IRS Form W-3 Instructions

At the end of each tax year, employers issue IRS Form W-2 to each of their employees. They must also send Copy A of all W-2 forms to the Social Security Administration, accompanied by IRS Form W-3, Transmittal of Wage and Tax Statements.

In this article, we’ll go over everything you need to know about IRS Form W-3, including:

- How to complete and file IRS Form W-3

- When you need to file this tax form

- Other frequently asked questions

Let’s start at the top with a breakdown of how to complete this form.

Table of contents

How do I complete IRS Form W-3?

We’re going to break down this tax form in order, starting with the taxpayer information on the left hand side of the form.

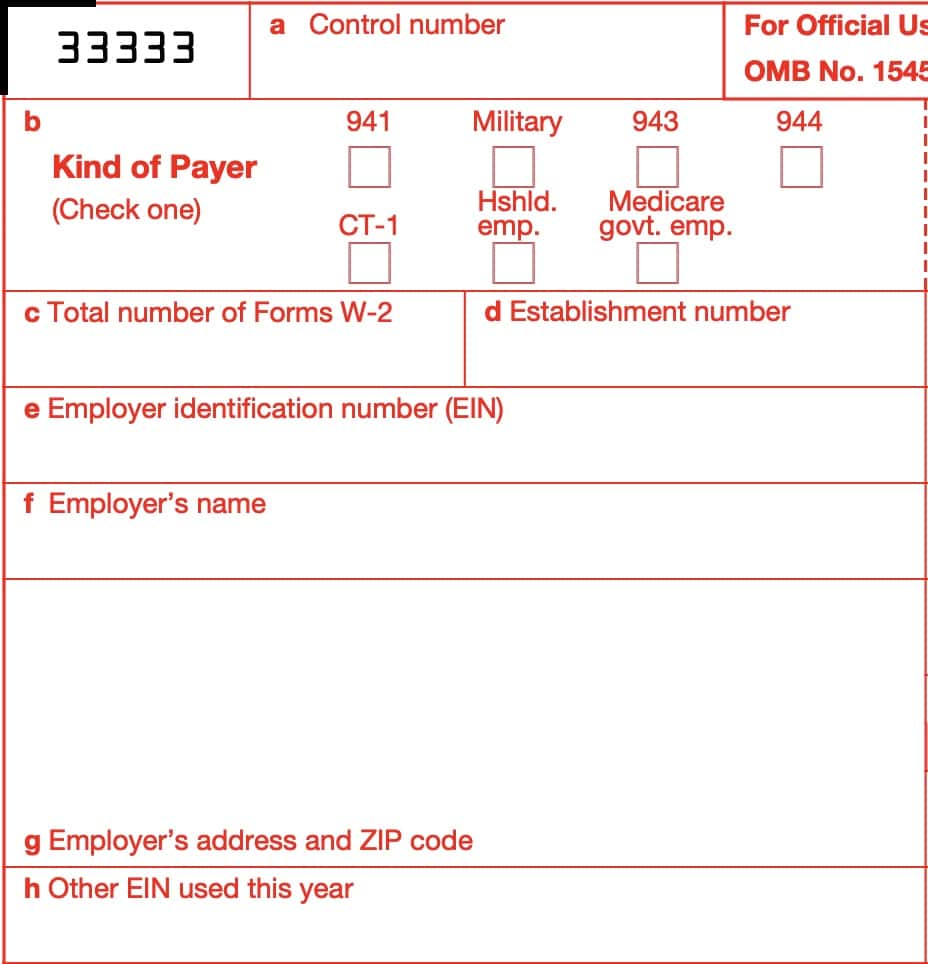

Payer information

Starting at the top, let’s proceed through the left side of this form.

Box a: Control number

This is an optional box that you may use for numbering the whole transmittal. If you do not choose to use this field, it is not necessary.

Box b: Kind of Payer

Check the box that applies to you. Check only one box.

If you have more than one type of Form W-2, send each type with a separate Form W-3. Below is information about each type of payer.

Form 941

Check this box if you file Forms 941 and no other category applies.

A church or church organization should check this box even if it is not required to file Forms 941 or 944

Military

Check this box if you are a military employer sending Forms W-2 for members of the uniformed services.

