IRS Form 8936 Instructions

If you recently purchased a qualifying clean vehicle, you may be able to claim an increased tax credit on IRS Form 8936, thanks to the changes made in the 2022 Inflation Reduction Act.

In this article, we’ll walk you through everything you should know about IRS Form 8936, including:

- How to complete IRS Form 8936 and Schedule A

- How to calculate the business use and personal use tax credits for your clean vehicle

- Qualifying clean vehicles

Let’s start with a step-by-step guide of the tax form itself.

Table of contents

How do I complete IRS Form 8936?

There are 5 parts to this one-page tax form:

- Part I: Modified Adjusted Gross Income Amount

- Part II: Credit for Business/Investment Use Part of New Clean Vehicles

- Part III: Credit for Personal Use Part of New Clean Vehicles

- Part IV: Credit for Previously Owned Clean Vehicles

- Part V: Credit for Qualified Commercial Clean Vehicles

Additionally, the IRS created Schedule A, which taxpayers use to calculate the clean vehicle tax credit for each qualified vehicle. We’ll cover Schedule A in the next section.

Let’s start by calculating the Modified Adjusted Gross Income (MAGI) amount in Part I.

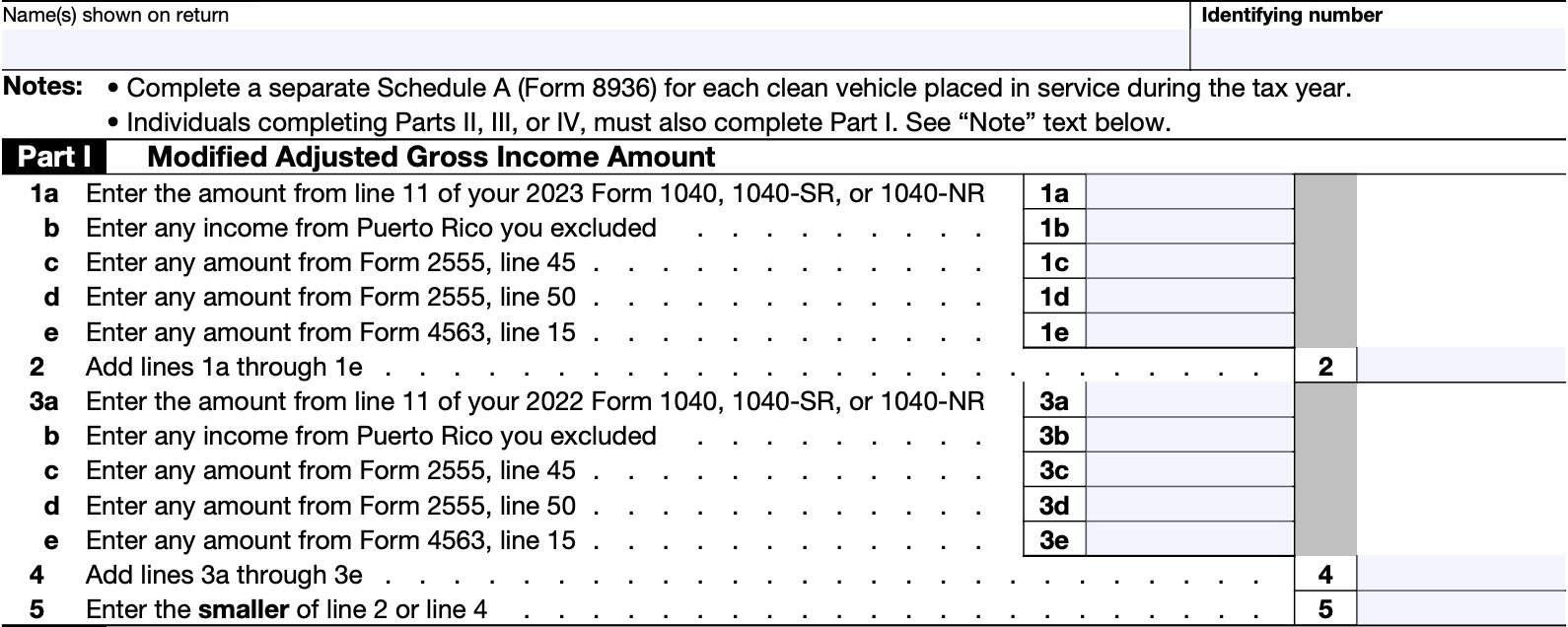

Part I: Modified Adjusted Gross Income Amount

If you’re completing Part II, Part III, or Part IV, you must complete Part I to determine if you are eligible to claim the tax credit. Individual taxpayers may not claim clean vehicle credits if their modified adjusted gross income (MAGI) exceeds the following:

