IRS Form 8815 Instructions

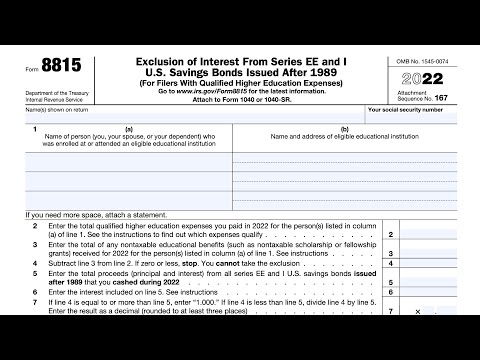

In the United States, the federal government gives tax incentives for people who invest in higher education. One of the most overlooked tax benefits is the ability for owners of qualified U.S. savings bonds to exclude interest that was used to pay for qualified education costs using IRS Form 8815.

In this article, we’ll walk through what you need to know about this tax form, including:

- How to complete IRS Form 8815

- Situations that qualify for exclusion of interest income

- Frequently asked questions about IRS Form 8815

Let’s begin with an overview of the tax form itself.

Table of contents

How do I complete IRS Form 8815?

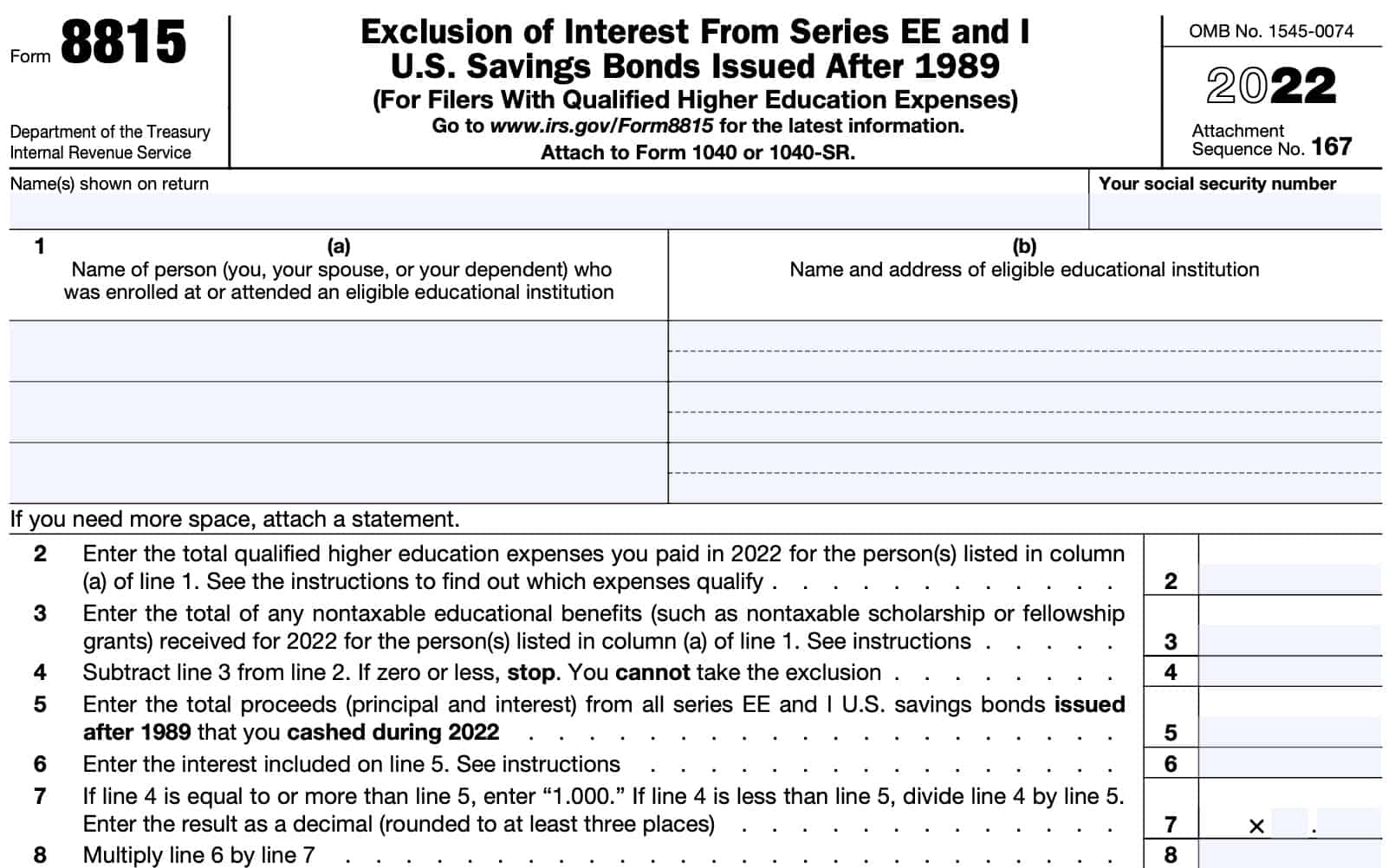

This one page tax form is fairly straightforward. Before Line 1, you’ll enter your name and Social Security number as they appear on the tax return.

From there, let’s start at the top of the form, with Line 1.

Line 1

In Line 1(a), enter the name of the person who was:

- Enrolled at, or attended an eligible educational institution during the tax year, or

- Form whom you made contributions to either of the following:

- Coverdell education savings account (Coverdell ESA)

- Qualified tuition program (known as college savings plans or college 529 plans)

This person must be one of the following as claimed on IRS Form 1040 or Form 1040-SR:

- Yourself

- Spouse

- Dependent

Eligible educational institution

An eligible education institution is generally any accredited public, nonprofit, or private college, university, vocational school or other postsecondary institution. The institution must be able to participate in student aid programs administered by the federal government through the Department of Education.

Almost all accredited postsecondary institutions meet this requirement.

In Line 1(b), enter the name and address of the institution. If the person was enrolled at or attended more than one education institution, list all of them.

If you contributed to a Coverdell ESA for the person, enter “Coverdell ESA” and the name and address of the financial institution where the account is located. For contributions to a QTP, enter “QTP” and the name and address of the program.

Line 2: Total qualified higher education expenses

In Line 2, enter the total qualified higher education expenses you paid on behalf of the person named in Line 1(a), attending the institution(s) listed in Line 1(b).

Qualified expenses also include contributions to a Coverdell ESA or college 529 plan.

Qualified higher education expenses do not include room and board expenses, or courses involving sports, games, or hobbies that are not part of a degree program or certificate program.

Additionally, do not include any college expenses that were:

- Covered by nontaxable educational benefits paid directly to, or by, the educational institution;

