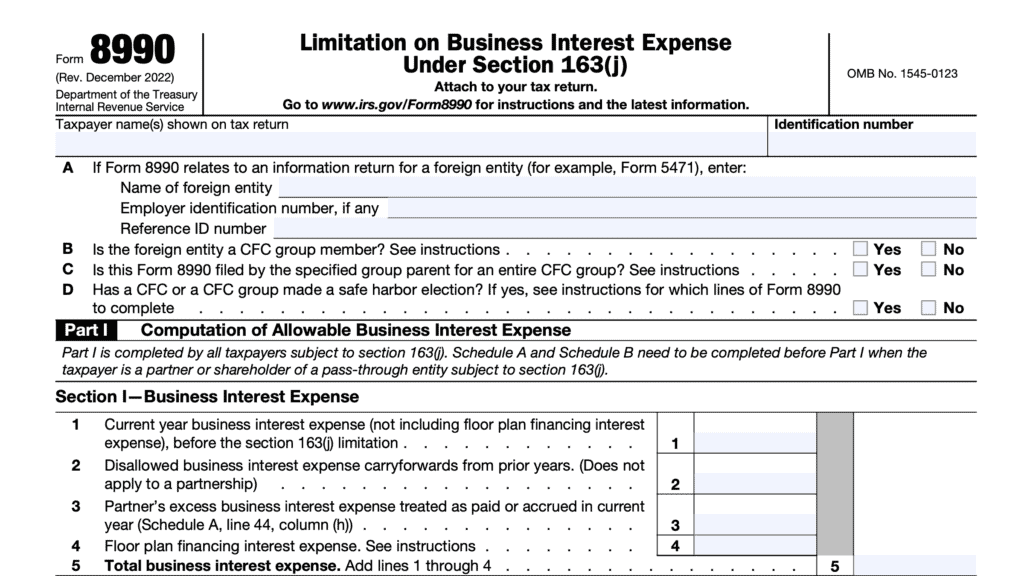

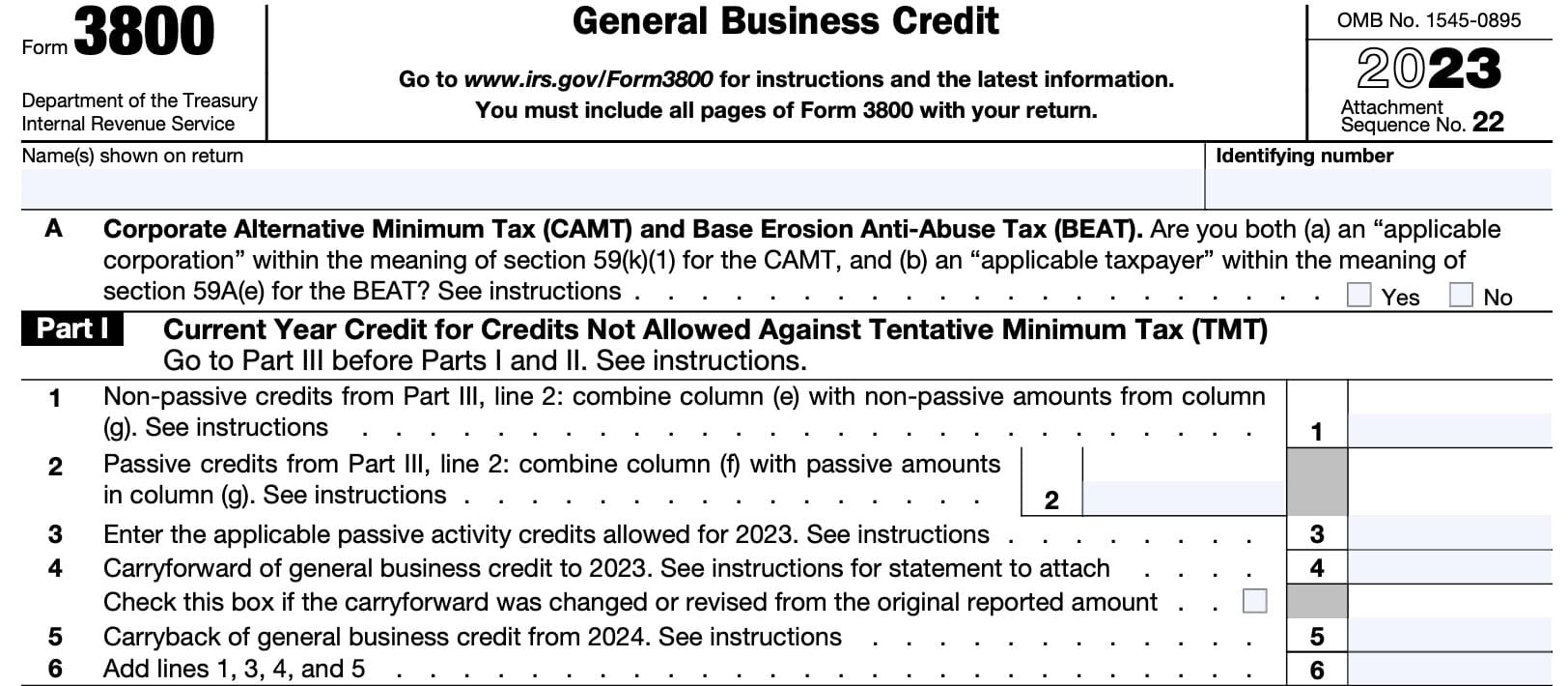

IRS Form 3800 Instructions

As an incentive for small business owners to create and grow businesses, the Internal Revenue Service allows for certain tax deductions and federal income tax credits. Most of these small business tax credits are reported on a variety of tax forms, then consolidated on IRS Form 3800, General Business Credit.

In this article, we’ll walk through this tax form in depth, to include:

- How to complete IRS Form 3800

- Different tax credits available

- Frequently asked questions about claiming business credits

Let’s start by going IRS Form 3800, step by step.

Table of contents

How do I complete IRS Form 3800?

There are six parts to this tax form:

- Part I: Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax

- Part II: Allowable Credit

- Part III: Current Year General Business Credits (GBCs)

- Part IV: Carryovers of General Business credits (GBCs) or Eligible Small Business Credits (ESBCs)

- Part V: Breakdown of Aggregate Amounts on Part III for Facility-by-Facility, Multiple Pass-Through Entities, etc.

- Part VI: Breakdown of Aggregate Amounts in Part IV

Although these Form 3800 instructions will go in chronological order, it’s important to note that before starting Part I, you must complete Parts III through VI. Once you’ve completed Part VI, you can then come back to begin Part I.

But before completing Part I, let’s look at Item A.

Item A. Corporate alternative minimum tax (CAMT) and base erosion anti-abuse tax (BEAT).

If you are both an applicable corporation within the meaning of Internal Revenue Code Section 59(k)(1)

and applicable taxpayer within the meaning of IRC Section 59A(e), check Yes.

Otherwise, check No.

Applicable corporation

According to the tax code, an applicable corporation is one that meets the average annual adjusted financial statement income test for one or more taxable years prior to the year, beginning with calendar year 2022. This means that the average adjusted financial statement for the preceding 3 year period exceeds $1 billion.

