IRS Form 8839 Instructions

For adoptive families who incurred certain qualified expenses in the adoption of a child, the Internal Revenue Service may allow a tax credit on your federal tax return on IRS Form 8839. Likewise, if you received employer-provided adoption benefits, you may be able to exclude the value of those benefits from your taxable income.

In this article, we’ll go over how you can use IRS Form 8839 to claim adoption tax benefits, as well as some

Table of contents

How do I complete IRS Form 8839?

There are three parts to IRS Form 8839, Qualified Adoption Expenses:

- Part I: Information About Your Eligible Child or Children

- Part II: Adoption Credit

- Part III: Employer-Provided Adoption Benefits

Let’s go over each part, step by step, starting with Part I.

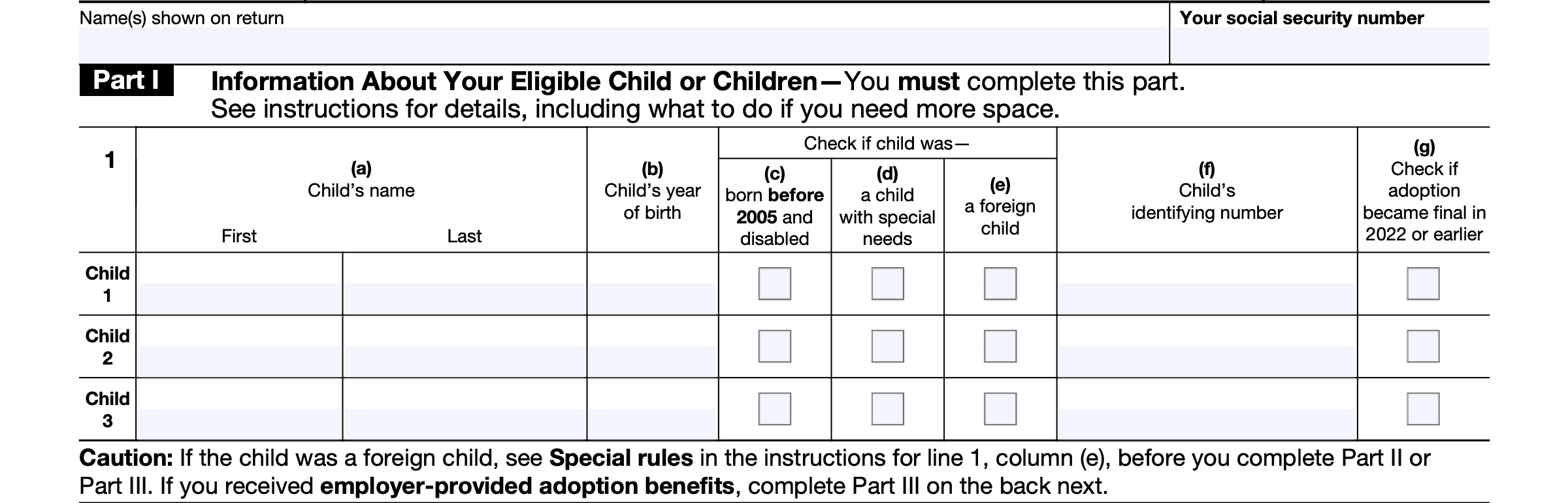

Part I: Information about your eligible child (or children)

All taxpayers must complete Part I, whether claiming a tax credit for eligible adoption expenses or excluding employer-provided benefits from your tax bill.

At the top of Part I, you’ll enter the taxpayer’s name and Social Security number as shown on your individual tax return. You may list up to three eligible children on a single Form 8839.

For each child, you’ll enter the necessary information in the following manner:

Column (a)

Enter the first name and last name of the child.

Column (b)

Enter the child’s date of birth.

Column (c)

Check the box if the child was born before 2005 and is considered to be disabled. According to the IRS instructions, a disabled person is one who is physically or mentally unable to care for himself or herself.

A disabled person can be an eligible child regardless of his or her age at the time of adoption.

Column (d)

Check the box in column (d) if this child is a special needs child. The IRS considers a special needs child as one who meets all three of the following conditions:

- The child was a citizen or resident of the United States or its possessions at the time the adoption effort began.

- A state has determined that the child can’t or shouldn’t be returned to his or her parents’ home. This includes the District of Columbia.

- The state has determined that the child won’t be adopted unless assistance is provided to the adoptive parents.