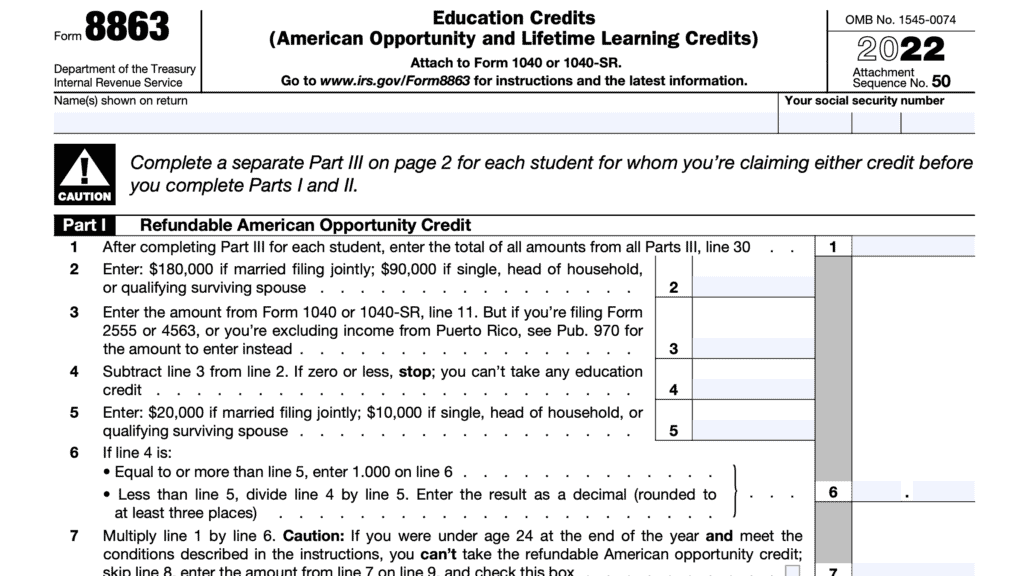

- Used to figure an education credit on IRS Form 8863; or

- Used to figure the nontaxable amount of a distribution from a Coverdell ESA or college 529 plan.

Line 3: Total nontaxable educational benefits received

On Line 3, enter the total qualified higher education expenses included on Line 2, which were covered by nontaxable educational benefits.

These benefits can include any of the following:

- Scholarship or fellowship grants excludable from taxable income under Internal Revenue Code Section 117.

- IRS Publication 570, Chapter 1 contains additional information

- Veterans’ educational assistance benefits.

- Employer-provided educational assistance benefits not included as taxable income in Box 1 of your Form(s) W-2

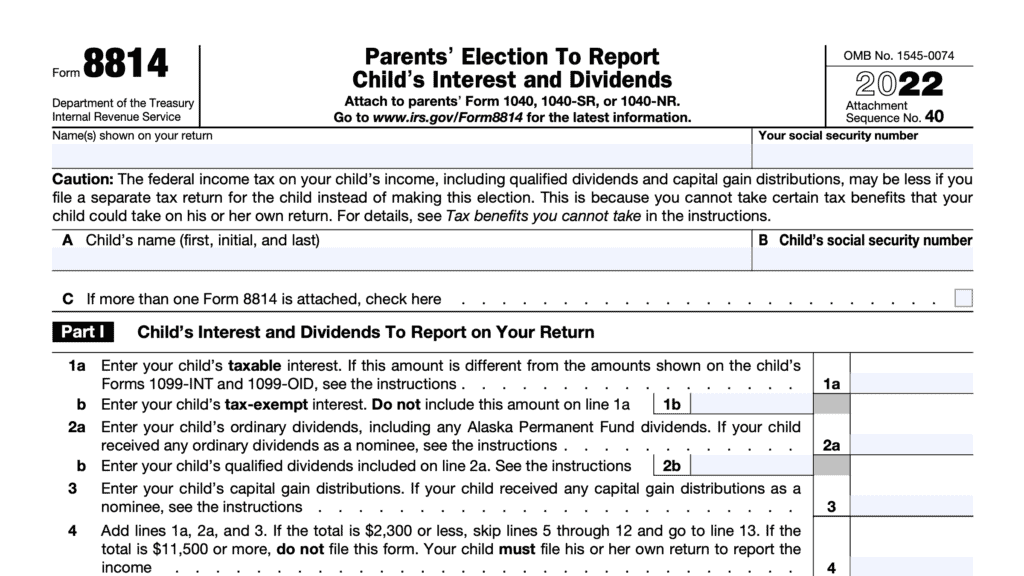

- Payments, waivers, or reimbursements of educational expenses under a QTP

- Any other payments for educational expenses that are exempt from income tax by any U.S. law.

- Excluding gifts, bequests, or inheritances

Do not include on line 3 nontaxable educational benefits paid directly to, or by, the educational institution.

Example

You paid $10,000 of qualified education expenses in 2022 to the college your son attended. None of the expenses are used to figure an education credit or the nontaxable amount of a Coverdell ESA or QTP.

You claim your son as a dependent on your 2022 tax return. Your son received a $2,000 nontaxable scholarship grant for 2022, which was paid directly to him.

In this situation, you would enter $10,000 of qualified educational expenses on Line 2 and $2,000 in nontaxable scholarships on Line 3.

