IRS Form 1099-INT Instructions

If you have investments that produce interest income, you should expect to receive IRS Form 1099-INT at the end of the tax year. While your financial institution is responsible for issuing this tax document, it’s worth taking the time to understand how to report this information on your income tax return.

In this article, we’ll help you understand everything you need to know about IRS Form 1099-INT, including:

- What you should expect to see in each box on this form

- How this tax information will impact your income tax return

- When you should expect your Form 1099-INT and what to do if you do not receive it on time

Let’s start by breaking down this tax form, one step at a time.

Table of contents

IRS Form 1099-INT Instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-INT form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 5 copies of Forms 1099-INT. Here is a summary of where all these forms go:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy C: For payer’s tax records

- Copy 1: For state, city, or local tax department

- Copy 2: To be filed with employee’s state, city, or local tax return

For employees who do not pay state, city, or local income tax, copies 1 and 2 are optional.

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer Identification Fields

Payer’s Name, Address, And Telephone Number

You should see the financial institution’s complete name, address, and telephone number in this field.

Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

As the recipient or payee, you should see your taxpayer identification number in this field. For payees, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which is sent to the Internal Revenue Service, is never truncated.

Recipient’s Name And Address

You should see your name and address, including city, state, and ZIP code, reflected in these fields. If your address is incorrect, you should notify the financial institution and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

FATCA filing requirement

If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its reporting requirement under the Foreign Account Tax Compliance Act.

You may also have a filing requirement. For additional information, see the instructions for IRS Form 8938, Statement of Specified Foreign Financial Assets.

Account number

The Internal Revenue Service requires each financial institution to complete this field if:

- You have more than one account with that institution, and

- The institution is issuing multiple 1099-INT forms

In this case, you can expect to see each copy of Form 1099-INT with a unique account number for each account.

Otherwise, the IRS encourages, but does not mandate, financial institutions to complete this field.

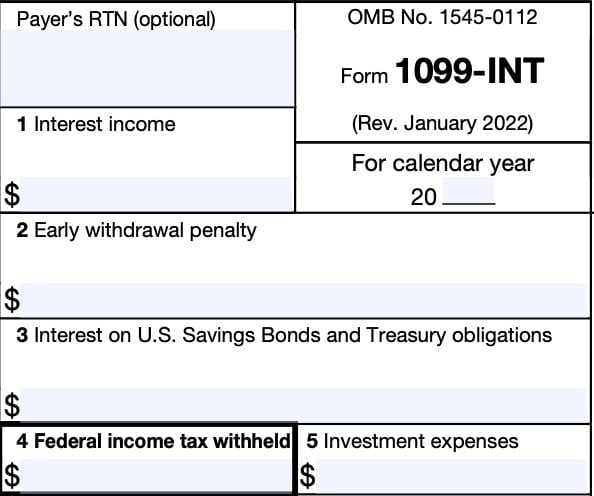

Boxes 1 Through 14

On the right-hand side of the form are boxes 1 through 14. In most circumstances, some of these boxes will be blank.

However, let’s go through each box so we can better understand what you should expect to see, and where you should report it on your federal income tax return.

Payer’s RTN

Your financial institution may choose to enter their routing and transit number in this field. However, it is optional, and not relevant to your tax return.

Box 1: Interest Income

Box 1 shows taxable interest that was paid to you during the calendar year. However, this does not include interest shown in Box 3.

This may also show the total amount of credits from certain bonds that must be included in your income, such as:

- Clean renewable energy bonds

- New clean renewable energy bonds

- Qualified energy conservation bonds

- Qualified zone academy bonds

- Qualified school construction bonds

- Build America bonds

For more information, see the instructions to IRS Form 8912, Credit to Holders of Tax Credit Bonds.

When to report interest income on Schedule B

You may need to report your interest income on IRS Schedule B if the total amount of interest income exceeds $1,500 in the taxable year, or if you meet any of the following other criteria:

- You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

- You have accrued interest from a bond.

- You are reporting original issue discount (OID) of less than the amount shown

on IRS Form 1099-OID. - You are reporting interest income of less than the amount shown on a Form 1099

due to amortizable bond premium. - You are claiming the exclusion of interest from series EE or I U.S. savings bonds

issued after 1989. - You received interest or ordinary dividends as a nominee.