States may use the following criteria to determine whether a child will be adopted without assistance:

- The child’s ethnic background and age,

- Whether the child is a member of a minority or sibling group, and

- Whether the child has a medical condition or a physical, mental, or emotional handicap.

Column (e)

Check this box if the child was considered to be a foreign child. A child is a foreign child if he or she wasn’t a citizen or resident of the United States or its possessions at the time the adoption effort began.

Column (f)

Enter the child’s identifying number in this column. An identifying number may be any of the following:

- Social Security number (SSN)

- Individual Taxpayer Identification Number (ITIN)

- Adoption Taxpayer Identification Number (ATIN)

You may apply for a Social Security number by filing Form SS-5, Application For Social Security Card. If you cannot get the child’s SSN before filing the income tax return, you may have to file one of the following:

- Form W-7A to obtain an ATIN (if the child is a U.S. citizen or resident)

- Form W-7 to obtain an ITIN (if the child is not a U.S. citizen or resident)

Column (g)

Check the box in column (g) if the adoption was finalized during the tax year or in a prior year.

More than three eligible children

In Line 1, there are spaces for up to three children. If you have more than three adopted children for whom you are trying to claim a tax credit, you may use more than one Form 8839. In this scenario, simply write, “See attached” on the lower right-hand side of the Caution box, below Line 1.

After completing Part I, you’ll proceed to either Part II or Part III. If you paid qualifying adoption expenses and need to claim a tax credit, go to Part II. If you did not incur adoption expenses, but your employer provided benefits, go to Part III.

