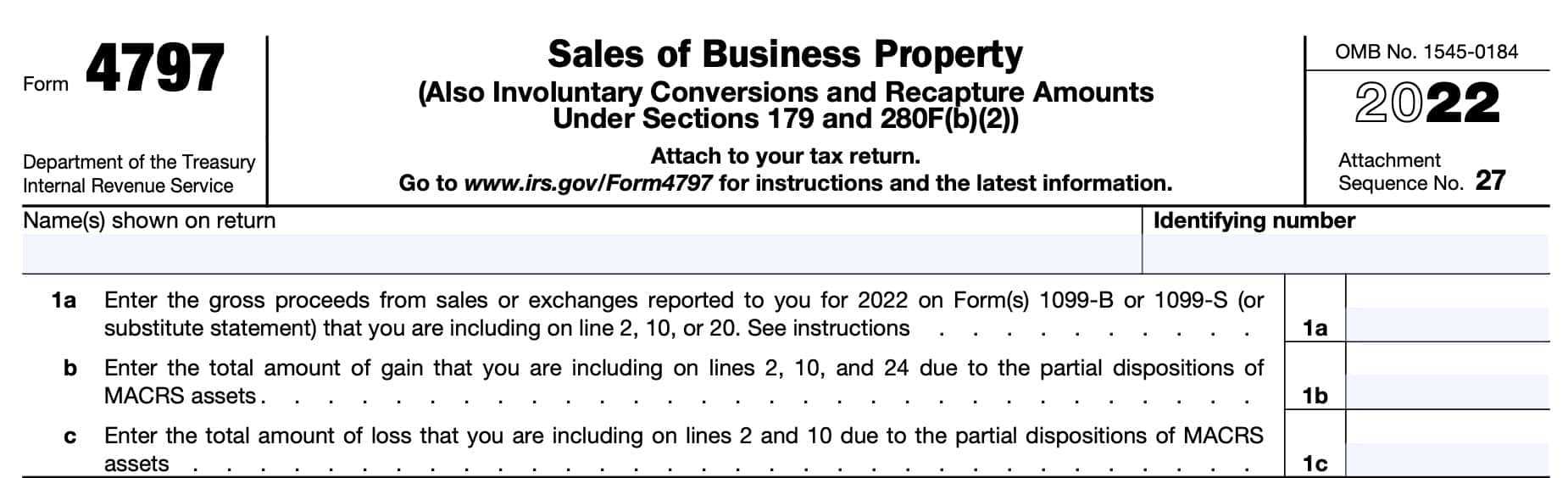

IRS Form 4797 Instructions

According to the Internal Revenue Service, taxpayers must use IRS Form 4797 to calculate and report the sale of certain types of property used for business. In this article, we’ll walk you through each step of this form, to include:

- How to complete IRS Form 4797 for your tax return

- How to calculate and recapture depreciation using this form

- Frequently asked questions

Let’s start with a step by step walkthrough of IRS Form 4797.

How do I complete IRS Form 4797?

Before getting into the form itself, here’s an overview of how to use this form.

Form overview

There are 4 parts to this two page tax form:

- Part I: Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year

- Part II: Ordinary Gains & Losses

- Part III: Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255

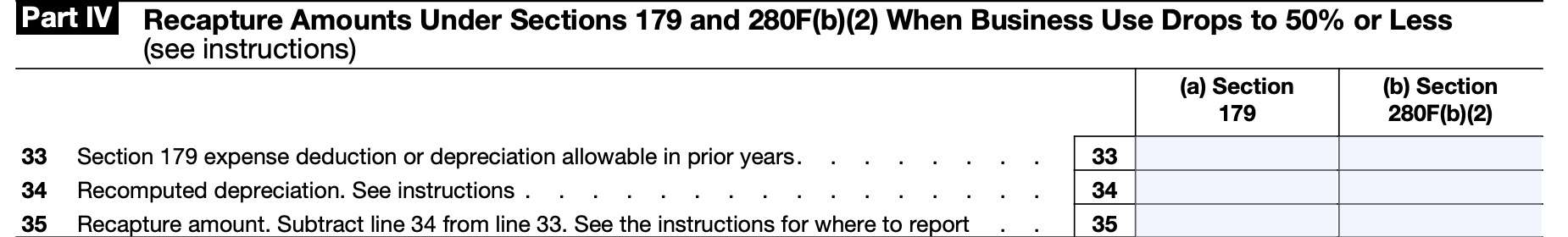

- Part IV: Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to 50% or Less

Depending on your tax situation, you may not need to use all parts of IRS Form 4797 to report sales of business property. The form instructions contain specific guidance on where to report the disposition of capital assets such as:

- Depreciable tangible trade or business property

- Depreciable real trade or business property

- Cattle and horses used in a trade or business for draft, breeding, dairy, or sporting purposes

Generally, taxpayers will use Part I to report the sale or exchange of property owned for more than one year, unless it is specifically reported in Part III. The sale of property held for less than a year is subject to ordinary tax treatment, and is reported in Part II.