Form 943

Check this box if you:

- Are an agricultural employer, and

- File IRS Form 943, and

- Are sending W-2 forms for agricultural employees

Send nonagricultural employees their Form W-2 reports separately, with a separate Form W-3, while checking the appropriate box.

Form 944

Check this box if you file IRS Form 944 and no other box applies.

Form CT-1

Check this box if you are a railroad employer sending Forms W-2 for employees covered under the

RRTA.

Do not show employee RRTA tax in Boxes 3 through 7 below. These boxes are only for Social Security and Medicare information.

If you also have employees who are subject to social security and Medicare taxes, send that group’s Forms W-2 with a separate Form W-3 and check the “941” checkbox on that Form W-3.

Household employee

Check this box if you:

- Are a household employer sending Forms W-2 for household employees, and

- Did not include the household employee’s taxes on Forms 941, 943, or 944

Medicare government employee

Check this box for federal, state, or local governments filing Forms W-2 for employees subject only to Medicare taxes.

Box c: Total number of Forms W-2

Enter the number of W-2 forms that you’re submitting with this W-3 form. Do not include VOID W-2 forms.

Box d: Establishment number

Use this box to identify separate establishments in your business.

Even if they all have the same employer identification number, you may file a separate Form W-3, with Forms W-2, for each establishment. As another option, you may also use a single Form W-3 for all Forms W-2 of the same type.

Box e: Employer identification number (EIN)

Enter the 9-digit EIN that the IRS assigned to you by.

The number should be the same as shown on:

- IRS Form 941

- IRS Form 943

- IRS Form 944

- Form CT-1

- IRS Schedule H, Household Employment Taxes

You should enter your EIN in the following format: 00-0000000. Do not truncate your EIN or use a prior owner’s EIN.

