IRS Schedule 3 Instructions

As a result of the Tax Cuts and Jobs Act, the Internal Revenue Service changed many of its tax forms to provide easier access for taxpayers. As a result, IRS Schedule 3 was created to report many types of tax credits that reduce a taxpayer’s tax liability.

In this article, we’ll walk through IRS Schedule 3, and what you should understand. This includes:

- Step by step instructions for this schedule

- Differences between nonrefundable tax credits and refundable credits

- Basic eligibility requirements for most tax credits

- Frequently asked questions

Let’s start with step by step guidance on completing IRS Schedule 3.

Table of contents

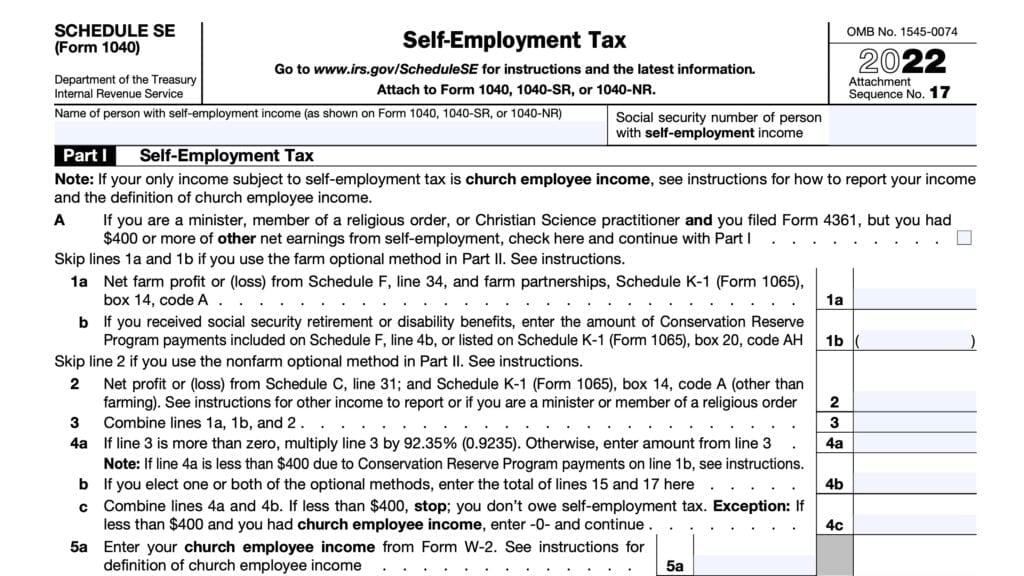

How do I complete IRS Schedule 3?

There are two parts to this tax form:

Let’s start at the top with Part I.