Part III of IRS Form 4797 is reserved for disposition of property under certain sections of the Internal Revenue Code. Finally Part IV is for calculating recapture amounts in specific situations.

Before diving into Part I, let’s look at the top of the form itself.

Top of form

At the very top of IRS Form 4797, enter your name and tax identification number. For most individual taxpayers, the identifying number will be a Social Security number or individual taxpayer identification number (ITIN). For business taxpayers, this will likely be an employer identification number, or EIN.

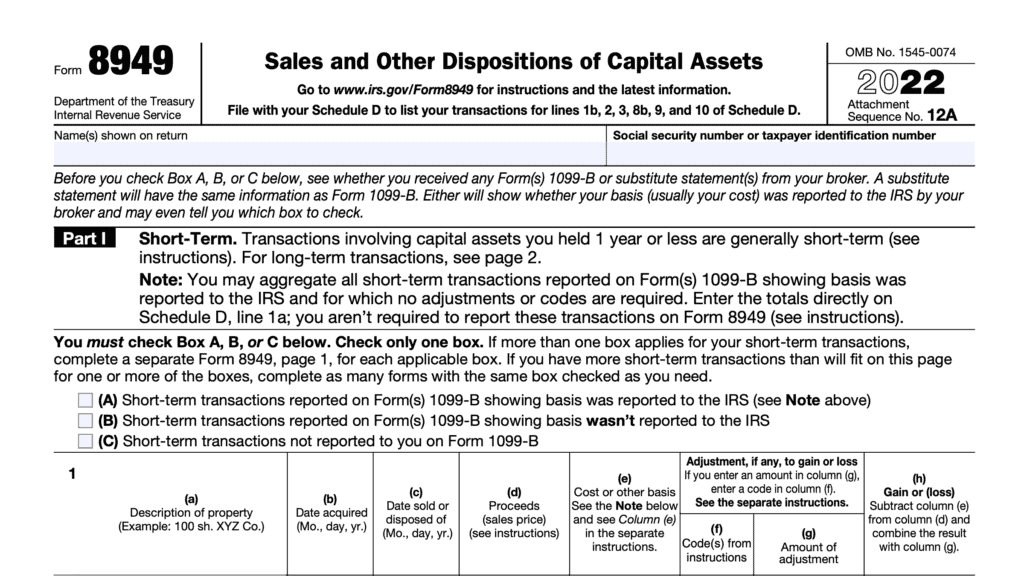

Line 1a

In this line, enter the gross proceeds from sales or exchanges that:

- Were reported to you on IRS Form 1099-B or Form 1099-S, and

- That you are including on one of the following lines:

Line 1b

In Line 1b, enter the total amount of gain due to the partial disposition of MACRS assets that you are including on the following:

- Line 2

- Line 10

- Line 24

Note: MACRS stands for Modified Accelerated Cost Recovery System, and is generally the most common depreciation system for assets placed into service after 1986. IRS Publication 946, How to Depreciate Property, contains more specific information about MACRS.

Line 1c

In Line 1c, enter the total amount of loss due to the partial disposition of MACRS assets included in the following lines:

- Line 2

- Line 10

Note: MACRS stands for Modified Accelerated Cost Recovery System, and is generally the most common depreciation system for assets placed into service after 1986. IRS Publication 946, How to Depreciate Property, contains more specific information about MACRS.

