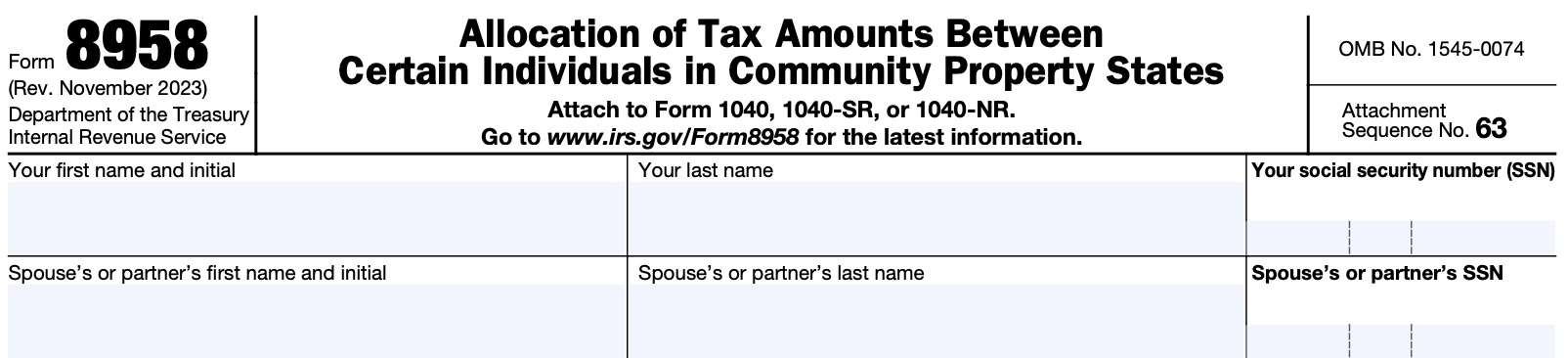

IRS Form 8958 Instructions

If you live in a community property state, or are a registered domestic partner, and you file separate tax returns, then you may need to file IRS Form 8958, Allocation of Tax Amounts Between Certain Individuals in Community Property States.

In this educational article, we’ll help you understand IRS Form 8958, including:

- How to complete and file IRS Form 8958

- How to classify various items of income, tax, deductions, and credits

- Frequently asked questions about community property taxes

Let’s start with a top-down review of this tax form.

Table of contents

How do I complete IRS Form 8958?

This two-page tax form is fairly straightforward. Let’s start with the taxpayer information at the top.

Taxpayer information

For each spouse, enter the following information:

- First name and initial

- Last name

- Social Security number

Before we get into each line, we should take some time to discuss the three columns.

