IRS Form 2441 Instructions

For many working families, child and dependent care expenses are a significant challenge. Either someone has to sacrifice work to care for family members or pay significant amounts to a child care provider or caretaker. Fortunately, the Internal Revenue Service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using IRS Form 2441.

In this article, we’ll help you break down everything you need to know about IRS Form 2441, including:

- How to complete this tax form

- Claiming the child care and dependent care expense tax credits

- Frequently asked questions

Let’s start with a step by step guide on how to complete Form 2441.

Table of contents

IRS Form 2441 Instructions

This tax form consists of three parts:

- Part I: Persons or Organizations Who Provided the Care

- Part II: Credit for Child or Dependent Care Expenses

- Part III: Dependent Care Benefits

We’ll go through each part, line by line. Before we start with Part I, let’s take a look at the taxpayer information fields just above.

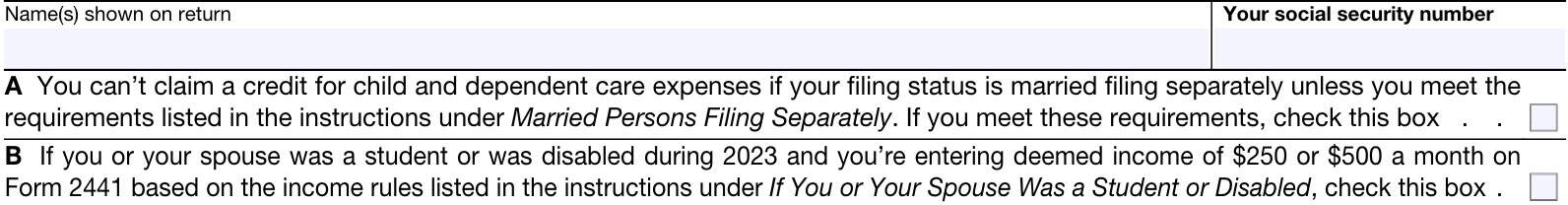

Taxpayer information

Before starting Part I, there are a couple of things worth pointing out.

Taxpayer name & Social Security number

If you’re filing an electronic return, your tax preparation software will likely complete your name and Social Security number automatically. Otherwise, enter that information at the top of the form.

Additionally, there are two boxes that you may need to check.

Box A

Check the first box if both of the following apply:

- Your filing status is married filing separately, and

- You meet the criteria for filing Form 2441

Box B

Check the second box if:

- Either you or your spouse was a full-time student or disabled during the tax year, and

- You’re entering deemed income of $250 (or $500 for both spouses) per month based on the income rules in the form instructions

