IRS Form 8865: Returns WRT Certain Foreign Partnerships

If you are a United States person participating in certain foreign partnerships, the federal government may require you to report information about your foreign financial assets to the Internal Revenue Service. For foreign partnership interests, many taxpayers report this information using IRS Form 8865.

This article will walk you through what you need to know about this tax form, including:

- What is IRS Form 8865?

- Who is required to file IRS Form 8865?

- How do you complete IRS Form 8865?

Let’s start with a brief introduction on this tax form, and what it’s used for.

Contents

What is IRS Form 8865?

A US person who qualifies under a specified category of filer (see Categories of filer, below), will file IRS Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, to comply with one or more sections of the Internal Revenue Code:

- Section 6038: Information reporting with respect to certain foreign corporations and partnerships

- Section 6038B: Notice of certain transfers to foreign persons

- Section 6046A: Returns as to interests in foreign partnerships

Who is required to file IRS Form 8865?

Generally speaking, U.S. citizens must fall under one of 4 categories of filers. The reporting requirements depend on which category of filer the taxpayer falls under.

Let’s take a closer look at each category.

Categories of filers

There are 4 categories of filers for purposes of filing Form 8865.

Category 1

This is a U.S. person who controlled the foreign partnership at any time during the partnership’s tax year. The IRS considers 50% ownership (or greater) to constitute a controlled foreign partnership.

This category can also include a U.S. transferor who must report certain information with respect to a Section 721(c) partnership for the tax year of contribution and subsequent years, pursuant to filing requirements outlined in Regulations Section 1.721(c)-6.

There may be more than 1 Category 1 filer during the tax year.

Category 2

This is a U.S. person who, at any time during the tax year of the foreign partnership, owned a 10% or greater interest in the partnership while the partnership was controlled by U.S. persons each owning at least a 10% interest.

However, if there was at least 1 Category 1 filer during the tax year, there will not be a Category 2 filer.

Category 3

This is a U.S. person who contributed property in a Section 721 transfer during that person’s tax year to a foreign partnership in exchange for an interest in the partnership. This must have led to one or both of the following:

- The taxpayer either directly or constructively owned at least a 10% interest in the foreign partnership immediately after the contribution, or

- The value of the property contributed by the individual (or a related party) exceeds $100,000, when combined with the value of any other property contributed during the 12-month period immediately before the transfer

Category 4

A Category 4 filer is a U.S. person that had a reportable event under Section 6046A during that person’s tax year. This could be one of three types of events:

- Acquisitions

- Dispositions

- Changes in proportional interest

See the IRS instructions for more details on Category 4 reportable events.

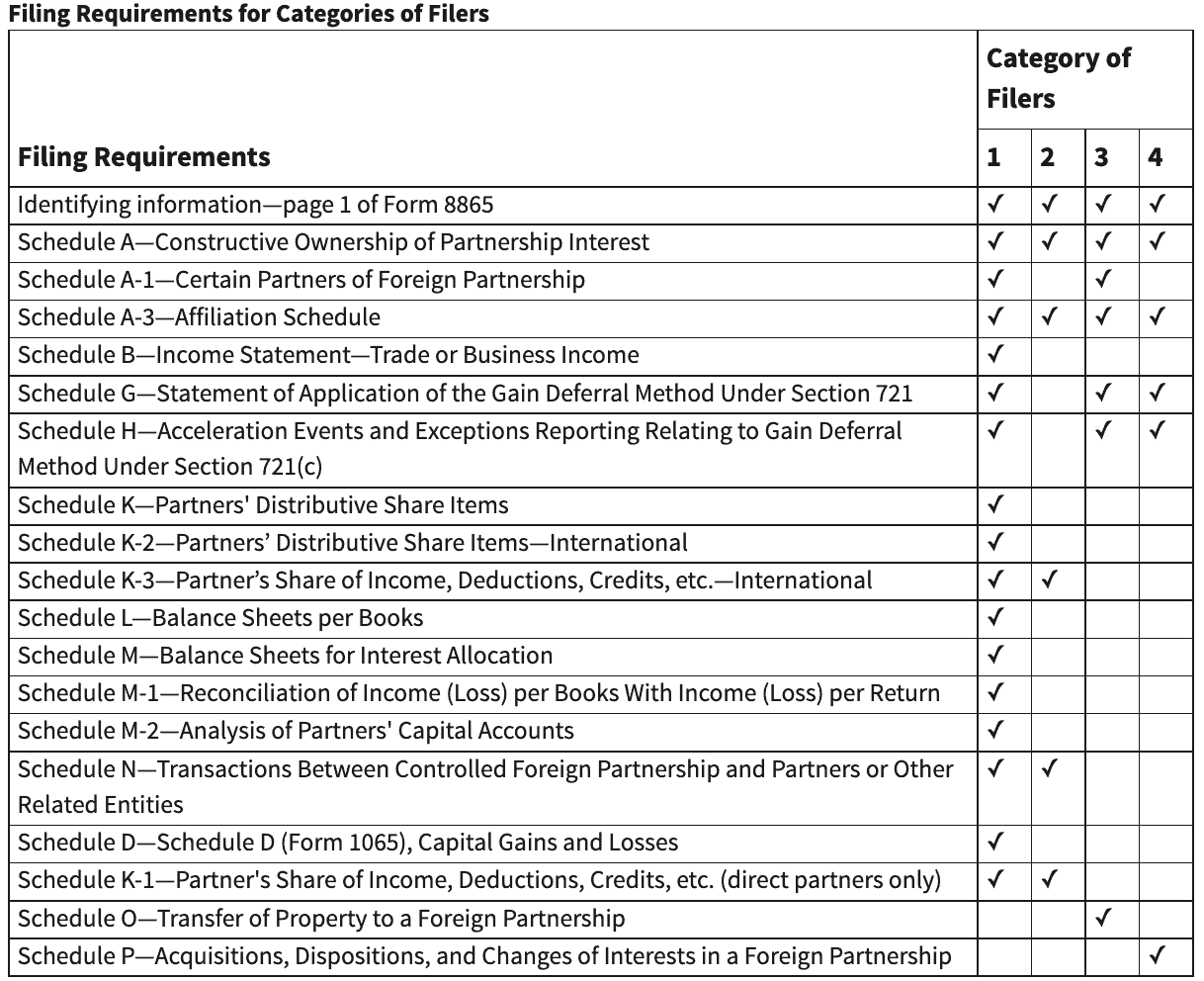

Filing requirements by category

The IRS instructions contain the below chart, which identifies the filing requirements for the different filing categories. All filers will complete the identifying information fields on page 1 of Form 8865 in addition to the outlined schedule for their particular category.

Filers must file a separate Form 8865 and schedules for each foreign partnership.

We’ve summarized this information under each category, below.

Category 1

These filers will file the following schedules:

- Schedule A: Constructive Ownership of Partnership Interest

- Schedule A-1: Certain Partners of Foreign Partnership

- Schedule A-3: Affiliation Schedule

- Schedule B: Income Statement-Trade or Business Income

- Schedule G: Statement of Application of the Gain Deferral Method Under Section 721

- Schedule H: Acceleration Events and Exceptions Reporting Relating to Gain Deferral Method Under Section 721(c)

- Schedule K: Partners’ Distributive Share Items

- Schedule K-2: Partners’ Distributive Share Items-International

- Schedule K-3: Partner’s Share of Income, Deductions, Credits, etc.-International

- Schedule L: Balance Sheets per Books

- Schedule M: Balance Sheets for Interest Allocation

- Schedule M-1: Reconciliation of Income (Loss) per Books with Income (Loss) per Return

- Schedule M-2: Analysis of Partners’ Capital Accounts

- Schedule N: Transactions Between Controlled Foreign Partnership and Partners or Other Related Entities

- Schedule D: Schedule D (Form 1065), Capital Gains & Losses

- Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc. (direct partners only)

Category 2

These filers will file the following schedules:

- Schedule A: Constructive Ownership of Partnership Interest

- Schedule A-3: Affiliation Schedule

- Schedule K-3: Partner’s Share of Income, Deductions, Credits, etc.-International

- Schedule N: Transactions Between Controlled Foreign Partnership and Partners or Other Related Entities

- Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc. (direct partners only)

Category 3

These filers will file the following schedules:

- Schedule A: Constructive Ownership of Partnership Interest

- Schedule A-1: Certain Partners of Foreign Partnership

- Schedule A-3: Affiliation Schedule

- Schedule G: Statement of Application of the Gain Deferral Method Under Section 721

- Schedule H: Acceleration Events and Exceptions Reporting Relating to Gain Deferral Method Under Section 721(c)

- Schedule O: Transfer of Property to a Foreign Partnership

Category 4

These filers will file the following schedules:

- Schedule A: Constructive Ownership of Partnership Interest

- Schedule A-3: Affiliation Schedule

- Schedule G: Statement of Application of the Gain Deferral Method Under Section 721

- Schedule H: Acceleration Events and Exceptions Reporting Relating to Gain Deferral Method Under Section 721(c)

- Schedule P: Acquisitions, Dispositions, and Changes of Interest in a Foreign Partnership

When do you have to complete this IRS tax form?