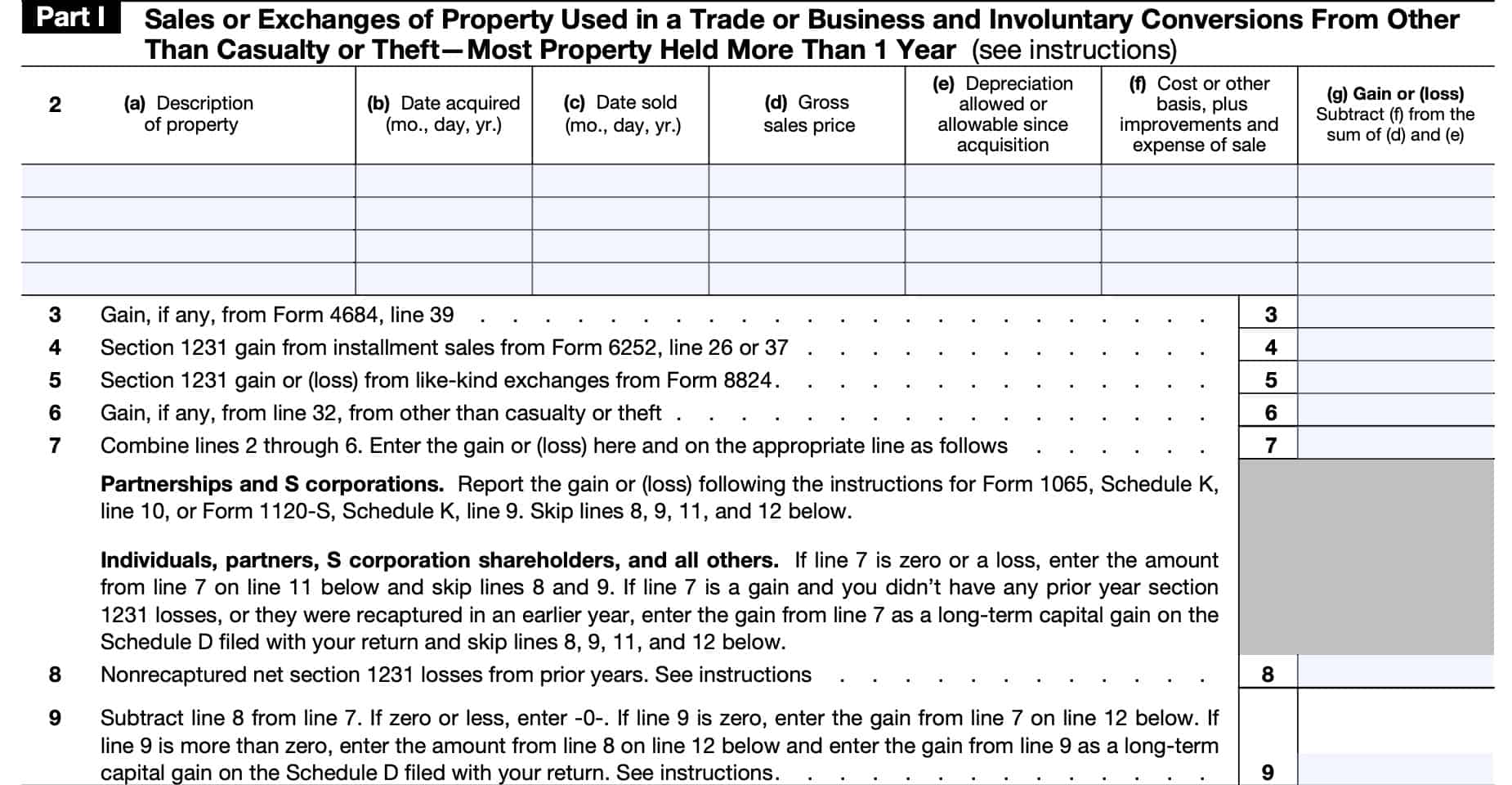

Part I

In Part I, we’ll report sales or exchanges of most Section 1231 property not required to be reported in Part III. Below are examples of such transactions:

- Sales or exchanges of real property or depreciable property used in a trade or business, that is held for more than 1 year.

- Begin counting on the day after receiving the property, and include the day you disposed of it to figure the holding period

- Cutting of timber, disposal of timber, or disposal of coal under IRC Section 631

- Sales of cattle and horses used in a trade or business, and held for 24 months or longer

- Sales of livestock, other than horses and cattle, used in a trade or business, and held for 12 months or longer

- Sales or exchanges of certain unharvested crops, based on IRC Section 1231(b)(4)

- Involuntary conversions of trade or business property or capital assets held more than 1 year in connection with a trade or business or a transaction entered into for profit

Line 2

In Line 2, you’ll need to enter the following information for each qualifying item:

- Column (a): Property description

- Column (b): Date of acquisition

- Column (c): Date of disposition

- Column (d): Gross sales price

- Column (e): Depreciation allowed or allowable since acquisition

- Depreciation allowed is depreciation actually taken on an income tax return

- Depreciation allowable is depreciation you were entitled to take, regardless of whether you actually did so

- Column (f): Cost or other basis, plus improvements and sales expenses

- Column (g): Gain or less

- Add gross sale price and depreciation, then subtract costs

Line 3: Casualties & Thefts

In Line 3, enter the Section 1231 gain, if applicable, reported on IRS Form 4684, Casualties & Thefts, Line 39.

Line 4: Installment sales

For Line 4, enter any Section 1231 gain from installment sales reported on IRS Form 6252. This may be on either Line 26 or Line 37.

Line 5: Like-kind exchanges

In Line 5, enter any Section 1231 gain or loss from like-kind exchanges reported on IRS Form 8824.

Line 6

Other than casualty or theft, enter the gain, that you reported on Line 32 below, if applicable.

Line 7

Add Lines 2 through 6 and enter the gain or loss here, and on the following as applicable:

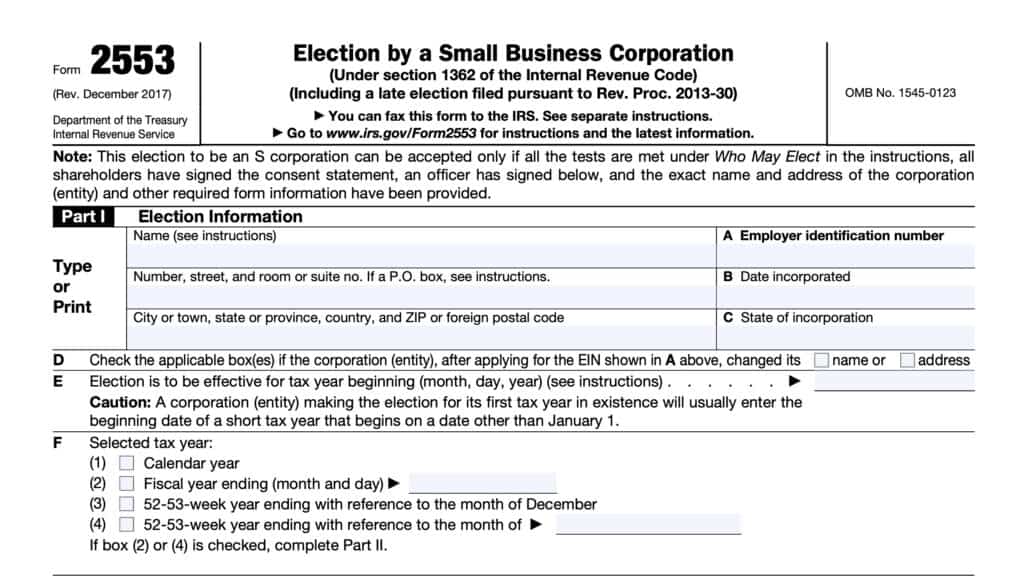

- Partnerships: Report the gain or loss on IRS Form 1065, Schedule K, Line 10. Skip Lines 8 through 12, and proceed to Line 13.

- S corporations: Report the gain or loss on IRS Form 1120-S, Schedule K, Line 9. Skip Lines 8 through 12, and proceed to Line 13.

- Individuals, partners, S-corporation shareholders, and all others:

- If Line 7 is zero or a loss, enter the amount from Line 7 on Line 11 below. Skip Lines 8 & 9.

- If Line 7 is a positive number, and you did not have any prior year Section 1231 losses, or if those losses were recaptured in a previous tax year, then enter the gain from Line 7 as a long-term capital gain on Schedule D. Skip Lines 8 through 12 below.

- Partners should enter any numbers reported on Schedule K-1, Box 10.

- S-corporation shareholders should enter information reported to them on Schedule K-1, Box 9.

Line 8: Nonrecaptured net section 1231 losses from prior years

Enter any nonrecaptured net Section 1231 losses from prior years. These are net Section 1231 losses:

- Deducted during the 5 preceding tax years, and

- That have not yet been applied against any net Section 1231 gain

Line 9

Subtract Line 8 from Line 7. Enter ‘0’ if the result is zero or less. This will determine what part of the gain is treated as ordinary income under this rule.

If Line 9 is zero, enter the gain from Line 7 on Line 12 below.

If Line 9 is more than zero, enter the amount from Line 8 on Line 12 below. Enter the gain from line 9 as a long-term capital gain on the Schedule D filed with your return.

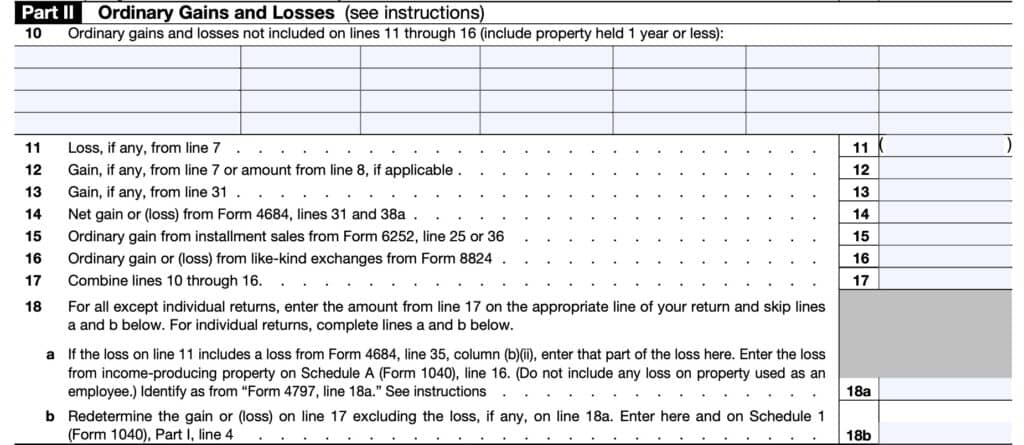

Part II

Use Part II to report transactions that meet the following conditions:

- The transaction is not reportable in Part I or Part III, and

- The property is not a capital asset reportable on Schedule D

Line 10

Use Line 10 to report ordinary gains and losses for property held one year or less, not already included on Lines 11 through 16, below. This includes the following:

- Ordinary income from the sale or other disposition of property where you deducted the property cost under the tangible property de minimis safe harbor

- Losses from a qualifying abandonment of business or investment property

See the form instructions for additional guidance on any of the following:

- Gain or loss from certain preferred stock

- Deferred gain from qualifying electric transmission transaction

- Securities or commodities held by a trader who made a mark-to-market election

- Small business investment company stock

- Section 1244 stock (or small business stock)

Line 11

In Line 11, enter any losses from Line 7, if applicable.