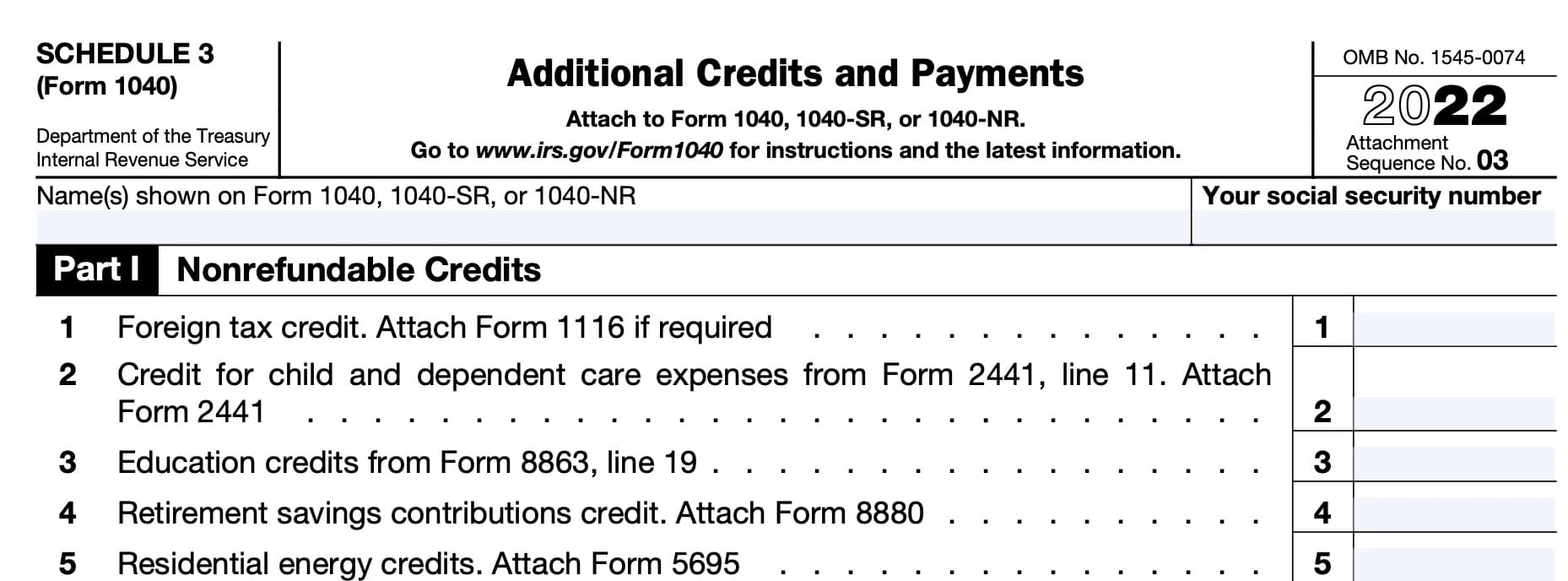

Part I: Nonrefundable credits

In Part I, we’ll calculate the total of non-refundable credits that you will claim on your income tax return. Non-refundable tax credits can reduce your tax liability to zero, but cannot generate a tax refund.

At the very top, enter the taxpayer’s name and identifying number as they appear on the income tax return.

For most taxpayers, the identifying number is the taxpayer’s Social Security number (SSN). However, if you are not a United States Citizen, this might be an individual taxpayer identification number (ITIN).

Line 1: Foreign tax credit

In Line 1, enter the amount of foreign tax credit that you claim. You can get this number from IRS Form 1116.

However, you do not need to file Form 1116 to claim the foreign tax credit if the following conditions apply:

- All of your foreign source gross income was from interest and dividends, and all of the combined income and foreign taxes paid were reported on one of the following:

- IRS Form 1099-INT

- IRS Form 1099-DIV

- Schedule K-1

- The total of your foreign taxes did not exceed $300

- $600 for a married couple filing a joint return

- You held the stock or bonds for which the dividends or interest were paid for at least 16 days and did not have to pay these amounts to another person

- You are not excluding income from sources in Puerto Rico nor are you filing IRS Form 4563 to exclude income from American Samoa

- All of your foreign taxes were legally owed, not eligible for a refund or reduced rate under a tax treaty, and paid to countries recognized by the United States that do not support terrorism

If required, attach IRS Form 1116 to your tax return.

Line 2: Credit for child and dependent care expenses

Enter the credit for child and dependent care expenses from IRS Form 2441, Line 11. Attach your completed Form 2441 to your U.S. individual income tax return.

You may be able to take this credit you had to pay someone to take care of one or more of the following persons so that you could work or look for a job:

- Your qualifying child, under age 13, whom you claim as your dependent,

- Your disabled spouse or any other disabled person who couldn’t care for themselves, or

- Your child whom you couldn’t claim as a dependent because of the rules for children of divorced or separated parents

Line 3: Education credits

In Line 3, enter the amount of total education credits you calculated on IRS Form 8863, Line 19. This represents the nonrefundable education credits, not the refundable portion of the American Opportunity Credit.

However, you cannot claim any education credits under any of the following circumstances:

- You, or your spouse if filing jointly, are claimed as a dependent on someone else’s (such as your parent’s) tax return.

- Your filing status is married filing separately.

- Your adjusted gross income (AGI), is $90,000 or more

- $180,000 or more if married filing jointly

- You, or your spouse, were a nonresident alien for any part of the current tax year

- Unless your filing status is married filing jointly

Line 4: Retirement savings contributions credit

In Line 4, enter any retirement savings contributions credits from IRS Form 8880.

You cannot take a tax credit for making retirement plan contributions if:

- Your adjusted gross income exceeds:

- Individuals: $34,000

- Heads of household: $51,000

- Married couples filing a joint return: $68,000

- The person(s) who made the qualified contribution or elective deferral:

- Is not at least 18 years of age by the end of the tax year, or

- Is claimed as a dependent on someone else’s tax return, or

- Was a student during the tax year

Attach your completed Form 8880 to Schedule 3 when filing.

