IRS Form 2210 Instructions

If you’re filing an income tax return and haven’t paid enough tax throughout the tax year, you may be filling out IRS Form 2210.

In this article, we will cover what you need to know about IRS Form 2210, including:

- How to complete IRS Form 2210

- How to determine whether your may have an underpayment penalty

- Frequently asked questions

Let’s begin by walking through the Form 2210 instructions, step by step.

Table of contents

How to Complete IRS Form 2210

In this section, we’ll go through each part of the form, step by step. Afterward, you’ll have a better understanding of how to complete the form.

There are 3 parts to this form:

Let’s start with Part I, below.

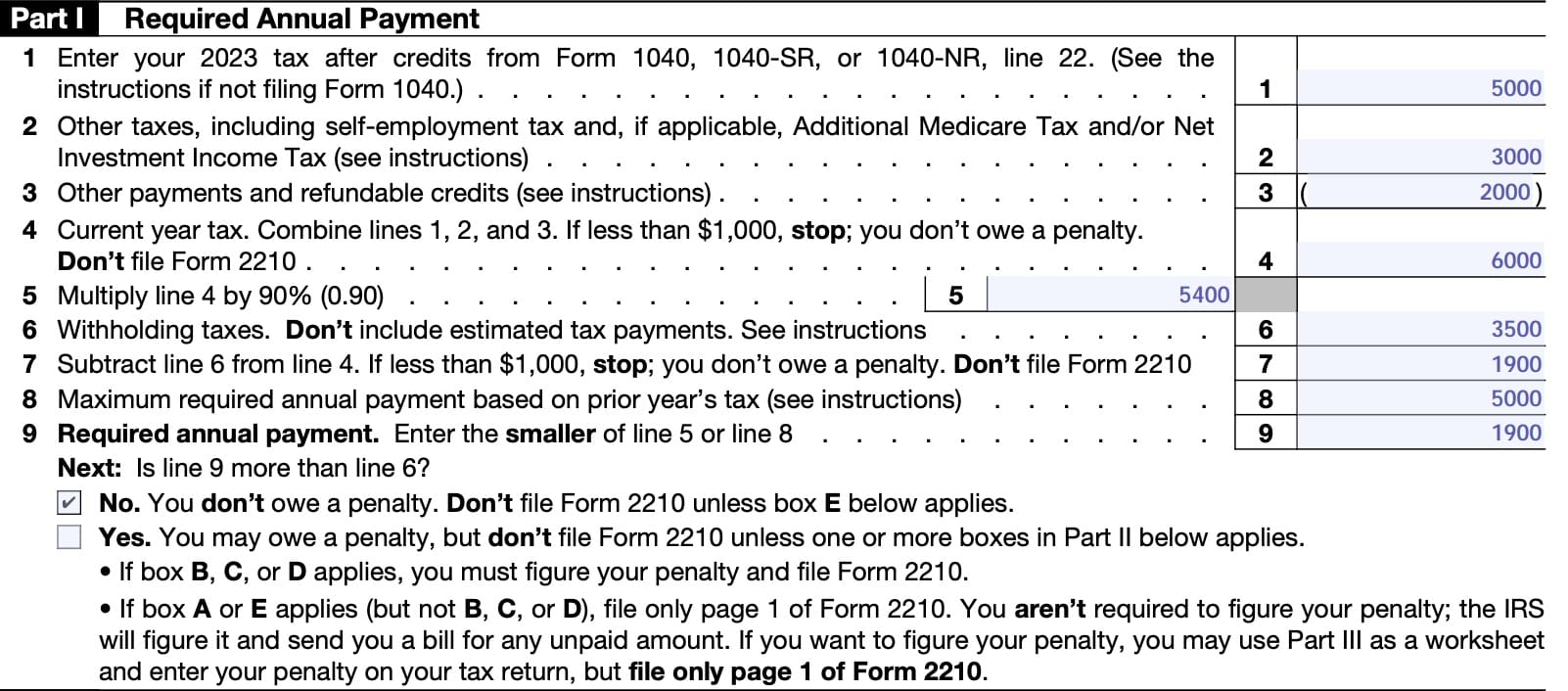

Part I: Required Annual Payment

Part I helps the filer determine the amount of tax that should have been paid over the course of the year. We’ll go through this line by line.