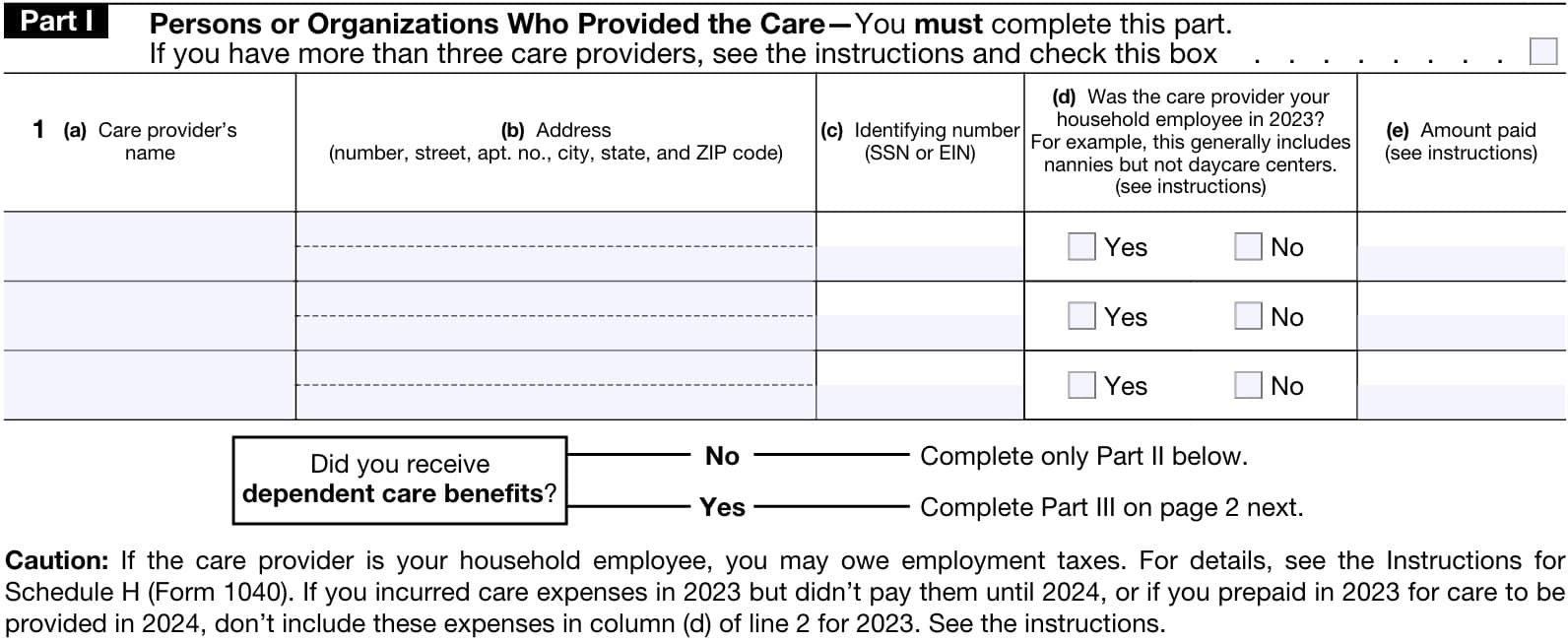

Part I: Persons or Organizations Who Provided the Care

For each care provider that you list, you must provide:

- Care provider’s name

- Address

- Identifying number

- For individuals, this will probably be their SSN or individual taxpayer identification number (ITIN)

- For business entities, like child care facilities, this will likely be the employer identification number, or EIN

- Check whether or not the care provider was a household employee

- Amount paid for either child care expenses or dependent care services

Tips on completing Part I

From the form instructions, below are some tips for completing Part I.

Taxpayers covered by an employer’s care plan

If you were covered by your employer’s dependent care plan and your employer either furnished the care at your workplace or hired a care provider to do so, enter the following and leave columns (c) through (e) blank:

- Column (a): Employer’s name

- Column (b): “See W-2”

If you are listing more than 3 care providers

For taxpayers with more than three care providers, check the respective box and attach a statement with similar information on the additional providers.

Household employees

If your household employee also served as your care provider, you may need to pay employment taxes. Use Schedule H to determine how to calculate employment taxes for your household employee.

Ineligible providers

Do not try to claim an ineligible care provider. Ineligible care providers include:

- Spouse

- Parent of a qualifying child

- Someone that you can claim as a dependent

- If your child provided care for another child or household member, then he or she must have been at least age 19 and cannot be your dependent

In column (e), only list the expenses that you paid in the given tax year, even if services were rendered in the following tax year.

Dependent care benefits

While Part I is mandatory for all taxpayers, you may not need to complete Part II or Part III of Form 2441, below.

- If you did not receive dependent care benefits, then complete Part II, below to calculate your tax credit.

- You do not have to complete Part III.

- If you did receive dependent care benefits, then you’ll need to complete Part III.

Part II: Credit for Child or Dependent Care Expenses

In Part II, we’ll calculate your tax credit based upon the qualifying persons in your household.

Line 2: Qualifying Person(s)

For each qualifying person, you must list the following:

- First name

- Last name

- Social Security number

- Whether the person was over age 12 and disabled

- Qualified expenses incurred during the tax year for that person

More than three qualifying persons

If you have more than three qualifying persons, check the respective box in Line 2.

You must also attach a statement with complete information on the additional qualifying persons. Please ensure that this statement contains your name and SSN so the IRS can recognize it as part of your federal income tax return.

Line 3

Add the total amount in column (d) from Line 2, above. Do not enter more than the allowable child and dependent care expense credit, which is:

- $3,000 for one qualifying person

- $6,000 for two or more qualifying persons

If you completed Part III, enter the amount from Line 31.

Line 4: Earned income

If you are filing a joint return with your spouse, you must calculate this amount separately. In this situation, enter your earned income in Line 4, and your spouse’s earned income in Line 5, below.

Earned income

Earned income generally consists of the following:

- The amount shown on Form 1040, 1040-SR, or 1040-NR, Line 1z, minus:

- Any amount excluded as foreign earned income on IRS Form 2555; or

- Also reported on Schedule SE because:

- You were a member of the clergy or

- You received $108.28 or more of church employee income

- The amount shown on Schedule SE (Form 1040), Line 3, minus any tax deduction you claim on Schedule 1 (Form 1040), Line 15.