If you do not have an EIN

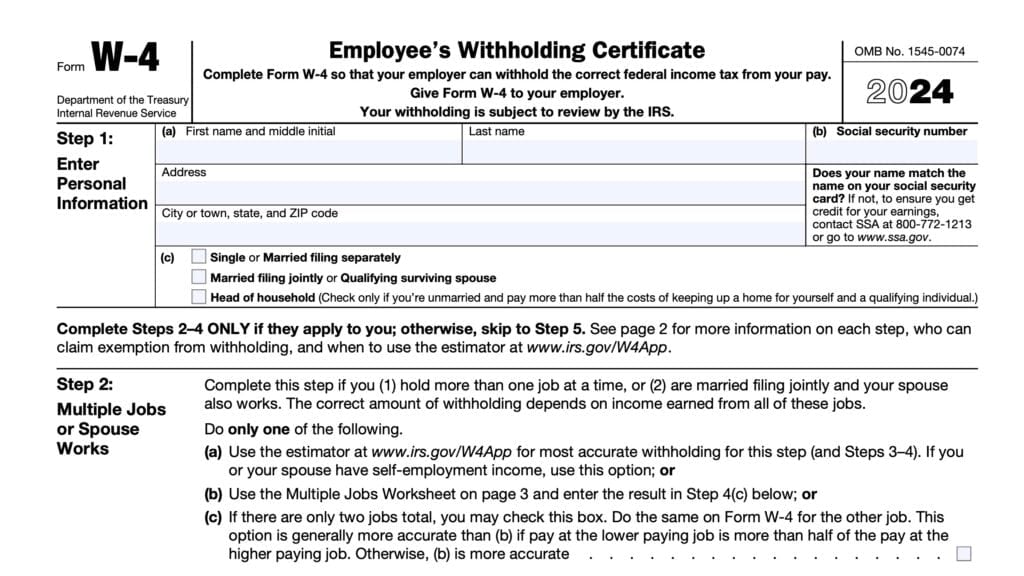

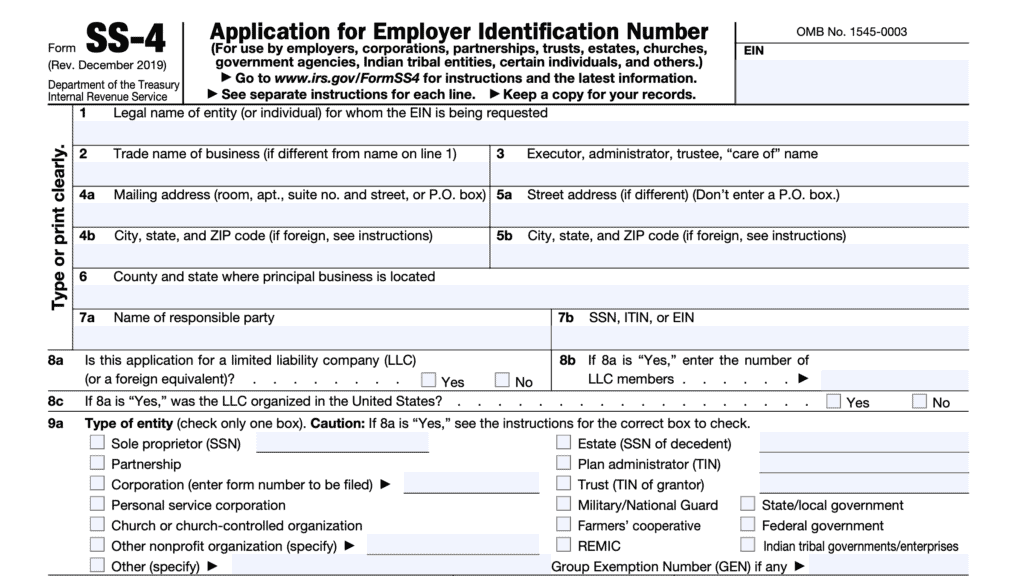

If you do not have an EIN when filing Form W-3, then you should enter ‘Applied For’ in this box. You can apply for an EIN on the IRS website or by filing IRS Form SS-4, Application for Employer Identification Number.

Box f: Employer’s name

Enter the name of the employer as it appears on the selected tax forms listed in Box b.

Box g: Employer’s address and ZIP code

Enter the employer’s address and zip code as they appear on the selected tax forms listed in Box b.

Box h: Other EIN used this year

If you used a different EIN earlier in the tax year, including a prior owner’s EIN, enter that EIN in Box h.

Kind of employer

In this field, check one box from the following available boxes.

None apply

Check this box if none of the other boxes apply to your situation

501c non-government

Check this box if you are a non-governmental tax-exempt section 501(c) organization.

Types of 501(c) non-governmental organizations include:

- Private foundations

- Public charities

- Social and recreation clubs

- Veterans organizations

IRS Publication 557, Tax-Exempt Status for Your Organization, contains additional information about different types of 501(c) non-governmental organizations.

State/local non-501c

If you are a state or local government, check this box. Examples of other publicly owned entities with government authority include:

- Cities and townships

- Counties

- Special-purpose districts, such as community development districts

- Public school districts

State/local 501c

Check this box if you are a state or local government or instrumentality, and you have received a determination letter from the Internal Revenue Service indicating that you are also a tax-exempt organization under Internal Revenue Code Section 501(c)(3).

Federal government

Check this box if you are a federal government entity.

Third-party sick pay

If applicable, you may check this box as well as one of the boxes under Kind of Employer, earlier.

Check this box if you are a third-party sick pay payer, or are reporting sick pay payments made by a third party, filing IRS Forms W-2 with the “Third-party sick pay” checkbox in Box 13 checked.

File a single Form W-3 for the regular and “Third-party sick pay” Forms W-2.

Boxes 1 through 13

Let’s take a look at the federal tax information on the right-hand side of this form.

Box 1: Wages, tips, other compensation

Enter the total wages, tips, and other compensation reported on IRS Form W-2. You’ll find employee wages and tip information in Box 1.

Box 2: Federal income tax withheld

Enter the total amount of federal income taxes withheld in Box 2 of all Forms W-2.

Box 3: Social Security wages

Enter the total Social Security wages in Box 3 of all IRS Form W-2 copies.

Box 4: Social Security tax withheld

Enter the total Social Security tax withheld from employee income on all IRS Form W-2 copies.

Box 5: Medicare wages and tips

Enter the total Medicare wages in Box 5 of all IRS Form W-2 copies.