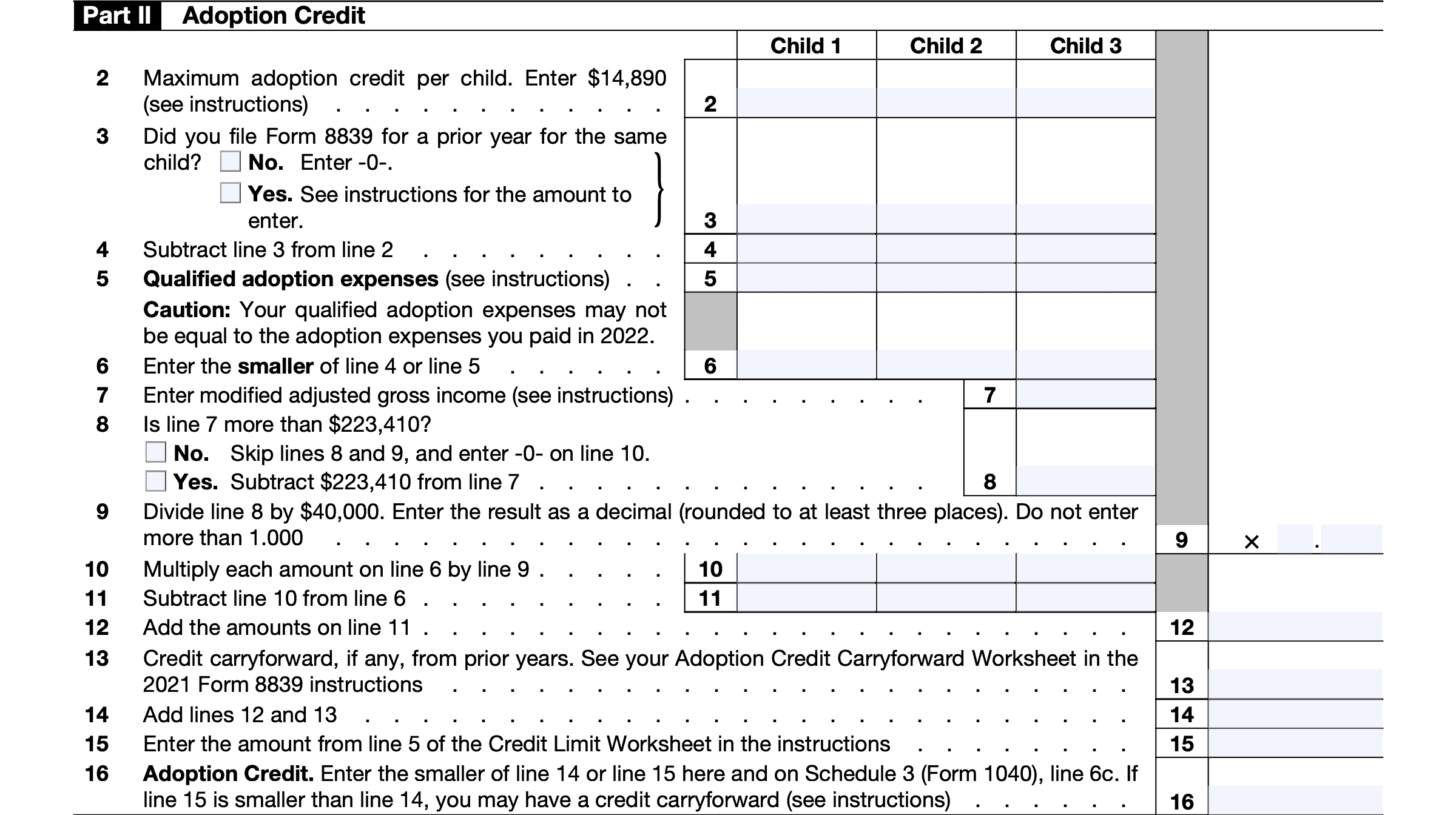

Part II: Adoption Credit

In Part II, we’ll calculate the adoption credit that you may take for each child. In 2022, the maximum amount of the credit that you can take for the legal adoption of an eligible child is $14,890 per child.

Line 2: Maximum adoption credit per child

In Line 2, enter $14,890, the maximum credit for each child, unless you and another person (besides your spouse filing a joint return) each paid adoption-related expenses for the same child.

In this case, you must divide the amount of the credit between yourself and the other taxpayer. You may divide this in any manner, as long as you both agree to the amount that each person can claim, and as long as the total amount does not exceed the maximum amount.

Line 3

If you did not file Form 8839 last year for the same child, select ‘No’ and move to Line 4. If you filed Form 8839 in one or more previous years, enter the total of the amounts shown on Lines 3 and 6 (or corresponding line) of the last form you filed for the child.

Line 4

If you selected ‘Yes’ in Line 3, subtract Line 3 from Line 2. Otherwise, carry the amount down from Line 2.

Line 5: Qualified adoption expenses

On Line 5, enter the total qualified adoption expenses you paid in:

- 2021 if the adoption wasn’t final by the end of 2022,

- 2021 and 2022 if the adoption became final in 2022, or

- 2022 if the adoption became final before 2022.

Note: Your qualifying adoption expenses may not be the same amount as the adoption-related expenses actually paid in 2022.

Line 6

In Line 6, enter the smaller of:

- Line 4

- Line 5

Line 7: Modified adjusted gross income

Enter your modified adjusted gross income. This includes your adjusted gross income from Line 11 of your Form 1040, Form 1040-SR, or Form 1040-NR, plus the following:

- Exclusion of income from Puerto Rico

- Amounts from IRS Form 2555, Lines 45 and 50; and

- Amount from IRS Form 4563, Line 15.

Line 8

Check the appropriate box. If your modified adjusted gross income is more than $223,410, then subtract $223,410 from the number in Line 7.

For taxpayers with modified adjusted gross incomes that are $223,410 or less, skip Lines 8 and 9, enter ‘0’ on Line 10, then go to Line 11. This means that you are below the phaseout threshold and that you can take the full credit this year.

Line 9

In Line 9, divide the amount in Line 8 by $40,000. This should result in a decimal value, which you can round to three places. Do not enter a number that exceeds 1.000.

If the number that you enter is 1.000, then your modified adjusted gross income exceeds the income limits for claiming the adoption tax credit for. However, you may be able to carry forward any unused credit for paid qualified adoption expenses from previous tax years.

Line 10

Multiply each amount on Line 6 by the decimal value on Line 9.

Line 11

Subtract Line 10 from Line 6.

Line 12

Add the amounts on Line 11, then enter the total in Line 12.

Line 13: Adoption credit carryforward

If you have any unallowed adoption credit from a different tax year, enter that amount in Line 13. You may find the amount of your adoption credit on the Adoption Credit Carryforward Worksheet from your previous year Form 8839 instructions.

Line 14

Add Lines 12 and 13, then enter the result here.