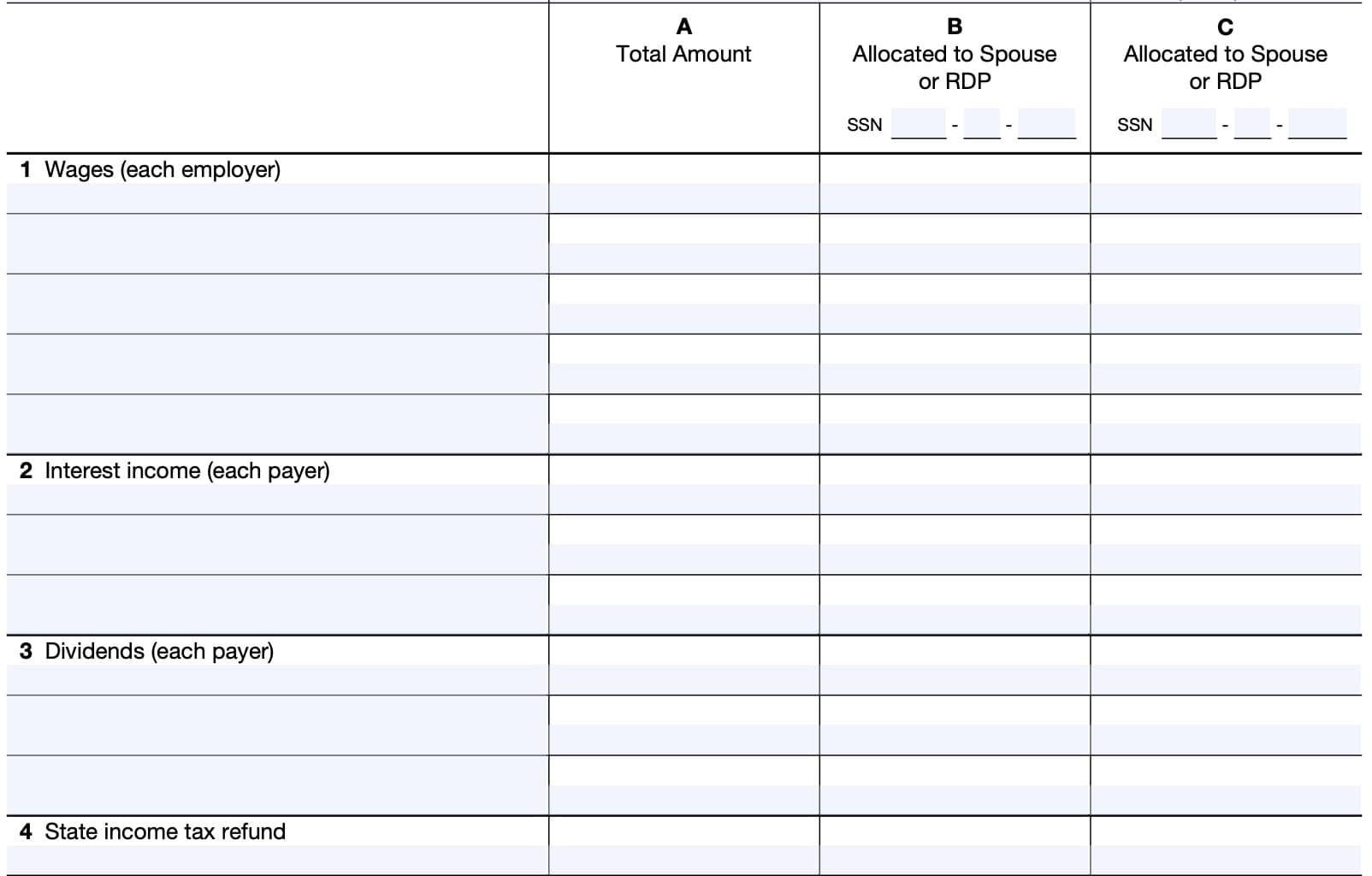

Meaning of each column on Form 8958

Column A

Column A represents the total amount of either community or separate income, deductions, credits, and other tax return amounts for each respective line.

The total of each spouse’s or registered domestic partner’s amounts from Column B and Column C should equal the amount reported in Column A.

Column B

Column B represents one spouse or registered domestic partner’s share of the corresponding line. Enter the Social Security number (SSN) for that spouse.

Column C

Column C is for the other spouse. The contents of that column represent the income, deduction, credit, or other tax return amount for the second spouse or registered domestic partner. Enter the SSN for the second spouse in Column C.

Each line on Form 8958 explained

For each line, we’ll discuss the type of item, and which tax form or tax forms you might find it, and where else you should report this information when filing your federal income tax return. We’ll also discuss the general position that the Internal Revenue Service takes when considering the tax treatment of each item.

Line 1: Wages

Identify the wages from each payer on separate lines. You will find wage income reported on IRS Form W-2.

Taxpayers who need to correct their tax information may request a corrected Form W-2 from their employer, known as a Form W-2C.

According to the IRS

The Internal Revenue Service considers each spouse’s or RDP’s wages and self-employment income from a sole proprietorship to be community income. You must evenly split this income between both spouses or partners.

Line 2: Interest income

Enter the interest income as reported on IRS Form 1099-INT. For community property, report half of all community income reported on Form 1099-INT in each column. However, you may report interest income from separately owned property in the column of its owner.

According to the IRS

The IRS considers interest income from community property to be community income. You must evenly split community income.

Line 3: Dividends

Enter dividend income, which should be reported on IRS Form 1099-DIV.

For community property, report half of all dividend income in each column. However, dividend income from separately owned property may be reported in the column of its owner.

According to the IRS

The IRS considers dividend income from community property to be community income. You must evenly split community income.

Line 4: State income tax refund

Identify the state income tax refund from each payer on separate lines. You may find your state income tax refund reported to you on IRS Form 1099-G, Certain Government Payments.

According to the IRS

The IRS instructions have no standard guidance on how to allocate state income tax refunds. You may need to discuss this with your tax professional, particularly if either spouse claimed state taxes paid as an itemized deduction on Schedule A.

