IRS Form 8879-F Instructions

A fiduciary has certain responsibilities when filing an estate or trust’s tax return. One of those responsibilities is to ensure the proper filing of a tax return. To help the tax return process go more smoothly, a fiduciary may use IRS Form 8879-F, IRS E-File Signature Authorization for Form 1041, to allow their tax professional to electronically sign the tax return on his or her behalf.

In this article, we’ll go over what you need to know about IRS Form 8879-F, including:

- How to complete IRS Form 8879-F

- Fiduciary and tax preparer responsibilities

- Frequently asked questions

Let’s start with an overview of how to complete this tax form.

Table of contents

How do I complete IRS Form 8879-F?

There are three parts to this one-page tax form:

- Part I: Tax Return Information

- Part II: Declaration and Signature Authorization of Fiduciary

- Part III: Certification and Authorization

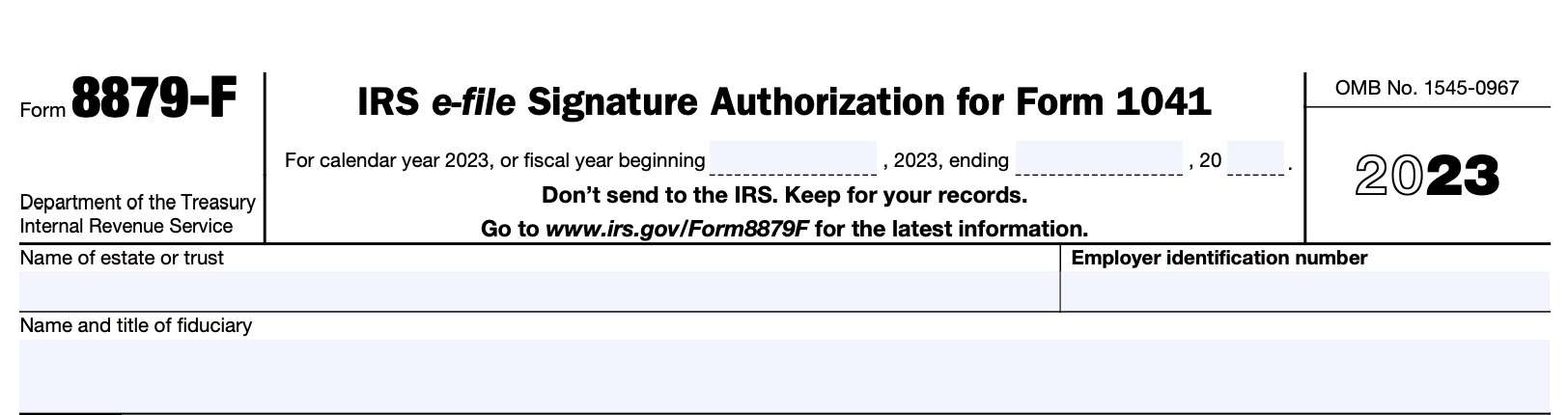

Before we begin with Part I, let’s take a look at the information fields at the very top of IRS Form 8879-F.

Top of IRS Form 8879-F

At the very top of IRS Form 8879, there are a few information fields to complete.

Fiscal year

If your estate or trust does not utilize a calendar year as its tax year, then enter the beginning and ending dates of the fiscal year that is used.

Name of estate or trust

Enter the name of the estate or trust in this line.

Employer identification number

Enter the employer identification number (EIN) of the estate or trust here. If you do not have one, you may apply for an EIN using IRS Form SS-4, Application for Employer Identification Number.

Name and title of fiduciary

Enter the name and title of the fiduciary here. If you have not already notified the Internal Revenue Service of your fiduciary relationship, you may file IRS Form 56, Notice of Fiduciary Relationship, to do so.

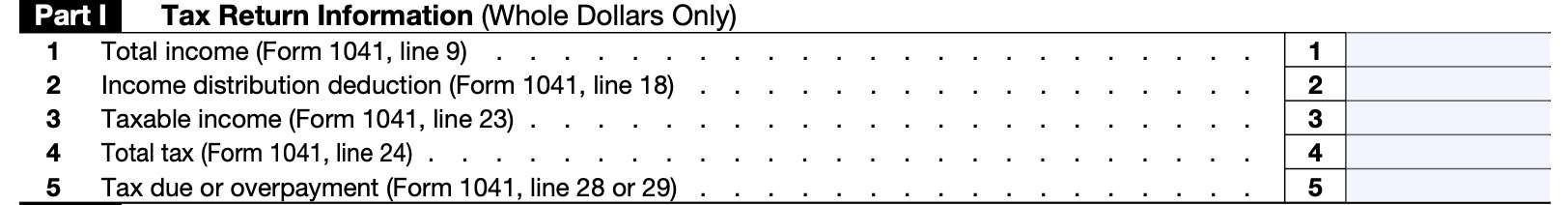

Part I: Tax Return Information

In Part I, we’ll enter certain information from the estate or trust’s electronic income tax return.

