IRS Form 8910 Instructions

If you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable income using IRS Form 8910.

In this article, we’ll walk through this tax form, including:

- How to complete and file IRS Form 8910

- Requirements for qualified alternative fuel vehicles

- When using another tax form might be more appropriate.

Let’s start with step by step guidance on how to complete IRS Form 8910.

Table of contents

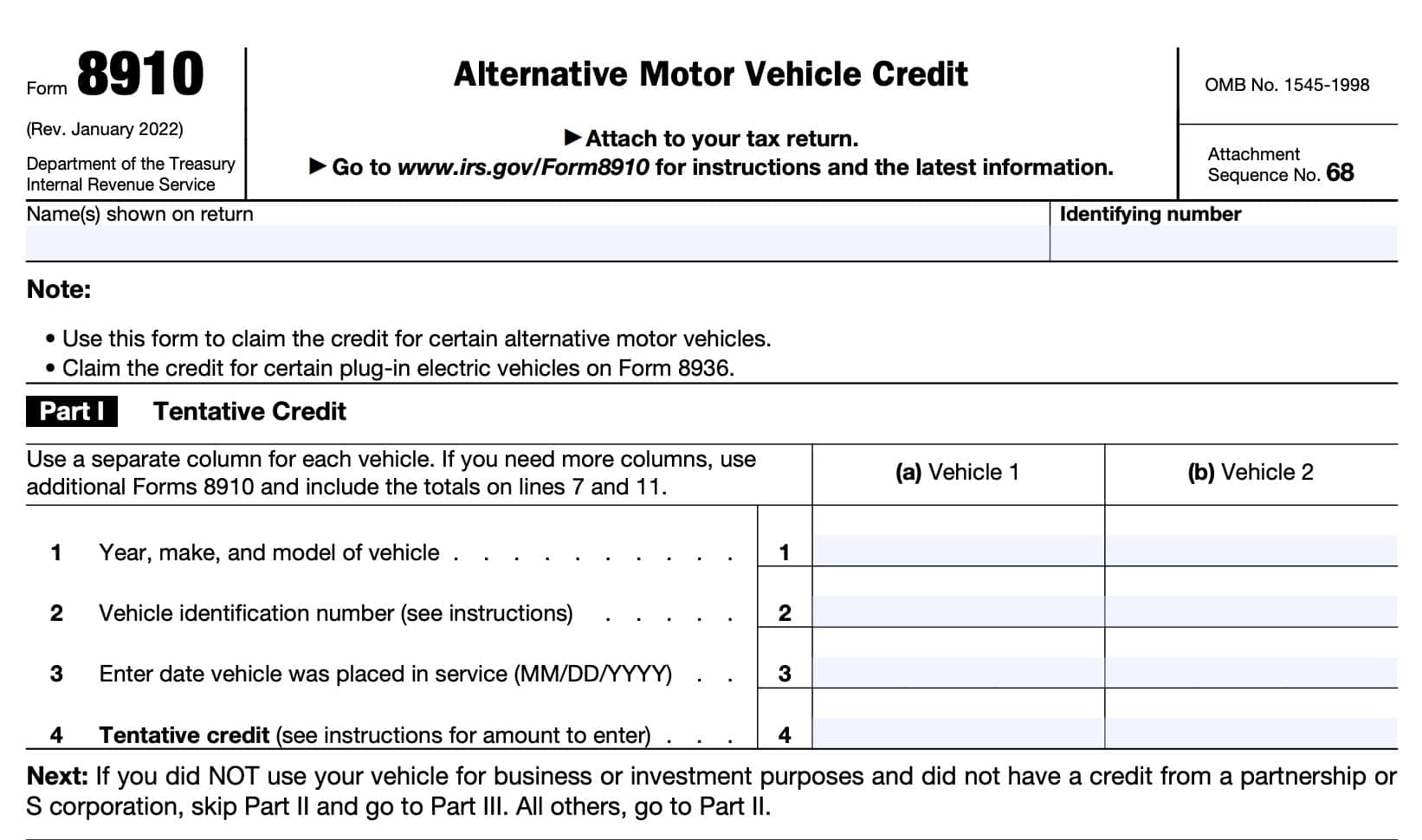

How do I complete IRS Form 8910?

