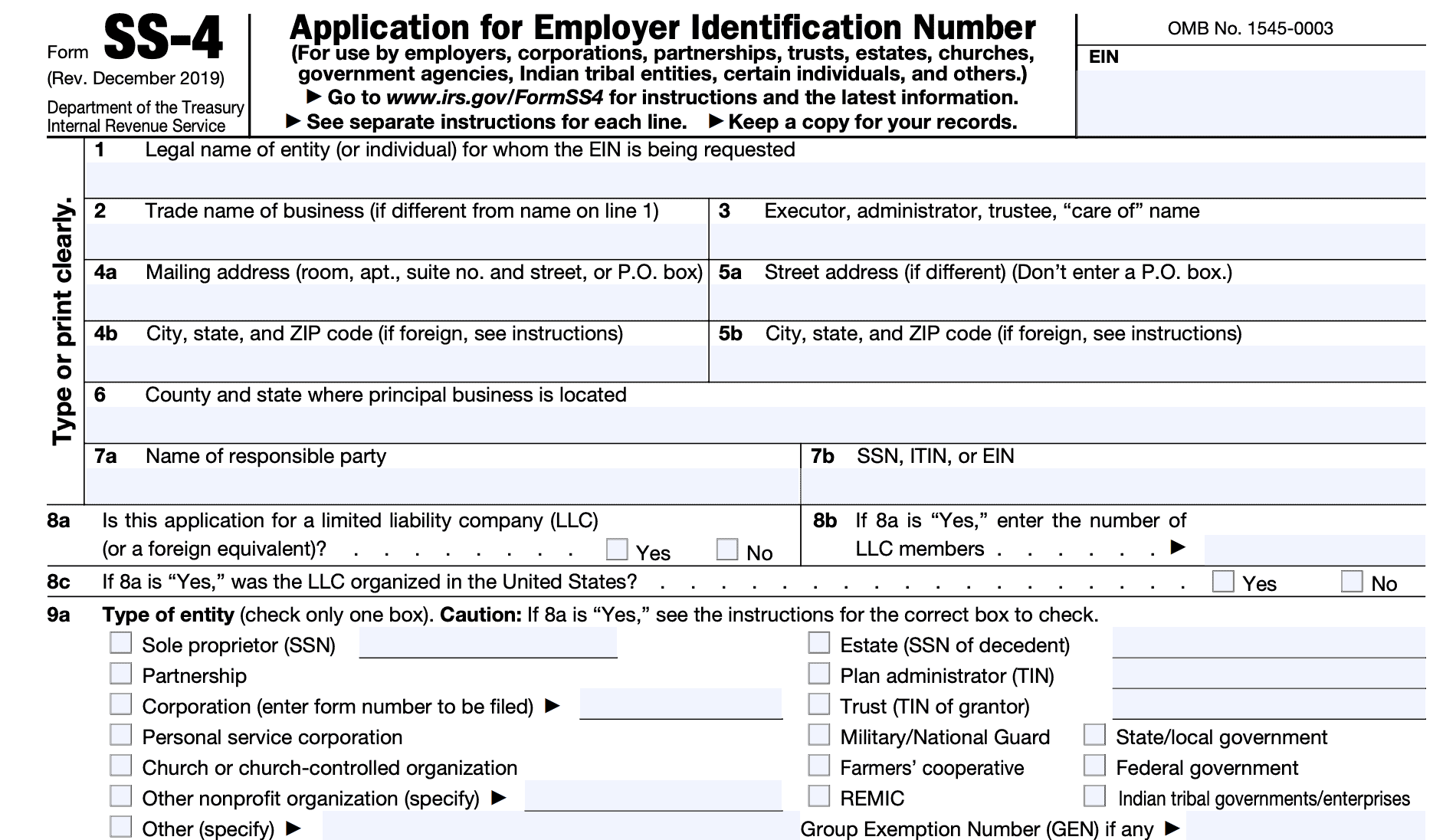

Form SS-4 Instructions

The Internal Revenue Service requires all taxpayer entities to have a federal taxpayer identification number. Many businesses, trusts, and other entities might have to obtain an employer identification number, or EIN. You may apply online or by using Form SS-4.

In this article, we’ll go over SS-4 in depth, including how to complete and submit the form, frequently asked questions, and other important details.

Let’s start with step by step instructions on how to use Form SS-4 to obtain your EIN.

Table of contents

How do I complete Form SS-4?

Let’s walk through this one-page form, line by line.

Line 1: Legal name of entity

Enter the legal name of your business or individual applying for the employer identification number. The name should be exactly as it appears on the applicable legal document, such as a Social Security card or trust document.

Line 2: Trade name of business

If different from the name in Line 1, enter the trade name of the business entity. This may also be the “doing business as” or DBA name.

Line 3

Enter the name of the responsible party. For a trust, this should be the trustee.