Line 1

This is your current year tax, after credits from your tax return. You’ll find this number on Line 22 on Form 1040, Form 1040-SR, or Form 1040-NR.

Estates & trusts

According to the IRS Form 2210 instructions, If you’re filing on behalf of an estate or trust, you’ll use the number found on Line 3, Schedule G on Form 1041.

Line 2

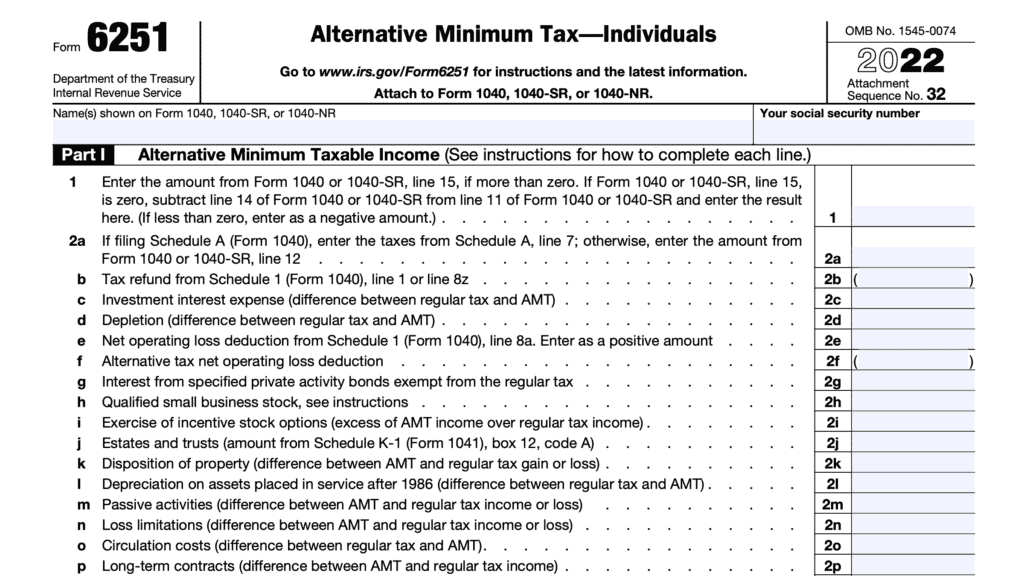

This line is the total of all additional taxes.

Individual tax returns

If you’re filing Form 1040, Form 1040-SR, or Form 1040-NR, you’ll find these additional taxes on Schedule 2:

- Line 4: Self-employment tax, calculated on IRS Schedule SE

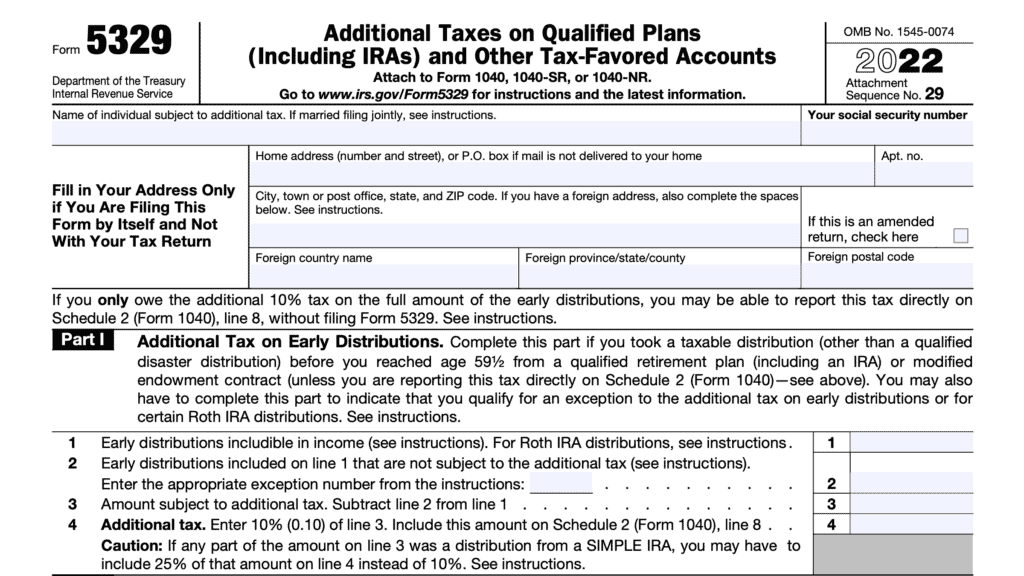

- Line 8: Additional tax on IRAs and other tax-favored accounts, calculated on IRS Form 5329

- Line 9: Household employment taxes (Schedule H)

- Line 10: Repayment of first-time homebuyer credit, calculated on IRS Form 5405

- Line 11: Additional Medicare tax, calculated on IRS Form 8959

- Line 12: Net investment income tax, calculated on IRS Form 8960

- Line 14: Interest on tax due on installment income from the sale of certain residential lots and timeshares

- Line 15: Interest on the deferred tax on gain from certain installment sales with a sales price over $150,000

- Line 16: Recapture of low-income housing credit, calculated on IRS Form 8611

- Line 17a: Recapture credits

- Line 17c: Additional tax on HSA distributions (IRS Form 8889)

- Line 17d: Additional tax on HSA because you didn’t remain eligible

- Line 17e: Additional tax on Archer MSA distributions (IRS Form 8853)

- Line 17f: Additional tax on Medicare Advantage MSA distributions

- Line 17g: Recapture of a charitable contribution

- Line 17h: Income from a nonqualified deferred compensation plan (Section 409A)

- Line 17i: Nonqualified deferred compensation plan income (Section 457A)

- Line 17j: Section 72(m)(5) excess benefits tax

- Line 17l: Tax on accumulation distribution of trusts

- Line 17z: Other taxes

Estates & trusts

If you’re filing Form 1041, you’ll include the following taxes, found on Schedule G:

- Lines 4-6

- Line 8, but not including the following write-ins:

- Look-back interest due as identified on IRS Form 8866

- Look-back interest due as identified on IRS Form 8697

- Interest accrued on deferred tax under a section 1294 election for the year of termination

In either case, if you’re a household employer, you must include household employment taxes on Line 2, unless both of the following are true:

- You didn’t have federal income tax withheld from your income

- You wouldn’t be required to make estimated tax payments, even if the household employment taxes were not included

Line 3

This line contains a variety of payments and refundable tax credits that you’ll subtract from Lines 1 and 2. This includes, but isn’t limited to:

- Earned income credit

- Additional child tax credit

- Refundable part of the American opportunity credit, as found on IRS Form 8863, Line 8

- Premium tax credit, calculated on Form 8962

- Credit for federal tax paid on fuels

- Qualified sick and family leave credits from Schedule(s) H and Form(s) 7202

- Refundable child and dependent expenses credit from Form 2441

- Health coverage tax credit

- Credit determined under Internal Revenue Code Section 1341(a)(5)(B)

Line 4: Current year tax

Combine Lines 1-3 to arrive at your current year tax.

If this number is less than $1,000, stop. You do not need to file IRS Form 2210, as you do not owe an underpayment penalty.

If this is more than $1,000, then proceed to Line 5.

Line 5

Multiply Line 4 by .90. This represents the 90% of the current tax liability previously discussed.

You’ll compare this number to last year’s tax number represented in Line 8 below.

Line 6: Withholding taxes

You’ll include your withholding taxes (not estimated payments), represented on the following:

- Form 1040 or 1040-SR, Line 25d;

- Form 1040-NR, Lines 25d, 25e, 25f, and 25g;

- Also, Schedule 3 (Form 1040), Line 11, if you filed the above forms;

- Form 1041, Schedule G, Line 14.

Line 7

On line 7, subtract Line 6 from Line 4.

If this number is less than $1,000 then you can stop. You do not have to file IRS Form 2210, and you do not owe an underpayment penalty.

If this number is more than $1,000, then continue to Line 8.

Line 8

You’ll need to enter your prior year’s tax, minus refundable credits.