- Married filing jointly or qualifying surviving spouse: $300,000

- Head of household: $225,000

- Single or married filing jointly: $150,000

Taxpayer information

Before we get to Line 1, we need to complete the taxpayer information at the top of the form. Enter the taxpayer name as shown on your federal income tax return, followed by the taxpayer’s identifying number.

The identifying number can be one of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Employer identification number (EIN)

Let’s take a look at the income adjustments we need to make to calculate MAGI.

Line 1a: Current year Adjusted gross income (AGI)

Enter your adjusted gross income from your income tax return. This should be Line 11 of your Form 1040, Form 1040-SR, or Form 1040-NR.

Line 1b: Current Year Excluded income from Puerto Rico

Enter any income from Puerto Rico that you excluded in the current taxable year.

Line 1c: Current Year Foreign earned income exclusion

Enter the amount of foreign earned income that you were able to exclude from AGI this year. You should find this on either Line 45 of IRS Form 2555, Foreign Income Exclusion, or Line 8d on Schedule 1 of your Form 1040.

Line 1d: Current Year Foreign housing deduction

Enter the amount of foreign housing deduction that you reported this year. You should find this on either Line 50 of IRS Form 2555, Foreign Income Exclusion, or Line 24j on Schedule 1 of your Form 1040.

Line 1e: Current Year Excluded income from American Samoa

Enter the amount of American Samoa income that you excluded from AGI on IRS Form 4563, Line 15.

Line 2: Current year modified AGI

Add Lines 1a through 1e, then enter the total here. This represents your modified AGI for the current taxable year.

Line 3a: Prior year Adjusted gross income (AGI)

Enter your adjusted gross income from your previous year’s income tax return. This should be Line 11 of your Form 1040, Form 1040-SR, or Form 1040-NR.

Line 3b: Prior Year Excluded income from Puerto Rico

Enter any income from Puerto Rico that you excluded in the prior tax year.

Line 3c: Prior Year Foreign earned income exclusion

Enter the amount of foreign earned income that you were able to exclude from AGI last year. You should find this on either Line 45 of IRS Form 2555, Foreign Income Exclusion, or Line 8d on Schedule 1 of your Form 1040.

Line 3d: Prior Year Foreign housing deduction

Enter the amount of foreign housing deduction that you reported last year. You should find this on either Line 50 of IRS Form 2555, Foreign Income Exclusion, or Line 24j on Schedule 1 of your Form 1040.

Line 3e: Prior Year Excluded income from American Samoa

Enter the amount of American Samoa income that you excluded from last year’s AGI on IRS Form 4563, Line 15.

Line 4: Prior year modified AGI

Add Lines 1a through 1e, then enter the total here. This represents your modified AGI for the current taxable year.

Line 5: Modified AGI

Enter the smaller of:

This represents your MAGI for calculating the clean energy vehicle tax credit.

Proceed to Part II unless either of the following applies:

- You did not use your vehicle for business or investment purposes

- You did not have a tax credit from a partnership or S corporation

If either of those applies, skip Part II and go to Part III.

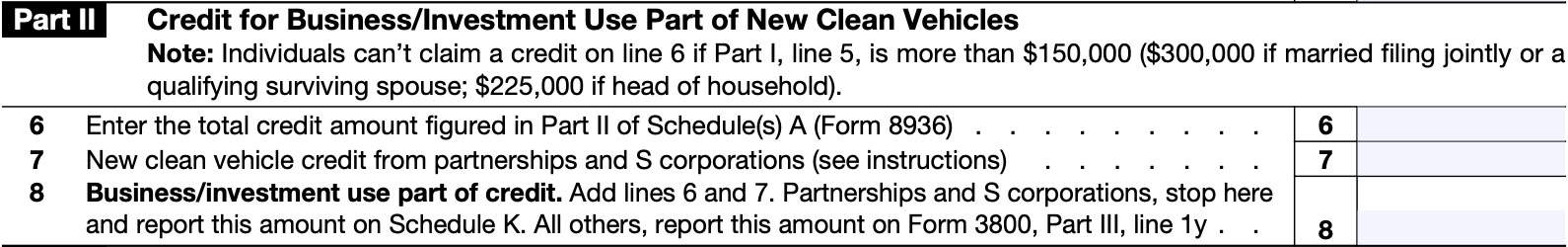

Part II: Credit for Business/Investment Use Part of Vehicle

In Part II, we’ll calculate the amount of the credit attributable to business or investment business use, and account for additional tax credits from pass-through business entities.