Line 12

Enter either of the following, if applicable:

- Gains, as listed on Line 7

- Prior year nonrecaptured net section 1231 losses, as listed on Line 8

Line 13

For Line 13, enter any gains from Line 31, if necessary.

Line 14

List the net gain or loss from IRS Form 4684, Lines 31 and 38a. Enter losses as a negative number.

Line 15

Enter the ordinary gain from installment gains from IRS Form 6252, Line 25 or Line 36.

Line 16

If applicable, enter the gain or loss from like-kind exchanges documented on IRS Form 8824.

Line 17

Combine the totals of Lines 10 through 16. Enter the result here.

Line 18

For all taxpayers except individuals, enter the Line 17 amount on the appropriate line of your income tax return. Skip Lines 18a and 18b, below.

For individual taxpayers:

Line 18a: If the loss on Line 11 includes a loss recorded on Form 4684, Line 35, Column (b)(ii), enter that number in Line 18a. This is the loss of income-producing property held over one year due to casualty or theft.

Note: You must complete Line 18a if there is a:

If there are losses on both Line 11 and Line 35, Column (b)(ii), enter the smaller of the two. Enter the loss from income-producing property on Schedule A, Line 16. Identify the loss as from “Form 4797, line 18a.”

Line 18b: Recalculate the Line 17 gain or loss by excluding any applicable losses recorded on Line 18a. Enter the result in Line 18b and on Schedule 1, Part I, Line 4.

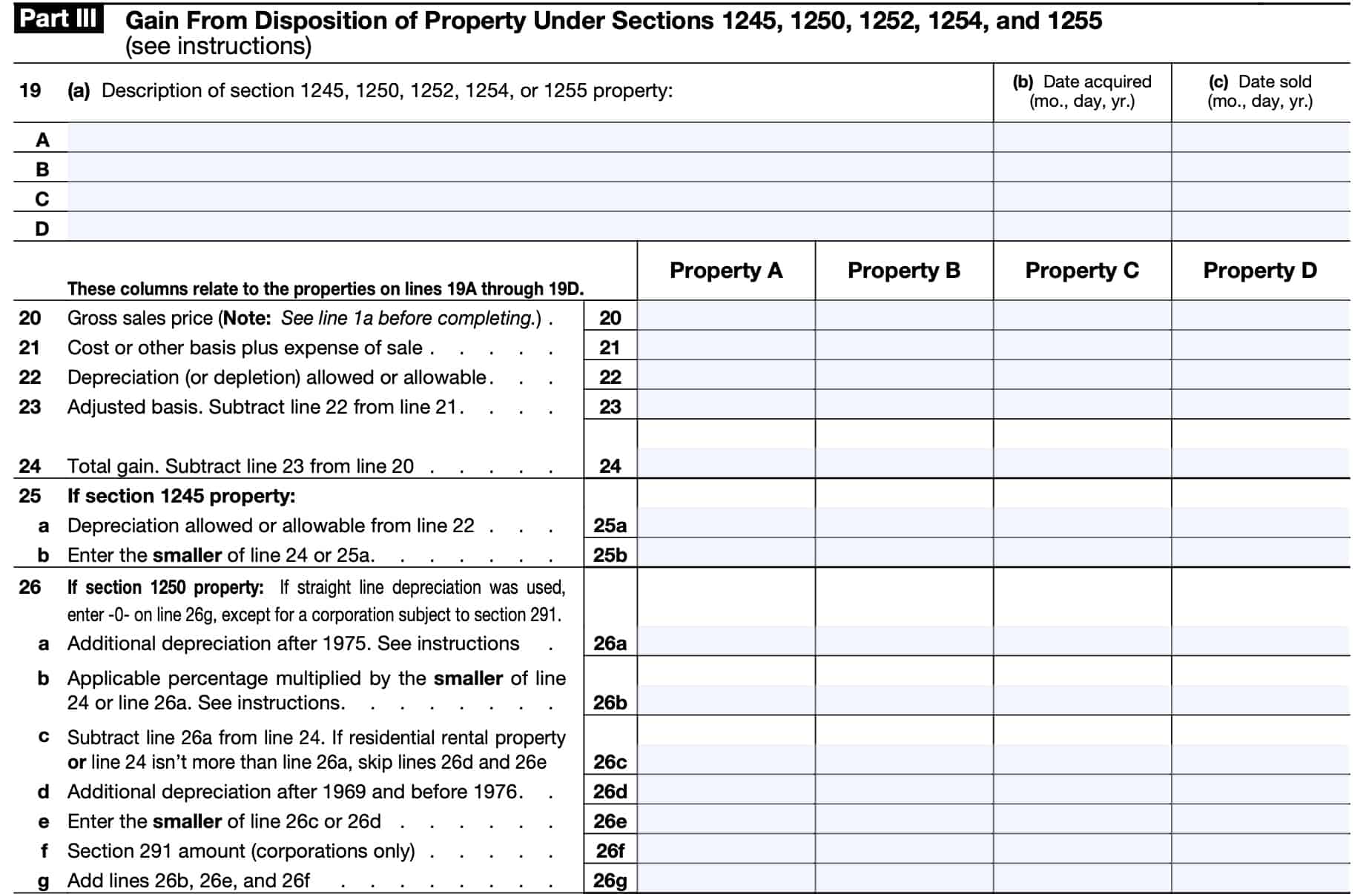

Part III

Use Part III to figure depreciation recapture and other items that must be reported as ordinary income on the disposition of certain property. But do not use Part III to calculate depreciation recapture for the sale of business property held for one year or less.