- If you are filing Schedule C as a statutory employee, the amount shown on Line 1

- Nontaxable combat pay, if you elect to include it in earned income.

Nontaxable combat pay

You should note that including nontaxable combat pay will only give you a larger tax credit if your other earned income is less than the amount entered on Line 3. To make the election, include all of your nontaxable combat pay in the amount you enter on Line 4 (Line 5 for your spouse if filing jointly).

If you are filing jointly and both you and your spouse received nontaxable combat pay, you can each make your own election. The amount of your nontaxable combat pay should be shown in Box 12 of your Form(s) W-2 with Code Q.

Line 5: Spouse’s earned income

If you are a married couple filing a joint tax return, enter your spouse’s income.

All other taxpayers should carry forward the amount from Line 4, above.

Line 6

Enter the smallest of:

- Line 3

- Line 4

- Line 5

Line 7

Enter your adjusted gross income from Line 11 of IRS Form 1040, 1040-SR, or 1040-NR.

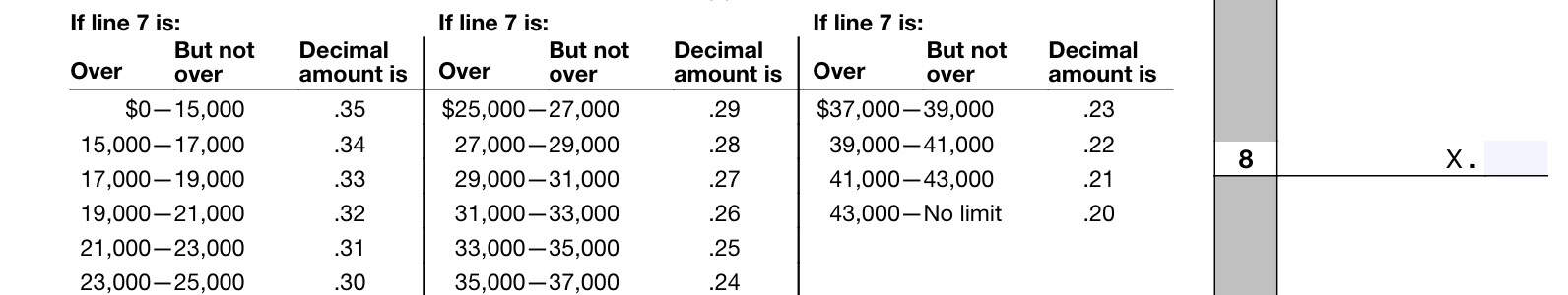

Line 8

Using the chart on the form instructions, enter the corresponding decimal amount. For example, if Line 7 is $28,000, then you would enter 0.28 in this field.

Line 9a

In Line 9a, multiply the number in Line 6 by the decimal amount in Line 8.

Line 9b

On Line 9b, complete Worksheet A in the instructions only if you prepaid qualified expenses in the previous tax year.

For example, on your 2023 individual tax return, you would complete Worksheet A if you prepaid 2023 child care expenses in 2022.

Line 9c

In Line 9c, enter the total sum of Lines 9a and 9b.

Line 10: Tax liability limit

Follow these instructions to calculate the tax liability limit:

- Enter the total tax amount from Line 18 on Form 1040, 1040-SR, or 1040-NR

- Enter the following amounts from Schedule 3:

- Line 1: Foreign tax credit, calculated on IRS Form 1116

- Line 6l: From IRS Form 8978, Line 14

- Subtract Line 2 from Line 1

Enter this result in Line 10. If the result is zero or a negative number, then you cannot take a tax credit.

Line 11: Credit for child and dependent care expenses

Enter the smaller of:

- Line 9c

- Line 10

Also enter this number on Schedule 3, Line 2.

Part III: Dependent Care Benefits

If you received dependent care benefits during the tax year, you must complete Part III before going on to Part II.

In Part III, we’ll calculate the amount of dependent care benefits received, but excludible from taxable income.

Line 12: Total dependent care benefits received during the tax year

Include the following:

- Any amounts received as an employee that is shown in Box 10 on your Form W-2

- If you were self-employed or a partner, any amounts received under a dependent care assistance program from your sole proprietorship or partnership

Don’t include any amounts reported as wages in Box 1 on your Form W-2.

Line 13: Amounts carried over from previous tax years

If you had an employer-provided dependent care plan, your employer may have permitted you to carry forward any unused amount from 2022 to use during a grace period in 2023 as described in Internal Revenue Notice 2005–42, 2005–23 I.R.B. 1204.