Line 4

Subtract Line 3 from Line 2. If the result is zero or a negative number, stop completing IRS Form 8815. You cannot take the tax exclusion for interest income from your savings bonds.

Line 5: Total proceeds

In Line 5, enter the total proceeds from all Series EE bonds and Series I U.S. savings bonds that:

- Were issued after 1989, and

- You redeemed during the calendar year

This includes both principal and accrued interest for each Series EE bond and Series I bond.

Line 6: Interest

In Line 6, include the bond interest from Line 5.

If you reported any of the interest in a prior year, refer to IRS Publication 550, Investment Income & Expenses to determine how much accumulated interest to enter.

Otherwise, you can do either of the following:

- Enter the amount from IRS Form 8818, Line 8

- If you used that form to record the EE bonds cashed,

- Use the Line 6 worksheet to figure the amount to enter

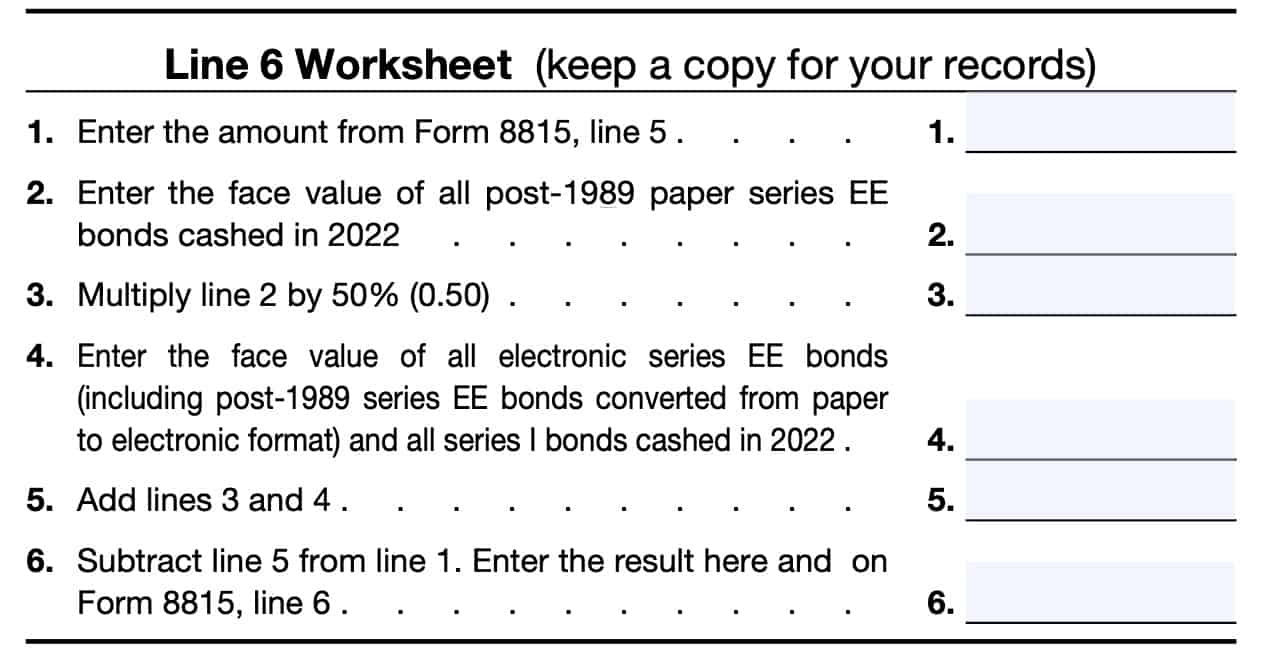

Line 6 worksheet

As outlined below, there are 6 steps to calculate the accumulated interest in Line 6:

- Enter the Line 5 amount

- Enter the face value of all post-1989 paper series EE savings bonds redeemed in the tax year

- Multiply the Line 2 amount by 50%

- Enter the face value of all electronic series EE bonds and all Series I bonds cashed during the tax year

- This includes any EE bonds converted from paper to electronic format

- Add Lines 3 & 4

- Subtract Line 5 from Line 1. Enter the result here and on Line 6.

