IRS Form 966 Instructions

Not all companies will last forever. For any number of reasons, some companies end up being dissolved or liquidated by its shareholders. Depending on the situation the company is in, this may be a taxable event for the company’s shareholders. And that’s where IRS Form 966 comes in.

Table of contents

Introduction

This in-depth article will walk you through IRS Form 966-Corporate Dissolution or Liquidation, specifically:

- What this form is used for

- How to complete this form

- How to obtain copies of this form

- Frequently asked questions about Form 966

However, this article is not a substitute for legal advice or tax advice. For a more detailed discussion about your specific situation, you should talk to an attorney that is knowledgeable about the state law where your corporation is located.

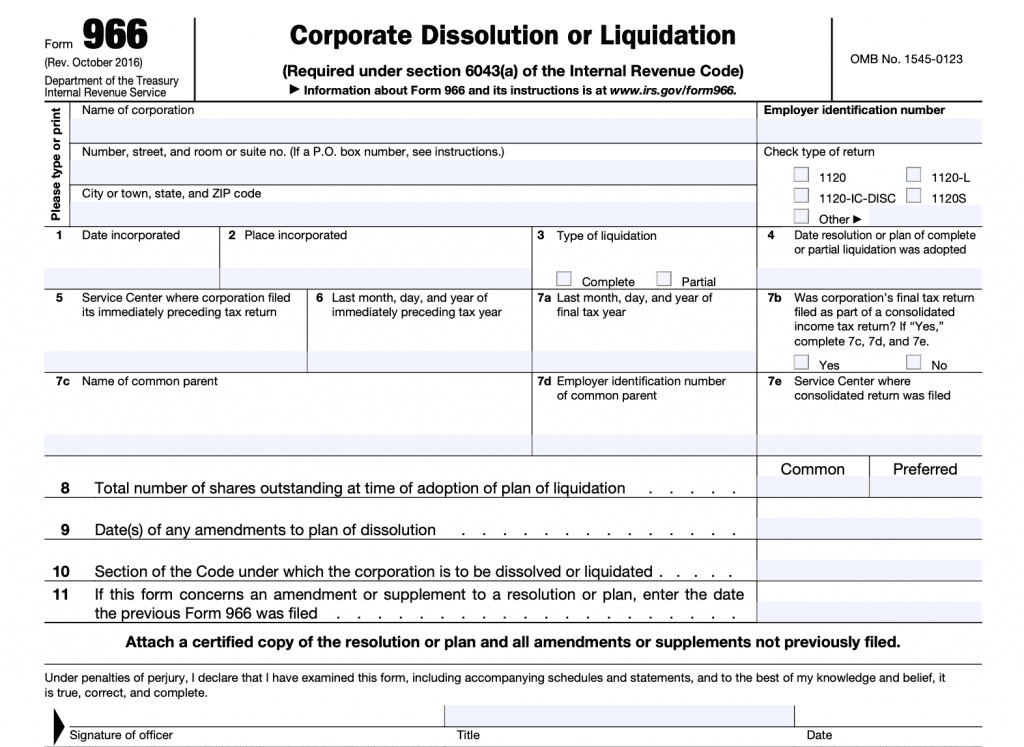

How do I complete IRS Form 966?

In this article section, we’ll walk through this form, step by step. Fortunately, this form is fairly straightforward, and only contains one page.

Top section

In the top section, you’ll input the corporation’s information. This includes:

- Name of corporation

- Mailing address, to include city, state, and zip code. If the corporation has a P.O. box number, include this as well

- Employer identification number

- Type of tax return included

Main form

When you complete the top section, you’ll move through this form, line by line. Most of these lines are self-explanatory. For the lines that are not, we’ll go into a little more depth for complete understanding.

Line 1: Date incorporated

Self-explanatory. However, this should match your company records.

Line 2: Place incorporated

Self-explanatory

Line 3: Type of liquidation

Is this a partial liquidation or a complete dissolution of the company?

Line 4: Date resolution or plan of liquidation was adopted

What day did the company’s board of directors elect to liquidate or dissolve the company?

Line 5: Service center where corporation filed its immediately preceding tax return

This line requests information about the Internal Revenue Service Center where the company filed its most recent tax return. If the company electronically filed its most recent tax return, simply enter “e-file” here.