For estates, you may enter the name of one of the following:

- Personal representative

- Administrator

- Estate executor

Line 4: Address

Enter the mailing address for the entity’s correspondence. If you completed Line 3, enter the address of the person named in Line 3.

If the entity is located outside the United States, include the city, province or state, postal code, and name of country. Do not abbreviate the country’s name.

Line 5: Street address

Enter the entity’s physical address only if different from the address provided in Line 5.

Line 6: County & state

Enter the entity’s principal place of business, or location here.

Line 7: Responsible party

In Line 7a, enter the full name of the responsible party. For Line 7b, enter a valid taxpayer identification number on the responsible party’s behalf, as applicable:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Employer identification number (EIN)

What is a responsible party?

According to the IRS instructions, a responsible party is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. Unless the applicant is a government entity, the responsible person must be a natural person or individual, not an entity.

Line 8: LLC information

For Line 8a, answer Yes or No, as applicable. If you answer ‘No’ to Line 8a, proceed to Line 9. If you answered ‘Yes,’ you must answer Lines 8b and 8c.

In Line 8b, enter the number of LLC members. If the LLC is owned completely by an individual and his/her spouse in a community property state, and the couple chooses to treat the LLC as a disregarded entity, you may enter ‘1.

For Line 8c, annotate whether the LLC was created in the United States.

Line 9: Type of entity

Check the box that best describes the type of entity applying for an EIN.

Sole proprietor

Check here if you file Schedule C or Schedule F and either of the following applies:

- You have a qualified plan

- You are required to file excise, employment, alcohol, tobacco, or firearms returns, or

- You are a payer of gambling winnings

Enter your SSN or ITIN in the space provided.

Corporation

Check this box for any corporation other than a personal service corporation. Enter the income tax form number to be filed, such as Form 1120 or Form 1120-S.

Personal service corporation

Check this box if the following apply:

- The principal activity of the entity during the testing period is the performance of personal services primarily by the employee-owners, and

- The employee-owners own at least 10% of the market value of the corporation’s outstanding stock.

Personal services include the performance of services in the following fields:

- Accounting

- Actuarial science

- Architecture

- Consulting

- Engineering

- Health (including veterinary medicine)

- Law

- Performing arts

Estate

Enter the decedent’s SSN or the ITIN in the line provided.

Plan administrator

Enter the plan administrator’s TIN in the space provided if the plan administrator is an individual.

Other

For other entities, you may need to refer to the form instructions. If not specifically listed, enter the type of entity and type of return filed. Do not enter ‘N/A.’