Line 7

If Line 4 is equal to or more than Line 5, enter “1.000.”

If Line 4 is less than Line 5, divide Line 4 by Line 5. Enter the result as a decimal (rounded to at least three places).

Line 8

Multiply Line 6 by Line 7. Enter the result in Line 8.

Line 9: Modified adjusted gross income

In Line 9, enter your modified adjusted gross income, or MAGI. The form instructions provide a worksheet (see below) to help you calculate MAGI.

However, you must perform these steps before using the Line 9 worksheet:

- If you received Social Security benefits:

- Use IRS Publication 915 to figure the taxable amount of your benefits.

- If you are claiming both the premium tax credit (PTC) and self-employed health insurance deduction

- See Self-Employed Health Insurance Deduction and PTC in IRS Publication 974, Premium Tax Credit

- If necessary, complete the appropriate worksheets

- If you made contributions to a traditional IRA for the tax year and you were covered by a retirement plan at work or through self-employment:

- Use IRS Publication 590-A, Contributions to IRAs, to figure your IRA deduction.

- Complete the following lines on your Form 1040 or 1040-SR and Schedule 1 (Form 1040) if applicable:

- If you use IRS Form 1040 or 1040-SR, complete Lines 2a, 3b-6b, and 7

- Schedule 1 (Form 1040), complete Lines 1-9, 11*-20, and 23-25

- If any of the following apply, see IRS Publication 550.

- You are filing either:

- IRS Form 2555, Foreign Earned Income

- IRS Form 4563, Exclusion of income for residents of American Samoa

- You have employer-provided adoption benefits for the tax year.

- You are excluding income from Puerto Rico.

- You have investment interest expense attributable to royalty income

- You are filing either:

*-Do not reduce your educator expenses, if applicable, by the amount on Line 14, below.

