IRS Form 8283 Instructions

Since the passage of the Tax Cuts and Jobs Act (TCJA) significantly increased the standard deduction, fewer taxpayers itemize their deductions on their income tax return than ever before. For significant noncash contributions, taxpayers use IRS Form 8283 to report the value of their donations to the Internal Revenue Service.

This article will walk through IRS Form 8283 and noncash charitable contributions, specifically:

- How to complete Form 8283 to report your non-cash contributions

- How reporting noncash charitable contributions works

- Records retention requirements for charitable contributions

- IRS guidance and statistics regarding noncash contributions

Let’s start by going through this tax form, step by step.

Table of contents

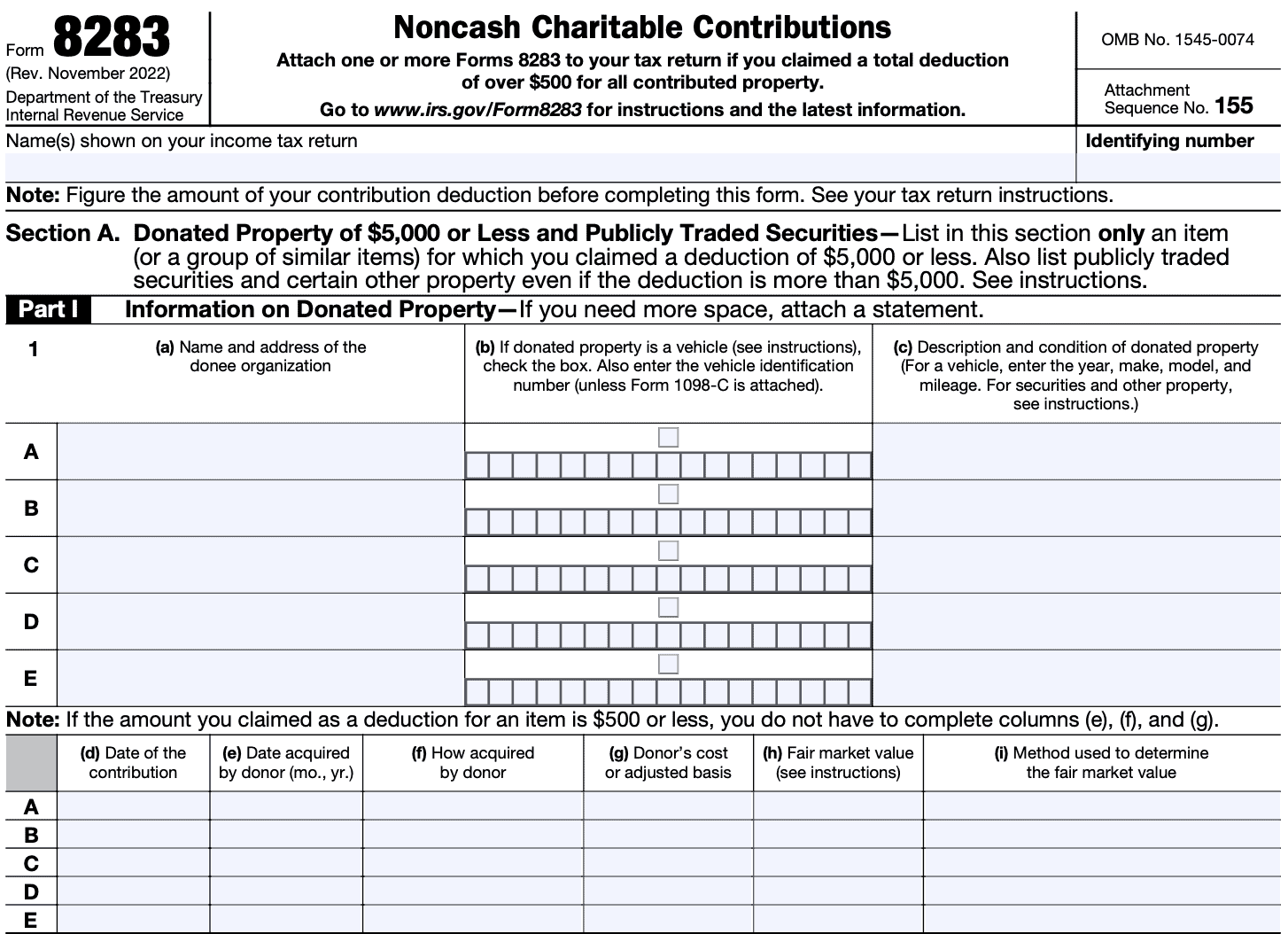

How do I complete IRS Form 8283?