The part of the credit attributable to business/ investment use of a new clean vehicle is treated as a general business credit. Any part of the credit not attributable to business/investment use is treated as a personal credit, as calculated in Part III.

Line 6: Total calculated credit

In Line 6, enter the total credit amount that you calculated in Part II of Schedule A (or multiple Schedules A), below.

Line 7: New clean vehicle credit from partnerships and S corporations

Enter the total new clean vehicle credits from either of the following:

- Partnerships: Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., Box 15 (Code AY); and

- S corporations: Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc., Box 13 (Code AY).

Partnerships and S corporations report the above credits on Line 7. All other filers figuring a separate credit on earlier lines also report the above credits on Line 7.

All others not using earlier lines to figure a separate credit can report the above credits directly on IRS Form 3800, General Business Credit, Part III, Line 1y.

Line 8: Business/Investment use part of credit

Add Lines 6 & 7, then enter the total here.

Partnerships and S corporations can stop here and report this credit on Schedule K. All other taxpayers report this on IRS Form 3800, General Business Credit, Part III, Line 1y.

Part III: Credit for Personal Use Part of Vehicle

In Part III, we’ll calculate the amount of credit you can claim for personal use.

Line 9: Total credit amount from Schedule A

Enter the total credits that you calculated in Part III of all Schedules A that you completed. You should find this on Line 12 of each Schedule A.

Line 10

Enter the amount from Line 18 of your Form 1040, Form 1040-SR, or Form 1040-NR. This should reflect your total tax liability, plus the following taxes reported on Schedule 2, Additional Taxes:

- Alternative minimum tax, calculated on IRS Form 6251, and

- Excess advance premium tax credit repayment, from IRS Form 8962

Line 11: Personal credits from tax return

As applicable, enter the total of the following tax credits, as reported on Schedule 3 of your individual income tax return:

- Line 1: Foreign tax credit from IRS Form 1116

- Line 2: Credit for child and dependent care expenses from IRS Form 2441

- Line 3: Education credits from IRS Form 8863

- Line 4: Retirement savings contributions credit from IRS Form 8880

- Line 5b: Energy efficient home improvement credit from IRS Form 5695

- Line 6d: Credit for the elderly or disabled from Schedule R

- Line 6l: Credit from IRS Form 8978, Line 14

- Line 6m: Credit for previously owned clean vehicles, from Line 18 of IRS Form 8936

Line 12

Subtract Line 11 from Line 10.

If the result is zero or less, enter ‘0,’ then stop here. You cannot claim a personal use part of the new clean vehicle credit.

Line 13: Personal use part of the credit

Enter the smaller of the following:

- Line 9: Total credit amount from Schedule A

- Line 12

Enter this total here and on Schedule 3, Line 6f.

If Line 12 is smaller than Line 9

If you cannot use part of the personal portion of the credit because of the tax liability limit, the excess credit is lost. The unused personal portion of the credit cannot be carried back or forward to other tax years.

Part IV: Credit for Previously Owned Clean Vehicles

In Part IV, we’ll calculate the total tax credit for previously owned clean vehicles.

Previously owned clean vehicle credit

The credit is equal to the lesser of $4,000 or 30% of the sales price of a previously owned clean vehicle you acquired and placed in service during your tax year.

Line 14: total credit amount from Schedule A

Enter the total credits that you calculated in Part IV of all Schedules A that you completed. You should find this on Line 17 of each Schedule A.

