IRS Form 8453-FE: Estate/Trust Declaration for IRS e-file Return

If you’re the beneficiary of an estate or trust, you might see IRS Form 8453-FE as part of the tax return paperwork. And if you’re the fiduciary of an estate or trust, you’ll definitely use Form 8453-FE to authorize the electronic filing of the tax return.

This article will walk you through what you should know about this tax form, including:

- What is IRS Form 8453-FE

- How to complete this form and when you should file it

- How to obtain a copy of this tax form

Let’s start with discussing exactly what IRS Form 8453-FE is.

Contents

What is IRS Form 8453-FE?

IRS Form 8453-FE U.S. Estate or Trust Declaration for IRS e-file Return is used to authorize:

- The electronic Form 1041, U.S. Income Tax Return for Estates and Trusts

- The electronic filer to transmit the completed return via a third-party transmitter, and

- An electronic funds withdrawal of federal taxes owed by the trust or estate

However, this is not the only tax form with the number 8453. It’s worth taking some time to note all the versions of IRS Form 8453 for clarification.

How many different versions of IRS Form 8453 are there?

According to the IRS website, there are 12 different versions of IRS Form 8453, including IRS Form 8453-FE. Below is a brief summary of each of the 11 other IRS forms, and what each form does.

IRS Form 8453 U.S. Individual Income Tax Transmittal for an IRS e-file Return

Taxpayers use IRS Form 8453 to send required paper forms or supporting documentation that cannot be submitted to the Internal Revenue Service via electronic means.

IRS Form 8453 U.S. Individual Income Tax Transmittal for an IRS e-file Return (Spanish)

Spanish version of the individual income tax transmittal tax form described above.

IRS Form 8453-EMP Employment Tax Declaration for an IRS e-file Return

Taxpayers use Form 8453 to:

- Authenticate an electronic Form 940, 940-PR, 941, 941-PR,

- 941-SS, 943, 943-PR, 944, or 945,

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if filing online without using an ERO, and

- Provide taxpayer’s consent to authorize an electronic funds transfer for payment of federal taxes owed

IRS Form 8453-TE Tax Exempt Entity Declaration and Signature for Electronic Filing

Tax-exempt entities use this tax form to:

- Authenticate one of the following tax forms:

- IRS Form 990, Return of Organization Exempt From Income Tax

- IRS Form 990-EZ, Short Form Return of Organization Exempt From Income Tax

- IRS Form 990-PF, Return of Private Foundation

- IRS form 990-T, Exempt Organization Business Income Tax Return

- IRS Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- IRS Form 4720, Return of Certain Taxes Under Chapters 41 and 42 of the Internal Revenue Code

- IRS Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return

- IRS form 5227, Split-Interest Trust Information Return

- IRS Form 5330, Return of Excise Taxes Related to Employee Benefit Plans, and

- IRS Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if filing online without using an ERO

- Authorize an electronic funds withdrawal for payment of federal taxes owed as determined by one of the following:

- IRS Form 990-PF

- IRS Form 990-T

- IRS Form 1120-POL

- IRS Form 4720

- IRS Form 5330

- IRS Form 8868

IRS Form 8453-EX Excise Tax Declaration for an IRS e-file Return

Taxpayers use IRS Form 8453-EX to:

- Authenticate electronic versions of the following forms:

- IRS Form 720

- IRS Form 2290

- IRS Form 8849

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online without an ERO

- Provide taxpayer’s consent for electronic funds withdrawal to pay taxes owed

IRS Form 8453-PE U.S. Partnership Declaration for an IRS e-file Return

Partnerships use this tax form to:

- Authenticate an electronic Form 1065, U.S. Return of Partnership Income, as part of return or administrative adjustment request (AAR)

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO).