Box 6: Medicare tax withheld

Enter the total Medicare tax withheld from employee income on all IRS Form W-2 copies.

Box 7: Social Security tips

Enter the total amount of Social Security tips reported on your employees’ Form W-2 forms during the given year.

Box 8: Allocated tips

Enter the total earnings from any allocated tips in Box 8.

Box 9

Do not enter any information in Box 9.

Box 10: Dependent care benefits

Enter the total amount of dependent care benefits that you reported on all W-2 forms during the year.

Box 11: Nonqualified plans

Enter the Box 11 totals from all W-2 forms.

Box 12a: Deferred compensation

Do not enter a code. Instead, enter the total of all amounts reported with the following codes from Form W-2:

- Code D: Elective deferrals to a section 401(k) cash or deferred arrangement.

- Also includes deferrals under a SIMPLE retirement account that is part of a section 401(k) arrangement.

- Code E: Elective deferrals under a section 403(b) salary reduction agreement

- Code F: Elective deferrals under a section 408(k)(6) salary reduction SEP

- Code G: Elective deferrals and employer contributions (including nonelective deferrals) to a Section 457(b) deferred compensation plan

- Code H: Elective deferrals to a section 501(c)(18)(D) tax-exempt organization plan

- Code S: Employee salary reduction contributions under a section 408(p) SIMPLE plan

- Code Y: Deferrals under a section 409A nonqualified deferred compensation plan

- Code AA: Designated Roth contributions under a section 401(k) plan

- Code BB: Designated Roth contributions under a section 403(b) plan

- Code EE: Designated Roth contributions under a governmental section 457(b) plan.

- This amount does not apply to contributions under a tax=exempt organization section 457(b) plan.

Codes not reported on IRS Form W-3

The following codes are not reported on Forms W-3:

- Code A: Uncollected social security or RRTA tax on tips.

- Code B: Uncollected Medicare tax on tip income

- Code C: Taxable cost of group-term life insurance over $50,000

- Code J: Nontaxable sick pay

- Code K: 20% excise tax on excess golden parachute payments

- Code L: Substantiated employee business expense reimbursements

- Code M: Uncollected Social Security or RRTA tax on taxable cost of group-term life insurance over $50,000

- Code N: Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000

- Code P: Excludable moving expense reimbursements paid directly to a member of the U.S. Armed Forces

- Code Q: Nontaxable combat pay

- Code R: Employer contributions to an Archer MSA, reported on IRS Form 8853

- Code T: Adoption benefits

- Code V: Income from exercise of nonstatutory stock options

- Code W: Employer contributions to a health savings account, as reported on IRS Form 8889

- Code Z: Income under a nonqualified deferred compensation plan that fails to satisfy Code Section 409A

- Code DD: Cost of employer-sponsored health coverage

- Code FF: Permitted benefits under a qualified small employer health reimbursement arrangement

Box 12b

Do not enter anything in this box.

Box 13: For third-party sick pay use only

Leave this box blank. Instead, you may need to refer to instructions for IRS Form 8922, Third-Party Sick Pay Recap.

Box 14: Income tax withheld by payer of third-party sick pay

Complete Box 14 only if you:

- Are the employer, and

- Have employees who had federal income tax withheld on third-party payments of sick pay

In this case, you should show the total amount of income tax withheld by third-party payers for all employees in the current year. This amount is also included in Box 2, but the IRS requires it to be shown separately here.

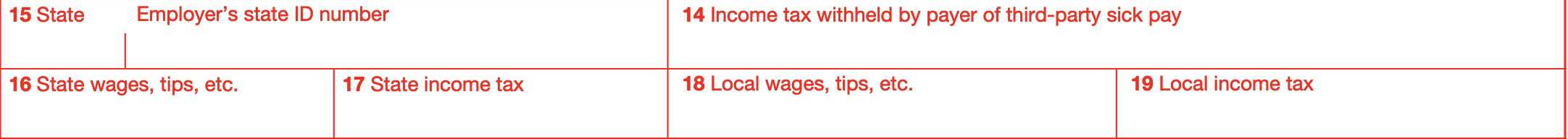

State and local tax information

In Boxes 15 through 19, we’ll be reporting on state and local income tax. Let’s start with Box 15.