Line 15

Enter the amount from Line 18 of your Form 1040, Form 1040-SR, or Form 1040-NR. This should reflect your total tax liability, plus the following taxes reported on Schedule 2, Additional Taxes:

- Alternative minimum tax, calculated on IRS Form 6251, and

- Excess advance premium tax credit repayment, from IRS Form 8962

Line 16: Personal credits from income tax return

As applicable, enter the total of the following tax credits, as reported on Schedule 3 of your individual income tax return:

- Line 1: Foreign tax credit from IRS Form 1116

- Line 2: Credit for child and dependent care expenses from IRS Form 2441

- Line 3: Education credits from IRS Form 8863

- Line 4: Retirement savings contributions credit from IRS Form 8880

- Line 5b: Energy efficient home improvement credit from IRS Form 5695

- Line 6d: Credit for the elderly or disabled from Schedule R

- Line 6l: Credit from IRS Form 8978, Line 14

Line 17

Subtract Line 16 from Line 15.

If the result is zero or less, enter ‘0,’ then stop here. You cannot claim a personal use part of the previously owned clean vehicle credit.

Line 18

Enter the smaller of the following:

- Line 14: Total credit amount from Schedule A

- Line 17

Enter this total here and on Schedule 3, Line 6m.

If Line 17 is smaller than Line 14

If you cannot use part of the personal portion of the credit because of the tax liability limit, the unused credit is lost. The unused personal portion of the credit cannot be carried back or forward to other tax years.

Part V: Credit for Qualified Commercial Clean Vehicles

In Part V, we’ll compute the total tax credit for all qualified commercial clean vehicles, as calculated on Schedule A.

Qualified commercial clean vehicle credit

Generally, the credit amount for each qualified commercial clean vehicle is equal to the lesser of:

- 15% of the basis of the vehicle

- 30% for a vehicle not powered by a gasoline or diesel internal combustion engine, or

- The incremental cost of the vehicle

Let’s start with Line 19.

Line 19: total credit amount from Schedule A

Enter the total credits that you calculated in Part V of all Schedules A that you completed. You should find this on Line 26 of each Schedule A.

Line 20: Qualified commercial clean vehicle credit from partnerships and S corporations

Enter the total commercial clean vehicle credit as reported to you on either of the following schedules:

- Partnerships: Schedule K-1 (Form 1065), Box 15, Code AZ

- S corporations: Schedule K-1 (Form 1120-S), Box 13 Code AZ

Line 21

Add Line 19 and Line 20.

Partnerships and S corporations, stop here and report this amount on Schedule K. All other taxpayers, report this amount on IRS Form 3800, Part III, Line 1aa.

How do I complete Schedule A on IRS Form 8936?

There are 5 parts to this two-page tax schedule:

- Part I: Vehicle Details

- Part II: Credit Amount for Business/Investment Use Part of New Clean Vehicle

- Part III: Credit Amount for Personal Use Part of New Clean Vehicle

- Part IV: Credit Amount for Previously Owned Clean Vehicle

- Part V: Credit Amount for Qualified Commercial Clean Vehicle

You must complete Schedule A for each qualifying vehicle, for which you are trying to claim a clean energy tax credit.

Let’s start with vehicle details in Part I.

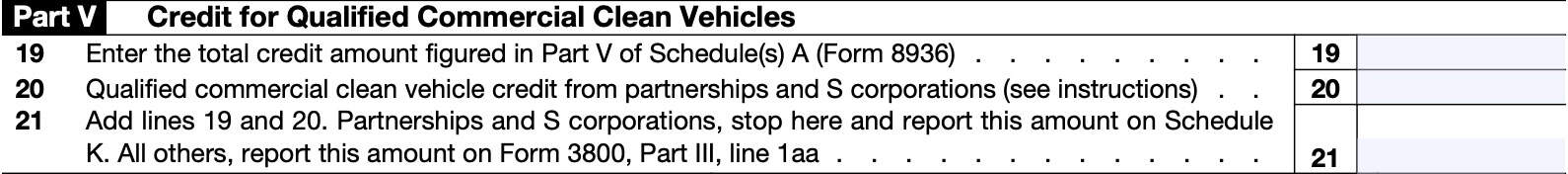

Part I: Vehicle Details

In Part I, enter details about the specific vehicle. Before beginning with Line 1a, enter your name and identifying number in the space provided.

Line 1a: Year

Enter the model year of the specific vehicle, regardless of when you purchased it.

Line 1b: Make

Enter the vehicle’s make.

Line 1c: Model

Enter the model of the vehicle here.