Enter on Line 13 the amount you carried forward and used in 2023 during the grace period.

Dependent care FSAs

The temporary special rules for dependent care flexible spending arrangements (FSAs) have expired. The

temporary special rules under Section 214 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 that allowed employers to amend their dependent care plan to carry forward unused amounts from 2020 and/or 2021 to be used in a subsequent year have expired.

For 2023, you may only enter on Line 13 amounts you carried over from 2022 and used in 2023 during the grace period.

Line 14: Forfeited amounts or carryovers

In Line 14, include the total of the following:

- Forfeited amounts. You forfeited an amount if you didn’t receive it because you didn’t incur the expense.

- Any amounts you didn’t receive but are permitted by your employer to carry forward and use in the following year.

Example

Under your employer’s dependent care plan, you chose to have your employer set aside $5,000 to cover your 2023 dependent care expenses. The $5,000 is shown in Box 10 of your Form W-2.

In 2023, you incurred and were reimbursed for $4,950 of qualified expenses. You would enter $5,000 on Line 12 and $50, the amount forfeited, on Line 14.

You would also enter $50 on Line 14 if, instead of forfeiting the amount, your employer permitted you to carry the $50 forward to use during the grace period in 2024.

Line 15

Combine the amounts from Lines 12 and 13. Subtract any amounts included on Line 14.

Line 16

Enter the total qualified expenses incurred during the tax year for the care of the qualifying person(s).

Line 17

Enter the smaller of Line 15 or Line 16.

Line 18: Earned income

If you are filing a joint return with your spouse, you must calculate this amount separately. In this situation, enter your earned income in Line 18, and your spouse’s earned income in Line 19, below.

Earned income

Earned income generally consists of the following:

- The amount shown on Form 1040, 1040-SR, or 1040-NR, Line 1z, minus:

- Any amount excluded as foreign earned income on IRS Form 2555; or

- Also reported on Schedule SE because:

- You were a member of the clergy or

- You received $108.28 or more of church employee income

- The amount shown on Schedule SE (Form 1040), Line 3, minus any deduction you claim on Schedule 1 (Form 1040), Line 15.

- If you are filing Schedule C as a statutory employee, the amount shown on Line 1

- Nontaxable combat pay, if you elect to include it in earned income.

Unlike in Lines 4 or 5, do not include any dependent care benefits shown on Line 12.

Line 19: Spouse’s earned income

If you are a married couple filing a joint tax return, enter your spouse’s income. All other taxpayers should carry forward the amount from Line 18, above.

Line 20

Enter the smallest of:

- Line 17

- Line 18

- Line 19

Line 21

Enter $5,000. If you are married filing a separate return, and you were required to enter your spouse’s earned income on Line 19, enter $2,500.

If you entered any amount on Line 13, add it to the number, but do not enter more than the maximum amount allowed under your dependent care plan.

Line 22

If you received any amounts from your sole proprietorship or partnership, enter that number here.

Otherwise, select ‘No’ and proceed to Line 23.

Line 23

Subtract Line 22 from Line 15.

If you selected ‘No’ in Line 22, this amount should be the same as Line 15.

Line 24: Deductible benefits

This number should be the smaller of:

Include your deductible benefits in the total entered on one of the following, as applicable, from your Form 1040:

- Schedule C, Line 14

- Schedule E, Line 19 or Line 28; or

- Schedule F, Line 15

Line 25: Excluded benefits

If you checked “No” on Line 22, enter the smaller of Line 20 or 21.

Otherwise, subtract Line 24 from the smaller of Line 20 or Line 21.

If this number is zero or less, enter -0-.

Line 26: Taxable benefits

Subtract Line 25 from Line 23. If zero or less, enter -0-.

Also, enter this amount on Form 1040, 1040-SR, or 1040-NR, Line 1e.

Line 27

Lines 27 through 31

If you are reporting child or dependent care benefits and claiming a tax credit for child and dependent care expenses in Part II, then you must complete Lines 27 through 31. If not, then you do not need to complete these lines.

In Line 27, enter the following:

- $3,000, if you only have one qualifying person

- $6,000 if you have two or more qualifying persons

Line 28

Enter the total of Lines 24 and 25.

Line 29

Subtract Line 28 from Line 27.

If this results in zero or a negative number, you cannot take the credit, unless you paid 2022 expenses in 2023. If you did so, then follow the instructions for Line 9b.