Applicable taxpayer

According to the tax code, an applicable taxpayer is one that:

- Is a corporation other than one of the following

- Regulated investment company (RIC)

- Real estate investment trust (REIT)

- S corporation

- Recorded average gross receipts of at least $500 million for the three year period ending with the preceding taxable year

- The base erosion percentage is 3% or higher

- As determined under subsection (c)(4)

Part I: Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

Once you’ve completed Parts III through VI, you can start here in Part I.

Line 1: Non-passive credits from Part III, Line 2

Enter non-passive credits from Part III, Line 2. Combine Column (e) amounts (credits from non-passive activities) with non-passive amounts from Column (g).

Line 2: Passive activity credits

This line contains passive activity credits. Combine the following:

- Part III, Line 2, Column (f): Credits from passive activities

- Part III, Line 2, Column (g): Passive amounts only

If you have credit carrybacks or carry forwards from other tax years

If applicable, enter the total of these credits from Part IV.

- Part IV, Line 2zz, Column (e): Credit carrybacks to current year

- Part IV, Line 2zz, Column (f): Credit carryforwards (excluding ESBCs)

Line 3: Applicable passive activity credits allowed

In Line 3, you’ll enter the applicable passive activity credit amount allowed from IRS Form 8582-CR, Passive Activity Credit Limitations, or IRS Form 8810, Corporate Passive Activity Loss and Credit Limitations.

The passive activity credit amount allowed on Part I, Line 3, only applies to the general business credits not allowed against TMT from Line 2. Do not include specified credits on Line 3.

If no credits are allowed, enter zero.

Line 4: Carryforward of general business credit to current tax year

Enter any carryforwards of unused tax credits that are reported from Line 2zz of Part IV, column (f).

Check the box

For each credit entered on Line 4, if the credit amount was changed or revised from the amount originally reported, check the box on this line.

See the instructions for Part IV and Part VI (if applicable) for Required statement, later.

Adjustment for the payroll tax credit

A qualified small business that elected on IRS Form 6765 to claim a portion of its research credit as a payroll tax credit must reduce its research credit carryforward by the amount elected as a payroll tax credit.

Line 5: Carryback of general business credit from future tax year

You will only enter an amount in Line 5 if carrying back business credits from later years. Enter the amount reported on Line 2zz, in Part IV.

Line 6: Total general business credits

Enter the total of the following lines:

Proceed to Part II, below.

Part II: Allowable Credit

In Part II, you’ll calculate the total allowable credit that you can take in the current year.

Line 7: regular tax before credits

In Line 7, enter your regular tax liability for the year, which you’ll find on your regular tax return.

Individuals

Individual taxpayers should enter the amounts from the following lines:

- IRS Form 1040, 1040-SR, or 1040-NR: Line 16

- IRS Schedule 2: Line 2

Corporations

Corporate shareholders will enter the amount found on IRS Form 1120, Schedule J, Part I, Line 2.

Estates & trusts

Estates and trusts will enter the sum of the following lines:

- IRS Form 1041, Schedule G: Line 1a & Line 1b

- IRS Form 8978: Line 1d

Line 8: Alternative minimum tax

If applicable, individuals will find their AMT liability on Line 11 of IRS Form 6251, Alternative Minimum Tax.

Estates and trusts will find AMT on Schedule I (IRS Form 1041), Line 54.

Line 9

Combine the totals of Line 7 & Line 8.

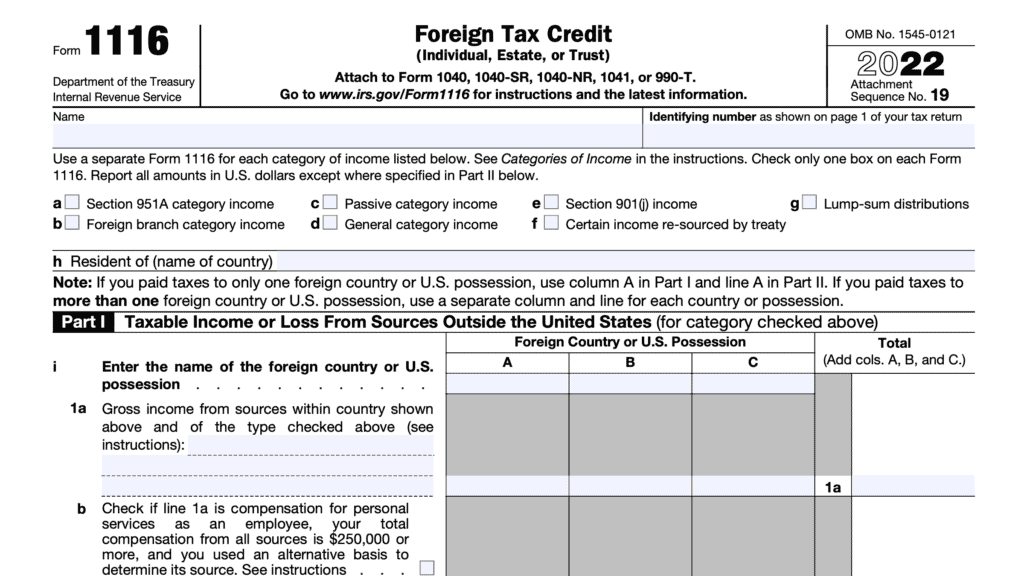

Line 10

In Line 10a, enter the total foreign tax credit as found on IRS Form 1116, Foreign Tax Credit. Corporate taxpayers will find their foreign tax credit on IRS Form 1118, Foreign Tax Credit for Corporations.

For Line 10b, enter the total allowable credit, determined as follows:

Individuals

Individuals should enter the amount from:

- IRS Form 1040, 1040-SR, or 1040-NR: Line 19

- Schedule 3, Line 2: Credit for child and dependent care expenses from IRS Form 2441, Line 11

- Schedule 3, Line 3: Education credits from IRS Form 8863, Line 19

- Schedule 3, Line 4: Retirement savings contributions credit from IRS Form 8880

- Schedule 3, Line 5a: Residential clean energy credit from IRS Form 5695, Line 15

- Schedule 3, Line 5b: Energy efficient home improvement credit from IRS Form 5695, Line 32

- Schedule 3, Line 7: Other nonrefundable credits

Estates & trusts

Estates & trusts will enter the total of any write-in credits from IRS Form Schedule G, Line 2e.

Corporations

Corporate taxpayers should enter the amount from IRS Form 1120, Schedule J, Part I, Line 5b. Corporations reporting on Form 8978 should also include the amount on Schedule J, Line 6 on Line 10b.

If Line 11 is zero or less, the corporation has no net income tax for the year. Enter zero on Line 11, skip Lines 12 through 15, and enter ‘0’ on Line 16.

For Line 10c, combine Lines 10a and 10b.

Line 11: Net income tax

Subtract Line 10c from Line 9. If zero or less, skip Lines 12 through 15 and enter ‘0’ on Line 16.

Line 12: Net regular tax

Subtract Line 10c from Line 7. If zero or less, enter ‘0.’

Line 13

Subtract $25,000 from the number in Line 12. If the result is a positive number, multiply the result by 25% and enter this number in Line 13.

