IRS Form 1098-E Instructions

If you received a copy of IRS Form 1098-E for student loan payments, you might be wondering how this impacts your income tax return.

In this article, we’ll break down what you need to know about IRS Form 1098-E, including:

- How to understand IRS Form 1098-E

- What constitutes a qualified student loan

- How to calculate your student loan interest deduction

- Frequently asked questions

Let’s start with an overview of the tax form itself.

Table of contents

IRS Form 1098-E instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1098-E is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1098-E form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of IRS Form 1098-E. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For payer or borrower

- Copy C: For the recipient or lender

Let’s get into the form itself, starting with the 1098-E information on the left side of the form.

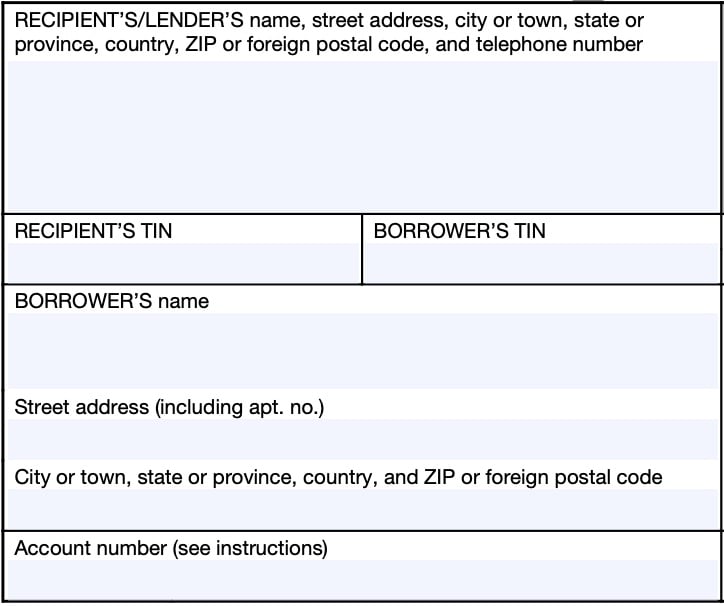

Taxpayer identification fields

On the left-hand side of the tax form, you’ll see taxpayer information for both the lender and the borrower.

Lender’s Name, Address, And Telephone Number

You should see the lender’s contact information, with complete business name, address, zip code, and phone number in this field.

Lender’s TIN

This is the filer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The lender’s TIN should never be truncated.

Borrower’s TIN

As the recipient of IRS Form 1098-E, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Borrower’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account number

Just below the address field, you’ll see the field for Account Number.

This field is present in many information returns, such as IRS Form 1099-INT or IRS Form 1099-DIV.

Your lender have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

However, IRS instructions dictate that the account number is required if the filer has:

- Created multiple accounts for a recipient, and

- Is filing more than one Form 1098-E for that person

In this situation, you would expect to see a separate Form 1098-E for each account number.

Let’s check out the numbered fields, which start on the right-hand side of this tax form.

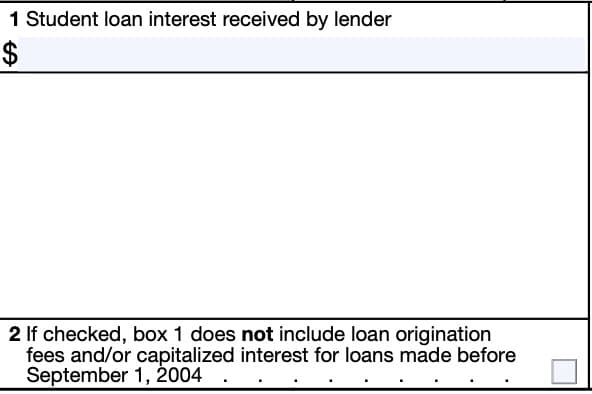

Box 1 and Box 2

There are only two information fields on the right-side of this form. Let’s start at the top.

Box 1: Student loan interest received by lender

Box 1 shows the interest received by the lender during the calendar year on one or more student loans made to you.

According to Treasury Regulations Section 1.221-1(f), Box 1 must include loan origination fees and capitalized interest received during the previous year for loans made on or after September 1, 2004.

If your qualified student loan was made before September 1, 2004, you may be able to deduct loan origination fees and capitalized interest not reported in Box 1.