Line 9: Required annual payment

Enter the smaller of either:

This represents the required payment for the given tax year. From here, you’ll determine if Line 9 is greater than Line 6.

If Line 9 is greater than Line 6

You don’t owe a penalty, and you don’t have to file Form 2210 unless you select Box E in Part II (see below).

If Line 9 is less than Line 6

You might owe a penalty. However, you shouldn’t file Form 2210 unless one of the following occurs:

- If you select Box B, C, or D in Part II below, you must calculate your penalty and fill out Form 2210.

- If you select Box A or E, you will complete Page 1 and submit it with your tax return.

- You are not required to calculate your penalty as the IRS will do this for you and send you a bill for any unpaid amount.

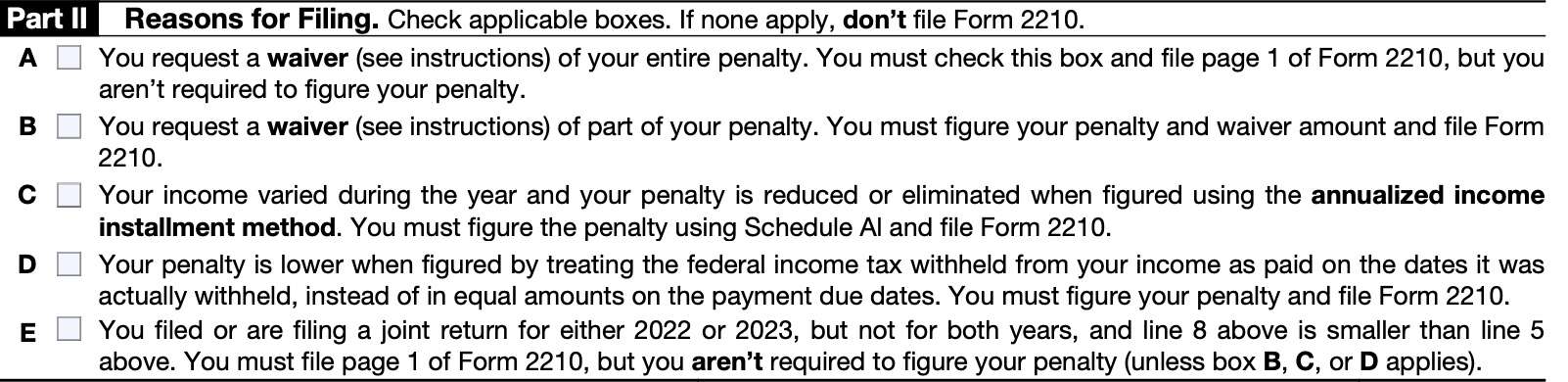

Part II: Reasons For Filing

Part II explains to the IRS why the taxpayer is filing Form 2210. If you end up selecting none of these boxes, then do not file IRS Form 2210.

Box A: Seeking a waiver of your entire penalty

You will select this box if you’re seeking a waiver of your entire underpayment penalty. However, you must also qualify for a waiver of the penalty for one of two reasons recognized by the Internal Revenue Service, outlined below:

- You retired in the current or previous tax year at age 62 or older, or became disabled. Your underpayment was due to reasonable cause, and not willful neglect, OR

- The underpayment was caused by a casualty, disaster, or other unforeseen circumstance, and a penalty would be inequitable.

- Taxpayers who are victims of a federally declared disaster automatically qualify for penalty relief. The IRS automatically identifies those who are eligible for disaster relief.

- Other taxpayers, such as individuals or fiduciaries who are not covered, but whose books and records are in a federally declared disaster area, or relief workers working in a covered area may be eligible for relief, but will need to contact the IRS disaster hotline (866-562-5227) to notify the federal government of their eligibility.

People who are seeking a complete waiver do not need to compute their penalty. If there is a penalty, the IRS will calculate it and send the taxpayer a bill for unpaid taxes due.

When seeking a waiver due to retirement or disability, you’ll need to send documentation that shows your retirement (and your age on the retirement date) or the date you became disabled.

If you’re seeking a waiver due to a disaster or casualty that wasn’t federally declared, you’ll need to submit documentation, such as police reports or insurance claims.