- You had a financial interest in, or signature authority over, a financial account in

a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust.

Box 2: Early Withdrawal Penalty

Box 2 shows interest or principal that you may have forfeited because of early withdrawal of time

savings.

You may deduct this amount on Line 18 of IRS Schedule 1, Additional Income and Adjustments to Income, to calculate your adjusted gross income on your income tax return.

Box 3: Interest On U.S. Savings Bonds And Treasury Obligations

Shows interest from any debt instrument issued by the federal government, including:

- U.S. Savings Bonds

- Treasury bills

- Treasury bonds

- Treasury notes

At the federal level, this may or may not be taxable, depending on circumstances. However, this is tax-exempt interest at the state and local level. This interest is not included in Box 1, above.

Exclusion Of Interest For Qualified Education Expenses

Taxpayers may be able to exclude interest on certain U.S. Savings Bonds, when used for qualified higher education expenses. See the instructions for IRS Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, for more detail.

Box 4: Federal Income Tax Withheld

You should see backup withholding amounts reported in Box 4.

If you have not given your taxpayer identification number (TIN) to the financial institution, you may be subject to backup withholding rules on certain interest payments reported on IRS Form 1099-INT.

In this case, you may be asked to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification, so they can report the correct TIN to the IRS. Foreign recipients may be asked to complete IRS Form W-8 instead.

Box 5: Investment Expenses

Box 5 contains investment expenses related to real estate mortgage investment conduits (REMICs).

If there is an amount listed here, those expenses are already included in Box 1. Therefore, they are not deductible on your annual tax returns.

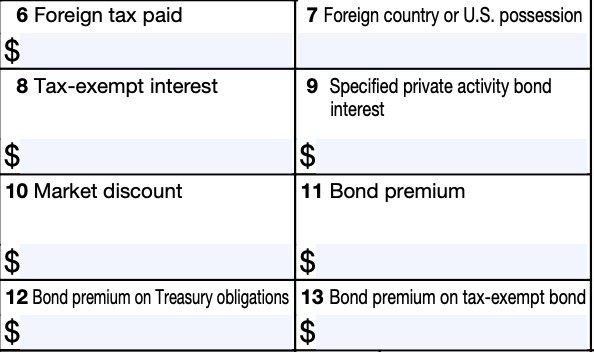

Box 6: Foreign Taxes Paid

Box 6 shows foreign taxes paid in the current tax year.

You might be able to claim foreign taxes paid as an itemized tax deduction on Schedule A of your Form 1040 or Form 1040-SR. You might also be able to claim taxes paid as a foreign tax credit by filing IRS Form 1116.

Box 7: Foreign Country Or U.S. Possession

If you paid foreign taxes, Box 7 will indicate the foreign country or United States possession to which you paid taxes.

Box 8: Tax-exempt interest

Box 8 contains tax-exempt interest paid to you during the calendar year by the payer.

Generally, you’ll report tax-exempt interest income on Line 2a of your income tax return. If you bought a tax-exempt bond at a premium, you should only report the net tax-exempt interest.

Box 9: Specified Private Activity Bond Interest

Box 9 contains tax-exempt interest from private activity bonds.

Although this is excluded from ordinary income for normal tax purposes, private activity bond interest is a preference item for alternative minimum tax (AMT) purposes. If you are subject to AMT, you may need to include this when calculating AMT on IRS Form 6251.

Box 10: Market Discount

For a covered security acquired with market discount, if you notified the payer that you made an IRC Section 1278(b) election, then you should see the amount of market discount that accrued during the tax year. However, this will not appear on tax form 1099-INT if it already appears on Form 1099-OID.

This discount is considered ordinary income on your tax return.

Box 11: Bond Premium

If an amount is reported in this box, you may need to refer to the instructions for Schedule B

to determine the net amount of interest includible in income on your tax return.

Box 12: Bond Premium On Treasury Obligations

If an amount is reported in this box, see the Instructions for Schedule B to determine the net

amount of interest includible in income your tax return.

The payer has reported a net amount of interest in Box 3 if:

- An amount is not reported in this box for a U.S. Treasury obligation that is a covered security acquired at a premium, and

- The payer is reporting premium amortization

Box 13: Bond Premium On Tax-Exempt Bond

For a tax-exempt covered security, Box 13 shows the amount of premium amortization allocable to the interest payment(s).