Qualified student loan

To be a qualified student loan for 2023, a student loan must be either:

- Subsidized, guaranteed, financed, or otherwise treated as a student loan under a program of the federal, state, or local government, or of a postsecondary educational institution; or

- Certified by the borrower as a student loan incurred solely to pay qualified higher education expenses.

Box 2

If Box 2 contains a check, this indicates that loan origination fees and/or capitalized interest are not included in Box 1 for loans made before September 1, 2004.

In these cases, IRS Publication 970, Tax Benefits for Education, provides additional guidance on how to allocate federal student loan payments. This should help taxpayers understand how to report the correct amount of student loan interest on their individual tax return.

Allocating student loan payments between interest and principal

According to Publication 970, the allocation of payments between interest and principal might not be the same for income tax purpose as what is shown on the copy of your 1098-E form or other statement that you receive from your federal loan servicers or lender.

In other words, the amount of interest that you should deduct on your individual returns might not be the same as the portion of the interest reported on your 1098-E statement.

To make this allocation for income tax purposes, a payment generally is applied in the following order:

- Stated unpaid interest as of the date of payment

- Loan origination fees allocable to the loan payment

- Capitalized interest that remains unpaid

- Outstanding principal

For student loans that originated before September 2004, the second two items are missing, so you may need to add them back in. For student loans where you did not receive a Form 1098-E at all, you will have to do all this manually.

Knowing how to properly allocate your student loan payments between principal and interest will help you:

- Appropriately report the total interest payments

- Maximize your student loan deduction.

Here’s an example.

Student loan interest allocation example

In August 2022, you took out a $10,000 student loan to pay the tuition for your senior year of college.

The lender charged a 3% loan origination fee ($300) that was withheld from the funds you received. The interest (5% simple) on this loan accrued while you completed your senior year and for 6 months after graduating.

At the end of that period, the lender determined the amount to be repaid by capitalizing all accrued but unpaid interest ($625 interest accrued from August 2022 through October 2023) and adding it to the outstanding principal balance of the loan.

The loan is payable over 60 months, with a payment of $200.51 due on the first of each month, beginning November 2023.

You didn’t receive a Form 1098-E for 2023 from the lender because the amount of interest you paid didn’t require the lender to issue an information return. However, you did receive an account statement from the lender that showed the following 2023 payments on your outstanding loan of $10,625 ($10,000 principal + $625 accrued but unpaid interest):

| Payment Date | Payment | Stated Interest | Principal |

| November 2023 | $200.51 | $44.27 | $156.24 |

| December 2023 | $200.51 | $43.62 | $156.89 |

| Totals | $401.02 | $87.89 | $313.13 |

From here, we’ll determine how much is interest, and how much is principal, using the four steps outlined above.

1. Allocate stated interest

To determine the amount of interest that could be deducted on the loan for 2023, you start with the total amount of stated interest you paid, $87.89.

2. Allocate loan origination fee

Next, allocate the loan origination fee over the term of the loan ($300 ÷ 60 months = $5 per month). A total of $10 ($5 of each of the two principal payments) should be treated as interest

for tax purposes.

Subtract this from the principal payments of $313.13, and you should have $303.13 remaining.

3. Allocate unpaid capitalized interest

You then apply the unpaid capitalized interest ($625) to the two principal payments ($303.13) in the order in which they were made.

Because the amount of capitalized interest exceeds the 2023 principal payments, you determine that the remaining amount of principal for both payments should be treated as interest for tax purposes. Assuming that you qualify to claim tax deductions for student loan interest payments, you can deduct $401.02 ($87.89 + $10 + $303.13).

If the principal payments exceeded the amount of unpaid capitalized interest, then the excess would be allocated to principal.

4. Amounts to allocate for next tax year

For 2024, you would continue to allocate $5 of the loan origination fee to the principal portion of each monthly payment you make and treat that amount as interest for tax purposes.

You will also apply the remaining amount of capitalized interest ($625 − $303.13 = $321.87) to the

principal payments in the order in which they are made until the balance is zero, and treat those amounts as interest for tax purposes.

How to deduct student loan interest on your tax return

Deducting student loan interest from your federal tax return is fairly straightforward.