Box B: Requesting a partial waiver of your penalty

You’re requesting a partial waiver of your penalty. You’ll do the following:

- Complete Form 2210 through Line 18, without regard to the waiver

- Fill in the amount that you would like waived (in parentheses) next to Line 19

- Subtract this amount from Line 18

- Enter the difference in Line 19

From there, you’ll fill in the amount you want waived in parentheses next to Line 19, and subtract this number from Line 18. You’ll input the difference on Line 19.

Box C: Income varied during the year and penalty is reduced or eliminated when using the annualized income installment method.

If a significant amount of your gross income was due to a single event, and not evenly spread throughout the year, you may need to calculate your penalty using the annualized income installment method.

In that case, you’ll complete both parts of Schedule AI:

- Part I: Annualized Income Installments

- Part II: Annualized Self-employment tax

You’ll find Schedule AI at the end of Form 2210. For a step by step walkthrough on how to complete Schedule AI, watch this YouTube video.

Box D: Penalty is lower when figured by treating federal income tax withheld as paid on dates it was actually withheld.

You’ll need to complete Part III to calculate your tax penalty.

Box E: Filed or are filing a joint return for current or previous tax years, but not both, AND Line 8 is smaller than Line 5 above.

You’ll need to complete Page 1 of Form 2210. However, the IRS does not require you to compute your tax penalty unless Box B, C, or D also apply.