We’ll walk through this two-page form, step by step. Let’s start with Section A.

Section A: Donated Property of $5,000 or Less and Publicly Traded Securities

Complete Section A only for:

- Items (or a group of similar items) resulted in a total deduction of $5,000 or less

- Publicly traded securities (even if valued at more than $5,000)

- Contributions of motor vehicles (even more than $5,000)

Identifying number

For identifying number, individuals must enter their Social Security number. Other taxpayers must enter their employer identification number (EIN).

Line 1

Most of the fields are self-explanatory, but below is specific guidance from the IRS form instructions:

Column (b)

If the donated property is a qualified vehicle, check the box and enter the vehicle identification number, unless Form 1098-C is attached.

Column (c)

Provide details according to the form instructions.

For a vehicle, enter the year, make, model, and mileage.

If you’re listing securities, enter the following:

- Company name

- Number of shares

- Kind of security

- Whether a share of a mutual fund,

- Whether regularly traded on a stock exchange or in an over-the-counter market

For personal property, enter the condition of the property and whether the donee certified the property for its own use as a tax exempt organization.

Column (d)

Enter the date of contribution for each item.

Column (e): Date acquired

If the amount of deduction for an item is $500 or less, you do not have to complete Column (e) through Column (g). Otherwise, enter the month and year you acquired each piece of property.

Column (f): How acquired

Enter the means by which you acquired the property. This could be by purchase, gift, inheritance, or exchange.

Column (g): Donor’s cost or adjusted basis

Enter your cost of adjusted basis, except for securities held longer than 12 months.

Column (h): Fair market value (FMV)

Enter the FMV of the property on the date you donated it. You must attach a statement if:

- You were required to reduce the FMV to figure the amount of your deduction, or

- You gave a qualified conservation contribution for which you claimed a deduction of $5,000 or less.

Column (i): Method used to determine FMV

This could be:

- Appraisal

- Thrift shop value

- Comparable sales

- Catalog list price

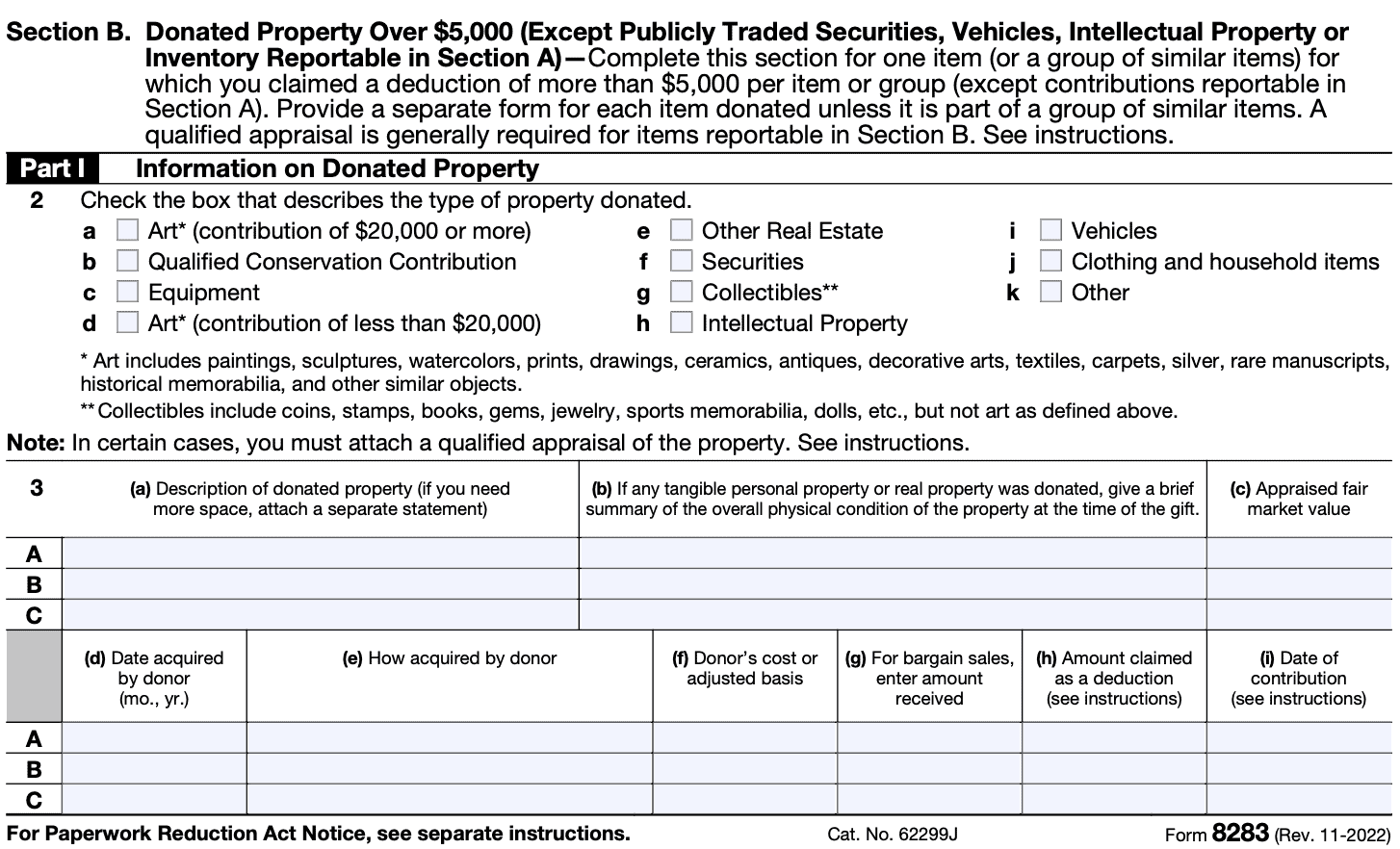

Section B: Donated Property Over $5,000

If the total deduction of a donated item exceeds $5,000, and is not already listed in Section A, then you must complete Section B.

Line 2: Check the appropriate box

Only check one applicable box. If there is more than one item, then you must complete a separate IRS Form 8283 for each.

Line 3

You must complete column (a) and column (b) (if applicable) before giving the form to the donee for completion. Most of the columns are similar to Section A. However, differences are noted below.

Column (a)

Provide a detailed description so a lay person unfamiliar with the property could be sure the property that was appraised is the property that was contributed. The greater the value of the property, the more detail you must provide.

For a qualified conservation contribution, describe the easement terms in detail, or attach a copy of the easement deed.

A description of donated securities should include the company name and number of shares donated. Do not include donated securities reportable in Section A.

Column (b)

If any tangible personal property or real property was donated, give a brief summary of the overall physical condition of the property at the time of the gift.

Column (c)

Include the FMV from the appraisal.

Column (d)

If you are donating a group of similar items and you acquired the items on various dates (but have held all the items for at least 12 months), you can enter “Various.”

Columns (d)–(f)

If you have reasonable cause for not providing the information in column (d), (e), or (f), attach an explanation so your deduction will not automatically be disallowed.

For a qualified conservation contribution, indicate whether you are providing information about the underlying property or about the easement.

Column (g)

A bargain sale is a transfer of property that is in part a sale or exchange and in part a contribution. Enter the amount received for bargain sales.

Column (h) & Column (i)

Complete column (h) and (i) only if you were not required to get an appraisal, as explained earlier.