Student loan interest is considered an above-the-line tax deduction. This means that eligible taxpayers can deduct student loan interest to arrive at adjusted gross income (AGI), instead of having to take this deduction from AGI.

This may help certain taxpayers access tax benefits that may be determined by AGI limitations, such as:

- Ability to make Roth IRA contributions

- Deductibility of traditional IRA contributions

- Tax credits subject to income limits

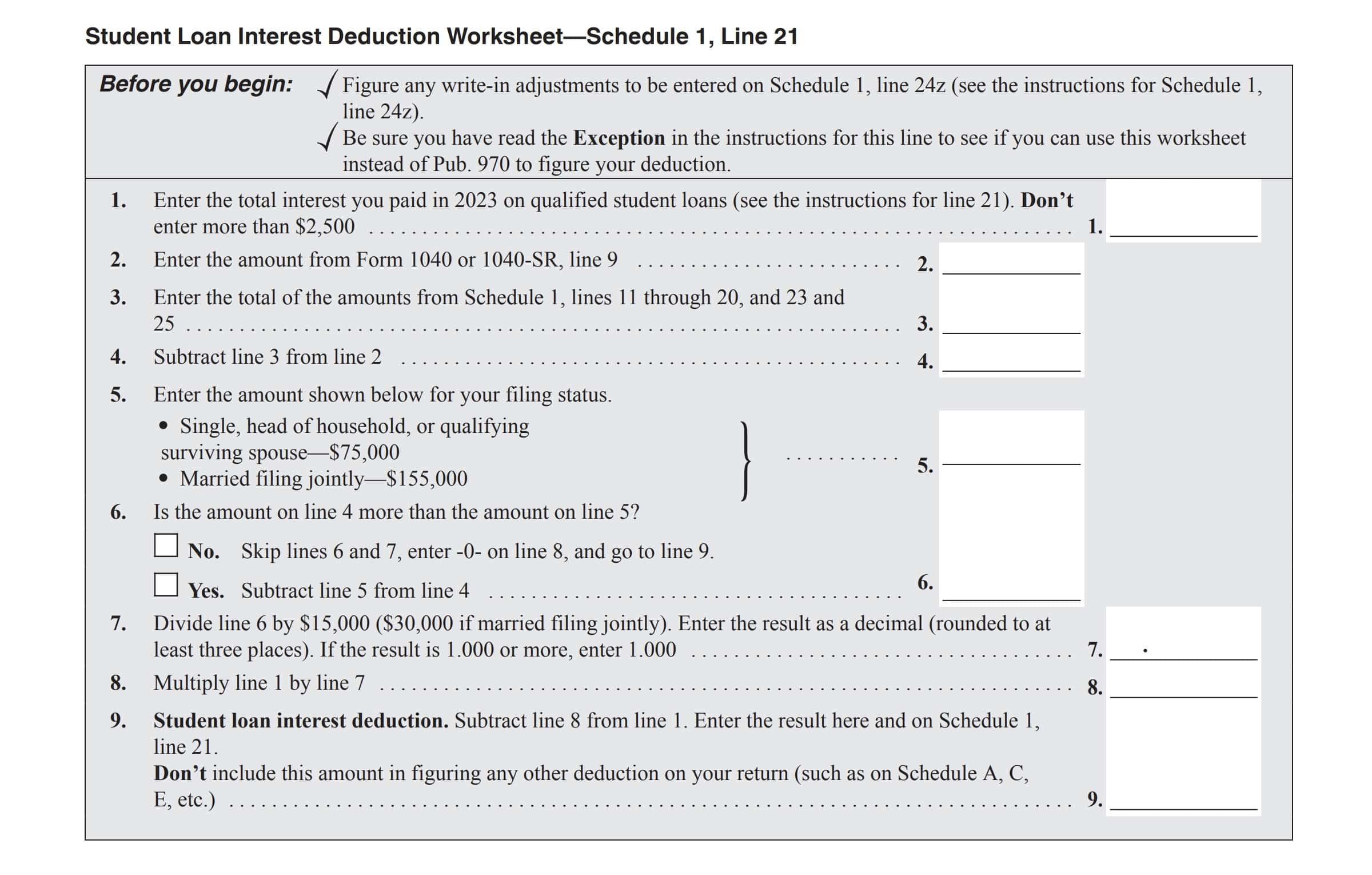

However, you may need to use one of two available worksheets to calculate your student loan interest deduction:

- Student loan interest deduction worksheet, located in the Schedule 1 instructions

- Worksheet 4-1, Student loan interest deduction worksheet, located in IRS Publication 970

Student loan interest deduction worksheet (IRS Schedule 1)

Most taxpayers may use the deduction worksheet located in the Schedule 1 instructions.