Line 19

In Line 19, enter the following information for each property disposed of during the tax year.

- Description of the property

- Date acquired

- Date sold

There are four rows in Line 19, one for each property. If you have disposed of more than four properties, you may need to use additional forms.

Line 20: Gross sales price

For Lines 20 through 29, you’ll enter the applicable information for each property that you listed in Line 19. Enter the information for a property based upon its corresponding row (i.e. column A should contain information for the property listed in row A, above).

In Line 20, enter the gross sales price for each property.

The gross sales price includes the following:

- Cash or other forms of money received

- Fair market value (FMV) of other property received, and

- Any existing mortgage or other debt the buyer assumes or takes the property subject to

For casualty or theft gains, include insurance or other reimbursement you received or expect to receive for each item. Include your insurance coverage, even if you do not plan to submit a claim for reimbursement.

For Section 1255 property disposed of in a sale, exchange, or involuntary conversion, enter the amount realized. For Section 1255 property disposed of in any other manner, enter the FMV.

Line 21: Cost or other basis plus sales expenses

Enter the cost basis or other basis used, plus sales expenses. Reduce the property’s cost basis by the amount of any:

- Enhanced oil recovery credit (IRS Form 8830) or

- Disabled access credit (IRS Form 8826)

Line 22: Depreciation or depletion

For Line 22, enter the depreciation or depletion that was allowed, or allowable, for each listed property. To calculate this, do the following:

Add the following:

- Deductions allowed or allowable for depreciation

- This includes any special depreciation allowance, amortization, depletion, or preproductive expenses

- Section 179 expense deduction.

- Commercial revitalization deduction for buildings placed in service before 2010.

- Downward basis adjustment under IRC Section 50(c)

- Deduction for qualified clean-fuel vehicle property or refueling property.

- Deductions claimed under

- Section 190: Removal of architectural and transportation barriers for the handicapped or elderly

- Section 193: Tertiary injectants

- Section 1253(d)(2) or (3): Transfer of franchises, trademarks, or trade names

- Basis reduction for any qualified plug-in electric or qualified electric vehicle credit.

- Basis reduction for the employer-provided childcare facility credit.

- Any applicable deduction for qualified energy efficient commercial building property under IRC Section 179D.

- Basis reduction for the alternative motor vehicle credit.

- Basis reduction for the alternative fuel vehicle refueling property credit for property placed in service before January 1, 2022.

Subtract the following:

From the Step 1 total, subtract amounts such as the following.

- Any investment credit recapture amount if the basis of the property was reduced in the tax year the property was placed in service under IRC Section 50(c)(1) or applicable prior law

- Any Section 179 or 280F(b)(2) recapture amount included in gross income in a prior tax year because the business use of the property decreased to 50% or less.

- Qualified clean-fuel vehicle property or refueling property deduction you were required to recapture

- Basis increase for qualified plug-in electric or qualified electric vehicle credit recapture

- Basis increase for recapture of the employer-provided childcare facility credit

- Basis increase for recapture of the alternative motor vehicle credit

- Basis increase for recapture of the alternative fuel vehicle refueling property credit

- Qualified disaster expense recapture

The total is your depreciation allowed or allowable.

Line 23: Adjusted basis

To arrive at adjusted basis, subtract Line 22 from Line 21 for each column.

Line 24: Total gain

Subtract the adjusted basis in Line 23 from the gross proceeds in Line 20. This is your total gain.

Line 25: Section 1245 property

Section 1245 property is property that is depreciable, amortizable or treated as amortizable under the IRS tax code, and is one of the following:

- Personal property

- Elevators and escalators placed in service before 1987

- Real property (see form instructions for a list of required adjustments)

- Tangible real property

- A single purpose agricultural or horticultural structure (as defined in IRC Section 168(i)(13)).

- A storage facility (not including a building or its structural components) used in connection with the distribution of petroleum or any primary petroleum product.

- Any railroad grading or tunnel bore (as defined in Section 168(e)(4)).

If the property is Section 1245 property, enter the depreciation allowed or allowable from Line 22 in Line 25a.

In Line 25b, enter the smaller of:

- Line 24: Total gain

- Line 25a: Depreciation allowed or allowable

Line 26: Section 1250 property

Section 1250 property is depreciable real property that is not otherwise considered Section 1245 property. Generally, section 1250 recapture applies if you did any of the following:

- Used an accelerated depreciation method

- Claimed any special depreciation allowance

- Claimed the commercial revitalization deduction

Line 26a

Enter the additional depreciation for the period after 1975.

