IRS Form 56-F Instructions

Federal law allows for the appointment of conservators or receivers in the case of businesses that become insolvent or cannot handle their own financial affairs. In the case of an insolvent financial institution, the U.S. government and federal agencies place additional oversight to ensure the banking system remains intact. Fiduciaries for financial institutions must notify the IRS of such relationships by filing IRS Form 56-F, Notice Concerning Fiduciary Relationship

of Financial Institution.

In this article, we’ll walk through this tax form, including:

- How to complete IRS Form 56-F

- Filing requirements

- Frequently asked questions

Let’s start with a deep dive into the tax form itself.

Table of contents

How do I complete IRS Form 56-F?

There are four parts to this tax form, plus the signature field:

- Part I: Identification

- Part II: Authority

- Part III: Tax Notices

- Part IV: Revocation or Termination of Notice

Let’s start at the top of the tax form.

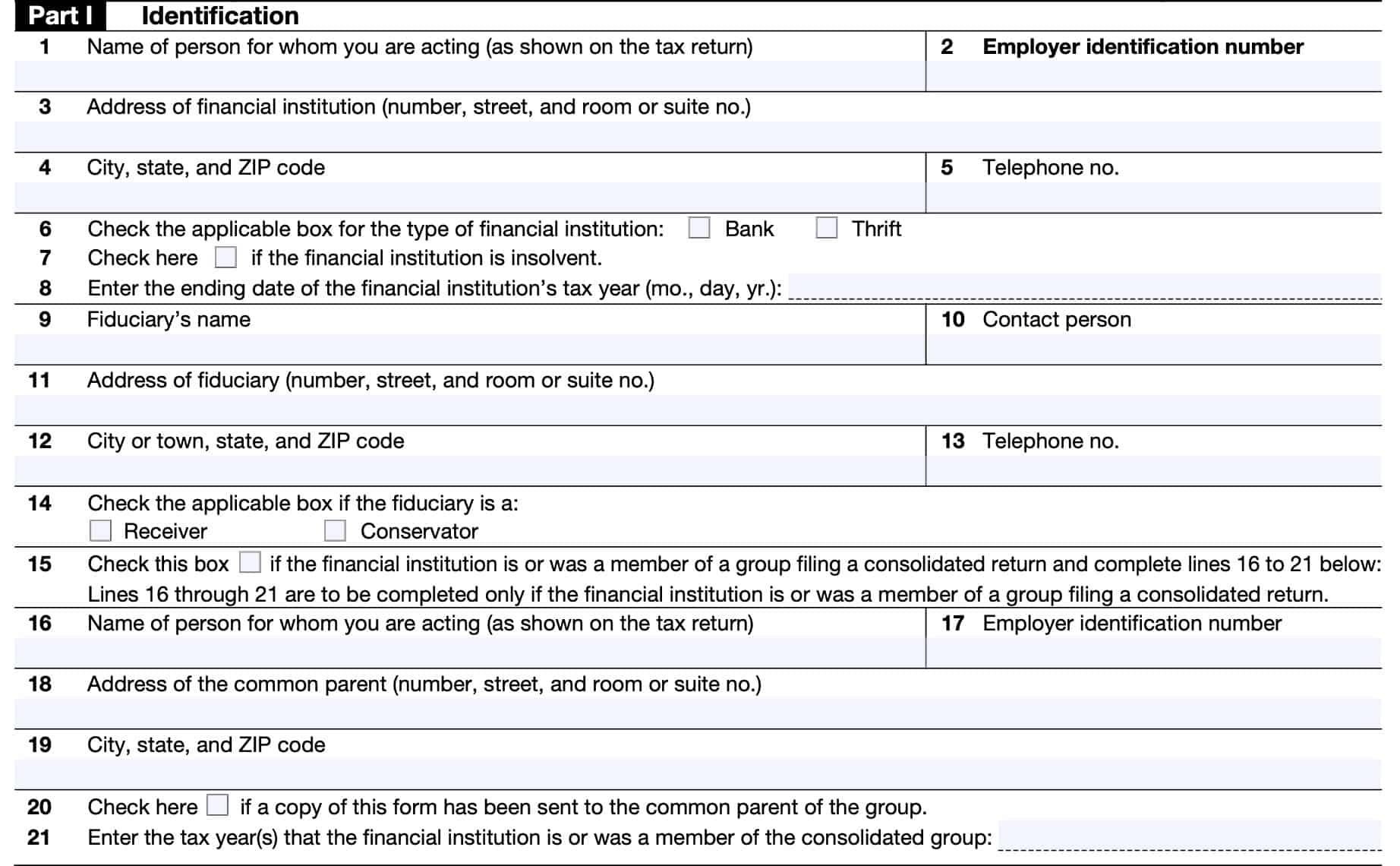

Part I: Identification

Line 1: Name of person for whom you are acting

Lines 1 through 5 specifically discuss the financial institution for which you are notifying the IRS of a fiduciary relationship.

In Line 1, enter the name of the financial institution.

Line 2: Employer identification number

In Line 2, enter the employer identification number (EIN) for the financial institution.

This is a requirement under Internal Revenue Code Section 6109-Identifying Numbers.

Line 3: Address of financial institution

Enter the financial institution’s street address, including street number and name.

Line 4: City, state, ZIP code

In Line 4, enter the city, state, and zip code for the financial institution.

Line 5: Telephone number

Enter the telephone number for the financial institution.

Line 6

In Line 6, you will check the applicable box for the type of financial institution. You may check either bank or thrift.

Generally, thrift institutions are less common today than they used to be. However, it is still possible to find thrift institutions that focus more on consumer needs than business lending.

Line 7

In Line 7, check the box if the financial institution is currently insolvent. There are several different meanings that could apply:

- 12 U.S.C. 191: Under this section, the Comptroller of the Currency has appointed a receiver for a national bank.

- 12 U.S.C. 1821(c)(5)(A): A corporation has been appointed as conservator for an institution whose assets are less than their obligations