Taxpayers are expected to timely file Form 8865 with their individual income tax return for the current tax year, including extensions.

For example, a taxpayer would have filed their 2021 Form 8865 with their 2021 U.S. income tax return.

What penalties apply if I do not complete IRS Form 8865 on time?

Taxpayers who do not timely file this form may face civil fines and certain criminal penalties, based upon their filing category.

Category 1 and Category 2 filers

Files in Categories 1 and 2 who do not file this required form on time may face:

- A $10,000 penalty for each tax year of each foreign partnership for failure to furnish the required information within the time prescribed

- After 90 days of the original notice of the failure to furnish information, the IRS will impose another $10,000.

- The IRS may impose additional fines of up to $10,000 for every 30-day period that the IRS tax form is not filed, up to a maximum of $50,000 per incident.

- 10% reduction of foreign tax credits available under IRC Sections 901 and 960.

- After 90 days, the IRS may impose an additional 5% reduction in foreign tax credit available for each 90-day period, or fraction thereof, during which the failure to file still exists.

- Criminal penalties may apply under one or more of the following IRC Sections for failure to file or filing false or fraudulent information:

- Section 7203: Willful failure to file return, supply information, or pay tax

- Section 7206: Fraud and false statements

- Section 7207: Fraudulent returns, statements, or other documents

Category 3 filers

These filers who fail to properly report a contribution to a foreign partnership must be reported under Section 6038B may face a penalty of up to 10% of the fair market value (FMV) of their contribution.

This penalty is subject to a $100,000 limit, unless the failure is due to intentional disregard. Additionally, the transferor must recognize gain on the contribution as if the contributed property had been sold for its FMV.

Category 4 filers

Any person who fails to properly report all the information requested by Section 6046A is subject to a $10,000 penalty. This is in addition to any Section 7203 criminal penalty that may apply, unless the taxpayer can show that the failure was due to reasonable cause.

If the failure continues for more than 90 days after the IRS mails notice of the failure, an additional $10,000 penalty will apply for each 30-day period (or fraction thereof) during which the failure continues after the 90-day period has expired. The additional penalty shall not exceed $50,000.

How do you complete IRS Form 8865?

We’ll break down this form, line by line, so you can understand it. If you’re interested in a particular schedule, you can skip down to the appropriate schedule through the Table of Contents.

For each of the different schedules, we’ll provide basic instructions. For in depth detail on any particular schedule, please visit the form instructions.

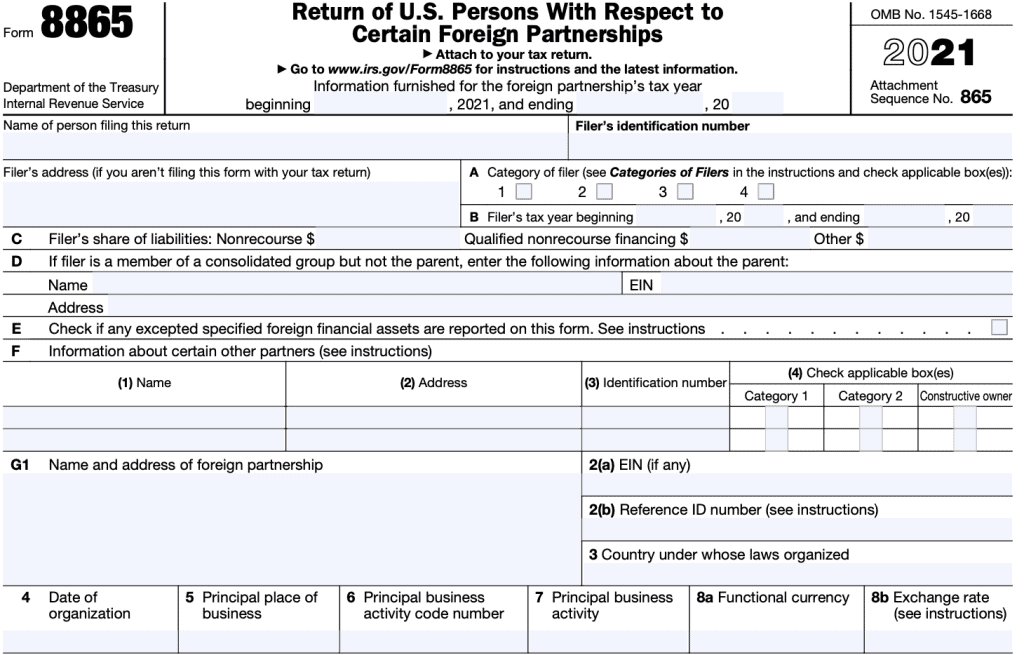

Identifying information

Starting at the top, we’ll go through each step, one at a time.

Tax year

Enter the beginning and ending dates of your foreign partnership’s tax year.

Category 1 or 2 filers must report information for the tax year of the foreign partnership that ends with or within their tax years.

A Category 3 or 4 filer must report on Schedule O or P, respectively, transactions that occurred during that filer’s tax year instead of during the partnership’s tax year.

Name of person filing return

Self-explanatory.

Filer’s identification number

Use an employer identification number (EIN) for corporations, partnerships, estates, or trusts.

Individuals should use their Social Security number or another taxpayer identification number here.

Filer’s address

Self-explanatory. If a foreign address, include city or town, state or province, and country. Do not abbreviate the country’s name.

Line A: Category of filer

Check the box next to the appropriate category of filer. If you belong to more than one category of filer, check all that apply.

Line B: Filer’s tax year

List the beginning and end of taxpayer’s tax year.

Line C: Filer’s share of liabilities

Enter the filer’s share of nonrecourse liabilities, partnership-level qualified nonrecourse financing, and other liabilities.

According to the IRS, nonrecourse liabilities are those liabilities of the partnership for which no partner bears the economic risk of loss.

The extent to which a partner bears the economic risk is determined under the rules of Treasury Regulations Section 1.752-2.

“Qualified nonrecourse financing” generally includes financing:

- For which no one is personally liable for repayment;

- That is borrowed for use in an activity of holding real property; and

- That is either:

- Borrowed from a qualified person as defined in IRC Section 49(a)(1)(D)(iv), or

- Lent or guaranteed by a federal, state, or local government.

IRC Section 465(b)(6) contains additional information on qualified nonrecourse financing.

Line D: Consolidated group information

If applicable, list the name, EIN, and address of the parent organization.

Line E

Check only if also:

- Filing IRS Form 8938, Statement of Specified Foreign Financial Assets, for the tax year and

- Including this form in the total number of Forms 8865 reported on Form 8938, Part IV, Line 19

Line F: Information about certain other partners

If identifying certain partners under the multiple Category 1 filers exception, you may need to fill in each partner’s:

- Name

- Address

- Identification number

- Filing category

See the form instructions if applicable.

Line G1: Name and address of foreign partnership

Self-explanatory.

Line G2(a): EIN

Enter foreign partnership’s EIN, if available. If there is no EIN, then you must complete Line G2(b).

Line G2(b): Reference ID number

Line G2(b) must be completed only if there is no EIN. However, taxpayers may complete Lines G2(a) and G2(b) if desired.