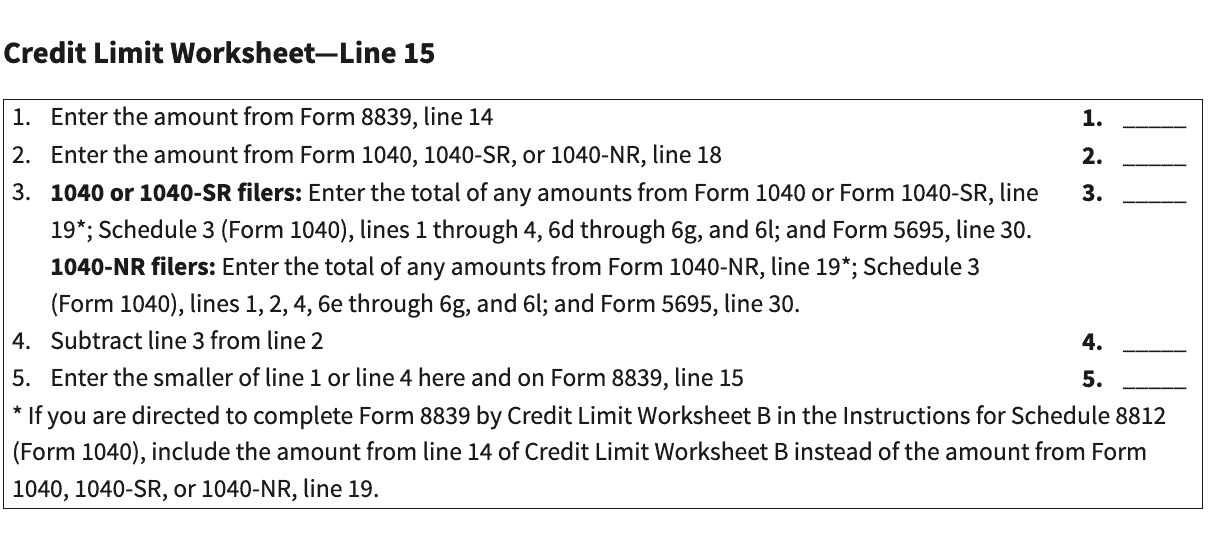

Line 15

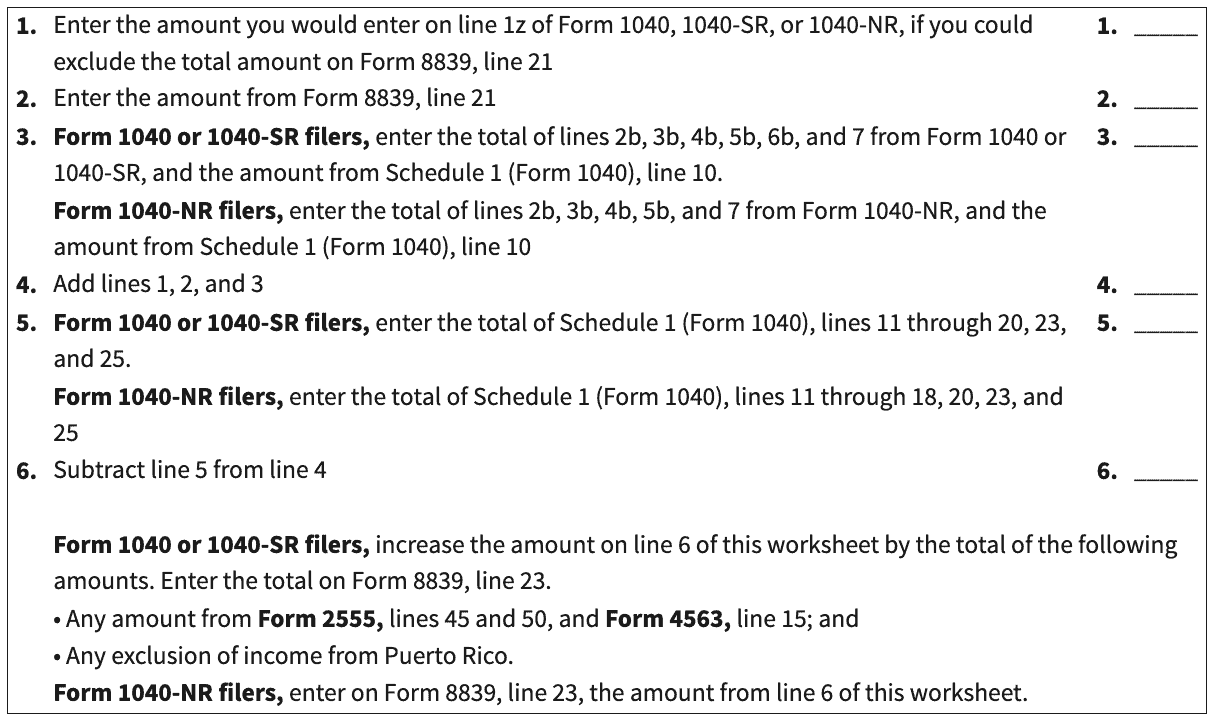

Complete the credit limit worksheet below, then enter the result in Line 15.