However, taxpayers may need to use the Publication 970 worksheet if any of the following conditions apply:

- You are filing IRS Form 2555, Foreign Earned Income

- You are filing IRS Form 4563, Income Exclusion For Residents of American Samoa

- You are excluding income from sources within Puerto Rico

In this case, you would use the worksheet from IRS Publication 970

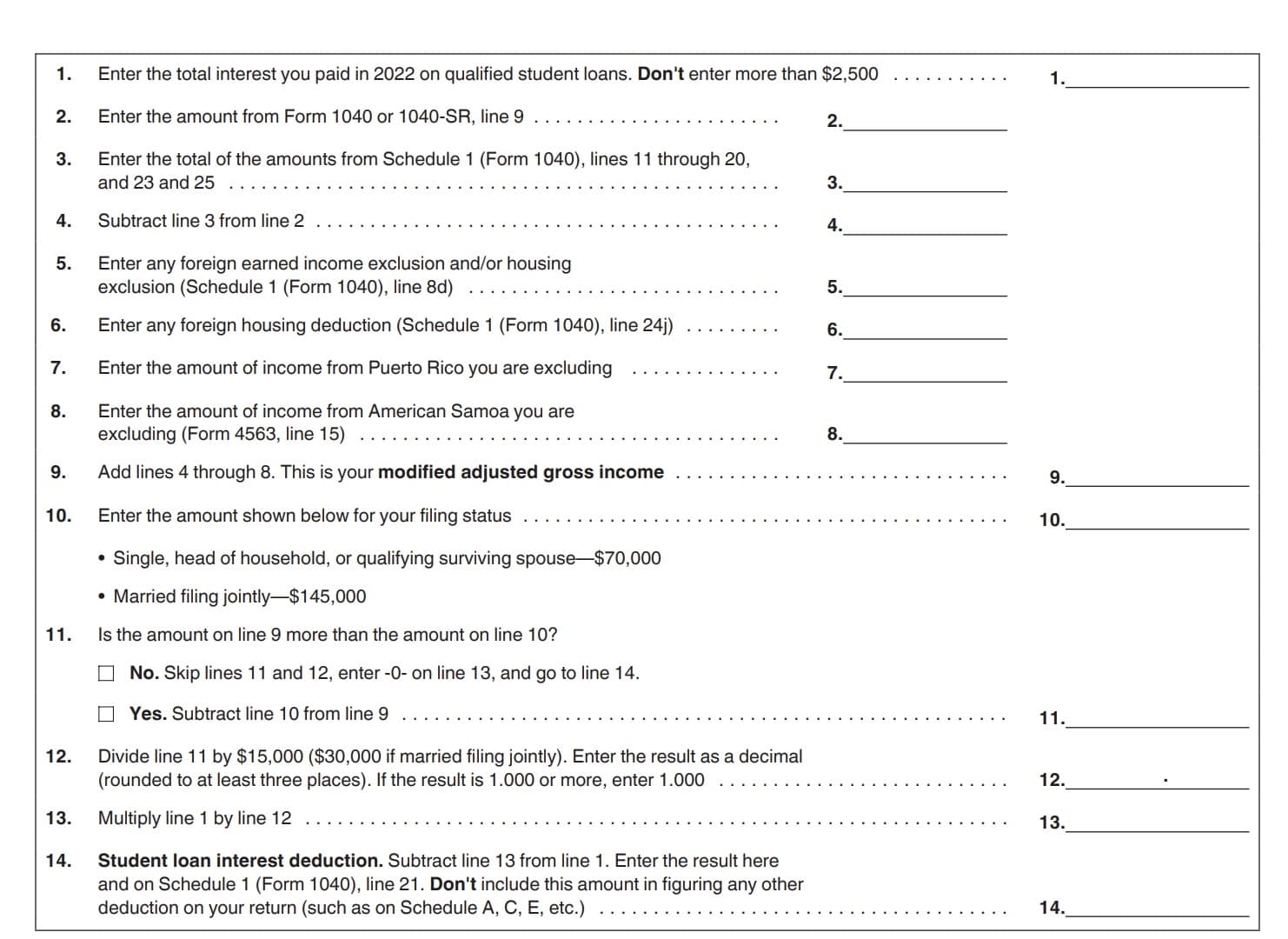

Student loan interest deduction worksheet (IRS Publication 970)

Taxpayers who file IRS Form 2555 or are excluding income from American Samoa or Puerto Rico must use this worksheet instead.