Line 30

Complete Line 2 from this form. Do not include any benefits shown on Line 28.

Line 31

Enter the smaller of Line 29 or Line 30. Enter this amount on Line 3, then complete Lines 4 though 11 as instructed.

Filing considerations

Below are some filing considerations for taxpayers trying to claim the child and dependent care tax credit.

Qualifying persons

A qualifying person is any of the following:

- A qualifying child under age 13 whom you can claim as a dependent. If the child turned 13 during the year, the child is a qualifying person for the part of the year he or she was under age 13.

- Your disabled spouse who:

- Wasn’t physically or mentally able to care for themselves, and

- Lived with you for more than half of the year.

- Any disabled person who wasn’t physically or mentally able to care for themselves who lived with you for more than half the year and whom you can claim as a dependent or could claim as a dependent except:

- The disabled person had gross income of $4,700 or more,

- The disabled person filed a joint return, or

- You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer’s 2023 return.

Qualified expenses

Qualified expenses include amounts that you paid for household services and care of a qualifying person, as listed on Line 2, while you were either working or actively searching for work. Your work may be inside your primary residence, or outside your home.

Household services

Household services include services needed to care for your qualifying person as well as to run the home while you worked or looked for work. Examples include the services of:

- Cook or food preparer

- Maid, cleaning service or housekeeper

- Babysitter

The services must be partly for the care of the qualifying person. Household services do not include don’t include the services of a chauffeur or driver, bartender, or gardener.

You can also include your share of the employment taxes paid on wages for qualifying child and dependent care services.

Care of the qualifying person

This includes expenses incurred for the qualifying person’s well-being and protection. These expenses do not include the cost of food, lodging, education, clothing, or entertainment.

You can include the cost of care provided outside your home for your dependent under age 13, or any other qualifying person who regularly spends at least 8 hours a day in your home.

If the care was provided by a dependent care center, the center must meet all applicable state and local regulations. A dependent care center is a place that provides care for more than six persons (other than persons who live there). A dependent care center generally receives a fee, payment, or grant for providing services for any of those persons, even if the center is not run for profit.

You can include amounts paid for items other than the care of your child only if the items are incidental to the care of the child and can’t be separated from the total cost.

You cannot include the cost of schooling for a child in kindergarten or above, but you can include the cost of a day camp. This does not extend to educational expenses, such as a tutoring program or overnight programs like a summer camp.

Medical expenses

Some disabled spouse and dependent care expenses can qualify as medical expenses if you itemize deductions on Schedule A. However, you can’t claim the same expense as both a dependent care expense and a medical expense.

Married taxpayers filing separately

Generally, married persons must file a joint return to claim the credit.

Unmarried taxpayers

If your filing status is married filing separately and all of the following apply, you are considered unmarried for purposes of claiming the credit on Form 2441.

- You lived apart from your spouse during the last 6 months of 2023.

- Your home was the qualifying person’s main home for more than half of 2023.

- You paid more than half of the cost of keeping up that home for 2023.

Taxpayers who meet all of the requirements to be treated as unmarried and meet the other filing criteria, can generally take the credit or the exclusion.

If you don’t meet all of the requirements to be treated as unmarried, you can’t generally take the credit. However, you may be able to take the exclusion if you meet the other criteria.

Video walkthrough

Frequently asked questions

IRS Form 2441, Child and Dependent Care Expenses, is the IRS form that taxpayers may use to calculate and deduct qualified care expenses from their tax liability. As a tax credit, these qualified expenses result in a dollar for dollar reduction in tax liability.

If you are not able to provide all the information requested in Part I, your credit may be disallowed by the IRS unless you can show that you conducted due diligence in trying to obtain the information. You can demonstrate due diligence if you can obtain a copy of the care provider’s Form W-10 or attach a separate statement indicating all the actions that you took to obtain the requested information from the care provider.

For tax year 2023, the child and dependent tax credit is: $3,000 for one qualifying child or qualifying person, and $6,000 for two or more qualifying children or persons.

In the case of children of separated or divorced taxpayers, generally the custodial parent can claim the tax credit, but the noncustodial parent cannot.

If you file electronic tax returns, your tax software will automatically include Form 2441 with your tax return. If you mail tax returns, you must include this form and any supporting documentation to the IRS Service Center where you normally file your income tax returns.

Where can I find IRS Form 2441?

You may obtain this tax form from the IRS website. For your convenience, we’ve included the most recent copy of this form at the end of this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!