There are three parts to this one-page tax form:

- Part I: Tentative Credit

- Part II: Credit for Business/Investment Use Part of Vehicle

- Part III: Credit for Personal Use Part of Vehicle

We’ll go through each part, one step at a time, beginning with Part I. First, let’s start with making sure that we’re using the correct tax form.

Correct use of IRS Form 8910

Do not use Form 8910 unless you purchased a qualifying vehicle in 2021 or earlier, but placed it into service in 2022 or later.

If you placed into service certain plug-in electric vehicles during the tax year, you may report them on either of the following:

- IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, or

- IRS Form 8936-A, Qualified Commercial Clean Vehicle Credit

Assuming that this is the correct form, let’s move on to Part I.

Part I: Tentative Credit

In Part I, we’ll calculate the tentative alternative motor vehicle credit. Use one column for each qualified alternative motor vehicle.

But first, let’s understand what the IRS considers to be qualified vehicles.

Qualified alternative motor vehicle

The Internal Revenue Service considers qualified alternative motor vehicles to be vehicles that:

- Have at least four wheels, and

- Qualify as a qualified fuel cell vehicle

Qualified fuel cell vehicle

A qualified fuel cell vehicle is a new vehicle:

- Propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with hydrogen fuel, and

- That meets certain additional requirements

Certification and other requirements

In general, taxpayers can rely on the manufacturer’s certification to the IRS that a specific make, model, and model year vehicle qualifies for the credit and the amount of the credit for which it qualifies. The manufacturer or domestic distributor should be able to provide you with a copy of the IRS letter acknowledging the certification of the vehicle.

However, if the IRS publishes an announcement that the certification for any specific make, model, and model year vehicle has been withdrawn, then you cannot rely on the certification for such a vehicle purchased after the date of publication of the withdrawal announcement.

If you purchased a vehicle and its certification was withdrawn on or after the date of purchase, you can rely on such certification even if you had not placed the vehicle in service or claimed the credit by the date the withdrawal announcement was published by the IRS. The IRS will not attempt to collect any understatement of tax liability attributable to reliance on the certification as long as you purchased the vehicle on or before the date the IRS published the withdrawal announcement.

The following requirements must be met to qualify for the nonrefundable alternative motor vehicle tax credit.

- You are the owner of the vehicle.

- If the vehicle is leased, only the lessor and not the lessee is entitled to the tax credit.

- You placed the vehicle in service during the current tax year

- The original use of the vehicle began with you

- You acquired the vehicle for use or to lease to others, and not for resale

- You use the vehicle primarily in the United States

Now that we’ve reviewed the criteria for qualified vehicles, let’s calculate this nonrefundable credit.

If you need more than two columns to calculate this vehicle tax credit, then you may attach additional versions of IRS Form 8910. Be sure to include the totals on Line 7 and Line 11.

Line 1: Year, make, and model of vehicle

Enter the year, make, and model for each vehicle you placed into service during the tax year.

Line 2: Vehicle identification number

Enter the vehicle’s vehicle identification number (VIN) on Line 2. A vehicle’s VIN is a 17 character combination of letters and numbers, which can be obtained from any of the following:

- Vehicle’s registration or title

- Proof of insurance

- Actual vehicle itself

the registration, title, proof of insurance, or actual vehicle. Generally, the VIN is 17 characters made up of numbers and letters.

Line 3: Date vehicle was placed in service

Enter the date that you placed the vehicle into service for either personal use or business use. Use the MM/DD/YYYY format.

Line 4: Tentative credit

In Line 4, enter the tentative credit for the vehicle you entered on Line 1.