Prior to beginning this student loan calculation, you must complete the following lines, as they apply to your tax situation:

- IRS Form 1040 or Form 1040-SR

- Line 9: Total Income

- Schedule 1, Additional Income & Adjustments to Income:

- Line 11, Educator expenses

- Line 12, Certain business expenses of reservists, performing artists, and fee-basis government officials: IRS Form 2106

- Line 13, Health savings account deduction: IRS Form 8889

- Line 14, Moving expenses for members of the Armed Forces: IRS Form 3903

- Line 15, Deductible part of self-employment tax: IRS Schedule SE

- Line 16, Self-employed SEP, SIMPLE, and qualified plans

- Line 17, Self-employed health insurance deduction

- Line 18, Penalty on early withdrawal of savings, reported on either:

- IRS Form 1099-INT, Interest Income, or

- IRS Form 1099-OID, Original Issue Discount

- Line 19, Alimony paid

- Line 20, IRA deduction

- Line 23, Archer MSA deduction: IRS Form 8853

- Line 25, Total other adjustments

Entering your student loan interest deduction into your tax return

However you calculate your student loan interest deduction, you can simply add that figure (up to $2,500 per household to Line 21 of your Schedule 1, Additional Income and Adjustments to Income.

Video walkthrough

Watch this instructional video to learn more about IRS Form 1098-E.

Frequently asked questions

Taxpayers should expect to receive their Form 1098-E student loan interest statement from their student loan servicer or financial institution by January 31 following the tax year that the loan interest was paid. Issuers must file Form 1098-E with the IRS by February 28.