- 12 U.S.C. 1464(d)(2)(A): An appropriate federal banking agency has appointed a conservator or receiver after determining that 1 or more of the following grounds specified in Section 11(c)(5) of the Federal Deposit Insurance Act exists.

- Assets insufficient for obligations

- Substantial dissipation

- Unsafe or unsound condition

- Cease & desist orders

- Concealment

- Inability to meet obligations

- Losses

- Violations of law

- Consent

- Cessation of insured status

- Undercapitalization

- Money laundering

- 12 U.S.C. 1464(d)(2)(C): Replacement of one receiver or conservator for another

- Applicable state laws or successor statutes

Line 8

In Line 8, enter the ending date of the financial institution’s tax year in MM/DD/YYYY format.

Line 9: Fiduciary’s name

In Lines 9 through 13, enter the information on behalf of the fiduciary being named.

For Line 9, enter the full name of the fiduciary. For example, enter Federal Deposit Insurance Corporation instead of FDIC.

Line 10: Contact person

Enter the name of the person who serves as the point of contact for tax matters. The contact person should be the individual within the federal agency with the fiduciary responsibility and authority to handle all tax matters on the financial institution’s behalf.

Line 11: Address of fiduciary

In Line 11, enter the street name and address of the person selected as the point of contact.

Line 12: City, state, ZIP code

Enter the city, state, and ZIP code for the fiduciary’s primary address.

Line 13: Telephone number

Enter the telephone number for the contact person.

Line 14

Check the appropriate box, depending on whether the fiduciary is a receiver or conservator.

Conservator

According to the FDIC’s official website, an appointed conservator has the following authority:

- Take necessary actions to put the insured depository institution in a sound and solvent condition; and

- Take any actions appropriate to carry on the business of the institution and preserve and conserve the assets and property of the institution

Receiver

In addition to the above conservator powers, the FDIC recognizes that a receiver may do the following:

- Place the insured depository institution in liquidation and

- Proceed to realize upon the assets of the institution, having due regard to the conditions of credit in the locality

Line 15

Check the box if the financial institution is or was a member of a group filing a consolidated return. If so, you will also need to complete Lines 16 to 21.