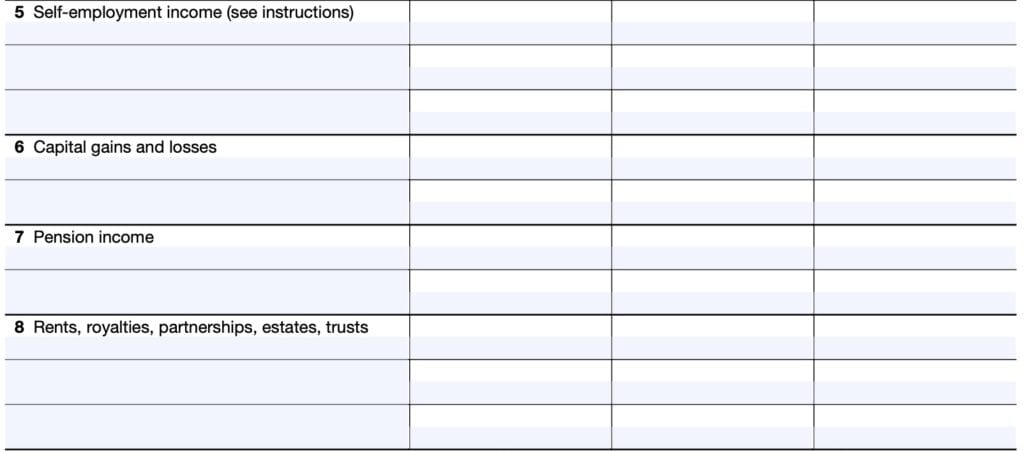

Line 5: Self-employment income

Identify the self-employment income from each entity on separate lines. Generally, taxpayers calculate self-employment tax income on either Schedule C or Schedule F (for farming income).

Enter the total from each entity in column A. Allocate the total from column A between each spouse or domestic partner in columns B and C.

According to the IRS

According to the Internal Revenue Code, each spouse’s or RDP’s wages and self-employment income from a sole proprietorship are considered to be community income. Half of all community income from self-employment must be allocated to each spouse.

Line 6: Capital gains and losses

Enter the total amount of capital gains or losses in Column. The amount allocated to each spouse or partner should be similar to the amounts reported on IRS Schedule D on your federal tax return.

Allocate gains and losses into each spouse or partner’s column.

Unless separately-held property is involved, the allocated amounts in Columns B and C should equal the total under Column A.

According to the IRS

Depending on how the property is held, capital gains and losses can be classified as community property or separate property.

Line 7: Pension income

Report pension income from each source on a separate line, as reported to you on IRS Form 1099-R.

According to the IRS

Generally, distributions from pensions will be characterized as community or separate income depending on the respective periods of participation in the pension while married (or during the registered domestic partnership) and domiciled in a community property state or in a non-community property state during the total period of participation in the pension.

These rules may vary between states. You may need to check the laws of your state for additional information on the allocation of pension income.

Line 8: Rents, royalties, partnerships, estates, trusts

Report rents, royalty income, partnership income, and income from estates and trusts, separately on Line 8.

Income items allocated under Line 8 are reported as supplemental income on Schedule E.

Reporting rental income

The IRS considers rental income from community property to be community income. You must evenly split community income.

However, rental income from separately owned property may be allocated to the spouse or partner’s return.

Rental income is reported as miscellaneous income on IRS Form 1099-MISC.

Partnership income

If an interest is held in a partnership, and income from the partnership is attributable to the efforts of either spouse or RDP, the partnership income is community property.

Partnership income is reported on Schedule K-1 (IRS Form 1065).

Estates and trusts

The IRS form instructions do not have much guidance on how to allocate income from estates and trusts.

As a practical matter, separate property rules may apply here, depending upon the circumstances and state law concerning community property rights.

Generally, all property acquired before the creation or after termination of the community property estate and property acquired by one spouse during marriage through gift, inheritance, or an award for personal injury damages.

There may be situations in which estate or trust distributions are considered separate property. You may need to discuss this with a tax expert to determine how to report distribution income for federal tax purposes.

Income from estates and trusts may be reported on Schedule K-1 (IRS Form 1041).