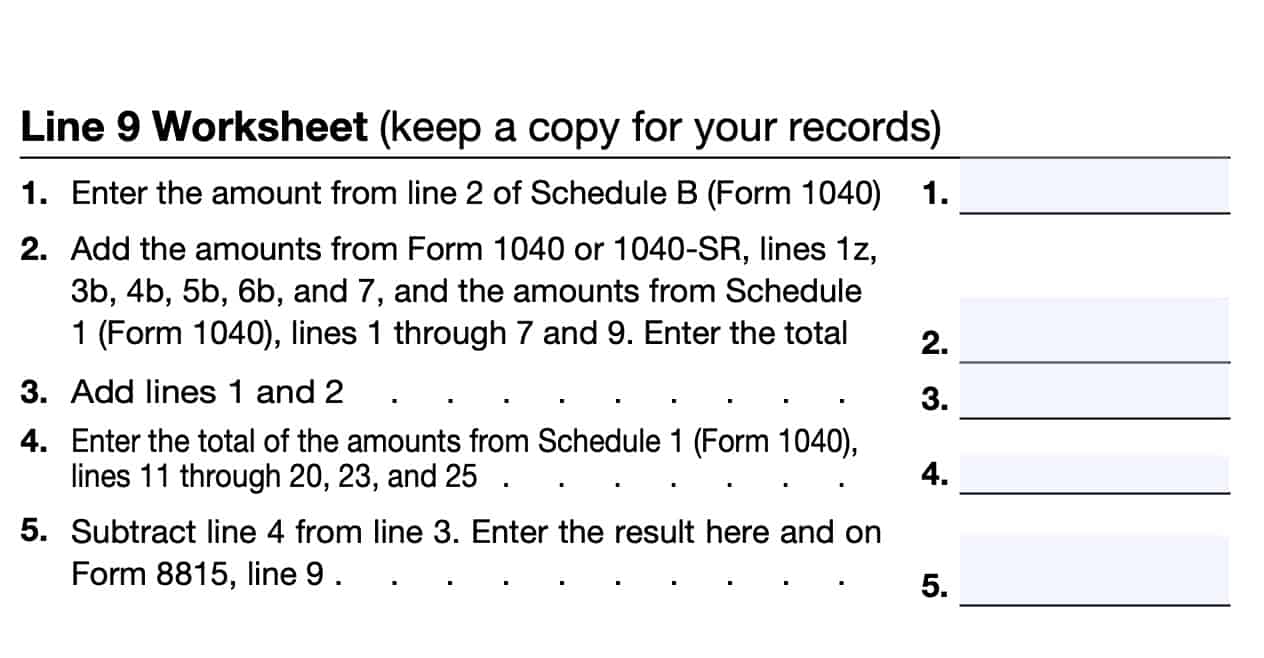

Line 9 worksheet

After you have completed these steps, then you may use the Line 9 worksheet to calculate MAGI:

- Enter the amount from Schedule B, Line 2.

- Add the following amounts from the following, then enter the total:

- IRS Form 1040: Lines 1z, 3b, 4b, 5b, 6b, and 7

- Schedule 1: Lines 1 through 7, Line 9

- Add lines 1 and 2 above

- Enter the total of the following amounts from Schedule 1:

- Lines 11-20, Line 23, Line 25

- Subtract Line 4 from Line 3. Enter the result on Line 9 of the Form 8815.

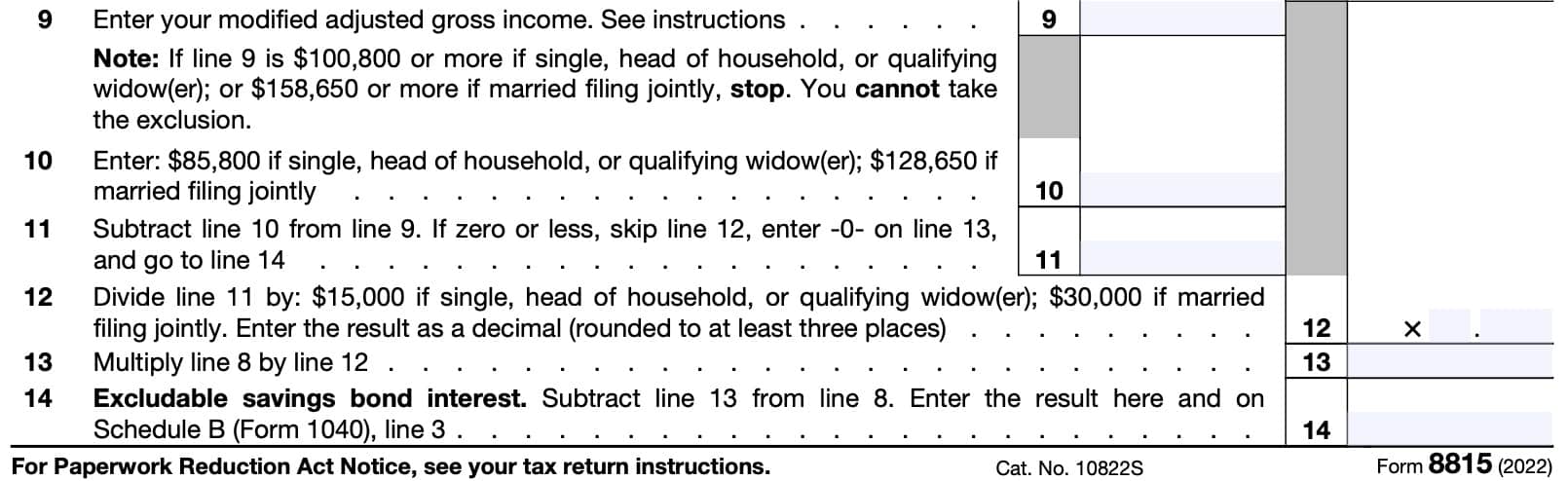

If the Line 9 amount exceeds the following income limits, stop. You cannot take the exclusion of interest.

| Taxpayer status | MAGI |

| Single Head of household Qualifying widow(er) | $100,800 |

| Married filing jointly | $158,650 |

Line 10

Enter the number that applies to your taxpayer filing status:

| Taxpayer status | Dollar amount |

| Single Head of household Qualifying widow(er) | $85,800 |

| Married filing jointly | $128,650 |

Line 11

If the result is zero or less, then enter ‘0’ on Line 13, and go directly to Line 14.