IRS Form 8453-I Foreign Corporation Income Tax Declaration for an IRS e-file Return

Foreign corporations use this form to:

- Authenticate an electronic Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize an electronic funds withdrawal for payment of federal taxes owed

IRS Form 8453-C U.S. Corporation Income Tax Declaration for an IRS e-file Return

U.S. corporations use IRS Form 8453-C to:

- Authenticate an electronic Form 1120, U.S. Corporation Income Tax Return

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize a direct debit for payment of federal taxes owed

IRS Form 8453-S U.S. S Corporation Income Tax Declaration for an IRS e-file Return

U.S. S-corporations use this tax form to:

- Authenticate an electronic Form 1120-S, U.S. Income Tax Return for an S-Corporation

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize a direct debit for payment of federal taxes owed

IRS Form 8453-X Political Organization Declaration for Electronic Filing of Notice of Section 527 Status

After electronically submitting IRS Form 8871, Political Organization Notice of Section 527 Status, an authorized official must sign, date, and send this form to the Internal Revenue Service. This allows the political organization to:

- File an amended or final Form 8871, or

- To electronically file Form 8872, Political Organization Report of Contributions and Expenditures.

IRS Form 8453-R Declaration and Signature for Electronic Filing of Form 8963

Taxpayers use IRS Form 8453-R to authenticate the electronic filing of Form 8963, Report of Health Insurance Provider Information.

How do I complete IRS Form 8453-FE?

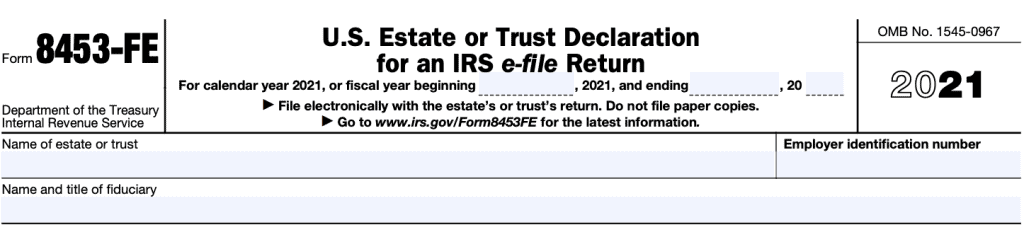

There are three parts to this tax form, which we’ll go through, step by step. However, let’s start at the very top of the form, before Part I.

Taxpayer information

In this section, you’ll enter:

- Beginning and end of fiscal year, if applicable. If the fiscal year coincides with the current year, leave blank.

- Name of estate or trust

- Employer identification number of the estate or trust

- Name and title of fiduciary responsible for the federal return

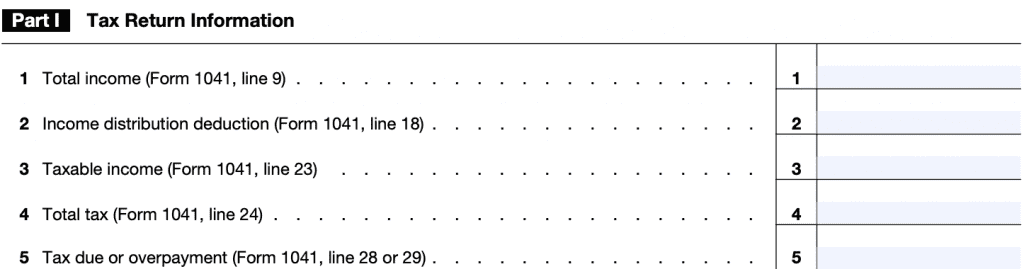

Part I: Tax Return Information

In Part I, fill in the corresponding lines from the estate or trust tax return in the current tax return.

Line 1: Total income

Fill in the number from Line 9 on the Form 1041, Total Income.

Line 2: Income distribution deduction

Fill in the number from Line 18 on the Form 1041. Also on Schedule B, Line 5 and substantiated on Schedules K-1.

Line 3: Taxable income

Fill in the number from Line 23 on the Form 1041, taxable income.

Line 4: Total tax

Fill in the number from Line 24 on the Form 1041. Also on Schedule G, Part I, Line 9.

Line 5

Fill in the number from Line 28 or 29 on the Form 1041. If the trust or estate owes additional tax, this will be Line 28. If the federal government owes a refund, this will be Line 29.