If the financial institution is not, or was not, a member of a group filing a consolidated return, proceed directly to Line 22.

Line 16: Name of person for whom you are acting

In Lines 16-20, you’ll provide additional information regarding the common parent of a consolidated group that includes, or previously included the financial institution on this form.

For Line 16, enter the name of the common parent of the consolidated group.

Line 17: Employer identification number

Enter the EIN for the common parent in Line 17.

If you use Form 56-F in compliance with the regulations under IRC Section 6402(k), the

tax identification number of the common parent should be disclosed.

If the financial institution was a member of more than one consolidated group during any

year(s) to which the fiduciary may claim a refund under section 6402(k), then the fiduciary must file a separate Form 56-F providing the information for each parent.

Line 18: Address of common parent

Enter the common parent’s address in Line 18.

Line 19: City, state, ZIP code

Enter the common parent’s city, state, and ZIP code.

Line 20

Check the box for Line 20 if a copy of this form has been provided to the parent company in compliance with Treasury Regulations Section 301.6402-7.

Line 21

Enter the tax year or tax years that the financial institution was a member of the consolidated group.

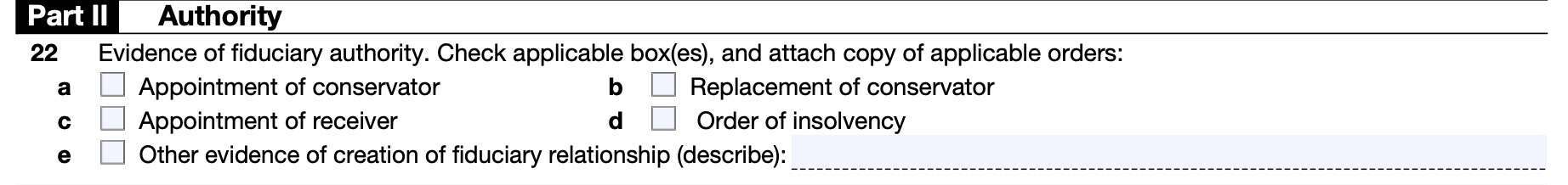

Part II: Authority

Line 22: Evidence of fiduciary authority

In Line 22, check the appropriate box and attach a copy of the applicable order:

- Appointment of conservator

- Replacement of conservator

- Appointment of receiver

- Order of insolvency

- Other evidence of the creation of a fiduciary relationship (provide written description)

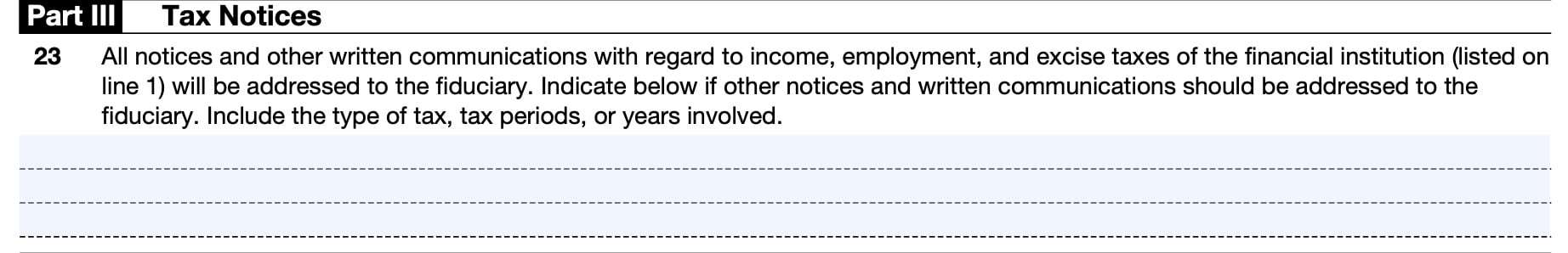

Part III: Tax notices

Line 23

All notices and other written communications with regard to income, employment, and excise taxes of the financial institution will be addressed to the fiduciary, with the exception of notices sent to the common parent under the provisions of Treasury Regulations Section 1.1502-77.