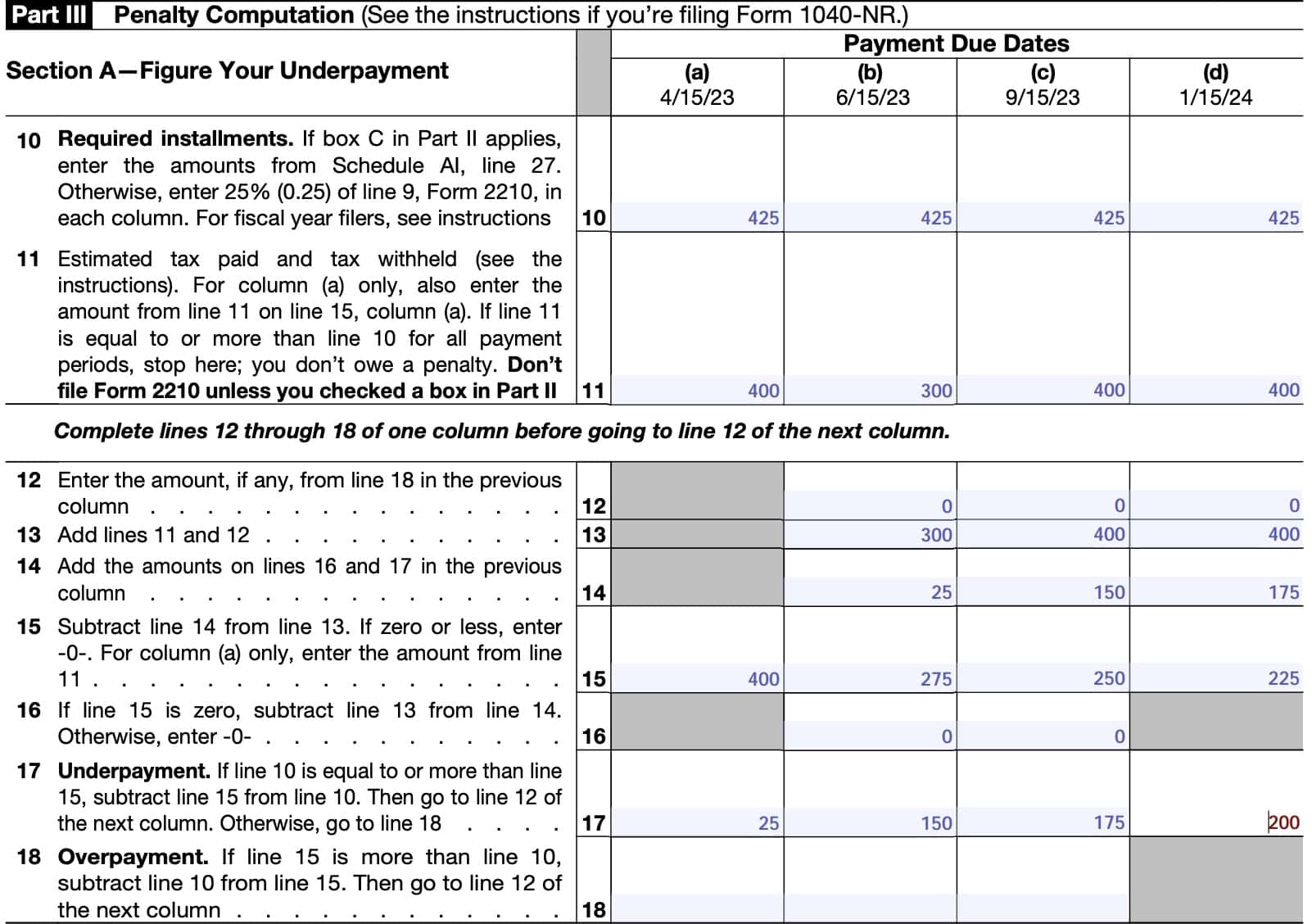

Part III: Penalty Computation

Part III is required for taxpayers who completed Boxes B, C, or D on Page 1. This is where the taxpayer calculates the estimated tax requirements that should have been paid on a quarterly basis.

Part III also contains the penalty calculations that help arrive at the estimated tax penalty for underpayment. There are two sections:

- Section A-Figure Your Underpayment

- Section B-Figure Your Penalty

Let’s go through Part III line by line, starting with Section A.

Section A

Line 10: Required installments

Under normal circumstances, you’ll multiply Line 9 by 25% to arrive at the required quarterly payments. These will go in each column under Line 10.

If you selected Box C under Part II, and completed Schedule AI, you’ll enter the amounts on Line 27.

Line 11

Enter the estimated tax payments for each time frame, based on the quarterly payment due date at the top of each column.

For Column A, you’ll input this same number into Line 15 below. Include the following payments.

- Any overpayment from prior year tax return applied to your current year estimated tax payments.

- Generally, treat the payment as made on April 15 of the tax year

- Estimated tax payments you made for the tax year, plus any federal income tax and excess social security and RRTA tax withheld.

- Any payment made on your balance due return for the tax year.

- Use the date you filed (or will file) your return, or the due date of the return, whichever is earlier, as the payment date for these purposes

If needed, Table 1 in the form instructions can help you track these payments.

If Line 11 is equal to, or greater than Line 10 for all 4 columns, you may stop here. You do not owe any underpayment penalties.

Line 12-Overpayment from previous quarter applied to current quarter

Except for Column A, Line 12 contains the information carried forward from Line 18 of the previous column. Proceed to Line 13, below.

Line 13

Except for Column A, add Lines 11 and 12. Input the sum in Line 13.

Line 14

Except for Column A, add Lines 16 and 17 in the previous column. Input the sum in Line 14, then proceed to Line 15.

Line 15

Except for Column A, subtract Line 14 from Line 13. For Column A, bring down the number from Line 11. If the number is zero or a negative number, enter 0.

Line 16

Except for Column A, if Line 15 is zero, subtract Line 13 from Line 14. Otherwise, enter zero.

Line 17: Underpayment

If Line 10 is equal to or more than Line 15, subtract Line 15 from Line 10. Then go to Line 12 of the next column. Otherwise, go to Line 18.

Line 18: Overpayment

If Line 15 is more than Line 10, subtract Line 10 from Line 15. Then go to Line 12 of the next column.

To review, you’re only completing Lines 12-18 because there was at least 1 quarter in which you did not make sufficient tax payments to cover that quarter’s tax liability.

If you did pay the required amount in each quarter, double-check the worksheet before proceeding to Section B. You should not have a penalty for underpayment of taxes if each of your quarterly installments was more than the required amount.