A reference ID number must meet certain requirements outlined in the form instructions.

Line G3: Country under whose laws organized

Enter the name of the foreign country whose laws apply to the foreign partnership.

Line G4: Date of organization

Self-explanatory.

Line G5: Principal place of business

Self-explanatory.

Line G6: Principal business activity code number

If the partnership filed IRS Form 1065, enter the business activity code number from that tax return. If not, enter the applicable business code from the IRS website.

Line G7: Principal business activity

Enter the primary business activity for the partnership.

Line G8a: Functional currency

List the partnership’s primary currency, according to Sections 985 through 989 and the applicable regulations.

If the partnership had more than one qualified business unit (QBU), list each QBU, country of business, and functional currency in a separate statement.

Line G8b: Exchange rate

You must use the methods outlined in Section 985 through 989 and their supporting regulations to calculate the exchange rate.

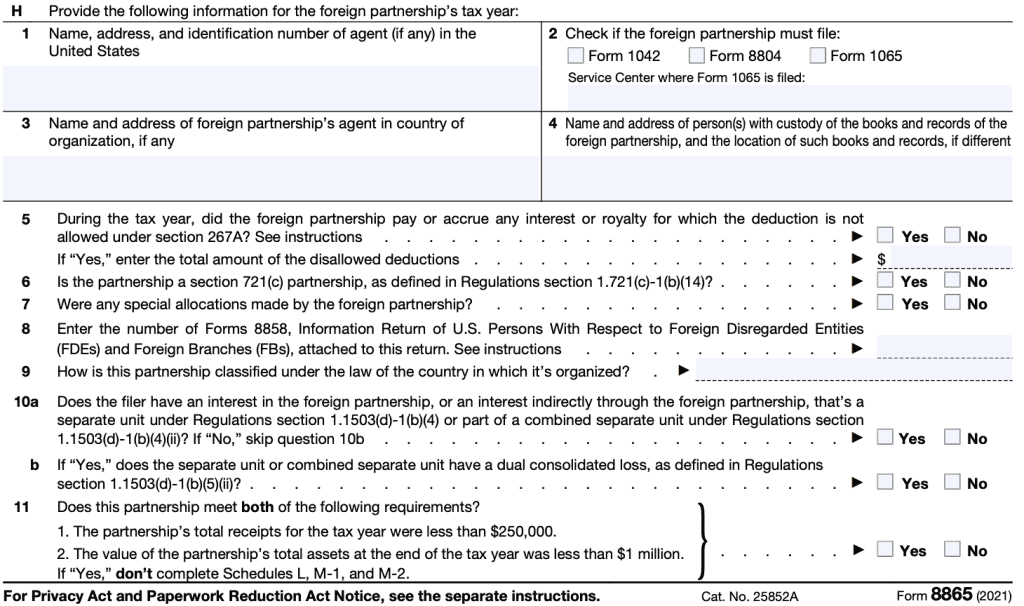

Line H1

Self-explanatory.

Line H2

Check the appropriate box, depending on the tax form the foreign partnership must file.

Line H3

Self-explanatory

Line H4

List name and address of person, if different from Line H3.

Line H5

Check the appropriate box, based on Section 267A rules.

Line H6

Check whether the partnership is a Section 721(c) partnership. If ‘Yes,’ you may need to complete Schedule A-2, below.

Line H7

Check the appropriate box.

Line H8

Only Category 1 or Category 2 filers need to answer this question.

Enter the number of IRS Forms 8858 you’ve attached to this tax return.

Line H9

Self-explanatory.

Line H10

Only Category 1 filers, or indirect owners who are filing the constructive ownership exception statement need to complete Lines H10a and H10b.

For Line H10a, check the appropriate box based upon Treasury Regulations. If the answer is “No,” go to Question H11.

Line 10b: If the answer to H10a is “Yes,” does the separate unit have a dual consolidated loss, as defined in Treasury Regulations Section 1.1503(d)-1(b)(5)(ii)?

Line H11

Only Category 1 filers need to answer this question.

Check “Yes” if:

- Total receipts were less than $250,000 for the tax year, AND

- The total value of partnership assets was less than $1 million

If “Yes,” do not complete the following schedules:

- Schedule L

- Schedule M-1

- Schedule M-2

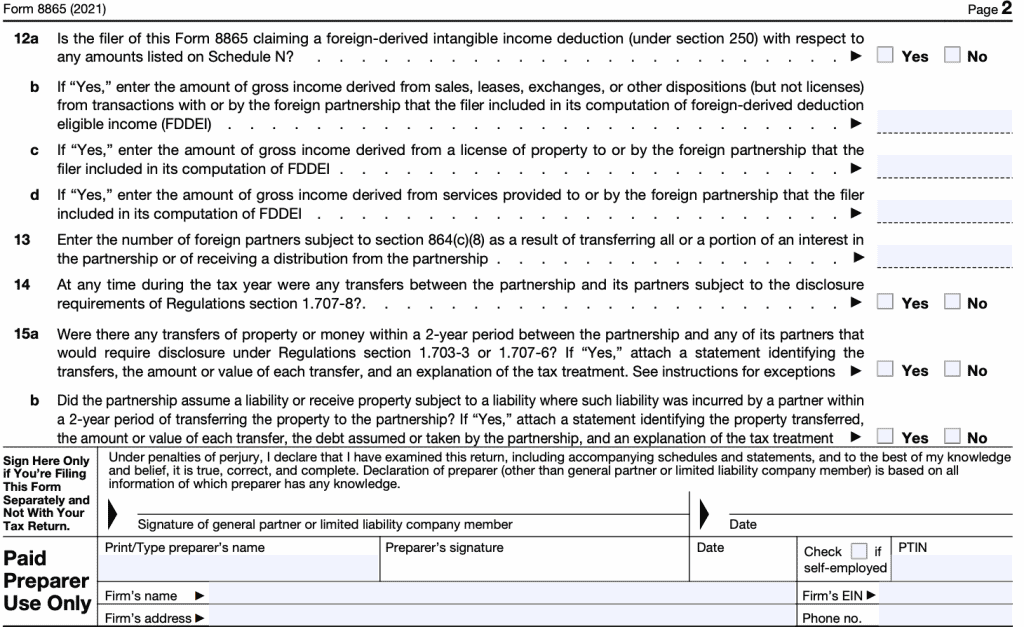

Line H12

Answer “Yes” to Line H12a if you are claiming a foreign-derived intangible income deduction under Section 250. If “Yes,” answer Lines H12b through H12d in US currency.

This must be converted using methods outlined in IRC Section 989(b).

Line H13

Self-explanatory. Refer to IRC Section 864(c)(8) for additional guidance.

Line H14

Check the appropriate box, using Treasury Regulations 1.707-8 as guidance.

Line H15

Check the appropriate box. If you answer “Yes” to either question, you must attach a statement identifying:

- The money or property transferred

- Value of transfers

- Whether or not debt was assumed by the partnership

- Explanation of the tax treatment

Signature field

Do not sign if you are filing IRS Form 8865 as part of your individual tax return. If you do not have to file a U.S. tax return, then you must sign and date the form.

Paid preparer use only

Only required if filing this form separately from a tax return.