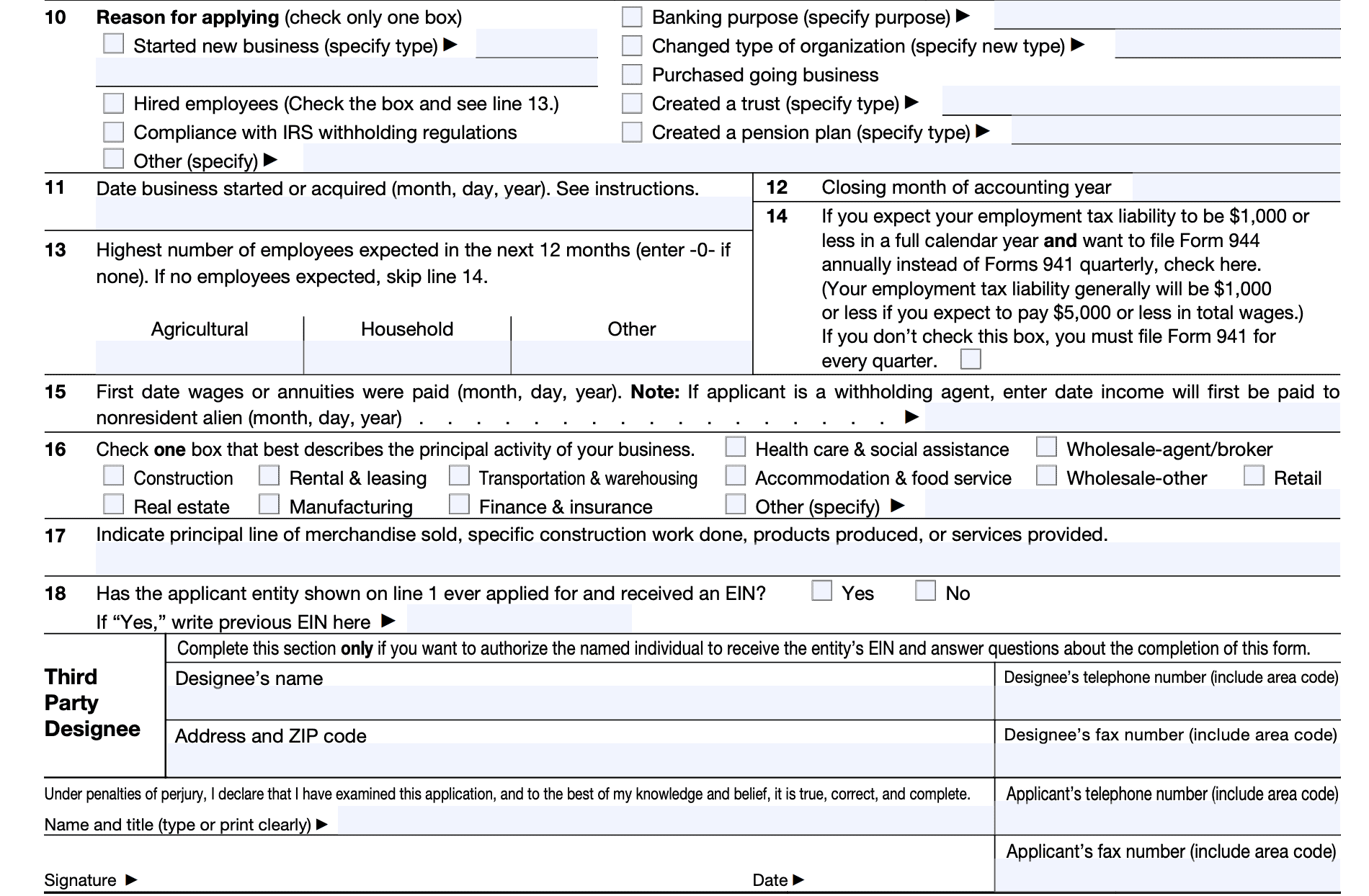

Line 10: Reason for applying

Check one box only. Do not enter ‘N/A.’

Line 11: Date business started or acquired

If you’re starting a new business, enter the business’s starting date. If you acquired an existing business that is already operating, enter the acquisition date of the business.

For foreign applicants, this date represents the date you began or acquired a business in the United States.

If the ownership of your business changes, enter the date of new ownership.

Line 12: Closing month of accounting year

Enter the last month of your accounting year or tax year. This can be a calendar year or fiscal year.

- Calendar year: A calendar year is 12 consecutive months ending on December 31

- Fiscal year: A fiscal year is 12 consecutive months ending on the last day of any month other than December

For individuals, this will generally be a calendar year. For other entities, you may need to refer to the Form instructions if you do not know which date your accounting year ends.

Line 13: Employees

Enter a number in each box (even if that number is zero). If you do not expect employees, you may skip Line 14.

Line 14

Check this box only if:

- You expect your employment tax liability to be $1,000 or less in a full calendar year, and

- You want to file Form 944 on an annual basis instead of quarterly Forms 941

Your employment tax liability will probably be $1,000 or less if you expect to pay $5,000 or less in total wages for the calendar year. If you do not check the box in Line 14, you must file quarterly employment taxes on Form 941.

Line 15

If the business has employees, enter the date that the business began to pay wages or annuities. For foreign or international applicants, this represents the date you first started paying wages to employees in the United States.

If the business does not have employees, you may enter ‘N/A.’

Line 16: Principal activity of business

Check the box that best describes the principal activity of the applicant’s business. If none of the listed boxes apply, check the ‘Other’ box and specify the principal activity in the space provided.

Line 17

Use Line 17 to describe the principal business in more detail. You must enter a description in Line 17.

Line 18

If the applicant was previously issued a separate EIN, enter that number here.

Third party designee

Only complete this section if you want to authorize the named individual to answer questions about the completion of Form SS-4 and receive the newly assigned EIN.

Signature field

The application must be signed by someone authorized to do so on the entity’s behalf.

Individual

The individual filing must sign, if filing as the individual owner of a sole proprietorship, or as the sole owner of a limited liability company

Corporation

The president, vice-president, or another corporate officer must sign on behalf of a corporation.

Partnership, government entity, or other unincorporated organization

A responsible and authorized member or officer must sign.

Trusts & estates

The fiduciary must sign on behalf of a trust or estate.