Line 12

Divide the number in Line 11 by one of the following:

| Taxpayer status | Dollar amount |

| Single Head of household Qualifying widow(er) | $15,000 |

| Married filing jointly | $30,000 |

Enter the result as a decimal, rounded to at least 3 places, in Line 12.

Line 13

Multiply Line 8 by Line 12. Enter the result here.

Line 14: Excludable savings bond interest

Subtract Line 13 from Line 8. This represents the excludable interest that you report on your federal tax return.

Enter this number on Line 14 and on Schedule B, Line 3 of your Form 1040.

Video walkthrough

Watch this instructional video to learn more about lowering your tax bill by excluding savings bond interest from taxable income using IRS Form 8815.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

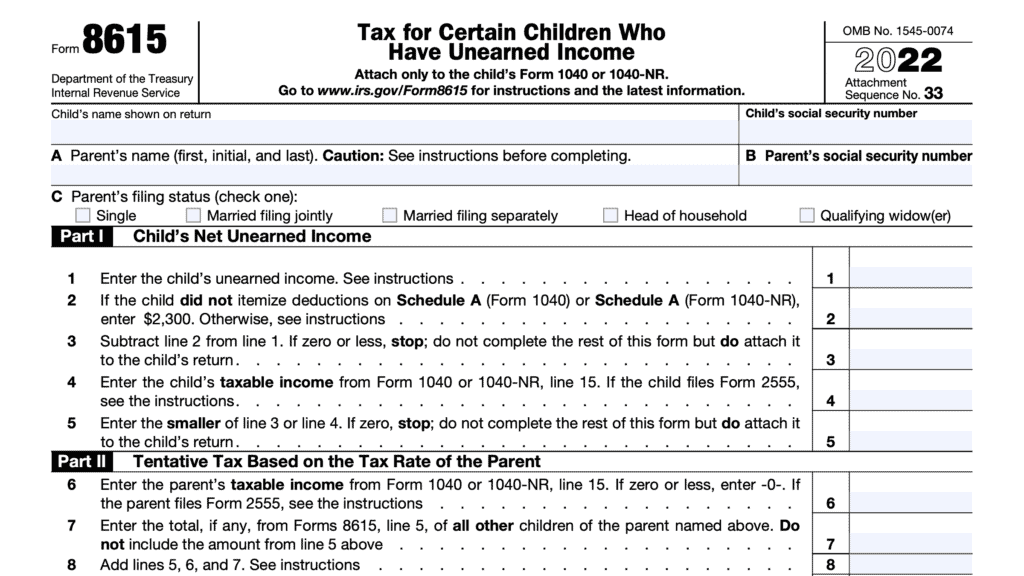

A taxpayer can exclude qualified savings bond interest on U.S. Savings Bonds issued after 1989, if the bonds were used for qualified higher education expenses, the taxpayer’s filing status is not married filing separately, and if the taxpayer’s modified adjusted gross income is below $156,800 (for married couples filing jointly), or $100,800 for all other taxpayers.

To qualify for the tax exclusion, the bonds must be either Series EE or I U.S. savings bonds issued after 1989 in your name, or, if you are married, they may be issued in your name and your spouse’s name. Also, you must have been age 24 or older before the bonds were issued.

If you cashed series EE or I U.S. savings bonds that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Taxpayers use this IRS Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, to figure the amount of any excludable interest.

Where can I find IRS Form 8815?

You can find this tax form on the IRS website. For ease of use, we’ve attached the most current version of IRS Form 8815 to this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!