Line 5: Residential energy credits

In Line 5, enter any residential energy credits from IRS Form 5695.

You may be able to claim the residential clean energy credit or the energy efficient home improvement credit, or both, based upon qualifying clean energy sources or home improvements you put into service during the tax year.

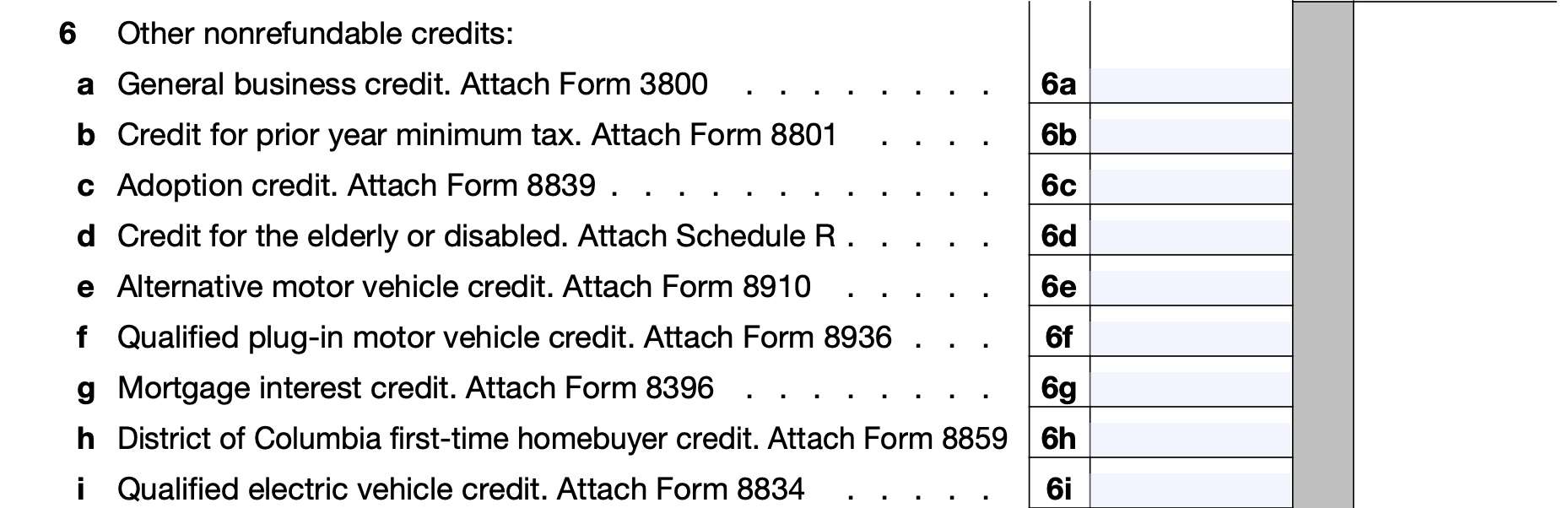

Line 6: Other nonrefundable credits

Line 6 contains a variety of other nonrefundable tax credits. Unless otherwise specified, attach your completed form to your income tax return.

Let’s start with Line 6a.

Line 6a: General business credit

In Line 6a, enter the amount of general business credit from IRS Form 3800.

The general business credit consists of a number of credits that usually apply only to individuals who:

- Are partners

- Shareholders in an S corporation, or

- Have rental real estate

Line 6b: Credit for prior year minimum tax

In Line 6b, enter the credit for prior year minimum tax paid as calculated on IRS Form 8801.

This tax credit might be carried forward for taxpayers who had to pay alternative minimum tax (AMT) in prior tax years.

Line 6c: Adoption credit

If applicable, enter any adoption credits that you’re claiming on IRS Form 8839.

Line 6d: Credit for the elderly or disabled

From Schedule R, enter any tax credits for the elderly or disabled.

Line 6e: Alternative motor vehicle credit

If applicable, enter the alternative motor vehicle credit, as calculated on IRS Form 8910.