Box 15: State

Enter the two-letter abbreviation for the name of the state or territory being reported on Forms W-2. Also, enter your state or territory-assigned taxpayer identification number.

If the Forms W-2 being submitted with this Form W-3 contain wage and income tax information from more than one state or territory, then do the following:

- Enter ‘X’ under State

- Do not enter a state or territory tax ID number

Box 16: State wages, tips, etc.

Enter the total of state taxable wages shown on Forms W-2.

If the W-2 forms show multiple states, then report them as one sum here. Verify that the reported amount is an accurate total of the W-2 forms.

Box 17: State income tax

Enter the total of state income tax shown on Forms W-2.

If the W-2 forms show multiple states, then report them as one sum here. Verify that the reported amount is an accurate total of the W-2 forms.

Box 18: Local wages, tips, etc.

Enter the total of local wages shown on Forms W-2 for the entire year.

If the W-2 forms show multiple localities, then report them as one sum here. Verify that the reported amount is an accurate total of the W-2 forms.

Box 19: Local income tax

Enter the total of local income tax withheld as shown on Forms W-2.

If the W-2 forms show multiple localities, then report them as one sum here. Verify that the reported amount is an accurate total of the W-2 forms.

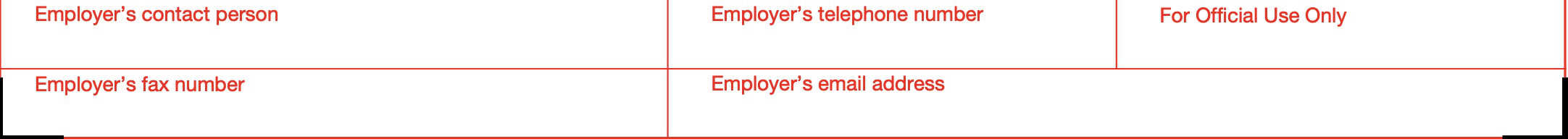

Employer contact information

Finally, enter contact information for the employer in this area. Your entry should include:

- Contact person’s name

- Telephone number

- Fax number

- Email address

Filing IRS Form W-3

The SSA strongly suggests employers report Form W-3 and Forms W-2 Copy A electronically instead of on paper. The SSA provides two free e-filing options on its Business Services Online (BSO) website.

Filing IRS Form W-3 electronically

- W-2 Online. Use fill-in forms to create, save, print, and submit up to 50 Forms W-2 at a time to the SSA.

- File Upload. Upload wage files to the SSA you have created using payroll or tax software that formats the files according to the SSA’s Specifications for Filing Forms W-2 Electronically (EFW2).

To be considered ‘on time,’ employers must submit W-2 online fill-in forms or file uploads by January 31 of the year following the calendar year in question.

Filing IRS Form W-3 by paper

Employers must send the completed Form W-3 as well as the entire Copy A page of all Form(s) W-2 to:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

- If you use “Certified Mail” to file, change the ZIP code to “18769-0002.”

- If you use an IRS-approved private delivery service,

- Add “ATTN: W-2 Process, 1150 E. Mountain Dr.” to the address

- Change the ZIP code to “18702-7997.”

Employers must file paper copies with the SSA no later than January 31 for Forms W-2 and W-3 from the previous calendar year.

Video walkthrough

Watch this instructional video for more information on IRS Form W-3.

Frequently asked questions

Employers use IRS Form W-3, Transmittal of Wage and Tax Statements, as a transmittal document for submitting employee W-2 forms to the Social Security Administration.

Employers file IRS Form W-2 to report compensation and withheld taxes for one employee during the tax year. Conversely, employers file IRS Form W-3 to report total compensation and taxes withheld for all employees during the same time period.

Employers must file IRS Form W-3 (along with relevant W-2 forms) with the Social Security Administration no later than January 31 after the end of the tax year. For example, 2024 W-2 and W-3 forms will be due no later than January 31, 2025.

Where can I find IRS Form W-3?

You can find most official IRS forms on the IRS’ official website. For your convenience, we’ve enclosed the latest version of IRS Form W-3 here.