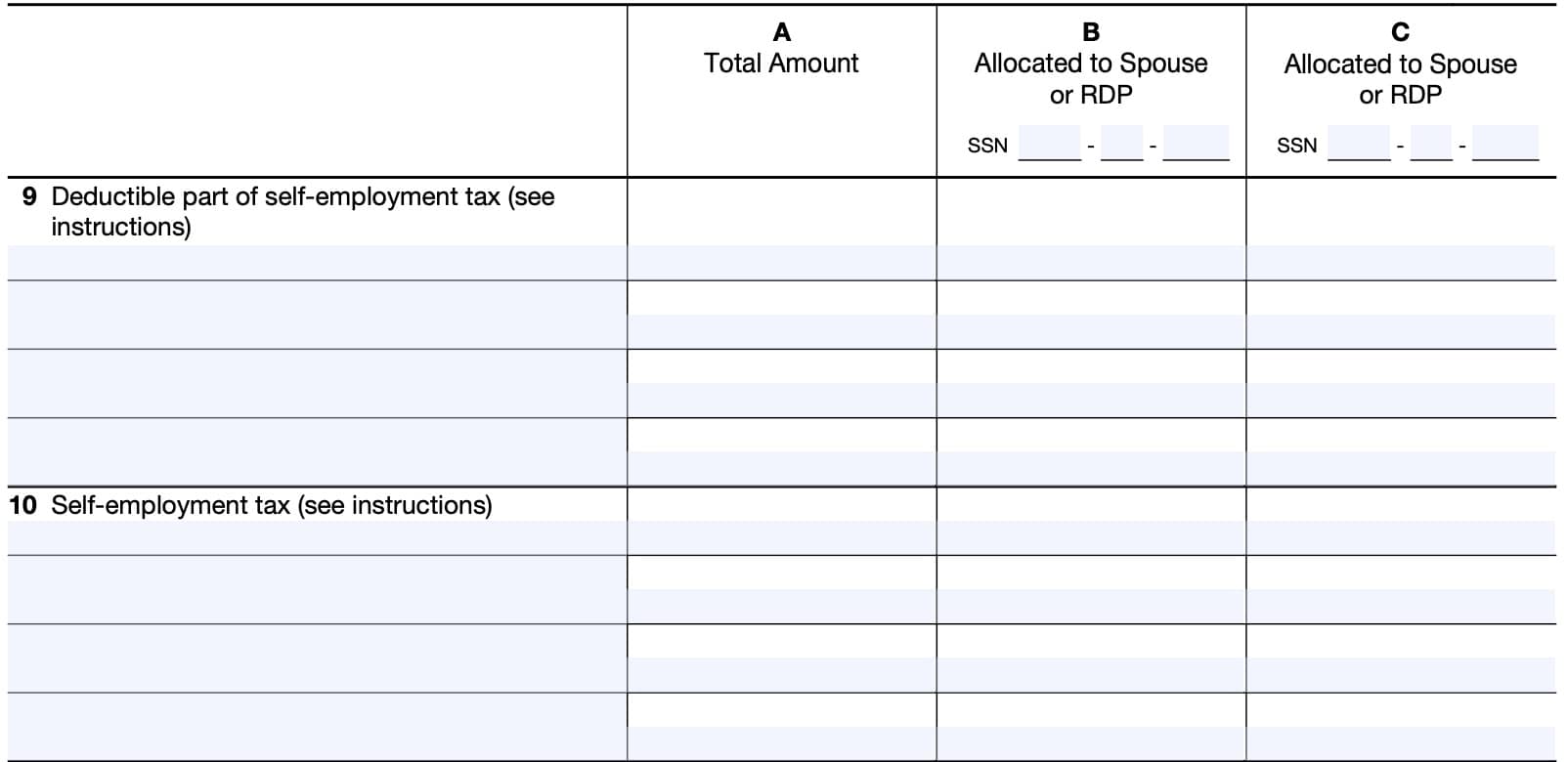

Line 9: Deductible part of self-employment tax

Identify the deductible part of self-employment tax from each entity on separate lines. Enter the total from each entity in column A and allocate the total from column A between columns B and C.

How self-employment tax is calculated

Although taxpayers calculate self-employment tax income on either Schedule C or Schedule F, taxpayers actually calculate self-employment tax on Schedule SE.

Finally, taxpayers may deduct the deductible part of self-employment tax on Schedule 1 of their tax return.

According to the IRS

The deductible portion of the self-employment tax is split only when the self-employment tax is split.

Line 10: Self-employment tax

Although Internal Revenue Code Section 1402(a)(5) contains a provision that overrides community income treatment in the case of spouses, this provision does not apply to domestic partnerships.

According to the IRS

RDPs split self-employment income from sole proprietorships and partnerships for self-employment tax purposes.