However, do not confuse this with either of the following:

- Qualified plug-in motor vehicle credit (Line 6f)

- Qualified electric vehicle credit (Line 6i)

- Alternative fuel vehicle refueling property credit (Line 6j)

Line 6f: Qualified plug-in motor vehicle credit

For Line 6f, enter the amount of qualified plug-in motor vehicle credit you’re claiming on IRS Form 8936.

Line 6g: Mortgage interest credit

Enter the amount of mortgage interest credit you’re claiming on IRS Form 8396 in Line 6g.

This mostly applies if a state or local government gave you a mortgage credit certificate under a state-sponsored home ownership program.

Line 6h: District of Columbia first-time homebuyer credit

If you carried over the District of Columbia first-time homebuyer credit from a previous tax year, enter the amount as reported on IRS Form 8859 in Line 6h.

Line 6i: Qualified electric vehicle credit

In Line 6i, enter the qualified electric vehicle credit as reported on IRS Form 8834.

In general, you can’t claim this tax credit for a vehicle placed in service after 2006. You can claim this tax credit only if you have an electric vehicle passive activity tax credit from a prior tax year.

Before claiming this credit, you should ensure that this doesn’t qualify as one of the other vehicle tax credits, such as the alternative motor vehicle credit or qualified plug-in motor vehicle credit.

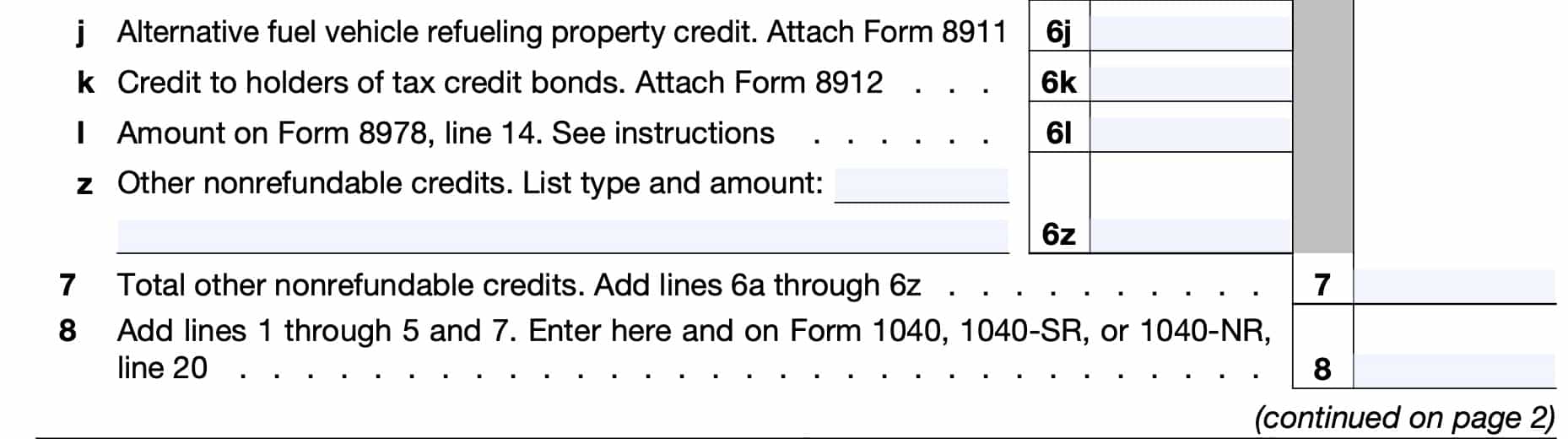

Line 6j: Alternative fuel vehicle refueling property credit

In Line 6j, enter the alternative fuel vehicle refueling property credit as reported on IRS Form 8911.

Line 6k: Credit to holders of tax credit bonds

If you held tax credit bonds, enter any tax credits reported on IRS Form 8912.