Line 1: Total income

From the Form 1041, enter the total income, as reported on Line 9.

Line 2: Income distribution deduction

Enter the income distribution deduction from the estate or trust return. You can find this on Line 18 of the form.

Line 3: Taxable income

In Line 3, enter the taxable income, found on Line 23 of the Form 1041.

Line 4: Total tax

Enter the total tax liability for the estate or trust. You can find this on Line 24 of estate or trust tax returns.

Line 5: Tax due or overpayment

Enter the tax due or the refund owed, which can be found on Line 28 or Line 29, respectively, of the estate or trust return.

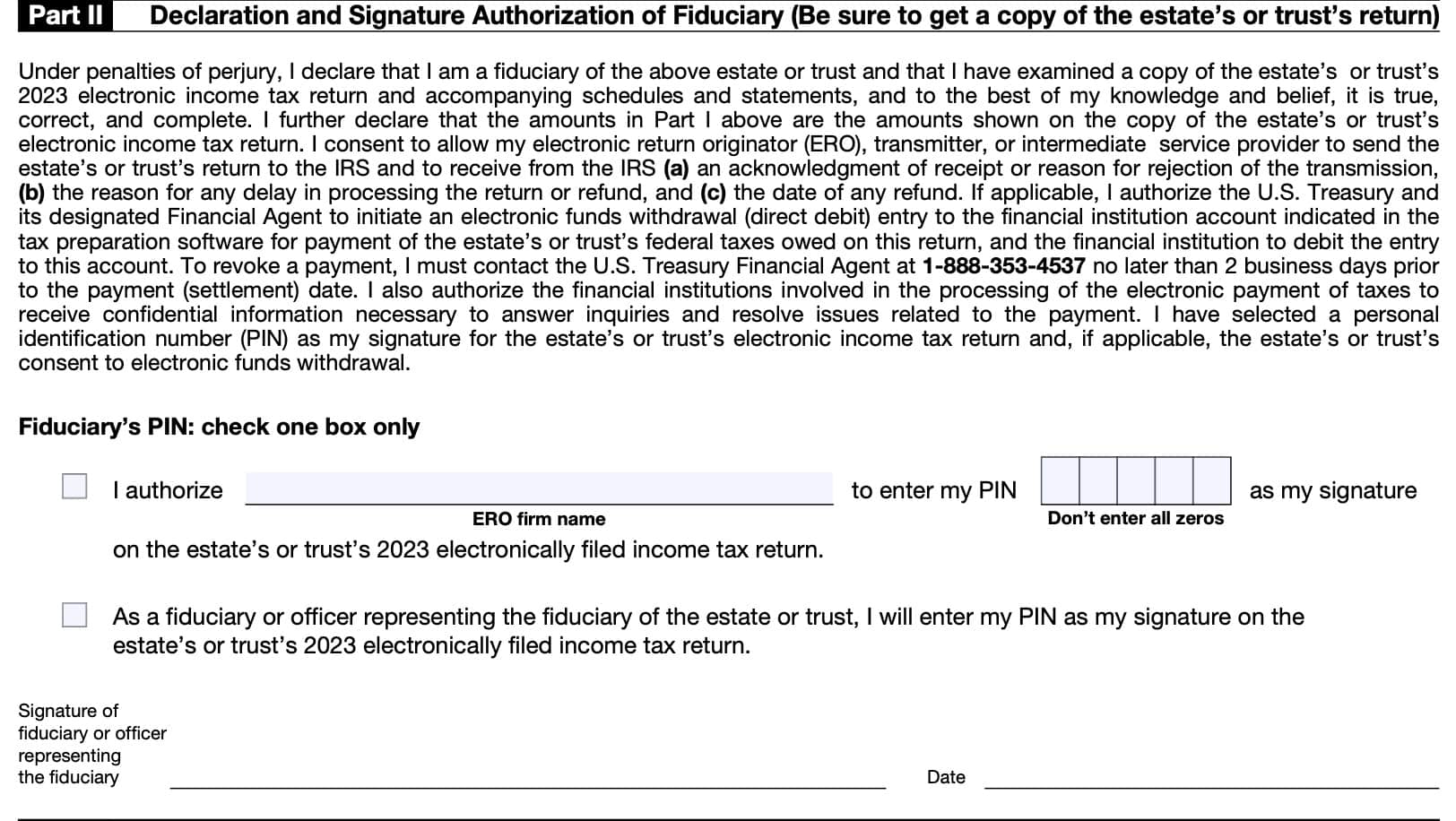

Part II: Declaration and Signature Authorization of Fiduciary

In Part II, we’ll go over the declaration and signature authorization of the fiduciary. Before we get into the instructions, we should take a moment to go over some of the IRS requirements outlined in the finer print.

What does the declaration say?

There are a few main points you should know, here.

You may be subject to legal penalties

In the first line, you are declaring, under penalties of perjury, that:

- You have personally reviewed the tax return, and

- The tax return is true, correct, and complete, to the best of your knowledge

You’re giving certain permissions to your tax professional

In the declaration, you are giving your electronic return originator (ERO), transmitter, or intermediate service provider permission to send and receive certain information to the IRS. Specifically, you are granting permission to receive:

- Acknowledgment of receipt or reason for rejection of the transmission (tax return)

- Reasons for delays in processing the tax return or tax refund

- Date of any refund that may be owed to the estate or trust

You’re giving the federal government permission to conduct electronic funds withdrawal from a bank account

If the estate or trust owes money to the U.S. government, your electronic signature authorizes the U.S. Treasury, through its designated financial agent, take electronic payment of the estate or trust’s tax bill.

The federal government will do this by direct debit from your financial institution account.

If you wish to revoke a payment, you must contact the financial agent no later than 2 business days prior to the payment or settlement date.

Fiduciary PIN

Once you’ve read the declaration, you may choose one of the available personal identification number (PIN) methods:

- ERO enters your PIN for you

- Enter your own PIN

Select the first box if you authorize your tax preparer to enter your PIN. You’ll enter the five-digit PIN on the electronic Form 8879-F, which your tax preparer will use to provide your IRS electronic signature.

Otherwise, you will enter your own PIN in the tax preparation software prior to electronic filing of the tax return.

Below the PIN, sign and date the form as the fiduciary or as an officer representing the fiduciary.