Internal Revenue Code Section 38(c)(6) may apply to the following taxpayers:

- Married couples filing separate returns

- Controlled corporate groups

- Regulated investment companies

- Real estate investment trusts (REITs)

- Estates

- Trusts

Line 14: Tentative minimum tax

To calculate tentative minimum tax, taxpayers should do the following:

- Individuals: Enter the amount from IRS Form 6251, Line 9

- Corporations: Enter ‘0’

- Estates & trusts: Enter the amount from Schedule I (IRS Form 1041), Line 52

Line 15

Enter the greater of:

Line 16

Subtract Line 15 from Line 11. If the result is 0 or less, enter ‘0.’

Line 17

Enter the smaller of:

For corporations, special rules may apply if there has been an ownership change, acquisition, or reorganization. See the form instructions for additional details.

Line 18

Before completing Lines 18 through 25, you should check to see if any of the following conditions apply:

- An amount is entered for the empowerment zone employment credit on Line 3 of Part(s) III with Box A, B, C, or D checked

- Any amount is entered for the renewal community employment tax credit on Line 3 of Part III with Box C checked

- You have prior year unallowed passive activity credit carryover for the empowerment zone or renewal community employment credit

If any of the above conditions apply, multiply Part II, Line 14 by 75% and enter the result in Line 18. Otherwise, do the following:

Line 19

Enter the greater of the following:

Line 20

Subtract Line 19 from Line 11. If this results in zero or a negative number, enter ‘0.’

Line 21

In Line 21, subtract Line 17 from Line 20. If the result is zero or less, enter ‘0.’

Line 22

Combine the amounts from Line 3 of all Parts III with either Box A, C, or D checked.

Line 23

Combine the amounts from Line 3 of all Parts III with Box B checked.

Line 24: Applicable passive activity credit allowed

Enter the applicable passive activity credit allowed for the empowerment zone and renewal community employment credit allowed from either Form 8582-CR or Form 8810.

This only applies to empowerment zone and renewal community employment credits reported on Line 3, plus any prior year unallowed passive activity empowerment zone and renewal community employment credits.

If no credits are allowed, enter zero.

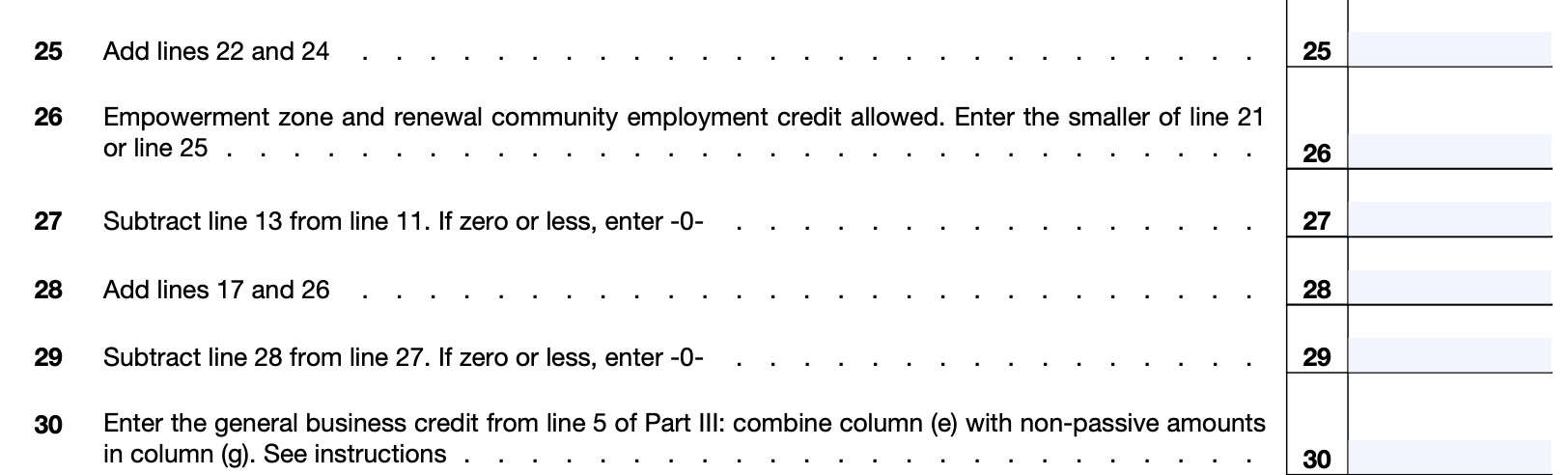

Line 25

Enter the sum of the following lines:

Line 26: empowerment zone and renewal community employment credit allowed

Enter the smaller of the following:

Line 27

Subtract Line 13 from Line 11. If the result is zero or a negative number, enter ‘0.’

Line 28

Add the following lines:

Line 29

Subtract Line 28 from Line 27. If the result is zero or a negative number, enter ‘0.’

Line 30

Enter the general business credit from Line 5 of all Parts III with Box A checked.

Line 31

Skip Line 31.

Line 32

Enter the applicable passive activity credits from Line 5 of all Parts III with Box B checked.

Line 33

Enter the applicable passive activity credit for general business credits allowed against TMT and eligible small business credits allowed from Form 8582-CR or Form 8810.

Line 34: Business credit carryforward

Enter the amount of carryforwards to the current tax year of unused credits reported on:

Line 35: Carry back of business credit from future tax year

Only use this line when filing an amended return to carryback unused credits from a future tax year.

Enter the amount reported from Line 5 of Part III with Box D checked.

Line 36

Enter the sum of the following lines:

Line 37

Enter the smaller of the following:

Line 38: Credit allowed in the current tax year

Add Line 28 and Line 37. Compare this number to the sum of the following lines:

If the number in Line 38 is smaller than the sum of the other lines, enter the Line 38 figure as indicated on your tax return:

- Individuals: Form 1040, Schedule 3, Line 6

- Corporations: Form 1120, Schedule J, Part I, Line 5c

- Estates & Trusts: Form 1041, Schedule G, Line 2b

If the Line 38 number is larger than the sum of the other lines, you may have a carryforward or carryback of tax credits that you cannot use in the current year. Refer to the form instructions on how to allocate unused credits.

Part III: General Business Credits or Eligible Small Business Credits

If you are claiming a current business credit on your tax return, you must complete the applicable lines and columns of Part III.

This requirement includes the following:

- Applicable entities and certain taxpayers

- Partnerships and S corporations making an elective payment election

- Eligible taxpayers making a transfer election under IRC Section 6418

- Transferees of a credit under Section 6418

In this section, we’ll begin by explaining each applicable column. Afterwards, we’ll discuss specific instructions for each line.

