IRS Form 8834 Instructions

In 2022, the Inflation Reduction Act introduced several changes to the Internal Revenue Code, allowing qualified taxpayers easier access to income tax credits for the purchase of an electric vehicle. However, many taxpayers still have tax credits available from prior tax years, which they can claim using IRS Form 8834.

In this article, we’ll walk through everything you need to know about this tax form, including:

- How to complete & file IRS Form 8834

- Applicable tax credits that might impact your ability to claim this tax credit

- Frequently asked questions about the qualified electric vehicle passive activity tax credit

Let’s start with a walkthrough of IRS Form 8834.

Table of contents

How do I complete IRS Form 8834?

This one-page tax form is relatively straightforward. But before we begin, it’s important to understand exactly which tax credit you can claim using IRS Form 8834.

Applicable tax credits

IRS Form 8834 only applies to qualified electric vehicle passive activity credits from prior years. The qualified electric vehicle credit was allowed for certain vehicles that were placed into service before 2007.

You can find these tax credits on either of the following tax forms, if applicable:

- IRS Form 8582-CR: Passive Activity Credit Limitations

- IRS Form 8810: Corporate Passive Activity Loss and Credit Limitations

Before you begin, you might want to ensure that this is the correct tax form, and that you don’t need to file IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, instead. This is the tax form that most taxpayers would use if they placed a qualified plug-in electric vehicle into service in the current year.

Assuming this is the correct tax form, let’s go through it starting at the top, with the taxpayer information fields.

Taxpayer information

At the very top of the form, enter the taxpayer name and Social Security number, as they appear on the income tax return.