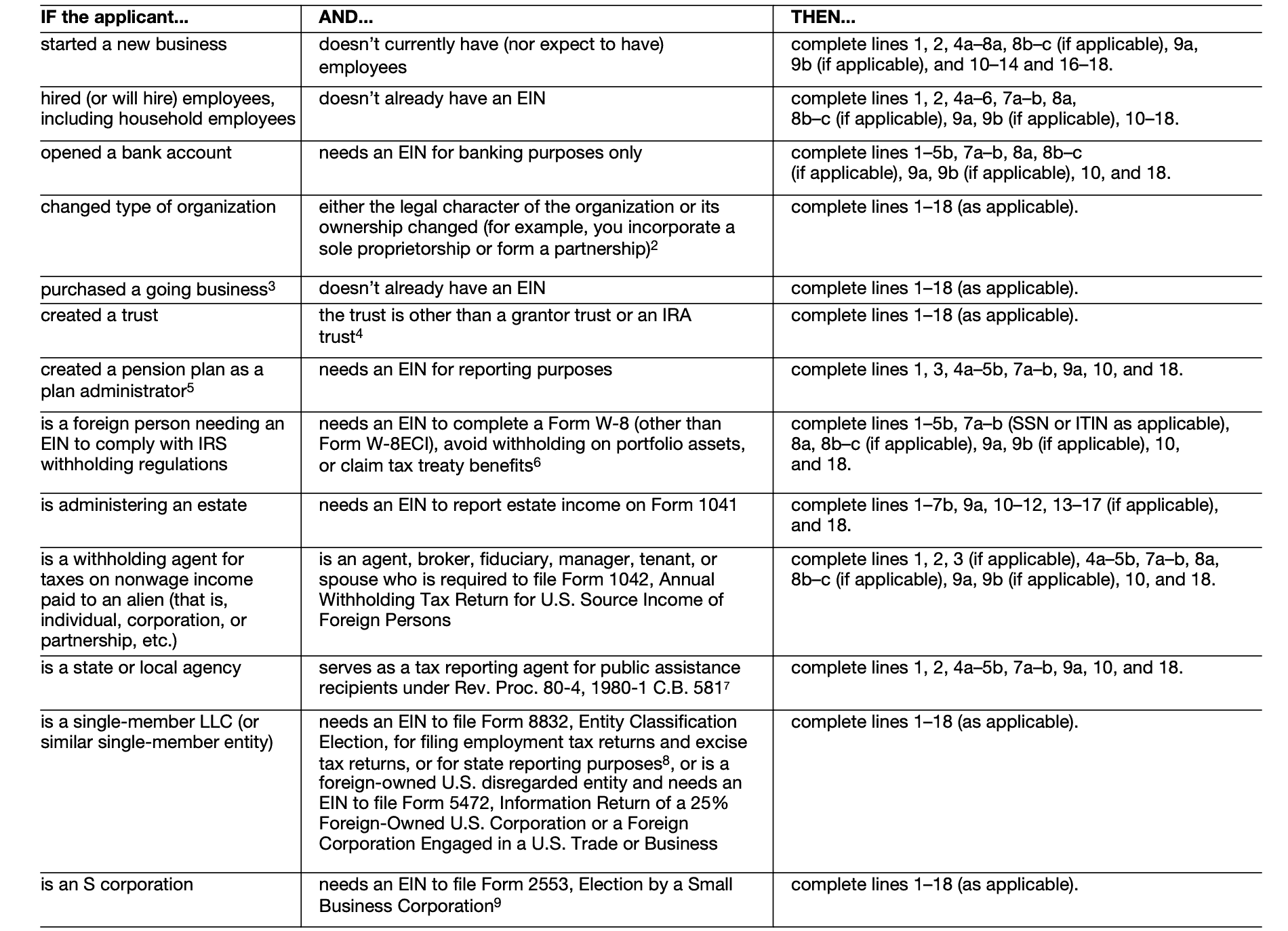

Do I need an EIN?

On the second page of the form, there is a section marked, “Do I need an EIN?” This section helps taxpayers determine whether they need to apply for an EIN, based upon their situation.

For example, a taxpayer who recently purchased a business, but does not already have an EIN must complete the entire application.

Below is the entire list of scenarios from the form itself.

Video walkthrough

Watch this instructional video to learn more about using Form SS-4 to obtain an EIN.

Frequently asked questions

If your legal residence is in the United States or a U.S. possession, you may submit an online application through the IRS website. You do not need to file an SS-4 Form to obtain an EIN number.

An EIN, or employer identification number, is a nine-digit number assigned to sole proprietors, corporations, estates, trusts, or other entities for tax filing purposes.

Form SS-4, Application for Employer Identification Number, is the paper form taxpayers may use to receive an Employer Identification Number (EIN), when they cannot apply for one online.

If you do not have an EIN by the time your federal tax return is due, simply write “Applied For” and the date you applied in the space shown. Do not use your SSN as an EIN.

You may mail your completed form to:

Internal Revenue Service

Attn: EIN Operation (international taxpayers use, Attn: EIN International Operation)

Cincinnati, OH 45999

If sending the form by fax, use the following fax number: (855) 641-6935. International filers refer to the form instructions for additional guidance.

If you apply through the IRS website, you may get your EIN back immediately. If you file by paper form, it may take 4 to 5 weeks before you hear back on the status of your application.

Where can I find a copy of Form SS-4?

You may find a copy of Form SS-4 on the IRS website. For your convenience, we’ve included the latest version of this form in the article, just below.