You should be able to use the manufacturer’s certification to the IRS to determine the amount of the vehicle tax credit. In the case of a foreign manufacturer, you should receive the certification from the domestic distributor.

If you did not use your vehicle for business or investment purposes, and you did not have a credit from a partnership or S corporation, you can skip Part II and go directly to Part III.

All other taxpayers, proceed to Part II.

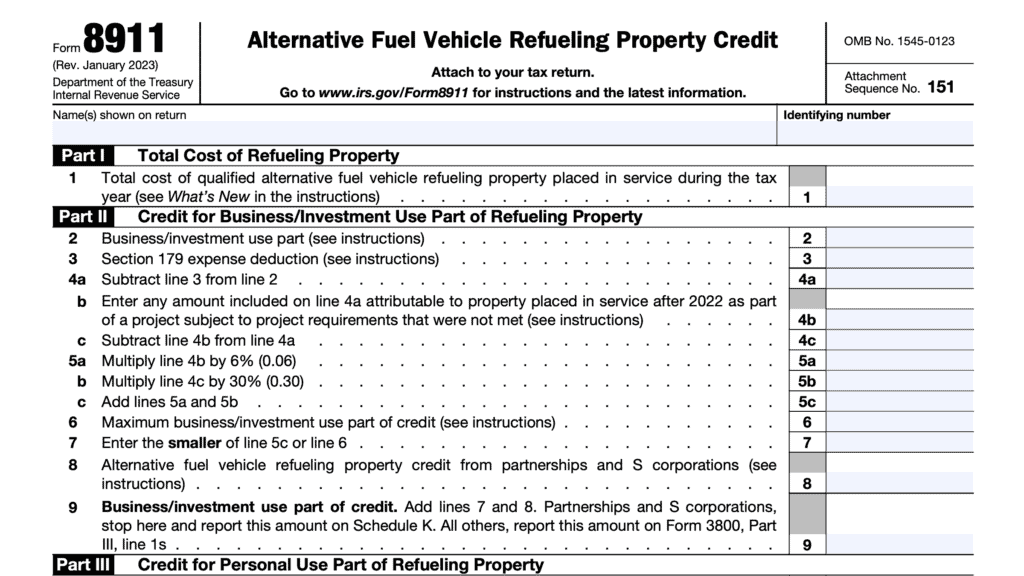

Part II: Credit for Business/Investment Use Part of Vehicle

In Part II, we’ll calculate the credit for business or investment use of the vehicle. Let’s start by calculating the business/investment use percentage in Line 5.

Line 5: Business/investment use percentage

In Line 5, enter the percentage of business/investment use. If the vehicle is used solely for business purposes or you are claiming the credit as the seller of the vehicle, then enter 100%.

If the vehicle is used for both business purposes and personal purposes, you will need to determine the percentage of business use

To do this, divide the number of miles the vehicle is driven during the year for business purposes or for the production of income by the total number of miles the vehicle is driven for all purposes. Do not include commuting mileage as part of the business use calculation.

Treat vehicles used by your employees as being used 100% for business/investment purposes if:

- The value of personal use is included in the employees’ gross income, or

- The employees reimburse you for the personal use

If during the tax year you convert property used solely for personal purposes to business/investment use (or vice versa), figure the percentage of business/investment use only for the number of months you use the property in your business or for the production of income. Multiply that percentage by the number of months you use the property in your business or for the production of income and divide the result by 12.

For example, if you converted a vehicle to 50% business use for the last 6 months of the year, you would enter 25% on Line 5 (50% multiplied by 6 divided by 12).

Line 6

For each column, multiply Line 4 by Line 5. Enter the result in Line 6.

Line 7

Add both columns on Line 6. If using more than one Form 8910, then enter the combined value of all columns in Line 7.

Line 8: Alternative motor vehicle credit from partnerships and S corporations

In Line 8, enter the total alternative vehicle tax credit passed down from partnerships or S corporations. You’ll find these credits on each of the following:

- Partnerships: Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., box 15 (code P); and

- S Corporations: Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc., box 13 (code P).