For example, if you were to list a 2022 Tesla Model X, you would enter the following:

- Line 1a: 2022

- Line 1b: Tesla

- Line 1c: Model X

Line 2: Vehicle identification number

In Line 2, enter the vehicle’s 17-digit identification number (VIN). The VIN of a

vehicle can be obtained from any of the following:

- Vehicle’s registration

- Title

- Proof of insurance

- Actual vehicle

The 17-digit VIN consists of letters and numbers.

Line 3: Date vehicle was placed in service

Enter the date that the vehicle was placed in service in MM/DD/YYYY format. Generally, this is the date that a taxpayer takes possession of the vehicle.

Line 4: Was the vehicle used primarily outside the United States?

Answer Yes or No.

If an exception applies, then answer No, even if you used the vehicle primarily outside the United States. Internal Revenue Code Section 168(g)(4) contains a list of exceptions.

If Yes, then stop here. You cannot claim a clean vehicle credit for a vehicle used primarily outside the United States.

Line 5: New clean vehicle

Does the VIN that you entered on Line 2 belong to a new clean vehicle placed in service during the tax year?

Answer Yes or No. If Yes, go to Part II. If No, go to Line 6.

Qualifying new clean vehicle

A qualifying new clean vehicle is a new vehicle with at least four wheels placed in service after 2022 that:

- Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 7 kilowatt hours and is capable of being recharged from an external source of electricity;

- Is manufactured primarily for use on public streets, roads, and highways;

- Has a gross vehicle weight rating (GVWR) of less than 14,000 pounds;

- Had its final assembly within North America;

- Has a manufacturer’s suggested retail price of not more than $55,000

- $80,000 for a van, sport utility vehicle (SUV), or pickup truck); and

- Meets certain additional requirements discussed under New Clean Vehicle Certification and Other Requirements, later

Certain new qualified fuel cell motor vehicles may also be treated as new clean vehicles. A qualified fuel cell motor vehicle is a new vehicle with at least four wheels placed in service after 2022 that:

- Is propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with hydrogen fuel;

- Is manufactured primarily for use on public streets, roads, and highways;

- Had its final assembly within North America;

- Has a manufacturer’s suggested retail price of not more than $55,000

- $80,000 for a van, sport utility vehicle (SUV), or pickup truck); and

- Meets certain additional requirements discussed under New Clean Vehicle Certification and Other Requirements, later

New Clean Vehicle Certification and Other Requirements

Except for qualified fuel cell motor vehicles, the vehicle must have been made by a qualified manufacturer.

A qualified manufacturer is a manufacturer who has entered into a written agreement with the IRS under which the manufacturer agrees to make periodic written reports to the IRS providing vehicle identification numbers (VINs) and other information about their new clean vehicles.

The licensed dealer or seller of a new clean vehicle, including a qualified fuel cell vehicle, must provide a clean vehicle seller’s report to you and the IRS providing additional information required to claim the credit. You might see this referred to as a clean vehicle seller’s report.

This information includes:

- Your name and taxpayer identification number (TIN)

- The vehicle’s VIN

- The battery capacity of the vehicle

- Verification that the original use of the vehicle begins with you

- The maximum new clean vehicle credit allowable for the vehicle

You must also meet the following additional requirements to claim the clean vehicle credit:

- You are the owner of the vehicle

- If the vehicle is leased, only the lessor and not the lessee is entitled to the credit.

- You placed the vehicle in service during the tax year

- The original use of the vehicle began with you

- You acquired the vehicle for use or to lease to others, and not for resale

- You use the vehicle primarily in the United States.

- If you use the vehicle primarily outside the United States, see IRC Section 168(g)(4) for a list of exceptions that may apply

- You meet the IRS modified AGI requirements.

- Use Part I of Form 8936 to figure your modified AGI.

Line 6: Previously owned clean vehicle

Does the VIN that you entered on Line 2 belong to a previously owned clean vehicle placed in service during the tax year?

Answer Yes or No. If Yes, go to Part IV. If No, go to Line 7.