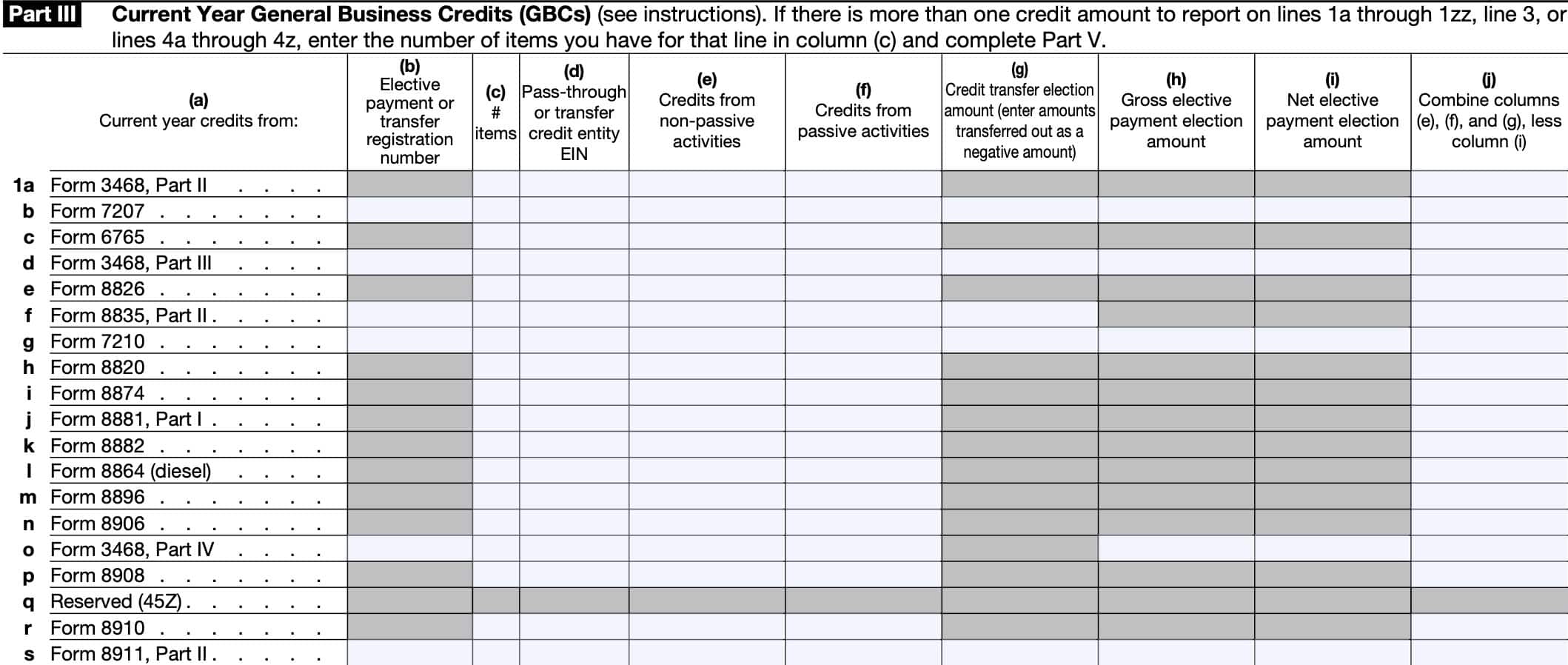

Column (a): Current year credits from

This column (a) lists the form that the business credit is reported from.

Column (b): Elective payment or transfer registration number

If an elective payment election or a transfer election has been made, enter the registration number in Column (b) as shown on the source credit form.

If there are multiple facilities for the same credit listed in Part V, enter in Column (b) of Part III the first registration number listed for that credit in Part V.

Column (c): Number of items

If you listed multiple facilities or multiple pass-through entities for any credit in Part V, enter in the number of facilities and/or pass-through entities listed for that credit in Part V. Otherwise, you can leave Column (c) blank.

Do not enter figures in the total rows for Column (c).

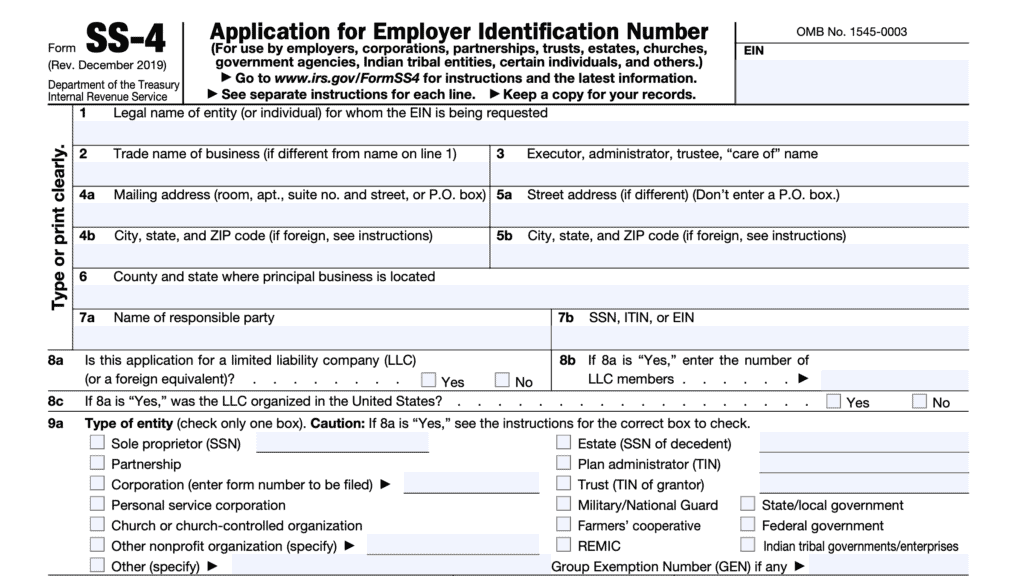

Column (d): Pass-through or transfer credit entity EIN

Complete column (d) only if you are receiving the credit on a Schedule K-1 from a pass-through entity, or receiving (as transferee) the credit from an unrelated taxpayer.

If you are reporting a credit allocated to you from a pass-through entity, enter that pass-through entity’s employer identification number (EIN) under column (d) for that credit.

Cooperatives

If you are reporting a credit reported to you on IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives, enter that cooperative’s EIN under column (d) for that credit.

Multiple pass-through entities

If there are multiple pass-through entities for the same credit, report the credit for each pass-through entity in Part V. Then enter the EIN of the pass-through entity allocating the greatest amount of the credit to you in Part III, column (d).

Section 6418

If you are reporting a transferred credit received from an eligible taxpayer or transferor under IRC Section 6418, enter that transferor entity’s employer identification number (EIN) under column (d) for that credit.

Multiple transferor entities

If there are multiple transferor entities for the same credit, report the credit for each transferor entity in Part V and then enter the EIN of the transferor entity that sold the greatest amount of the credit to you in Part III, column (d).

Column (e): Credits from non-passive activities

Enter the credits that for you are non-passive based on your level of participation in the activity.

Column (f): Credits from passive activities

Enter the current year passive activity credits allowable to you before applying the passive activity credit limitations of IRS Form 8582-CR or IRS Form 8810.

Column (g): Credit transfer election amount

Indicate the transfer election by entering the amount transferred by you to another entity as a negative number.

If you are a transferee, enter the amount transferred to you as a positive number.

Column (h): Gross elective payment election amount

Enter the amount of the elective payment election based on the total credit for which an elective payment election is being made before calculating the net elective payment election amount and before considering limitations from Part II.