Line 16: Adoption Credit

Enter the smaller of Line 14 or Line 15 here, and on Schedule 3, Line 6c, of your income tax return.

If Line 15 is smaller than Line 14, you may have an unused credit to carry forward to a future tax year.

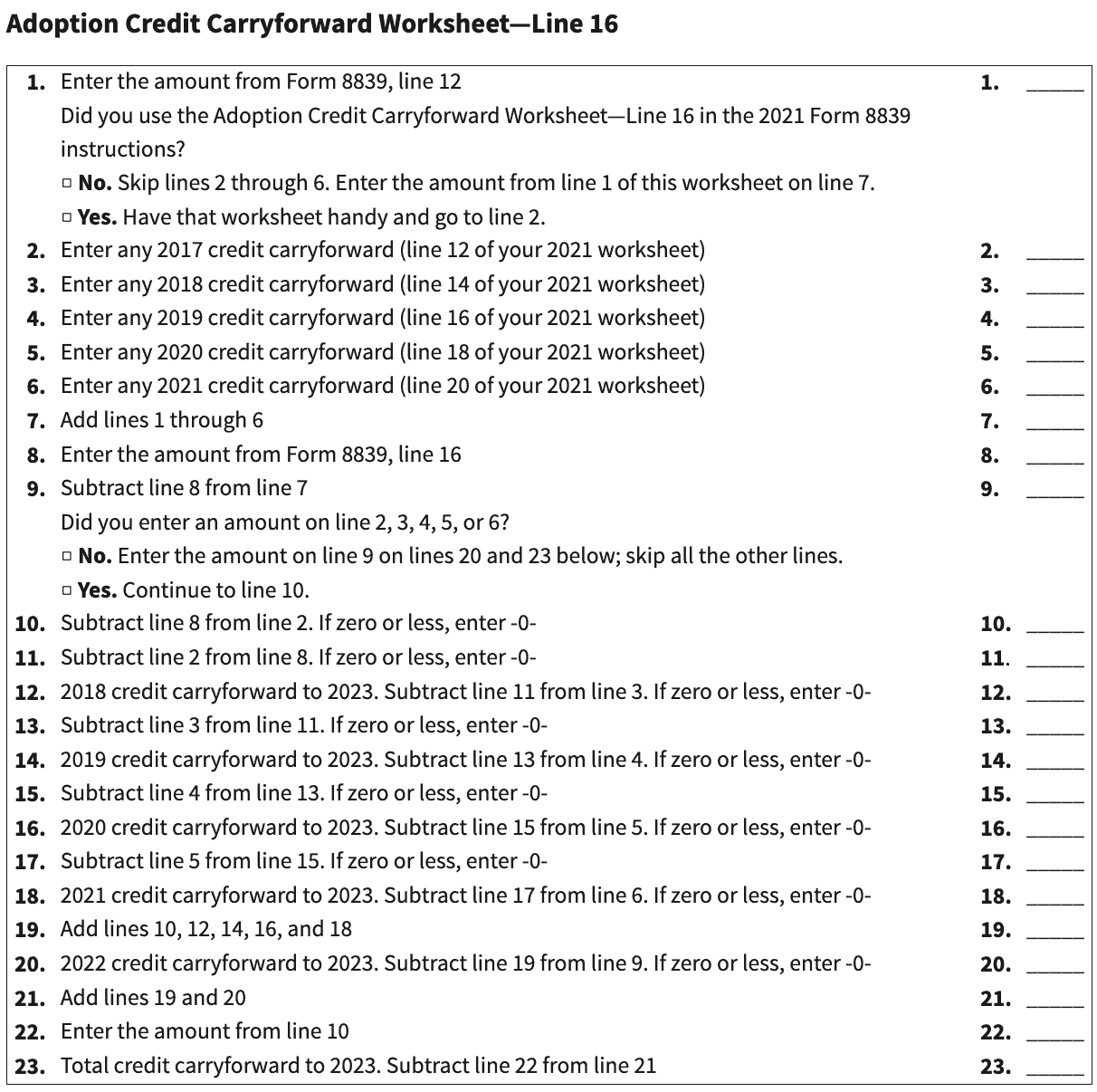

To calculate your tax credit carryforward, you’ll need to complete the Adoption Credit Carryforward Worksheet for Line 16. Follow the steps outlined below.