Partnerships and S corporations report the above credits on Line 8. All other filers figuring a separate credit on earlier lines also report the above credits on Line 8.

All others not using earlier lines to figure a separate credit can report the credit amount as part of the general business credit directly on IRS Form 3800, Part III, Line 1r.

Line 9: Business/investment use part of credit

Add Line 7 & Line 8, then enter the total here.

For partnerships & S corporations, stop at the end of Part II and report this nonrefundable tax credit on Schedule K.

For all other taxpayers, report this amount as a general business credit on IRS Form 3800, Part III, Line 1r. If applicable, go to Part III to determine calculate the personal use part of this federal tax credit.

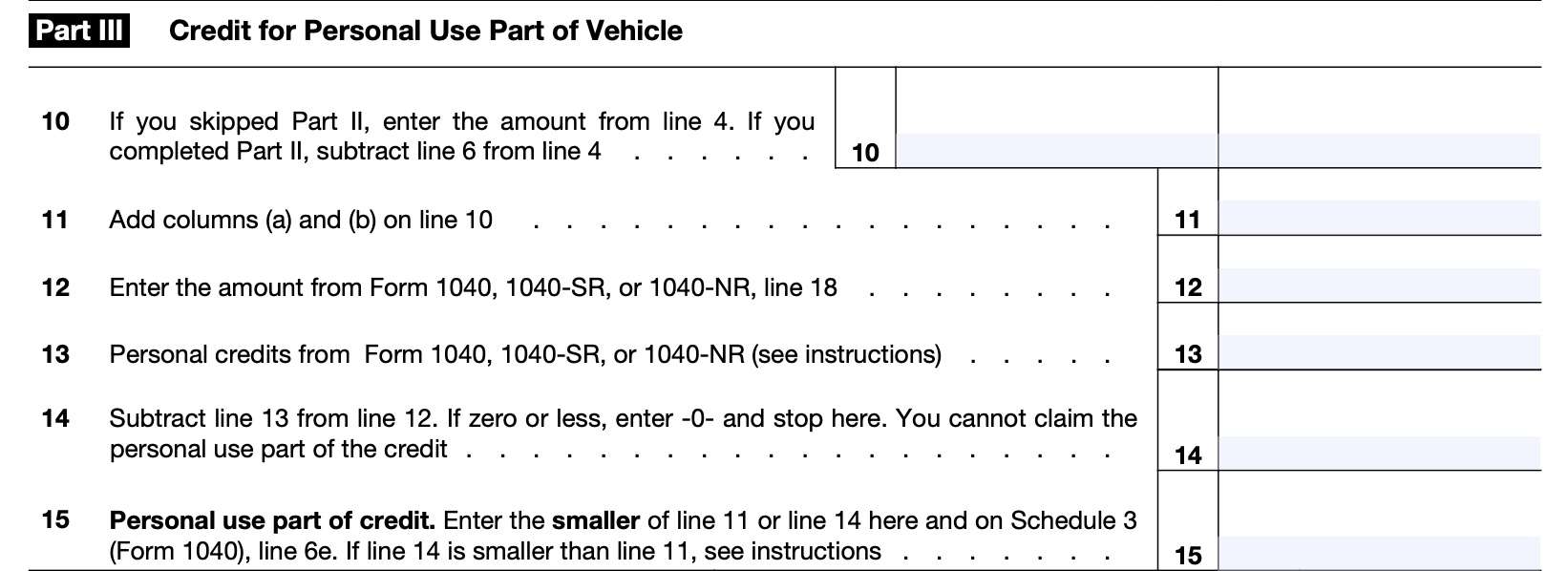

Part III: Credit for Personal Use Part of Vehicle

In Part III, we’ll calculate the personal credit you might receive for use of the alternative motor vehicle, starting with Line 10.

Line 10

If you skipped Part II, enter the Line 4 amount.

Otherwise, subtract the Line 6 number from Line 4.