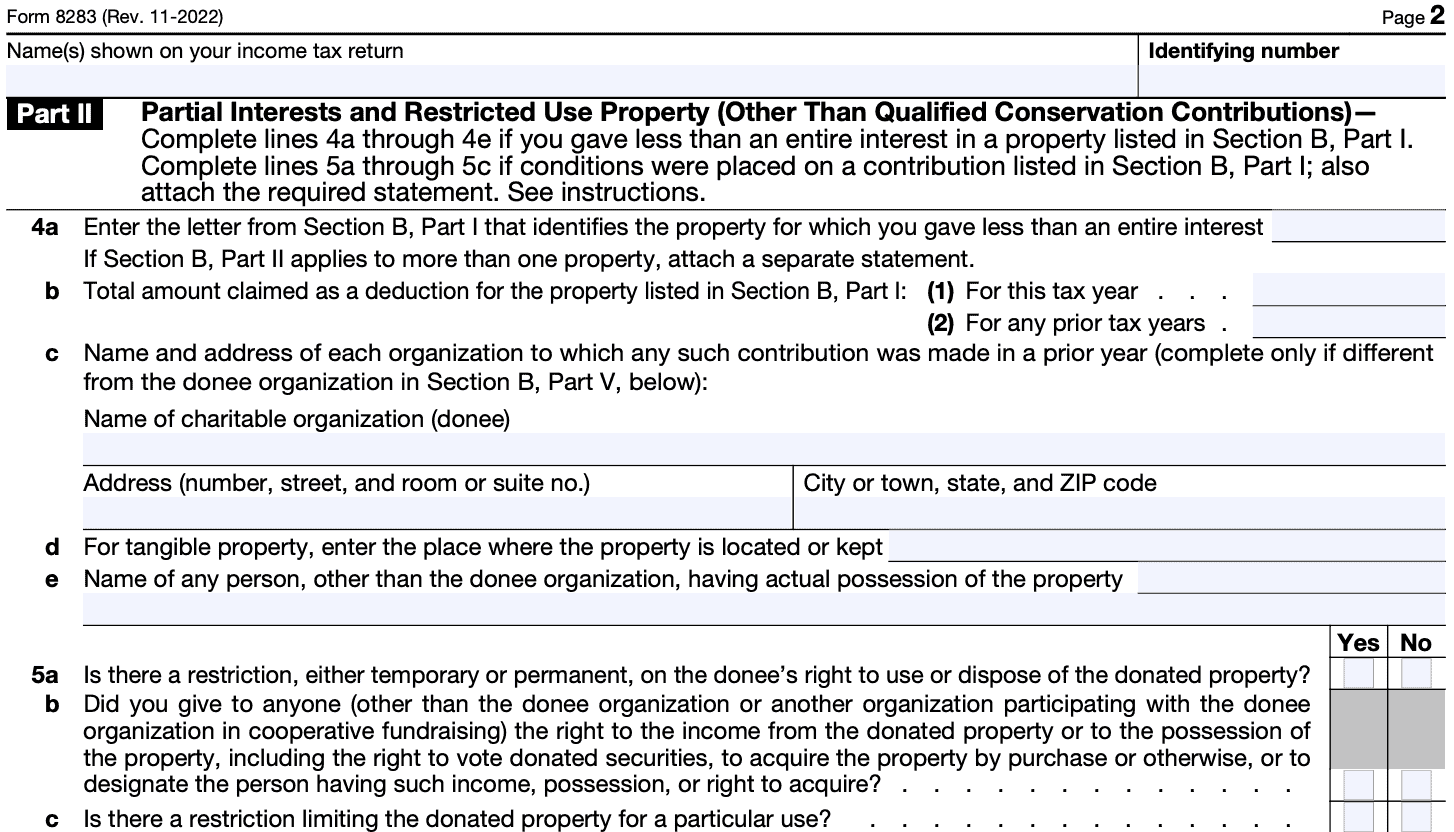

Line 4: Partial interests

Only complete Part II if either of the following applies:

- You contributed less than the entire property interest listed in Part I

- You attached restrictions to the right to the income, use, or disposition of the donated property

Complete Lines 4a–4e only if you contributed less than the entire interest in property listed in Section B, Part I.

Line 5: Restricted use property

Complete Lines 5a–5c only if you attached restrictions to the right to the income, use, or disposition of the donated property.

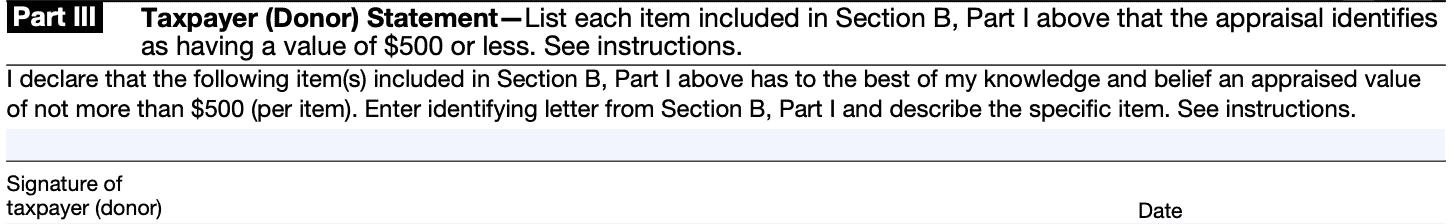

Section B, Part III: Taxpayer statement

Complete Section B, Part III, for each item included in Section B, Part I, that has an appraised value of $500 or less.