The following rules apply only to persons married for federal income tax purposes.

Sole proprietorship

With regard to net income from a trade or business (other than a partnership) that is community income, the spouse carrying on the trade or business must pay the related self-employment tax.

Partnerships

All of the distributive share of a married partner’s income or loss from a partnership trade or business is attributable to the partner for computing any self-employment tax.

This is true even if a portion of the partner’s distributive share of income or loss is community income or loss that is attributable to the partner’s spouse for income tax purposes.

If both spouses are partners, their distributive shares will determine the allocation of self-employment tax.

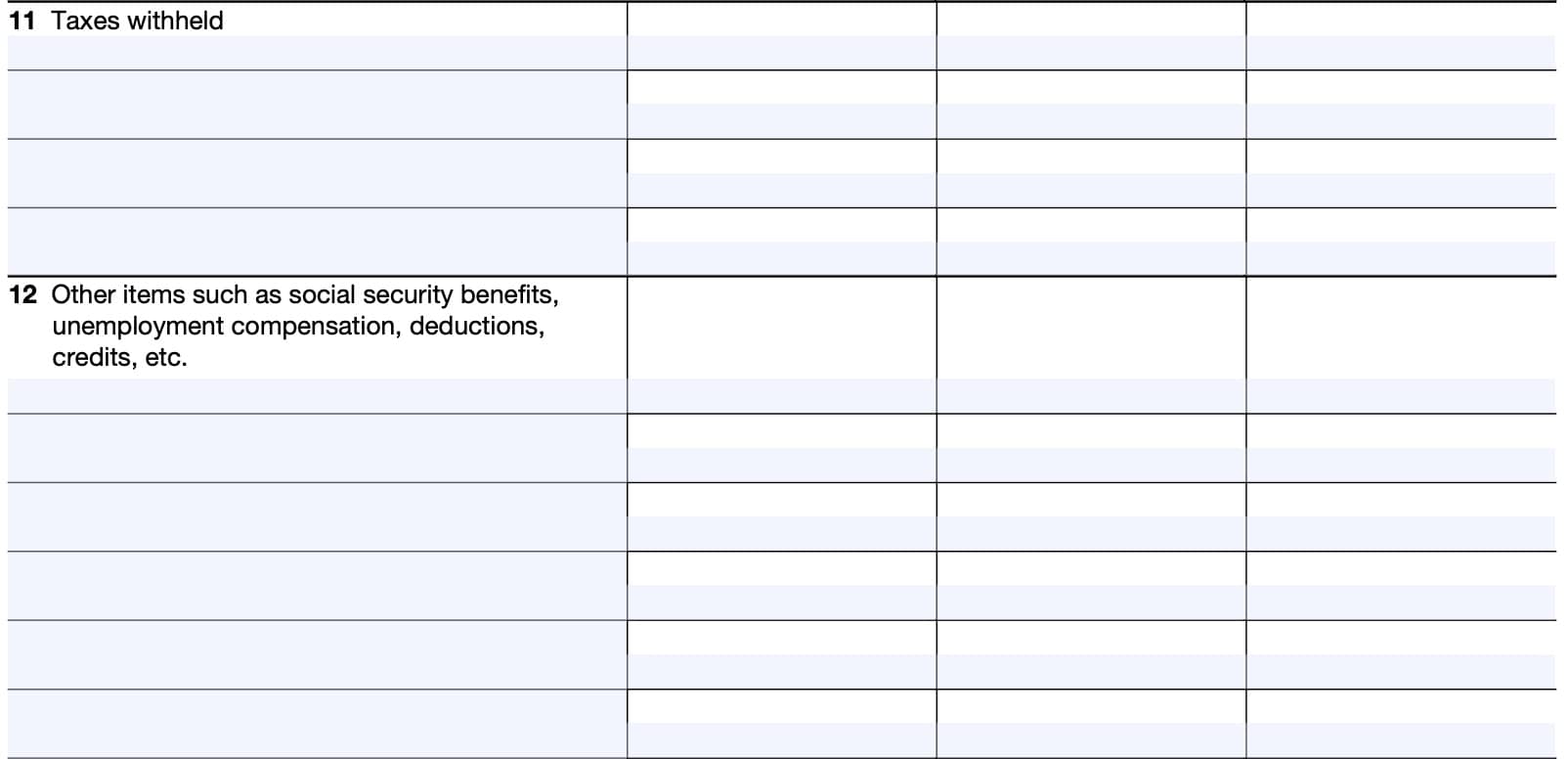

Line 11: Taxes withheld

Identify the taxes withheld from each payer or entity on separate lines.