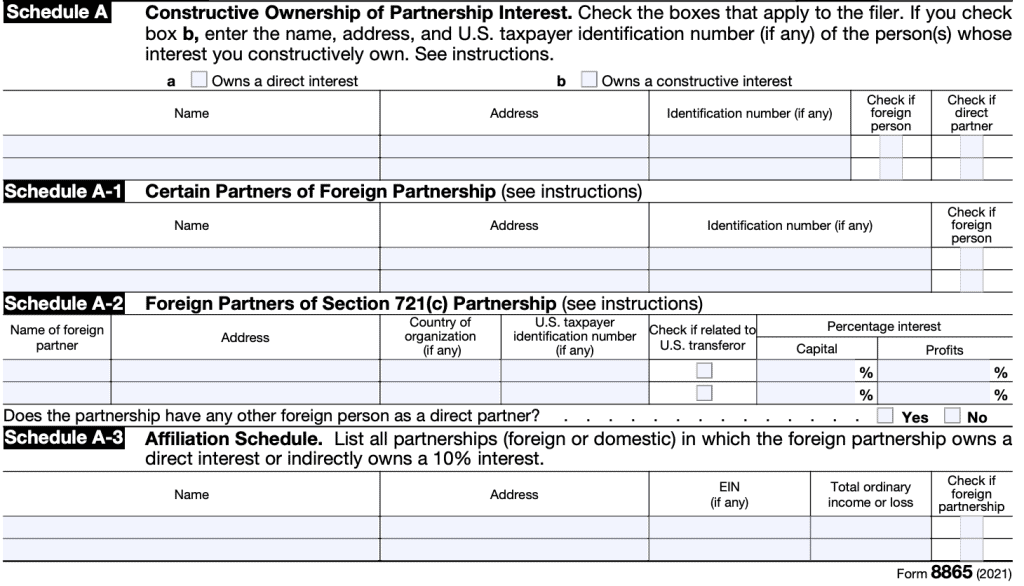

Schedule A: Constructive Ownership of Partnership Interest

All filers must complete Schedule A.

Check Box a if the person filing the return owns a direct interest in the foreign partnership.

Check Box b if the person filing the return constructively owns an interest in the foreign partnership. See the IRS instructions for guidelines on constructive ownership.

Category 1 and 2 filers

These filers must list the persons (U.S. and foreign) whose interests in the foreign partnership they constructively owned during the partnership tax year.

Category 3 filers

These filers must list the persons (U.S. and foreign) whose interests in the foreign partnership they constructively owned during the filer’s tax year that the reportable transfer occurred.

In all cases, list the following:

- Name

- Address

- Identification number

- Check whether person is a foreign person

- Check whether person is a direct partner

Schedule A-1: Certain Partners of Foreign Partnership

Category 1 and certain Category 3 filers must complete Schedule A-1. However, you do not need to list any person already listed on Schedule A.

Category 1 filers

These filers must list all U.S. persons who owned at least a 10% direct interest in the foreign partnership during the partnership’s tax year listed at the top of Page 1.

Category 3 filers

These filers must list:

- Each U.S. person that owned a 10% or greater direct interest in the foreign partnership during the Category 3 filer’s tax year, and

- Any other person related to the Category 3 filer that was a direct partner in the foreign partnership during that tax year.

However, Category 3 owners who only contributed cash, and maintained less than 10% ownership after the transfer, do not have to file Schedule A-1.

In all cases, list the following:

- Name

- Address

- Identification number

- Check whether person is a direct partner

Schedule A-2: Foreign Partners of Section 721(c) Partnership

Only complete Schedule A-2 if you checked “Yes” in Line H6, and either:

- During the current tax year, a gain deferral contribution occurred, or

- A gain deferral contribution occurred in a prior tax year and, during the current tax year, the gain deferral method is applied to Section 721(c) property contributed in the prior gain deferral contribution

Country of organization

Insert the 2-letter country code for the country of organization for any foreign partner, other than an individual.

Check if related to U.S. transferor

Check the box if the partner is directly or indirectly related to the U.S. transferor, and is not a U.S. person. Use Sections 267(b) and 707(b)(1) to determine the definition of related.

Percentage interest.

Include the foreign partner’s percentage of interest in the partnership’s capital and profits immediately after the gain deferral contribution. If multiple gain deferral contributions occurred during the tax year, enter the percentages immediately after the most recent gain deferral contribution.

Schedule A-3: Affiliation Schedule

All filers

All filers must complete Schedule A-3 and list all partnerships, foreign or domestic, in which the foreign partnership owned:

- A direct interest, or

- A 10% indirect interest (under the rules of Section 267(c)(1) and (5)) during the partnership tax year listed at the top of Page 1

Category 1 filers

Only Category 1 filers must complete the ordinary income or loss column. In this column, report the foreign partnership’s share of income or loss from partnerships in which the foreign partnership owned a direct interest.

This includes income not received. This should be the same number the taxpayer inserts into Schedule B, Line 4.

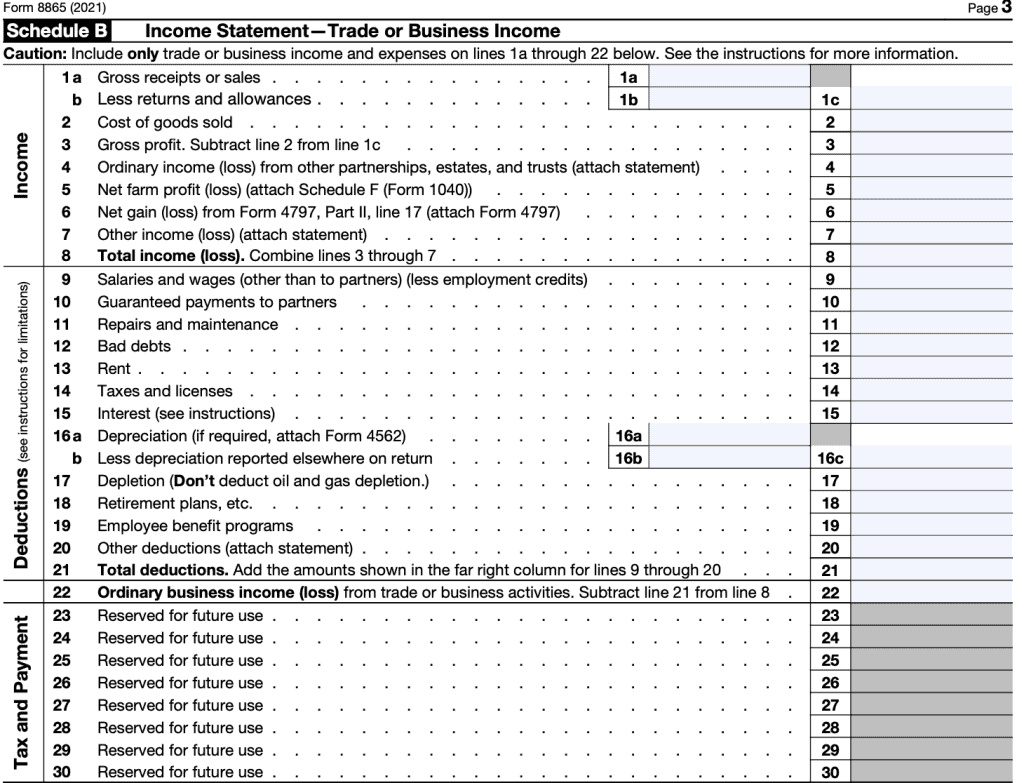

Schedule B: Income Statement-Trade or Business Income

All Category 1 filers in partnerships engaged in a domestic or foreign trade or business must complete Schedule B.

For specific line-by-line instructions to Schedule B, please refer to the instructions for Lines 1a through 21 on IRS Form 1065, U.S. Return of Partnership Income.

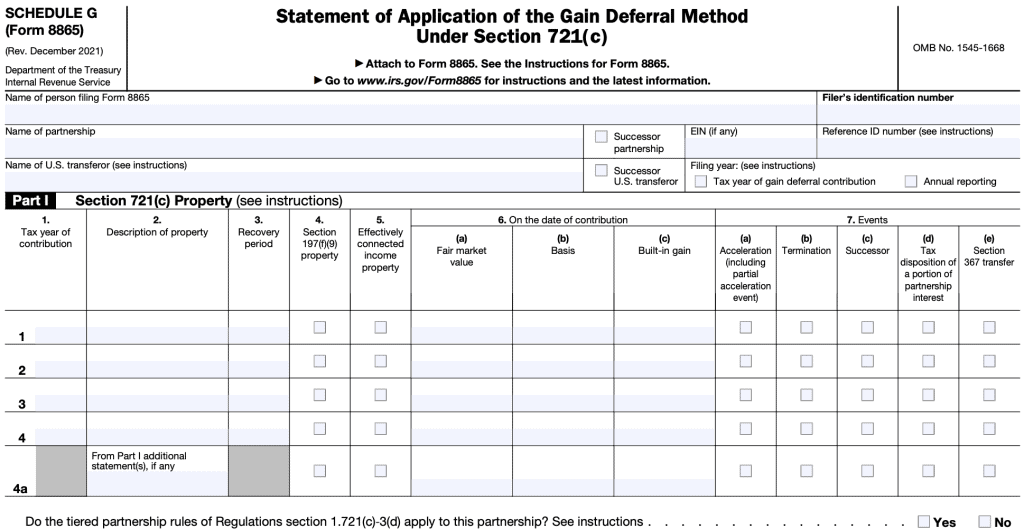

Schedule G: Statement of Application of the Gain Deferral Method

Under Section 721(c)

If the gain deferral method is applied to Section 721(c) property, a U.S. transferor must file Schedule G for the tax year of a gain deferral contribution. Additionally, the taxpayer must file Schedule G for each subsequent tax year to which the gain deferral method is applied to Section 721(c) property.