Qualifying previously owned clean vehicle

A qualifying previously owned vehicle is a vehicle with at least four wheels that you acquired and placed in service after 2022 that:

- Has a model year that is at least 2 years earlier than the calendar year in which you acquire the vehicle;

- For example, a 2021 model acquired in 2023 or later

- Had its original use begin with a person other than you;

- Has a sales price that does not exceed $25,000;

- Was purchased from a registered dealer and was the first transfer since August 16, 2022, to an individual eligible to claim the credit;

- Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 7 kilowatt hours and is capable of being recharged from an external source of electricity;

- Is manufactured primarily for use on public streets, roads, and highways;

- Has a gross vehicle weight rating (GVWR) of less than 14,000 pounds; and

- Meets certain additional requirements discussed under Previously Owned Clean Vehicle Certification and Other Requirements

A qualifying previously owned fuel cell motor vehicle is one that meets the above requirements (except for electrical motor), and is propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with hydrogen fuel.

Previously Owned Clean Vehicle Certification and Other Requirements

Generally, for previously owned clean vehicles (other than qualified fuel cell motor vehicles), the vehicle must have been manufactured by a qualified manufacturer, similar to a new clean vehicle.

The dealer or seller of a previously owned clean vehicle must provide a clean vehicle seller’s report to you and the IRS providing information required to claim the credit, including the following.

- Your name and taxpayer identification number (TIN)

- The vehicle’s VIN

- The battery capacity of the vehicle

- The sales price

- The maximum previously owned clean vehicle credit allowable for the vehicle

Additionally, you must meet the following additional requirements to claim the credit:

- You are an individual

- You are the owner of the vehicle

- If the vehicle is leased, only the lessor and not the lessee is entitled to the credit

- You placed the vehicle in service during the tax year

- You acquired the vehicle for use, and not for resale

- You can’t be claimed as a dependent by another taxpayer

- You have not claimed another previously owned clean vehicle credit in the 3 years before the purchase date

- You use the vehicle primarily in the United States

- If you use the vehicle primarily outside the United States, see IRC Section 168(g)(4) for a list of exceptions that may apply

- You meet the IRS modified AGI requirements.

- Use Part I of Form 8936 to figure your modified AGI.

Line 7: Qualified commercial clean vehicle

Does the VIN that you entered on Line 2 belong to a qualified commercial clean vehicle placed in service during the tax year?

Answer Yes or No. If Yes, go to Part V. If No, stop here. You cannot use Schedule A to determine a credit amount for a vehicle not listed in Line 5, Line 6, or Line 7.

Qualified commercial clean vehicle

A qualified commercial clean vehicle is one that was acquired and placed in service after 2022 that:

- Is propelled to a significant extent by an electric motor which draws electricity from a battery that has a capacity of not less than 15 kilowatt hours and is capable of being recharged from an external source of electricity;

- 7 kilowatt hours for a vehicle with a GVWR of less than 14,000 pounds

- Is either manufactured primarily for use on public streets, roads, and highways, or is mobile machinery as defined in IRC Section 4053(8)

- Is of a character subject to the allowance for depreciation

- Except for vehicles not subject to a lease placed in service by certain tax-exempt and governmental entities)

To claim this credit, you must:

- Be the owner of the vehicle

- If the vehicle is leased, only the lessor and not the lessee is entitled to the credit.

- Have placed the vehicle in service during the tax year

- Have acquired the vehicle for use or to lease to others, and not for resale.

- Use the vehicle primarily in the United States.

- If you use the vehicle primarily outside the United States, see IRC Section 168(g)(4) for a list of exceptions that may apply