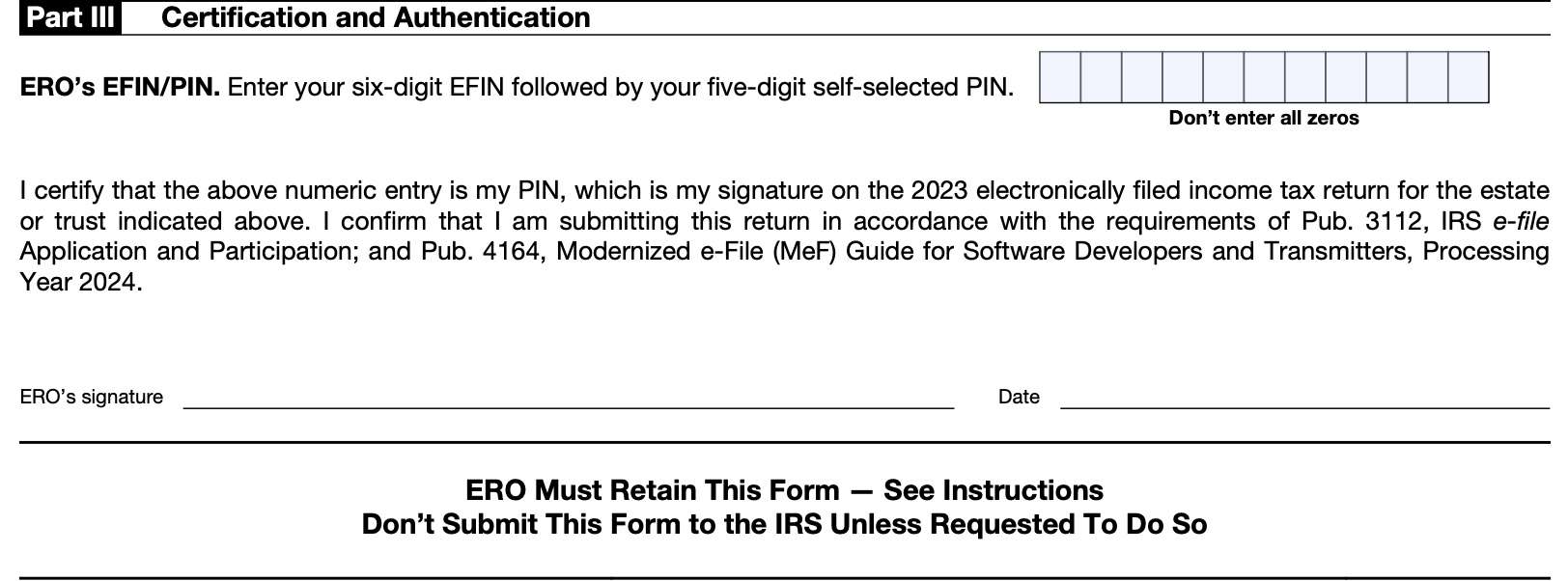

Part III: Certification and Authorization

In Part III, your tax return preparer will enter his or PIN, which consists of:

- The ERO’s six-digit electronic filing identification number (EFIN), followed by

- A five-digit PIN

Below this field, the ERO will sign and date the Form 8879-F.

Filing IRS Form 8879-F

As the taxpayer, there are a couple of things you may want to know about IRS Form 8879-F.

Your tax return preparer won’t send this form to the IRS

In fact, the form itself says in bold print, “Don’t send to the IRS. Keep for your records.” Your tax return preparer is required to keep this form for at least 3 years after the tax return is filed, or after the IRS has received the tax return, whichever is later.

You don’t have to complete IRS Form 8879-F

A fiduciary and an ERO use Form 8879-F when the fiduciary wants to use a personal identification number (PIN) to:

- Electronically sign an estate’s or trust’s electronic income tax return and,

- Consent to electronic funds withdrawal (direct debit), if applicable

A fiduciary who doesn’t want to use Form 8879-F must use IRS Form 8453-FE, U.S. Estate or Trust Declaration for an IRS e-file Return.

Your tax preparer has certain responsibilities

According to the IRS instructions, your tax return preparer (or ERO) must do the following:

- Enter the name and EIN of the estate or trust at the top of the form;

- Complete Part I using the amounts from the estate’s or trust’s income tax return;

- Zero may be entered when appropriate

- Enter on the authorization line in Part II the ERO firm name if the ERO is authorized to enter the fiduciary’s PIN;

- Not the name of the individual preparing the return

- Give the fiduciary a copy of Form 8879-F for completion and review, and

- Acceptable delivery methods include hand delivery, U.S. mail, private delivery service, email, Internet website, and fax

- Complete Part III, including a signature and date

You have responsibilities as well

As the fiduciary, you must do the following:

The fiduciary must:

- Verify the accuracy of the estate’s or trust’s prepared income tax return;

- Check the appropriate box in Part II to either:

- Authorize the ERO to enter the fiduciary’s PIN or

- Choose to enter it in person;

- Indicate or verify your PIN when authorizing the ERO to enter it

- The PIN must be five numbers other than all zeros

- Sign and date Part II; and

- Return the completed Form 8879-F to the ERO

The acceptable delivery methods include:

- Hand delivery

- U.S. mail

- Private delivery service

- Internet website, and

- Fax

Your tax return preparer will not submit the tax return until after he or she receives your signed form.

Video walkthrough

Watch this informative video to learn more about using Form 8879-F to authorize your ERO to use your PIN to electronically sign IRS Form 1041.

Frequently asked questions

No. According to the IRS form instructions, each Form 8879-F can only be associated with a single Form 1041, U.S. Income Tax Return for Estates and Trusts.

A fiduciary may use IRS Form 8879-F to authorize an electronic return originator (ERO) to use a personal identification number (PIN) to electronically sign a tax return on behalf of an estate or trust.

According to the IRS instructions, a fiduciary does not have to complete IRS Form 8879-F. However, if the fiduciary does not, then he or she must complete IRS Form 8453-FE, U.S. Estate or Trust Declaration for an IRS e-file Return.

Where can I find IRS Form 8879-F?

You can find IRS forms on the Internal Revenue Service website. For your convenience, we’ve included the latest version of this IRS efile signature authorization form here.