Most fields are self-explanatory with the following exceptions:

Tax year of gain deferral contribution

Check the box for “Tax year of gain deferral contribution” if your tax year is a gain deferral contribution year.

Annual reporting

Check the “Annual reporting” box if:

- A gain deferral contribution occurred in a year prior to the current tax year and,

- In the current tax year, the gain deferral method applies to Section 721(c) property

Part I: Section 721(c) Property

Complete each section, as requested in the tax form. For specific guidance on a particular part, please refer to the Schedule G, Part I instructions.

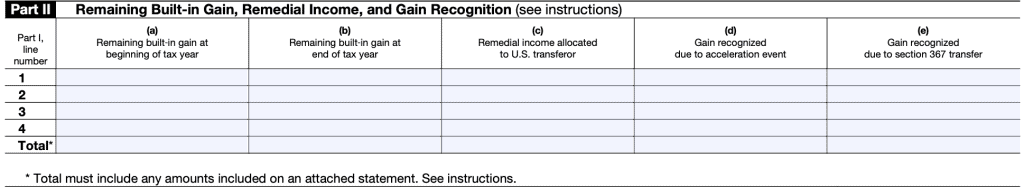

Part II: Remaining Built-In Gain, Remedial Income, and Gain Recognition

On Line 4a, provide the total amounts in each column with respect to all reportable property. Please see the Schedule G, Part II instructions for more detailed guidance.

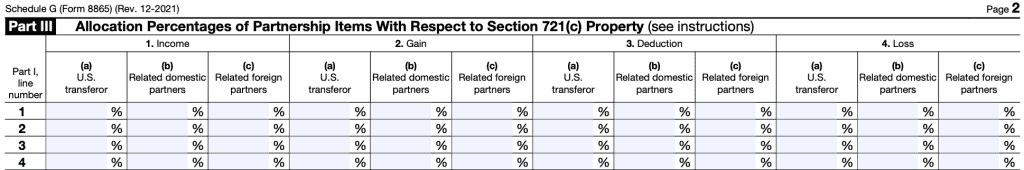

Part III: Allocation Percentages of Partnership Items with Respect to Section 721(c) Property

For each reportable Section 721(c) property, enter the percentage of income, gain, deduction, and loss allocated to:

- The U.S. transferor

- Related domestic partners

- Related foreign partners

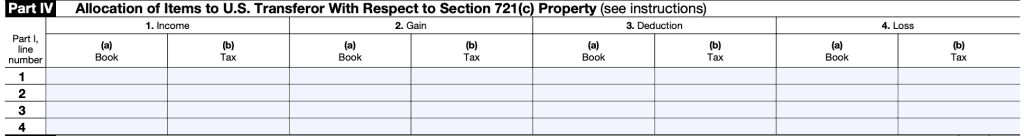

Part IV: Allocation of Items to U.S. Transferor with Respect to Section 721(c) Property

In Part IV, for each reportable section 721(c) property, enter the following amounts allocated to the U.S. transferor under the gain deferral method:

- Amount of book income

- Amount of taxable income

- Amount of book gain

- Amount of taxable gain

- Amount of book deduction

- Amount of taxable deduction

- Amount of book loss

- Amount of taxable loss

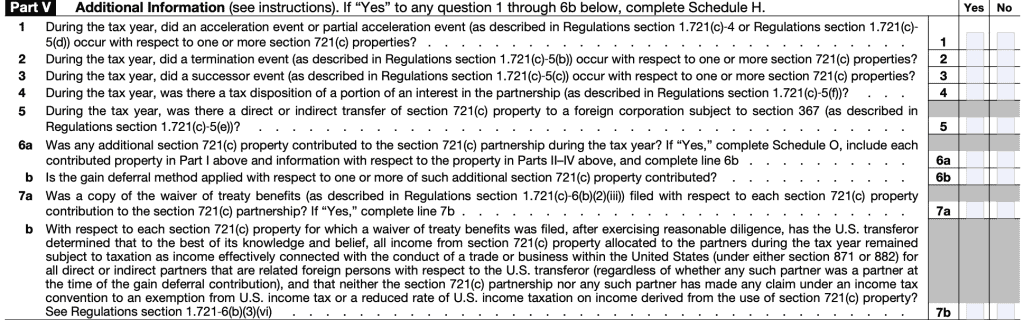

Part V: Additional Information

Answer the following questions pertaining to certain events, such as an acceleration event, that may have happened during the tax year. If you answer “Yes” to any question from 1 through 6b, you must complete Schedule H.

Part VI: Supplemental Information

Use this section to provide supplemental information as required by Treasury Regulations Section 1.721(c)-6.

You may download the entire Schedule G here.

Schedule H: Acceleration Events and Exceptions Reporting Relating

to Gain Deferral Method Under Section 721(c)

If the gain deferral method is being applied to reportable Section 721(c) property, complete and file Schedule H to report certain events related to that property. You must file a separate Schedule H for each partnership.

Complete all parts of Schedule H that correspond to the box or boxes checked in Schedule G, Part I, Column 7, and the related line on Part V checked “Yes.”

Part I: Acceleration Event

An acceleration event is any event that either would reduce the amount of the remaining built-in gain that a U.S. transferor would have recognized under the gain deferral method if the event had not occurred or could defer the recognition of the remaining built-in gain.

Part II: Termination Event

A termination event causes the gain deferral method to no longer apply with respect to the affected Section 721(c) property on a property-by-property basis.

Part III: Successor Event

A successor event allows for the continued application of the gain deferral method with respect to the affected Section 721(c) property on a property-by-property basis by a successor U.S. transferor or a successor Section 721(c) partnership.

However, if the successor doesn’t continue the gain deferral method, the event is an acceleration event and must be reported in Part I above.

Part IV: Taxable Disposition of a Portion of an Interest in Partnership Event

Part IV reports the information relating to a fully taxable disposition of a portion of an interest in a Section 721(c) partnership.

Complete this part if a U.S. transferor or a partnership in which a U.S. transferor is a direct or indirect partner disposes of (directly or indirectly through one or more partnerships) a portion of an interest in a Section 721(c) partnership in a transaction in which the gain or loss, if any, is recognized.

Part V: Section 367 Transfer Event

Part V reports transfer events covered under Section 367.

Section 367 events include:

- Transfer of Section 721(c) property by a Section 721(c) partnership to a foreign corporation, or

- Transfer by a U.S. transferor or a partnership in which a U.S. transferor is a direct or indirect partner transfers (directly or indirectly through one or more partnerships) all or a portion of the section 721(c) partnership that owns Section 721(c) property to a foreign corporation.

Part VI: Supplemental Information

Part VI provides supplemental information as required by Treasury Regulations Section 1.721(c)-6, but not reported above.

Since Schedule H does not accompany the rest of IRS Form 8865, you may download it as a separate attachment from the IRS website or by selecting the file below.