Because you may not have to show the individual value of these items in Section B, Part I, of the donee’s copy of IRS Form 8283, clearly identify them for the donee in Section B, Part III. That way the donee does not have to file IRS Form 8283 for the items valued at $500 or less.

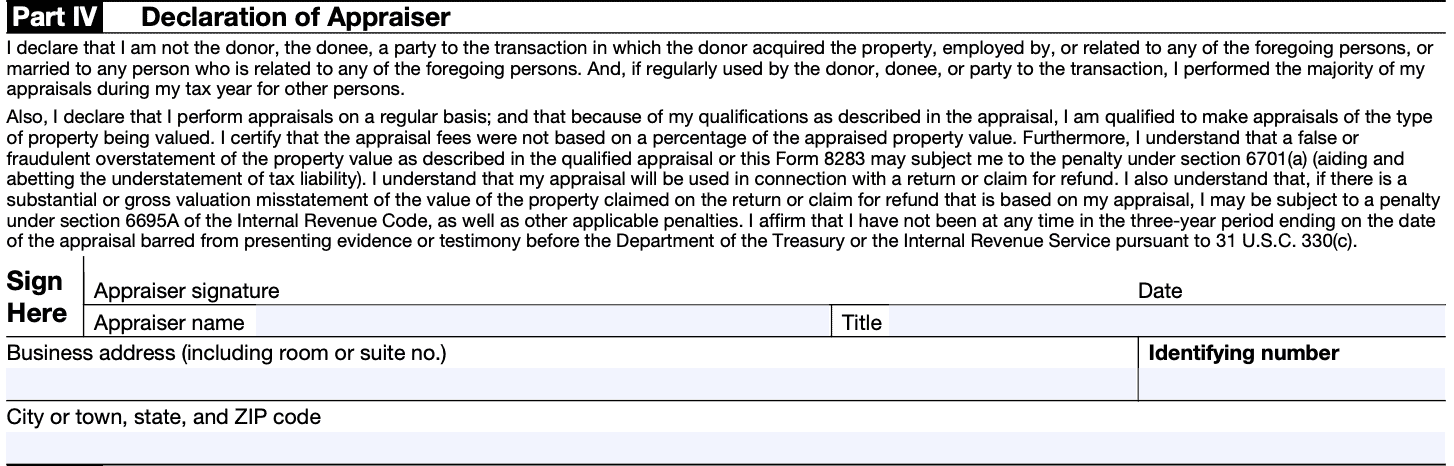

Section B, Part IV: Declaration of Appraiser

This section includes the name, address, identifying number, and address of the appraiser. This declares that the appraiser meets all the qualified appraiser requirements previously mentioned.

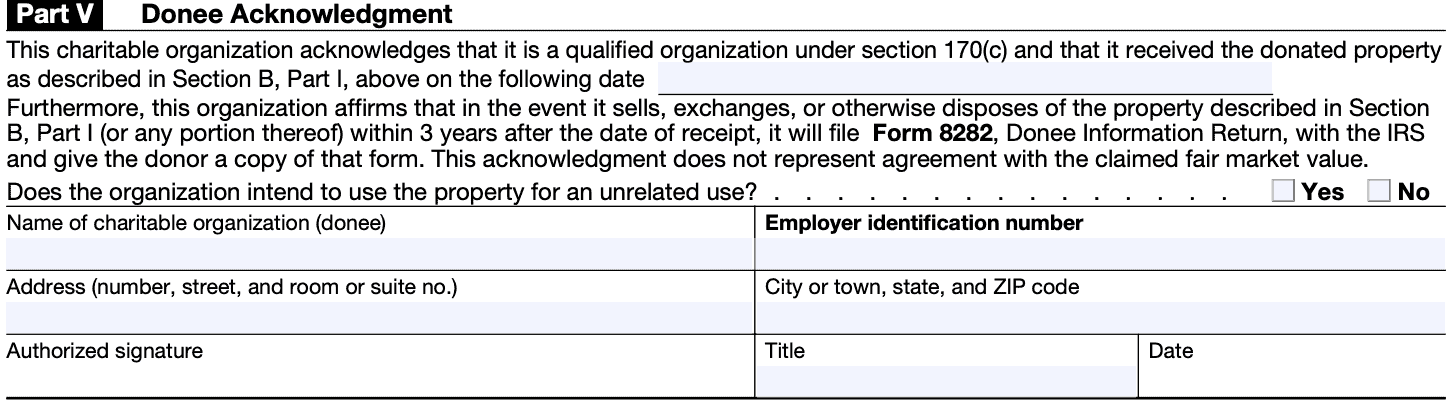

Section B, Part V: Donee acknowledgement

The person acknowledging the gift must be an official authorized to sign the tax returns of the organization, or a person specifically designated to sign IRS Form 8283.