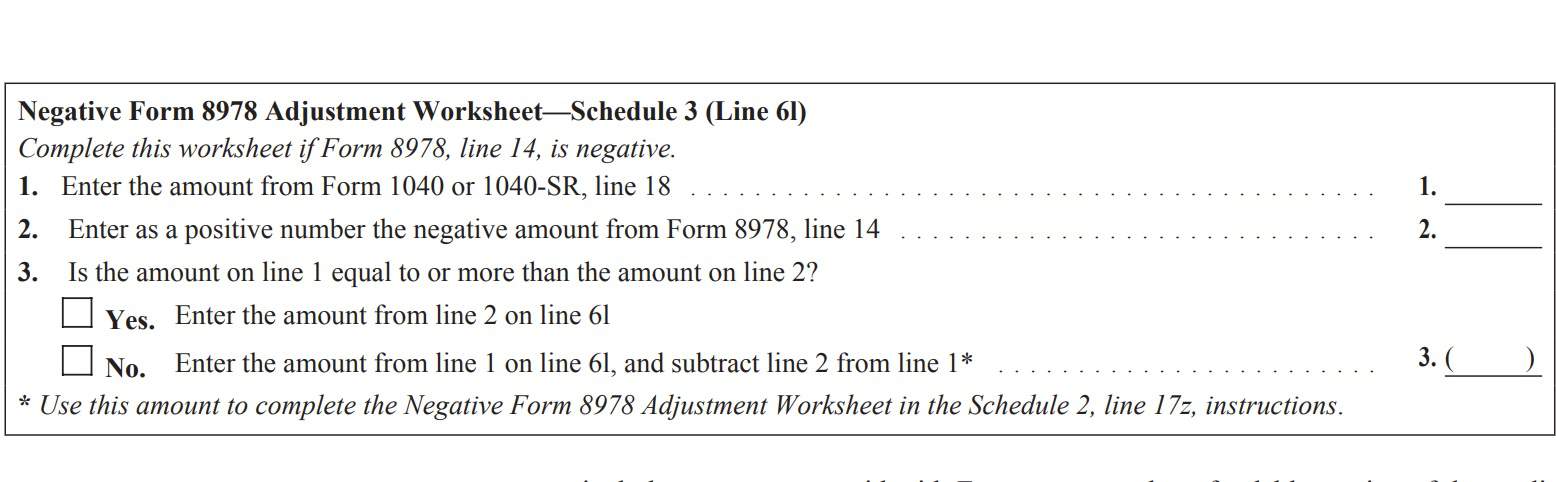

Line 6l: Amount on Form 8978, Line 14

In Line 6l, enter the amount from Line 14 on IRS Form 8978, Partner’s Additional Reporting Year Tax. If the amount on Line 14, is negative, you’ll have to complete the following worksheet from the IRS website to figure the amount to enter.

The instructions do not specifically state that you have to attach Form 8978 to your tax return. However, you may consider doing so, as it does provide financial information that will help the Internal Revenue Service better understand your tax situation in an audit.

Line 6z: Other nonrefundable credits

Use Line 6z to report any additional credits not reported elsewhere on your return or on other schedules. You’ll need to list the type and amount of each tax credit.

Line 7: Total other nonrefundable credits

Add Lines 6a through 6z. Enter the total in Line 7.

Line 8

Add Lines 1 through 5 and Line 7. Enter the result in Line 8 as well as on Line 20 for any of the following:

- IRS Form 1040

- IRS Form 1040-SR

- IRS Form 1040-NR

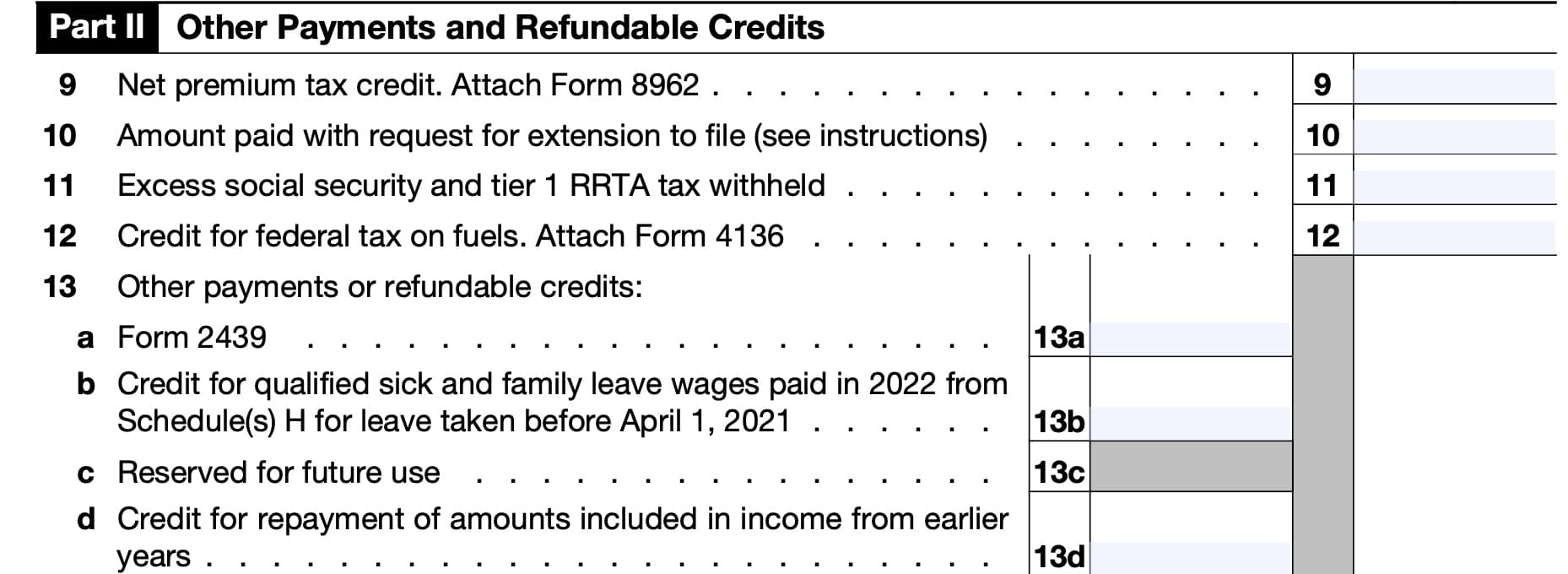

Part II: Other payments and refundable credits

In Part II, we’ll calculate other tax payments you may have made, as well as refundable tax credits that you may be entitled to.

If these payments and credits exceed your tax liability, you may receive a refund when you file your U.S. individual income tax return. If you were already expecting a refund, any of these refundable credits might result in a larger refund.

Let’s start with Line 9.

Line 9: Net premium tax credit

In Line 9, enter the net premium tax credit you calculated on IRS Form 8962.

You may be eligible to claim the premium tax credit if you, your spouse, or a dependent enrolled in

health insurance through the Marketplace. If this is the case, then you should have received Form 1095-A from the Marketplace with information about your coverage and any advance credit payments.

Eligible individuals might have advance payments of the premium tax credit made on their behalf directly to the insurance company.

Line 10: Amount paid with request for extension to file

If you filed an extension to file your income tax return, include any tax payments you might have made when you filed either of the following:

- IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

- IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return For U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment

Line 11: Excess Social Security and tier 1 RRTA tax withheld

Enter any excess Social Security taxes or Tier 1 railroad retirement (RRTA) taxes withheld from your earned income.

This usually doesn’t happen to taxpayers with only one employer. However, overwithholding of Social Security taxes happens to taxpayers who:

- Have two or more sources of earned income, such as a part-time job or side hustle, or

- Who pay self-employment tax, and

- Whose combined income from these sources exceeds the Social Security wage base

- $147,000 for 2022

- $160,200 for 2023

If a single employer withheld Social Security taxes in excess of the annual wage base, or if excess Tier 2 RRTA taxes were withheld, do not report them here. Instead, you should file IRS Form 843, Claim for Refund and Request for Abatement.

Line 12: Credit for federal tax on fuels

If you received a tax credit for federal tax on fuels ultimately used for a nontaxable purpose, then enter that number in Line 12 and attach IRS Form 4136 to your tax return.

Line 13: Other payments or refundable credits

In Line 13, we’ll total other tax payments or refundable credits from other sources, starting with Line 13a.

Line 13a: Undistributed long-term capital gains

If you received IRS Form 2439, enter any tax payments reported to you in Line 2.

Line 13b

If applicable, enter any refundable portion of the credit for qualified sick and family leave wages you are eligible for, as reported on Schedule H:

- Due to coronavirus related reasons, and

- Related to leave taken before April 1, 2021

You’ll find this information on Line 8e of your Schedule H.