Be sure to keep a copy of this worksheet for next year.

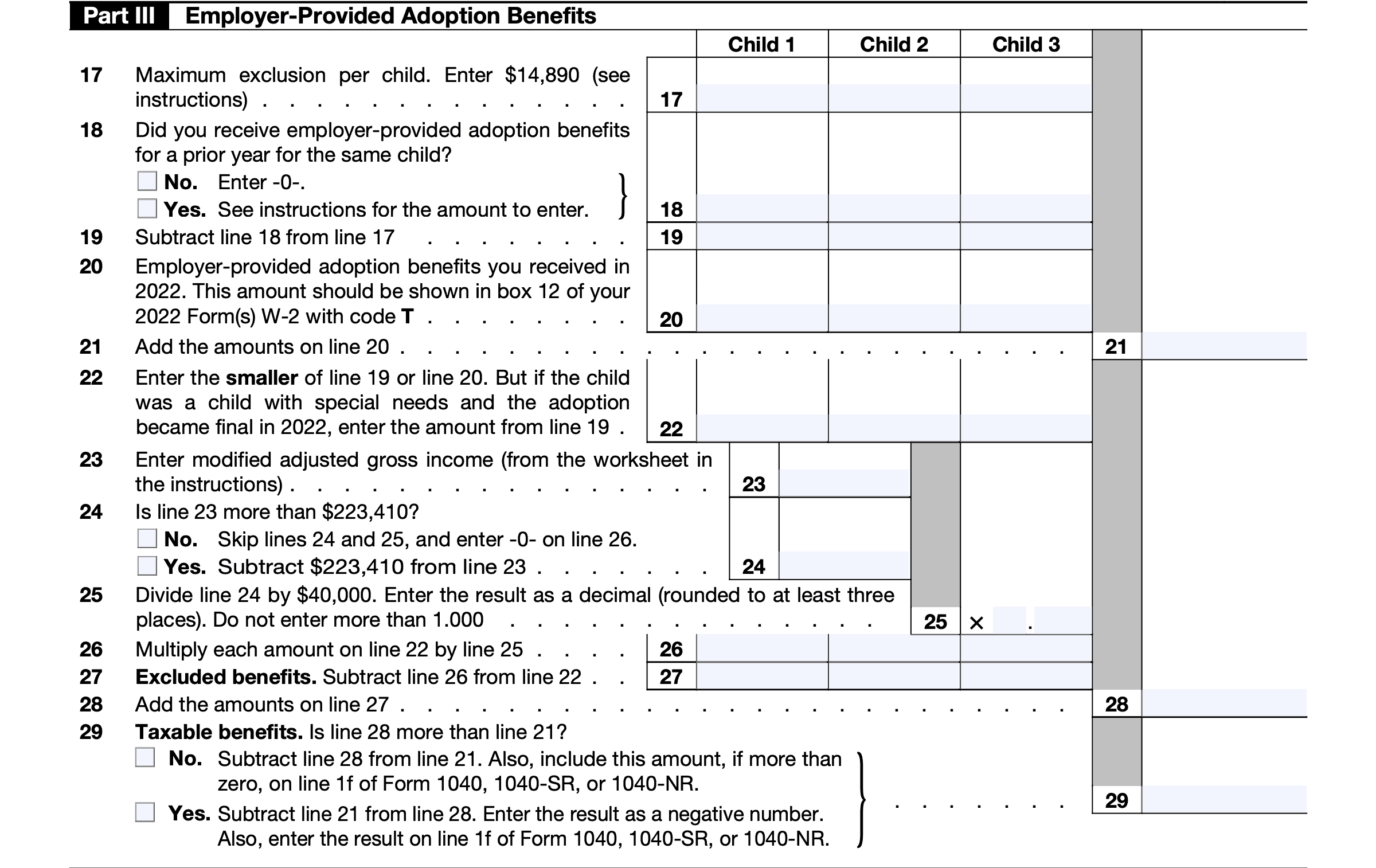

Part III: Employer-provided adoption benefits

If your employer funded some or all of the necessary expenses for the legal adoption of child, you may be able to exclude part or all of these expenses from your taxable income. In Part III, we’ll determine how much you can exclude from taxable income for the given tax year.