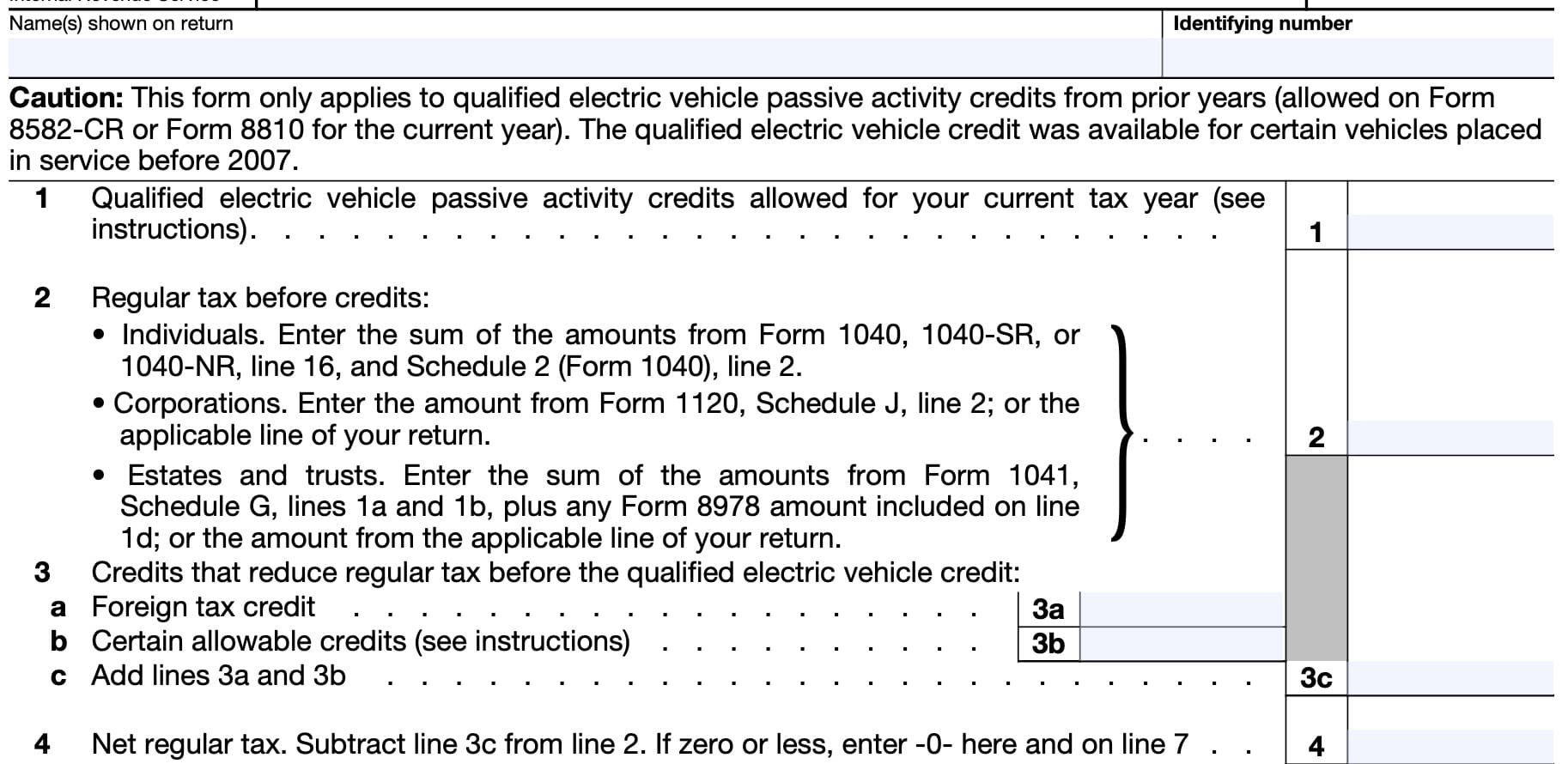

Line 1: Qualified electric vehicle Passive Activity Credits Allowed

In Line 1, enter the qualified electric vehicle passive activity credit amount that was allowed for your current tax year. You may have to refer to the IRS instructions for either Form 8582-CR or Form 8810 for more details.

Line 2: Regular tax before credits

In Line 2, we’ll enter the tax liability before accounting for any tax credits.

Individuals

Individual taxpayers will enter the sum of the following:

- IRS Form 1040, 1040-SR, or 1040-NR, Line 16 (tax liability)

- Schedule 2, Line 2 (Excess advance premium tax credit repayment from IRS Form 8962)

Corporations

For corporations, enter the amount from IRS Form 1120, Schedule J, Line 2, or the applicable line from your income tax return.

Estates & trusts

Estates and trusts will enter the sum of the following amounts:

- IRS Form 1041, Schedule G, Line 1a

- IRS Form 1041, Schedule G, Line 1b

- Any IRS Form 8978 amounts reported on IRS Form 1041, Schedule G, Line 1d

Once you’ve entered your tax liability into Line 2, move on to Line 3.

Line 3: Credits that reduce regular tax before the Qualified electric vehicle credit

In Line 3, we’ll enter any tax credits that reduce regular tax liability before the qualified electric vehicle tax credit.

Foreign tax credit

In Line 3a, enter any foreign tax credits from IRS Form 1116.

Certain allowable credits

In Line 3b, we’ll enter certain allowable tax credits, based upon tax filing status.

Form 1040, 1040-SR, or 1040-NR filers

Enter the total of any tax credits on the following:

- IRS Form 1040, 1040-SR, or 1040-NR, Line 19

- Child tax credit or credit from other dependents from Schedule 8812

- Schedule 3, Line 2: Credit for child and dependent care expenses from IRS Form 2441

- Schedule 3, Line 3: Education credits from IRS Form 8863

- Schedule 3, Line 4: Retirement savings contributions credit from IRS Form 8880

- Schedule 3, Line 5: Residential energy credits from IRS Form 5695

- Schedule 3, Line 7: Other nonrefundable tax credits

You will reduce this amount by the following:

- Any general business credit from IRS Form 3800 reported on Line 6a

- Previous year minimum tax from IRS Form 8801 reported on Line 6b

- Alternative fuel vehicle refueling property credit from IRS Form 8911 reported on Line 6j

- Credit to holders of tax credit bonds from IRS Form 8912 reported on Line 6k

Enter the result in Line 3b.

Form 1041 filers

From Schedule G, enter the total of any credits on Line 2e (not including any alternative fuel vehicle refueling property credit (personal use part) from Form 8911, Line 19; or any credits from lines 2a through 2d).

Forms 1120 filers

From Schedule J, enter the total of any credits on Line 6 (not including any credits from Lines 5a and 5c through 5e).

Total credits

Add Lines 3a and 3b. Enter the sum in Line 3c.

Line 4: Net regular tax

Subtract Line 3c from Line 2, and enter the result in Line 4. If this results in zero or a negative number, enter ‘0’ here and in Line 7, below.

Line 5: Tentative minimum tax

For individuals, enter the alternative minimum tax amount from IRS Form 6251, Line 9.

Corporations should enter ‘0,’ since corporations are exempt from AMT for tax years beginning after 2017.

Estates and trusts should enter the amount from IRS Form 1041, Schedule I, Line 52.

Line 6

Subtract Line 5 from Line 4, then enter the result in Line 6.

Line 7: Qualified electric vehicle credit

In Line 7, enter the smaller of:

Also, report this amount on:

- Individual eligible taxpayers: Schedule 3, Line 6i

- Corporate taxpayers: Form 1120, Schedule J, Line 5b

- Other taxpayers: the appropriate line on your tax return

If Line 6 is smaller than Line 1, then this means that you cannot take the maximum credit due to the tax liability limit. Unfortunately, you also lose any remaining credit, as you cannot carry forward or carry back this credit to other tax years.

Video walkthrough

Watch this instructional video to learn more about using IRS Form 88344 to claim a passive activity electric vehicle tax credit.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

No. You only would use IRS Form 8834 to claim a passive activity electric vehicle tax credit from prior tax years. Use IRS Form 8936 to calculate the new EV tax credit for an electric car or vehicle placed into service after 2022.

The Inflation Reduction Act of 2022 introduced new rules that allow eligible taxpayers to take a tax credit for placing electric vehicles into service between tax years 2023 and 2032. The maximum credit for a new vehicle is $7,500.