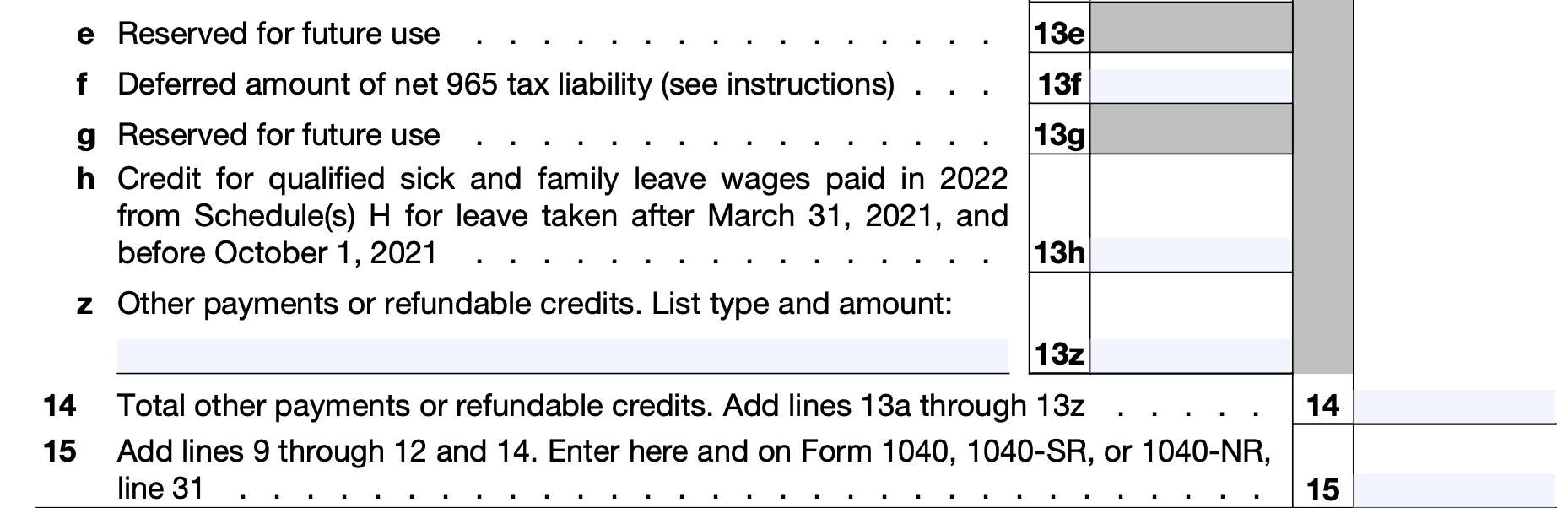

Line 13c: Reserved for future use

Skip Line 13c.

Line 13d

Line 13e: Reserved for future use.

Skip Line 13e.

Line 13f: Deferred amount of net 965 tax liability

As applicable, if you elected to pay your net 965 tax liability in installments, report the deferred amount on Line 13f. Enter the amount of net 965 tax liability remaining to be paid in future years.

Line 13g: Reserved for future use

Skip Line 13g.

Line 13h

If applicable, enter any refundable portion of the credit for qualified sick and family leave wages you are eligible for, as reported on Schedule H:

- Due to coronavirus related reasons, and

- Related to leave taken before April 1, 2021

You’ll find this information on Line 8e of your Schedule H.

Line 13z

Use Line 13z to report any additional credits not reported elsewhere on your return or on other schedules. You’ll need to list the type and amount of each tax credit.

Line 14: Total other payments or refundable credits

Add Lines 13a through 13z. Enter the total here.

Line 15

Add Lines 9 through 12, and Line 14. Enter the result here and on Line 31 of your income tax return.

Video walkthrough

Watch this instructional video to learn more about reporting tax credits and tax payments using IRS Schedule 3.

Frequently asked questions

Generally, taxpayers will use IRS Schedule 3 when they are claiming nonrefundable credits, other than the child tax credit or the credit for other dependents, or other payments and refundable credits.

Both types of tax credits can reduce your income tax bill to zero. The primary difference is that a refundable tax credit can result in a tax refund, even if you do not owe any income tax. A nonrefundable tax credit can only reduce your tax liability to zero.

How do I get IRS Schedule 3?

As with other federal income tax forms, you may find this IRS form on the IRS’ official website. For your convenience, we’ve attached the latest version of this tax form to this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!