For amounts reported in this box, IRS Publication 550, Investment Income and Expenses, contains additional information to help determine the net amount of tax-exempt interest reportable on your tax return.

If an amount is not reported in this box for a tax-exempt covered security acquired at a premium, the payer has reported a net amount of interest in either Box 8 or Box 9, whichever applies.

If the amount in Box 13 is greater than the amount of interest paid on the tax-exempt covered security, the excess is a nondeductible loss.

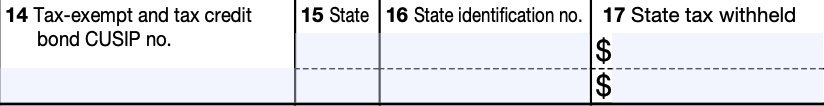

Box 14: Tax-Exempt And Tax Credit Bond CUSIP No.

Box 14 shows CUSIP number(s) for:

- Tax-exempt bond(s) on which tax-exempt interest was paid, or

- Tax credit bond(s) on which taxable interest was paid or a tax credit was allowed during the tax year

If this field is blank, no CUSIP number was issued for the bond(s).

State tax information

At the bottom of the form, you’ll see Boxes 11 through 16. Before reviewing those fields, let’s discuss the other fields that you’ll see on the left-hand side of the form.

Box 15: State

If you live in a state without income tax, you may not see any information in Boxes 15 through 17. However, Boxes 15 through 17 may contain relevant tax information for up to 2 different states.

If applicable, Box 15 will contain the abbreviated name of the applicable state(s).

Box 16: State Identification Number

If your financial institution has a specific state tax identification number, that TIN will appear in Box 16.

Box 17: State Tax Withheld

Box 17 contains any state income tax withheld on income items reported on Form 1099-INT.

Filing IRS Form 1099-INT

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Watch this instructional video to learn more about reporting your interest income when filing your income tax return.

Frequently asked questions

The IRS requires financial institutions to issue Form 1099-INT by January 31 of the year following the tax year they paid interest. However, the institution may not have to file IRS Form 1099-INT in certain cases.

The IRS recommends that you first contact your financial institution. If you still haven’t received Form 1099-INT by February 15, you may call the IRS at: 800-829-1040 for additional assistance.

The IRS expects taxpayers to report all income on their tax return. However, if you received less than $10 in interest income, interest from U.S. Savings bonds, or tax-exempt interest during the year, the IRS may not require your financial institution to file IRS Form 1099-INT.

Where can I find IRS Form 1099-INT?