Line 11

Add columns (a) and (b) from Line 10, above. If using more than one Form 8910, combine all Line 10 values from all forms, then enter the result in Line 11.

Line 12

Enter the Line 18 amount from your IRS Form 1040, 1040-SR, or 1040-NR.

This represents your tax liability, plus the following:

- Alternative minimum tax from IRS Form 6251

- Excess advance premium tax credit repayment from IRS Form 8692

Line 13: Personal credits

In Line 13, enter the total of the following personal credits:

- Schedule 3, Line 1: Foreign tax credit from IRS Form 1116

- Schedule 3, Line 2: Credit for child and dependent care expenses from IRS Form 2441

- Schedule 3, Line 3: Education credits from IRS Form 8863

- Schedule 3, Line 4: Retirement savings contributions credit from IRS Form 8880

- Schedule 3, Line 6d: Credit for the elderly or the disabled from Schedule R

- Schedule 3, Line 6l: Total increase/decrease to reporting year tax, from IRS Form 8978

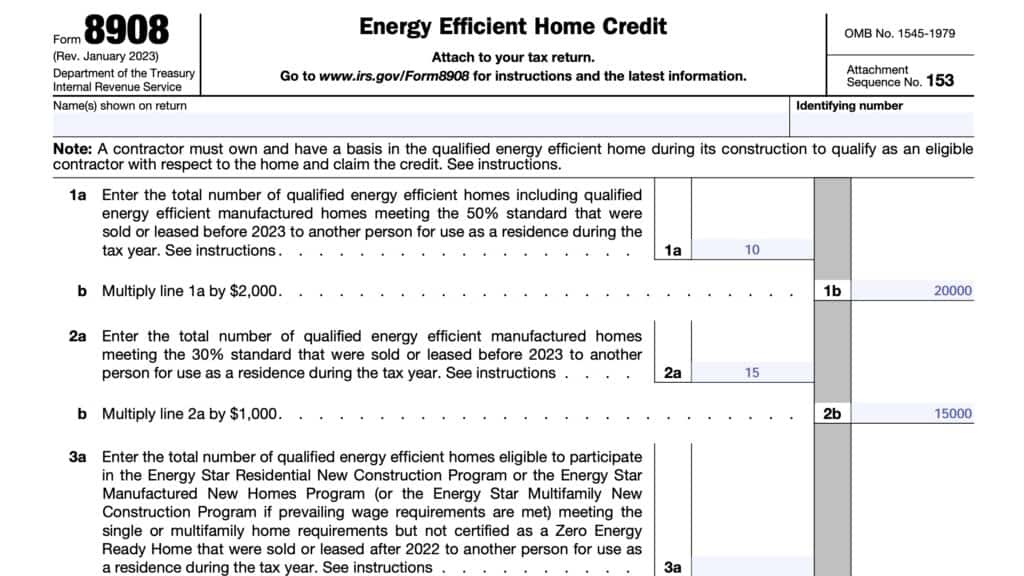

- Energy efficient home improvement credit from IRS Form 5695, Line 30

Line 14

Subtract Line 13 from Line 12, then enter the result here.

If the result is zero or a negative number, enter ‘0’ and stop. You cannot claim the personal use portion of this tax credit on your individual returns.

Line 15: Personal use part of credit

Enter the smaller of:

Enter this number on Schedule 3, Line 6e of your individual income tax return.

If Line 14 is smaller than Line 11, then you may have an unused credit due to the tax liability limit. Unfortunately, the unused personal portion of the credit cannot be carried back or forward to future tax years.

Video walkthrough

Check out this instructional video to learn more about using IRS form 8910 to claim the nonrefundable alternative motor vehicle tax credit.

Frequently asked questions

No. The credit for vehicles placed in service in a tax year beginning after 2022 will be figured on IRS Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit.

Where can I find IRS Form 8910?

You can find this tax form on the IRS website. For easier access, we’ve attached the latest version of IRS Form 8910 to this article in PDF form.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!