Other notices and written communications will be addressed to the fiduciary only as specified. For example, use this line to identify a transferee tax liability under IRC Section 6901.

Use Line 23 to indicate whether other notices or written communications should be addressed to the fiduciary. Indicate the following:

- Type of tax

- Tax periods involved

- Tax years involved

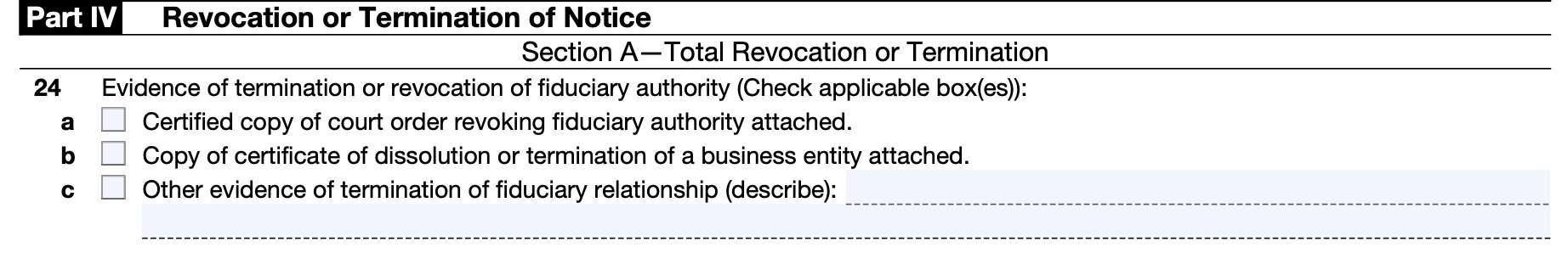

Part IV: revocation or termination of notice

Only complete Part IV for the revocation or termination of a fiduciary relationship, in which you revoke all prior notices concerning relationships on file with the IRS for the tax matters, years, or periods covered by this notice.

In other words, only complete Part IV if you previously filed Form 56-F and are revoking the

Line 24: Evidence of termination or revocation of fiduciary authority

Check the appropriate box, regarding the termination or revocation of fiduciary authority:

- Certified copy of a court order revoking fiduciary authority

- Copy of a certificate of dissolution or termination of a business entity

- Other evidence of the termination of a fiduciary relationship

Attach a copy of the document to the form.

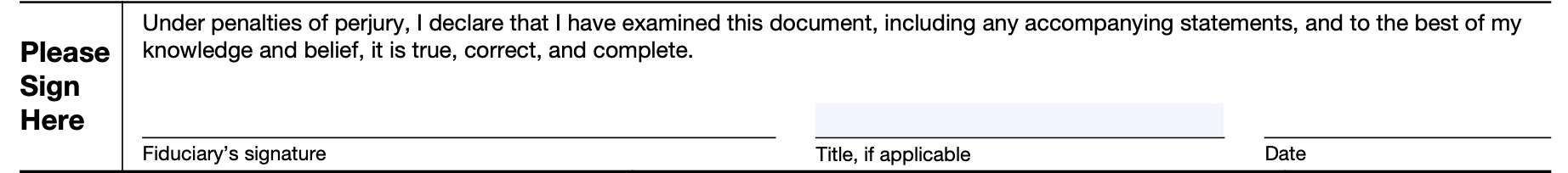

Signature

Enter your sworn signature, title, and date. Your title should indicate whether you are an appointed receiver or conservator.

Video walkthrough

Watch this instructional video to learn how to file Form 56-F to notify the IRS of the creation of a fiduciary relationship or fiduciary relationship changes regarding a financial institution.

Frequently asked questions

Depending on the circumstances, you may file with the Internal Revenue Service Center that previously served the financial institution, or you may file with the advisory group manager for the IRS department with jurisdiction over the financial institution.

The IRS requires that you file Form 56-F with the appropriate IRS center within 10 days of the date of appointment.

Where can I find IRS Form 56-F?

You may find this tax form on the IRS website. For your convenience, we’ve attached the most recent version of Form 56-F here.