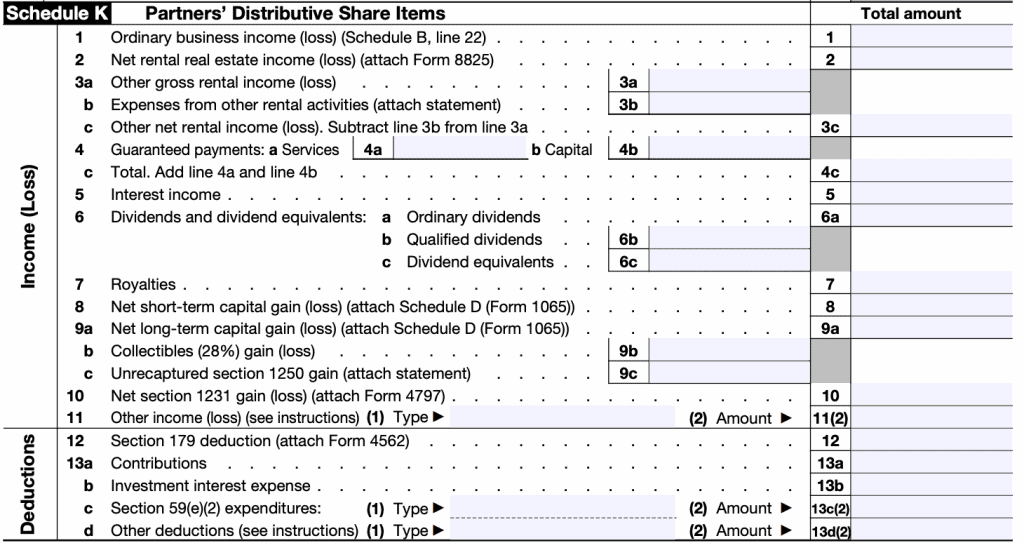

Schedule K: Partners’ Distributive Share Items

Only Category 1 filers need to complete Schedule K. Schedule K is a summary schedule of all of the partners’ shares of the partnership income, credits, deductions, etc.

As a result, it’s fairly straightforward.

Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.

All Category 1 and 2 filers must complete Schedule K-1 (Form 8865) for any direct interest they hold in the partnership. A Category 1 or 2 filer that doesn’t own a direct interest is not required to complete Schedule K-1 (Form 8865).

Complete steps 1 through 21 for any direct interest that a partner owns in the partnership.

For more specific guidance on a particular step, please refer to the Schedule K-1 instructions. Since Schedule K-1 does not accompany the rest of IRS Form 8865, you may download it as a separate attachment from the IRS website or by selecting the file below.

Schedule K-2: Partners’ Distributive Share Items—International

Schedule K-2 (Form 8865) is an extension of Schedule K of the Form 8865 and is used to report items of international tax relevance from the operation of a partnership.

Since Schedule K-2 does not accompany the rest of IRS Form 8865, you may download it as a separate attachment from the IRS website or by selecting the file below.

Schedule K-3

Schedule K-3 (Form 8865) is an extension of Schedule K-1 and is generally used to report the partner’s share of the items reported on Schedule K-2.

The information reported on Schedule K-3 is used to report information on a partner’s tax or information returns.

Since Schedule K-3 does not accompany the rest of IRS Form 8865, you may download it as a separate attachment from the IRS website or by selecting the file below.

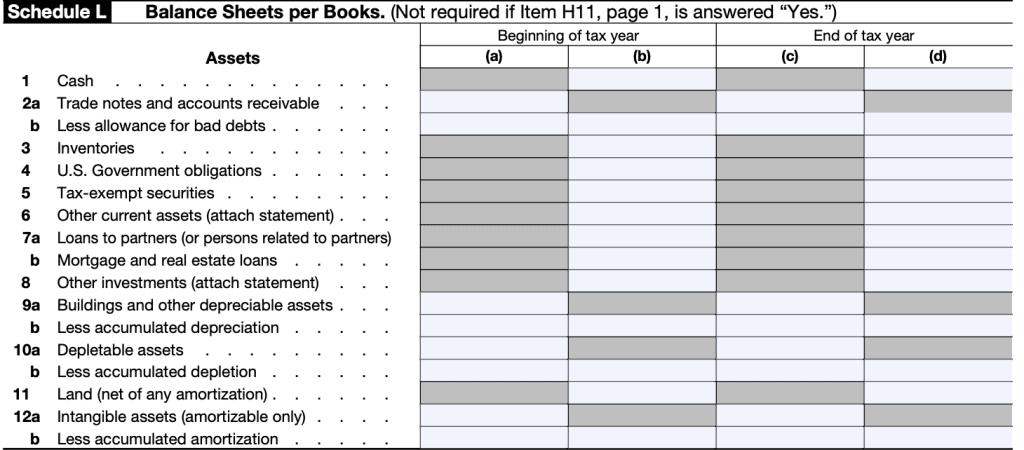

Schedule L: Balance Sheet per Books

Taxpayers do not need to complete Schedule L if they checked “Yes” to Item H11, outlined below.

- Total receipts were less than $250,000 for the tax year, AND

- The total value of partnership assets was less than $1 million

Schedule L requires balance sheets prepared and translated into U.S. dollars in accordance with U.S. generally accepted accounting principles (GAAP). The balance sheet should agree with the partnership’s books and records. If there are any differences, attach a statement with an explanation.

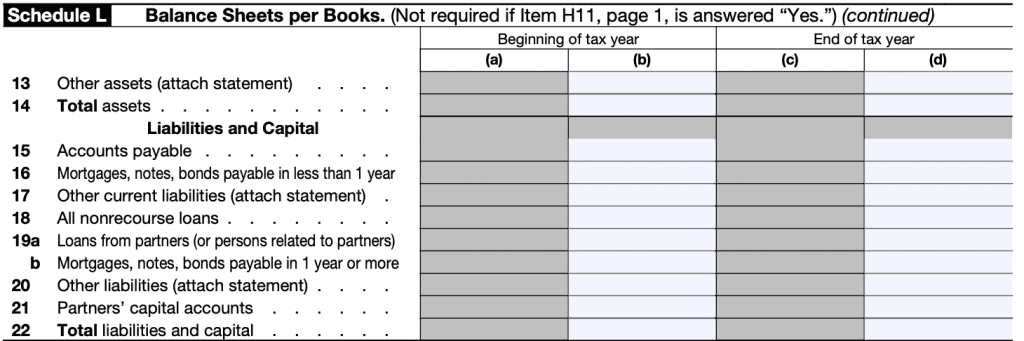

Schedule L carries over to Page 5, and continues as follows:

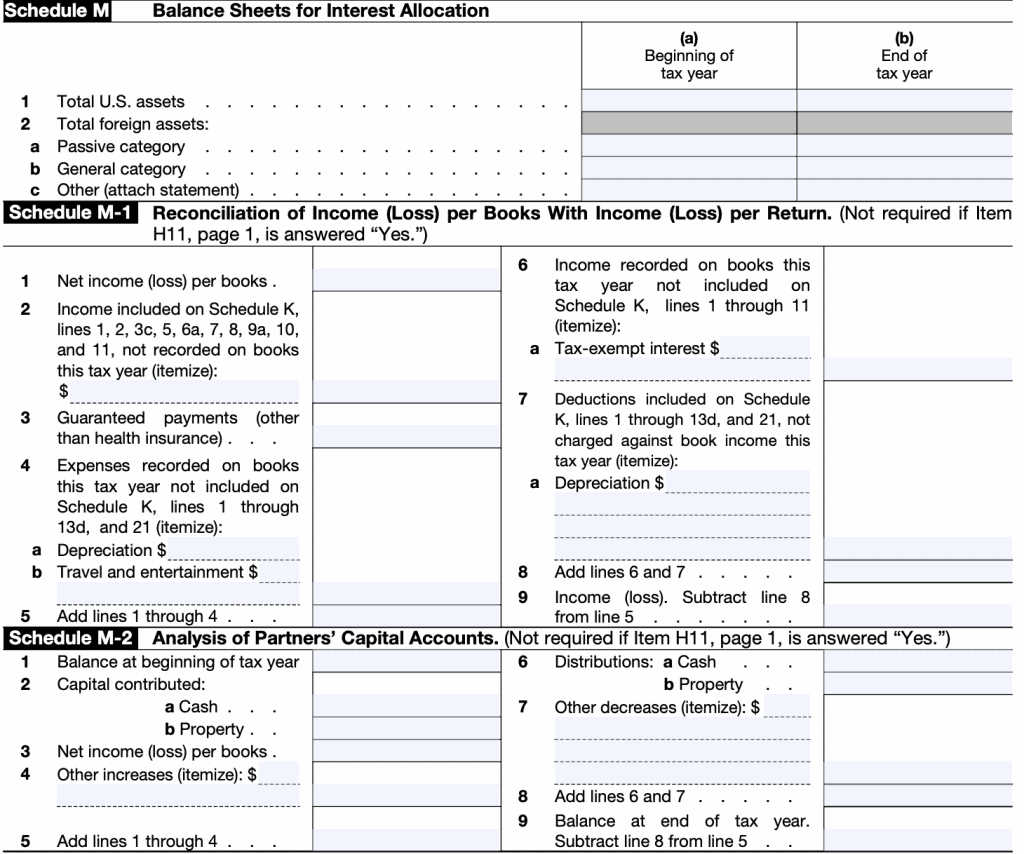

Schedule M: Balance Sheets for Reconciliation

All Category 1 filers must complete Form 8865, Schedule M. Schedule M should reflect the book values of the partnership’s assets, as described in Regulations Sections 1.861-9T(g)(2) and 1.861-12T.

Schedule M-1: Reconciliation of Income (Loss) per Books With Income (Loss) per Return

Taxpayers do not need to complete Schedule M-1 if they checked “Yes” to Item H11, outlined below.

- Total receipts were less than $250,000 for the tax year, AND

- The total value of partnership assets was less than $1 million

Only Category 1 filers are required to complete Form 8865, Schedule M-1. For specific instructions on Schedule M-1, see the instructions for IRS Form 1065, Schedule M-1.

Schedule M-2: Analysis of Partners’ Capital Accounts

Taxpayers do not need to complete Schedule M-2 if they checked “Yes” to Item H11, outlined below.

- Total receipts were less than $250,000 for the tax year, AND

- The total value of partnership assets was less than $1 million

Only Category 1 filers are required to complete Form 8865, Schedule M-2. For specific instructions on Schedule M-2, see the instructions for IRS Form 1065, Schedule M-2.

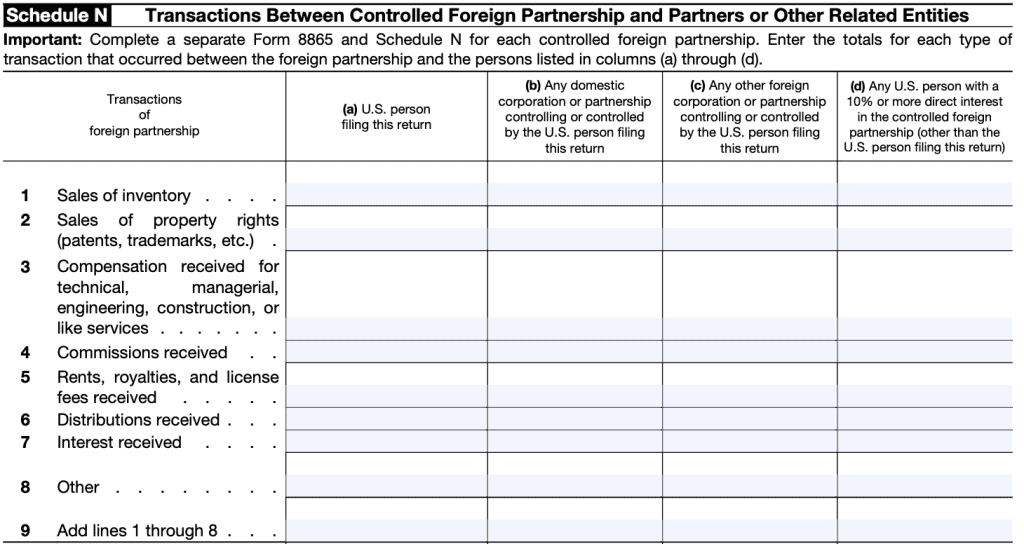

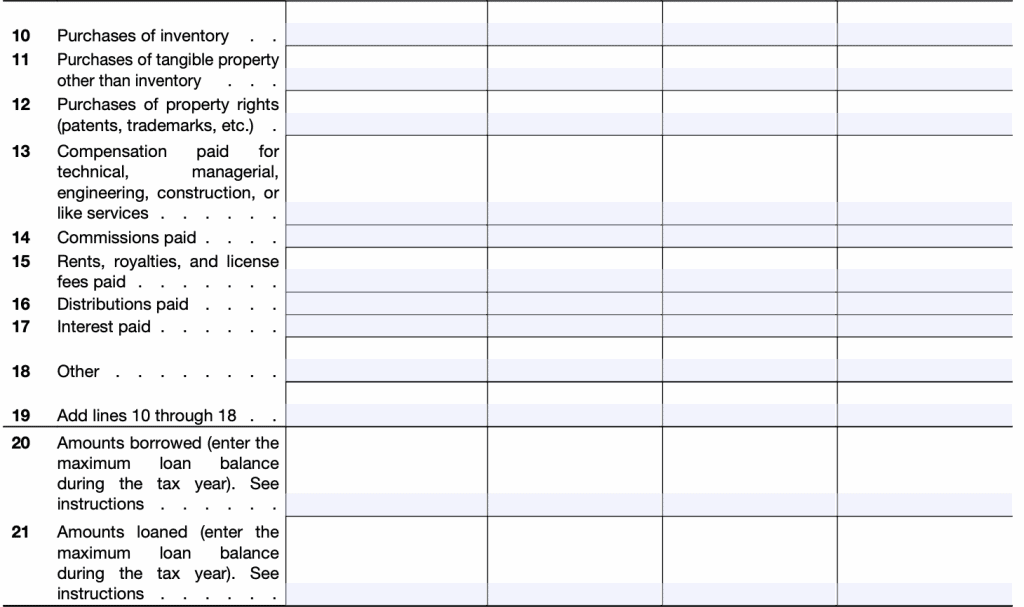

Schedule N: Transactions Between Controlled Foreign Partnership and Partners or Other Related Entities

All Category 1 filers must complete Schedule N and report all transactions of the foreign partnership during the tax year of the partnership listed on the top of Form 8865.

A Category 1 filer filing a Form 8865 for other Category 1 filers under the multiple Category 1 filers exception must complete:

- A Schedule N for itself and

- A separate Schedule N for each Category 1 filer not filing Form 8865

Any category 2 filers are required to complete columns (a), (b), and (c) of Schedule N. These filers don’t have to complete column (d).

Column (a)

Use Column (a) to report transactions between the foreign partnership and the person filing the Form 8865.

Column (d)

Use Column (d) to report transactions between the foreign partnership and any U.S. person with a 10% or more direct interest in the foreign partnership. However, if such a transaction also qualifies under Column (b), then report the transaction in Column (b), not Column (d).

Lines 6 and 16

For Lines 6 and 16, enter distributions received from other partnerships and distributions from the foreign partnership for which this form is being completed.

Lines 20 and 21

For Lines 20 and 21, enter the largest outstanding balances during the tax year of gross amounts borrowed from, and gross amounts lent to, the related parties described in columns (a) through (d).

Schedule D (Form 1065)

All Form 8865 Category 1 filers in partnerships which have partnership items described in the Instructions for Schedule D (Form 1065), Capital Gains and Losses, must complete that schedule.