Additional depreciation is the excess of actual depreciation over depreciation figured using the straight line method. Do not reduce the basis under section 50(c)(1) or the corresponding provision of prior law to figure straight line depreciation.

If you claimed a commercial revitalization deduction, figure straight line depreciation using the property’s applicable recovery period under IRC Section 168.

Line 26b

Generally, use 100% as the percentage for this line.

However, for low-income rental housing described in IRC Section 1250(a)(1)(B), see that section for the percentage to use.

Line 26c

For Line 26c, subtract Line 26a from Line 24. If the real property is considered residential rental property or Line 24 isn’t more than Line 26a, skip Lines 26d and 26e, below.

Line 26d

Enter the additional depreciation after 1969 and before 1976.

If straight line depreciation exceeds the actual depreciation for the period after 1975, reduce Line 26d by the excess. Do not enter less than zero for Line 26d.

Line 26e

Enter the smaller of Line 26c or Line 26d.

Line 26f

For corporation use only. Enter the amount considered to be ordinary income under Section 291 as a corporate preference item.

This is generally 20% of the excess, if any, of the amount that would be treated as ordinary income if such property were Section 1245 property, over the amount treated as ordinary income under Section 1250.

If the corporation used the straight line method of depreciation, the ordinary income under Section 291 is 20% of the amount figured under Section 1245.

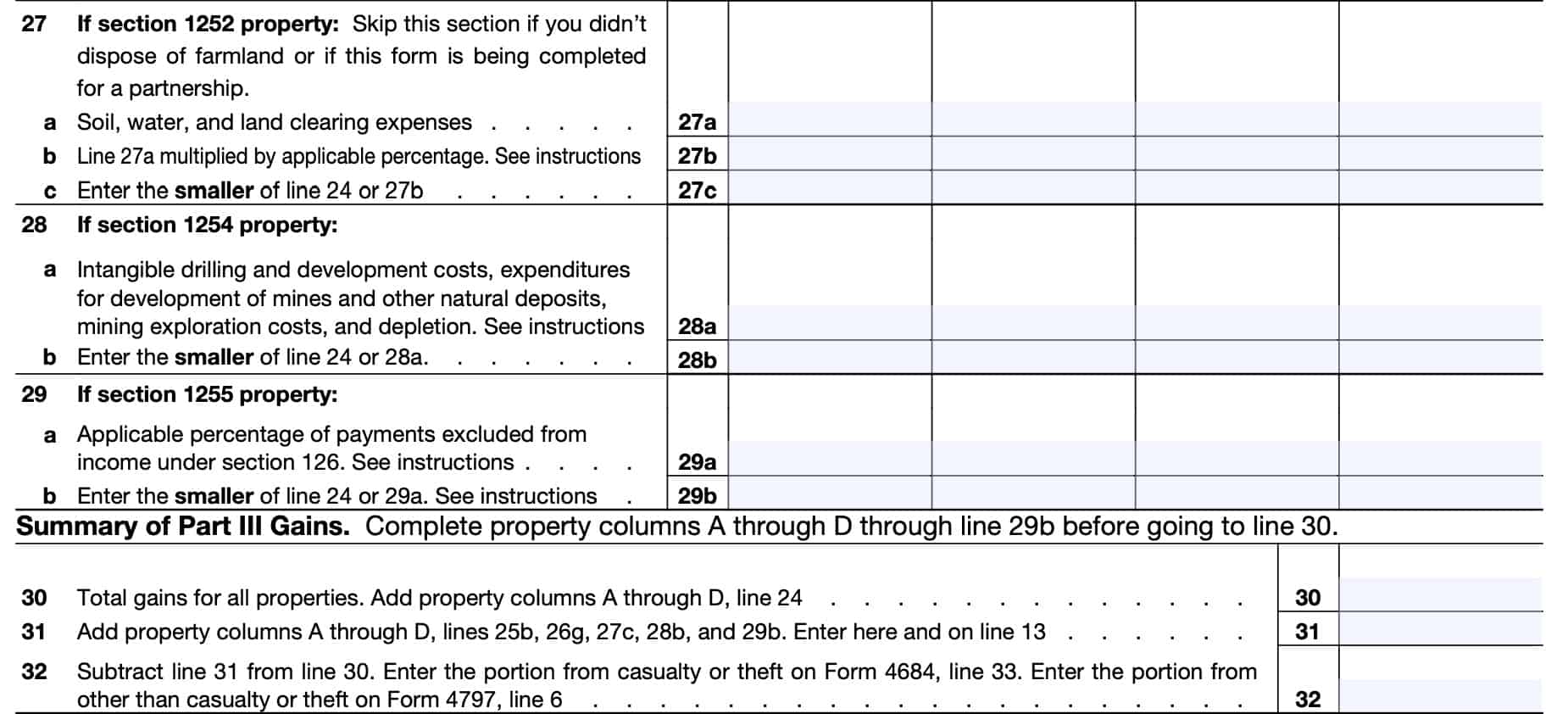

Line 27: Section 1252 property

If you did not dispose of farmland, or if this form is being completed on behalf of a partnership, skip Line 27. Partners must enter on the applicable lines of Part III amounts subject to Section 1252 according to instructions from the partnership.