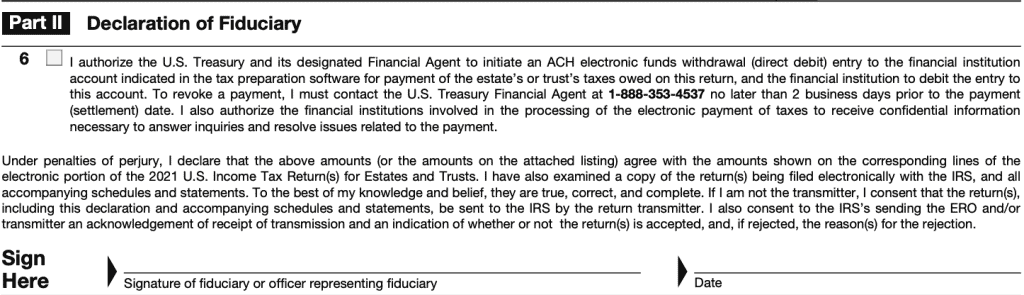

Part II: Declaration of Fiduciary

In Part II, the fiduciary responsible for the estate or trust will sign, under penalty of perjury, that:

- Declare that the amounts listed above match the amounts shown on the associated tax return.

- The submitted information is true, correct, and complete, to the best of their knowledge

Additionally, this contains the authorization for the U.S. Treasury to withdraw funds from the estate or trust bank account to pay any outstanding tax liability.

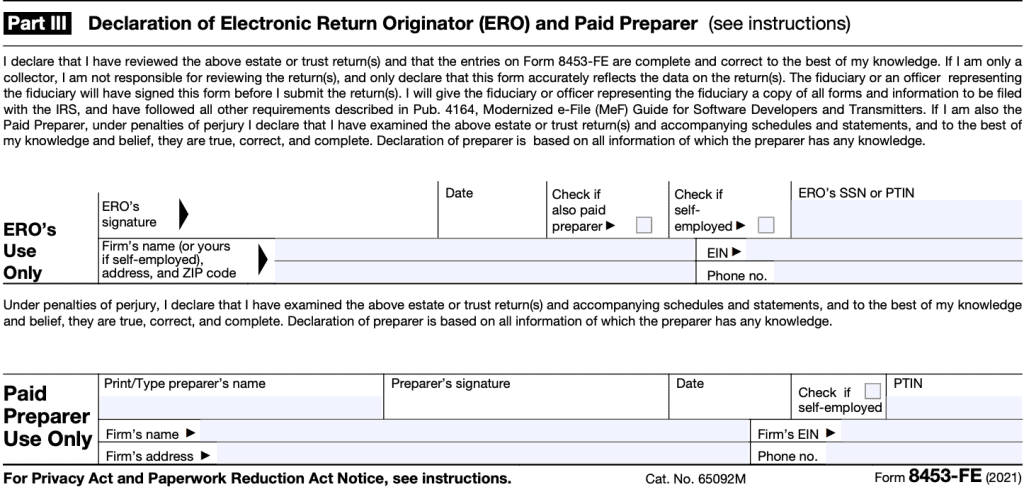

Part III: Declaration of Electronic Return Originator (ERO) and Paid Preparer

In Part III, the ERO and paid tax return preparer declare that the submitted information is complete and correct, under penalty of perjury.

However, the ERO is not responsible for reviewing the return. The ERO is only responsible for ensuring that the information on Form 8453-FE matches the information on the tax return itself. Additionally, the ERO will give the fiduciary a copy of all forms and information submitted to the IRS.

If also the paid preparer, then the ERO is responsible for reviewing the return. If there is a separate paid tax return preparer, he or she must sign below.

ERO’s use only:

In this section, the ERO will provide:

- Signature & date

- Check if also the paid preparer (does not need to complete the paid preparer use only section, below)

- Check if self-employed

- Social Security number or preparer tax identification number (PTIN)

- Firm’s name or ERO’s name, if self-employed

- Employer identification number (EIN)

- Phone number

Paid preparer use only:

In this section, the paid preparer will provide:

- Name

- Signature & date

- Check if self-employed

- PTIN

- Firm’s name

- Firm’s EIN

- Address

- Phone number

When should I file IRS Form 8453-FE?

This tax form is due with the estate or trust tax return. An estate or trust must file its income tax return by the 15th day of the 4th month following the close of its tax year.

This filing date also applies to returns filed electronically.

Where do I find a copy of this tax form?

You may find a copy in the Forms and Instructions page of the IRS website or download the PDF file below.