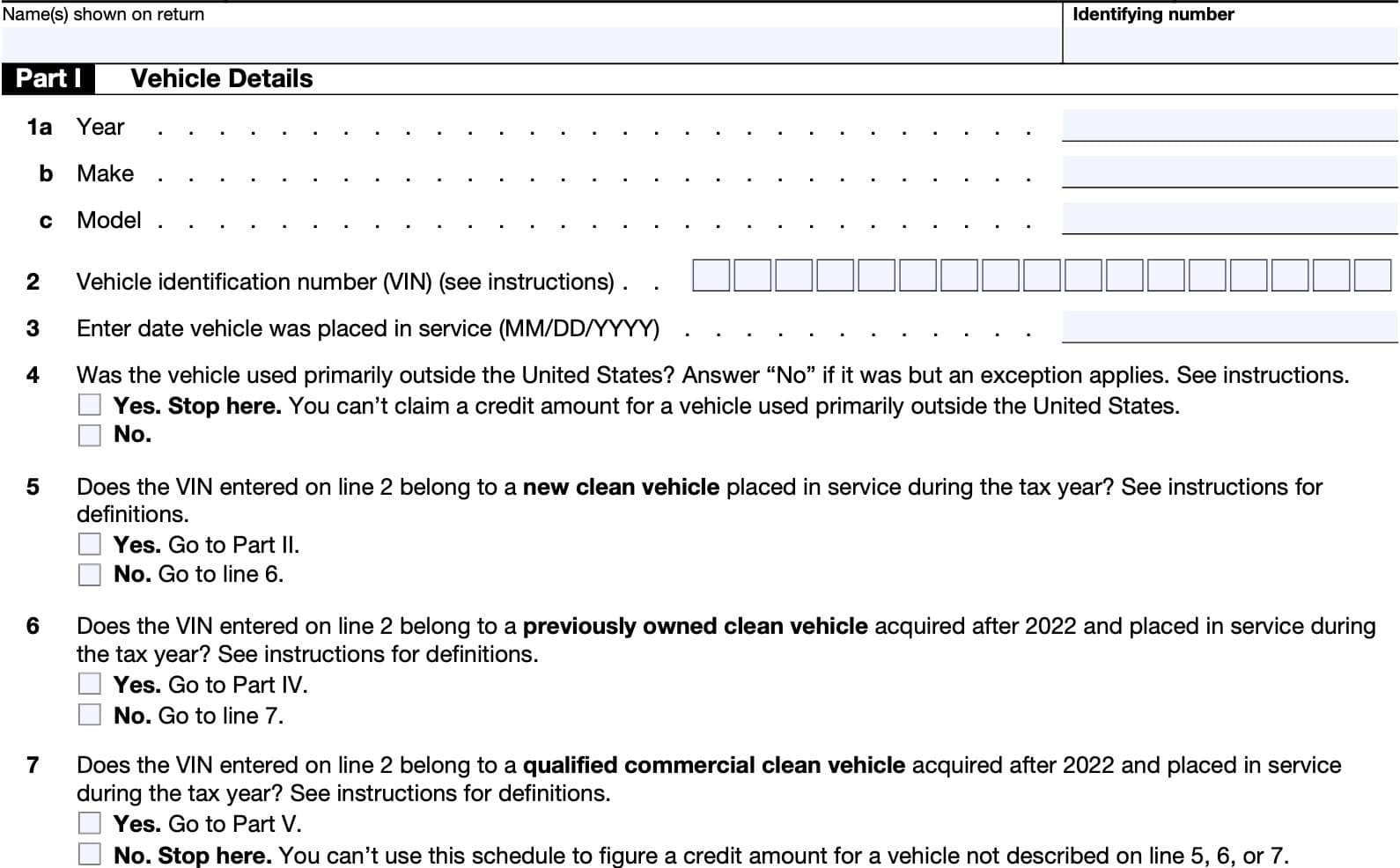

Part II: Credit Amount for Business/Investment Use Part of New Clean Vehicle

Line 8

Did you acquire the vehicle for business use, or to lease to others (not for resale)? Answer Yes or No.

If Yes, go to Line 9. If No, stop. You cannot claim a credit for a vehicle that you didn’t acquire for use or to lease to others.

Line 9: Tentative credit amount

Enter the tentative credit amount here.

Tentative credit amounts for new clean vehicles are provided to the purchaser by the seller at the time the vehicle is sold, and later forwarded to the IRS. Generally, this amount will be the maximum credit amount listed in the seller’s report for the vehicle.

Line 10: Business/investment use percentage

Enter the percentage of business/investment use. Enter 100% if the vehicle is used solely for business purposes.

If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing:

The number of miles the vehicle was driven during the year for business purposes or for the

production of income, known as business miles, by the total number of miles the vehicle was driven for all purposes.

Vehicle use by employees

Treat vehicles used by your employees as being used 100% for business/investment purposes if:

- The value of personal use is included in the employees’ gross income, or

- The employees reimburse you for the personal use.

If you report the amount of personal use of the vehicle in your employee’s gross income and withhold taxes, then enter ‘100%’ for the percentage of business/investment use.

Property converted during the tax year

If during the tax year you convert property used solely for personal purposes to business/investment use (or vice versa), figure the percentage of business/investment use only for the number of months you use the property in your business or for the production of income.

Multiply that percentage by the number of months you use the property in your business or for the production of income and divide the result by 12.