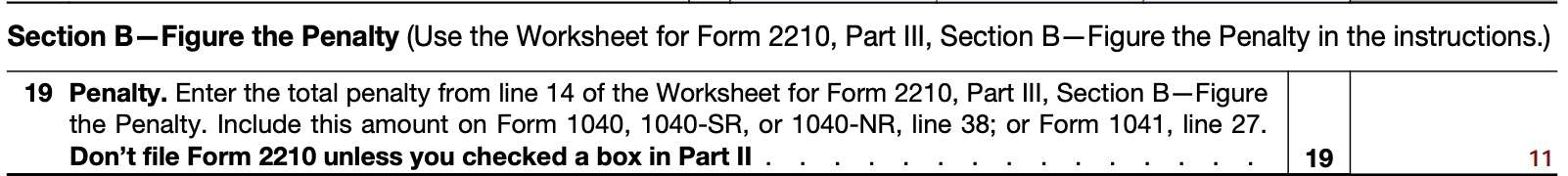

Section B

Section B contains the required worksheet and charts to calculate your tax penalty. This is covered in detail on the IRS instructions page.

Line 19: Penalty

Once the required worksheet has been completed, that number will go into Line 19. This will be the same number that goes into Line 38 of your Form 1040, Form 1040-SR, or Form 1040-NR. If filing Form 1041, this number will go to Line 27.

Filing considerations

Below are some things you may consider about filing IRS Form 2210.