Line 6: Last month, day, and year of immediately preceding tax year

This should correspond with the end of the tax year reported on the company’s most recent tax return.

Line 7a: Last month, day, and year of final tax year

This line contains the last day, month, and year of the company’s last tax year.

Line 7b: Was corporation’s final tax return part of a consolidated income tax return?

If yes, then you’ll need to complete lines 7c through 7e. If not, proceed to Line 8.

Line 7c: Name of common parent

Self-explanatory

Line 7d: Employer identification number of common parent

Self-explanatory

Line 7e: Service center where consolidated return was filed

This refers to the IRS center where the company filed their most recent consolidated tax return

Line 8: Total number of shares outstanding at the time of liquidation

There are columns for preferred shares and for common shares.

Line 9: Dates of any amendments to plan of dissolution

Self-explanatory

Line 10: Sections of the Code under which the corporation is to be dissolved or liquidated

In this line, you’ll identify the code section under which the corporation is to be dissolved or liquidated. According to the IRS website, two of the more common code references are:

- Section 331: Complete or partial liquidation of a corporation

- Section 332: Complete liquidation of a subsidiary company that meets the requirements of Section 332(b)

Line 11: If this form is an amendment or supplement to a resolution or plan, enter date the previous form was filed

Self-explanatory

Signature

An officer of the corporation must sign this form. This could be the president, vice-president, secretary, treasurer, or another corporate officer. If filed on behalf of a corporation by a trustee, receiver, or assignee, then the fiduciary must sign the form.

It’s important to note that the signature is accompanied by a declaration, under penalties of perjury, to the accuracy of the reported information.

Who must file Form 966?

A corporation, or farmer’s cooperative, must file Form 966 if it plans to dissolve the corporation or liquidate the company’s stock, in accordance with Internal Revenue Code Section 6043(a).

IRC Section 6043(a)

Section 6043(a) specifically pertains to corporate liquidations and dissolution transactions.

According to this section, companies must file IRS Form 966 within 30 days of any resolution or corporate decision to dissolve the corporation or liquidate company stock, either partially or completely.

The company must also include the following information in the return:

- Shareholder name

- Shareholder address

- Total number of shares owned by a shareholder

- Class of shares owned

- Amount paid to each shareholder, or fair market value of property distributed

However, there are some special rules, depending on the situation, type of business and the type of liquidation. These rules might dictate using different tax forms to report their deemed liquidation event.

S corporation stock

Subchapter S subsidiaries should file IRS Form 8869-Qualified Subchapter S Subsidiary Election.

Exempt organizations

Tax-exempt organizations should not use IRS Form 966 to report their event. They may need to refer to one of the following:

- IRS Form 990: Return of Organization Exempt from Income Tax

- IRS Form 990-PF: Return of Private Foundation

- Internal Revenue Code Section 4947(a)(1): Trust Treated as Private Foundation

Foreign corporations

A foreign corporation that does not have to file Form 1120-F: U.S. Income Tax Return of a Foreign Corporation, or any other U.S. tax return usually does not file IRS Form 966.

In cases where the IRS requires a company to file a U.S. tax return, the company usually will file this form. IRC Section 6043(a) determines whether a company must file this form.

However, the IRS may require U.S. shareholders of foreign corporations to report information about the corporate dissolution or liquidation of their foreign holding. IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, and its instructions, contain more information about this requirement.

Disregarded entities

If a business entity elects to be treated as a disregarded entity for tax purposes, then it will not use Form 966 to report liquidation events.

Businesses that may elect to be treated as a disregarded entity include:

- Sole proprietorship

- Single member limited liability companies (LLC)

- An LLC owned by a husband and wife

Video walkthrough

Watch this instructional video to learn more about completing IRS Form 966.

Frequently asked questions

When corporate entities completely liquidate their stock, they must recognize the gain or loss on the distribution of its assets. In order to properly report this distribution of property, they will use IRS Form 966-Corporate Dissolution or Liquidation.

A corporation, or farmer’s cooperative, must file Form 966 if it plans to dissolve the corporation or liquidate the company’s stock, in accordance with Internal Revenue Code Section 6043(a).

Taxpayers should file IRS Form 966 with the Internal Revenue Service Center at the address where the corporation or cooperative files its income tax return.

How do I Find iRS Form 966?

You may obtain a copy of this form from the IRS website. You may also download a copy at the bottom of this article.

Related Tax Forms

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.