The figures for Columns (i) and (j) do not flow directly from the columns to the left. Don’t complete Columns (i) and (j) until you have completed the following, in order:

- Part III, columns (a) through (h)

- Part IV

- Part V

- Part VI (if applicable

- Part I

- Part II

Column (i): Net elective payment election amount

Your net elective payment election amount is equal to the lesser of:

- The sum of all current credits for which an elective payment election is made, or

- The excess of the total available carryforward credits in Part IV and current business credits on Line 6 of Part III over the amount of otherwise allowable credits included on Line 38

Column (j): Total of Columns (e), (f), and (g), minus column (i)

If you are a partnership or S corporation that only transferred a portion of any eligible credit, report the non-transferred portion shown in column (j) on the applicable line of your Schedules K and K-1.

Complete columns (b), (g), (h), and (i) of Part III (as applicable) only if you:

- Are making the elective payment election under IRC Section 6417,

- Are making the transfer election under Section 6418 as a transferor, or

- Receive a credit from a transfer as transferee

Limitations for certain credits

Before reporting individual credits, it’s worth noting that some credits come with dollar limitations. These credits include:

- IRS Form 3468, Part VI, Line 11c: There is a $4,000 limit on qualified small wind energy property

- IRS Form 8826, Line 8: A $5,000 limit applies to the overall tax credit as reported on Part III, Line 1e

- IRS Form 8882, Line 7: A $150,000 limit applies to the overall tax credit reported on Part III, Line 1k

Line 1

In Line 1, you’ll enter the applicable tax credit for each row, in column (c). If you are claiming the tax credit from a pass-through entity such as a partnership or S corporation, then you’ll also enter the employer identification number of that passthrough entity in column (b).

If there is any line where that particular credit comes from more than one source, you must file a separate Part III for each passthrough entity.

For each credit listed below, we’ve included specific instructions from the IRS website.

Special rules for cooperatives

For cooperatives as described in IRC Section 1381(a), special rules may apply. You must allocate any excess investment credit (above your tax liability limit) to your patrons. Refer to the form instructions for calculating this excess tax credit if this situation applies to you. This applies to the following:

- Line 1a

- Line 1d

- Line 1o

- Line 4a

- Line 4k

Line 1a: Form 3468, Part II

Enter any qualifying advanced coal project credit and qualifying gasification project credit from Part II of IRS Form 3468, Investment Credit.

Line 1b: Form 7207

Enter the amount of advanced manufacturing production credit calculated on IRS Form 7207.

Line 1c: Form 6765

A qualified small business must complete Form 3800 before completing Section D of IRS Form 6765 if claiming the payroll tax credit.

Eligible small businesses will enter the amount of tax credit for increasing research activities calculated on IRS Form 6765 on Line 4i, below. All other taxpayers will enter their research credit on Line 1c.

Research credit limitation

For individuals, the amount of research credit that you can claim on either Line 1c or Line 4i is limited to the amount of tax attributable to your taxable income from the sole proprietorship or your interest in the pass-through entity.

To calculate this credit limit, divide your taxable income attributable to your passthrough entity by the total taxable income for the year. Multiply this fraction by the dollar amount in Line 11.

This represents the amount of the credit you may claim this year.

Line 1d: Form 3468, Part III

Enter the amount of qualifying advanced energy project credit under Section 48C, as calculated in Part III of IRS Form 3468.

Line 1e: Form 8826

When reporting disabled access credit calculated on IRS Form 8826, do not enter more than $5,000 in Line 1e.

Line 1f: Form 8835, Part II

Cooperatives, estates, and trusts: Enter the applicable part of the amount from IRS Form 8835, Line 17.

All other taxpayers: Enter the applicable part from Form 8835, Line 15.

Do not enter any amounts already included on Part III, Line 4e, below.

Line 1g: Form 7210

Enter the amount of clean hydrogen production credit calculated on IRS Form 7210.

Line 1h: Form 8820

Enter the amount of orphan drug credit claimed on IRS Form 8820.

Line 1i: Form 8874

Enter the amount of new markets tax credit calculated on IRS Form 8874.

Line 1j: Form 8881, Part I

When reporting the tax credit for small employer pension plan start up costs and auto-enrollment for retirement savings, enter amount from Part I of IRS Form 8881.

Line 1k: Form 8882

If reporting the tax credit for employer-provided child care facilities and services from IRS Form 8882, do not enter more than $150,000 in column (c) on all combined Parts III.

Line 1l: Form 8864 (diesel)

Enter the amount of biodiesel, renewable diesel, or sustainable aviation fuel credit calculated on IRS Form 8864.

Line 1m: Form 8896

Enter the amount of low sulfur diesel fuel production tax credit calculated on IRS Form 8896.

Line 1n: Form 8906

Enter the amount of distilled spirits credit calculated on IRS Form 8906.

Line 1o: Form 3468, Part IV

Enter the amount of advanced manufacturing investment credit under Section 48D, as calculated on IRS Form 3468, Part IV.

Line 1p: Form 8908

Enter the amount of energy efficient home tax credit calculated on IRS Form 8908.

Line 1q: Reserved

This line is reserved for future use.

Line 1r: Form 8910

Enter the amount of alternative motor vehicle credit calculated on IRS Form 8910.

Line 1s: Form 8911, Part II

Enter the amount of alternative fuel vehicle refueling property tax credit calculated on IRS Form 8911, Part II.

Line 1t: Form 8830

Enter the amount of enhanced oil recovery credit claimed on IRS Form 8830.

Line 1u: Form 7213, Part II

Enter the amount of zero-emission nuclear power production credit under Section 45U, as reported on IRS Form 7213, Part II.

Line 1v: Form 3468, Part V

Do not enter anything in this line.

Line 1w: Form 8932

Enter the amount of employer differential wage payments claimed on IRS Form 8932.

Line 1x: Form 8933

Enter the amount of carbon oxide sequestration credit as calculated on IRS Form 8933.

Line 1y: Form 8936, Part II

Enter the amount of credit for business/investment use part of new clean vehicles from IRS Form 8936, Part II.

Line 1z: Reserved

Do not enter anything in Line 1z.