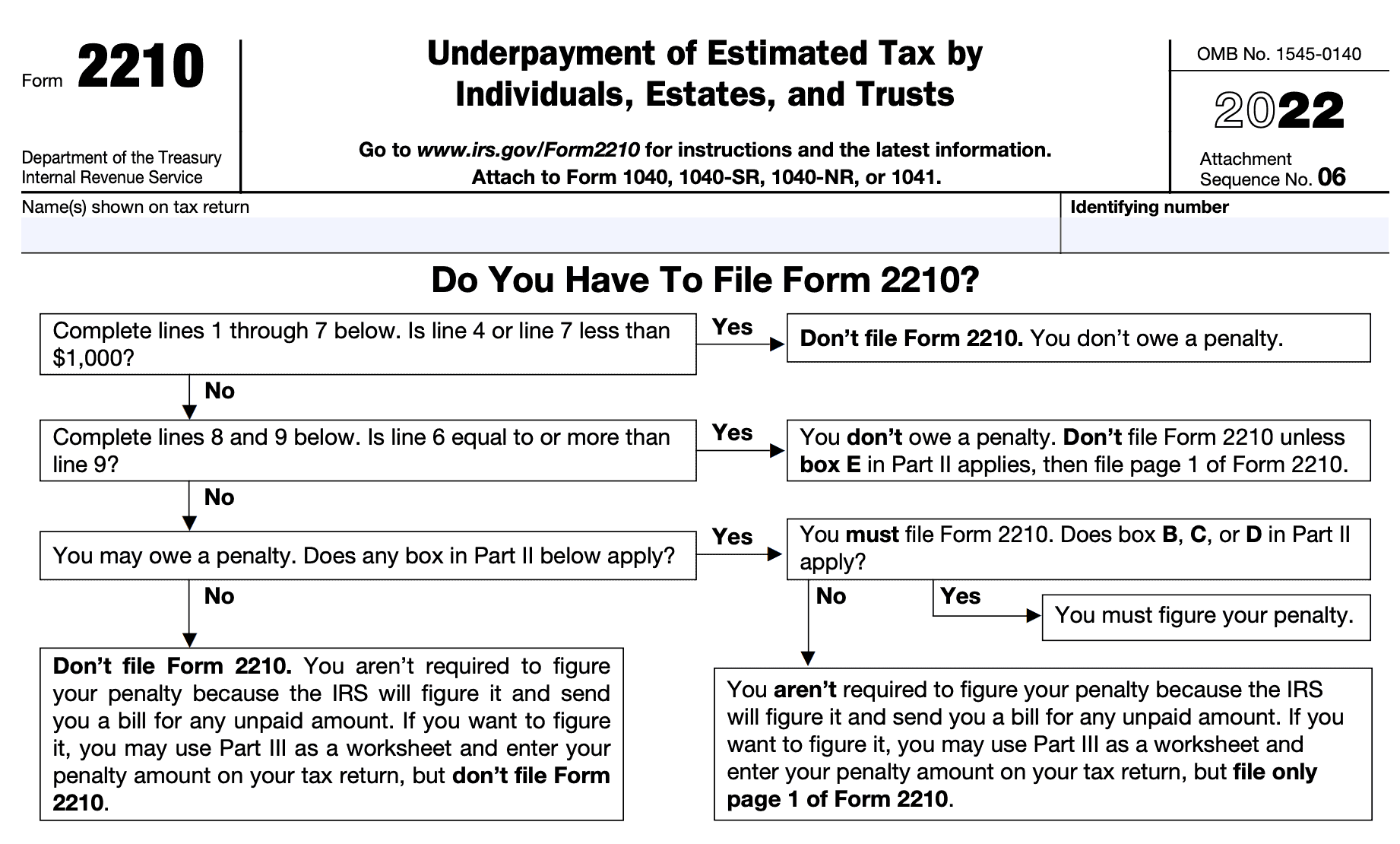

What is IRS Form 2210?

According to the IRS website, Form 2210 is known as Underpayment of Estimated Tax by Individuals, Estates and Trusts. In other words, if you’re filing a tax return on behalf of an individual, estate, or trust, you’ll use Form 2210 to determine:

- Whether the total of your withholding for the given tax year was sufficient

- Whether you owe an underpayment penalty

- The amount of the penalty, if there is one

Who must file IRS Form 2210?

The top of Form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form. According to the flow chart and the instructions, you do not owe a penalty if one of the following is true:

- Your total outstanding payment due is $1,000 or less, OR

- You are expecting a tax refund

If you an underpayment penalty does not apply, then you do not need to file Form 2210. If a penalty may apply, then you may have to file Form 2210, depending on how you complete the rest of the form.

Case studies

Below are two case studies. One is an example of a taxpayer who may need to file IRS Form 2210, while the other is about a taxpayer who does not need to file.

Example of having to file IRS Form 2210

Jane Smith cashed out a significant amount of her stock options during the tax year. This caused her taxable income to be much higher than the previous tax year.

Even though she appears to have an underpayment penalty, that penalty actually disappears when she uses Schedule AI-Annual Income Installment Method.

In this situation, Jane would select Box C under Section II and complete the rest of Form 2210, including Schedule AI. She would attach Form 2210 and Schedule AI to Form 1040 of her tax return.

Example of NOT having to file IRS Form 2210

Using the above example, let’s imagine that Jane paid estimated taxes when she cashed out her stock options. Working with her tax professional, Jane estimated how much tax she would owe for cashing out her stock options.

Since Jane qualifies as a high-income earner, she submitted enough taxes to pay over 110% of last year’s tax bill.

Because Line 9, Required Annual Payment, was larger than either 90% of her current tax bill or 110% of the previous year tax liability, Jane is not subject to a penalty. As a result, Jane does not have to file IRS Form 2210.

Video walkthrough

IRS Form 2210 Frequently asked questions

You may owe the penalty for the tax year if the total of your tax withholding and timely estimated tax payments didn’t equal at least the lesser of 90% of your current year’s tax or 100% of your previous year’s tax, and your tax bill was over $1,000. High earners (AGI above $150,000, or $75,000 if married filing separately) must pay 110% of the prior year tax bill, not 100%.

The purpose of this form is to determine whether the taxpayer owes an underpayment penalty. If the taxpayer owes a penalty, this form’s instructions contain a penalty worksheet to help the taxpayer determine the penalty amount.

If there is an accuracy-related penalty, then you may be susceptible to a substantial underpayment penalty. The substantial underpayment penalty applies if you underpay your taxes by the higher of 10% of the amount you should have paid, or $5,000. Generally, this penalty is 20% of the unpaid or underpaid taxes.

You will complete IRS Form 2210 to determine whether you have an underpayment penalty. If you’ve paid at least 90% of the current year’s tax or 100% of the previous year’s tax bill (110% for high-income earners), you generally will not have an underpayment penalty.

Where can I find a copy of IRS Form 2210?

You may obtain copies of IRS Form, such as Form 2210, from the IRS website. For your convenience, we’ve attached the latest version of Form 2210 to this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!