On Line 27a, enter any expenses incurred in soil, water, or land clearing operations.

For Line 27b, enter 100% of the Line 27a number unless one of the following applies:

- 80% if the farmland was disposed of within the 6th year after it was acquired

- 60% if disposed of within the 7th year

- 40% if disposed of within the 8th year

- 20% if disposed of within the 9th year

For Line 27c, enter the smaller of:

- Line 24

- Line 27b

Line 28: Section 1254 property

Section 1254 property refers to interests in oil, gas, geothermal, or other mineral properties. If not applicable, skip Line 28.

Line 28a

In Line 28a, you will enter total expenses related to the following, based upon when the property was placed in service:

- Intangible drilling and development costs

- Expenditures for development of mines and other natural deposits

- Mining exploration costs

- Depletion

If the property was placed in service before 1987, enter the total expenses after 1975 that:

- Were deducted by the taxpayer or any other person as intangible drilling and development costs under IRC Section 263(c), except for previously expensed mining costs that were included in income upon reaching the producing state, and

- Would have been reflected in the adjusted basis of the property if they had not been deducted

For property placed in service after 1986, enter the total expenses that:

- Were deducted under Section 263, 616, or 617 by the taxpayer or any other person; and but for such deduction, would have been included in the basis of the property; plus

- The deduction under Section 611 that reduced the adjusted basis of such property.

If you disposed of a portion of Section 1254 property or an undivided interest in it, see Section 1254(a)(2).

Line 29: Section 1255 property

Section 1255 refers to the taxable gain on the disposition of Section 126 property.

In Line 29a, enter the applicable percentage of payments excluded from taxable income under Section 126.

Use 100% if the property is disposed of less than 10 years after receipt of payments excluded from income. From 100%, subtract 10% for each year, or part of a year, that the property was held over 10 years after receipt of the excluded payments.

Use zero if the property holding period was 20 years or more.

In Line 29b, enter the smaller of:

- Line 24

- Line 29a

Line 30

Prior to starting Line 30, be sure that columns A through D for Lines 20 through 29b are complete.

In Line 30, add the totals of property columns A through D, Line 24. Enter the total here.

Line 31

For each property columns A through D, add the totals of:

Enter the result here and in Line 13.

Line 32

Subtract Line 31 from Line 30.

Enter the casualty or theft-related portion on IRS Form 4684, Line 33. Enter the remaining portion on Line 6, above.

Part IV

Part IV helps calculate recapture amounts under Section 179 and Section 280F(b)(2) when the business use of an asset drops to 50% or less.

Line 33

In Line 33, do the following:

In Column (a), enter the Section 179 expense deduction you claimed when the property was placed in service.

For Column (b), enter the depreciation allowable on the property in prior tax years, plus any Section 179 expense deduction you claimed when the property was placed in service.

Line 34

For Column (a), enter the depreciation that would have been allowable on the Section 179 property from the year the property was placed in service through (and including) the current year.

For more specific information, refer to IRS Publication 946, How To Depreciate Property.

In Column (b), enter the depreciation that would have been allowable if the property had not been used more than 50% in a qualified business.

Calculate the depreciation from the year it was placed in service up to (but not including) the current year. Refer to IRS Publication 463, Travel, Gift, and Car Expenses, and Publication 946.

Line 35

Subtract Line 34 from Line 33.

Enter the recapture amount as “other income” on the same form or schedule on which you took the deduction. As an example, if you took the deduction on Schedule C (Form 1040), report the recapture amount as other income on Schedule C.

If you filed Schedule C or F (Form 1040) and the property was used in both your trade or business and for the production of income, the portion of the recapture amount attributable to your trade or business is subject to self-employment tax.

Allocate the amount on Line 35 to the appropriate schedules. Increase your cost basis in the property by the recapture amount.

Video walkthrough

Watch this instructional video to learn more about reporting the gain or loss from sales of business property on IRS Form 4797.

Frequently asked questions

In general, taxpayers will use Schedule D to report gains and losses on the sale of personal investments while Form 4797 is primarily used to report the gain or loss on the disposition of business assets.

Generally, taxpayers must use Form 4797 to report the sale, exchange, or disposition of property used for business purposes that is not reported on another form or schedule, such as Schedule D.

Depreciation allowed is the depreciation actually taken and deducted on a previous tax return. Depreciation allowable is the depreciation that the taxpayer was entitled to take, regardless of whether it was actually taken.

Where can I find IRS Form 4797?

Like other IRS tax forms, can download IRS Form 4797 from the IRS website. We’ve enclosed the most recent version of this form in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!