When you ask the donee to fill out Part V, you should also ask the donee to provide you with a contemporaneous written acknowledgment required by Section 170(f)(8).

What charitable contributions do people report on IRS Form 8283?

According to 2018 IRS tax data (the latest available at the time of this writing), over 4.2 million individual taxpayers reported noncash charitable donations on Form 8283. These non-gifts represented over $70.8 billion in charitable deductions reported on Schedule A during that year.

By comparison, in 2017, the final year before TCJA took effect, 8.8 million taxpayers reported over $84 billion in deductions on Form 8283 and Schedule A. This represents a 52% decrease in donations but only a 16% decrease in the dollar value of donations.

It appears that there is a difference between the type of contributions people are making and the dollar value of the contributions.

What types of contributions are people making

Here are the 5 most common types of non-cash donations:

- Clothing (53.3% of donations)

- Household items (29.9%)

- Corporate stock (2.9%)

- Electronics (2.1%)

- Food items (1.7% of donations)

However, when you rank these donations in terms of dollar value, you get a different outcome:

- Corporate stock (54% of donation value carried to Schedule A)

- Clothing (9.7%)

- Easements (9.2%)

- Household items (6.7%)

- Mutual funds (3.4% of donation value)

In other words, many households donate clothing and household items. But those donations are not nearly as valuable as the dollar value of stock and other securities or land easements donated to charity. Part of that appears to be the reporting requirements involved in reporting contributed property.

How does reporting noncash charitable contributions work?

Reporting cash contributions is simple. You donate a specific amount of money, either by cash, check, or other monetary gift, receive a written acknowledgement or receipt from the charity, and keep proper records.

With a noncash charitable deduction, it can be a little trickier, depending on the dollar value of the contribution. Let’s take a look at each dollar threshold, according to IRS Publication 526, Charitable Contributions.

Noncash donations valued at less than $250

For all donations, each taxpayer should obtain a receipt, or maintain adequate records. For non-cash gifts valued at less than $250, a taxpayer doesn’t need to obtain a receipt, if it is impractical to do so. However, the taxpayer must keep records containing:

- The name and address of the qualified organization which received the contributed property

- The date and location of the charitable contribution

- A description of the property in sufficient detail under the circumstances for a layperson to understand that the description is of the contributed property (taking into account the value of the property); and

- For a security, the following information:

- Name of the issuer

- Type of security

- Whether it is publicly traded as of the date of the contribution

A security is generally considered to be publicly traded if the security is:

- Listed on a recognized stock exchange whose quotations are published daily,

- Regularly traded on a national or regional over-the-counter market, or

- Quoted daily in a national newspaper of general circulation in the case of mutual fund shares

A taxpayer’s records must also reflect the following:

- If the donated item is clothing or a household item, a description of the condition of the clothing or item.

- The fair market value of the property at the time of the contribution and

- How you figured the fair market value.

More than $250 but less than $500

For noncash gifts between $250 and $500, a taxpayer must get and keep a contemporaneous written acknowledgment of the contribution from the donee organization. For more than one contribution of $250 or more, taxpayers must have either:

- A separate acknowledgment for each, or

- One acknowledgment that shows the total contribution

What is a contemporaneous written acknowledgement?

Charitable organizations usually send written acknowledgements by January 31 of the following tax year. All acknowledgements must:

- Be in written form

- Contain the following information:

- The amount of cash contributed, if applicable

- Whether the qualified organization rendered any goods or services as a result of contribution contribution (other than certain token items and membership benefits),

- A description and good faith estimate of the value of any goods or services described. If the only benefit rendered by the organization was an intangible religious benefit, the acknowledgement must say so

To qualify as a contemporaneous written acknowledgement, the taxpayer must receive it on the earlier of the following dates:

- The date the taxpayer files their income tax return for the year of the contribution; or

- The due date, including extensions, for filing the federal tax return.