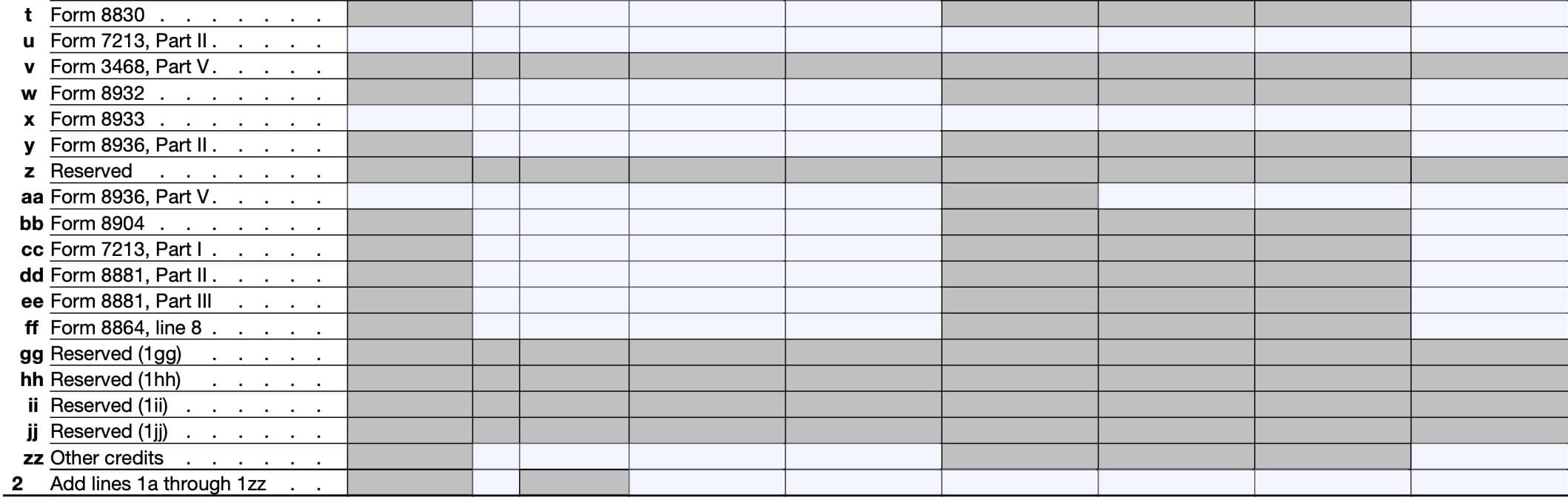

Line 1aa: Form 8936, Part IV

Enter the amount of credit for previously owned vehicles from IRS Form 8936, Part IV.

Line 1bb: Form 8904

Enter the credit amount from Line 8 on IRS Form 8904 Credit, for Oil and Gas Production from Marginal Wells.

Line 1cc: Form 7213, Part I

Enter the credit for production from advanced nuclear power facilities, Section 45J as calculated on IRS Form 7213, Part I.

Line 1dd: Form 8881, Part II

Enter the amount of small employer auto-enrollment credit calculated on IRS Form 8881, Part II.

Line 1ee: Form 8881, Part III

Enter the amount of military spouse participation credit as calculated on IRS Form 8881, Part III.

Line 1ff: Form 8864, Line 8

Enter the amount of sustainable aviation fuel credit from IRS Form 8864, Line 8.

Line 1gg through Line 1jj

Reserved for future use.

Line 1zz: Other credits

Taxpayers use Line 1zz to report other tax credits not previously listed here, and not listed elsewhere on this form.

Line 2

Add Lines 1a through 1zz. Enter the totals in the respective columns in Line 2.

Line 3

Enter any carryforward of the renewal community employment tax credit from IRS Form 8844 here and on the applicable line of Part II.

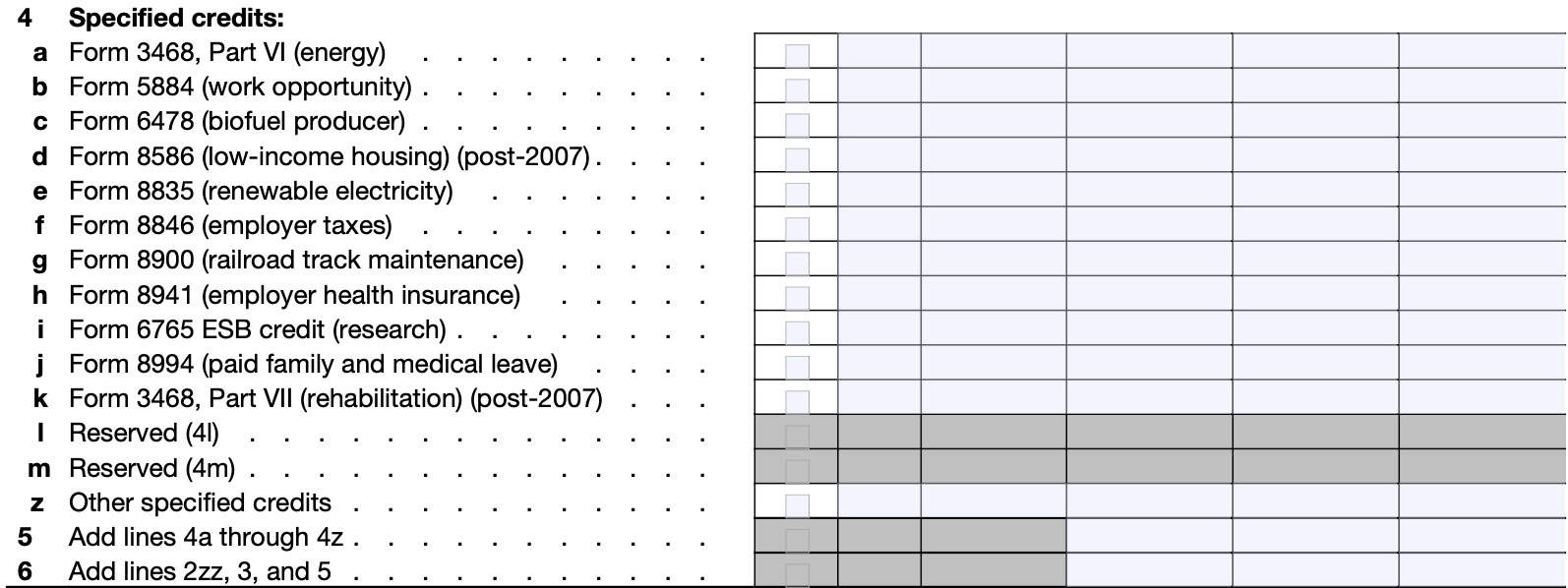

Line 4: Specified credits

Here, you’ll enter the amount of the specified credit on the applicable line.

Line 4a: Form 3468, Part VI

Report the energy credit under Section 48 as reported on Part VI on IRS Form 3468, as applicable.

Line 4b: Form 5884

Report the work opportunity credit from IRS Form 5884.

Line 4c: Form 6478

Report the biofuel producer tax credit reported on IRS Form 6478.

Line 4d: Form 8586

Report the low-income housing credit from IRS Form 8586.

Line 4e: Form 8835, Part II

Report the renewable electricity production credit from IRS Form 8835, Part II.

Line 4f: Form 8846

Report the credit for taxes paid as recorded on from IRS Form 8846.

Line 4g: Form 8900

Report the qualified railroad track maintenance credit from IRS Form 8900.

Line 4h: Form 8941

Report the credit for small employer health insurance premiums as follows:

Tax-exempt eligible small employers (except certain farmers’ cooperatives): Do not report your credit on IRS Form 3800. Instead, report this on IRS Form 990-T, Exempt Organization Business Income Tax Return.

If your only source of credit for Line 4h is from pass-through entities, do not complete IRS Form 8941. Instead, enter the credit directly on Line 4h.

Otherwise, enter the credit from either Line 16 or Line 18 on Form 8941.

Line 4i: Form 6765 ESB credit

Report the eligible small business portion of the increasing research activities tax credit from IRS Form 6765.

Line 4j: Form 8994

Report the employer credit for paid family and medical leave from IRS Form 8994.

Line 4k: Form 3468, Part VII

Enter the energy credit under Section 48 from Part VII of IRS Form 3468.

Line 4l and Line 4m: Reserved

This line is reserved for future use. Do not use these li to report tax credits.

Line 4z: other specified credits

Enter other specified credits not mentioned elsewhere in Line 4z.

Line 5

Add Lines 4a through 4z. Enter the total on Line 5.