Enter the total from each payer or entity in column A and allocate the total from column A between each spouse or RDP in columns B and C.

According to the IRS

If you and your spouse file separate returns on which each of you reports half the community wages, then each of you is entitled to credit for half the income tax withheld on those wages.

Likewise, each RDP is entitled to credit for half the income tax withheld on those wages.

Line 12: Other items

Identify any item not previously reported on separate lines. Examples include

- Social Security benefits reported on Form SSA-1099

- Unemployment compensation reported on Form 1099-G

- Tax deductions and tax credits

Enter the total from each item in column A, then allocate the total from each item from column A between each spouse or RDP in columns B and C.

According to the IRS

Below is IRS guidance on other income items, deductions, and tax credits not previously discussed

Business and investment expenses

Expenses incurred to earn or produce community business or investment income are generally divided between you and your spouse or RDP. IRS Publication 555, Community Property, contains additional information.

IRS deduction

Deductions for IRA contributions cannot be split between spouses or RDPs. The tax deduction for each spouse or RDP is figured separately and without regard to state community property laws.

Personal expenses

If one spouse or RDP pays expenses out of separate funds, such as medical expenses, that spouse can deduct those expenses individually.

If these expenses are paid from community funds, divide the deduction equally between you and your spouse or RDP.

Filing IRS Form 8958

Since each spouse or partner filing Form 8958 must file a separate tax return, each spouse should attach a completed form to their individual tax return.

Below are some considerations for married couples trying to determine their tax filing status. However, registered domestic partners don’t have the option to determine their filing status.

Joint returns vs. separate returns

Ordinarily, filing a joint tax return will give you a greater tax advantage than filing a separate return. But in some cases, your combined income tax on separate returns may be less than it would be on a joint return.

Except for spouses living apart all year, below are some of the limitations that exist for a married couple looking to file separately.

Itemized deductions vs. standard deduction

If one spouse itemizes deductions on his or her return, then the other spouse cannot claim the standard deduction.

However, a registered domestic partner may itemize or claim the standard deduction on his or her individual tax return regardless of whether his or her partner itemizes or claims the standard deduction.

You may be ineligible for certain Tax credits

Married couples filing a separate return may be ineligible for the following tax credits:

- Credit for child and dependent care expenses (in most cases), claimed on IRS Form 2441, unless:

- You lived apart from your spouse during the last 6 months of the tax year

- Your home was the qualifying person’s main home for more than half of the year

- You paid more than half of the cost of keeping up that home for the year

- Earned income credit, claimed on Schedule EIC

- Credit for the elderly or disabled on Schedule R

- Unless both spouses lived apart for the entire tax year

- Education credits on IRS Form 8863

- Adoption expense exclusion or tax credit, calculated on IRS Form 8839, in most cases, unless

- You lived apart from your spouse during the last 6 months of the tax year

- The eligible child lived in your home more than half of the year

- You provided over half the cost of keeping up your home

- Your modified adjusted gross income (MAGI) is below a specified amount or you are carrying forward a tax credit from prior years

Other tax benefits may be limited

For example, taxpayers can normally exclude interest income from qualified U.S. savings bonds redeemed for higher education expenses. However, you cannot do this as a married couple filing a separate return.

You also may experience the following:

- A greater percentage of Social Security benefits or equivalent railroad retirement benefits may be subject to taxation

- You cannot deduct interest paid on a qualified student loan, as reported on IRS Form 1098-E

- You may have a smaller child tax credit and credit for other dependents than you would on a joint return

Video walkthrough

Watch this instructional video to learn more about allocating tax amounts using IRS Form 8958!

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

Taxpayers who are married filing separate tax returns and live in a community property state should complete Form 8958 to properly allocate tax amounts between each spouse. Registered domestic partners also use this tax form, even with single filing status.

The following states are community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

IRS Publication 555 states that there are 3 states which recognize domestic partnerships: Nevada, Washington, and California. Registered domestic partnerships in these states are subject to community property income laws.

Where can I find IRS Form 8958?

You can find IRS Form 8958 on the IRS website. For your convenience, we strive to keep the latest versions of IRS forms on our site. Below is the most recent version of IRS Form 8958.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!