The maximum amount of employer-paid adoption expenses that you can exclude from income is the same as the maximum adoption tax credit: $14,890 per qualifying child.

Line 17

In Line 17, enter $14,890, the maximum exclusion dollar limit, unless you and another person (besides your spouse filing a joint tax return) each had employer-provided adoption expenses for the same child for the same child.

In this case, you must divide the amount of the income exclusion between yourself and the other taxpayer. You may divide this in any manner, as long as you both agree to the amount that each person can claim, and as long as the total amount does not exceed the maximum exclusion.

Line 18

If you did not file Form 8839 last year for the same child, select ‘No’ and move to Line 19. If you filed Form 8839 in one or more previous years, enter the total of the amounts shown on Lines 18 and 22 (or corresponding line) of the last form you filed for the child.

Line 19

If you selected ‘Yes’ in Line 18, subtract Line 18 from Line 17. Otherwise, carry the amount down from Line 17.

Line 20: Employer-provided adoption benefits received in the tax year

Enter the amount of employer-funded adoption benefits you received in the given tax year. You can find this amount in Box 12 of your Form W-2, with code T.

Line 21

Add the amounts for each qualifying child on Line 20, then enter the total on Line 21.

Line 22

Enter the smaller of:

- Line 19

- Line 20

However, if the child was a child with special needs and the legal adoption of the child became finalized during the tax year, enter the amount from Line 19.

Line 23: Modified adjusted gross income

Enter the modified adjusted gross income as calculated using the worksheet from the form instructions (see below)

Line 24

If the amount from Line 23 does not exceed $223,410, then you may be eligible for the maximum exclusion with no phaseout. In this case, skip Lines 24 and 25, enter ‘0’ on Line 26, and proceed to Line 27.

If the amount in Line 23 does exceed $223,410, then subtract $223,410 from the number in Line 23 and enter the result here. Proceed to Line 25.

Line 25

In Line 25, divide the amount in Line 24 by $40,000. This should result in a decimal value, which you can round to three places. Do not enter a number that exceeds 1.000.

Line 26

Multiply each amount in Line 22 by the decimal value in Line 25.

Line 27: Excluded benefits

Subtract Line 26 from Line 22. This represents the benefits that are excluded from taxable income.

Line 28

Add the excluded benefits on Line 27 and enter the total on Line 28.

Line 29: Taxable benefits

If the answer is no, then subtract Line 28 from Line 21. Include this amount, if greater than zero on Line 29 and Line 1f of Form 1040, Form 1040-SR, or Form 1040-NR.

If the answer is yes, then subtract Line 21 from Line 28. Include this amount as a negative number on Line 29 and Line 1f of Form 1040, Form 1040-SR, or Form 1040-NR.

Video walkthrough

Watch this instructional video to go through IRS Form 8839, step by step.

Frequently asked questions

In 2022, the maximum tax credit that you can claim for necessary adoption expenses is $14,890.

In 2022, the maximum amount of employer funded adoption expenses that you can exclude from gross income is $14,890.

Qualified adoption expenses are reasonable and necessary expenses directly related to, and for the principal purpose of, the legal adoption of an eligible child.

Qualified adoption expenses may include:

-Necessary adoption fees,

-Attorney fees,

-Court costs,

-Travel expenses (including meals and lodging) while away from home, and

-Re-adoption expenses relating to the adoption of a foreign child.

Examples of adoption costs that the IRS does not consider as qualified expenses include the following expenses:

-For which you received funds under any state, local, or federal program;

-That violate state or federal law;

-For carrying out a surrogate parenting arrangement;

-For the adoption of your spouse’s child;

-Reimbursed by your employer or otherwise; or

-Allowed as a credit or deduction under any other provision of federal income tax law.

You can claim both a tax credit for expenses that you incurred and an an income exclusion for expenses paid by your employer. However, you cannot claim a tax credit and an income exclusion for the same expenses.

Where can I find a copy of IRS Form 8839?

You can find this tax form on the IRS website. For your convenience, we’ve enclosed the latest version of Form 8839 below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!