Line 6

Add the following lines from Part III:

Enter the result here and on the applicable line of your respective returns.

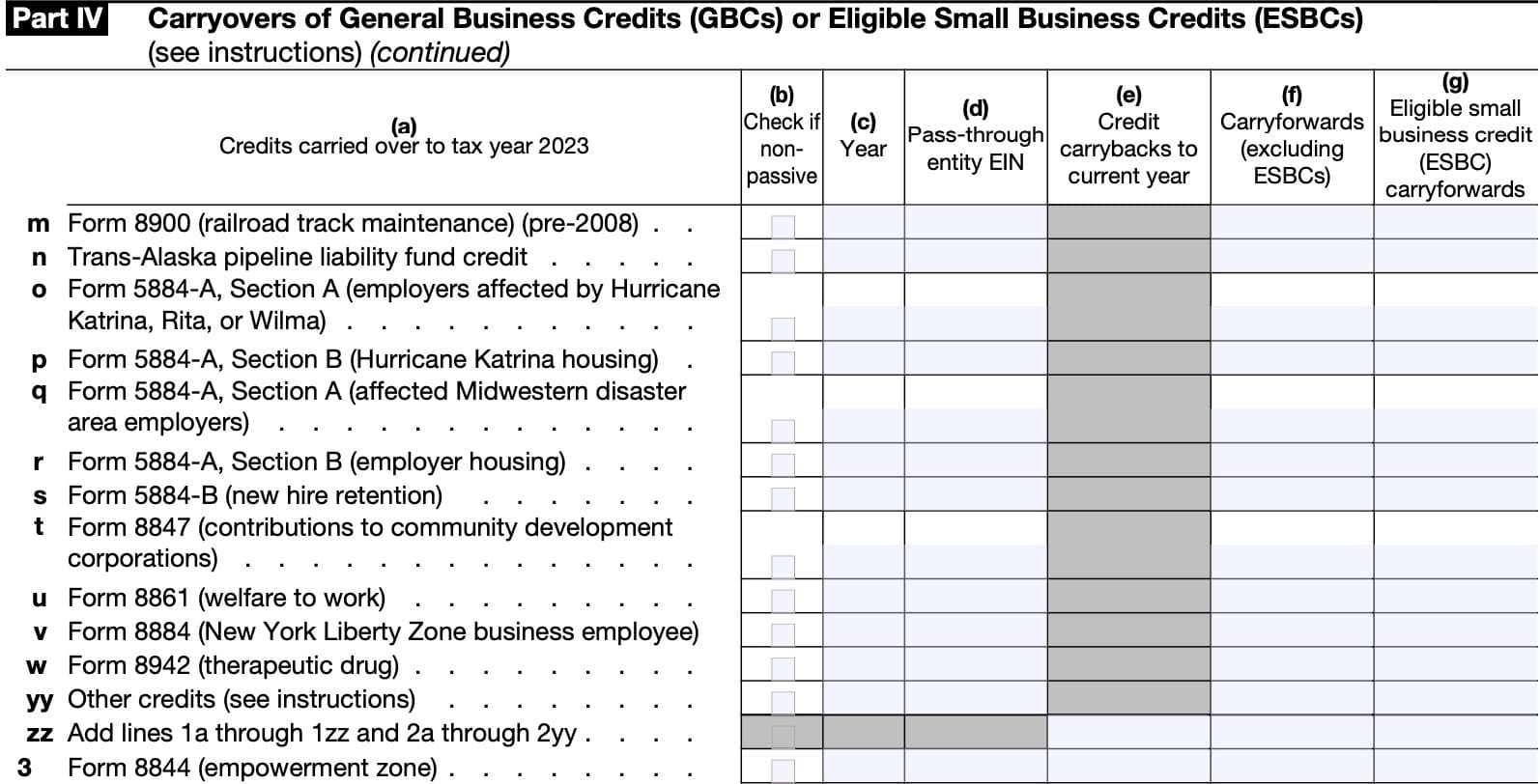

Part IV: Carryovers of General Business Credits (GBCs) or Eligible Small Business Credits (ESBCs)

In Part IV, you will enter relevant information concerning carryovers of general business credits (GBCs) or eligible small business credits (ESBCs), as they are shown in your business records before applying the credits to your current year tax liability.

Line 1

The forms mentioned on these lines are listed in the same order as in Part III. For each applicable, you’ll enter the appropriate information in each column.

Column (a): Credits carried over to the tax year

This column lists the credits from previous years (or subsequent year, for carrybacks). Keywords from the credit title are in parentheses for your benefit.

Column (b): Check if non-passive

Check the box if the credit is non-passive based on your level of participation.

Column (c): Year

Enter the earliest applicable year.

Column (d): Pass-through entity EIN

If the credit was allocated to you from a pass-through entity, enter the EIN of the pass-through entity.

If multiple pass-through entities are listed for the credit in Part VI, enter the EIN of the entity allocating the greatest amount of the credit to you.

Column (e): Credit carrybacks to current year

This column is used when Form 3800 is being submitted with an amended return. Enter the amount carried back from a subsequent year to the year for which you are filing the amended return.

In general, no part of the unused credit for any year attributable to any credit can be carried back to any tax year before the first tax year for which that credit was first allowable.

Column (f): Carryforwards (excluding ESBCs)

Include in this column carryforwards from all prior years, excluding ESBCs.

Column (g): Eligible small business credit (ESBC) carryforwards

Include in this column only carryforwards of ESBCs claimed under former Section 38(c) for tax year 2010.

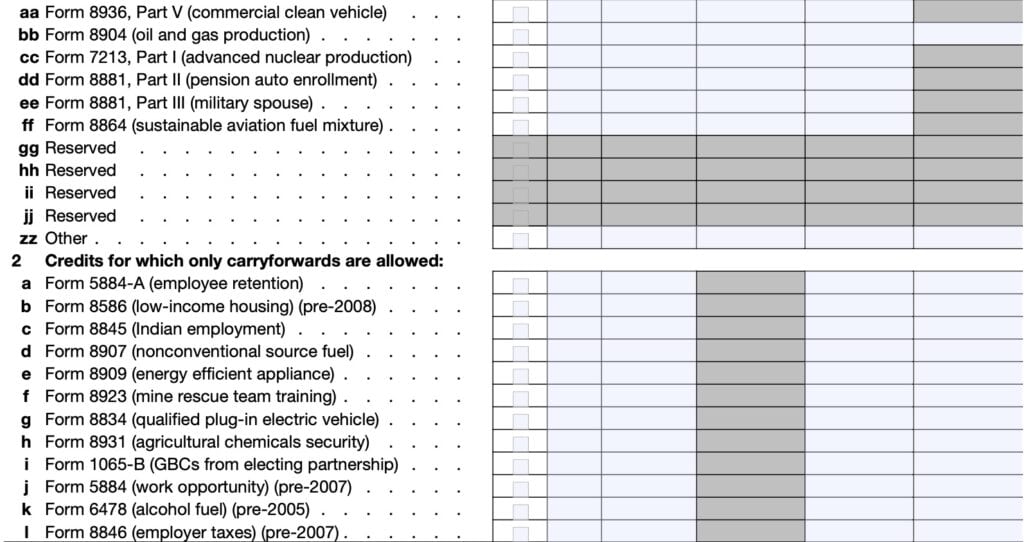

Line 2: Credits for which carry forwards are allowed

Here, you’ll complete the applicable lines for the following forms, where only carry forwards are allowed:

- Line 2a: IRS Form 5884-A (employee retention)

- Line 2b: IRS Form 8586 (low-income housing, pre-2008)

- Line 2c: IRS Form 8845 (Indian employment)

- Line 2d: IRS Form 8907 (nonconventional source fuel)

- Line 2e: IRS Form 8909 (energy efficient appliance)

- Line 2f: IRS Form 8923 (mine rescue team training)

- Line 2g: IRS Form 8834 (qualified plug-in electric vehicle)

- Line 2h: IRS Form 8931 (agricultural chemicals security)

- Line 2i: IRS Form 1065-B (GBCs from electing partnership)

- Line 2j: IRS Form 5884 (work opportunity) (pre-2007)

- Line 2k: IRS Form 6478 (alcohol fuel)

- Line 2l: IRS Form 8846 (employer taxes) (pre-2007)

- Line 2m: IRS Form 8900 (railroad track maintenance) (pre-2008)

- Line 2n: Trans-Alaska pipeline liability fund credit

- Line 2o: IRS Form 5884-A, Section A (employers affected by Hurricane Katrina, Rita, or Wilma)

- Line 2p: IRS Form5884-A, Section B (Hurricane Katrina housing)

- Line 2q: IRS Form 5884-A, Section A (affected Midwestern disaster area employers)

- Line 2r: IRS Form 5884-A, Section B (employer housing)

- Line 2s: IRS Form 5884-B (new hire retention)

- Line 2t: IRS Form 8847 (contributions to community development corporations)

- Line 2u: IRS Form 8861 (welfare to work)

- Line 2v: IRS Form 8884 (New York Liberty Zone business employee)

- Line 2w: IRS Form 8942 (therapeutic drug)

- Line 2yy: Other credits

- Use Line 2yy for the carryforward of any credit not listed for which only carryforwards are generally allowed, and write the name and form number of the credit on line 2yy in column (a).

Line 2zz

Add Lines 2a through 2yy for each column. Enter the respective totals here.

Line 3: Form 8844 (empowerment zone)

Line 4

As applicable, enter the corresponding figures in each line for the following specified credits:

- Line 4a, Form 3468, Part VI (energy)

- Line 4b, Form 5884 (work opportunity)

- Line 4c, Form 6478 (biofuel producer)

- Line 4d, Form 8586 (low-income housing) (post-2007)

- Line 4e, Form 8835 (renewable electricity)

- Line 4f, Form 8846 (employer taxes)

- Line 4g, Form 8900 (railroad track maintenance)

- Line 4h, Form 8941 (employer health insurance)

- Line 4i, Form 6765 ESB credit (research)

- Line 4j, Form 8994 (paid family and medical leave)

- Line 4k, Form 3468, Part VII (rehabilitation) (post-2007)

- Line 4z, other specified credits

Line 5

Add Lines 4a through 4z. Enter the total here.

Line 6

Add the following and enter the total in Line 6:

- Line 2zz

- Line 3

- Line 5

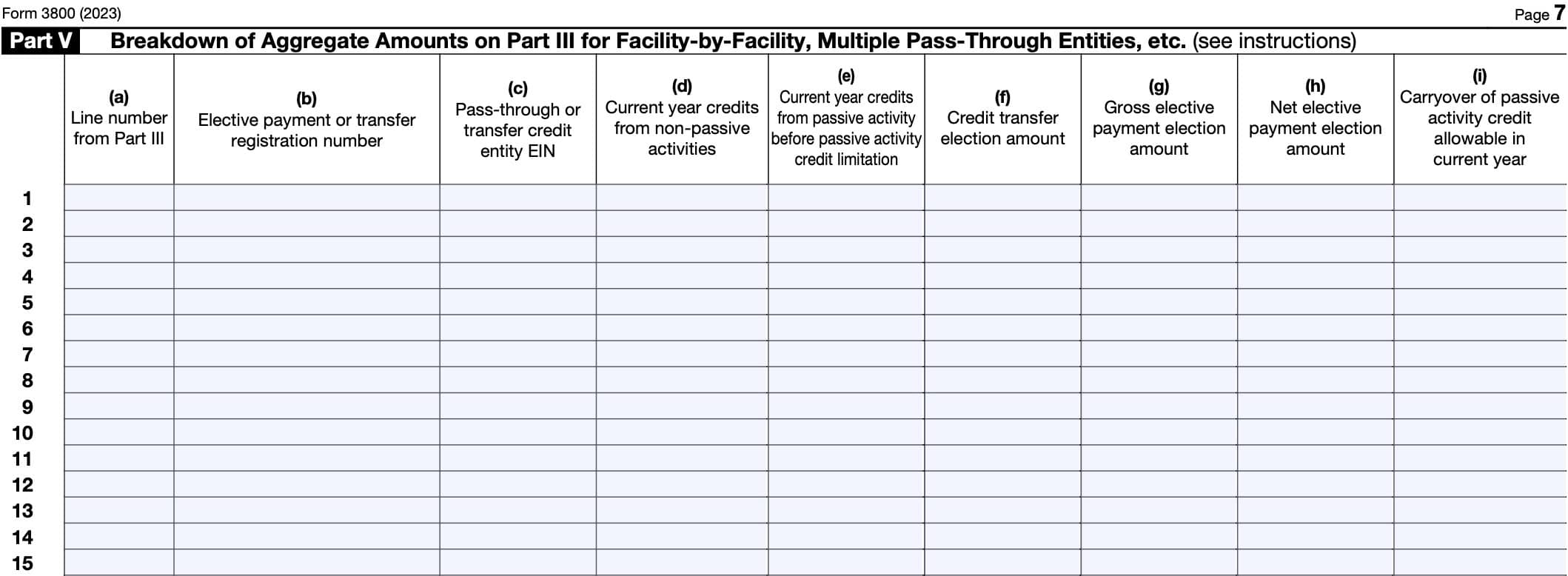

Part V: Breakdown of Aggregate Amounts on Part III for Facility-by-Facility, Multiple Pass-Through Entities, etc.

Part VI: Breakdown of Aggregate Amounts in Part IV

Video walkthrough

Watch this instructional video for more detail on claiming business credits with IRS Form 3800.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

IRS Form 3800 may contain tax credits from multiple tax years. The proper order for using tax credits in a given year is: carryforwards (earliest years first), general business credit earned in the current year, carrybacks from a future taxable year.

Some tax credits may only be available to an eligible small business. An eligible small business can be a partnership, sole proprietorship, or corporation whose stock is not publicly traded. For the 3-year period prior to the year of the credit, gross receipts cannot exceed an average of $50 million per year.

Depending on your situation, there may be multiple Parts III. The IRS instructions state that you should place your pages in the following order: Page 1, Page 2, Part III with Box I checked, All Parts III with Box A checked, All Parts III with Box B checked, Part III with Box C checked, Part III with Box D checked, and Part III with Box G checked.

Where can I find IRS Form 3800?

You may download this tax form from the IRS website. For your convenience, we’ve attached the latest version of this document as a PDF file in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!