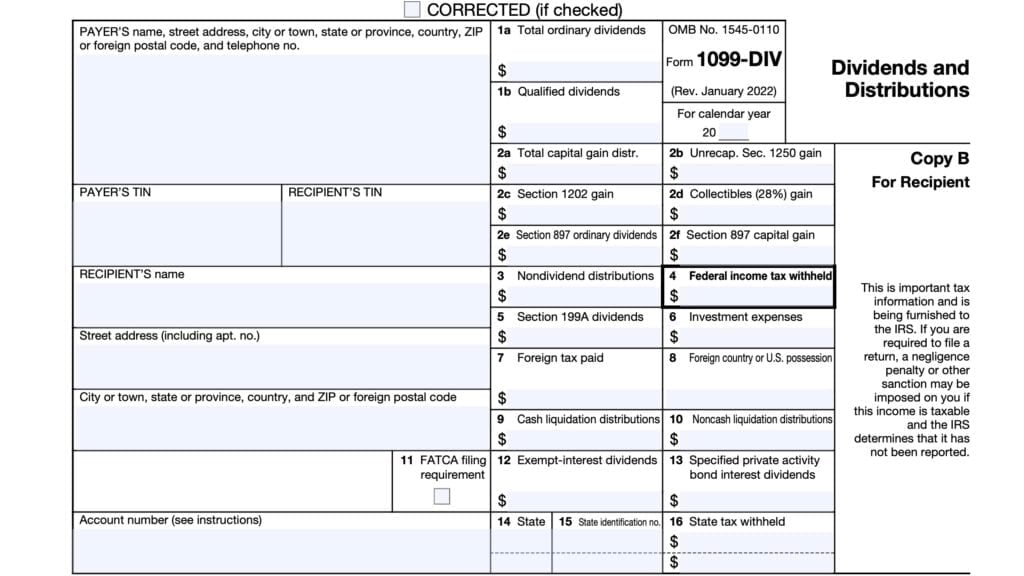

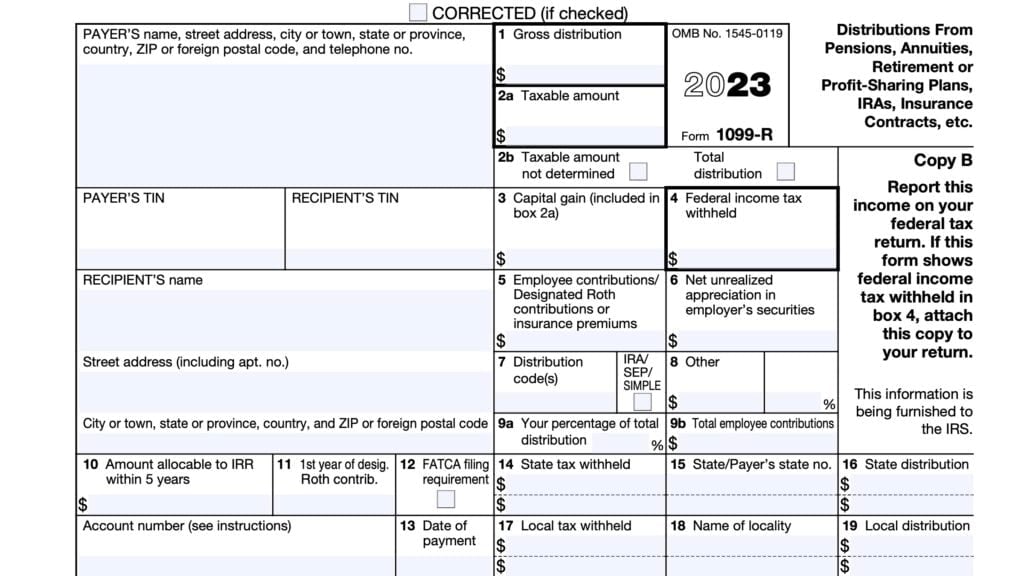

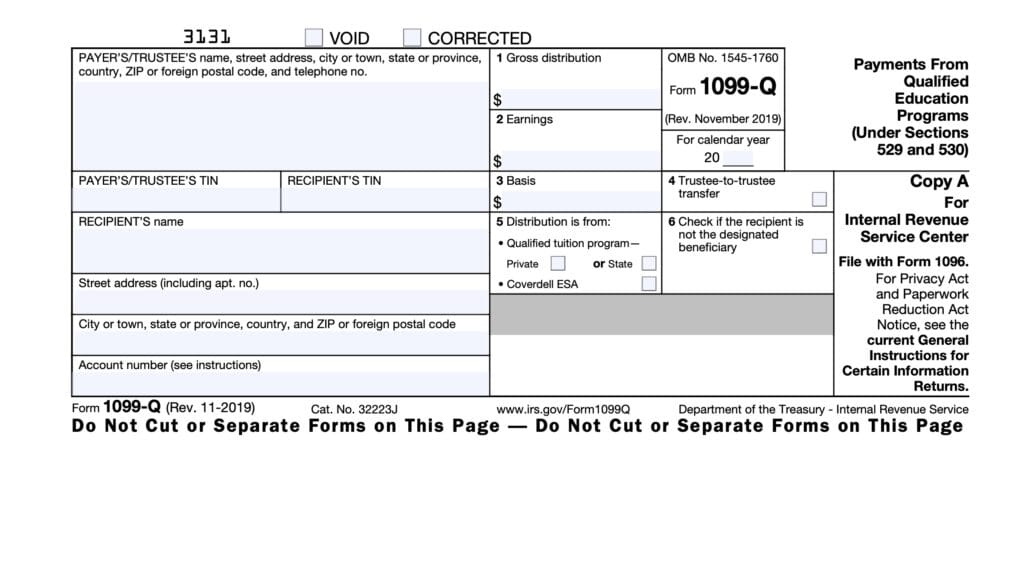

As with other tax forms, you may find IRS Form 1099-INT on the IRS website. For your convenience, we’ve included the most recent copy of the form in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!