More than $500 but less than $5,000

In addition to the above, any taxpayer claiming a tax deduction of more than $500 but less than $5,000 must complete Form 8283, Section A. The completed Form 8283 must contain:

- Taxpayer’s name and taxpayer identification number

- The name and address of the qualified organization,

- The date of the contribution, and

- The following information about the contributed property:

- A description of the donated property in sufficient detail for a layperson not generally familiar with the type of property to understand that the description is of the contributed property;

- The fair market value of the property on the contribution date and the method used in figuring the fair market value;

- How the taxpayer received the property

- The approximate date the taxpayer received such property or, if created, produced, or manufactured, the approximate date the property was substantially completed; and

- The cost or other basis, and any adjustments to the basis, of property held less than 12 months and, if available, the cost or other basis of property held 12 months or more.

- Doesn’t apply to publicly traded securities.

Depending on the type of property contributed, there might be additional required information:

- In the case of real or tangible property, its condition;

- In the case of tangible personal property, whether the donee has certified it:

- For a use related to the purpose or function constituting the donee’s basis for exemption under Section 501 of the Internal Revenue Code or,

- In the case of a governmental unit, an exclusively public purpose

- In the case of securities, the following:

- Name of the issuer

- Type of securities

- Whether they were publicly traded as of the date of the contribution

Contributions over $5,000

For a noncash donation above $5,000, taxpayers must do everything above. In addition, the taxpayer must obtain a qualified appraisal conducted by a qualified appraiser, for most items.

Art contributions over $20,000

If the amount of donated art exceeds $20,000, you must attach a complete copy of the signed written appraisal to your tax return.

Contributions over $500,000

In addition to the above, for contributions over $500,000, a copy of each qualified appraisal must accompany the completed tax return. Treasury Regulations Section 1.170A-16 contains more information.

Video walkthrough

Frequently asked questions

According to the IRS website, a qualified appraisal document is one that is:

-Made, signed, and dated by a qualified appraiser in accordance with generally accepted appraisal standards

-Meets Treasury Department standards

-Has a valuation effective date no earlier than 60 days before the date of the contribution and no later than the date of the contribution

-For an appraisal report dated on or after the date of the contribution, the valuation effective date must be the date of the contribution; and

-Does not involve a prohibited appraisal fee.

The IRS considers an individual to be a qualified appraiser if they meet the following criteria:

-Has earned an appraisal designation from a generally recognized professional appraiser organization, or

-Has met certain minimum education requirements and 2 or more years of experience.

-The individual regularly prepares appraisals for which he or she is paid

-The individual is not an excluded individual.

To meet the minimum education requirement, the individual must have successfully completed professional or college-level coursework obtained from:

-A professional or college-level educational organization,

-A professional trade or appraiser organization that regularly offers educational programs in valuing the type of property, or

-An employer as part of an employee apprenticeship or education program similar to professional or college-level courses.

An excluded individual is one of the following:

-The donor of the property or the taxpayer who claims the deduction

-The donee of the property

-A party to the transaction in which the donor acquired the property being appraised, unless the property is donated within 2 months of the date of acquisition and its appraised value is not more than its acquisition price. This applies to the person who sold, exchanged, or gave the property to the donor, or any person who acted as an agent for the transferor or donor in the transaction.

-Any person employed by any of the above persons.

-Any person related under Internal Revenue Code Section 267(b) to any of the above, or someone married to a person related to any of the above persons

-An appraiser who appraises regularly for a related party, as described above, and who does not perform a majority of his or her appraisals made during his or her tax year for other persons

-An individual who receives a prohibited appraisal fee for the appraisal of the donated property. Generally, a fee structured as a percentage of the overall value is a prohibited fee

-An individual who is prohibited from practicing before the IRS under Section 330(c), Title 31 of the United States Code at any time during the 3-year period prior to the appraisal date.

A qualified appraisal is not required for contributions of:

–Qualified vehicles for which you obtain a contemporaneous written acknowledgement

-Certain inventory

-Publicly traded securities, or

-Certain intellectual property

You must keep all qualified appraisals in your records and submit Form 8283 with your tax return.

Where can I find a copy of IRS Form 8283?

You can download a copy of this and other tax forms on the IRS website. Otherwise, you may download a copy of Form 8283 by selecting the file below.

Related tax forms

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.