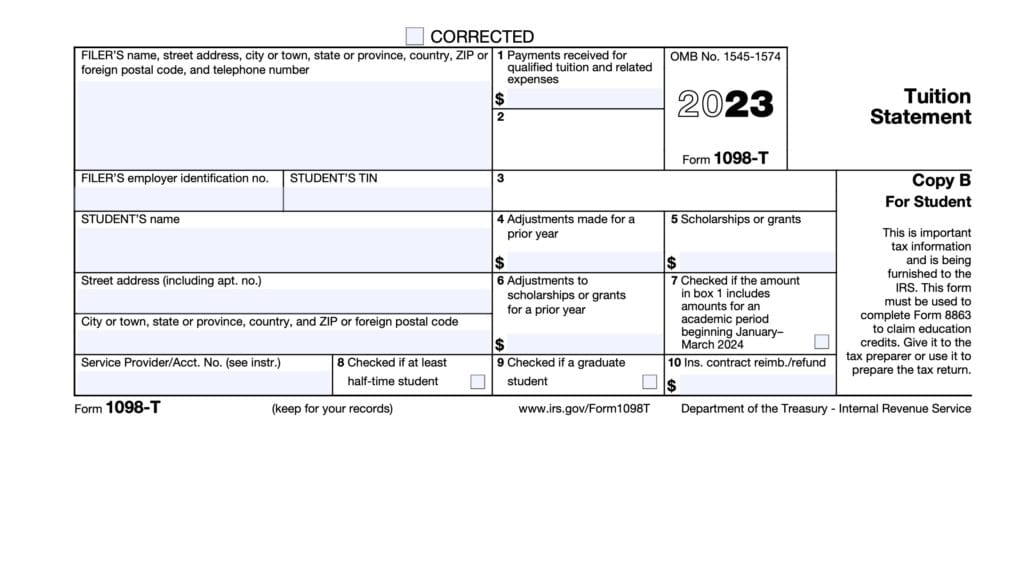

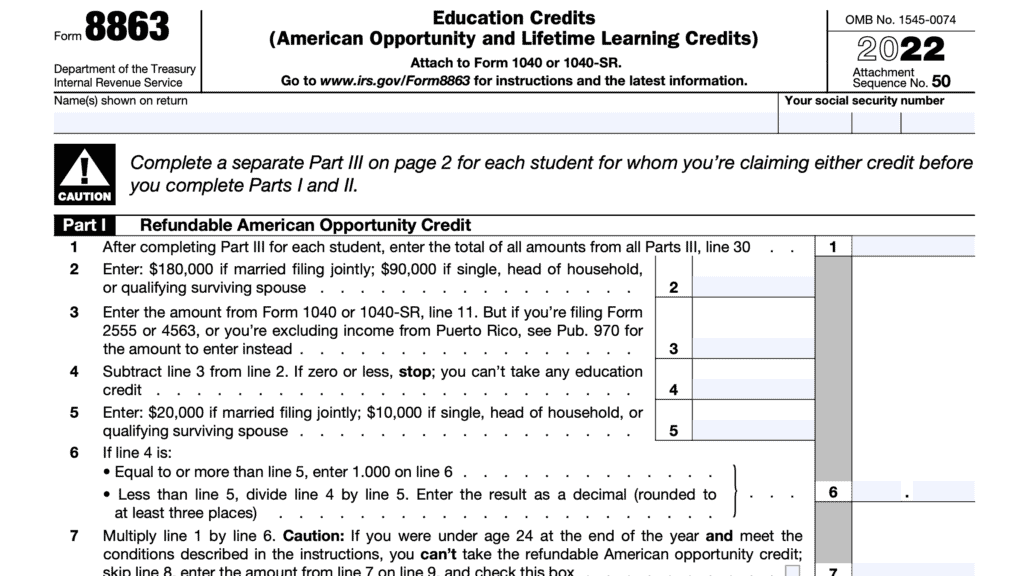

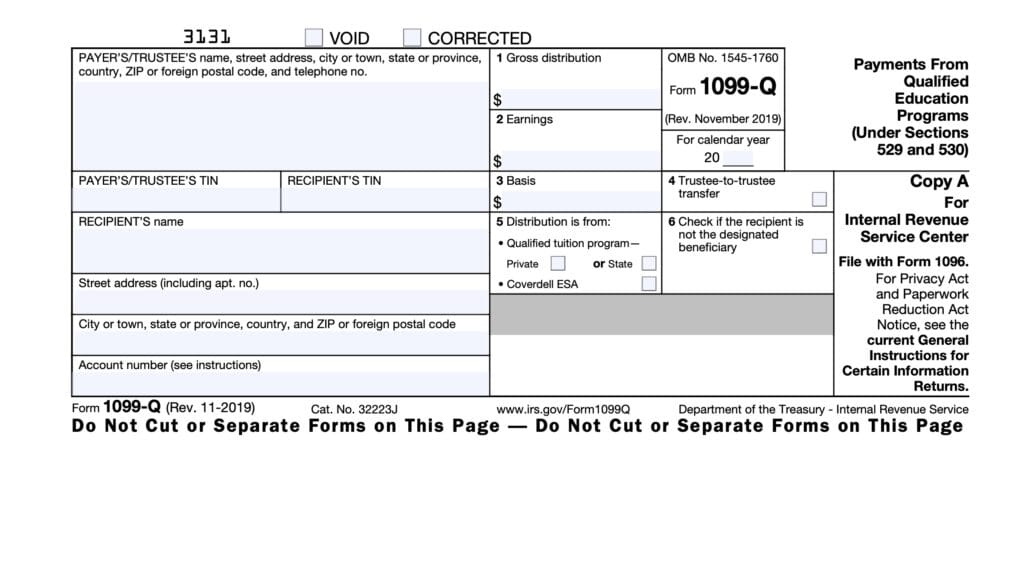

Taxpayers may file IRS Form 8863 to take a tax credit for any qualified educational expense paid. However, this information appears on IRS Form 1098-T, Tuition Statement, which should be used to apply for either the American Opportunity Credit or the Lifetime Learning Credit.

Where can I find IRS Form 1098-E?

As with most IRS Forms, you can find IRS Form 1098-E on the IRS website. For your convenience, we’ve attached the latest version of this tax form here in this article.