For example, if you converted a vehicle to 50% business use for the last 6 months of the year, you would enter 25% on Line 5 (50% multiplied by 6 divided by 12).

Line 11

Multiply Line 9 by Line 10. Enter the result here.

Include this credit amount on Line 6 in Part II.

If you entered 100% on Line 10, stop here. Otherwise, go to Part III below.

Part III: Credit Amount for Personal Use Part of New Clean Vehicle

Line 12: Personal use credit

Subtract Line 11 from Line 9 in Part II above. Enter this amount here, and on Line 9 in Part III of Form 8936.

Part IV: Credit Amount for Previously Owned Clean Vehicle

Line 13a: Is the vehicle sales price more than $25,000?

Answer Yes or No. If Yes, stop. You cannot claim the credit for a used vehicle.

Line 13b: Did you acquire the vehicle for use and not for resale?

Answer Yes or No. If No, stop here. You cannot claim a tax credit for a vehicle that you acquired for resale, or that you did not acquire for use.

Line 13c: Can someone else claim you as a dependent on their tax return?

Answer Yes or No. If Yes, stop here. You cannot claim a credit if someone else can claim you as a dependent.

Line 13d: is the vehicle a qualified fuel cell motor vehicle?

Answer Yes or No.

Line 14: Vehicle sales price

Enter the vehicle’s sales price in Line 14.

Line 15

Multiply Line 14 by 30%, then enter the total here.

Line 16: Maximum vehicle credit amount

The maximum credit for a previously owned vehicle is $4,000. Do not enter anything here.

Line 17

Enter the smaller of Line 15 or Line 16. Enter the credit here and on Line 14 in Part IV of Form 8936.

Part V: Credit Amount for Qualified Commercial Clean Vehicle

Line 18a: Is the vehicle of a character subject to the allowance for depreciation?

Answer Yes or No. Answer Yes if the exception for certain tax-exempt entities applies.

If No, stop. This vehicle is not a qualified commercial clean vehicle unless the exception applies.

Line 18b: Did you acquired the vehicle for use or to lease to others?

Answer Yes or No. Answer No if you are leasing the vehicle from someone else.

If No, stop. You cannot claim a tax credit for this vehicle.

Line 18c: Is the vehicle also powered by gas or diesel?

Answer Yes or No.

If it is also powered by a gas or diesel engine, the credit rate is reduced from 30% to 15%.

Line 19: Vehicle cost or basis

Enter the vehicle’s cost or tax basis in Line 19.

Line 20: Section 179 expense deduction

Enter any Section 179 expense deduction you claimed for the vehicle from Part I of IRS Form 4562, Depreciation and Amortization.

Line 21

Subtract Line 20 from Line 19. Enter the result here.

Line 22

Multiply Line 21 by the following amount, depending on how you answered Line 18c:

- Yes: 15%

- No: 30%

Line 23: Incremental cost of the vehicle

Enter the incremental cost of the vehicle.

Incremental cost defined

The incremental cost of any qualified commercial clean vehicle is an amount equal to the

excess of the purchase price for the vehicle over the price of a comparable vehicle.

A comparable vehicle is a vehicle powered solely by a gasoline or diesel internal combustion engine and which is comparable in size and use to such vehicle.

Line 24

Enter the smaller of Line 22 or Line 23.

Line 25: Maximum credit

Enter $7,500.

If the vehicle’s gross vehicle weight rating (GVWR) is 14,000 pounds or more, then enter $40,000.

Line 26

Enter the smaller of Line 24 or Line 25.

Include this credit amount on Line 19 in Part V of Form 8936

Video walkthrough

Watch this instructional video to learn more about claiming the electric vehicle tax credit with IRS Form 8936.

Frequently asked questions

The qualified plug-in electric drive motor vehicle credit is a nonrefundable tax credit. This means that the credit can reduce your tax liability to zero, but it cannot produce a tax refund.

When you purchase your electric vehicle, you will want to obtain a clean vehicle seller report so that it can be forwarded to the IRS when you claim the credit on your personal tax return. The letter should specify the vehicle’s make, model and the tax year that it qualifies for the EV tax credit.

Where can I find IRS Form 8936?

As with other tax forms, you may find IRS Form 8936 on the IRS website. For your convenience, we’ve enclosed the latest version of the form and Schedule A in our article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!