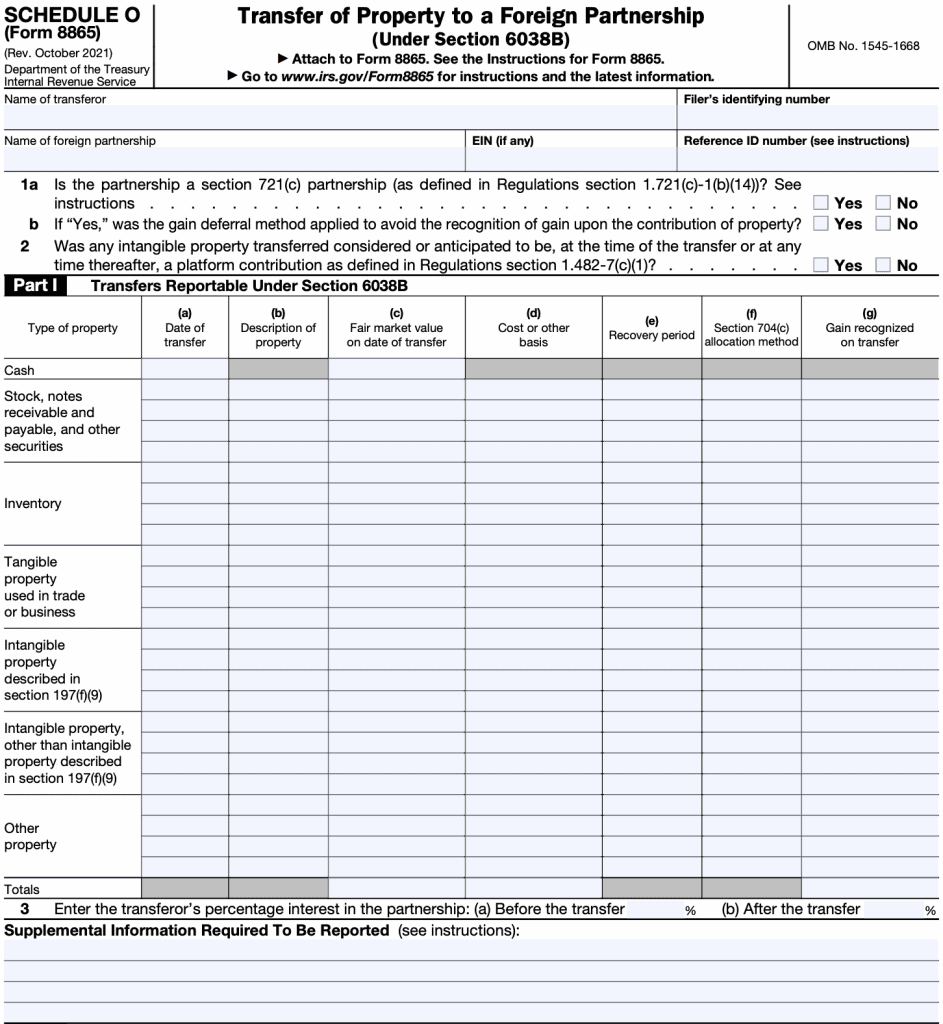

Schedule O: Transfer of Property to a Foreign Partnership (Under Section 6038B)

Category 3 filers must complete Schedule O. Schedule O, broken down into 3 parts, is outlined below. For detailed guidance on this schedule, please refer to the IRS Form 8865 instructions.

Part I: Transfers Reportable Under Section 6038B

This part is used to report the transfer of property to a foreign partnership.

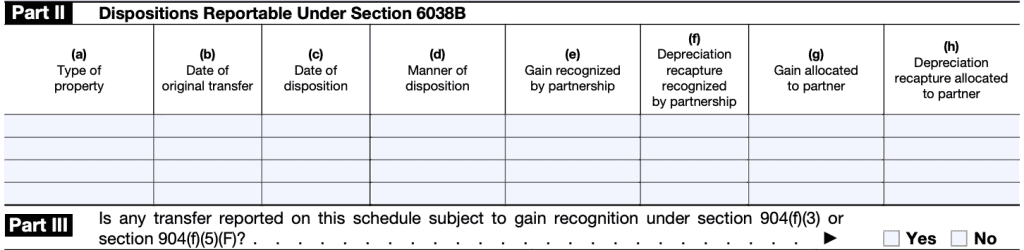

Part II: Dispositions Reportable Under Section 6038(B)

Use Part II to report certain dispositions by a foreign partnership.

Part III

Answer the question based upon guidance in IRC Section 904(f)(3) or Section 904(f)(5)(F). If applicable, attach a statement.

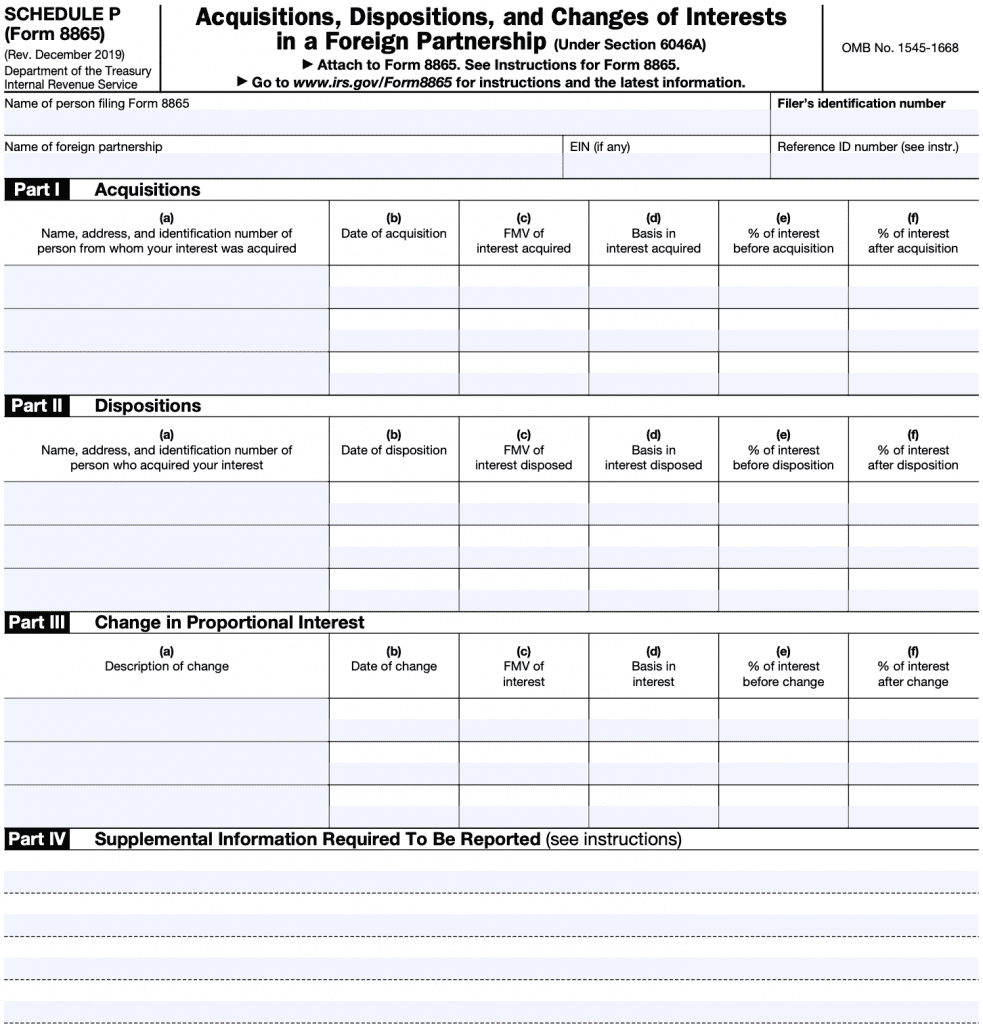

Schedule P: Acquisitions, Dispositions, and Changes. ofInterests in a Foreign Partnership.

Category 4 filers must complete Schedule P, unless they qualify for certain exceptions. Schedule P, broken down into 4 parts, is outlined below. For specific guidance, please refer to the form instructions.

Part I: Acquisitions

This part is completed by Category 4 filers required to report an acquisition of an interest in a foreign partnership.

Part II: Dispositions

This section is completed by U.S. persons who are Category 4 filers because they disposed of an interest in a foreign partnership.

Part III: Change in Proportional Interest

This section is completed by U.S. persons who are Category 4 filers because their direct proportional interest in the foreign partnership changed.

Part IV: Supplemental Information Required to be Reported

Enter any information asked for in Part I, Part II, or Part III that must be reported in detail.

Where can I get a copy of IRS Form 8865?

Except for the schedules previously included in this article, you may download a copy of this tax form from the IRS website, or by selecting the link below.