to start. The start date reported is shown in the format: MM/DD/YYYY.

Box 2

If Box 2 is checked, this indicates that the QLAC start date may be accelerated.

Box 3: Total premiums

Box 3 shows the cumulative total amount of premiums paid for the qualified longevity annuity contract. This includes premiums paid in the current tax year as well as prior years.

Thanks to the passage of SECURE Act 2.0, as of December 29, 2022, the limit on cumulative total premiums paid for all QLACs is now $200,000. SECURE Act 2.0 repealed the 25% account balance limitation on QLACs.

QLACs purchased prior to December 29, 2022

QLACs purchased prior to December 29, 2022 under an IRA cannot exceed 25% of your total IRA account balances. Likewise, QLACs purchased before December 29, 2022, under an employer’s plan cannot exceed 25% of your account balance in the plan.

If you have questions about your QLAC, you should contact your contract issuer.

Box 4: Fair market value of QLAC

This box shows the fair market value (FMV) of your QLAC as of December 31 of the reporting year.

Box 5a: January

Box 5a shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for January, Box 5a will include:

- Total payments for January

- Date of the last payment in January

Box 5b: February

Box 5b shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for February, Box 5b will include:

- Total payments for February

- Date of the last payment in February

Box 5c: March

Box 5c shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for March, Box 5c will include:

- Total payments for March

- Date of the last payment in March

Box 5d: April

Box 5d shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for April, Box 5d will include:

- Total payments for April

- Date of the last payment in April

Box 5e: May

Box 5e shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for May, Box 5e will include:

- Total payments for May

- Date of the last payment in May

Box 5f: June

Box 5f shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for June, Box 5f will include:

- Total payments for June

- Date of the last payment in June

Box 5g: July

Box 5g shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for July, Box 5g will include:

- Total payments for July

- Date of the last payment in July

Box 5h: August

Box 5h shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for August, Box 5h will include:

- Total payments for August

- Date of the last payment in August

Box 5i: September

Box 5i shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for September, Box 5i will include:

- Total payments for September

- Date of the last payment in September

Box 5j: October

Box 5j shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for October, Box 5j will include:

- Total payments for October

- Date of the last payment in October

Line 5k: November

Box 5k shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for November, Box 5k will include:

- Total payments for November

- Date of the last payment in November

Line 5l: December

Box 5l shows the amount of each premium paid for the contract and the date each premium payment was made in the reporting year.

If there is more than one payment for December, Box 5l will include:

- Total dollar amount of payments for December

- Date of the last payment in December

Filing IRS Form 1098-Q

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Learn more about QLACs in this instructional video.

Frequently asked questions

You should receive a copy of Form 1098-Q beginning in the year that your premiums are paid. You will receive Form 1098-Q each year until you either turn 85 years old or pass away, whichever is first.

No. IRS Form 1098-Q is an information return, which does not need to be included in a taxpayer’s income tax returns for tax purposes. However, IRS Form 1098-Q may contain information for a beneficiary’s income tax return after the death of the original annuitant.

No. Form 1098-Q does not contain information related to taxable income. When you start taking distributions from your QLAC, they will be reported on IRS Form 1099-R, and included as taxable income on your individual tax return.

Where can I find IRS Form 1098-Q?

Generally, you can find IRS forms on the IRS website. We also strive to maintain the latest versions of IRS forms in our articles.

Below is the most recent version of IRS Form 1098-Q for your convenience.